Len Kolff, Interim CEO of Atlantic Lithium Limited (AIM: ALL, OTC: ALLIF) (formerly "IronRidge Resources") Discusses Their Ewoyaa Project in Ghana. Ewoyaa is a Significant Lithium Pegmatite Discovery that is Funded to Production, Under an Agreement with Piedmont Lithium for US$102m. The Project is Set to Produce a Premium Lithium Concentrate.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/5/2022

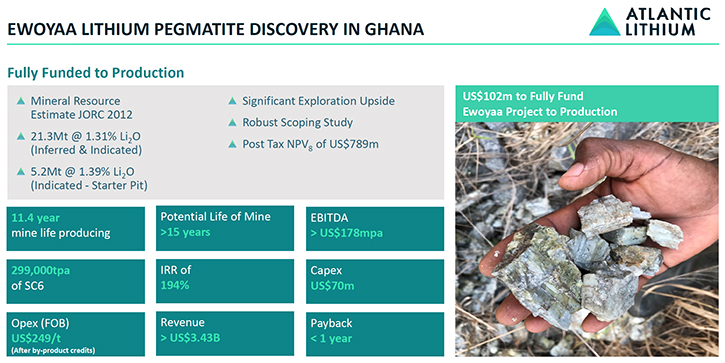

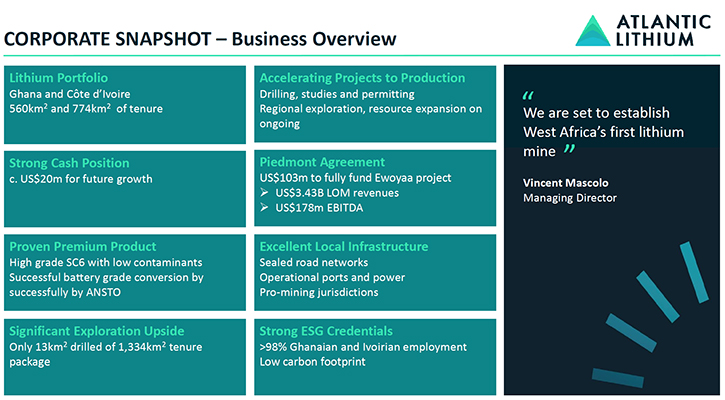

We spoke with Len Kolff, Interim CEO of Atlantic Lithium Limited (AIM: ALL, OTC: ALLIF) (formerly "IronRidge Resources"), a fully funded, African- focused lithium exploration and development company. The Company's flagship project, the Ewoyaa Project in Ghana is a significant lithium pegmatite discovery and is on track to become one of West Africa's first lithium producing mines. The project is funded to production, under an agreement with Piedmont Lithium for US$102m and is set to produce a premium lithium product. A robust updated Scoping Study indicates life of mine revenues exceeding US$3.4bn. Atlantic Lithium holds a total of 1,334km²; including 560km2 & 774km2 tenure across Ghana and Côte d'Ivoire respectively. Tenure comprises significantly under-explored, highly prospective licenses. Atlantic Lithium's main goal is to deliver the PFS study, during Q3 this year, and to continue advancing the project towards production.

Atlantic Lithium Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Len Kolff who is Interim CEO of Atlantic Lithium. Len, could you give our readers/investors an overview of your Company and what differentiates it from others?

Len Kolff: Atlantic Lithium Ltd is listed on the London Alternative Exchange. We've made the first hard rock pegmatite discovery in Ghana. It's a very unique deposit geologically and is exceptionally well located to operational infrastructure. Those two things combined really help drive down our CAPEX and OPEX to make us stand proud among our peers. We're on an exciting journey now, to deliver our studies and forge the project ahead towards production.

Dr. Allen Alper:

That sounds excellent. Could you tell us a little bit more about your lithium resources?

Len Kolff:

Early this year we announced a resource upgrade, which was the culmination of almost a year of continuous drilling. The Teams in Ghana worked exceptionally well, to complete approximately 37,500 meters of additional drilling. As the assay results were received, it was in early Q1, this year, that we put out our resource upgrade of 30.1 million tons at 1.26% lithium oxide. This was a 42% increase over the last resource.

Not only did we grow the resource by 42%, but we also increased our conversion from inferred to indicated, from 5 million tons to 20.5 million tons. Doing the infill and extensional drilling wasn't at the detriment of the grade, so it really gives us confidence in the continuity of mineralization and grade, which was a real plus for the project.

Dr. Allen Alper:

Well, that's fantastic. Could you tell our readers/investors your primary goals for 2022?

Len Kolff:

Our main goal is to deliver our PFS study, during Q3 this year. On the back of that, further studies and permitting will be the focus, with submission of mining license application, and advancing our EPA permit. We've recommenced drilling on site, with one rig active, drilling new targets, to further grow the resource and to convert more of the resource from inferred to indicated. Going forward, the rig will be used for studies, with geotechnical and hydrological drilling. Although we will continue, with our current resource for the PFS, we will also see a further resource upgrade this year.

Dr. Allen Alper:

Well, that sounds excellent. Could you tell our readers/investors a little bit about the arrangement you have with Piedmont Lithium and a little bit about Piedmont Lithium itself?

Len Kolff:

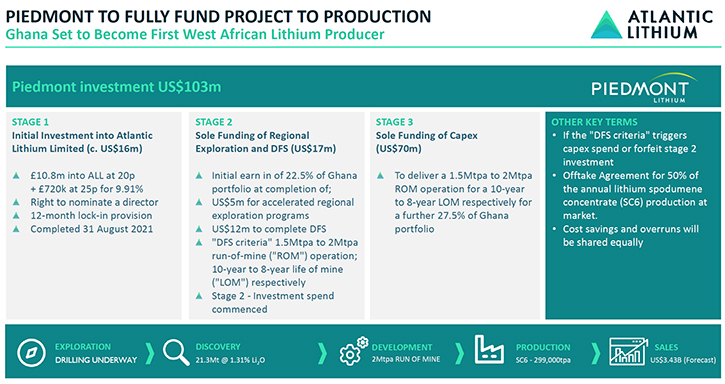

Piedmont Lithium joined us through the last downturn in the lithium market. During the downturn, we attracted Piedmont Lithium, who shared our vision, and they spent a week on site, with us, in Ghana and were happy with what they saw on the ground. Piedmont invested in the project and Company and will fund, through studies, to production. They will cover the cost of our studies and the CAPEX to build the plant to production. Doing that, they'll earn 50% at the project level, and hold just under 10% of the Company. They also have rights to 50% of the offtake at market rates.

Dr. Allen Alper:

That sounds excellent. It’s good to have such strong support.

Len Kolff:

Their deposit has a lot of similarities to Ewoyaa. That was really apparent, during our site visits and discussions between our Teams. The key to unlocking the value of pegmatites is understanding the mineralogy. Piedmont’s learnings helped us unlock value in our deposit. In the past, these continents were joined, before the opening of the Atlantic Ocean. There are geological similarities there and we're learning, on both sides of the Ocean, to help unlock value. There are strong historical ties between the US and Ghana, which are still strong to this day. So, I think it's a win-win relationship.

Dr. Allen Alper:

Well, that's excellent. Could you tell us a little bit more about what your financial studies show? I think your IRR was 194%. Can you give us some more detail about that?

Len Kolff:

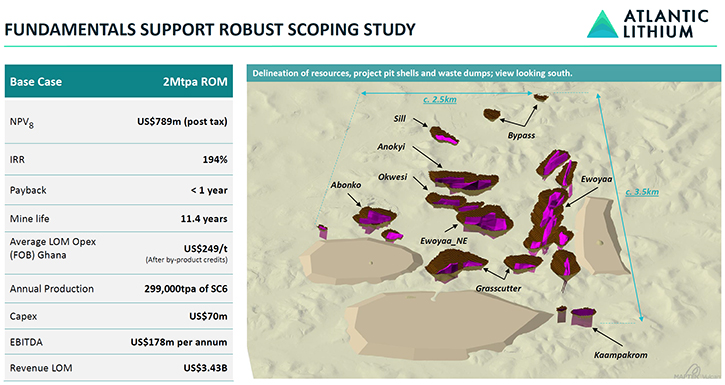

The last project financials we put out were an updated scoping study that was done on the previous resource of 21.3 million tons. We've now increased that resource by 42% to 30.1 million tons. These financials are based on a much smaller resource. We used a long-term price forecast of $900 a ton for SC6 spodumene concentrate. Now, when you look at current spot prices of up to $5,000/t and average pricings around $2,000, you can see that the spodumene pricing, we used for the study, was very conservative. Going into the PFS, we will look to revise that more in line with current long-term pricing.

On the basis of a smaller resource and a conservative spodumene price, we are looking at a two million ton, per annum, run of mine rate, and an 11-year mine life. We see payback, in less than a year, for the $70 million CAPEX estimate, done at the time. The estimated life of mine revenue would be 3.4 billion US and internal rate of returns of 194%. So, you can see some really strong economics to the project that's driven by strong fundamentals: simple mineralogy and proximity to infrastructure.

Coming into the next round of studies, with the increase in the resource and a revised spodumene pricing, we expect to see significantly improved numbers here. I think it’s important for readers to note that over the last six months alone, inflation has hit hard; especially in Ghana. The prices of diesel and steel have risen significantly. So that may have some impact on CapEx, but the project can carry that.

Dr. Allen Alper:

That's excellent. Could you tell our readers/investors, a little bit about the metallurgy of your project?

Len Kolff:

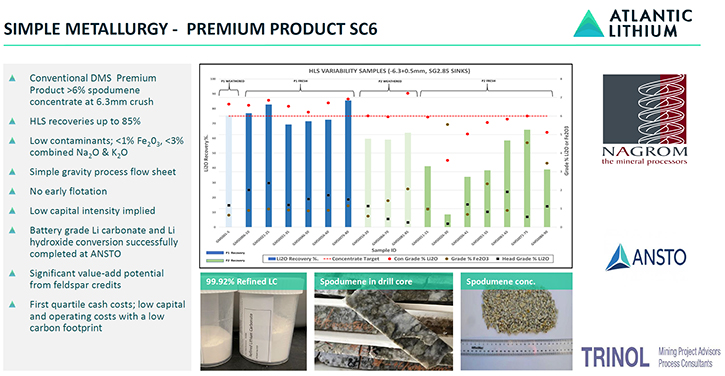

What's critical, in the understanding of lithium hard rock pegmatites, is your mineralogy. The simpler the mineralogy, the better it is for processing the beneficiation. That being how you separate and concentrate the spodumene out of the pegmatite rock mass. There are several minerals that can host lithium and the most favorable of those is spodumene. So, the more spodumene credits you have, in the pegmatite, the more coarse grained it is, the better for your process flow sheet. Our project has both; it is predominantly spodumene and it is coarse grained, making processing much simpler and cheaper.

In our case our deposit is exceptionally clean or mono mineral. It's just spodumene, quartz and feldspar, with a minor amount of mica. The lion's share of lithium credits are from spodumene. It means that we're easily able to concentrate our spodumene, through a conventional gravity process, flow sheet. It's a simple process that is used to beneficiate the spodumene and we don't need to do flotation, which means low CapEx and low OPPEX.

Dr. Allen Alper:

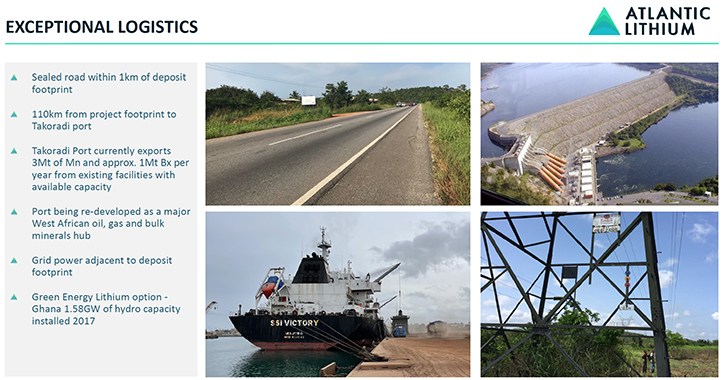

That's excellent! Could you tell us a little bit about the exceptional logistics of your project?

Len Kolff:

I think there are few projects globally, that have a logistics footprint, similar to what we have. There are a couple, but not many. We are, literally, within one kilometer of the national highway, which is a bitumen-sealed road, from the deposit, 110 kilometers to the operating port of Takoradi. Takoradi is a large bulk mineral handling terminal. They currently export in excess of 4 million tons per annum, of manganese and bauxite and have excess capacity. So, ideal for us to truck our concentrate to the port, along existing infrastructure, and load onto ships, with the new port facilities built at Takoradi.

In addition to that, we have grid power that runs adjacent to the project. That grid is fed by hydro power from the Akosombo Dam, as well as two solar plants close to the project. So very low energy costs from the grid and its green energy is primarily through hydro and solar. It’s hard to improve your carbon footprint in that regard tapping into the grid.

Dr. Allen Alper:

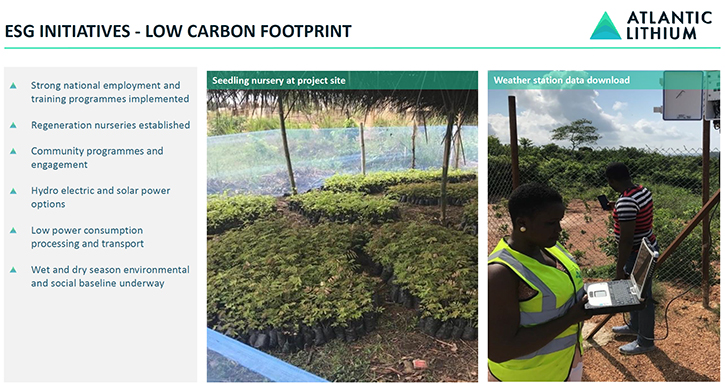

Well, that's excellent. Could you tell us about your ESG initiatives?

Len Kolff:

I'm an Exploration Geologist and Project Developer having worked 80% of my career in Africa and predominantly West Africa. It's paramount to understand that we are guests in the countries, where we operate, and that we must treat our hosts with respect and dignity – as you would anywhere. That’s really the founding principle of how we operate in Ghana and everywhere in Africa. It's about building relationships of integrity, trust, and rapport, within our host communities.

To do that, we employ as many as we can locally and where we can't employ, we train. In the case of Ghana, it has a very long mining history, with multiple universities that teach all aspects of the mining life cycle; you can easily find skilled staff. A large portion of our staff comes from the community where we operate. You actually have Team Members that have a vested interest to see this project come to fruition, and they're living in the communities around the project, going home every night.

Recruiting, training and empowering, through education and skills, in our local community, is our number one priority. We have nurseries that we manage in the community to regenerate and replant drill sites and access around our project footprint. There's a lot of small-scale subsistence farming, so we manage surface water runoff and erosion through regeneration. It also creates jobs and more sustainable practices, and we also support initiatives in the community.

We help joint community projects, such as the building of market halls or other community buildings, as well as financial support to the local hospitals for medical equipment. These are examples of our ESG practices, in terms of how we interact with the community directly and leave a more sustainable footprint.

From the project point of view, our biggest ESG initiative is our small carbon footprint. The plant has a low power consumption that comes from hydro and solar predominantly. It's a short trucking distance to the port, meaning lower carbon emissions.

Dr. Allen Alper:

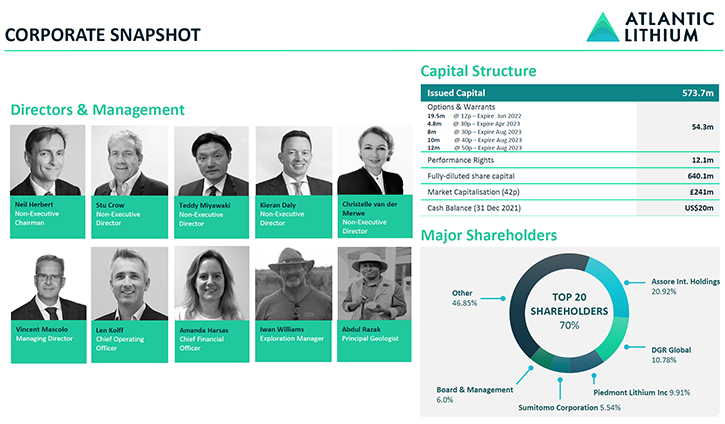

That sounds excellent. It's great to see a Company so responsible, with the community and the environment. Len, could you tell our readers/investors a little bit more about your Directors and Management Team?

Len Kolff:

Very sadly, Vincent Mascolo the Founding Director of Atlantic Lithium and our previous CEO passed away suddenly. His passion and energy will be sorely missed, but we're charging ahead to realize his vision and legacy, with the project. The current Board has significant mining and corporate experience in Africa and elsewhere globally.

We have Board representation from our major shareholder, Assore International Holdings, who are a private family-owned business. They operate iron ore, manganese and ferrochrome mines, throughout South Africa and have a long history of development and mine production, and plant builds. They're very supportive and have been with us since Vincent founded the Company.

Operationally, on the ground, our key Management Team is Iwan Williams and Abdul Razak Shaibu Ballah. They're really the driving force behind field activities and having successfully completed a 37,500-meter drilling program last year. We have continued to work throughout the COVID pandemic, with minimal delays. We have a very strong Operational Team, who are now pushing ahead with ongoing drilling and studies.

Dr. Allen Alper:

That’s excellent! You have a very strong, diversified, experienced and successful Board. Len, could you tell our readers/investors a bit about your capital structure and share structure?

Len Kolff:

We have a fully diluted share capital of just over 640 million shares, with current market capitalization of roughly $395 million US. The cash balance as of 31st December was $20 million US and funded through the agreement with Piedmont. So, a strong balance sheet and capital structure with supportive shareholders.

Dr. Allen Alper:

That’s excellent! Could you tell our readers/investors the primary reasons for them to consider investing in Atlantic Lithium?

Len Kolff:

The main reasons to invest in Atlantic Lithium are that we have a unique deposit that is simple to process, with a low CapEx and low OPPEX to deliver a premium spodumene concentrate to market, in a potentially short timeframe. The deposit is adjacent to the National Highway and within easy trucking distance of the port; all within the mining friendly jurisdiction of Ghana, with a long mining history.

We have a supportive government that wants to see its mining register diversified. Currently Ghana is predominantly a gold destination, with some bauxite and manganese, but now we have a lithium discovery in Ghana. Those are the key points.

It's a fantastic opportunity to invest, at these levels. We see huge upside, not only with our current resource footprint, but the potential to grow it. We've only drilled 13 square kilometers of a 560 square kilometer portfolio and we're drilling currently to grow the resource further and de-risk it. We see significant upside in growing this resource further, within that broader portfolio, where exploration is really starting to kick off now. There's a lot of latent value there that would certainly appeal to investors, coming into this story now.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Atlantic Lithium. Len, is there anything else you would like to add?

Len Kolff:

I feel we have covered the key topics. We're very focused on delivering our studies and pushing to the next stage of permitting. We see significant upside in resource potential, notwithstanding the economics of the study; especially with the increased resource tonnage and pricing that we're seeing, in the spodumene market now. We have a supportive Board and shareholder base, to see this project advance on an aggressive timeline and with a supportive government.

Dr. Allen Alper:

Well, there's no doubt that you have an outstanding Company. It's an excellent opportunity for readers/investors to consider.

https://www.atlanticlithium.com.au/

For any further information, please contact:

Atlantic Lithium Limited

Neil Herbert (Chairperson)

Amanda Harsas (Finance Director and Company Secretary)

Len Kolff (Interim CEO - COO)

Tel: +61 2 8072 0640

atlantic@yellowjerseypr.com

info@atlanticlithium.com.au

|

|