Donald Bubar, Professional Geologist and CEO, Avalon Advanced Materials Inc. (TSX: AVL, OTCQB: AVLNF) Discusses Establishing a New Lithium Battery Materials Refinery in Thunder Bay, Ontario, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/24/2022

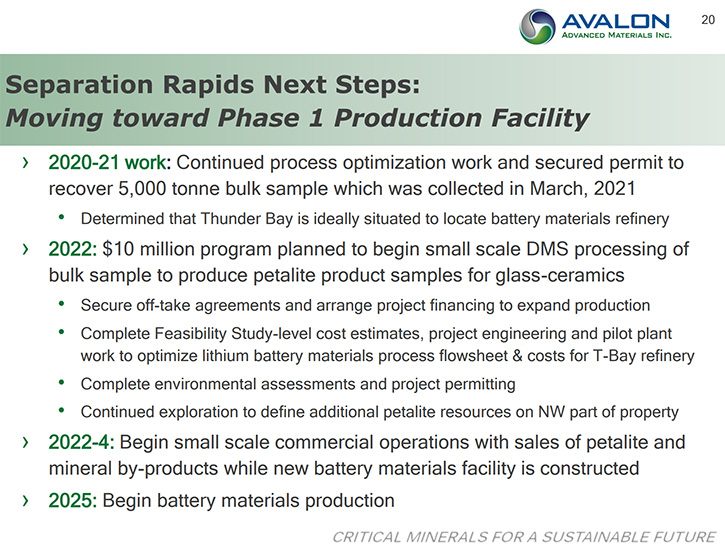

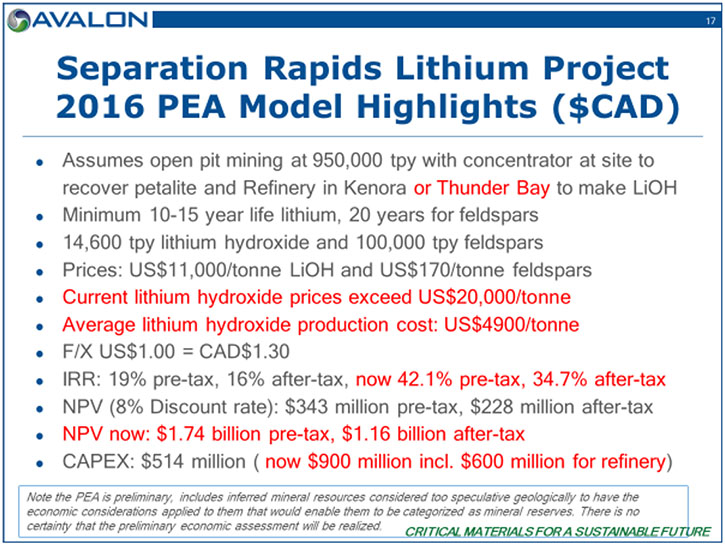

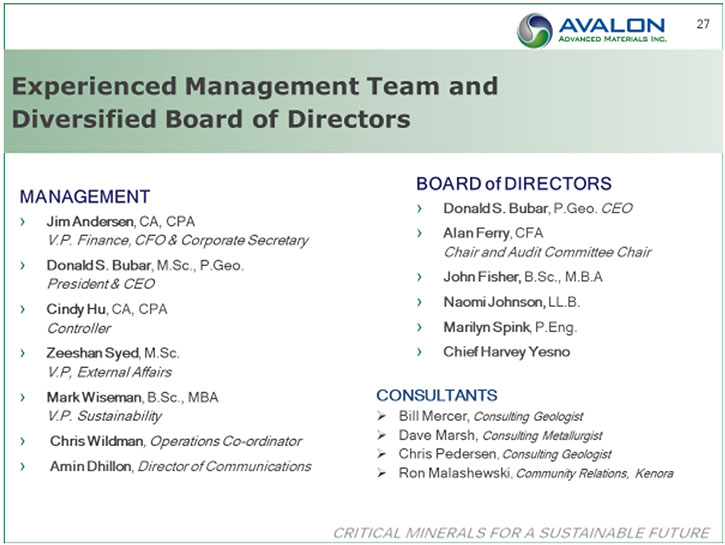

We spoke with Donald Bubar, who is a Professional Geologist and CEO of Avalon Advanced Materials Inc. (TSX: AVL, OTCQB: AVLNF), a Canadian mineral development company, specializing in sustainably produced materials, for clean technology. The Company is developing -domestic critical materials supply chains, including establishing a new lithium battery materials refinery, in Thunder Bay, and getting access to closed mine sites, to recover critical minerals from the wastes. Avalon has four advanced stage projects, providing investors, with exposure to lithium, tin, and indium, as well as rare earth elements, tantalum, cesium, and zirconium. The Company is currently moving toward a Phase 1 production facility, at its Separation Rapids Lithium Project, near Kenora, Ontario, while continuing to advance other projects, including its 100%-owned Lilypad Cesium-Tantalum-Lithium Project, located near Fort Hope, Ontario.

Avalon Advanced Materials Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Donald Bubar, who is a professional Geologist and CEO of Avalon Advanced Materials, Inc. Don, could you give our readers/investors an overview of your Company and what your strategy is and also tell them about the good, exciting recent news?

Donald Bubar: Avalon is a long-time diversified player in this new world of critical minerals, as they're called now, non-traditional mineral commodities used in new technologies. We've been seeing the future possibilities, in this space, for a long time. But finding the right market opportunity to be able to deliver a product, where there is new demand, has never been easy, especially when there's been essentially no local demand here in Canada. But with a whole new world evolving here, with the transition to the clean, green economy and electric vehicles, that's creating huge new demand for lithium. And we've had a lithium project for 25 years, waiting for that market opportunity, to allow us to get something started there and it looks like it finally arrived.

Dr. Allen Alper:

That sounds exciting. Could you tell our readers/investors, about your new partnership agreement with Ontario's first Regional Lithium Battery Materials Refinery in Thunder Bay?

Donald Bubar:

Establishing the midstream processing capacity that takes the mineral concentrates and turns them into the derivative battery material product, lithium hydroxide or lithium carbonate, is the key next step to getting the supply chain started. It's an expensive facility to build, so you really can't justify the investment until you have confirmed buyers for the product. In our case, being a small cap company, finding an investing partner to provide some of the capital required to help get it going has been the key next step.

We've been looking for those partners for some time now. The offtake interest is definitely there now, and we were recently introduced to the Essar Group, by an agency here in Canada, called Invest in Canada, that introduces potential international investors to Canadian business opportunities. Essar is a very large corporation, already in the energy industry, and wanting to participate in this transition to the new clean, low carbon future economy, going forward. This is an opportunity for Essar to get involved in a lithium project, that can lead to other growth opportunities for them, back in India.

Dr. Allen Alper:

That's great. Could you tell our readers/investors what your goal and vision is for your Company?

Donald Bubar:

We want to get production started. We have always seen this business as a growth business, where you start at a modest scale and expand production, as demand for the product grows. The lithium pegmatite types, that we have, are always enriched with other rare elements, notably cesium and tantalum, which can be recovered, as by-products, creating future growth opportunities for our business.

Plus, a domestic rare earth market still needs to be established and we would still like to be able to participate in creating that supply here in Canada as well, once the downstream demand and processing capacity is established. But that's our model now, to start production, with one commodity having new demand, like lithium and grow into a bigger business that's diversified in producing a number of other non-traditional commodities.

Dr. Allen Alper:

That sounds great. Could you tell our readers/investors a little bit more about the Essar Group?

Donald Bubar:

They're a very large, diversified, industrial company based in Mumbai, India with plenty of investment capital available to participate in new business development. Producing energy, using fossil fuels, has been a big part of their business, but they are now looking for opportunities to participate in other industry sectors, related to clean energy.

Dr. Allen Alper:

Interesting. Don, could you tell our readers/investors your primary plans for 2022?

Donald Bubar:

The next steps are to finalize our lithium battery materials process flow sheet and complete a feasibility level study on it, while we firm up the location for the refinery. There are a number of available industrial sites that would be well-suited for this facility, in Thunder Bay and once we have secured a site, we hope to get construction initiated later this year.

Dr. Allen Alper:

Good stuff. Could you tell our readers/investors a little bit more about the resource you have?

Donald Bubar:

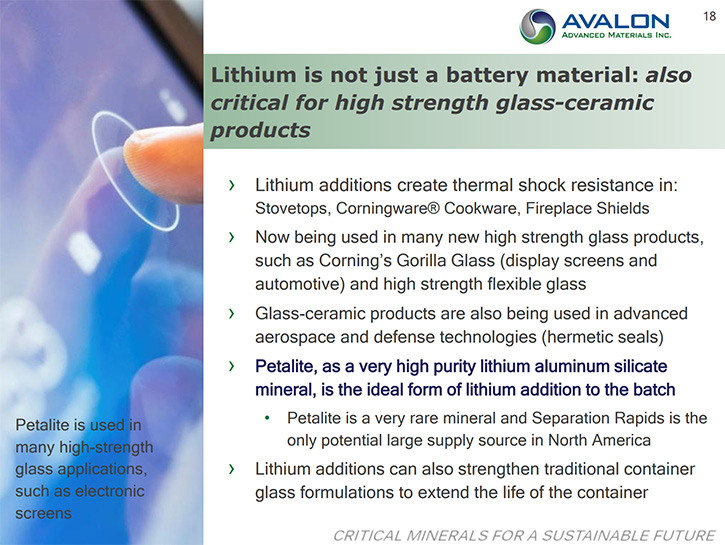

Our Separation Rapids Project resource is located north of Kenora, not too far west from Thunder Bay. It's a unique lithium-cesium-tantalum pegmatite resource enriched in the rare lithium mineral Petalite, a high purity lithium alumino-silicate, that is still in demand for high strength glass ceramic products. That is the market we had originally hoped to serve, when we defined the resource 20 years ago, and that market is actually growing, as well as there is more and more innovation on different variants of high-strength, glass ceramic products. We are well- positioned to serve this market, as well as the battery materials market, since Separation Rapids is the only undeveloped petalite resource of any size, in the world, that's not already controlled by China. The resource also contains a lithium mica, called lepidolite that will also be concentrated for recovering a battery material product. In addition, both cesium and tantalum can be recovered as by-products, along with a rubidium-rich K-feldspar product.

The present resource is big enough that we can certainly serve both the battery and glass-ceramic markets and there's lots of potential to expand the initial resource. There are also other similar lithium pegmatites, on our property, that need some further exploration work, to define their size, that can also contribute future supplies. The Project is at an advanced stage now and ready to move forward through the last steps of a final feasibility study, to get petalite production started in the next year or two.

Dr. Allen Alper:

Very interesting. Could you tell our readers/investors a little bit about yourself and Avalon’s early history?

Donald Bubar:

I’m an Exploration Geologist. I have been in the industry for 47 years now. I started Avalon back in 1995, when it was basically a dormant shell company, with a listing on the Vancouver Stock Exchange, but no active business. I wanted to do something entrepreneurial. I had been successful in gold and base metal exploration, prior to that and intended to continue in that sector of the mineral industry, but in 1995-97 the Bre-X Scandal happened and that changed everything, in terms of market interest for doing gold exploration.

That's when we got the opportunity to acquire Separation Rapids. Because of the circumstances at the time, I thought that lithium might be a good alternative commodity to focus on. We did have some interest in the petalite for glass ceramics but couldn't quite get a firm commitment on the offtake, to allow us to pursue development. But we knew there would be a future for lithium in batteries. We didn't think it would take another 20 years, but here we are.

Dr. Allen Alper:

Oh, that's great. It's good you had the vision and the determination to stick with the project, work on the project, and now the market with the lithium-ion batteries. It looks like it's growing and there's going to be a shortage even of lithium. Maybe you'll say a few words about the lithium market and its use in electric vehicles.

Donald Bubar:

Well, there is definitely a shortage right now. It's a matter of getting more resources developed and producing these battery materials. But longer term, there are plenty of opportunities out there for different types of lithium resources to produce it. But in Canada, the best and most abundant lithium resources are lithium pegmatites. There are other circumstances now, where there are concentrations in clays and in brines, including oil field brines that are being looked at as an opportunity too. No shortage of lithium resources globally, it's just a matter of creating more battery materials supply, to meet the future demand by building more of the mid-stream processing capacity.

Dr. Allen Alper:

Well, that sounds good. Could you tell our readers/investors, the primary reasons they should consider investing in Avalon Advanced Materials?

Donald Bubar:

The primary reason, right now, is Avalon is very undervalued as a lithium equity. Many other lithium equities that aren't even as advanced as we are, have valuations of several hundred million dollars, whereas Avalon is still less than a hundred million. I think that's just because we did all the original work on our lithium project at Separation Rapids over 20 years ago. We haven't had a whole lot of news flow on lithium exploration results, to get noticed by speculative investors, as a lithium player and the work we have been doing recently has been subject to confidentiality agreements.

The other factor is we're a diversified critical minerals business, so we have a name, Avalon Advanced Materials, which doesn't contain the word lithium. That would make it hard for a lot of investors to recognize Avalon as a lithium equity. Hopefully this recent news will start to inform more investors that we are undervalued and if you're looking for a lithium equity, with good upside potential, they should look at Avalon.

Dr. Allen Alper:

Those sound like extremely good reasons for readers/investors to consider investing in Avalon.

Donald Bubar:

The other factor is many investors, particularly in the US, still know Avalon as a rare earth equity, because we were so well- known during rare earth days 10-12 years ago.

Dr. Allen Alper:

And now your new agreement with Essar Group, which is a billion-dollar group, to work on developing lithium products and to supply products for electric vehicles, differentiates you from many other Companies.

Donald Bubar:

Yes. We're not simply a mining company, looking to develop a mine, we're also trying to develop the mid-stream processing capacity to serve the EV/battery market, while looking at other opportunities to inspire development of more of the downstream value-added components of this new world of critical materials for new technologies.

Dr. Allen Alper:

That sounds great! Don, is there anything else you'd like to add?

Donald Bubar:

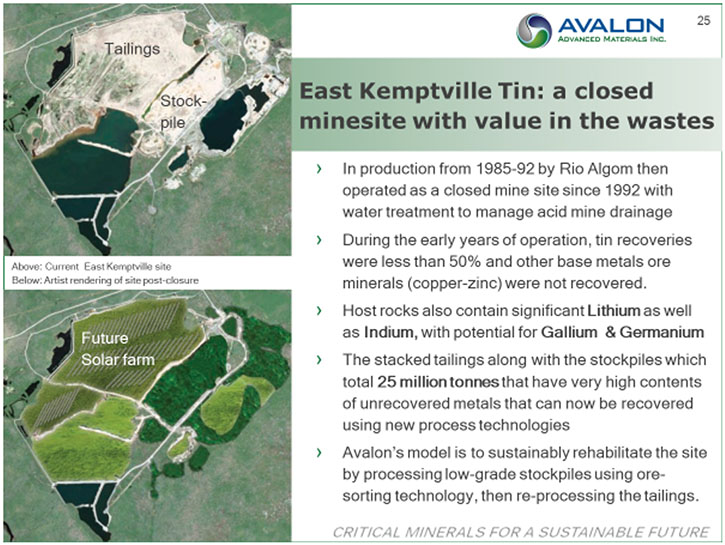

Well, that's most of what I had to say today, with regards to our lithium project. We are looking at other things too, including our East Kemptville Project in Nova Scotia, the old, closed tin mine that was the only primary tin producer ever in North America. We have an opportunity finally to get access to the site again to reactivate our ambitions on extracting value from the wastes. Tin greisen deposits, like that one, also have lithium enriched in the wall-rocks, so all the waste piles and tailings have quite a bit of lithium in them. It's just a matter of designing an appropriate extraction process to recover the lithium efficiently. We'd really like to pursue that as another future potential supply of lithium, along with tin, indium, gallium, germanium as well as copper and zinc that are in that resource and in the waste materials. Tin is now in short supply and trading at record high prices of over US$40,000/tonne as it is in high demand for many new technologies.

Dr. Allen Alper:

That sounds great. Like a good, excellent opportunity. Is there anything else, Don?

Donald Bubar:

That's good for now.

Dr. Allen Alper:

Okay. That all sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.avalonadvancedmaterials.com/

1901-130 Adelaide St. W.

Toronto, Ontario, Canada

M5H 3P5

+1 (416) 364-4938

ir@AvalonAM.com

|

|