Tim Gabruch, President and CEO of IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF) Discusses Its Recently Discovered High-Grade Hurricane Zone Uranium Mineralization in the Eastern Athabasca Basin.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/19/2022

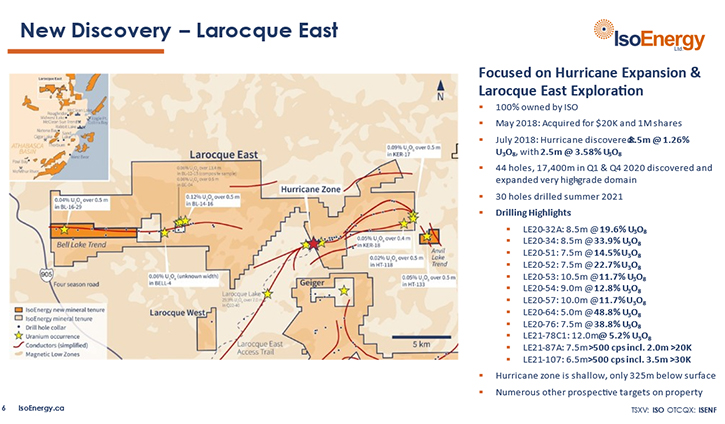

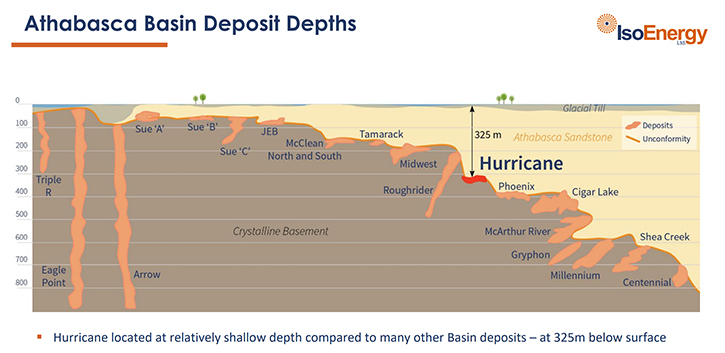

We spoke with Tim Gabruch, President, and CEO of IsoEnergy Ltd. (TSXV: ISO; OTCQX: ISENF), a well-funded uranium exploration and development Company, with a portfolio of prospective projects, in the eastern Athabasca Basin in Saskatchewan, Canada. IsoEnergy was founded by NexGen Energy Ltd., who owns 50% of the Company and provides IsoEnergy with tremendous support and strategic advantage. The Company recently discovered the high-grade Hurricane Zone, of uranium mineralization, on its 100% owned Larocque East property, in the Eastern Athabasca Basin. Situated 40km from Orano’s McClean Lake mill, it has key features of a significant discovery, relatively shallow, with high grade mineralization over widths and thicknesses seen at major deposits – up to 12m thick x 93m wide. Near term plans include a winter drilling program at its Larocque East property, including further drilling at its Hurricane deposit, and exploration drilling on the eastern portion of the property. The timing appears to be very favorable for IsoEnergy. Uranium market fundamentals and the nuclear industry narrative continues to strengthen, and uranium price and equities are seeing significant increases in recent months.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News. Talking with Tim Gabruch, who is the CEO of IsoEnergy, Ltd. Tim, could you give our readers/investors an overview of your Company and what differentiates it from others? At some point, talk a little bit about what's been happening with the uranium market, this past year and going into the future.

Tim Gabruch: Well, there's a lot to unfold in there. But yes, thanks Al, for taking the time with us. IsoEnergy is a uranium exploration and development junior company, operating exclusively in the Athabasca Basin, in Northern Saskatchewan. We have 24 properties, of which our flagship property is the Larocque East property, on the Eastern side of the Basin, which is home to our Hurricane zone deposit. Hurricane is, and this is to your point on what differentiates us, the newest high-grade deposit that's been found over the last number of years. Really, it’s the only high-grade deposit found globally in this period, in the uranium space. So, it's Hurricane that really sets us apart.

Yes, we've had a lot of success. 2021 was a very exciting and a big year for IsoEnergy. We continued to advance Hurricane and it has been good to be able to share with folks the fact that we have found, what looks like a very substantial, very exciting, high-grade uranium deposit.

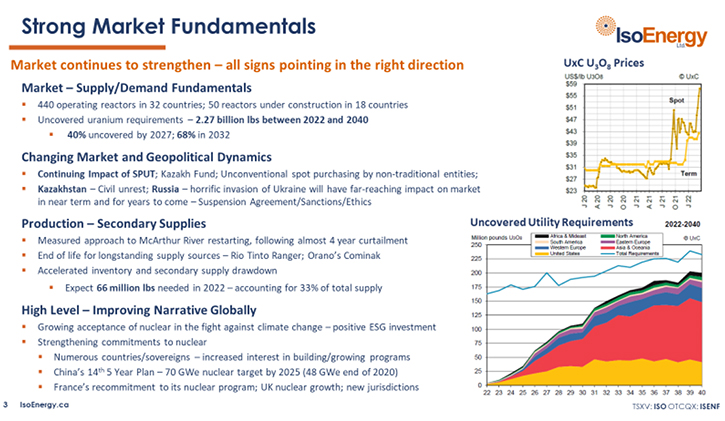

IsoEnergy’s discovery has also coincided with the market changing and experiencing a significant upward movement In a uranium market that over the last decade, really since 2011 and Fukushima, has been in a super- down cycle . Last year we saw some of the things that we knew were bound to happen with respect to the supply, demand fundamentals start to take place – especially on the supply side, which has really struggled over the last decade. and then settled in around the mid $40s. 2022 has already seen a lot of uncertainty and change which has resulted in a further rebound in price, with the spot price now sitting close to $60 per lb.

Dr. Allen Alper: There's one other thing. Uranium is the most likely candidate to replace oil and gas, as a carbon-free energy source, is that correct?

Tim Gabruch: Yes, those of us that are in the nuclear industry, and I've been in the industry for more than 25 years, are obviously big advocates of nuclear, for all those reasons you're alluding to. Given that it is a carbon-free source of clean, dependable baseload energy, we believe it has to be a growing part of the world’s energy solution. I think the world is starting to realize a bigger part of the answer to climate change and creating a carbon-free or a low carbon emitting future is dependent on the electricity generation side.

Certainly, we understand wind, solar, these are all part of the portfolio of energy sources that are going to be an important part of the energy mix in the years to come. But nuclear offers the best alternative to dependable and sustainable baseload energy, to power the grids. Solar and wind will certainly play a big role, but they certainly have some limitations and are not able to provide that same baseload energy.

Dr. Allen Alper: It sounds like the marketplace is very strong and that looks very encouraging. Also, there's a lot of uncertainty with Kazakhstan, where a lot of uranium is coming from, is that correct?

Tim Gabruch: Yes, earlier in the year there certainly was some instability in the country that was very unfortunate. Through my career, I've worked with a lot of people in Kazakhstan and yes, they're the world's largest producer of uranium. They've become more and more depended on, not only in their part of the world, but throughout the globe, by power utilities. Thankfully, the situation appeared to have resolved itself fairly quickly. But the nuclear industry will certainly continue to assess that situation and how it might impact the dependability and viability of the uranium that comes out of Kazakhstan in the future, to fuel nuclear reactors around the world.

More recently, of course, the horrific situation in Ukraine has, among all of the more terrible impacts, also begun to impact the uranium market. Russia has remained a significant supplier of uranium to the world and clearly there are going to be long-term ramifications on the supply of uranium and all nuclear fuel products that have traditionally come out of the country. The US has continued to rely on Russia for around 20% of its nuclear fuel supply – uranium, conversion, and enrichment – from Russia. Clearly that will change going forward, and likely sooner or later with the US Senate having recently introduced legislation proposing to ban imports of Russian uranium.

Dr. Allen Alper: Tim, could you highlight the deposits that you have, bring our readers/investors up to date on what's been happening with them? What your plans are for exploration going forward in 2022?

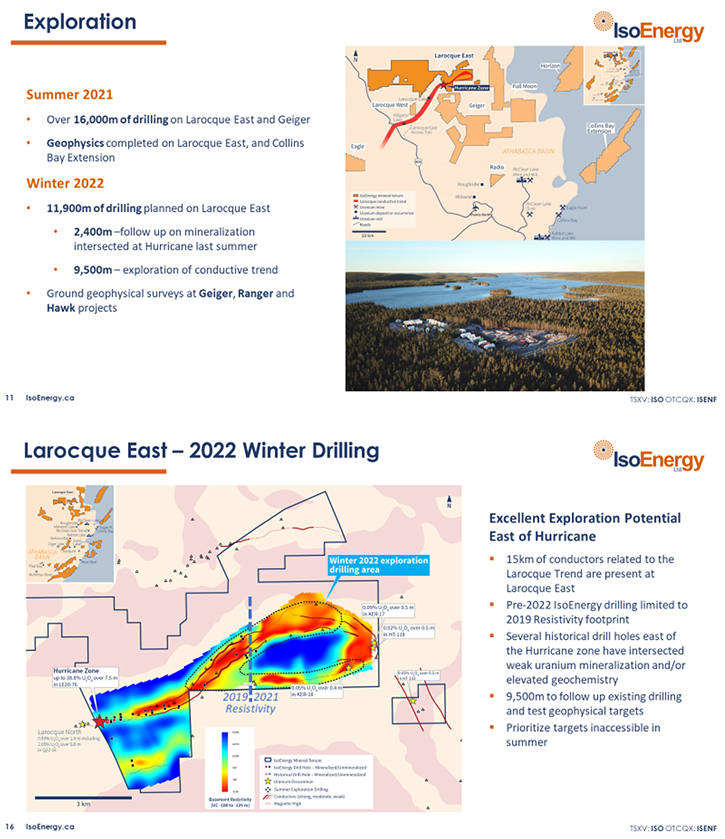

Tim Gabruch: Certainly. Last year we finished a summer exploration program, in Northern Saskatchewan. We didn't do a winter program, at the end of 2020/beginning of 2021, because of COVID and some of the potential implications on Northern Saskatchewan. So, we did get back up north in the summertime and finished up that drill program in November.

A lot of that program focused around our Larocque East property. It is a large property, with several kilometers of very highly prospective conductors that we're very interested in and excited to explore. And it's also home to our Hurricane zone deposit, which has become our flagship asset.

So, a lot of the work was being focused on continuing to develop the Hurricane deposit. To try to see where the limits and edges of that deposit are. We are starting to get a sense for size and scope of that deposit and were doing expansion drilling. We were also, though, doing several exploration holes, out to the east on the deposit, in some of the other areas that are less explored and that we still believe have a lot of prospectivity.

Then we actually, for the first time in a few years, got back to one of our other properties that we like a lot, which is the Geiger property. It is relatively close to Larocque East, but we hadn't been on it for quite a while since we have been focusing on Hurricane. We did a smaller program, 14 holes in that property, and had some good results. As we have assessed those results, we actually quite quickly moved into our winter program in January, which included some more geophysical work on Geiger, based on some of the summer results, in order to find new targets for upcoming drill programs at that site.

With that in mind, we did mobilize our winter program in January. Despite tough conditions, as you would expect in Northern Saskatchewan, we have had a good season. Our plan was to drill 11,900m, with 2,400 of that earmarked as expansion drilling on Hurricane to follow up on targets we had good success with over the summer. The remaining work has also focused on Larocque East, but rather on exploration drilling to the far eastern side of the property. We have been winding up the program, and will put out some news on that winter program

Also, in addition to geophysical work on Geiger, we have also been spending time on our Ranger and Hawk projects, doing some ground geophysics to help us plan for future drill programs.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit more about the region, how significant that whole region is for uranium?

Tim Gabruch: Of course, the Athabasca Basin in general is really the predominant uranium jurisdiction in the world, for a lot of reasons. It is home to the highest-grade mines, by a huge margin, in the world. This is home to Cameco's McArthur River, to Cigar Lake. It's home to the old McClean Lake mine. But it has the mill there as well, that Orano, the French nuclear company, operates in the region. It's been home to Rabbit Lake, which is currently in a shutdown, to Key Lake, which is an existing mill and a former mine, and to other great mines of the past. It's also home to some of the best development properties, on the planet. For example, NexGen is developing its Arrow project, which is being developed as the world's next large, very high-grade uranium mine.

There are other projects under development in the Basin as well, including Denison’s Wheeler River project. The Phoenix deposit is smaller, but they're doing some very innovative things with mining technologies. So, it really is a hub of uranium exploration development and mining in the world. It's like that because the grades in that jurisdiction and the mines that have come on line, are typically upwards of a hundred times the world average. Though it’s not without its challenges; it's a very water intensive area. Lots of lakes. Lots of underground water in the sandstone basin. But these are incredibly good deposits. And, of course, geopolitically, Northern Saskatchewan, Canada is a very mining friendly, very good place to do business. It’s a very, very secure area for mining uranium and, today, that geopolitical stability is becoming an increasingly important characteristic

Dr. Allen Alper: Oh, that's excellent. I know you Tim and you have a great background. Your Team and your Board have successful discoveries and experience. Could you say a little bit about yourself, your Team and your Board?

Tim Gabruch: Yeah, sure. I'm a long-time uranium and nuclear guy. My entire career has been in uranium, nuclear. I spent 20 plus years at Cameco, working in marketing and corporate development. The last seven of which, were as the Vice President of Marketing based here in Saskatoon, Saskatchewan at Cameco's head office. I then spent two and a half years at Denison Mines, as they started to move forward with the Wheeler River project. I was helping them start to build a commercial function there to develop, as they begin to interact with the utilities – the end user customers. Also at the time, Dennison was managing Uranium Participation Corp, a company that people following uranium would know. I was the Chief Commercial Officer at UPC. As many know, it was bought by Sprott last year and is now the Sprott Uranium Trust.

I then decided to take on an exciting new challenge here at IsoEnergy, just last February. I talked about its projects and its properties, but the one thing I haven’t mention about IsoEnergy, is that it is very unique in another respect in that we are owned, just over 50%, by NexGen Energy. So, we have a very solid ownership base that provides an incredible amount of stability, within the company. Through NexGen we gain enormous support technically, functionally and on all corporate matters.

From a Board perspective, our chairman is, Leigh Curyer, who's also the CEO of NexGen. Our other Board Members are all Board Members on NextGen. So, they provide a great amount of continuity and a lot of experience, with a Company like NexGen, that has just gone through enormous growth and tremendous success over the last decade. We're working to bring that model to IsoEnergy. The first aspect of success in that model is that, before we found the Hurricane deposit back in 2018 now. Really on some of the first holes we drilled on the Larocque property when we bought it from Cameco. That has help establish IsoEnergy as a bigger, well supported company, and has already given us a very strong base to move forward. So, we have the Hurricane asset, we have a portfolio of other terrific assets, and we have a great Team in place with strong technical, financial and organizational support.

Dr. Allen Alper: Oh, that's excellent! That's a great Team!

Tim Gabruch: Yeah!

Dr. Allen Alper: Great support! So that's excellent! Maybe you could add a little bit about the share and capital structure.

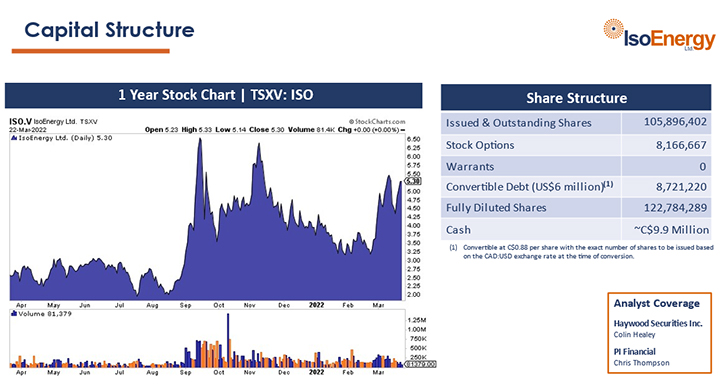

Tim Gabruch: Right now, we're about 107 million shares outstanding. Our share price has been moving around a fair bit, as a result of volatility in the uranium market. But, we have certainly gained a lot of market value over the last year, as the market has improved. We've continued to develop Hurricane, and we entered the year in really good shape, financially. We've started 2022, with over $12 million in the bank and our balance remains around $10 million, having made some expenditures related to our winter drilling program We are obviously in, what's become, a very positive uranium market. There are excellent opportunities to raise capital and it’s a very good environment in general. So, we feel very fortunate. We're in good shape financially to take us through the winter program and even potentially even through the summer. Of course, we’re always, keeping an eye on where to raise capital down the road, when it's needed. So, at the moment, we're really well-positioned and in good shape to move forward and grow.

Dr. Allen Alper: Oh, that's excellent, Tim! Could you summarize the primary reasons our readers/investors should consider investing in IsoEnergy?

Tim Gabruch: If you like uranium and the nuclear story in general, IsoEnergy is very well positioned to participate in those positive trends. Certainly, one of the big things I've seen really shift over the last couple years is that people are really starting to recognize the importance of nuclear, in managing and dealing with the climate change issues that becoming increasingly evident. More companies and countries are beginning to realize that in order to reduce carbon emissions globally, in a meaningful way, nuclear needs to be a bigger part of that solution. So, if you support that narrative, and obviously uranium plays a big part in facilitating that nuclear energy story and its importance in the world, then uranium, is a great place to consider investing.

Then, if you're looking for a company that's well-positioned in that market at the moment, Iso is a great one to consider, for some of the reasons I've already mentioned. First, we have the only new high-grade deposit that's come into the market over the last number of years. So, we’re in a very unique position from that perspective. We also hold 24 high quality properties in Northern Saskatchewan, which we were very successful in picking up because we started the Company in 2016, at a time when the market was arguably at the bottom of its curve. So, there were lots of properties to access, which today would absolutely not be available. Today there are an increasing number of entities, trying to expand their holdings, or enter into the market for the first time.

So, we're well positioned with Hurricane and Larocque generally. Again, financially and from a corporate perspective, we have money in the treasury, and we have a very supportive majority shareholder, NextGen. They support everything we do, certainly financially, but also technically and from a corporate level. So yes, we're in a unique position and we're very stable. We're very well positioned to continue moving forward and growing, in line with this tremendous growth opportunity in the nuclear sector.

Dr. Allen Alper: It sounds excellent! It sounds like ISO Energy is an outstanding Company. It has great properties, a great Team, great financial support, in an excellent area. Those are very compelling reasons for our readers/investors to consider investing in IsoEnergy.

Tim Gabruch: Great! Yes, I think you nailed it, Al. That is exactly it.

Dr. Allen Alper: Well Tim, I'm very impressed with your Company.

Tim Gabruch: Thank you.

Dr. Allen Alper: And what you have been doing overall. That's excellent. Is there anything else you'd like to add, Tim?

Tim Gabruch: Just that I appreciate your interest, Al, and your publication’s. Certainly anyone, who ever wants to talk uranium or IsoEnergy, we're easy to get ahold of and happy to chat anytime.

Dr. Allen Alper: Oh, that's excellent.

Tim Gabruch

President and Chief Executive Officer

IsoEnergy Ltd.

+1 306-261-6284

info@isoenergy.ca

www.isoenergy.ca

|

|