Chris Doornbos, President and CEO, E3 Metals Corp. (TSXV: ETMC, FSE: OU7A, OTCQX: EEMMF) Discusses Their Emerging Lithium Development and Leading Direct Lithium Extraction Technology at Clearwater Lithium Project Alberta, CA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/28/2022

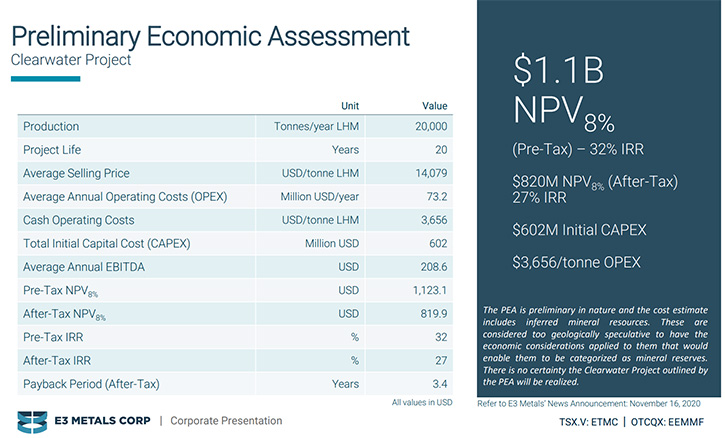

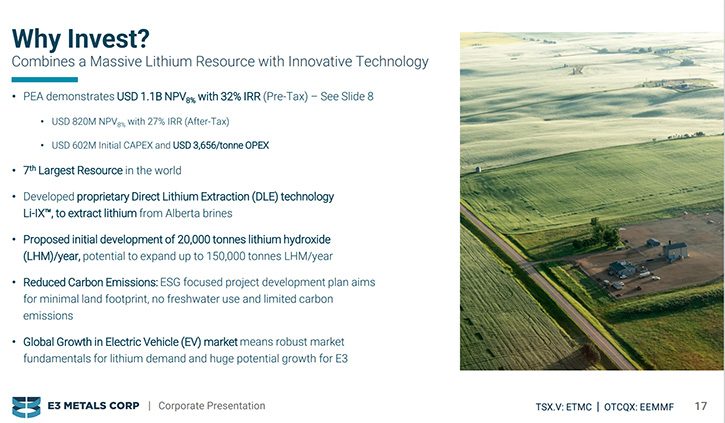

We spoke with Chris Doornbos, who is President and CEO of E3 Metals Corp. (TSXV: ETMC, FSE: OU7A, OTCQX: EEMMF), an emerging lithium developer and leading direct lithium extraction technology (“DLE”) innovator, developing their large Clearwater Lithium Project in Alberta, Canada. The Company's Lab-Pilot Prototype, which has been operating since October, has delivered 97% lithium recovery. Through the successful scale up, of its DLE technology, towards commercialization, E3 Metals’ goal is to produce high-purity, battery grade, lithium products. The recent PEA showed $1.1 billion NPV pretax at an 8% discount and $820 million NPV, after tax. Plans, for 2022, include; commissioning and operating the DLE field pilot, upgrading the resource, and evaluating available technologies, to produce a lithium hydroxide product.

E3 Metals Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Chris Doornbos, who is President and CEO of E3 Metals. Chris, I wonder if you could give our readers/investors an overview of your lithium project, in Alberta. I realize it's an excellent project, but I wonder if you could give them an overview and tell them what differentiates your Company from others.

Chris Doornbos:

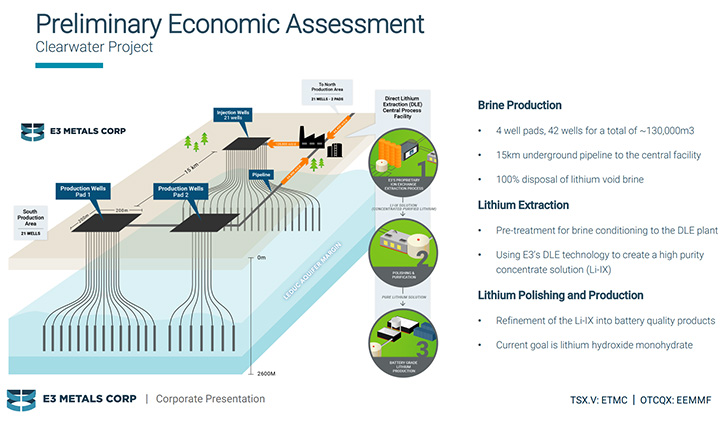

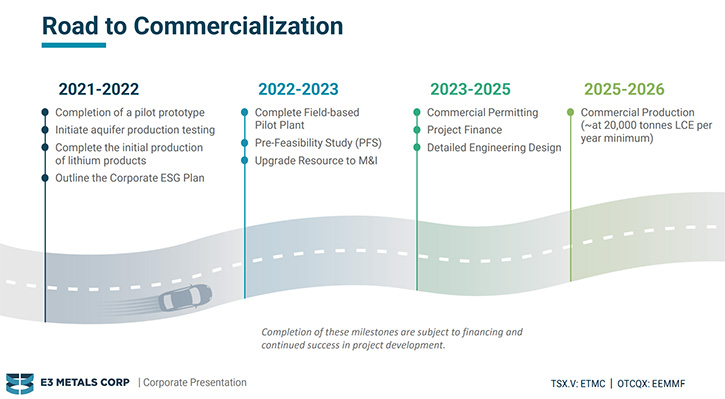

Absolutely, E3 Metals combines both a resource and technology in the DLE space, to deliver a lithium development company. Our goal is to get lithium production up and running by 2025 to 2026, starting at a 20,000-ton goalpost. That's a starting point of phase one of our commercial operation, at the Leduc Aquifer, here in Alberta, to which we own the mineral rights. It is an incredible asset for us. It was discovered in 1947 by Imperial Oil, who developed the asset for oil, up until it was sold off in the 90s. Even when it was discovered, the majority it’s composition was lithium enriched brine and about 2% oil. The oil was produced over a 70-year period and now all of that brine is still remaining in the aquifer.

Because there is very little oil left in this aquifer, the majority, of what you bring to surface is the brine. It is well understood how to remove fluids from the aquifer as we have already been moving the brine around, in a commercial sense, in Alberta for decades. With that in mind and given its 70 year history of exploration and development, we have a lot of data available from that work, along with a very detailed understanding of the skill set it takes to develop this asset into a commercial operation here in Alberta.

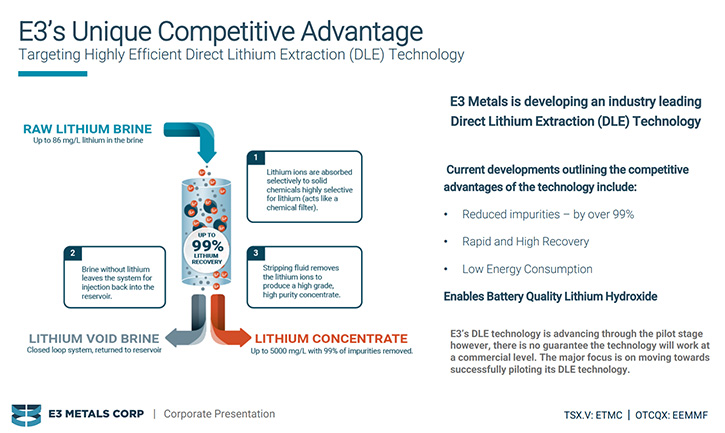

At the time we started, DLE did not exist, so developing direct lithium extraction has been E3’s focus for the past four and a half years. Finding a methodology that allows us to extract the lithium directly from the brine, enables us to capitalize on the value of this aquifer. This extraction challenge, when we first started developing it, was not being utilized in the world. Now it is quickly becoming a common methodology to extract lithium.

The traditional methods for extracting lithium, include evaporation ponds or hard rock mining. E3 will use the direct lithium extraction method. It allows us to, in a continuous flow environment, remove the lithium from the brine directly, without having to do some primary step, like evaporation to concentrate it. The technology that we developed has a twofold benefit. One is that it reduces the impurities. We remove over 99% of the impurities in this process. The other thing that it does, is it concentrates the lithium. So, we get this lithium concentrated solution that has very few impurities in it that allows us to upgrade it to lithium hydroxide, using conventional processing methodology so that we can simplify a flow sheet and create a low-cost lithium operation.

If you look at our economics, we demonstrate $3,656 U.S. per ton, produced for battery lithium hydroxide, at a preliminary economic assessment level. That is on the bottom end of the lower quartile, for operating costs for lithium hydroxide, at a better grade.

Dr. Allen Alper:

That's excellent !

Chris Doornbos:

That's the overview.

Dr. Allen Alper:

Could you also tell us about your PEA?

Chris Doornbos: E3 produced a PEA last year at $1.1 billion NPV pretax, at an 8% discount and $820 million NPV after tax. What we've been able to demonstrate is 20,000 tonnes at $14,000 per ton, for lithium hydroxide. Right now, lithium hydroxide is selling for over $20,000 a ton. So I think that there's some room to move on these numbers. but even at this rate, it is still extremely economic for E3 to put this project into production. It is based on standard oil production equipment, to get the brine out of the ground, based on a third-party process technology, to make the lithium hydroxide itself.

The only piece that is currently outstanding, before E3 can move ahead to commercial development, is de-risking the DLE technology. If we didn't have this technology to pilot, if that risk had already been accomplished, we would be well into commercial development of this project already. The only thing holding us back, from moving towards commercial, is to make sure our DLE technology works commercially in the field. The 20,000 tons, outlined in the PEA, is just the starting point. There's enough brine in the aquifer to produce at a rate of 150,000 tons a year, and that can run for probably about 30 to 35 years. It is a huge opportunity!

Dr. Allen Alper:

That's really great. Could you tell us a little bit about your schedule?

Chris Doornbos:

As expected, 2022 is going to be a very, very big year for E3. There are three major milestones that we plan on accomplishing by the end of the year. The first one is the DLE pilot, which is obviously a very important piece of our overall business plan, which we aim to have constructed by the end of this year. The second piece is an M&I upgrade to the resources, for which we are going to drill up to three wells, in our actual production area. We will drill these wells in the location we anticipate putting in the commercial production network. This will give us the data we need to upgrade that area as is critical to book a reserve under pre-feasibility study, particularly to measured and indicated. The last milestone, that is currently underway, is vetting different technologies, to produce a lithium hydroxide product. This will enable us to ship large volumes of our concentrate we plan to produce.

At the pilot scale, we can produce this concentrate and can have it refined to make a significant amount of hydroxide. Significant at this scale are several kilograms and then we can start sending that off to customers for testing and third-party validation. These three major project milestones are expected to come together in 2022. The result of all of that work, when it's all completed, is a pre-feasibility study that we expect to have out in 2023. That Pre-Feasibility study will be the marker for the beginning of our commercial operations.

The next step, once the pre-feasibility study is out, would be to apply for our permits for the projects. There are three required permits for our operation: well licenses, pipeline licenses and a facility license. After obtaining permits, a detailed interim design, of a process facility, will be done and then we can move ahead to project finance. Once those three pieces come together, we're building a plant, we're drilling wells and we're putting this into production. So that's the goal right now. That's where we're aiming.

Dr. Allen Alper:

Well, that's an excellent plan! Sounds like you're in a great position to move the project forward! Could you tell our readers/investors a little bit about the lithium market supply, demand and uses, etc?

Chris Doornbos:

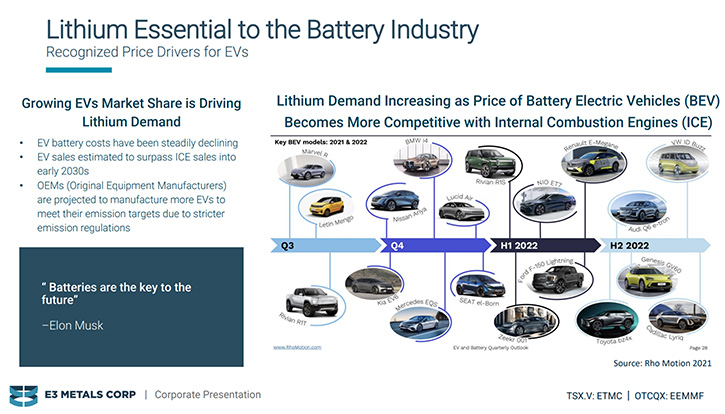

The lithium market has seen a couple of major catalysts recently that have changed the market and brought lithium into the forefront of the lithium battery and the EV market, in terms of the commodity rate. One catalyst is that almost every single automobile manufacturer, in the world, has committed to electrifying its fleet, in part or in whole. The other catalyst is all those Companies are building their EV lines, on the back of the lithium-ion battery. There is potential that one day lithium solid state might become an option, which would bring the energy density to the next level, but at the moment, the lithium-ion battery is the battery of choice, for every single one of these electric vehicles.

The combination of the two have meant that the market for lithium and the demand for lithium is going to be astronomical. Third party predictions, including Rio Tinto, is talking about three million tons of demand by 2030. The market to produce lithium in 2020 was around 300,000 to 350,000 tons. Meaning, in 10 years, it must grow by 10 times. That is just not heard of. The results of that will be every project that's out there will be needed, plus some, to get enough lithium to the market in order to meet this demand for these vehicles. This means good prices and a strong market for the next 10 years and well into the 2030s. This is a perfect time for E3 and peer companies that are equally advanced to be bringing projects this far forward.

This high demand means that there will be more opportunities for financing, grant funding, and other opportunities to continually advance and build these projects. Lithium is a specialty commodity, in particular a specialty chemical. It differentiates itself from other battery metals because in 2030, if the estimates are correct, over 90% of the lithium produced in the planet will be going into electric cars.

Our aim is to develop a product that meets specifications for that market. So, battery quality, ESG, carbon footprint, all of these things are incredibly important for lithium specifically. I think E3 stands out among the peers on its ESG profile. We’re aiming for a very low carbon product, one option for that is through carbon sequestration, here in the province. We have a very small footprint, and we don't interact with the freshwater aquifer. We have a very good ESG story to tell, and our DLE concentrate is a very high purity-based product. Combined, these things provide an opportunity for E3 to make lithium for the future. We're not a hard rock mine that has high impurities, that was never designed for the battery market. We are designing a product, specifically for this new industry.

Dr. Allen Alper:

That sounds excellent. Chris, could you tell our readers/investors a little bit about yourself, your Team and your Board?

Chris Doornbos:

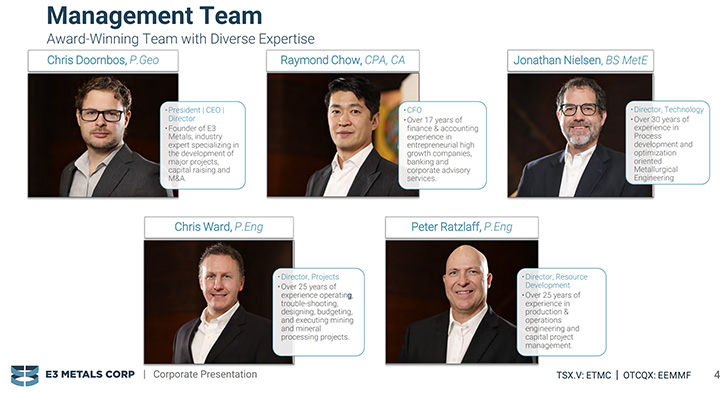

Including myself, we have five Directors, on the Board of this Company, who have been very supportive since its inception. All bring a breadth of experience across capital markets, oil and gas development and operations, and project finance. Two of the Directors have joined, in the past 12 months, that have been very beneficial to E3 and very impactful on the business.

A little bit about myself, I have a strong technical background and have developed major projects in both Canada and across the globe. I founded E3 Metals in 2016 and was formerly the CEO/Director of Revere Development Corp. and Vice-President of Exploration for MinQuest Ltd.

Within the Management Team, we have five highly skilled executives:

Chris Ward is on the projects side. He is the person directly responsible for building out this project. He has been in charge of building-out multiple large-scale projects, throughout his career, including the $17 billion Fort Hills Project, which was a huge oil sands project here in Alberta.

Jonathan Nielsen is our Director of Technology. He is the odd one out, he's the non-Albertan of the crew. The one skill set we don't have in Alberta is lithium processing, so we brought him in from the states to fill that gap.

Ray Chow, the CFO, worked in the oil gas space, as the CFO of Project Finance at ATB. He is very experienced in this space and is leading that side of the business, including assisting me on capital raising and all other financial activities.

Peter Ratzlaff, who is the Director of Resource Development, has been working in oil and gas for 25 years, on the conventional side of things, drilling and completions and production of fluids from these aquifers. He has the important job of managing the drill program, and delivering brine to the process facility, in a commercial scenario.

We currently have 18 people, who are led by our Management Team, which makes 23 employees in total. We are lucky to have some amazing staff. They are a great group of people to work with.

Dr. Allen Alper:

It sounds like you have a very experienced, accomplished Team and a diversified one, so that's excellent. Chris, could you tell our readers/investors a little bit about your share and capital structure?

Chris Doornbos:

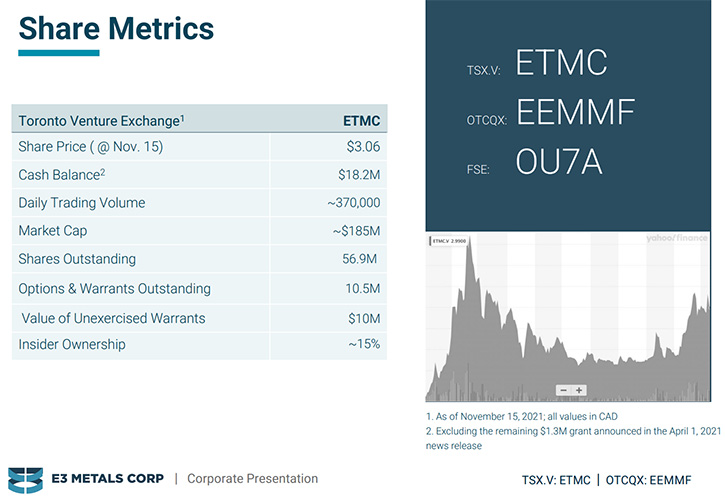

We have about 58.1 million shares on issue today. There are about 10 million warrants and options outstanding. We've worked really hard to protect the capital structure. We've been able to do a lot of work on the back of oil and gas industry using the existing geological and production data which has reduced the necessary capital needed to progress our development. That's obviously changed now, we're going to drill our own wells, but until now it's been more than enough to keep this going.

To date we have only raised $28 million for this Company, and we currently have a little over $16 million of that left in the bank. Five years since going public, we've been able to efficiently deploy our capital towards the development of the Clearwater project and DLE technology. We have also been able to use non-dilutive financing, by securing grants and other opportunities to keep the capital structure relatively tight. 2022, obviously is going to be a historic year, as we are well funded to accomplish the three major goals we have set out for the Company.

Dr. Allen Alper:

That's excellent, Chris! Could you tell our readers/investors the primary reasons they should consider investing in E3 Metals Corp?

Chris Doornbos:

If you are a resource investor, E3 has all of the hallmarks of a story that creates value for shareholders. We have a commodity on the rise, and we're in a great market for this commodity. There is a lot of positive sentiment for lithium stories, we’ve garnered lots of attention. You look at a peer like Lake Resources, who's worth almost $2 billion Canadian and who were worth around $300 million a couple of years ago. We are worth $170 million and we are on the same path as they are.

I would also point to jurisdiction, being in Alberta is a great place to be developing a lithium story. We're not in outback, we're not in the middle of nowhere. We're north of Calgary, by 40 minutes. We have grid, roads and power and all the things that we need to develop. All the people we need in Red Deer are 20 minutes away. It's a big service city in Alberta that serves as a central city, where all the service companies are for the oil and gas industry.

We have supportive government. We have Bill 82 on the floor of the Legislative Assembly. Bill 82 provides regulatory oversight of the Alberta Energy Regulator, who is the regulatory body that manages oil and gas. This is important because producing a mineral from a brine is just like producing oil from a brine. It is identical in terms of how you operate. You pump, you drill a well, you put in a pipeline, identical to oil and gas operations, which means the AER is a perfect body to regulate these operations, because they have all of the policies in place, all the regulations in place to manage lithium.

If you compare the way the AER works, versus other regulatory bodies, they're very streamlined, very efficient. Although not perfect, no regulator is, but they stand out in my mind as one of the top regulators, for mineral extraction, in Canada. We're very excited that this bill is on the floor and provides them the authority to regulate lithium. There are more reasons I could get into, but these are the things that stand out to me the most.

Dr. Allen Alper:

Well, those sound like very compelling reasons to look at investing in E3 Metals. You have a great Team, a great product, you have great technology, a great location and a great market that's growing. There's a huge gap developing and you're serving a good cause for electric vehicles. So that's excellent!

Chris Doornbos:

Yeah, absolutely, absolutely! We wouldn't be getting anywhere without our Team, right, so that is number one.

Dr. Allen Alper:

Well, that's excellent! Is there anything you'd like to add, Chris?

Chris Doornbos:

No, I think that covers it. It's a good overview.

Dr. Allen Alper:

Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.e3metalscorp.com/

Chris Doornbos, President & CEO

Phone: (587) 324-2775

investor@e3metalscorp.com

|

|