Brett Richards, CEO and Director, Goldshore Resources Inc. (TSXV: GSHR, OTCQB: GSHRF, FSE: 8X00) Discusses Creating the Next Tier One Gold Asset in Ontario, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/23/2022

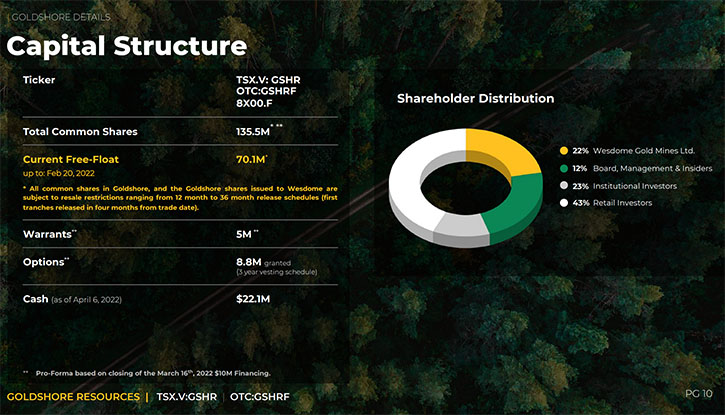

We spoke with Brett Richards, CEO and Director of Goldshore Resources Inc. (TSXV: GSHR, OTCQB: GSHRF, FSE: 8X00), an emerging junior gold development company that owns the Moss Lake Gold Project, located approximately 100 km west of the city of Thunder Bay, Ontario. Moss Lake has 3.98 M oz of historical gold resources and untapped exploration upside, with extensive infrastructure, for a district scale mining camp. Plans for this year include a 100,000 meters extensive drill program to update the resource statement, followed by a brand-new PEA. Goldshore is well-financed and supported by an industry-leading Management Group, Board of Directors and Advisory Board. Wesdome Gold Mines Ltd. is currently a strategic shareholder of Goldshore, with an approximate 26% equity position in the Company.

Goldshore Resources Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Brett Richards, who was CEO and Director of Goldshore Resources. Brett, could you give us an overview of your Company and tell us what differentiates it from others?

Brett Richards: Goldshore Resources is about a one-year-old Company now. We transacted to acquire the Moss Lake Project, from Wesdome Gold Mines, back in January 2021. After that, we raised $25 million, and we listed on June 4, 2021. Throughout all last year we started working on our exploration program. The Moss Lake Project has a 4-million-ounce historic resource, so it is a large starting point. We took the view that we are going to try and drill this up and prove up a resource that is of Tier 1 asset status. By Tier 1, I mean 10 million ounces, 10 years + mine life, a big production profile (>500,000 oz pa) and cash costs, in the lower half of the sector’s cost curve. This is what the majors and mid-tier producers indicate as a Tier 1 asset.

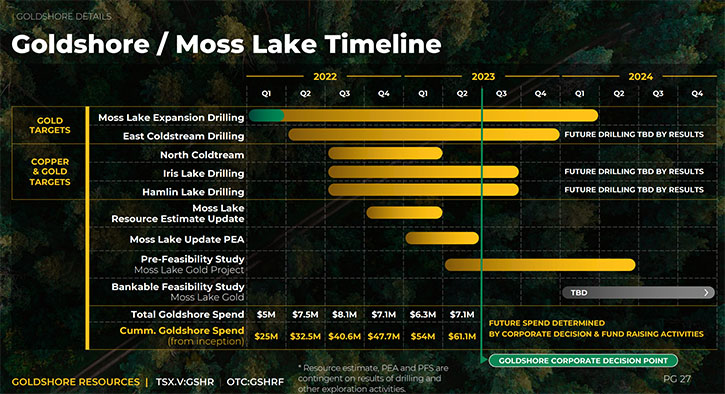

We started our program last year, with a large airborne VTEM geophysical survey, over the property, conducted by Geotech, and the interpretation done by TechnoImaging. This comprehensive data and excellent 3D models have guided us towards high probability drill targets, both at Moss Lake and at two other prospects, we have called Coldstream (North Coldstream, East Coldstream and Iris Lake) to the north-west and Hamlin Lake to the south-west.

We have an extensive drill program underway, 100,000 meters, and we're going to get through that program this year. By the end of this year, we'll look to update our resource statement and then put together a brand-new preliminary economic analysis (“PEA”), to understand the economic benefits of the project. That's the focus for this year, get through our drilling and get started on our studies, so that we can really crystallize what the value we've created is.

Dr. Allen Alper:

Well, that's a major drilling program that you have planned, Brett, that's excellent!

Brett Richards:

Yes, it is. It is a big program, one of the biggest in the industry right now. But we feel that the size of the land package we have, the quality of the targets that we've identified, through the survey and our ability to raise capital to support that has been really well supported by the market. We've raised $50 million since January of last year, so quite a phenomenal amount of capital. We just finished a $10 million raise that we closed on yesterday, and we have $22 million in the bank going forward. We'll get well down the road of completing our 100,000-meter program by the end of the year.

Dr. Allen Alper:

Well, that's excellent. Very few juniors are in a position that your Company is in, and to have such a huge resource, in such a great location is fantastic. And with the funds to carry out such an extensive drilling program is truly excellent.

Brett Richards:

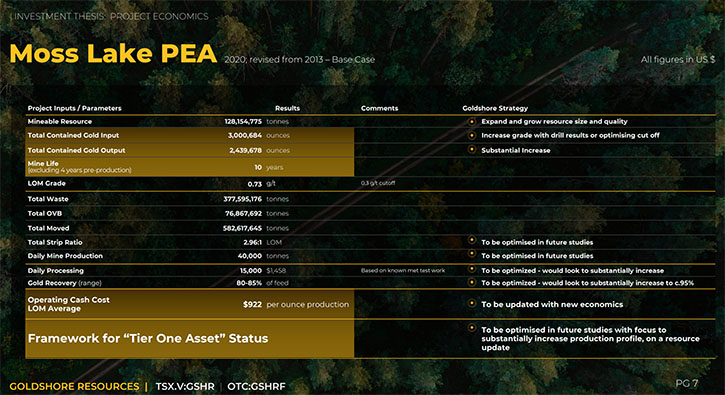

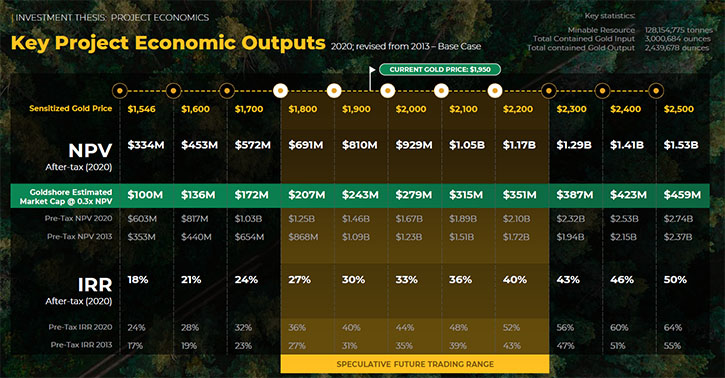

Yeah. We're trying to put as much money into the ground as possible because the existing economics of this project, that were done in 2013 and updated in 2020 by Wesdome, showed a 3-million-ounce pit shell, in the PEA study, out of the 4-million-ounce resource and had about a 250,000-ounce annual production profile, for 10 years and that's our starting point. We're going to expand upon that. But the economic outputs from that, show an $800-$900 million NPV, at today's gold levels and companies like ours trade at 0.3 times NPV, which illustrates that we should be trading at anywhere from $200 to $300 million market cap today, and we're sadly at just under C$60 million.

We are quite undervalued for the economics of the historic resource, and that's the resource we're starting from and building on. So, I see a lot of shareholder value to be created, through this exploration program. I think eventually the market will understand what it is we're doing and where it is we're going to go, and we'll start to see that priced in. We just haven't seen that priced in, so far this year, simply because of the other macroeconomic factors going on around the world and in our space have placed a “risk off” approach to earlier stage junior miners.

Dr. Allen Alper:

Well, it sounds like an excellent opportunity for investors. Brett, could you tell our readers/investors about your background, your Team and your Board? All of you really have fantastic backgrounds, tell us about them.

Brett Richards:

I've been in this business for 35 years. I cut my teeth for several years at Kinross, with the original Management Team. In 2004 the CEO, another gentleman from Kinross and I left, and we started a Company called Katanga Mining. It was a copper cobalt company in the DRC. Our original shareholders realized 86 times money. From there, I went on to run several listed companies, including Avocet Mining plc, Roxgold, and Midnight Sun Mining, before working in the private sector, for the past 8 years, with private equity firms.

Pete Flindell is our VP of Exploration. Pete and I have been together for over 15 years, he also has 35 years of experience. He's seen orogenic deposits and greenstone belts like this one all over the world. He also began his career with a major gold miner, called Newmont and he and I have been working primarily in Africa, for the last 8 to 10 years, on various private projects.

I thought it was very important for us to surround ourselves with a very strong Board and a very strong Advisory Board. Our Board of Directors is comprised of several CEOs of mining companies. Galen McNamara, who's our Chairman, runs Summa Silver. Shawn Khunkhun runs Dolly Varden, Victor Cantore runs Amex. On our Strategic Advisory Board, David Garofalo leads our Advisory Board. He was the former CEO of Goldcorp and now the CEO of Gold Royalties. There's a lot of depth in our Team. I utilize our Team for their deep experience and strong investor contacts, in the investment community. We do a great job networking all together to get the story out there and I think it's just a brilliant group of guys and women.

Dr. Allen Alper:

It's an amazing group and it's really the top names in the industry, so that’s fantastic! It's great to be supported with a Team like that and it's great to be able to attract a Team like that. They must have confidence in you and Peter and also in the property you have.

Brett Richards:

Yeah, I believe that to be the case. They're all very supportive in every possible way, including financially. Management and the Board own 12% of this Company, all through cheques and private placements. We all have a little bit of skin in the game, but we also believe in this project. There are not very many times in your career, when you get a chance to take something and move it up the development curve and do >10 times your money. You just don't have many of these opportunities!!! Goldshore Resources is one of those opportunities.

I was fortunate to have one with Katanga. I was fortunate to have a second close one with Avocet, where we did five times money for our shareholders. And now I have another opportunity to do this with Goldshore. It's why I was so attracted to running this Company and moving back from London to Toronto to be directly involved in this project, I just think it's a great investment opportunity.

Dr. Allen Alper:

Well, that's fantastic. It really looks like a great Company and a great opportunity for investors. Could you tell us a little bit more about your capital structure?

Brett Richards:

Sure. We announced yesterday we had closed a $10 million fund raising around $3.5 million of hard dollars and $6.5 million of flow through. That leaves us now at 135.5 million outstanding shares, of which about a third don't trade, because they're held by Wesdome or they're held by insiders, and they simply just don't trade. A pretty tight cap structure. And now we have about $22 million in the bank. That will take us well through our program, for the remainder of the year.

Dr. Allen Alper:

Well, that's excellent. It’s great to have that much cash on hand and also to see that the Management Team has skin in the game. Brett, could you tell our readers/investors, the primary reasons they should consider investing in Goldshore?

Brett Richards:

I think the first one, it may not be the most important, but the first reason to invest in Goldshore is because this project is highly leveraged to the gold price, and significantly undervalued to its economics and peer group. In this macro environment, we're seeing very high CPI inflation, January was 7%, February was 7.5%. We're going to see significant inflation for some time to come. Other factors in the macro, the U.S. running a $30 trillion deficit, and $3 trillion deficit annually in their budget is only going to prop up the price of gold; as well as “black swan events” like the pandemic, associated lockdowns and geopolitical crises in the world today. I think the trajectory, at which our share price will appreciate, will be much, much greater than our peers and even the mid-tiers and majors for that matter. From a macro level, I think all the planets are aligning now, for a really strong support of gold trading between, (in my view) $1,800 to $2,200 for the foreseeable future. If you want a leveraged gold play to the gold price, you know, Goldshore is the answer.

We may see spikes up above it, but they're more driven by other macro factors like new black swan events, like the current unfortunate hostilities in Ukraine and Russia. I think those events will drive the price of gold above this trading range. But generally, I think we're in a climate now, where gold is going to trade very strongly for the foreseeable future, maybe up to 5 to 10 years, much like it did from 2001 to 2011.

The second reason is micro. It is the project itself, the project itself is stellar. It has a 4-million-ounce historic resource, and it has a pathway, we can demonstrate, to certainly becoming a Tier 1 asset or a 10 plus million-ounce resource. Those two things combined are very compelling at the end of the day. The economics of such a big resource is a very compelling investment thesis. We are trading at one-fifth our current project economics (the starting point from which we are building), and we're trading at one quarter the average of our peer group, and that's our starting point.

So, I can appreciate there's a lot of Goldshore shareholder value to be created this year and growth in the share price and accelerated growth, given kind of where we're starting at. We're trading at $60 Million market cap today, and by all indications, we should have a multiple of that by the end of the year.

Dr. Allen Alper:

Well, it sounds like a fantastic opportunity for readers/investors. You have great property, a great Team, great financial support and the gold environment looks very promising. So, you have very strong reasons for our investors to consider investing in Goldshore Resources. Brett, is there anything else you would like to add?

Brett Richards:

No. I appreciate the time coming on to tell the story again and be updated. We will be putting out news flow, about once every three or four weeks, for the foreseeable future, mostly drill results. I'm excited about what the future holds for us, for this year, and we're well-funded to execute on it. So, thanks for your time, Dr. Allen.

Dr. Allen Alper:

Well, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://goldshoreresources.com/

Brett A. Richards

President, Chief Executive Officer and Director

Goldshore Resources Inc.

P. +1 604 288 4416

M. +1 905 449 1500

E. brichards@goldshoreresources.com

|

|