Rudi Fronk, Chairman and CEO, Seabridge Gold (TSX: SEA, NYSE: SA) Discusses Developing One of the World's Largest Resources of Gold, Copper and Silver

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/22/2022

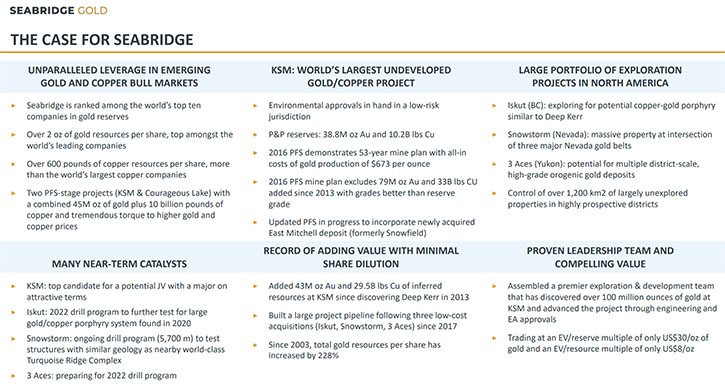

We spoke with Rudi Fronk, Chairman and CEO of Seabridge Gold (TSX: SEA, NYSE: SA), one of the world's largest resources of gold, copper and silver, with the Company’s principal projects, located in Canada. The Company’s objective is to grow resource and reserve ownership, per share, by applying this risk-reducing strategy: Acquire North American deposits; expand them through exploration; move them to reserves, through engineering; and sell or joint venture them to established producers, for mine construction and operation.

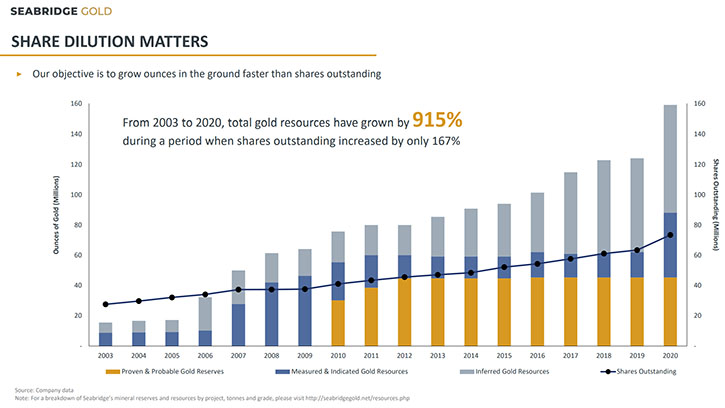

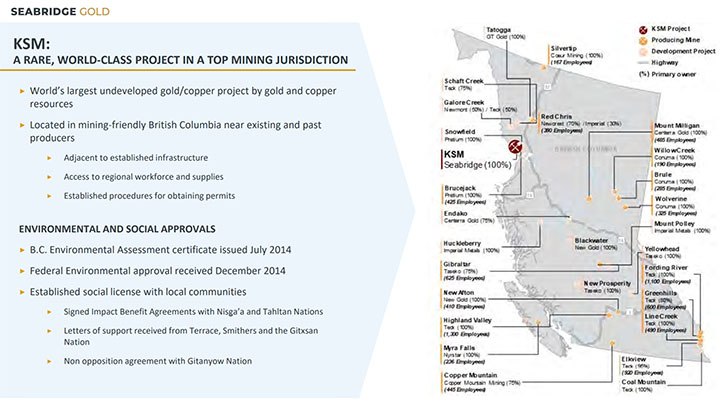

From 2003 to 2020, Seabridge Gold's total gold resources have grown by 915%, while its shares outstanding increased by only 167%. The Company has advanced its core project significantly: the KSM Project, located in British Columbia. KSM is the largest undeveloped gold-copper project in the world that has successfully gone through the environmental approval process, as well as gained the support of the local indigenous population. Seabridge Gold plans to advance Substantial Start Activities at the KSM Project that will extend its permits in perpetuity, a major de-risking of the asset.

Seabridge Gold

Dr. Allen Alper:

This Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Rudi Fronk, Chairman and CEO of Seabridge Gold. Rudi, could you give our readers/investors an overview of your Company and what differentiates it from others? Then I'd like you to explain the significance of the fantastic raise you just did, of US$225 million from Sprott Royalties and Ontario Teachers Pension Plan.

Rudi Fronk:

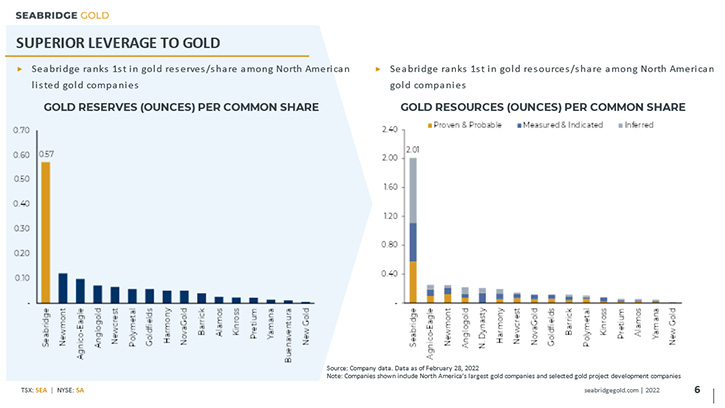

We formed Seabridge in 1999, with the objective of creating the industry's best leveraged play to a rising gold price. We've done that through the concept of growing ounces in the ground faster than shares outstanding. If you look at Seabridge today, we provide our shareholders with more ownership of gold per share, either in terms of reserves or resources, than any other Company in our space.

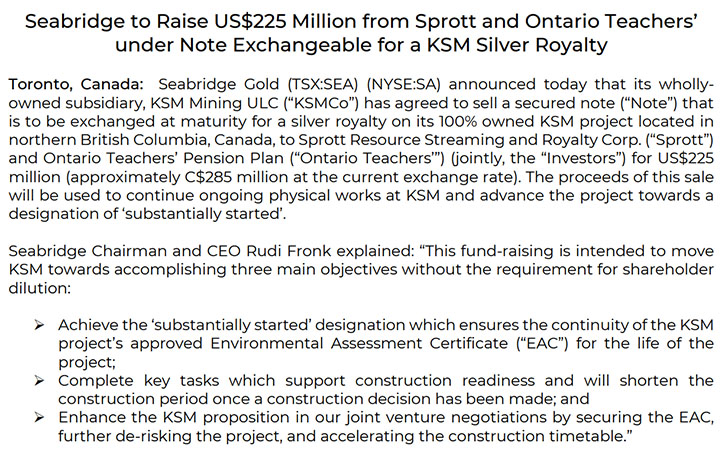

Our most significant asset, at this time, is the KSM Project in British Columbia, Canada. KSM is the world’s largest undeveloped gold-copper project. It has successfully gone through the environmental approval process and gained the support of the local indigenous population and is now poised to become one of the largest and lowest cost gold mines, in the world. Last week we announced a US$225 million financing with Sprott Royalties and Ontario Teachers’ Pension Plan that will be used to continue to advance and de-risk the asset.

The funds from the note will be used to advance what are called substantial start activities at KSM. Once a project in British Columbia is designated as “substantially started” the environmental assessment certificate does not expire but rather remains valid for the life of the project, which, in the case of KSM, is for many decades. Achieving substantial start will be a major de-risking for KSM, which will only strengthen our hand, in ongoing joint venture discussions.

Dr. Allen Alper:

That’s excellent! That a great relief for you, your shareholders and stakeholders.

Rudi Fronk:

The structure of this financing is unique. We are issuing a note for US$225 million that will automatically convert into a silver royalty, when KSM commences production. As you know we've always been stingy with our common shares, trying to minimize equity dilution, while we grow ounces of gold in the ground. Our goal, in looking to raise the dollars needed to advance substantial start, was to minimize share dilution. Had we done a more traditional equity raise for US$225 million, we would have diluted our shareholders by about 16%. In that the US$225 million note will automatically convert into a silver royalty at KSM, there is no equity dilution to our shareholders.

In essence, what we're doing is letting the project fund itself, with silver in the ground that eventually will be paid as a royalty to Sprott and Ontario Teachers. KSM is known best for its gold and copper reserves and resources, not for its silver. Silver represents less than three percent of the KSM’s projected revenues, so it's a small portion of the project. The note will convert into a 60% royalty on silver production, meaning we are giving away well below two percent of the project's revenues. For this amount of cash up front that de-risks the asset and makes our environmental approvals permanent, we think this was a very creative way to get it done. Our major shareholders are very pleased with the transaction.

Dr. Allen Alper:

That's fantastic. That shows great insight, great business ability, and it's like what you've been doing all these years of not diluting your shares and increasing the value for your shareholders.

Rudi Fronk:

Yep, keep that share count low! People buy gold stocks, with the expectation that in a rising gold market, the share price of a gold company should outperform the price of gold. It's interesting to note that in our industry, over the past 20 years or so, the share prices of the major gold companies have underperformed the price of gold. You would have been better off owning physical gold than shares of most of the major mining companies. In my opinion, this underperformance, by the majors, is a result of them destroying per share metrics, in terms of gold reserves and gold production.

If you look at our share price performance, since we started the Company in 1999, our share price is up over 8,000%, while the gold price is up about 500%. We've delivered on our core objective of providing our shareholders optionality and leverage to the gold price, and it's driven by our per share metrics.

Dr. Allen Alper:

That's excellent. That's a great business procedure, careful and protecting your shareholders and stakeholders. Could you tell us a little bit more about the KSM Project and your plans going forward?

Rudi Fronk:

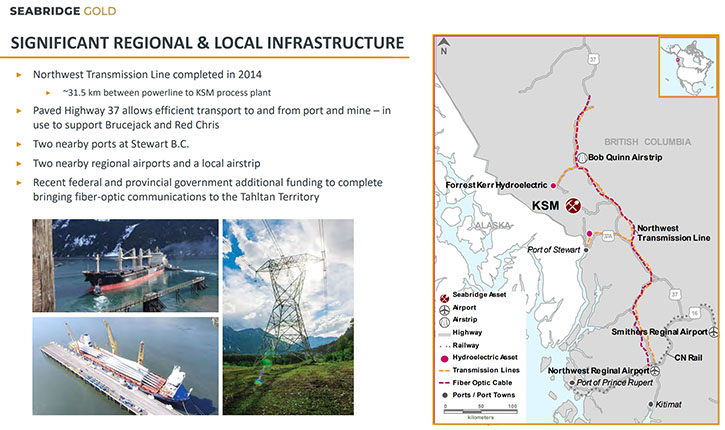

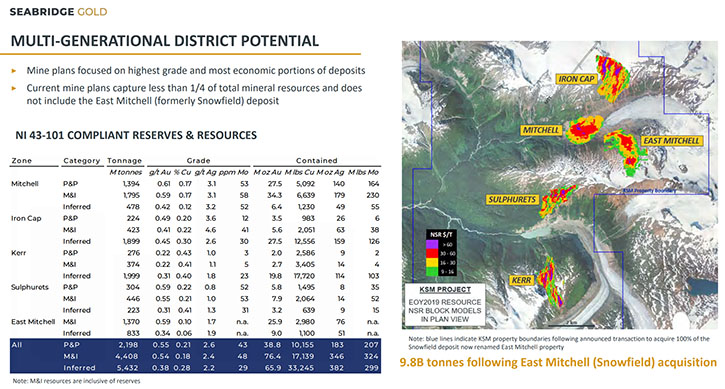

KSM is a project, in which we have invested about C$500 million, since we started working there in 2006. At KSM we have 9.8 billion tons of economic resources, in five different deposits that yield over 75 million ounces of measured and indicated gold resources and over 17 billion pounds of copper, plus a lot more behind that, in the inferred resource category. Over the past decade plus, significant infrastructure has been installed, using other people’s money. These include highways, port facilities and power.

Although we have 9.8 billion tonnes of economic resources, we are only permitted for 2.3 billion tonnes of tailings capacity. We've analyzed a number of mine plans, over the years, looking at how to develop KSM, limiting the life of mine throughput to 2.3 billion tonnes. A preliminary feasibility study, completed in 2016, demonstrated the potential for a mine that would operate for 52 years and capture 38.8 million ounces of gold plus 10 billion pounds of copper, as reserves, with an all-in cost of gold production, of about US$670 per ounce. Not bad, considering the gold industry’s current, all-in sustained cost of gold production is about US$1,000 per ounce. This mine plan captured ore from 2 deposits that would be mined as open pits, and 2 deposits that would be mined as underground block caves.

However, in late 2020 we acquired the Snowfield deposit, from our next-door neighbor, Pretium Resources, for US$100 million in cash. We are now working on another mine plan that will incorporate the Snowfield deposit into the KSM project. Snowfield sits right in the same valley as our Mitchell deposit and, in fact, is the sheared off top of Mitchell that has been displaced by a fault. That’s why we are now calling Snowfield the East Mitchell deposit. East Mitchell has the highest gold grade of the 5 deposits at KSM and also has the lowest strip ratio. The new 2.3 billion tonne KSM mine plan is expected to be open pit only, thereby eliminating the higher-cost, underground block caves, in our previous mine plans. The new preliminary feasibility study for KSM is expected to be completed in June of this year, which we expect to show significant improvements to the project’s economics. We're excited about this updated study; we think it's a game changer

We've made it very clear that KSM is a project that we want to co-develop in a joint venture. There are only about 7 or maybe 8 companies in our industry that have the technical, financial, and social capabilities to build and operate a mine the size of KSM and only 2 of these companies have block caving experience. Being able to show a project that's open pit only, for 30 years or more, will be a big benefit in widening our joint venture discussions.

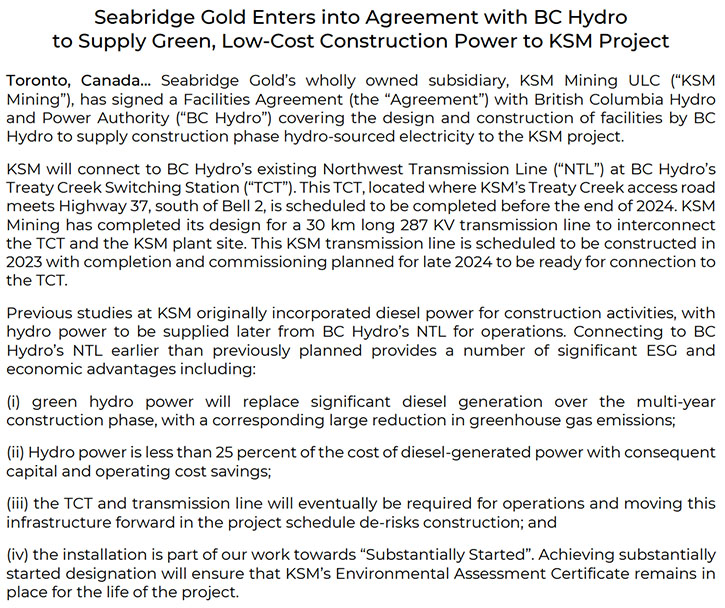

And, with the financing in place now, to continue site capture and substantial start, we have also concluded a deal to tie up low-cost green hydroelectric power, for the project, from the BC Hydro Northwest transmission line.

Dr. Allen Alper:

That's fantastic! You announced that deal with BC Hydro right after the silver royalty financing. That brings low-cost power to KSM. Power is so critical in developing a project and operating a project. Can you please elaborate on that?

Rudi Fronk:

Yes. We are very fortunate the government has invested over C$700 million in bringing cheap hydro-power to the region. We have been working with BC Hydro for more than 10 years and have secured 245 megawatts of low-cost hydro power, exclusively for KSM, from this newly installed transmission line. In all of our mine plans to date, we were not planning to have hydro power to the site, until after construction was essentially completed and production begins. By having the funding in place now, from Sprott and Ontario Teachers’, we've executed an agreement with BC Hydro, for them to construct a switching station for us, which we can connect to in 2023. This will allow us to have low-cost hydro power available, for most of the project’s construction activities.

Dr. Allen Alper:

That's excellent, that's great! It gives you low-cost power and non-carbon power.

Rudi Fronk:

Yes, with everyone’s focus on carbon footprints, KSM will be able to show one of the industry’s lowest carbon footprints.

Dr. Allen Alper:

That sounds excellent. Could you tell us a little bit more about your plans for KSM in 2022?

Rudi Fronk:

For 2022, our prime focus is advancing substantial start activities, with physical activities on the ground. We're building roads, we're building camps, we're building fish compensation areas and we're bringing power in. All of these expenditures count towards substantially starting to make sure that our permits get extended for the life of the project. They also are key parts of the capital cost of the project.

The second thing we're doing is updating KSM’s preliminary feasibility study. We expect this study to show a much-improved project. The study should be done in June.

And then last, but not least, is to continue dialog with potential partners, to bring in a partner able to provide most of the funding for production and the skills to construct and operate a project of this size. We are now very well positioned to make a deal that rewards our shareholders.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors your thoughts on the future of gold and copper markets, in which you have such a strong position that your Company is leveraged to?

Rudi Fronk:

Yeah, we remain bullish on both metals. When we started the Company back in 1999, we were clearly bullish on gold. Gold then was trading at about US$260 an ounce. Today, it's north of US$1,900.

If you look at the copper market today, because of the need for copper in green energy initiatives, whether it be electric power vehicles, solar panels or wind turbines or the electrification system, needed to bring power to end users, copper plays a vital role. Right now, the market is essentially in balance. With the growing demand that we will see for copper, and declining production from mature mines, we are going to need lots of new copper production.

However, it is becoming difficult, if not impossible, to get new large copper mines permitted, built and in operation. The same groups that are demanding green energy are the very same groups that tend to oppose mining. This will likely lead to growing deficits in the copper market which should be constructive for higher copper prices.

Gold, on the other hand, is not an industrial metal like copper is. Gold is money and has been for thousands of years.

We think what's gone on in the global financial system, over the past 10 years, is very constructive for the gold price going forward. In the U.S. we are at record debt to GDP levels. In addition, inflation continues to ramp higher, while the Fed still has rates at essentially zero. We believe that if the Fed moves forward, with their plan to raise rates, they will remain well behind the curve and inflation will continue higher. We also believe that the Fed can only tighten so far, without causing a recession and a train wreck in stocks.

Gold started to move higher and broke out of a recent trading range, before the invasion of Ukraine happened. Obviously, the Ukrainian situation has brought in a lot of war buyers that will likely exit once a resolution is reached. But we believe the impact of the war is a further disruption to supply chains and war is always inflationary. As it becomes clear there is no acceptable solution to inflation, the dollar will have a significant decline and gold will move on to new record highs.

Dr. Allen Alper:

That sounds like a bright outlook for gold and copper. Rudi, could you tell our readers/investors a little bit about some of your other projects too?

Rudi Fronk:

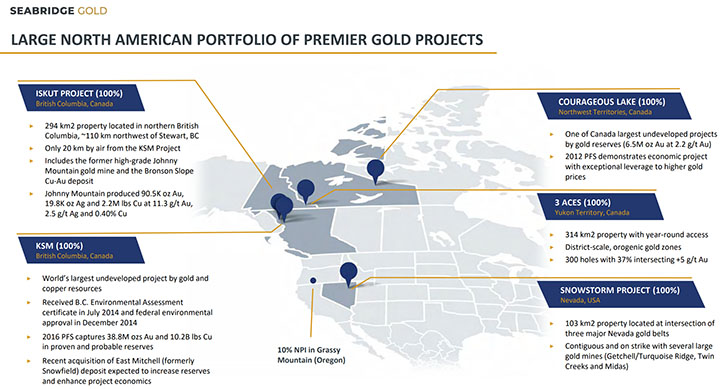

We always talk a lot about KSM where we have spent most of our money over the past 15 plus years. But we have another large project, at an advanced stage in Canada, called Courageous Lake, situated in the Northwest Territories. In 2012, we completed a preliminary feasibility study, capturing 6.5 million ounces of gold, in proven and probable gold reserves, but showed marginal returns, at the then gold price and C$/US$ exchange rates. At today’s gold price, and with a much weaker C$, relative to the US$, the economics at Courageous Lake look much improved.

We are now looking at the best path forward for Courageous Lake, to drive value for our shareholders. Options include getting back to work on it ourselves, bringing in a joint venture partner or perhaps selling the asset and keeping a stream or royalty on its gold. In the past we have not shied away from selling non-core assets, at times when the market conditions are strong. In fact, we have generated over US$75 million in cash proceeds, from non-core asset sales. We hope to make a decision on Courageous Lake, over the next year or so, in terms of the best path forward.

Our success over the past 20+ years has been through the drill bit and exploration. We have found more gold, over the past 15 years, than any other Company on the planet, and that includes the majors. We take advantage of down markets to do our acquisitions, like we did from 1999 to 2002, before the price of gold went higher. When the gold market bottomed again, in 2015, we started to look for new acquisitions, and since then we have acquired 3 new projects: Iskut in British Columbia, Canada; Snowstorm in Nevada; and 3 Aces in Canada’s Yukon. These deals were cost effective, after gold made a bottom at about $1,050 an ounce in 2015, after hitting a $1,900 a few years before that.

We believe Iskut has the same potential we saw at KSM and we’re looking for large gold-copper porphyry deposits. Snowstorm sits on the intersection of three prolific gold belts in Nevada and just north of two big mines that are operated in the Newmont-Barrick Nevada joint venture, Twin Creeks, and Turquoise Ridge. 3 Aces comprises a large land package, over 300 square kilometers, with lots of high-grade gold showings, along a 30-kilometer belt. We are planning to conduct exploration, this year, at all 3 of these projects.

Dr. Allen Alper:

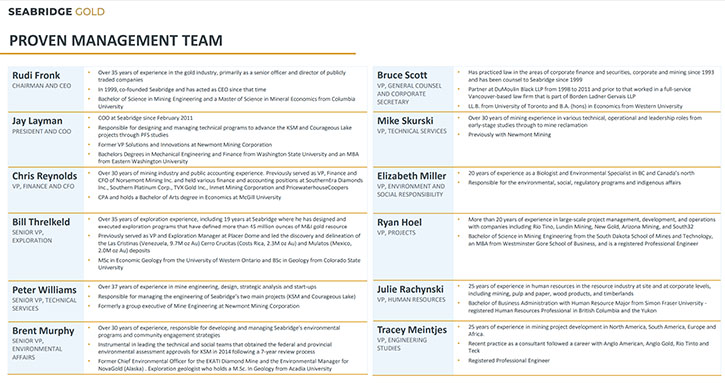

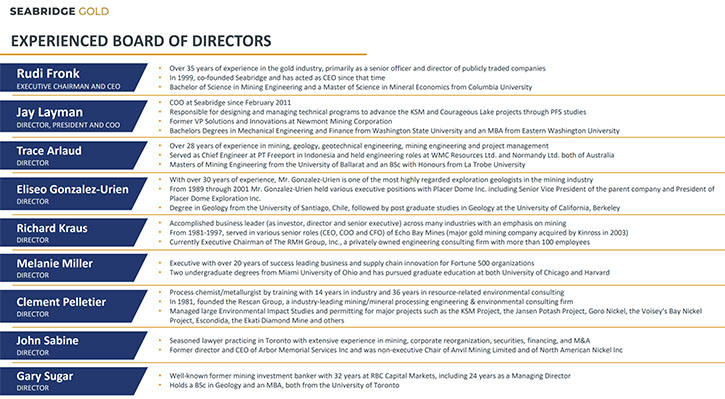

That's a very strong portfolio of great assets that you have. That's excellent. Could you tell our readers/investors a little bit about your background and your Team?

Rudi Fronk:

We have a Team of seasoned veterans, from our industry that have spent most of their careers, with much larger companies, finding, engineering, permitting and building large mining projects. My background is I'm a mining engineer. I've been in the business for about 40 years now, educated at Columbia University with degrees in mining engineering and mineral economics.

Dr. Allen Alper:

By the way, that's a great school.

Rudi Fronk:

I know you went there, Al.

Dr. Allen Alper:

Yeah.

Rudi Fronk:

I have spent most of my career in the gold space. I've been involved in building mines around the world. I've had mines I've built expropriated, learning the hard way, how real political risk can be. When we started Seabridge, we said, okay, let's try to minimize political risk. The best way to do that is to focus on jurisdictions, where you don't worry about going to bed at night, and waking up the next morning to find out you no longer own the mine. If you look at our portfolio of assets, they're all in North America, either the United States or Canada, where political risk tends to be much less than in other parts of the world.

Dr. Allen Alper:

That’s excellent! It's great to be in a safe area that supports mining and has a long history of supporting mining. Rudi, I wonder if you could summarize and highlight the primary reasons our readers/investors should consider investing in Seabridge Gold?

Rudi Fronk:

Well, I think first and foremost, it's the leverage we have to gold and copper prices. We have a 23-year track record of showing significant outperformance, in our share price, relative to gold and other gold equities. If you believe the price of gold is going higher or you want some gold in the form of portfolio insurance, Seabridge is a good way to get it.

Second, would be owning 100% of the world's largest, undeveloped gold copper project, in a world quite honestly, where the major mining companies need new projects. The major gold companies’ reserves continue to fall and they now need to start focusing on what comes next for them. Fortunately for them, with gold prices near all-time highs, they are now able to satisfy shareholder demands for dividends while at the same time look for new projects to ensure their future.

Last but not least, it's our ability to find gold. We have found more gold than any other Company on the planet. Most of that coming from KSM and Courageous Lake. We now have three new projects in the portfolio, any one of which we believe can be a Company maker.

These are the reasons why I have 95% of my family’s net worth in Seabridge common shares.

Dr. Allen Alper:

Well, those are very compelling reasons for our readers/investors to consider investing in Seabridge Gold. It's great that not only do you know how to find gold, but you also know how to protect investors from dilution, and you know how to leverage your stock price to the price of gold and copper. That and the market outlook for both looks very promising.

Rudi Fronk:

We believe so. We think, as we transition KSM to a production decision, in a joint venture, over the next few years, the price of gold and copper will be a lot higher than we're looking at today.

Dr. Allen Alper:

Well, it sounds excellent! Rudy, is there anything else you'd like to add?

Rudi Fronk:

No, I think that's good.

Dr. Allen Alper:

Well, it sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.seabridgegold.com/

Rudi P. Fronk, Chairman and C.E.O.

Tel: (416) 367-9292 • Fax: (416) 367-2711

Email: info@seabridgegold.com

|

|