Simon Delander, VP of Sustainability, Federation Mining, Discusses development of Snowy River Gold Project in New Zealand with OceanaGold Support

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 5/4/2022

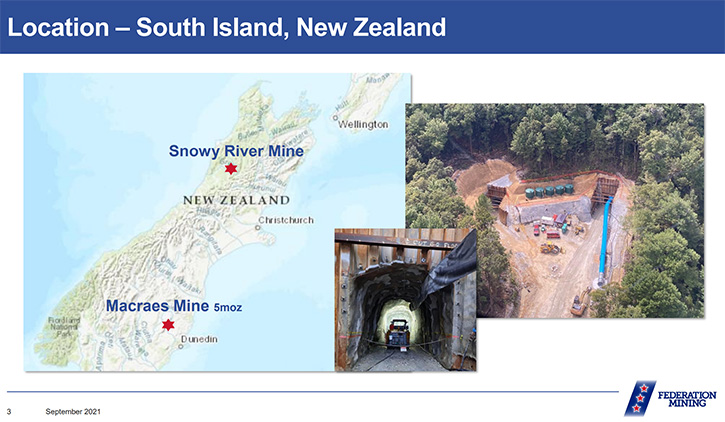

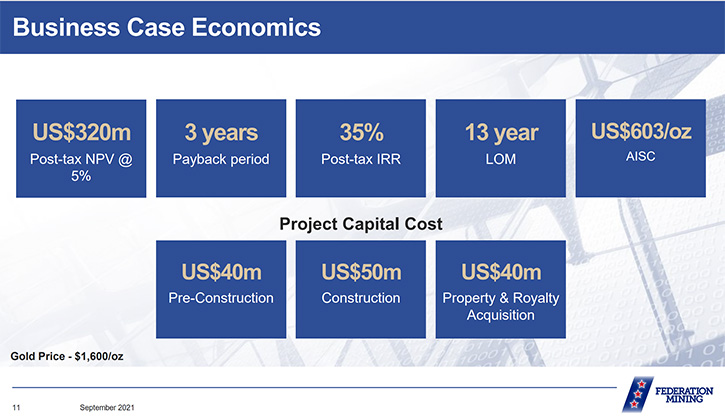

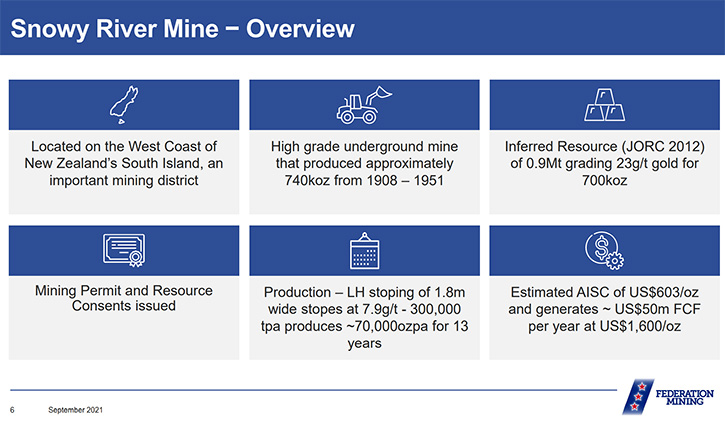

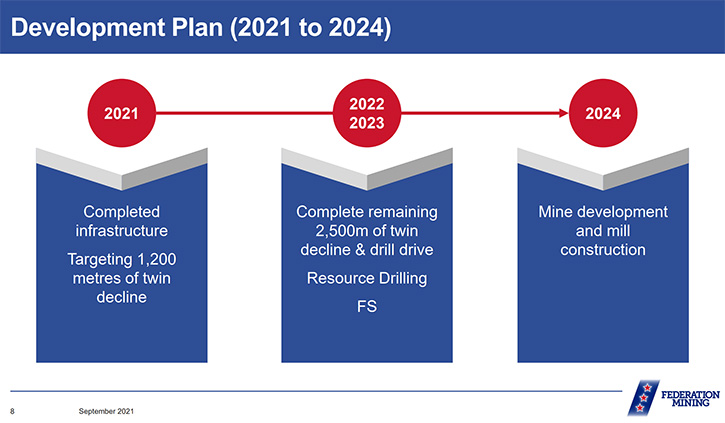

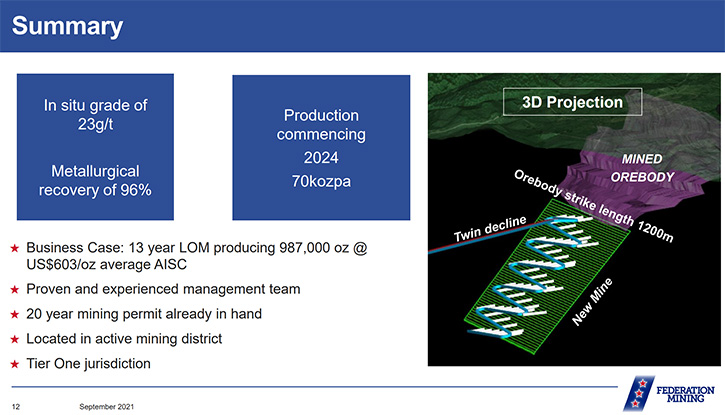

We spoke with Simon Delander, who is Vice President of Sustainability for Federation Mining, an Australian incorporated company, established by experienced Australian underground mining engineers Mark Le Messurier & Jim Askew, with the purpose of building a new gold/copper mining company. Federation Mining has signed an Agreement, with leading gold miner OceanaGold, for the future development of Snowy River Gold Project, located near Ikamatua, on the West Coast of the South Island of New Zealand. OceanaGold supported the project’s establishment, with seed financing for the construction of a decline (tunnel) to the base of the historic workings. According to Mr. Delander, the plan is to conduct a comprehensive drilling and metallurgical testing program, then fast track building the plant and commence production in mid-2024, producing about 70,000 ounces of gold per year, over 10 years. The Company is currently privately held with potential for IPO in the future.

The Snowy River Gold Mine project

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Simon Delander, who is Vice President of Sustainability for Federation Mining. Simon, I wonder if you could start off giving us an overview of your Company and what differentiates it from others?

Simon Delander:

We're a private company, we are set up with investors Australian Super, one of the largest superannuation firms in Australia, and we have a loan from Crown Holdings, a fund administrated by the New Zealand national government. Both of those parties are our principal investors. We're developing the Snowy River Gold mine, on the South Island of New Zealand. At the moment, our primary focus is developing a twin decline, we're about halfway through that process, now reaching over 3400 metres, so far. This time next year, it'll end up being about seven kilometers worth of declines.

We'll set up some drill platforms and then we are intending to spend about six months, drilling 30 kilometers of diamond drill holes. The intent is that we would then finalize our studies and our metallurgical test work with a view that we would build a plant in the early stages of 2024 and move into production late 2024. Our view is that the ore body there would produce about 70,000 ounces of gold per year over 10 years, we're hopeful the mine life is a little bit longer than that.

The plant, we're looking to put in, is a 300,000 ton per year plant, and it's a very compact plant. We're currently doing environmental and technical work to understand the permit arrangements, necessary for having that processing on site. Originally, this particular asset was going to be managed and run by OceanaGold, but they gave us the opportunity to develop the declines and we have an option to buy the asset, at the end of that feasibility period. Once we've completed the drilling and all our test work, we can then buy the asset from OceanaGold and we could then build the plant and move forward.

Dr. Allen Alper:

Well, that sounds very good. Could you give us a little more detail on the Snowy River Project?

Simon Delander:

At the moment, we have 47 employees and contractors on site. The Snowy River mine is near State Highway 7. The nearest town is a small town, called Ikamatua, and the nearest larger town is Reefton. The mine is on the West Coast, in a historical mining area of New Zealand. Our staff has largely been recruited locally. They live on the South Island. There are a couple that travel from further afield, on the South Island to come up and spend their seven days on, and then go home for their seven days off. But predominantly, about 75% of the workforce lives on the West Coast, so they're locals. We've been fortunate enough to recruit a good workforce, from the local area. We have jumbo operators, loader operators, truck drivers, charge-up crews, supported by specialists such as technical support, mining engineers, and health and safety professionals. And we have a number of geologists and other technical support folks on site.

Dr. Allen Alper:

That’s very good. Could you tell our readers/investors a little bit about your background, the Management Team and the Board?

Simon Delander:

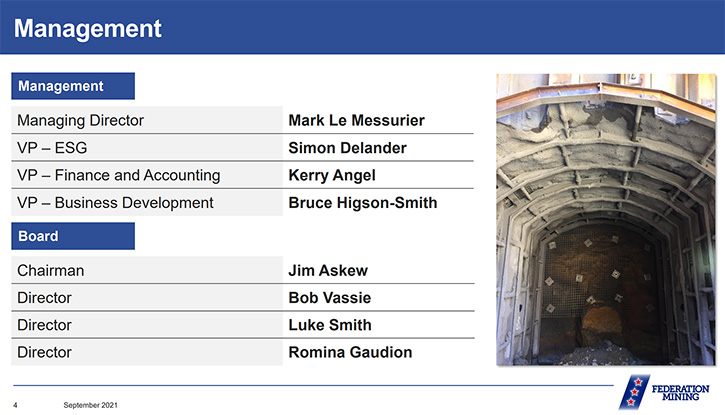

Our structure is set up similar to an ASX listed Company. We have a Board; we have two members of the Australian Super organization, as Directors. We have our Managing Director, Mark Le Messurier and we have Jim Askew, as our Chairman. We also have an independent Director, Bob Vassie, who’s very well known in the industry. We have a really good Board, who provides guidance to the Executive and Management Team. The Board meets regularly. We have subcommittees, as you would in an ASX listed Company.

We have a Risk and Sustainability Committee; we have an Audit Committee, and the Board operates in a similar fashion to any large company. In terms of the Executive Team, it's a small Executive Team. Mark Le Messurier is the Managing Director, he's formerly of Evolution Mining, where he spent a number of years as the COO. He built the Company’s operation up, with Jake Klein, from quite a small Company, with a handful of assets, to a very large Company, to what it is today, a $5 billion Company.

I work in the Company, as the Vice President, responsible for sustainability and also heavily involved in permitting, government relations and business support. My background is with Evolution Mining. I was their Corporate General Manager, for sustainability, for about eight years. I was involved in health, safety, environment, government relations, permitting and operations support. Prior to Evolution, I worked for an engineering firm called Jacobs Engineering, building mines, and delivering projects around the world. I also spent time with Minerals and Metals Group, MMG, and Gold Corp. prior to that.

Our CFO, Kerry Angel, joined us about a year ago. She has extensive experience, in finance and working as CFO and in high level financial functions. She works in our Sydney office, as well. She has a number of people working with her, on the finance side, and we have a Vice President of Business Development, Bruce Higson-Smith. He's actually based in Denver, in the US, and he's working closely, with Mark and our Board on business development opportunities, be that merger acquisitions or things that might make sense to join forces with us and moving forward and growing the Company.

We have a goal of growing the Company over the next five years. The Board and the Executive Team put together a strategic plan, which talked about some of the jurisdictions we're interested in, the types of projects we'd be interested in joining with Snowy. Obviously, our primary focus, right now, is delivery of the Snowy River mine, but we're also looking to grow the Company.

At the moment, were remaining private. Australian Super has been a really great investor and supporter of us. It is great to have the New Zealand government supporting the project, through Crown Holdings, which is a loan system they have, so we'll pay that back over time. We're working closely with the national government and have good working relationships with the regional councils and the local councils, who administer a lot of the mining related permits in New Zealand.

Dr. Allen Alper:

Oh, you have a very strong, diversified Team! That's excellent! Simon, could you tell us a little bit about ESG philosophy and plans?

Simon Delander:

We're in a unique position, in the South Island. Almost all the power in New Zealand is hydro, so very low carbon intensity. We see that as a strength. For our production fleet, we're looking at electric rather than diesel models. So, we want to be running electric trucks, or certainly a hybrid fleet model as a minimum.

We've been working with Epiroc, our OEM for our development fleet. They provide our loaders and our jumbos. We're looking at what they're doing in Australia and abroad trialing electric loaders.

We're looking to set ourselves up to be carbon neutral. There are Government expectations, in New Zealand, of achieving that by 2050. We think we can do that before, and we've been actively working around carbon offset arrangements. We've looked into a number of different projects, and we've been talking with stakeholder groups about potential opportunities, be it some type of forestry investment or forestry offsets, to couple with our electrification and already low carbon footprint.

We actually track our carbon, at the moment. We reported that foot print, in our first sustainability report last year, we'll continue to do that. Also, we're looking for ways to reduce our carbon footprint, as we go forward. We think we're well placed to be in the much lower end of a carbon generation intensity operation, around the world. We're working really hard to understand what our carbon footprint looks like and know how we would offset that and know how to absolutely minimize the carbon emissions from our operations.

Dr. Allen Alper:

That sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Federation Mining?

Simon Delander:

When the time comes that we look to list, the opportunity would be the Snowy River mine, which has a long life. At the moment we believe that it's 10 years, we think it's potentially more than that. That operation would be delivering 70,000 ounces a year, over that period, at a low unit cost, delivering high margins.

We have very strong ESG credentials, operating in developed and safe jurisdictions. Our focus would be delivering to our community as well. So, we want to be a positive partner, in that community. We would be a significant employer, in the West Coast, and we’d be looking to have over 100 staff, when we move into full production.

We like to support our local community, not just through staff, but also community groups, and we’re looking for opportunities, with our regional councils and governments, to support things like health and education, and some of the other environmental projects they have.

We think we have a unique offering in terms of a long life, low cost, low emissions assets, which will ultimately be coupled with other assets, over time, where people can look at that and say, this Company has strong ESG programs in place, they have local employment, they're looking for opportunities to partner with the community.

We're seeking to understand how we can leave a lasting legacy, with that local community and the Greater West Coast. So, we're already talking to Government, we're already engaging, with the local community, seeking to understand how we can do things right. We're hopeful that we will be seen in that way by stakeholders.

We're seeing some good support from our local and regional communities and also some good interest in Australia, in terms of what's going on in the Snowy River, in terms of an owner, operator, workforce, good local employment, building up the Team, where we increase our bench strength, by training internally, giving people opportunities to develop and grow.

The business will be large enough, when we're in full operation, to allow our people to ultimately spend a career with us. A number of our staff have been with us for well over 12 months and potentially looking at another 13 years, by the time they move into full production with us. So that's a fairly significant tenure to offer for most mines. Once we do additional drilling and we actually get down to that ore body, we're hopeful it's much longer than that and we'll be working really hard to understand the geology.

We have a strong Geology Team, led by Don Maclean and we look for opportunities to extend that ore body and extend our presence in New Zealand. We're looking to be there for the long term, we're not looking to sell that asset. That's our cornerstone asset, so we hope to be on the West Coast for a very long time and seen as a good community partner and hopefully a showcase, in terms of what can be done, ESG and community wise.

Dr. Allen Alper:

Well, that's excellent. Now, do you plan to stay private or at some point to go on the Stock Exchange?

Simon Delander:

At some point we would likely list on the ASX, there isn't an active date, set at the moment to do that. We're currently private, that's working right now. We have another year of development to do. Then we're going to have the drill rigs firing up and starting that drilling program. It'll come down to the right time and the Board's been discussing that for a little while. I think that will happen in the future, that could be a year or two away or even longer. But it's certainly our view that we remain private for a period of time, and until such time, due to acquisitions or some type of business development activity, where we need to go to the ASX or another stock exchange and seek to raise funds.

Dr. Allen Alper:

Well, that sounds very good. Is there anything else you’d like to add, Simon?

Simon Delander:

No, I think this has been a great opportunity. Really appreciate the chance to talk to you a little bit about what we're doing and happy to provide any further information on anything that you might want from us. I spoke earlier, about the processing plant. We are actively working on the permit, to allow processing on site. We have a mining permit that allows us to mine, for the full life of the mine. The previous mine plan around processing was that ore would be trucked to an Oceana facility and processed offsite. Our view is we can do that on site. So, we're seeking to get the approval from the Regional Council, who is the authority, over here, on these matters, to allow on site processing, which would mean more jobs and more opportunity for the community also.

Dr. Allen Alper:

It sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.federationmining.com.au/

Federation Mining

Simon Delander

+61 8330 6785

info@federationmining.com.au

|

|