George Bee, President, CEO and Chairman, U.S. Gold Corp. (NASDAQ: USAU), Discusses Near-Term Production Potential, at Their CK Gold Project in Southeast Wyoming, USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 4/10/2022

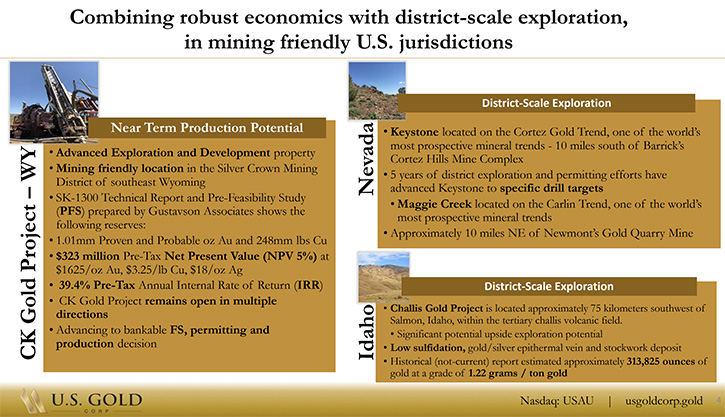

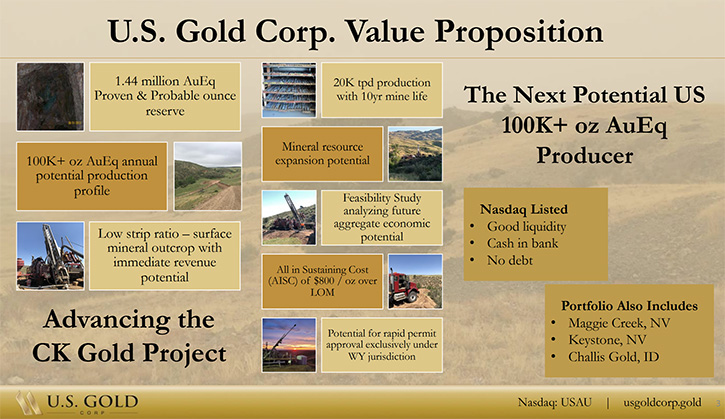

We spoke with George Bee, President, CEO and Chairman of U.S. Gold Corp. (NASDAQ: USAU), a U.S. focused gold exploration and development Company, with near-term production potential, at their CK Gold Project, located in Southeast Wyoming that has had a PFS completed on it. The Company is advancing CK Gold to bankable FS, permitting and production decision. U.S Gold Corp also owns a portfolio of exploration projects, including Keystone and Maggie Creek properties, on the Cortez and Carlin Trends in Nevada, as well as the Challis Gold Project located in Idaho.

U.S. Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with George Bee, who is President, CEO and Chairman of U.S. Gold Corp. George, I would like you to give our readers/investors an overview of your Company and on the most important things that have happened in 2021, and your key goals for 2022?

George Bee:

This is an opportune time to give you an update about what we are doing at U.S. Gold. We have our flagship asset, the CK Gold Project, in southeast Wyoming. Since mid-2020 we have been working very hard on gathering the pertinent information necessary to continue to move CK Gold down the potential development path. To this end, we collected more samples in 2020 for metallurgical, geotechnical and geohydrological testing. All that came together in a pre-feasibility study that we published, in the beginning of December 2021. The pre-feasibility study results show that CK Gold is a very attractive, robust project.

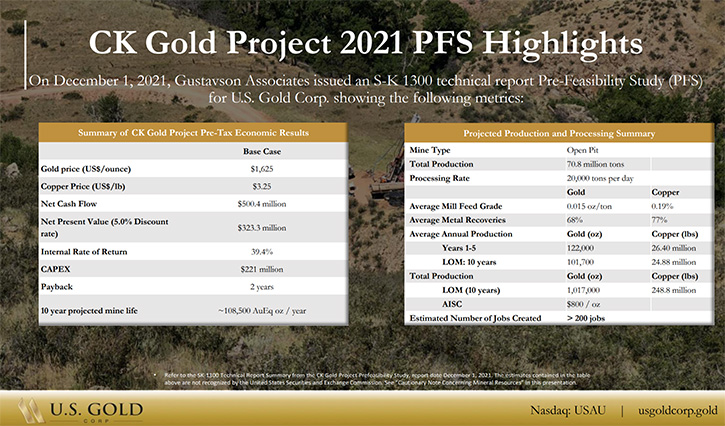

We have proven and probable reserves of just over a million ounces of gold and 248 million pounds of copper and we will mine that over a ten-year period. The pre-feasibility study assumed a gold price of $1,625 per ounce and $3.25 per pound of copper, yielding a 39.4% internal rate of return on a before-tax basis. It is a very attractive, robust project at the prices we then used, and I think we have all seen what is happening with the price of gold and price of copper. Additionally, our all-in sustaining cost of operations is $800 per equivalent gold ounce produced, assuming a gold price of $1,625 gold and $3.25 per pound of copper,

As we move forward, there will be some inflation and we are all seeing the price of fuel go up, but nevertheless we expect CK Gold to be a very robust project. We have a lot of potential upsides because the non-mineralized rock that we have to mine, to expose the rock with gold and copper mineralization in it, is really good quality rock and we've tested it for a potential use as aggregate. We are so close to Cheyenne, just 20 miles, Laramie, 30 miles and situated at the northern end of the Colorado Front Range, with the ability to provide aggregate to other potential markets further afield due to our proximity to railheads.

We think there is a market for the non-mineralized rock that we mine, in any event, which we have not factored in yet. So, there is really good upside, as an associated byproduct that still has to be considered as part of the plan. The PFS is available on our website, anybody can go and have a look at it and look at the assumptions, all are very current.

Dr. Allen Alper:

That a very robust PFS. So that’s excellent!

George Bee:

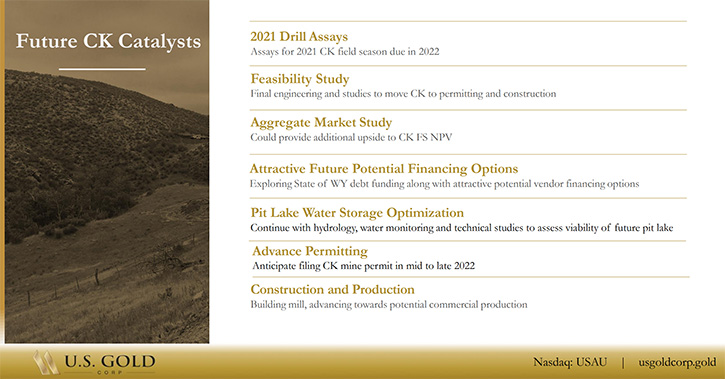

Yeah! Because we were very bullish on the project, that is really why I came into U.S. Gold, because I think that this project is something that can be brought into operation, very quickly. Even while we were finishing out the PFS in 2021, we launched a field program, which lasted through the early part of December, wherein we gathered the data necessary for preparing the feasibility study. Now, with this data in hand, the feasibility study should be out mid-year 2022. We recently announced that we have contracted Samuel Engineering out of Denver, Colorado for the next phase of engineering. That is underway at the moment.

In September 2020, we launched environmental baseline studies. We now have in excess of a year of environmental data, surrounding the project. We hired a company out of Laramie, Wyoming, Trihydro, to do our environmental baseline work and also prepare the permit application, that is coming together nicely. We look to mid-year 2022 to be presenting our permit application to the authorities. One of the unique features about this project is that we are on a Wyoming State section and the surrounding land is private, owned by a fifth-generation rancher. We have executed an agreement with the rancher for the land that we need beyond the Wyoming State section and for a right of way.

We have estimated, under the lease conditions, the royalty and tax payments from the minerals that we would mine from the state section, would generate about $50 million to the state of Wyoming, over the life of the project. We are looking at a fairly positive outlook from the state, who are looking for this income, from their state lands. The custodians of state lands have an obligation to look for the highest and best use of the lands in their portfolio. The royalty payment is earmarked for K through grade 12 education, so that’s a really great outcome of the potential development of the project. With the environmental work that we did, we have established that we are not under the jurisdiction of federal government agencies, typical of projects located on BLM and Forestry land.

We did a wetland survey and if you are impacting any waterway or streams, one would be under the scrutiny of the Army Corps of Engineers. In February 2021, we received a letter establishing that we are non-jurisdictional, with respect to the footprint of the project. So, all of our permitting is within the auspices of the Department of Land Quality and the Wyoming Department of Environmental Quality. There is no federal government involvement, so that really gives us a window into a fairly short period of time for a permit application and approval. We could envision having a permit in hand around mid-2023 and then we could really start into the development of the project.

Dr. Allen Alper:

That sounds excellent. It's great to be in an area that's mine friendly and a safe political region and to have the support of the community.

George Bee:

Yes. We have had extensive outreach with our local community. We have spoken to everybody from Governor Gordon, all the way to our local neighbors. We have had two meetings with our neighbors, telling them what we are doing with the exploration program and what we hope to do with the project. We have met with the mayors of the local cities, the county commissioners, all the trade organizations, and we are keeping the regulatory agencies informed. We are in southeast Wyoming, what we see as a very mining friendly part of the world. Martin Marietta operates a very big quarry for aggregates 3-miles south of us, so the community is familiar with mining. Martin Marietta feeds the local community with aggregate and goes onto the Union Pacific rail line too.

The one thing I would like to mention is, I have been engaged with developing projects in very remote locations. This is a safe jurisdiction. We know the rules of the game here. But importantly, we have all the infrastructure very close to us. There are existing power lines and substations, within 16 miles of the project, we are very close to water, and we do not have to build any roads. We are 4 hours from Gillette, Wyoming, an hour and a half from Denver, Colorado, 6 hours from Salt Lake City, Utah. All the major equipment operator providers are represented in those locations. Being close to both Cheyenne and Laramie, the workforce would be able to go home at night, so no need to build housing and related infrastructure for our employees. It really is a very interesting project to work on and in a great location.

Dr. Allen Alper:

That sounds excellent. From what I see, your Company is very environmentally safe and a carbon conscious company. Could you say a few words about that?

George Bee:

The Western U.S. is suffering from a drought - a lack of water, precipitation, and runoff. Certainly, the Colorado River, the large dams for generating power, is suffering at the moment because of the lack of water. What we decided to do, understanding that water is a very key issue out West, is that rather than having a conventional tailings dam, we would employ a dry stack tailings scenario. We will pay the additional operating cost and the additional equipment cost, to put in filter presses to reclaim and reuse the water from our process plant.

Once we have extracted the gold and copper from the crushed and ground mineral, we then take the tailings and squeeze all the water out and recycle that back into the plant. Minimal water goes out, with the tailings, and we conserve water. The other big aspect of this project is having extracted the copper and gold in the form of a concentrate, we then ship the concentrate off site to an existing smelter. The gold and copper are extracted offsite and as a consequence does not have any stack or refinery emissions at site. We do not have any furnaces or refinery at the CK Gold Project. We just export a concentrate.

No tailings dam, no stack or smoke emissions and we are not employing chemicals, which have the reputation of being toxic, in the extraction of the gold and copper. It is a very clean, simple operation and one on which we are planning the reclamation and concurrent reclamation along the way. We are very concerned about making sure that we maintain the habitat and mitigate any impact on the big game animals in the area.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit more about yourself, your Team and Board?

George Bee:

I came on board with the Company in August 2020, along with some experienced professionals in Management. We are few in number and that helps us with our “burn rate” and the amount of money that we are consuming from Treasury. After 40 years in operating and developing mines, I am very blessed with having many, many friends and contacts in the resource industry space. We are in a position that we hire some of the best people in the business, to assist us with the design and development of the project, on an as needed basis. We do not have to carry a lot of overhead. That is resulting in a very good, defensible, well-thought-out project for minimal cost. That is a benefit of having had the experience that I have had, including the sixteen years at Barrick and various other major and junior mining companies.

Dr. Allen Alper:

Oh, that's excellent! You have a great background to move the Company forward into production. So that's excellent! Also, it's great to have such an experienced, accomplished and knowledgeable fellow running the Company.

George Bee:

Well, thank you. Just to ensure that we can deliver on our next two big milestones, the next phase of engineering and the permit application, we raised capital twice, just recently. We have money in Treasury to see us through those two milestones, mid-year and into next year. We could always do more with U.S. Gold, not to forget the fact that we have some excellent exploration properties in our portfolio. At Maggie Creek, which is on the Carlin Trend, we drilled into the all-important Popovich Formation, which is the host formation for all the big gold deposits and found very interesting arsenic anomalies. We would like to drill some more there, either ourselves or with a partner. That is very prospective ground on the Carlin Trend.

Then we have the Keystone Property where we did some drilling before my arrival. We have been looking at the structural fabric and the anomalies that we see there. We think there is an elephant, in terms of gold deposit, within the 20 square miles that we hold, on the Keystone deposit. We would love to be advancing that. We also have our Idaho Property, and our next-door neighbor just published some interesting high-grade intercepts, which probably continue onto our property. We would love to be in a position to do more exploration, but our focus, at the moment, is on the value proposition around the CK Gold Project. When we can, we will turn our attention to the excellent exploration portfolio that we hold.

Dr. Allen Alper:

That sounds excellent, sounds like a wise business procedure going forward. And that will also, at some point, generate cash for you to do more exploration in your key projects in Nevada and Idaho.

George Bee:

The issue is, in a rising gold and copper market and global supply chain uncertainty, the potential to have domestic production is attractive. Also, the rock we mine, feeding the aggregate in the demand area, would serve the area well. We think that with the U.S. domestic production, we do not have to fear the global uncertainties that are present at the moment. We are in a rising market, in terms of the metals that we produce, so we think that all bodes very well for the project. We want to advance a value proposition, around our flagship asset, and then move forward toward the exploration portfolio in due course. It is going very well, and we hope to see progress reflected in our share price soon. I think that will definitely occur as we get to our milestones.

Dr. Allen Alper:

That sounds excellent. George, I wonder if you could highlight and summarize the primary reasons for our readers/investors to consider investing in U.S. Gold?

George Bee:

The primary issue is that there's not been a lot funding for junior resource companies as of late. If you look at the majors, they tend to do brownfield exploration leaving greenfield exploration to the junior companies. Hence the pipeline of new projects, feeding the gold and copper market, are few and far between, certainly the ones, which can be brought into operation and into production quickly. With our CK Gold Project, we can bring this project into production quickly, filling a production need at a time, when the gold price and copper price is increasing and there is increasing uncertainty in the delivery and supplies from overseas markets. We are in a rising gold and copper market; we are a domestic producer and want to put people to work in Wyoming. I think we have the support, within the state, to create jobs and opportunities. That all bodes very well for U.S. Gold. Beyond that, we are sitting on some prime real estate for exploration, I think that is why your readers/investors should be investing in U.S. Gold.

Dr. Allen Alper:

Sounds like very strong reasons for our readers/investors to invest in U.S. Gold! You have a great background, you have a strong Team, you have a great property, in a great location, with great infrastructure and a great resource.

George Bee:

About 25% of our shareholder base, which is very tight, is held by Management and insiders. We believe in our story and would recommend that others take a really serious look, because it is a great opportunity.

Dr. Allen Alper:

Well, it's great to see the Management Team have skin in the game, believe in the project and invest for appreciation of the Company.

George Bee:

Well, thank you.

Dr. Allen Alper:

George, is there anything else you'd like to add?

George Bee:

With all this global uncertainty I believe in having a bit of gold in your portfolio, as a security measure. And goodness, with all the potential for infrastructure, development and electrification, copper is the place to be. We hit both of those marks, we are going to produce copper, we are going to produce gold and I think that people should be looking at that, for their portfolios, as they look and try and weather the uncertainty that we see in the markets in general.

Dr. Allen Alper:

Well, that sounds like great advice for our reader/investors. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.usgoldcorp.gold/

U.S. Gold Corp.

Investor Relations:

+1 800 557 4550

ir@usgoldcorp.gold

|

|