Brett Matich, CEO and President, Max Resources Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2) Discusses Advancing the District-Scale Cesar Copper-Silver Project, with Support of Endeavor Silver, along the Colombian Portion of the World’s Largest-Producing Andean Copper Belt

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/29/2022

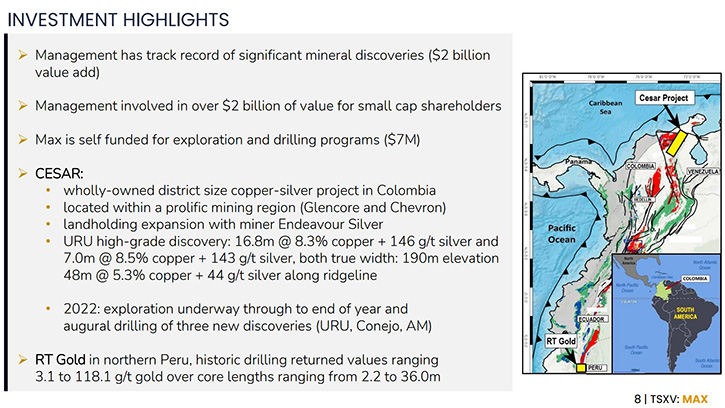

We spoke with Brett Matich, CEO and President of Max Resources Corp. (TSX.V: MAX; OTC: MXROF; Frankfurt: M1D2), a mineral exploration company, advancing the newly discovered, district-scale Cesar copper-silver project. The wholly owned Cesar project sits along the Colombian portion of the world’s largest producing Andean copper belt, with world class infrastructure and the presence of global majors, such as Glencore and Chevron. Plans for 2022 include exploration at the Company’s high-grade, AM, Conejo, and Uru discoveries. In addition, Max controls the high-grade RT Gold project (100% earn-in) in Peru, encompassing a bulk tonnage, primary gold porphyry zone, and 3-km to the NW, a gold bearing massive Sulphide zone.

Max Resources Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Brett Matich, CEO and President of Max Resources. Brett, I wonder if you could give our readers/investors an overview of your Company, what differentiates it from others and update them on what’s been happening with your Company.

Brett Matich: Max Resource is listed on the Toronto Venture Exchange. We recently changed our ticker, so our ticker is now TSXV:MAX. We have two projects. Our focus project is called, Cesar Copper Silver Project, in Colombia. It is a project we are focusing on, that covers a significant portion of the Cesar Basin. It’s in northeast Colombia. It has a basin style geography and topography, so you don’t have the dense forestry and high elevations that you normally have in South America.

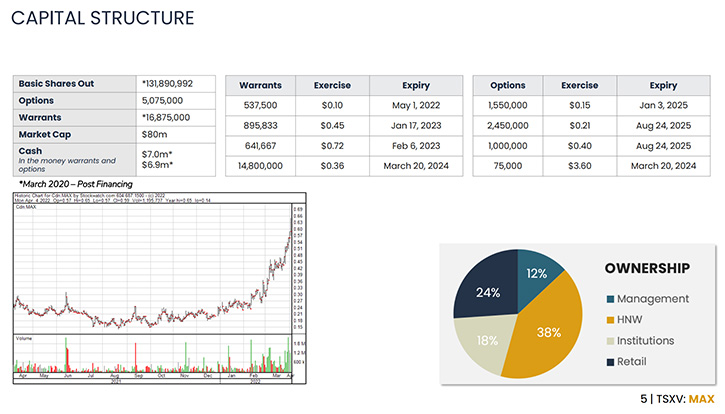

From the corporation side, Max has 132 million shares on issue. Currently it has $7 million in cash, so it’s cashed up, in relation to the drilling and work that we’re going to be doing, over the next 12 months. We also have $7 million in options and warrants that are in the money. We’re in a very great, cashed up position. If we go back to the Cesar Project, it’s also in the northeast of Colombia, which is very important, in that it’s a prolific mining district. It’s a prolific coal mining district and oil and gas district. It also has one of the largest open pits, in the world, which is owned by Glencore. This is very significant because in Colombia there’s no open pit mining, unless it’s in a region that already has open pit mining. So that’s significant.

It's also in a region where thermal coal for government is pushing for copper exploration here, knowing that with the larger companies, on what they’re doing and getting out of thermal coal, the region depends on royalties from mining. There’s established infrastructure from the coal mining, there are railway lines, there are shipping ports, there are hydro dams, everything you need from a bulk mining operation.

We are based in a town called Valledupar, it’s an hour and half domestic flight from the capital city Bogota. It is a direct six-hour flight from Toronto, Canada.

From an exploration side, it’s excellent. And more importantly, it’s an area that has mining and where you know you can mine.

There are a lot of places in the world that have all the right geology, but there’s no point for a junior company doing exploration in an area where you’re never going to be able to mine.

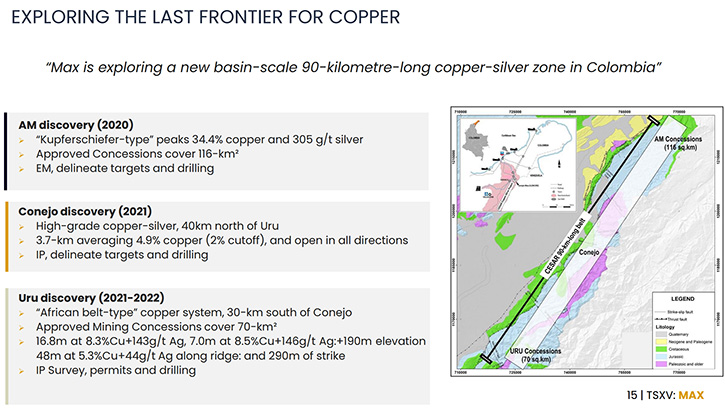

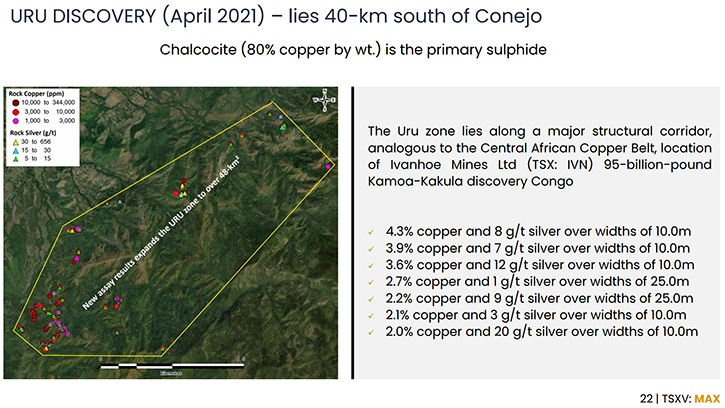

We’ve progressed now. We’ve been in this Cesar Project, the copper and silver belt, since 2020. We are now reaching a different stage in 2021 and 2022. We initially had the Kupferschiefer-style discovery in 2020. We’ve now moved 40 kilometers and 80 kilometers south, where we’ve discovered lower in the system, it seems to be more similar to the African belt, which we are focusing on, simply because of the tonnage.

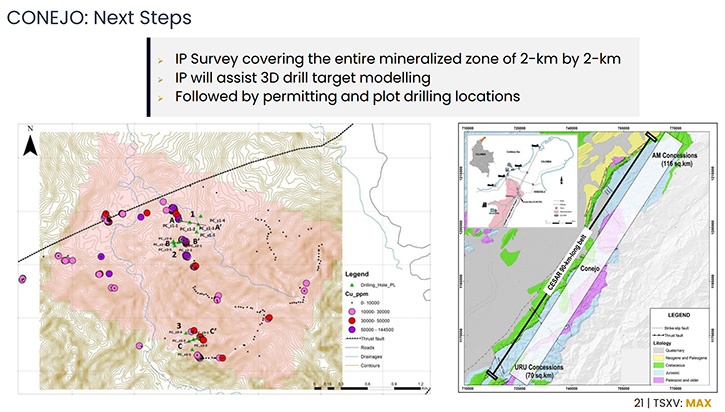

We have two main prospects we plan to drill. One is called Conejo, it’s quite a large volumetric drilling target. It has exceptional grades, where we have over 3.7 kilometers of strike. Their copper grade is averaging as high as 5% in outcrops, which is extremely high. We are looking at drilling, as early as June this year. In between drilling, there’s drill permitting, but there’s also, quite importantly, some preparation work. We’re going to be conducting an IP survey, which takes two months.

Then we go down south to Uru, which is our second drill target. This system is more vertical, so we trace the system vertically up topography, for 300 meters. We believe it’s going to continue at depth. We’re just finishing some assays there, so we’ll have the results of what we call Uru, the priority area, where we plan early drilling. We’ll be doing IP surveys prior to drilling of Uru, in June.

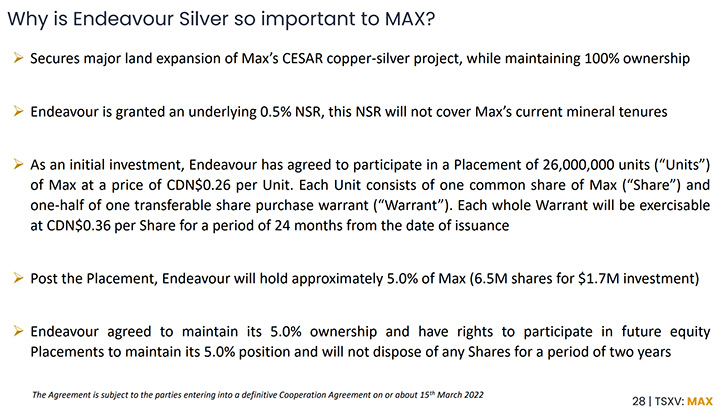

The interest that happened in Max, in 2022, was the catalyst of having mining concessions approved in 2021. Max had more mining concessions approved than any other Company in Colombia. The next part is having a pathway to drilling. We recently did our financing at 26 cents. Endeavour Silver came in as a partner, and we had a number of institutions that made up the total, raising of 7.7 million, we did that at 26 cents, I think we’re trading around 60 cents now.

There were a lot of institutions that missed out on that placement and we’re getting an amazing amount of interest. What’s so important about Endeavour Silver? The importance of Endeavour Silver is that we have a significant land position, and that land position is around 700 square kilometers. What we want to do is to tie up a much larger portion of the Cesar Basin, but we need a partner, with a strong balance sheet, to be able to do the requirements of having financial capabilities, to be able to have a large land area. That’s where Endeavour came in.

We utilize their balance sheet, which expands our financial capabilities significantly. I think Endeavour has a market cap of nearly a billion dollars and also expertise in mining. In the alliance, they provide that, and they also provide some technical assistance, where required, and all this staking, or the land consolidation that happens from March 18, of this year, Endeavour will have a one half per cent NSR. A one half per cent NSR is not going to block any type of joint ventures that we may see moving forward, remembering that we are targeting a very large portion of the basin. A joint venture would only be on one particular deposit, but we’re not looking at joint ventures now. We see that the added value for shareholders is to move forward and continue, with exploration and drilling, over the next 12 months.

Dr. Allen Alper:

That sounds excellent. It sounds like you’ve made great progress, since we last talked. And this agreement you have, with Endeavour, so far, is really a very strategic agreement and I think will be very helpful moving your Company forward. Brett, could you tell us about your primary goals for 2022?

Brett Matich:

The primary goal for 2022 is to drill specifically, what we call, Conejo and Uru. Then from drilling those two prospects, we see the mineralization continuing for some kilometers, on both prospects. Following drilling, we then will trace the mineralization of the drill prospects to expand the footprint of the mineralization. To give an example, where we’re looking at the year, through prospect initial drilling, will be on an area of roughly one kilometer by one kilometer, and then from there, we will expand it. We look at expanding it, for a number of kilometers, to show the size of these prospects, but also to expand and demonstrate the footprint of the basin. Each prospect that we are drilling, would be a project for a junior company! Each single one! That’s where we’re looking at the whole basin. It’s nearly like having control of a huge, mineralized greenstone belt, for example.

Dr. Allen Alper:

That’s fantastic. Copper and silver are really great products! And the use of copper and demand is growing. The price is very strong for electric

vehicles. Maybe you could say a few words about that.

Brett Matich:

If we look at copper, as a base metal, copper is the metal most in demand. In electric vehicles, there's more copper than any other metal. An electric vehicle takes three times the amount of copper as a normal combustion vehicle does. Anything in relation to infrastructure, whether it's motors in windmills, whether it's the conductors that are needed in solar heaters, whether it's building the infrastructure in relation to charging stations for electric cars, everything relates to copper.

The last super cycle for metals, and we'll talk about copper, was back in the 2000s. I think it was 2008. It reached a price of $10,800 a ton for copper. It was in that $10,000 range, not for a huge amount of time, you're talking something in the range of under 12 months. You look at the copper cycle at the moment, it's been in the range of the $10,000 dollar per ton range, for the last 12 months alone. So, we see this cycle as not only a super-cycle, but as a very sustained cycle.

You have different financial groups, predicting the copper price rate raising to $12,000 a ton in 2022 and going to $15,000 a ton in 2023. And think about how the highest previously, in the last cycle, was $10,800 a ton. You see the demand for copper. Copper is also in huge deficits. What COVID has done, it has restricted the copper mining in that there's a lot more in relation to COVID protocols infrastructure required, in relation.

You have a number of countries like Chile, the largest copper producer in the world, who have raised royalties. It is simply more expensive to mine copper. Large mining companies are not looking for small copper deposits, they're looking for large deposits. For a mining company to come into a country, to set up infrastructure for mining, it's a huge amount of infrastructure and it just doesn't make sense on small copper mining operations. So that's where the attention is and why there's been so much attention with the Cesar Copper Silver Project, even though it's been early stage.

If we look at silver, it is used in 5G networks, it's also used in solar heaters and so forth. Silver is mined as a byproduct. In Cesar, silver would be a byproduct. The biggest example of silver production would be the Kupferschiefer, which is in Poland, very similar geology. Kupferschiefer is the sixth largest copper producer in the world and silver is just a byproduct, the silver fortified byproduct, Kupferschiefer, is the number one silver producer in the world. So that gives you a bit of an idea of where we are. It's not just the traction of copper production, but also the interaction of silver production.

Dr. Allen Alper:

Absolutely. Fantastic. Could you tell our readers/investors, a little bit about the Management and the industry Team?

Brett Matich:

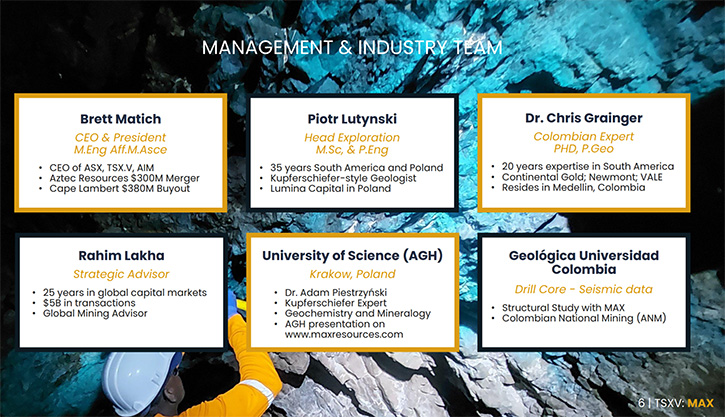

I have been involved in activities, in the mining industry for over 20 years. I'm a Mechanical Engineer. I'm from Australia, now living in Canada. I've taken early-stage projects, all the way through to mining and development. One of those was a Company, called Aztec Resources, in Australia. It had a junior market cap of $1 million. We acquired a mined out, iron ore mine and we brought that all the way through to development and we'll be taken over for $300 million. My experience is not only as CEO, but also directing projects from early stage all the way through to the different stages or phases.

Another standout we have, is Dr. Chris Grainger, who is an Australian. He's based in Medellin, Colombia. He was one of the founders, in relation to exploration, for Continental Gold in Colombia, which was taken over for $1.4 billion. It was the first commercial gold mine in Colombia. He's also involved in a Company called Cordoba, who are going through the feasibility stage, which will be the first commercial open pit copper mine in Colombia. He has experience there as well.

We are very big on building the local community, so from an employment standpoint, we employ two senior geologists that are both Colombian and we have another 40 full-time employees. 30 of those are local to the community, where we are. Another, nine geologists, are local to the community as well. That's part of the community side.

We're not just employing local community; we're employing local students out of a geology school. We're also teaching skills. We're very well known in relation to the work we're doing. We established a presence in our development in a short time, two years. We've moved a long way, not just from a geology side, but also in relation to social community and so forth. Now we're going to be going to the next step.

There's a lot of work there, but a lot of experience. I've been involved in this before, and the same with Chris. I'm not your normal CEO, in that I'm directing operations from the corporate and financing side all the way down to the exploration side and direction of where the exploration is going. The long-term view is to demonstrate the size and prospectivity of this basin.

The long-term view for Max shareholders is capital return, with a prospect of a company being taken over, with multiple capital returns for shareholders. Our plan is to accumulate maximum value for the Max shareholders. Right now, we're just entering the exciting stage of value-adding for Max shareholders.

Dr. Allen Alper:

That's excellent. You and your Team have a fantastic background. And having a district size copper and silver project in Colombia, which is very highly rated by the Fraser Institute. Really excellent! Could you tell our readers/investors a little bit about your RT Gold Project in northern Peru?

Brett Matich:

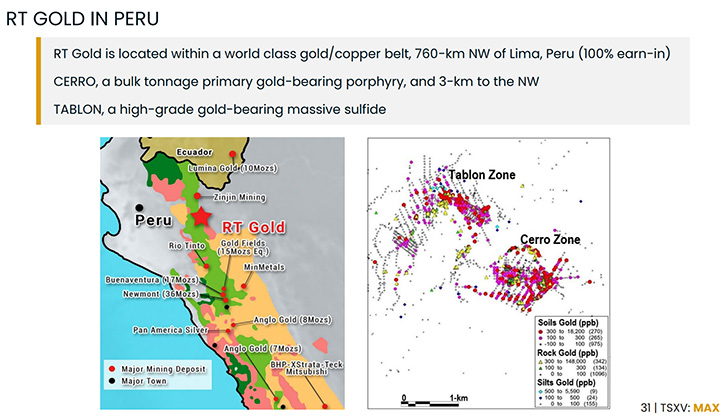

Just to go back to the Cesar Copper Project, we own 100% of the project, so that's very important. The RT Gold Project is in Peru, in a prolific copper and gold mining belt. You have gold deposits in the tens of millions of ounces. You basically have every major miner in the world down, in this belt. It's huge!

RT Gold is basically drill ready. It has drilling two targets. One target is a primary porphyry system. Then you have a secondary system, some three kilometers away from the primary, which is essentially a vein system. The vein system has been drilled in 2001. It's extremely high-grade at surface and there is a 43-101 report on this. If you look on the Max website, you can view that report.

The drilling was over 600 meters strike distance. We'll give you some examples, these drilling results are just off the map. You have 19 grams per ton gold over 16 meters from 35 meters. You have 9 grams per ton gold, over 25 meters, from 13 meters. You have 5 grams per ton gold over 17 meters from 12 meters. You have 5 grams per ton gold over 14 meters from 41 meters, 7 grams per ton gold over 6 meters from surface. This vein system is drill ready. It looks like it has repetitions as well. There is a 43-101 on this particular one.

There is a second zone, we call the Cerro Zone, which is the primary vein system. The primary vein system hasn't been drilled, but it's drill ready. It has gold anomaly, over two kilometers by one and a half kilometers, which is a huge area over a topography of 300 meters. This is a porphyry target and a multi-million-ounce target, which is a huge system.

The reason it hasn't been drilled is simple. Back in 2012, it was drill ready, but they couldn't get a community agreement. This is really the bottleneck, the community agreement. We think we'll be able to get to a community agreement and drill permitting, but we think it's a 12 month-process and we don't see any value of having RT Gold in Max. Our plan is to spin that out, but we’d like to do a 43-101 report on it. That's RT Gold, a company maker, within itself. But the bottleneck is a drilling permit and that’s the risk. Worst scenario, we may never get a drilling permit for RT Gold.

Dr. Allen Alper:

Could you tell our readers/investors why they should consider investing in Max?

Brett Matich:

From Max, in relation to the Cesar Copper Silver Project, it is extremely unique, in that I don't know of any other copper rich basin, in the world, that hasn't been exploited. That's the attention. The last major copper discovery was by Ivanhoe Mines, in the African Copper Belt, which is a very similar belt. Ivanhoe Mines has a multi-billion-dollar market cap and that's on a really attractive deposit.

The difference with Max is, we potentially have a number of these deposits, because we are targeting the whole basin. So, where we are attracted is because of that value and being at a prime time now because it's never been drilled. Cesar Copper Silver Project is about to be drilled, in the next few months, and that's where you're going to get the valuation. If we can get the right results from drilling, there's going to be multiples of value. You look at any junior company, where you get the multiple increases in value, it is after a successful drilling program. So that's what we see in Max. Max value from the upside of achieving drilling results, is a prime time to be a shareholder of Max.

Dr. Allen Alper:

Well, those sounds like very compelling reasons to invest in Max. You have a huge silver-copper project.

Brett Matich:

And you look at it from this side, right? It's still not drilled. So, there are always risks prior to drilling. All our assaying and all our sampling is being on exposed mineralization, meaning that normally the mineralization is covered by soil. Normally you do geochemical sampling to then find where the mineralization is. We have a huge advantage in having the mineralization exposed at surface, which decreases our risk, in relation to the risk of drilling. There's always risk, but we're very confident because of the mapping and the exposure of the actual copper mineralization.

Dr. Allen Alper:

That’s excellent! Brett, is there anything else you'd like to add?

Brett Matich:

In between now and drilling there's going to be a lot of news coming out to the market. We still have assays that we will be releasing over the coming weeks. In one of the assay areas, we think what we see is going to be the very first drill target for Uru. Over the time, in between now and drilling, we will have a comprehensive IP survey. There could be a number of concessions approved between that time and completing the environmental survey, so those results will be coming out and of course, drill permitting. There's going to be a lot of activity. We've expanded our exploration Teams. Over the coming months, prior to drilling, there will be a lot of activity. Please keep an eye on Max, in relation to news releases, that will be coming out in the coming weeks and months.

Dr. Allen Alper:

Well, it definitely sounds like 2022 will be an exciting time for your shareholders and stakeholders.

Brett Matich:

Yeah, absolutely. We've been involved in this area now for two years. We're expanding. This coming year is going to be the largest comprehensive drilling and exploration program, in the life of the Company.

Dr. Allen Alper:

That’s fantastic. Brett, is there anything else you'd like to add?

Brett Matich:

I think that's it. If you look at our website, we continually update our website. It's www.maxresource.com. I have nothing really to add now. There will be continuous updates, over the coming weeks and months.

Dr. Allen Alper:

Sounds great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.maxresource.com/

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

|

|