Dev Randhawa, Chairman and CEO of Fission 3.0 Corp. (TSXV: FUU) (OTCQB: FISOF), An Outstanding Uranium Exploration Leader Discusses Their projects in the Athabasca Basin, Several Near Large Uranium Discoveries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/14/2022

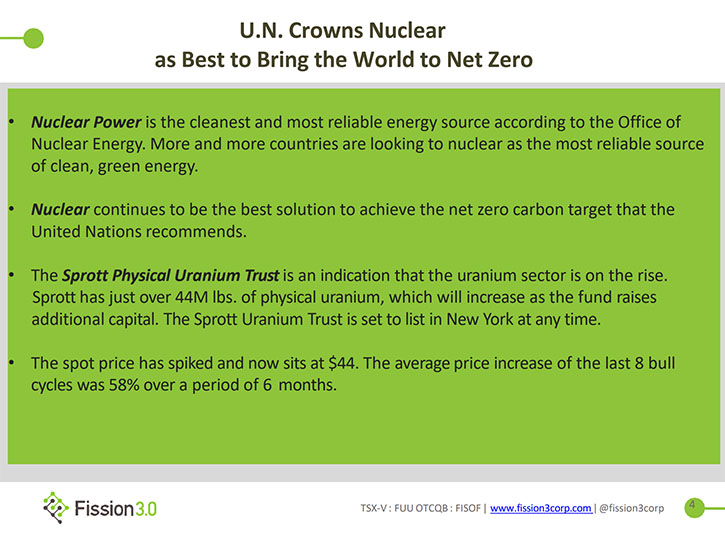

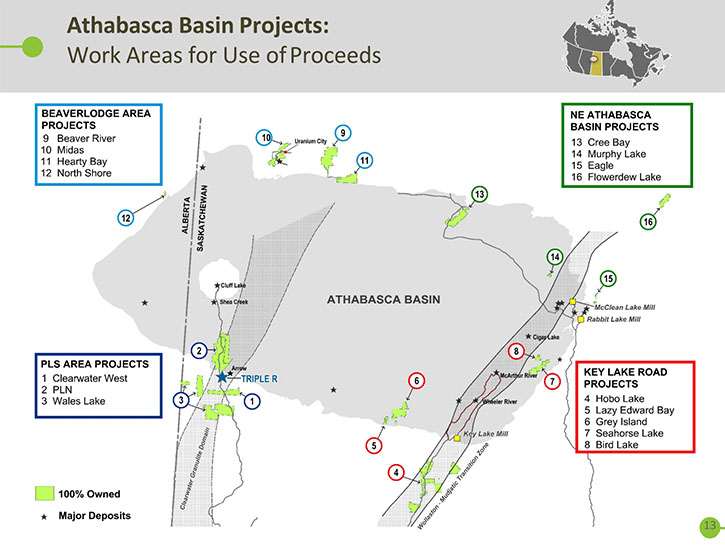

We spoke with Dev Randhawa, who is Chairman and CEO of Fission 3.0 Corp. (TSXV: FUU) (OTCQB: FISOF), a uranium project generator and exploration company, focusing on projects in the Athabasca Basin, home to some of the world's largest high-grade uranium discoveries. Fission 3.0 currently has 16 projects in the Athabasca Basin. Several of Fission 3.0's projects are near large uranium discoveries, including Arrow, Triple R and Hurricane deposits. Fission 3 attracts joint venture partners like Traction Uranium Corp. to fund exploration. Nuclear energy continues to be the best solution to achieve the net zero carbon target that the United Nations recommends. Nuclear needs are set to double by 2050 to achieve the Paris Accord 1.5C goal. The spot price of uranium has spiked and now sits at $44. The Sprott Physical Uranium Trust owns just over 44M lbs. of physical uranium, which will grow, as the fund raises additional capital.

Fission 3.0 Corp.

Dr. Allen Alper:

This Dr. Allen Alper Editor-in-Chief of Metals News, talking with Dev Randhawa, who is Chairman and CEO of Fission 3.0. Dev, could you give us an overview of your Company and some historical information on how the Company developed and all the wonderful things you've done in uranium?

Dev Randhawa:

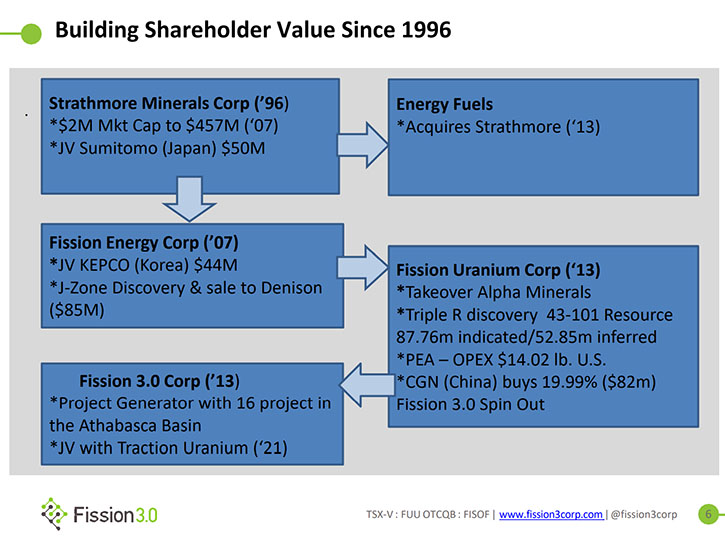

We started a Company, back in the late ‘90s, called Strathmore, which split in two. One was sold to Energy Fuels, the other half started a brand-new company, in Canada, strictly based on the Athabasca, and that was Fission Energy. We brought in a partner from Korea to fund everything. We put out very little money, we put up our land, though. Then they earned 50%, Korean Electric Power Company did that.

We have a great technical Team that made a big discovery and that turned into selling that to Lukas Lundin, for about $128 million. We split the assets in the Company. The basin has two sides to it, East and West. We made the discovery in the east, we sold that to Lukas Lundin family and then we took the assets on the west side and put them in a separate company. We gave a free dividend back to our shareholders and we started a company called Fission Uranium.

Again, we were thankful to make a big discovery. That company is worth about 700 million today. Our Chinese partners didn't really want to be funding exploration. So, we again took all those assets, that were not the main mining that was going in production and we put them into Fission 3.0. We call it Fission 3 because we’ve been fortunate to make two major discoveries in the basin. Nobody else has ever done that before. We've been able to attract partners from Asia.

Asia has a much longer, long-term view of energy, unlike our Western utilities, who tend to be going quarter by quarter. They were buying assets, looking for uranium ten years down the road. Korean Electric Company did that with us and then CGM from Hong Kong did that. Fission 3 is a result of a group of projects we had. Each time we made a discovery on one of them, we took the others into another Company. Right now, Fission 3 is strictly focused on exploration in the basin.

We have about 16 projects and we have about $13 million in the bank. We're well funded, well-managed and we're strictly focused on uranium exploration. I think what excites most people is what the role of uranium has become in the last year. Last year was the first year I could stand up, in front of a crowd, and talk about how green energy includes nuclear power. There was a bit of, I call it politicians’ hot air, that they thought at one time that they could, using solar power and wind turbines, have lots of energy. Unfortunately, that has not happened and as a result North America has not funded any kind of exploration in oil or gas or uranium. Now, of course, it's showing.

Unfortunately, this administration chose to not extend the pipeline, not allow drilling for this. That was a big piece of how he got elected from the left, saying we're not going to allow any drilling, we don't want any pipelines, we're going to invest in green renewables. The problem is renewables provide intermittent power. You can't tell the sun to turn on any brighter or tell the wind to start. It doesn't work that way.

Germany is a classic example of being foolish enough to believe that. This year they used so much coal, their pollution is up 25%. So instead of pollution being down one or two points, which was their goal, they went up 25%. So, people are realizing that’s why Gates and Buffett are building a reactor in Wyoming. And that's why a lot of utilities are buying more uranium.

The uranium price spiked up last year because Peter Roskam, at Sprott, recognized that trend. So, we set up a fund to buy physical uranium, that's all it does, is just buys physical uranium. Sure enough, he bought quite a few pounds, 63 million pounds, and he's about to list on the New York Stock Exchange. I believe that if he does that, he'll be able to raise another $3 billion and buy more uranium and drive that price up. Uranium is around in the mid-50s, I believe it needs to get in the 70s and 80s before you see any more exploration in the U.S. specifically, and also turning on mines.

That's where we are today. is that finally nuclear power is considered a part of the green solution. The Russian Ukraine war has certainly pointed out the value of clean energy, which we haven't had, also owning energy, rather than relying on Russia. Putin's not a fool, he purposely made sure he had the oil and gas sector in his control before he started a war. Germany can't shut off their relationships with Russia because they get so much coal, oil and gas from Russia.

Dr. Allen Alper:

Thank you, I appreciate you telling us about your history. I know you and your Team have been recognized many times, by many associations, for the great work that you all have done. You have been exemplary! That's fantastic! Could you tell our readers/investors a little bit more about your current properties and your plans for 2022?

Dev Randhawa:

Absolutely! You're right. No other Management Team has garnered the number of awards we have. If it were the Oscars, we'd have swept everything, best project, which London Mines and Money did. Ernst Young recommended us for the entrepreneur of the year. I was Dealmaker of the Year. Then Ross and I were Mining People of Canada. That was all because we were able to discover here, sell that to Lukas, turn around, buy another Company for $300 million, and spin out another Company.

That was in the past and now what are we going to do? The past tells you whether the Management Team can repeat, if they have the skill set? But you also need luck when you make a discovery, so I believe that we have the right Team.

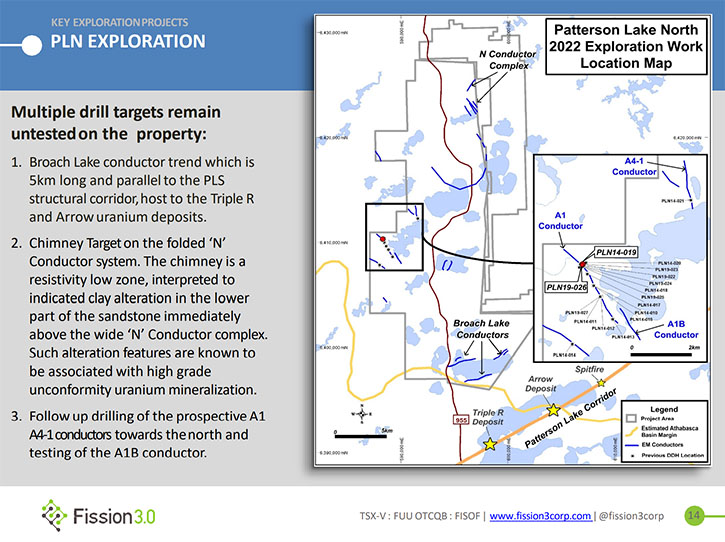

Currently, we raised enough money, flow through, about $10 million and we have a joint venture partner kicking in $2.5 million. We are a project generative model, if it can use your property, your brain, somebody else's money it really mitigates your risk. We have 16 projects, and we will drill at least three this year, if not five. The best project, most advanced project, I would say, would be the PLN, which is just within a few miles of two great discoveries, the Triple R Pierpoint and the Arrow. So, we have a really good handle on where that's going.

We are drilling and we had some good success here, we found a corridor on PLN, which is our more advanced. In order to find uranium, the first thing you have to narrow down is you have to find a corridor, a conductor. We've done that with our discovery of that conductor this year. Now, the next step, obviously, is have radioactivity, lots of it, to find a mine, that’s PLN. Then we have a property called Hearty Bay, on which we have found boulders that we're tracing back.

We are hoping to hit some faults that we identified and we're hitting them. You need these fitted conductors and you need these faults. Well, we seem to have both. It takes time to work back through the clues, but you're looking for certain other discoveries. You need boron, you need this, you need that. Well, we're getting those, so we’re vectoring in. This summer we will do PLN again and we're going to drill a project on the east side. Now, depending how much money we have, we might drill a couple of more. Our main prize is the Patterson Lake North (PLN) and then we have Hearty Bay and Lazy Edward. Those we're going to drill, for sure. We're still debating on the rest, or if the rest will happen.

Dr. Allen Alper:

It sounds like 2022 will be an exciting time for your investors and stakeholders.

Dev Randhawa:

You need a bit of luck in this industry, you know that. But, I found people who work hard to create their own luck. We wisely kept paying some people, when we couldn't afford it. I couldn’t take a salary and we kept them on. We have a Team of about 12 people. We really count on geoscientists. It's a big Team and we're quite excited to have a good technical team, a great land position. The land we bought, we bought during tough times, anybody that bought real estate in 2010 or 12, they're tripling their money today.

Well, it's the same thing here. You take a look at the deal we did with Traction. We only put a couple hundred thousand into it, but we just sold the right for them to drill it for $600,000 in cash and $4 million in stock. That's a pretty good return on your investment of finding good properties. We're excited for this year. We're going to have over $12.5 million of drilling, about 7,000 meters. Of course, a lot of things out of our control, which will make life better. For example, if our friends as frat get listed, that would be great. And if Joe Biden does cut uranium from Russia, that's going to be great, too. So those things will only help the stock go higher.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors, what are the primary reasons they should consider investing in Fission 3.0?

Dev Randhawa:

Well, I think number one is a demand for clean, carbon free energy, which is what uranium is. There's a lot of demand for it. Two, we have a great technical team, great properties and just the growth of nuclear power, the role that's going to play. The main reason of our success is the growth of nuclear power where it is today than it was two years ago. The world's finally picked up on the idea that we can't live off simply the sun and the wind. So that's really helping us raise more money and allows us to do more drilling.

Dr. Allen Alper:

Well, those are very compelling reasons to consider investing in Fission 3.0. You have a great Team, a proven Team, and you're working in the area you know, your Team knows and the time for uranium has come. There's a need for green energy, for uranium to play a very strong role in delivering it.

Dr. Allen Alper:

Is there anything else you'd like to add, Dev?

Dev Randhawa:

Well, I hope that investors are realizing that we have vilified oil and gas and anything that wasn't wind. I think people are realizing just how this whole deal with Russia, when they're cutting people off, how important it is for a country to have its own energy. The western civilized world has to finally realize they have to have their own sources of energy, they can't keep relying so much on foreign entities. For example, COVID stopped people, you can’t produce everything in China. What if our supply chain breaks down?

I think the same thing is here, as companies like Gatorade bring home their projects. As we're doing over there, we need our own energy sources, and the Western world has to have its own uranium mines. It can’t count on Russia. Kazakhstan maybe is 40% of the market, they're owned by Russia. I think if anything, one, it's sad that someone is killing children and women to control a country. From the business side of it, people need to realize oil and gas, uranium, we have to have our own sources. To do that, we need to have our own exploration companies like Fission 3.0.

Dr. Allen Alper:

Well, that's excellent!

It's great to be in the area that will give potential wealth to your investors and also will help the world.

Dev Randhawa:

Absolutely. People forget India and China are 4 billion people almost and every year, if they grow 10%, with their middle class growing. Okay. That's a brand-new United States every year. Just to give you an idea, if their middle class grows like that, that's like their growth is ours. Just imagine how these big groups are. And that's why we need more energy. But we need clean energy. We just can't use coal and all the gas, but air, solar and wind are not ready.

Dr. Allen Alper:

It's very important for the green energy revolution in uranium.

Dev Randhawa:

Absolutely. I used to have a slide way back and I go around to some of the people, Bob Bishop and those fellows I used to have a geo risk. What's the problem with relying on Russia and everything else? Well, there's a lot we're finding out. I think we've been put to sleep a little bit by having so much peace around the world, but we don't anymore. What are we going to do? It teaches us a lot, sometimes we need a reality check of our own energy needs, this is what's really happened.

Dr. Allen Alper:

We’ll publish your press releases as they come out, so our readers/investors can follow your progress. You have given us all a lot to think about. Thank you.

https://www.fission3corp.com/

Dev Randhawa, CEO

Investor Relations

Ph: 778-484-8030

TF: 844-484-8030

ir@fission3corp.com

|

|