Don Mosher, President, Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01) Discusses Exploration and Development of the World's Potentially Highest-Grade Helium and Noble Gas Properties, in Northeastern Arizona, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/9/2022

We spoke with Don Mosher, President and Director of Desert Mountain Energy Corp. (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01), a forward-looking Vancouver-based resource company, actively engaged in the exploration and development of the world's potentially highest-grade Helium and Noble Gas properties, in Northeastern Arizona. Currently, the Company is focused on its Tier 1 Holbrook Basin Helium project, advancing the McCauley Helium Field, to initiate production and positive cash-flow in Q3 2022. According to Don Mosher, Desert Mountain Energy is planning to become a vertically integrated producer of Zero Carbon Helium, powered with solar, backed up by free hydrogen, from within their helium field. Going forward, the Company has already pre-ordered strategic components for the Rohlfing Helium Field finishing facility.

Desert Mountain Energy Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in Chief of Metals News, talking with Don Mosher, who is President and Director of Desert Mountain Energy Corp. Don, could give our readers/investors an overview, you could tell us the most significant things that took place last year and your plans for 2022.

Don Mosher:

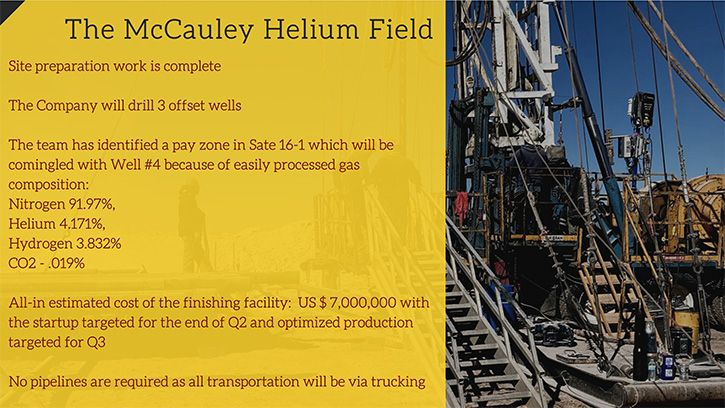

2021 was really a Team building year for us. We drilled one hole, which was well number four, and that was a very difficult well for us to drill, but it taught us a lot and it also identified the first field that we're going to put into production, when we drill number four and we saw the gas composition, it proved to be very simple composition. So, we decided that putting that field into production first, because we're only dealing with nitrogen, a little bit of methane ethane, 1.1 37% helium and a trace amount of CO2. To separate and sequester those elements is relatively simple.

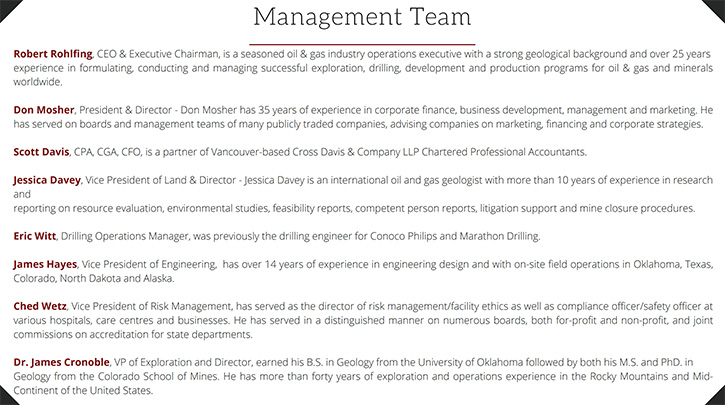

That CapEx on that finishing facility came in under $7 million. It really reduced the number of long lead time items that needed to be ordered in, as opposed to the original Rolfing field that we discovered. In addition to that, we hired a VP of Land and we brought in a drilling Operations Manager, we brought in a VP of Engineering. Rob's really started to build a Team to help him out and ease some of the burdens.

Just the VP of Land that Jessica Davey took over, she deals with all the Land Commission issues, the Oil and Gas Commission issues, securing surface rights, where we're going to drill wells. We really prefer to own the surface rights around our wells and not have to deal with the landowners. It just eases everything for us. Land in Arizona is relatively inexpensive, so it makes a lot of sense not to have to deal with maybe an unfriendly surface owner.

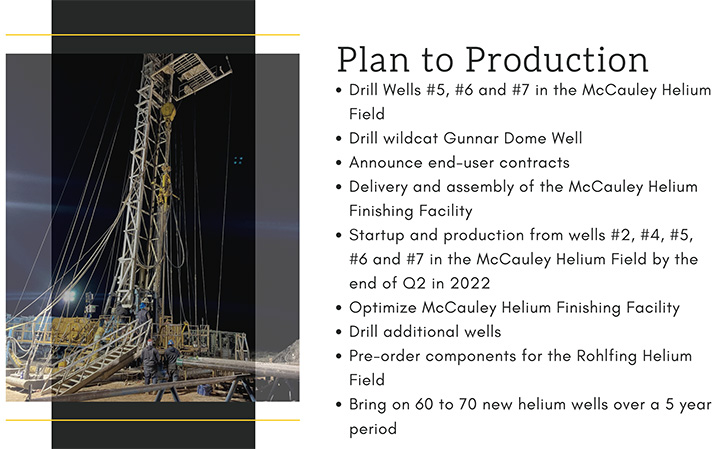

This year we've already drilled three wells and successfully set cemented casing in the wells five, six and seven. They were offsets to well number four, in the McCauley Helium Field. What we've now found is the parameters of that field, where we're very confident we own all necessary mineral leases in the area. The field is about 10 square miles in size. We'll be able to drill a few more offset holes in that field and we'll get in and actually sample those holes probably in about three weeks. We're just waiting for a completion rig to be released for some plugging job that it's working on for one of the states.

At that point in time, we expect Generon will start to work on our finishing facility. The Company is planning to become a vertically integrated producer of Zero Carbon Helium, so the McCauley Helium Field will be powered with solar, backed up by hydrogen. We've discovered hydrogen, within our helium fields, so it's more or less a free source of backup energy for us.

We look to be into optimization and production in Q3 on that facility. We expect to be in a cash flow position by the end of Q3 and we feel we have sufficient money in the bank, right now, to get to that point where we are producing positive cash flow and we're not looking to go back to the market for more money.

Dr. Allen Alper:

It's an excellent position to be in. That's great! Could you tell our readers/investors some of the data on the amount of helium and other gases that some of your wells have yielded?

Don Mosher:

We really don't have reservoir analysis to date. We've been very secretive as to the downhole information that we have. If we go into a reservoir analysis, we're going to have to publish a lot of information that is considered proprietary by us, and we don't want to share with any potential competitors out there. When we get the completion rig in three weeks or four weeks, we'll be putting out numbers.

We can probably give some rough numbers. We think we have sufficient product to go into production, with wells and we expect they'll have a 20-year life, as far as helium production goes. We'll look to probably drill another six or seven wells this year and just keep adding on to the production. The helium market is currently in an interesting stage, as a result of a Russian facility that started on fire and blew up. That facility was supposed to supply up to 25% of global needs. That is now off the market for the foreseeable future.

The BLM facility down in the U.S. that supplies about 25% of the domestic supply for the U.S. is down, and it'll be down for an undisclosed period of time, it's a 70-year-old plant. There have been issues in Algeria, and issues in Qatar, so the helium market is now in a critical shortage. The industry talk is that the price of crude helium now is trading at around $1,000 an MCF, six weeks ago, it was about $300 an MCF. And that's crude helium, which is 90% to 95% pure helium.

When you start taking a look at 99.9999% helium, you're looking at well in excess of $2,000 an MCF. We're in the right place at the right time and the sooner we can get to production, the better it will be for us. Supplying a domestic helium product to the U.S. industry, specifically in Arizona, we’re within 300 miles of the end users, in the state of Arizona.

Dr. Allen Alper:

That's great. Could you tell our readers/investors a little bit more about the uses of helium, why it's so important, and where it comes from and what's happening?

Don Mosher:

Helium is created in the earth's crust, it’s degradation of Uranium 238 and thorium. Both helium and hydrogen are the two lightest elements in the periodic table. As those molecules move up through the Earth's crust, if they're not trapped, they escape into the atmosphere and basically back into the universe. Helium is very abundant in the universe and it's very rare on planet Earth. The traps that we've discovered in northeastern Arizona are quite different from helium production everywhere else around the world, which mostly comes out of natural gas fields.

We're looking at drilling into structural highs, in crustal folds. These anticlines are surrounded by lower areas of structure called synclines. We really are focused on the anticlines. When you look at our property maps, they kind of look like checkerboards and the reason for that is, is we don't have any interest in owning the leases that are lower end structures.

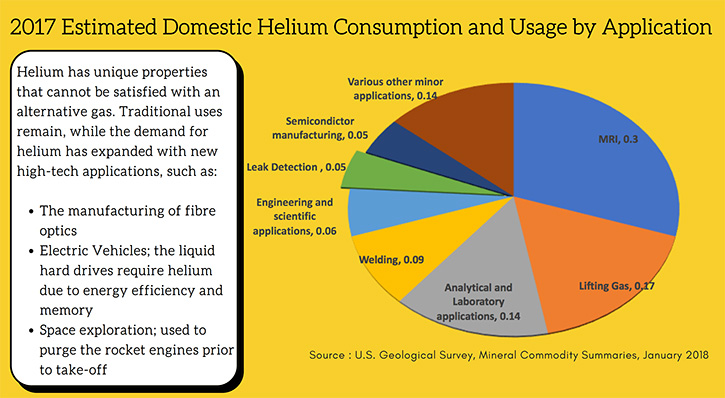

Helium uses continue to increase, traditionally lifting; gas, welding, deep sea diving and leak detection. The new applications are really as a coolant, as a majority of the use. MRIs use about 25% of the world's helium production. But all the large data centers that are now popping up to power the cloud-based technologies are all cooled with helium. In addition to that, liquid hard drives, manufacturing fiber optics. It's used for purging rocket engines before space launches those types of applications. An example of the space programs, when you purge a rocket engine and launch the rocket, of course, that helium is lost. There's no way to really recover it. It's a resource that continues to be depleted and it's difficult to find and trap.

Dr. Allen Alper:

Well, it's great. And you've been recognized for discovery and the work you've been doing. Could you mention that some of the recognition you've received?

Don Mosher:

The Canadian Business Magazine recognized this as North America's Top Helium Explorer. Some recognition for Rob Rohlfing, our Executive Chairman and CEO. Rob has spent a couple of decades studying helium traps, the geology, figuring out where to drill, and getting a thorough understanding of the helium industry and space in general. I think he's worth all the recognition that he's starting to get and I hope he continues to get more recognition. He was way ahead of the curve.

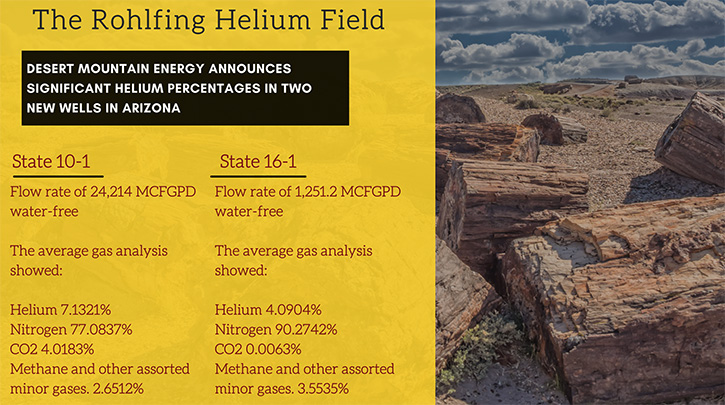

Our geological model is based on an old producer in northeastern Arizona called the Pinta Dome and it produced mid-60 through to the mid-0. It had helium percentages between six and 12%. Then I think as a result of low helium prices back in the mid-70s and 80s, even into the 90s, it was kind of forgotten about. Everybody just expected they'd get plenty of helium out of natural gas fields and nobody ever went out looking to explore for alternative sources of helium.

Rob has been studying this since 1998. Now helium is really coming into its own and now that the industry is in a critical shortage, we're quite happy that we can supply some domestic helium to U.S. high tech firms. Looking forward into Q3 is when we expect to start production.

Dr. Allen Alper:

That sounds excellent. My understanding is you've gotten some favorable court hearings lately, is that correct?

Don Mosher:

Yeah. Well, we drilled our third well in December of 2020. We were issued a temporary restraining order by the City of Flagstaff. Last week we got a favorable opinion out of the Appellant Court in Arizona, so that has pulled that temporary restraining order and we will be able to go back in there and finally test that well and look to develop that field as we move forward. The market reacted quite favorably to that court decision. We're currently trading around $3.20 Canadian.

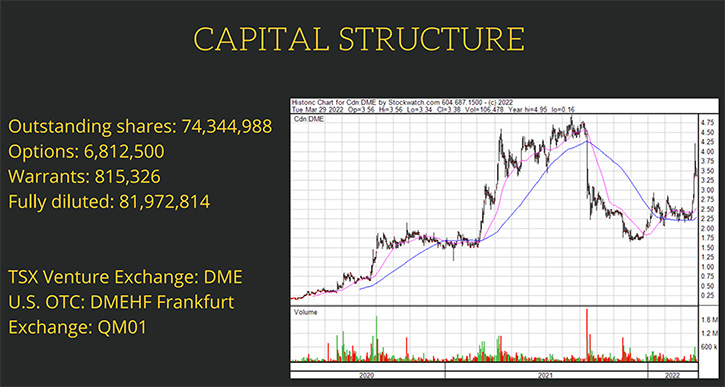

We've seen a lot of volatility in the stock, not day to day volatility, but I'm talking quarter to quarter order volatility. In 2021, we saw our price go as high as $4.95. Basically, on very little news, as I said, all we really did was build a team and drill one hole. But when we announced the news on, well, number four, the market reacted very negatively to what we thought was a very exciting discovery. We saw the stock drop all the way down during tax loss to a price of $1.65 Canadian. So, it's nice to see it build its way back up to $3.20.

Dr. Allen Alper:

That's very good. It's good to see that the market is recognizing what you're doing and the value of it. Could you tell us a little bit more about your capital structure?

Don Mosher:

Sure. Currently, we've got 74 million shares out since Rob and I took over management of the company in August of 2020. At that time, there were 55 million shares out, all issued at under 35 cents by previous management. We've only done one financing since we've taken over, and we did a $13 million unit financing in October of 2020. I had put a two-year $2 warrant on that unit and a $3.50 force trigger on it. When the stock traded north of $3.50 in March of 2021, we forced the warrants so that financing became a $29.3 million financing.

We've been fairly careful how we've spent it, we've still got over $18 million in the Treasury, and we believe that we will be able to get to production without having further dilution. Those 75 million shares are held by high-net-worth individuals, family offices and a very large retail shareholder base. We're really not an institutional play to date. We would like to move in that direction but for now we've got very, very loyal shareholders and I have to say thank you to all of them for their confidence in us.

Dr. Allen Alper:

Oh, that's excellent. And it's good to see management has skin in the game and will be rewarded.

Don Mosher:

Rob has for over 4 million shares himself, yes. And he's bought them. None of this is free stock that were handed out to management, at an early stage.

Dr. Allen Alper:

That's excellent. Could you tell us what are the primary reasons why our readers/investors should consider investing in Desert Mountain Energy Corp.?

Don Mosher:

I would think, if people have an interest in owning an investment in the helium space, we like to look at ourselves as a first mover in the space. We're looking to be a primary vertically integrated zero carbon helium producer. We've got markets that are very close to us. We're within four months of production, and at that point, we should be very, very profitable. I think when we do get to production, you'll see a different level of investor come into our market.

People that are looking for revenue from a growing situation. We've got a lot of blue sky left in the company. We're looking to have 60 to 70 producing wells, we're not just going to bring five wells online and stop there. We plan to drill probably at least seven more wells this year and obviously we can continue to fund everything through cash flow once we get production turned on.

Dr. Allen Alper:

That's excellent. Those are very compelling reasons for our readers/investors to consider investing in Desert Mountain Energy Corp. Don, is there anything else you'd like to add?

Don Mosher:

No, I think that pretty well covers it. I really can't think of anything else off the top of my head.

Dr. Allen Alper:

Okay.

https://www.desertmountainenergy.com/

Don Mosher, President & Director

(604) 617-5448

E-mail Don@desertmountainenergy.com

|

|