Darch, Chairman, and Kenneth MacLeod, President & CEO, Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP) Discuss Plans to Develop a 15,000 Ton per Day, Heap Leach Mining Operation (HLMO) at its Flagship Property, the Cerro Caliche Gold Project in Sonora, Mexico, and Utilize the Generated Cash Flow to Fund Further Exploration and Development.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/17/2022

We spoke with John Darch, Chairman & Director, and Kenneth MacLeod, President, CEO and Director of Sonoro Gold Corp. (TSXV: SGO | OTCQB: SMOFF | FRA: 23SP) (formerly, Sonoro Metals Corp., TSXV: SMO), a junior gold exploration development, and soon to be gold producer, with properties in the mining-friendly jurisdiction of Sonora, Mexico. The Company plans to develop a 15,000 ton per day, heap leach, mining operation (HLMO) at its flagship property, the Cerro Caliche gold project, and utilize the generated cash flow to fund further exploration and development. The project has a robust Preliminary Economic Assessment (PEA), completed in October 2021, and recently filed an Environmental Impact Statement, a key milestone in the development of its planned mining operation. Drilling is ongoing, with an initial target of doubling the mine life. The Company continues to fine tune its mine plan, with the intent of adding to the project's already compelling economics – definitely an additional potential catalyst, investors should keep an eye out for.

Sonoro Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with John Darch, Chairman and Director of Sonoro Gold Corp and Kenneth MacLeod, President, CEO and Director of Sonoro Gold Corp. Maybe I'll start with you, John. Could you give our readers/investors an overview and tell us what the primary accomplishments were in 2021 as well as your primary plans for 2022? Also, update us on the overview of the Company.

John Darch:

I think some of the more technical aspects are best answered by Ken, while I will give a broad overview of Sonoro's activities. 2021 enabled the Company to transition from exploring, to become a development Company, which is moving on to production, our stated goal from our business plan in 2019. That goal is to go into production as soon as practical, with the minimum number of ounces, so that in the future, exploration and development is funded by cash flow and consequently, shareholder dilution is minimized. From there, once we're in production, our focus will be to materially increase and upgrade the resource and extend the life of our proposed mine as defined in the project's PEA.

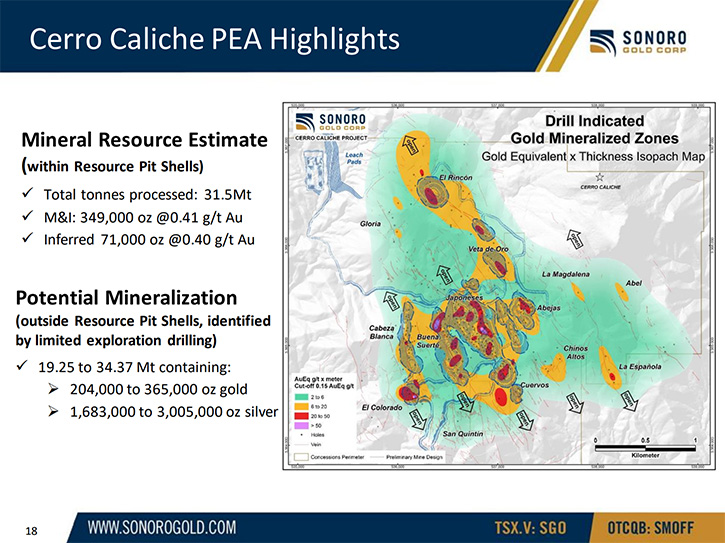

In terms of the accomplishments, the PEA was filed last October and is based on drill results up until April 2021. The drilling that's been done, since that time, has also been very successful. It has identified areas containing significantly higher gold grades, while defining additional areas of extensive shallow oxide gold mineralization, as originally projected by the Company. So, we are confident that we can increase the overall size of the resource and increase the grade. The purpose is to extend the life of the mine towards a 14, 15-year mine life. To do this, we need to establish a million ounces, a target, which is in accordance with the project's 2020 development report and given the ongoing drilling, appears to be an increasingly reasonable objective.

Should we accomplish this, not only would it extend the life of the mine, but it also would improve the economics. The big accomplishments, so far, have been to continue to expand the resource and to demonstrate the increasing size and grade. Ken, would you like to comment?

Kenneth MacLeod:

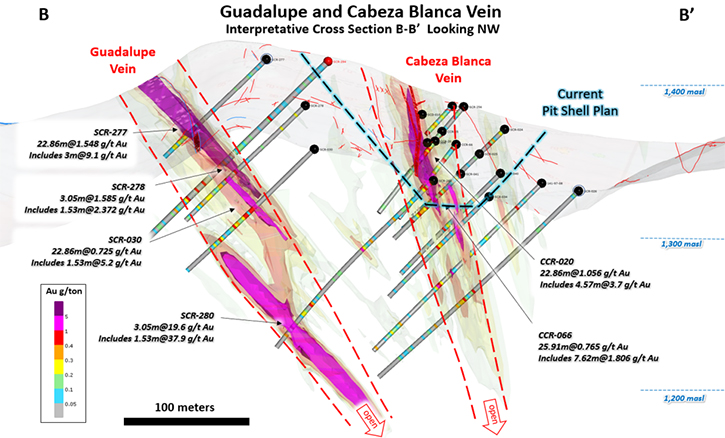

Yes, I can add a few other things along with that. The geology has been performing for us admirably, especially since we completed the PEA, in October. We certainly have added substantial mineralization to the existing zones. We also created new zones, as well. Off to the West, at the Guadalupe Zone, there is a brand-new zone that was not included, in the resource estimation, in our PEA. We now have probably around 14 holes in that zone, showing high-grade ore shoots that were not evident there before, except for the Colorado Zone, where high-grade gold intercepts were initially reported, beginning as early as 2019.

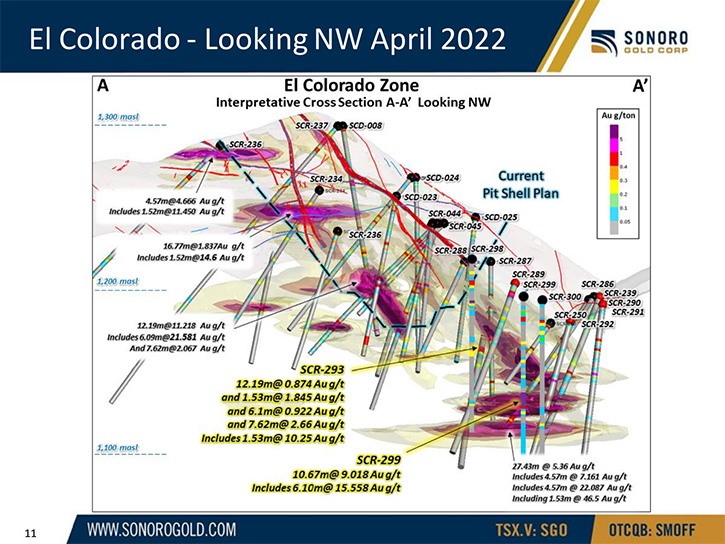

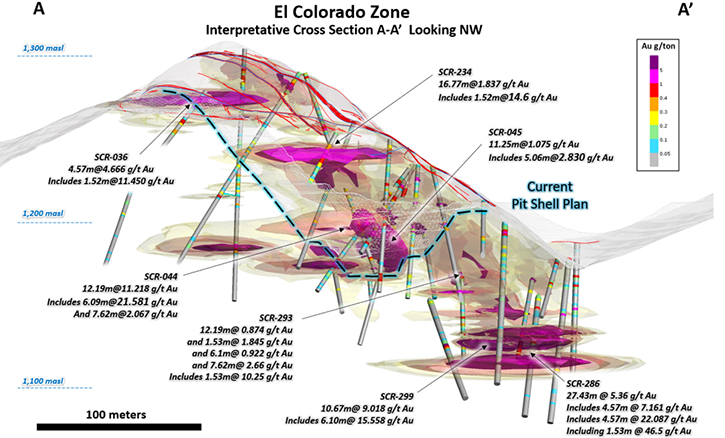

The Colorado Zone, which is to the southwest, continues to demonstrate increasing potential for high-grade gold, with the latest ore shoots that have been intercepted by drilling. These ore shoots increase the average grade of gold mineralization, thus increasing the potential resource substantially, because with these higher grades, you're able to create a larger resource, with fewer drill holes, and thereby positively affect the potential economics of the project. Because if you're mining a higher-grade resource, all other things being equal, each ounce of gold that will be produced, will be produced at a reduced cost per ton.

To the northeast area, in the Rincón Zone, we've now started to infill drill, between the mining pit shells that are outlined in the PEA and the results continue to expand the gold mineralization between these pits. The results thus far are very supportive of our expectation that the three pit shells will coalesce into one considerably larger open pit in the future.

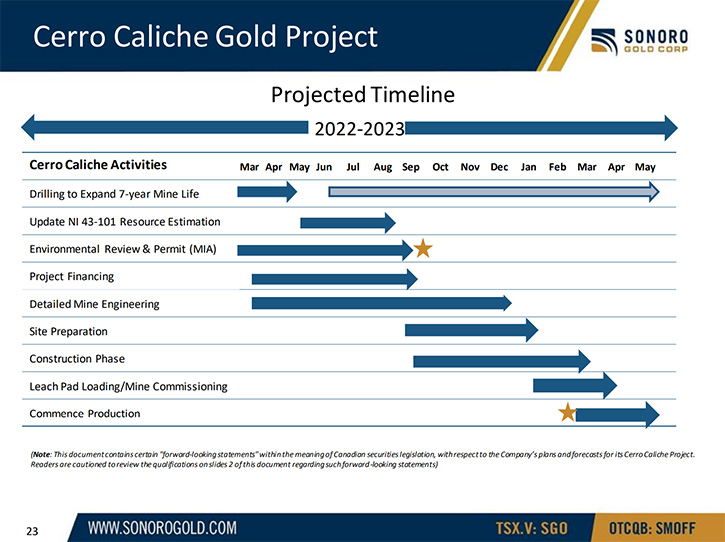

The other major task we completed in 2021 and 2022 was the environmental studies that recently have enabled us to apply for an environmental permit, to construct the future mine. It's a key milestone and is indicative of how far we have advanced the project. Under Mexican law, mining construction and operation activities require both a Change of Land Use permit and an Environmental Impact Statement, to be filed and approved. We accomplished much in 2021. We've completed sufficient drilling to enable an estimation of the resource that potentially supports a minimum seven-year mine life. We've also completed preliminary engineering and metallurgical studies and a preliminary mine-design. Add to that our completion of environmental studies and we are on track to begin construction, in the latter part of this year, as we're planning.

Dr. Allen Alper:

That sounds excellent. Those were great accomplishments in a very short time! Could you give our readers/investors a feel for the grades and the resources?

Kenneth MacLeod:

Certainly. Just to recap a little bit on the contents of the economic assessment and the PEA of October 2021. We had drilled to that date 47,500 meters, right across the property and within five or six distinct areas in the property. The amount of drilling that was calculated, within the resource, at that time, was based on 41,000 meters of drilling. Now, these 41,000 meters of drilling yielded a grand total of 440,000 mineable ounces at an average gold grade of 0.41 grams per tonne.

There was another 6,000 or 7,000 meters of drilling that had been done that was not granted any kind of resource estimation simply because they were outside of the pit shells or their spread between the holes was just too wide, so you couldn't calculate a resource. We've analyzed some of these additional drill holes and subsequent infill drilling has intercepted gold mineralization in between them, so we expect to be converting those sterile zones into productive zones in the future.

Right now, our plan is to calculate a new resource estimate, in July of this year, that's based on all the 2021 drilling results, included in the PEA, plus additional drilling from the 2022 program. Our latest drilling should add around 7,000 meters, which will be added to the resource estimate, calculated in the October 2021 PEA.

Our expectation, of what we think is a reasonable target, is that the proposed mine life, which is currently seven years minimum, may be extended closer to a 10-year life of mine, at that point. The original average grades for the property were calculated at 0.41-gram gold by Micon International, the consulting geologists, and based on the latest results from the Western Zones of Guadalupe and Colorado, for example, we think it is reasonable to anticipate an increase in this gold grade.

The average grade in the western zone of Colorado was almost one gram. So, it's a much more prolific area, as far as the grades are concerned. We have recently been drilling, in the western zones, and we've added 12 to 15 additional holes, in that Colorado area. Hole 286 was a very successful hole that we drilled in March this year. It was drilled down to about 120 meters at a 45 degree down dip and in the bottom quarter, it returned a very strong intercept of 27.5 meters grading 5.5 grams of gold. Hole 286 has returned one of the finest intercepts we've encountered on the property so far.

We've encountered other areas of higher grade, within the Colorado zone, and this is now starting to establish itself as a new, deeper high-grade zone, showing multiple high-grade ore shoots. The excellent thing, with the 27.5-meter intercept, is that because it's in the bottom of the valley, the true depth is only about 50-60 meters below the surface. Which means that if one were to project the pit shell that Micon had designed for the earlier resource, it's conceivable that this deeper zone at 1,100 meters above sea level will be incorporated into a much, much larger open pit.

We've been working at further defining that particular area, near Hole 286, and have been very successful in that we've drilled a vertical hole 50 meters away from the projected area of the intercept and ended up with 10.7 meters of 9 grams per tonne of gold that includes 6 meters of 15 grams. On top of that, another hole, about 80 meters to the North, came in with high-grade intercepts at similar depths to the hole number 299 and 286 where we ended up with 7.5 meters of 3 grams, and which included 1.5 meters of over 10 grams.

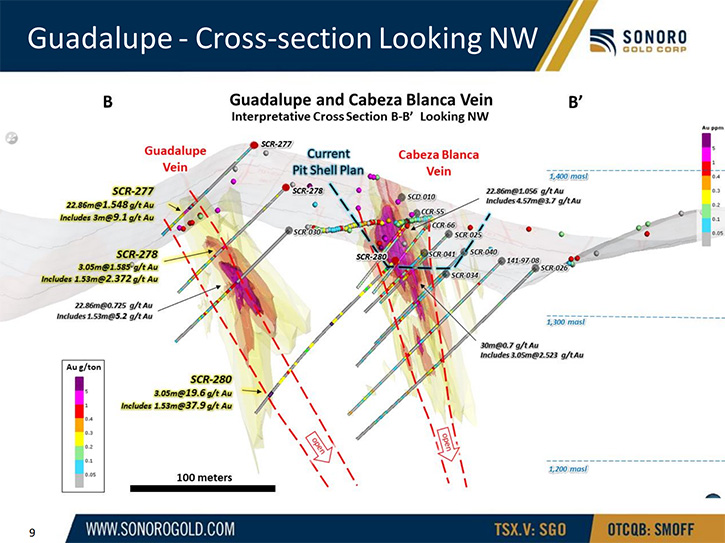

We're starting to get a better definition of this high-grade ore shoot and the direction in which it is laying. To the north, there is another zone named Guadalupe that we've now interpreted to coalesce with the Colorado zone. In fact, there are two zones to the north of Colorado, where Micon has postulated a large open pit at Cabeza Blanca. But off to the West, and parallel to Cabeza Blanca, is the Guadalupe Zone. We've traced the vein zone at Guadalupe for over a kilometer and it coalesces with the Colorado zone to the south.

What we're finding, in this Guadalupe vein zone, are high-grade ore shoots that seem to correlate to the high-grade shoots that we've encountered at the Colorado zone. There are at least seven instances of high-grade intercepts, or high-grade shoots, at this Guadalupe vein zone. The more we drill at Guadalupe, the more we're finding that there's continuity of this high-grade and these high-grade shoots. We're getting 3 meters of 9 grams per tonne, 1.5 meters of 2.4 grams per tonne and 1.5 meters of 37 grams per tonne. These are extremely good and valuable intercepts for us. The resource builds up very, very quickly when you're getting these high-grades and if it continues, it is not unreasonable to anticipate increases in the overall average gold grade. With these ongoing exploration successes, we are extremely encouraged.

We are delighted with the results that we've been encountering at the Guadalupe Vein Zone. We anticipate that there will be a meaningful increase in the resource estimation, when we update the resource estimation, in July of this year and, based on the updated resource commission, an updated PEA in August of this year. All in all, it's been a very successful five-month period of drilling for us. We expect to stop the drilling this month and we'll take a break so we can fully assess all of the data that we have amassed to date.

At this point in time, we have done sufficient work to enable us to say that it is potentially a viable resource and that it may be capable of supporting a mine for a minimum of seven years. The latest campaign adds to our confidence that this next update to the resource estimate could increase the mine life towards the 10-year mark.

Dr. Allen Alper:

Oh, that sounds excellent. Could you tell us what the plans are to go to production?

John Darch:

The plans are very simple. We have submitted the environmental permit application and anticipate approval of that by September or October of this year. If that comes about, as we anticipate, then that should enable us to complete the project financing and begin building the plant. Our expectation is that site preparation could then start right away and factoring in the time for construction, we would like to be able to start loading the leach pad, in the first half of 2023. That's a schedule we're adhering to at this point.

Dr. Allen Alper:

That sounds excellent! It’s nice that you're so close to production. That puts you in a very unusual position, compared to your peers.

John Darch:

Well, I agree. The junior resource sector, right now, has been suffering because exploration companies have not been getting the recognition in the marketplace that everybody needs to be able to continue to raise capital. But projects and Companies that are going into production are getting far more attention - they are getting the support. We're now at that position where we fully anticipate the milestones to be accomplished, over the next few months, ticking off the environmental permit, ticking off the update to the resource, our ongoing refinement of our mine plan and ticking off the Change of Land Use Permit, when that occurs, and ticking off project finance. We should be starting to get the recognition of the market, in general, that yes, these guys are truly serious about going to production and we expect to get recognition in the market for that.

Dr. Allen Alper:

That sounds excellent. John, could you tell our readers/investors a little bit about your background and about your Team. Then Ken, I'd like you to also talk about yours.

John Darch:

My background has always been in finance in the UK and Canada, in commercial banking. I created a small group of public companies, with a former partner, and we had mining operations in various parts of the world. The most successful was the development of Asia Pacific Resources, with over 1 billion tons of high-grade potash that was acquired by Italia Thai.

Another Company was Crew Development, where we had a controlling interest in an African Company, Metorex, and we headed up the privatization of the Chibuluma Copper Mine in Zambia, built Greenland's first gold mine, in addition to our mining operations and exploration projects around the world. I was also involved in a successful geothermal project, with Ken MacLeod for about a decade in the early 2000s. So, that's my background.

Kenneth MacLeod:

My own background started off in engineering. But, in 1981 I got into the oil and gas business, based in Houston, operating in seven states, in the southern United States. I moved on from there to exploring for oil and gas in the Philippines, where we were developing an offshore gas field, near Palawan Island. It was the world's first offshore horizontal completion to be conducted at that time. That field's development was a major success, to the extent that the Company moved to the New York Stock Exchange.

Then I became involved in mining in the Congo. In fact, my Company was the first foreign mining Company to actually sign an agreement, with the state mining enterprise, Gecamines. We conducted a feasibility study on a copper, cobalt tailings, and hard rock project in Katanga Province. John and I then got together in 2001 and created a geothermal Company that operated in Canada and moved into the United States and California. The Company was taken over in 2009, which was a very good outcome for the shareholders. Subsequently, I set up a private Company, in renewable energy in the Philippines, from 2009 to 2014. That was taken over in 2014.

In 2014, I joined Sonora as CEO and I've been there ever since. I’m working very, very closely with the technical Team, out of Hermosillo, Mexico. The two key Team members there are Melvin Hedrick and Jorge Diaz. Mel is an American citizen, educated at the Idaho School of Mines. He was working as a geologist for Phelps Dodge and Kennecott in the U.S., moved to Mexico and became Head of Exploration, in Mexico, for Phelps Dodge for 13 years. In 2005, he was one of the founders of a small Company called Pediment Gold that had exploration activities in various parts of northern Mexico.

Pediment ended up with two major discoveries - one being the La Colorada, the deposit one hour's drive south of Hermosillo and the San Antonio deposit, on the Baja Peninsula, a 2-million-ounce deposit. (That was a catalyst for Pediment Gold to be taken over by Argonaut Gold in 2011, at a significant premium. It was an extremely satisfactory outcome for shareholders at that time.

Mel's partner was Jorge Diaz, a Mexican citizen, educated at Colorado School of Mines. He has been designing, constructing, and operating gold mines and copper mines in northern Mexico for over 40 years. He was the number one employee of Alamos Gold, when they started constructing the Mulatos Mine. Jorge has a lot of hands-on experience. He built his own private gold mine about five or six years ago and is operating independently now. He’s been with us since Sonoro was created in 2012.

This Team, John, Mel, Jorge and I, are a very close-knit Team. We also have other highly qualified people working with us. Katharine Regan, the Corporate Secretary, has over 25 years’ experience running public companies. Curtis Turner has over 15 years’ experience in resource financing and operations, mergers and acquisitions and project management. Salil Dhaumya is the CFO, with 20 years’ experience in managing public companies. Neil Maedel has overseen the acquisition, financing and development of mines and major oil and gas concessions globally, with over 30 years’ experience. Collectively, we have well over 200 years’ experience in the design and development of resource companies, mainly in the mining sector.

Dr. Allen Alper:

Ken, you and John, and your Team, have very impressive backgrounds and records of success. You have a very well-balanced Team of financial backgrounds and exploration, and even mine development. So very impressive!

Kenneth MacLeod:

We believe we have a Team that has the capability of taking any project through from early-stage exploration, development, into construction and to operate that mine as well. So, it's very well-rounded. At the end of the day, we are truly of one mind, with the management level in Sonora, and we are going to take the Cerro Caliche Project to production and make it a very successful outcome.

Dr. Allen Alper:

It's a big advantage to have an experienced, knowledgeable, and diverse Team and very unusual for a Company of your size. With that, you can move the project right through to production. That's excellent!

John Darch:

I’d like to add maybe just a comment. What really distinguishes Sonoro Gold from the other junior companies is that over just the last two years, we've been able to take a concept through to near-term production. Not only that, but we also actually have the capability of going into production. The reason being is we clearly have all the essential components of a successful mining Company, beginning with the people, the project, the corporate finance and business plan and access to funding.

As for the people, we have a very well-rounded, very experienced, complementary, dedicated Team of professionals, who have been working together now for these three years, but independently have each been in the business for 35 years. On the project side of it, it is developing exceptionally well. The drilling that has been done, the work that's been done has all been on time and within budget and we're very pleased with the outcome and the potential.

On the corporate structure side, the fact that the insiders, the senior people, have a 20% holding in the Company and the average cost is 19 cents per share. It means that we're heavily invested in the Company. We're not promoting; this is a commercial operation.

One other point I think is very important, which distinguishes us, is that we have always had a very clear business plan and that business plan was to go to production, with a minimum of seven years of mine-life. But, to do it professionally and generate revenue, with which we could fund drilling to define the project's extensive gold mineralization. Our goal has always been to minimize the dilution to shareholders, and I think we can say we've accomplished a lot. We're going to do everything that we can to control dilution, with Management's execution of each phase, advancing on time, and within budget.

Dr. Allen Alper:

Well, it's great to see that Management has skin in the game and is aligned with investors. That's great!

John Darch:

Well, that's a very important part of our Company and it's clear that we're not coming at this as promoters. We are creating a business. We're creating a junior mining Company that potentially will be very profitable and has great room for expansion.

Dr. Allen Alper:

That sounds excellent. John and Ken, could you tell our readers/investors the primary reasons they should consider investing in Sonoro Gold Corp.?

John Darch:

As an individual, who comes from a financial background and has been exposed to junior mining companies for 30 or 40 years, like yourself, I first look at the people, then the project, then the structure of the Company and if there's a viable business plan. So, those are the reasons why Sonoro would be, in my opinion, an excellent investment, because we tic all the boxes as to what sophisticated investors would want to see: management's ability, commitment and dedication, combined with an exceptional asset to develop.

Kenneth MacLeod:

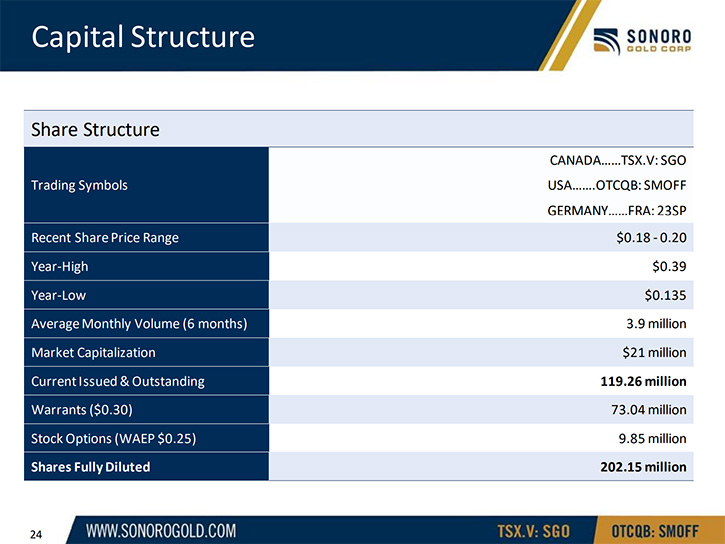

Adding to John' s comments, the value of the gold in the ground at Cerro Caliche currently has a discounted value to a potential investor. At this point in time, we have 440,000 mineable ounces. We have a market cap, in the Company, right now of $20 million. The stock is not showing the value of those 440,000 mineable ounces in the ground, and I think it’s reasonable to expect the amount of gold, and possibly the average gold grade, to be increased. The catalyst for unlocking the value is going towards, and achieving, production. The key milestones for that will be the receipt of the environmental permit to build the mine, the construction finance to build, see the actual start of construction and taking it all the way through to production.

The reality at that point is the initial production will be based on the 440,000 ounces. But, given our drilling success, we are optimistic that we should have expanded the resource by then. At the same time, the per ounce gold value of our resource may also increase. When I look at some of the takeovers of companies that occurred over the past decade, it's not unusual to see a minimum of $100 an ounce being paid for in-ground resources that are either ready to be mined or have already started the mining phase. Proven and Probable reserves are often valued about four to five times the value of measured and indicated (M&I), so going into production and developing an M&I resource to the Proven and Probable level, certainty adds to the potential for value creation. At this point, we are, I must emphasize, a long way from achieving this, but it is a logical progression and adds to the opportunity, if and when we are producing gold.

Assuming a stable gold price, I think there are four complimentary ways for Sonoro to build shareholder value. The first is the various milestones to be achieved as we work toward gold production. The second is the potential for improvements in project economics and net present value, as our mine plan is refined. The third is the recent very encouraging results, as we work to increase both the size of the project's gold resource and its average grade. A fourth factor to consider occurs when we commence mining, which in turn should cause the Company to be also valued, on a cash flow basis, while production may also confer a decreased risk for finding additional gold resources. This could make the projected resources more valuable on a per ounce basis. As we described earlier, the future valuation can be substantial.

Dr. Allen Alper:

That sounds excellent. Is there anything else you'd like to add, Ken or John?

Kenneth MacLeod:

No, I think that covers it at this point. We haven't missed a beat going forward, over the past two years that we have been talking to you, and we're setting the milestones, the targets and meeting these milestones and, we'll continue to do so.

Dr. Allen Alper:

Well, that's excellent. You have a very impressive Company and I think you have very compelling reasons for our readers/investors to consider investing in your Company. You're very close to production, you have an excellent, well-balanced Team and an excellent resource, which is growing as you explore and spend, as you drill, which is yielding results.

Kenneth MacLeod:

We agree.

Dr. Allen Alper:

We will publish your press releases as they come out so our readers/investors can follow your progress.

https://sonorogold.com/

Kenneth MacLeod

President & CEO

Tel: (604) 632-1764

Email: info@sonorogold.com

|

|