Ross McElroy, Chairman and Sherman Dahl, CEO SKRR Exploration Inc. (TSXV: SKRR; OTC Pink: SKKRF; FSE: B04Q) Discuses Their Hall of Fame Team, Exploring in the Best Potential Gold District in Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/24/2022

We spoke with Ross McElroy, Chairman and Sherman Dahl, CEO of SKRR Exploration Inc. (TSXV: SKRR; OTC Pink: SKKRF; FSE: B04Q). SKRR is a Canadian-based, precious metal explorer, with properties in Saskatchewan – one of the world’s highest ranked mining jurisdictions. The primary focus is on the, significantly under-explored, Trans-Hudson Corridor, in Saskatchewan, in search of world class precious metal deposits. In 2022, SKRR is focused on drilling, at their Olson Lake Property, that is prospective for high-grade orogenic gold and VMS mineralization, as well as drilling at their Manson Bay Property, with historic gold resources and new high-grade targets. In addition, SKRR has a high-grade nickel property and recently acquired a property, with a historic zinc-lead-silver deposit, important metals for the battery market. According to Mr. McElroy, SKRR has the best portfolio, of any junior explorer in Saskatchewan and they are going to be very aggressive.

SKRR Exploration Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ross McElroy, Chairman, and Sherman Dahl, CEO of SKRR Exploration. Ross, could you give us an overview of your Company, the services you provide the mining industry and what differentiates your Company from others?

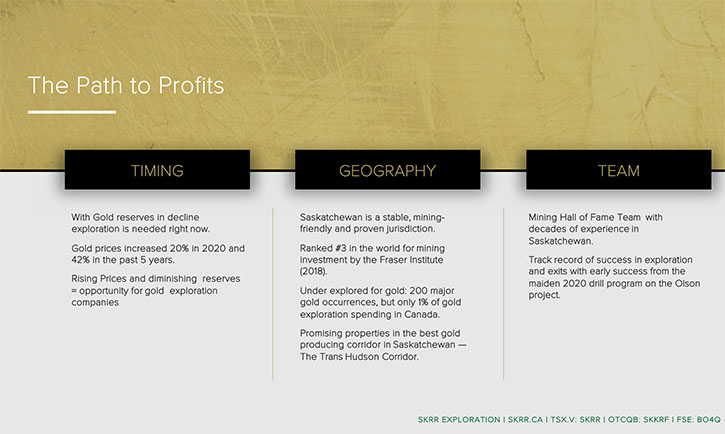

Ross McElroy: SKRR is an early-stage exploration company, focused on properties in Saskatchewan. We're very comfortable, with the province of Saskatchewan. Both Sherman and I have had long histories, associated with Saskatchewan. We think the geologic potential there is incredible. The environment, the jurisdiction is top notch. It's highly rated, it has always been considered to be one of the top mining investment jurisdictions, in the world, by anybody surveyed. The geologic potential is amazing. It's been an important player, obviously in uranium, but gold and base metals and a whole plethora of commodities.

At SKRR, we’ve acquired a number of projects in precious metals. We have some very good gold properties, in our portfolio. We've also looked at adding properties that are focused on nickel as well, with an eye on battery metals, the important sector in battery metals. We have high-grade nickel. Recently, we have also acquired a property that has a historic zinc-lead-silver deposit as well. We consider them exploration stage projects, but they all have a certain amount of historic work, on a number of them, that have historic deposits.

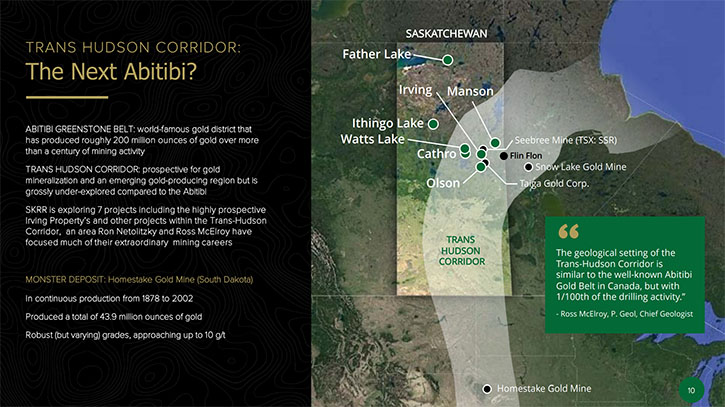

They're not truly the grassroots exploration projects that some might have, these are ones that have projects that can be developed, deposits that could be developed, to meet new 43-101 standards. We have a great number of properties. We're focused on, what we call geologically, the Trans-Hudson Corridor, which is a very large geologic feature that runs up through the spine of North America.

It covers a lot of the province of Saskatchewan and heads off towards the Hudson's Bay Area. The Trans-Hudson Corridor is such an important geologic feature because that's what's responsible for hosting the world famous Flin Flon District, which has some of the world's best VMS deposits. It also hosts mega gold deposits, such as the Homestake Mine in South Dakota, a 45-million-ounce historic producer. It’s really responsible for the uranium that you see in the Athabasca Basin. It’s a key part of the story and why we're looking for projects in the province. That's just a quick overview.

Dr. Allen Alper:

It sounds great, could you tell us your plans for 2022?

Ross McElroy:

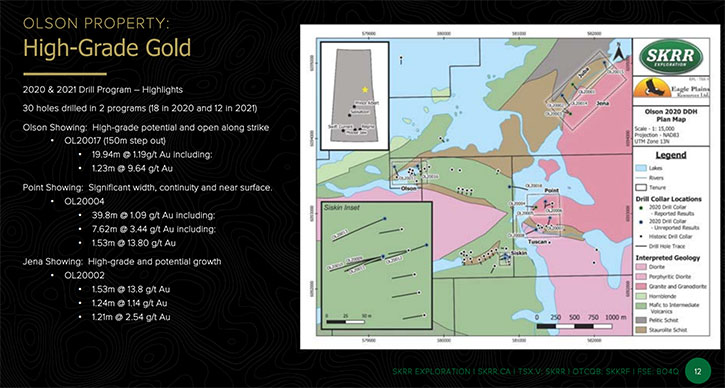

We've already begun, quite aggressively, in 2022, and we've just completed a drill campaign, on our Olson Lake Property. Olson Lake was the first project brought into the Company, about three years ago. We've already conducted three drill programs, each one very successful, in building on the success of the previous ones. So, we have a number of very encouraging target areas, on the property. The drills have been very successful.

Recently, we put out a news release, updating our just completed 10 Hole Program at Olson, where every single one of the holes hit mineralization. We tested four different target areas. Each one of them getting mineralization, being sulfides and quartz. We know from previous historic drilling and things that we've done in the last couple of years, that these areas are very anomalous in gold.

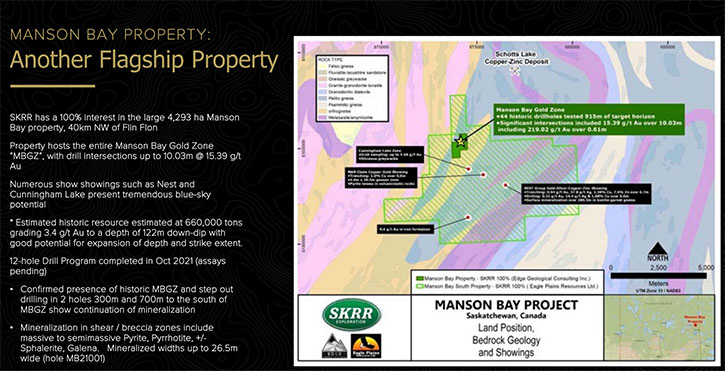

There have been high-grade, encouraging gold intersections. We're awaiting assays from the drilling we've just completed, but we're encouraged by the results we've seen so far. We've been able to raise money. We have raised capital and we're going to continue to put that capital to work. We’ll be looking at other targets, on our Manson Bay Property. Later this summer, we will be doing some drilling, which would be our second campaign. We did drilling there in the fall of 2021.

Again, a historic discovery of VMS zone, very gold rich VMS targets. On our first drill program, we hit a lot of really encouraging zones, with intersections up to 20 plus meters in width. One of the better holes on the property was 15 grams per ton over 10 meters. It does pose some high-grade gold in Manson Bay. We plan on being back drilling Manson Bay, later on in 2022, in the summer.

We're going to continue to evaluate the projects. But we have probably the best portfolio of any junior explorer in the province and we're going to be very aggressive. Sherman is out there raising money, getting our story out there. I think, with the kind of traction that we are getting and the commodity cycles, the way they are, we're going to be continuing to be very aggressive in 2022.

Dr. Allen Alper:

Well, that sounds great. Sherman, could you tell us a little bit about your share and capital structure and your financial plans?

Sherman Dahl:

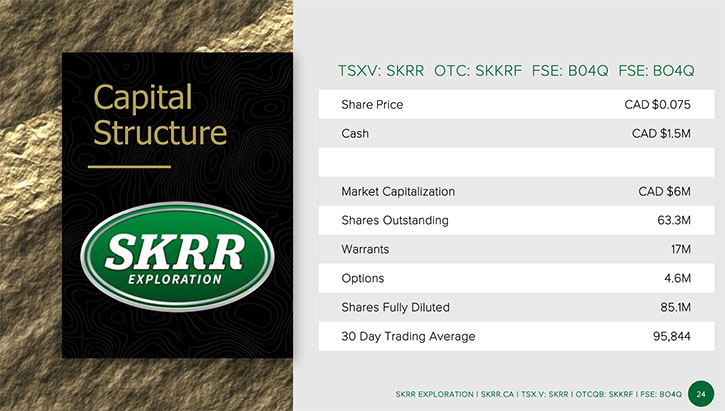

I think the focus for all retail investors and even institutional investors should be on the people that are involved, the projects that the underlying Company has and then of course, the price. We can talk a little bit about the price, with regards to the share structure. We have about 70 million shares outstanding, so we have a very low market cap, at roughly a 10-cent share price. We have a $7 million market cap. We have about $2.5 million in cash currently. We have been aggressive with the drilling, so we have a very low burn rate. We don't have any staff. We work very closely with Terralogic and we have a very tight Team in Vancouver. We work with Ryan Cheung, who's our CFO, Nick Ahling, who's our corporate lawyer, all guys that have been with the Company since inception. And then, of course, Ross and I have a very, very strong advisory Board. So, we have like a $7 million market cap Company, with about $2.5 million in cash. But we have been drilling aggressively, putting as much money as we possibly can into the ground. We know that when you're working these greenstone belts and when you're working these bigger areas, in Saskatchewan, it does take time. You're always one drill hole away from a big discovery, or big news that's come out of similar style belts, like Abitibi and Red Lake. Even the Santoy Gap, if we go back to when that was first discovered, that was a complete game changer for Claude Resources. It took them from the edge of bankruptcy to a $600 million buyout, by SSR Mining.

These big deposits, these very rich deposits are in Saskatchewan. To answer your question on the price side of it. There are about 70 million shares outstanding with roughly a 10-cent share price, relatively low market cap, given that we have $2.5 million cash. And a portfolio of properties, much to Ross's point, as he's mentioned on previous calls, there is no way that you would be able to go out and stake the kind of land position that we have, with one of our shareholders recently quoted saying, “Staking for ounces”.

We’re not talking about Moose Pasture Mining, we're talking more advanced properties that have, in some cases, drilling that goes back to the 50s, by companies like COMINCO and Claude Resources. It has obviously attracted the attention of some world class people like, Ron Netolitzky and Ross McElroy on our Advisory Board. We have guys like Mike Halvorson, with guys like Craig Roberts, the founder of New Found Gold.

They know what they're looking for. They're going to jurisdictions that are safe. They go into jurisdictions that have significant mineralization and they’re discovery type individuals. So, I think we have all the right projects, all the right people, and the price is abundantly cheap, given the assets that we have.

Dr. Allen Alper:

Sounds great! Sherman and Ross, could both of you comment on the primary reasons our readers/investors should consider investing in SKRR Exploration?

Sherman Dahl:

I'm happy to answer that. I think for individual investors, if we look at the essence of the right projects, the right people at the right price, clearly the right people and the right projects can bail you out, even if you overpay for an asset. We always encourage investors to look at the quality of the projects and the quality of the people. If in addition, you're able to buy those projects and people at a discount, well, then that's even a bonus. But I would never, ever sacrifice the quality of the people in the project.

Saskatchewan is one of the top ranked jurisdictions in the world. The Trans-Hudson Corridor is producing world class assets the entire time. It's just been underexplored in Saskatchewan.

You should invest because it has world class projects, it clearly has world class people. Then an added bonus is you're buying it at a significant discount. I don't think it gets much better than that. We're trying to attract long-term investors, people that understand the opportunity in Saskatchewan. These things don't happen overnight, as long as you have a patient, informed and aware investor. Buying shares in SKRR, they're becoming shareholders right along with us.

Ross and I have very big positions. The whole Team is committed to growing this Company, in Saskatchewan. I think those are the main reasons to buy. You want to make money and you want to be protected on the downside.

Dr. Allen Alper:

Well, that sounds excellent. Ross, do you have anything else you'd like to add?

Ross McElroy:

I just want to continue to build off exactly what Sherman was saying. You can't underestimate or under assume the importance of Management, like the people that backed companies like this. You find successful people continue to be successful in this business. Sherman’s been able to put together just an incredible Team of experts that have all been very successful in their endeavors, in the sector before. Everybody is very committed to making discoveries and capitalizing on projects like we have.

For me, any time I look at investing it’s always about who’s running the Company? Who’s behind it? Who’s backing it? It's such an important part. When you layer that on top of the jurisdiction that we're in, the potential for Saskatchewan. We put land together that I think it's a very good statement to make and I think it's important to emphasize the fact that you couldn't take that ground right now.

When we picked things up, it was at a time where the sectors were very quiet. There wasn't a lot of activity. In the exploration hunt, people weren't staking ground. We were able to pick up top projects that are now exactly what people want and the kind of projects that we think we can build deposits on.

We do have a really nice portfolio of properties, in precious metals and also in strategic metals, such as nickel and zinc. We're very active and we're going to continue to invest all the money that is around to make discoveries. That's really what we emphasize. I just want to make sure that we do emphasize those key points.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in SKRR. You have a great Leadership Team, great track record, and you're in a fantastic area and the price is right. It sounds like you have everything going for you, indeed. Is there anything else either of you would like to add?

Ross McElroy:

I don't have anything else.

Sherman Dahl:

No.

Dr. Allen Alper:

Thank you. That sounds great. I'm very impressed with your Company and your group. You couldn't be a more successful, diversified Team and you’re in a great area. I'm looking forward to a long-term relationship, with you. I'm very happy to bring your Company to our readers/investors, in your very early stage, which gives them a great opportunity for making money, which all of our readers/investors like. I'm very impressed with Ross and have been throughout the many years I’ve known him. I could write an article just on all the rewards and recognition he has had.

https://skrr.ca/

Sherman Dahl

President & CEO

Tel: 250-558-8340

|

|