James Wilson, CEO, Alchemy Resources Limited (ASX: ALY) Discusses Gold, Base Metal, and Nickel-Cobalt Exploration and Development of High Quality Projects in Australia.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/26/2022

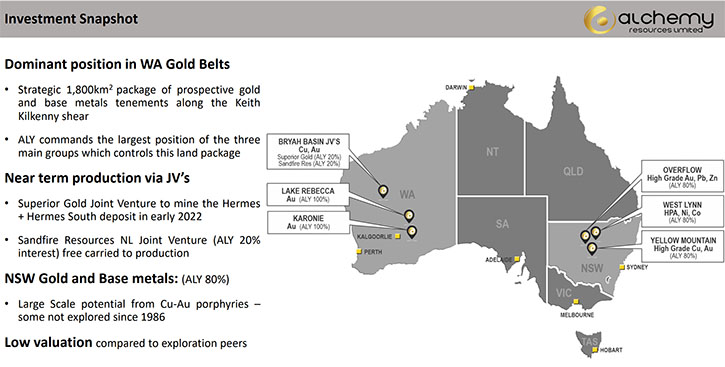

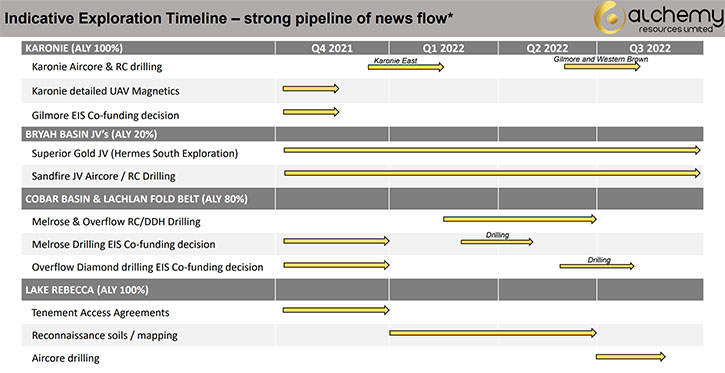

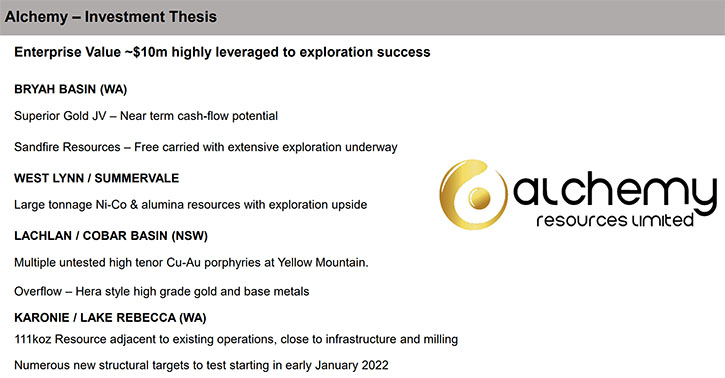

We spoke with James Wilson, the CEO of Alchemy Resources Limited (ASX: ALY). Alchemy Resources is an Australian gold, base metal, and nickel-cobalt exploration company, focused on growth, through the development of high-quality exploration projects, across multiple commodities, within Australia. Alchemy has built a significant land package, in the Carosue Dam - Karonie greenstone belt, in the Eastern Goldfields region, in Western Australia and has an 80% interest in the Lachlan/Cobar Basin Projects, in New South Wales. The Company is doing three back-to-back exploration drilling programs and has raised just over $3 million AUD, with the intention to put all the money into the ground. In addition, Alchemy Resources has near-term production and cash-flow potential, through joint ventures with Superior Gold and Sandfire Resources.

Alchemy Resources Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, I’m talking with James Wilson, who is the CEO of Alchemy Resources. James, tell us a little bit about your Company, give us an overview of it and tell us what differentiates it from others.

James Wilson:

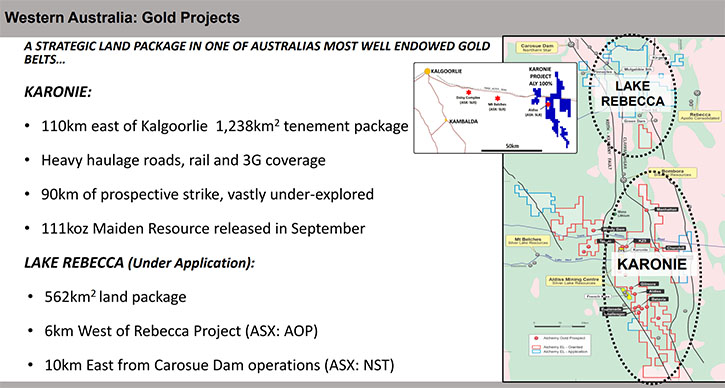

I came into Alchemy last year. It has a significant portfolio, based in precious metals, and quite an extensive land position, with about 1,200 square kilometers, in the more prolific gold bearing district, around Kalgoorlie. Another 600 or so of square kilometers are under application at Lake Rebecca, which is next to Carosue Dam, with Northern Star, and Apollo, now Ramelius, at Lake Rebecca next door. We have an extensive land position of advanced assets, in and along the Gilmore Suture, which is in New South Wales, which hosts the huge CSA Mine. It's a really good strategic set of assets, across multiple commodities. We're now starting to see that bear fruit, because we've actually stepped up our exploration drilling, by a multiple this year.

Alchemy has never really done this many drill programs before. We have also just finished one out of Kalgoorlie. The second one is about to commence, in about two weeks, and the third one should be commencing a month or two after that. We're trying to get across the assets. We're trying to go and work them as hard as we can. We've stepped up our Team. We’ve quadrupled the number of personnel that was there historically, before I came on board, and we have a lot more bandwidth to go and hit the ground running now, with multiple targets.

It's an exciting time. Historically Alchemy used to raise about $1.5 million a year and we doubled that this year and raised just over $3 million AUD and we're aiming to spend the bulk of that, hopefully this year. We're going to be a lot more aggressive, with our drill programs, and putting our money where our mouth is, and putting all the money into the ground.

Dr. Allen Alper:

Well, that sounds excellent. James, could you tell our readers/investors, a little bit about your background and your Team?

James Wilson:

I'm a geologist by background. I started my career working for CRA, which is now Rio Tinto, up in the Pilbara, doing energy metals and base metals exploration. I then progressed into the Kalgoorlie Goldfields, working for Great Central Mines, at their high-grade Bronzewing Mine, early on in my career, and then going into open pit regional exploration and underground there. I went overseas and went to work in Ghana, doing gold exploration, up in the Obuasi Region, next to the Obuasi Mine, with Ashanti Gold and then went to other parts of Africa and Burkina Faso, and New Guinea, working for Semafo.

Then I went to China, working for an Australian company that was eventually taken over by Eldorado Gold and they took over our Tanjianshan Gold Mine asset over there. I came back to Australia and moved over into the sell-side analysts game, working for a number of brokers over here and finishing most recently, with a local Perth Australian broker, doing institutional brokering into North America and into Europe, doing predominantly precious metals and gold and the bulks in iron ore.

I saw an opportunity, going back into the corporate world, with Alchemy. I saw assets that looked very favorable and saw that we could work them. The market cap was very small, and I believe that if we actually went and worked those assets a bit harder and put more people on and put some more bandwidth into it, that we could actually have some value accretion there.

I jumped on board at the start of last year and we've now been on the job for just over 12 months. We’ve solved a lot of the legacy issues of either marketing or putting the Company more outwardly facing to the market. We engaged institutional shareholders, with our recent raise and put a number of experienced people on, trying to get some traction in the market, with our assets, and talking to a lot of people all the time about everything, trying to monetize assets and, and also actually making Greenfields discoveries.

Dr. Allen Alper:

Sounds excellent! James, could you tell our readers/investors a little bit about your share and capital structure?

James Wilson:

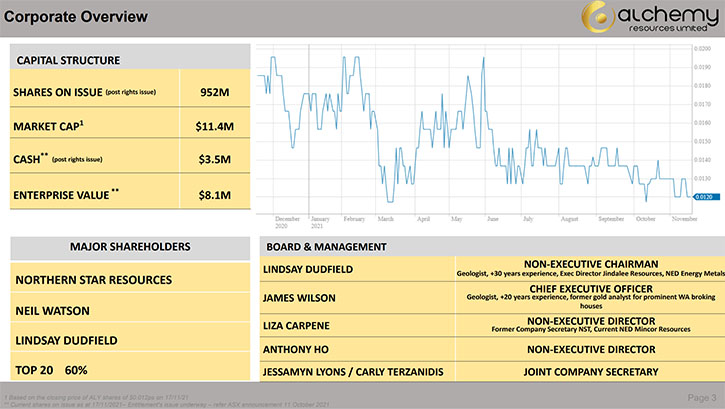

We have about 962 million shares on issue. Of that, probably 60% of the shareholder register is controlled by the top 20, including a number of high-net-worths, including Chairman, Lindsay Dudfield, who is also the Executive Director of Jindalee Resources. We have a number of high-net-worth clients, based on the east coast of Australia. Our largest investor is Northern Star Resources, who holds just under 10% of the stock, they've been there for some years and are very, very supportive.

We have a good register, it's a good institutional register. After we did our raise, we put that raise to the institutional guys and also to retail investors to go and try and free up some liquidity, there as well. We're trying to leverage the power of the retail network, as well as also having cornerstone institutional shareholders.

Dr. Allen Alper:

It sounds very good. James, could you tell our readers/investors the primary reasons they should consider investing in Alchemy?

James Wilson:

In Western Australia the gold assets that we have, have largely been looking for the easy wins that were in Australia, which is the supergene oxide gold and that's been something that's been going on for probably the last 20 to 40 years on our tenement package. What we have found recently, especially at Karonie, is that Silver Lake, our neighbor next door, is mining a number of deposits. The new deposits that they're finding have very short strike lengths, less than 200 to 300 meters, but they're high-grade, so they're averaging anywhere between 3 to 15 grams per ton gold.

We've changed our exploration philosophy, in this part of the world, to target similar structures and we've been having a win on our recent drill program. We're finding gold in areas where people have historically passed over it with rudimentary RAB (rotary air blast) drilling or near surface drilling and did not have any results. We've gone back in there with a much more powerful rig and we have results, where we're actually seeing free gold, in the alluvial profile, as well as some reasonable intercepts of >5g/t gold in areas that historically didn’t return anything from previous drill programs

Our follow up programs are similarly oriented, to be more closely spaced drilling, to target those short strike lengths, but high-grade structures. At our Lake Rebecca assets, up in the north tenement package, we’re on the cusp on getting these granted and to commence work. A lot of the areas at Lake Rebecca haven't really been explored, because they've had historical problems, solving the heritage issues and being able to actually go and do drilling on that ground. We are very far advanced, in getting those agreements in place. I would be expecting that those agreements will probably be signed, sometime before mid-year this year. That's been close to a two-year process. But once that's done, we will have access to ground up there that largely has never been explored for the past 20 years.

In New South Wales there's a huge resurgence in base metals exploration, as we've seen with a lot of the junior companies, like Helix and the Kingston Resources guys, buying Mineral Hill for $23 million recently. Again, it's a resurgence, not only a change of exploration ideas, but also having more capital, to go in there, to look for these assets. Peel Mining has had a great win at their Malee Bull assets, finding higher grade copper and we are echoing their successes. We are getting the access agreements to get in there now, and hopefully drilling in the next few months.

We're hopeful that we'll be drilling there sometime mid-year, looking for that high grade copper that we have, in particular, on our Yellow Mountain asset. There were samples, taken on the waste spoils, next to the historic shafts, that were coming up to 7% copper and 6.5% lead, in the surface sample. We're really eager to get back on the ground there.

We also have an advanced battery metals asset up there, with the West Lynn Nickel-Cobalt-HPA asset. That already has a resource on it and we're looking to doing some further metallurgy test work and expand the resource. Were also talking to interested parties, to partner with us, because high purity aluminum is obviously a big thing, in the battery metals space, at the moment, as is nickel and cobalt.

It's an extensive portfolio! I think that differentiated us from a lot of other people. We probably have the equivalent of four or five IPOs, within our portfolio, because of our advanced position in a lot of these areas. It's a good place to be and we have extremely strategic assets that we aim to monetize and build value for shareholders.

Dr. Allen Alper:

That sounds excellent, James. Is there anything else you'd like to add?

James Wilson:

Obviously, we have a lot of other things, going on in our portfolio. We're gold-focused, generally over in Western Australia, but that doesn't discount the fact that there may be other areas that we're looking at. We've just seen our neighbors in Karonie, which is the Breaker Resources, sell 80% of their Manna Lithium Project to Global Lithium Resources. We basically surround that tenement, and we are within a stone’s throw of the ~10Mt Manna deposit so it makes sense that we investigate the possibility that we might have similar exploration potential on our ground.

Dr. Allen Alper:

Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://alchemyresources.com.au/

James Wilson

Chief Executive Officer

E: james@alchemyresources.com.au

P: 08 9481-4400

|

|