Zach Flood, CEO and Director Kenorland Minerals Ltd. (TSXV: KLD, OTCQX: NWRCF, FSE:3WQ0) Discusses Early to Advanced Stage Exploration Projects, in North America and Their Portfolio of Farm-Outs’ Joint Ventures, Optioned Projects, with Sumitomo Metal Mining, Newmont, Centerra Gold and Barrick Gold and Equity/Royalty Generation

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/15/2022

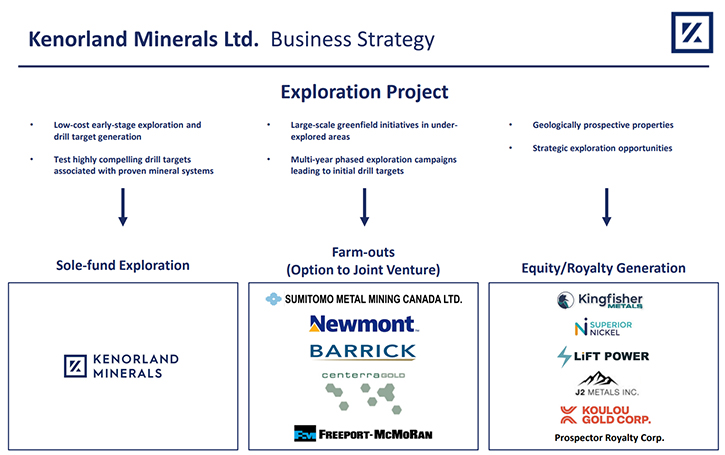

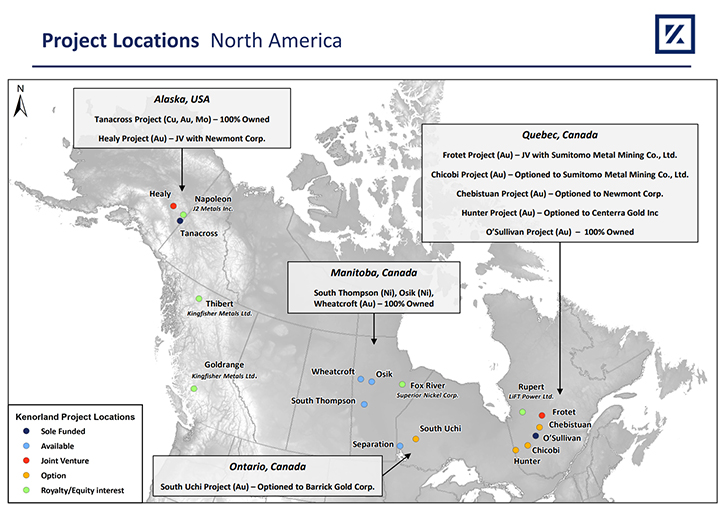

We spoke with Zach Flood, who is CEO and Director of Kenorland Minerals Ltd. (TSXV: KLD, OTCQX: NWRCF, FSE:3WQ0), a Canadian mineral exploration Company, focused on early to advanced stage exploration, in North America. The Company's business strategy includes sole-funded exploration, farm-outs (option to joint venture), and equity/royalty generation. Kenorland's large property portfolio includes four projects in Quebec, where work is being completed, under joint venture and earn-in agreements from third parties. The Frotet Project is held under joint venture, with Sumitomo Metal Mining Co., Ltd., the Chicobi Project is optioned to Sumitomo Metal Mining Co., Ltd. The Chebistuan Project is optioned to Newmont Corporation, and the Hunter Project is optioned to Centerra Gold Inc. In Ontario, the Company holds the South Uchi Project, under an earn-in agreement, with a wholly owned subsidiary of Barrick Gold Corporation. In Alaska, USA the Company owns 100% of the advanced stage Tanacross porphyry Cu-Au-Mo project, as well as a 70% interest in the Healy Project, held under joint venture with Newmont Corporation.

Kenorland Minerals Ltd.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Zach Flood, who is CEO and Director of Kenorland Minerals. Zach, could you give our readers/investors an overview of your Company and what differentiates it from others? Also, could you tell us what the main accomplishments were last year and what your plans are for this year?

Zach Flood: Kenorland Minerals is a very active exploration Company, focused on mineral discovery in North America. We have a broad range of projects, in areas including Quebec, Ontario, Manitoba, and Alaska. We just started trading on the Toronto Venture Exchange, at the beginning of 2021, so, last year was our first year as a publicly traded company. Our most significant asset is a minority interest in an emerging high-grade gold discovery, in northern Quebec, called Regnault, which is held under a joint venture, with Sumitomo Metal Mining. Our business is largely focused on earlier stage exploration and project generation, with major partners, including: Newmont Corporation, Barrick Gold, Freeport-McMoRan, Centerra Gold, along with Sumitomo Metal Mining.

Dr. Allen Alper:

That's fantastic. It's great to have those heavy hitters as your partners, and it shows that they recognize the work that you're doing, the discoveries that you and your Company are making.

Zach Flood:

Absolutely!

Dr. Allen Alper:

Could you tell us more about the projects and your plans?

Zach Flood:

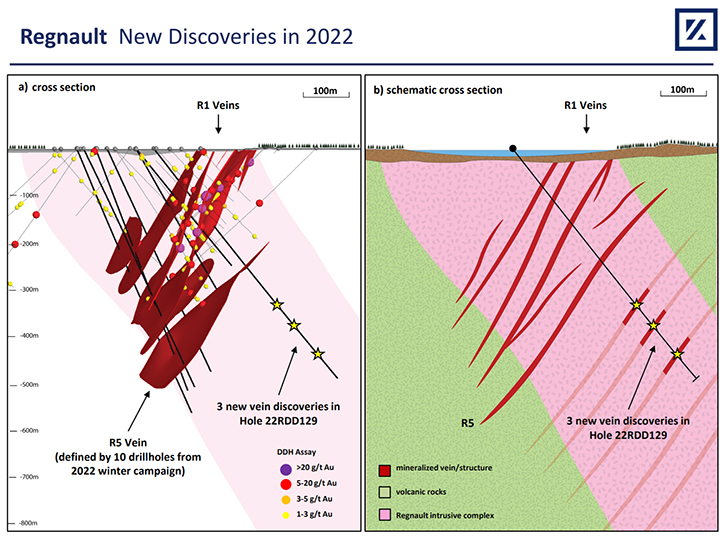

Most of our exploration is focused on Quebec and Alaska. This year in Quebec, we are carrying out additional diamond drilling, at the Frotet Project, where the Regnault Discovery is located. Since the discovery, in early 2020, we have, along with Sumitomo, completed approximately 45,000 meters of drilling into this new gold discovery. In Q1 of this year, we added roughly 10,000 meters of drilling to the approximate 45,000 meters total. Going forward, and over the next 12 months, we expect to add an additional 40,000 meters of drilling to the property.

Outside of Regnault, many of our other projects are earlier stage, and are undergoing large scale systematic exploration programs, to advance them to the next stage. Large-scale, systematic soil and glacial till geochemical surveys are very important early-stage phases of exploration, which we’ve used to narrow our search at Chebistuan, O'Sullivan, Chicobi, Hunter and the South Uchi Project. All of these projects are very similar, in the sense that they cover vast areas of underexplored terrain and we're advancing them systematically, from regional exploration to target generation towards eventual diamond drilling.

In Alaska, our portfolio is slightly different, in the sense that our two projects host known gold and copper systems. The Healy Project, which is held under a joint venture with Newmont, covers a large-scale low-grade gold system in the Goodpaster District, near the Pogo gold mine. The Tanacross Project, which is located in Eastern Alaska, hosts a significant copper-gold-porphyry system.

This year, in Alaska, we’re focusing our efforts on the Tanacross Project and are looking forward to drill testing the South Taurus target, which we've recently developed, over the past two years of systematic property-wide exploration. In Eastern Canada, our primary focus will be advancing drilling at Regnault.

Dr. Allen Alper:

I can see that 2022 is going to be an extremely exciting year for Kenorland, with all the drilling, and exploration they will be reporting, I think discoveries and information on a monthly basis.

Zach Flood:

Absolutely. Last year we operated around $20 million of exploration expenditures, with a large component, around $15 million, funded by our partners. In 2022, we're looking to increase this to around $25 million, in exploration expenditures, with $20 million funded by partners and around $5 million sole funded. These are very large exploration budgets, especially when applied to earlier stage exploration. This really reflects the scale of exploration we're carrying out. We’re very optimistic and look forward to 2022 and the prospect of further discoveries.

Dr. Allen Alper:

That’s really amazing. I think you stand out, above almost all junior companies, with the amount of money you're spending on exploration.

Zach Flood:

Yes, I agree with that statement. There are not many junior exploration companies, with this size budget. There’s no other junior exploration company, with the amount of exposure to mineral projects that we have, that I know of. Currently Kenorland has direct or royalty interests, in over a million hectares of ground in North America, which is a very, very large area.

Dr. Allen Alper:

That's fantastic. Zach could you tell our readers/investors a little bit about yourself, your Management Team, and your Board?

Zach Flood:

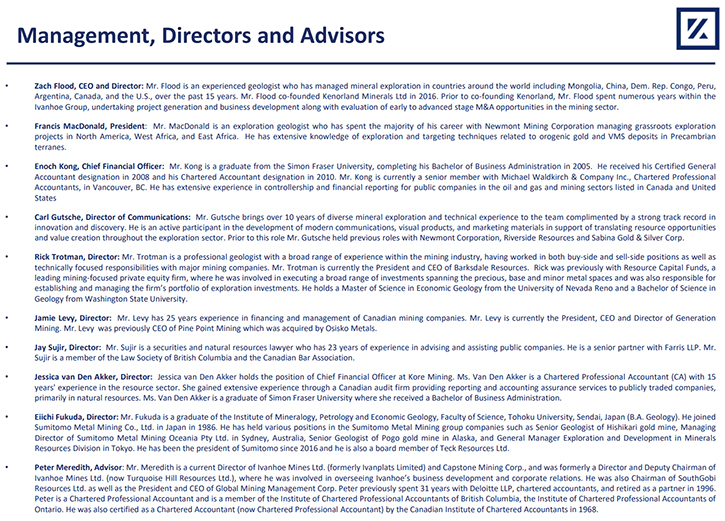

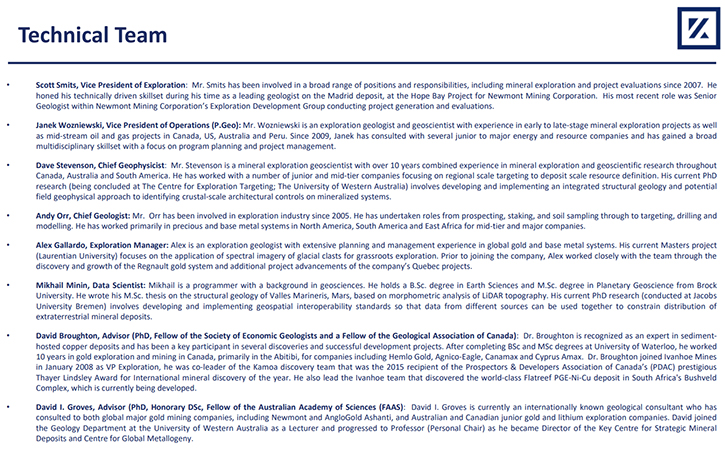

I'm a geologist first and foremost, and so are the other co-founders of Kenorland; Francis MacDonald is our President, Scott Smits is our Vice President of Exploration, and Dave Stevenson is our Chief Geophysicist. Recently we have been building the Team, with the addition of Janek Wozniewski, as our VP of Operations and Andy Orr as our Chief Geologist, as well as our Exploration Manager, Alex Gallardo.

We have a large technical Team which is dedicated to operating the very significant amount of exploration that we're looking at, and the number of projects that we have, which are all being advanced simultaneously through the pipeline.

The Board of Directors at Kenorland is very experienced. Rick Trotman is a professional geologist, within the mining industry. He was previously with Resource Capital Funds and currently he's the President and CEO of Barksdale Resources. Jamie Levy is also a Director. Jamie is the current CEO of Generation Mining, who are developing the Marathon PGE Deposit, in Ontario. Jay Sujir is another Director, he is a well-known natural resource lawyer, based in Vancouver, involved in multiple public resource companies. Jessica van Den Akker is another Director, and she is the CFO of Kore Mining and again another very experienced professional in the mining industry.

Lastly, Eiichi Fukuda joined our Board last year in November, after Sumitomo Metal Mining made a strategic investment in Kenorland and represents Sumitomo on the Board. Sumitomo now owns just over 10% of Kenorland Minerals, and are joint venture partners in the flagship Frotet Project, where we are currently advancing the discovery at Regnault. Eiichi is a fantastic geologist and mining executive, and is based in Tokyo, Japan.

Dr. Allen Alper:

You definitely have a very accomplished, experienced Board and a very extensive Technical Team, with great experience. That enables you to do all of the exploration and discoveries that you're doing.

Zach Flood:

Yes, definitely it helps to have a large and experienced Team to accomplish all this work. We're very passionate about exploration. Many of us are still relatively early in our careers, very energetic and very focused on making new discoveries, going forward.

Dr. Allen Alper:

Fantastic! Zach, could you tell us a little bit more about your share and capital structure?

Zach Flood:

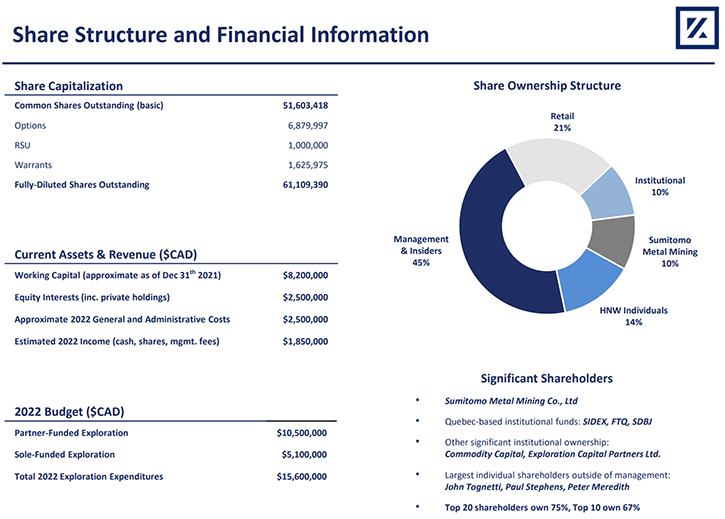

Currently, Kenorland Minerals has 51.6 million shares out. Basic and fully diluted shares outstanding are around 61.1 million, and we have around $7 million in working capital. One thing that's unique about Kenorland is that, through managing a lot of the partner funded exploration and doing project generator style deals, which sometimes come with cash and share payments, we've been able to generate a significant amount of income each year, sometimes exceeding our annual general and administrative costs of running the Company.

This year we expect to bring in around between $2.4 and $2.5 million Canadian, which will cover, entirely, our general and administrative costs for the year. In terms of the share ownership, we’re very tightly held, with Company Management and insiders owning around 45% of the Company and Sumitomo Metal Mining owning 10%. We have other institutional shareholders, including the Quebec-based fund - SIDEX, FTQ and SDBJ, as well as other institutions such as Commodity Capital and Exploration Capital Partners Limited, who are significant shareholders as well. Other high-net-worth individuals own around 14% of the Company, and retail owns around 21%. So again, it's a very tightly held Company, with some very serious and successful individual investors and funds involved.

Dr. Allen Alper:

It's great to see that Management has such a strong stake in the Company and is aligned, with shareholders, for getting rewards. It shows that your group has confidence in what you're doing and is willing to invest. It's great that you have strong institutional backing. The backing of Sumitomo is really outstanding.

Zach Flood:

Certainly! I think it shows that very well.

Dr. Allen Alper:

Could you tell our readers/investors the primary reasons they should consider investing in Kenorland Minerals?

Zach Flood:

I think first and foremost, there's incredible value created during a mineral discovery. We're at the very early stages of that happening in northern Quebec, where we have a high-grade gold system that’s growing significantly, with each drill program. There’s around 45,000 meters of drilling in the discovery to date, so it’s still early days. The discovery is clearly significant, in terms of size and grade, and there is real value in that, even with a minority interest. I think the fact that a major mining company is advancing this, along with us, really demonstrates the potential here as well.

Outside of the intrinsic value of the discovery itself, there's an incredible amount of option value in all of the other exploration we're completing. The budgets we're looking at are similar to some mid-tier mining companies and we've been advancing a huge portfolio of projects, through the exploration pipeline, from regional first pass exploration, through to drill targeting and diamond drilling as well. There are consistently new targets being tested, within Kenorland, and new areas being screened. I believe that Regnault is really just the first discovery of what we hope to be many, within the Company.

Dr. Allen Alper:

That sounds fantastic. Sounds like extremely compelling reasons for readers/investors to consider investing in Kenorland. With all the great money and time and effort you're putting into exploration, you'll have a great Team with great properties. It sounds like a very great, excellent opportunity for our readers/investors. Is there anything else you'd like to add?

Zach Flood:

No. I think we’ve covered a lot of it. I really appreciate you reaching out and giving us the opportunity to talk about our Company, Kenorland Minerals.

Dr. Allen Alper:

I know our readers and investors will be pleased to learn more about Kenorland Minerals. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://kenorlandminerals.com/

Kenorland Minerals Ltd.

Zach Flood

CEO, Director

Tel: +1 604 363 1779

zach@kenorlandminerals.com

|

|