Tony Schreck, Managing Director Pacgold Ltd. (ASX: PGO) Discusses Exploring its Alice River Gold Project in Gold-Rich Northeast Queensland Mineral Province

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/13/2022

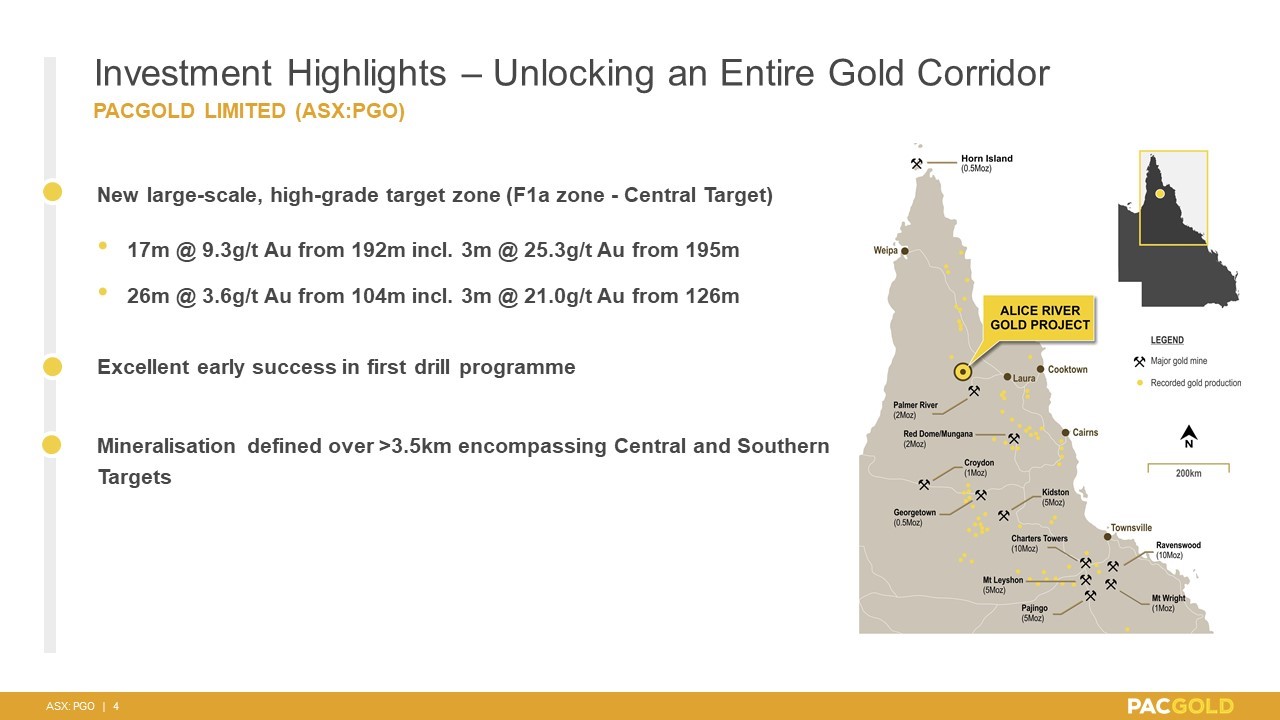

We spoke with Tony Schreck, who is the Managing Director of Pacgold. Pacgold Limited (ASX: PGO) is a gold exploration Company, focused on progressing its key asset, the 100% owned Alice River Gold Project, in North Queensland, at the northern end of the Northeast Queensland Mineral Province. This gold-rich Province contains several multi-million-oz gold deposits. There are several past producing gold mines in the area. Acquired in 2020, the Alice River Gold Project comprises 30km of prospective gold targets, within 377km2 of granted exploration permits and eight granted mining leases, covering an historical high-grade goldfield and open pit mine. Plans for 2022 include an ongoing resource drilling program at the Alice River Gold project.

Tony Schreck, who is the Managing Director of Pacgold

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Tony Schreck, who is the Managing Director of Pacgold. Tony, I wonder if you could give our readers/investors an overview of your Company and what differentiates it from others?

Tony Schreck:

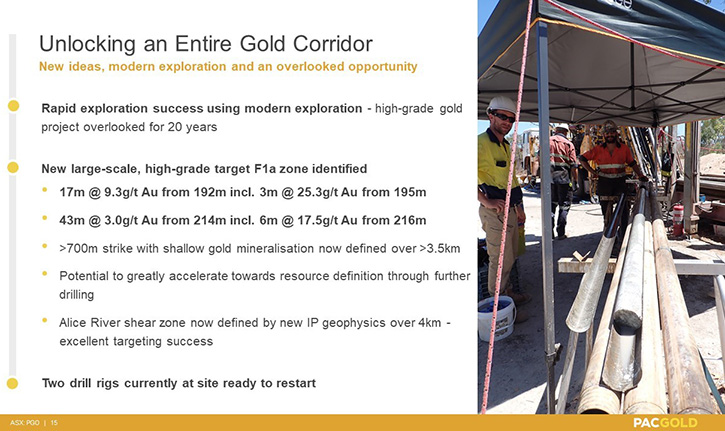

We're a gold exploration company. Our projects are focused on far north Queensland in Australia. We're at the top end of a belt that contains quite a few large gold mines. About 40 million ounces of gold have come out of this whole belt, with a number of large historical operating gold mines in that region. The Company itself, we IPOed on the Australian Stock Exchange, ASX: PGO, in July 2021, with strong institutional investment support. Quite rapidly, from our first drill program, we've achieved some amazing high-grade gold drill intersections.

On the back of those results, the share price has risen. We IPOed at A25c and the share price has hit a high of A$1.00 and we're currently trading around A80c. That actually places us as the top performing gold IPO of 2021 on the ASX.

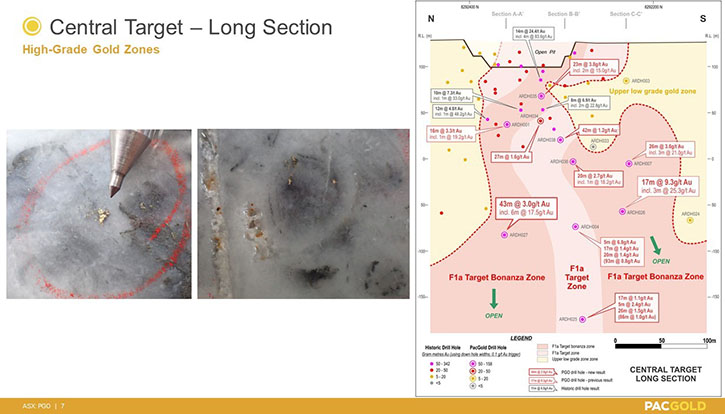

Some of the results that we’ve achieved, in this very first drill program that have captured the market’s attention; has been 17 meters at 9.3 grams per ton gold, and that includes three meters at 25.3 gold and another intersection, 26 meters at 3.6 grams gold, including three meters at 21 grams gold.

Now these are from a brand-new target zone that sits about 100 meters below surface, beneath an historical open pit mine. The standout for us has been that this historical gold field has had limited exploration over the past 20 years. The project was held by a private company, and we secured the project in December 2020. We’re the first company to really come in here and apply modern intrusion related gold models and techniques on this large-scale project. That’s how we’ve achieved rapid success, applying modern thinking to an overlooked historical gold field.

Dr. Allen Alper:

Well, that’s excellent, that’s really great progress and discovery that you’ve made in such a short time. Could you tell our readers/investors a little bit more about your plans for this year?

Tony Schreck:

We completed our first program that kicked off August through to mid-December last year. We have two rigs on site, an RC rig, and a diamond rig. We’ve done a deal with the drilling company to leave both rigs there over the wet season. The wet season is happening right now up on site, so by leaving the two rigs on site, it means as soon as there’s a break in the weather, we can restart the drilling program.

Our plan with those two rigs is to commence resource drilling. The high-grade intersections that we’ve intersected to date are situated 100m to 300m below surface and the focus of the next drilling will extend that down to greater than 500m depth and also expand along strike where we can demonstrate potential for several hundred meters. That structure fits in a much larger target zone that extends for many kilometers either side. In fact, we have about 30 kilometers of prospective structure, secured under tenure.

Dr. Allen Alper:

That sounds excellent. Sounds like 2022 will be a very exciting time for your shareholders and stakeholders.

Tony Schreck:

That’s right, and at the end of December, we had A$3.2 million in cash, so we’re well funded to execute the next phase of our drill program.

Dr. Allen Alper:

That sounds excellent. Tony, could you tell us a little bit about yourself and your Board and your Management Team?

Tony Schreck:

I’m a geologist, I’ve spent over 35 years in the mineral exploration business. Half my career is with the majors and the other half of my career has been utilizing my business development skills to secure assets and identify opportunities and then taking them forward as successful junior resource companies. I’ve been involved with Pacgold for just over 18 months.

Cathy Moises is the Chair; she is a geologist with an extensive career in the resource finance industry. Geoff Lowe is the Exploration Manager. Geoff and I worked together many times over the years, we worked in Newmont together. Geoff’s a very experienced geologist, with 35 years’ experience. Michael Pitt is one of the founding Directors. He’s a chemical engineer, and his specialty is building mines and putting them into production.

Shane Goodwin is a Specialist Landman, so he navigates native title processes and getting access granted on the ground. Some of the priority targets have not been drilled for 30 years due partly to a function of previous explorers having difficulty navigating the process. But we’ve come in here, with the aid of Shane and his experience and in our very first drill season achieved full access to the whole project and completed drilling on some of the targets, which were the first holes in over 30 years.

Dr. Allen Alper:

Well, that’s excellent! It sounds like you have a very strong Exploration Team and financial people that could help, so it sounds like a well-balanced Team.

Tony Schreck:

Yes, we are well positioned to take it forward with a Board and Management who are all aligned, and discovery focused.

Dr. Allen Alper:

Well, that’s excellent! Could you tell us a little bit more about your share and capital structure?

Tony Schreck:

We IPOed in July last year with a very tight capital structure. There are only 49.3 million shares on issue and approximately 10 million of those shares are escrowed until July 2023. There are also 5.5 million unlisted options which are also escrowed until July 2023. At the end of December, we had a healthy cash balance of A$3.2 million.

If you look at the spread of the shareholders, we have strong Institutional Investment including Resource Capital Funds who are a major North American based resource fund, Lowell Resources Fund, they’re an Australian listed resource investing fund, Altor Fund, they're in as well. 13% of our shareholder base is institutional investors. Directors and Management are about 13% of the register.

Dr. Allen Alper:

That sounds excellent. Tony, could you tell our readers/investors the primary reasons they should consider investing in Pacgold?

Tony Schreck:

I think the success that we've achieved, in such a short period of time will accelerate to timeline to resource definition. Given that the new high-grade gold zone is located within granted mining leases this can also significantly contribute to a shorter timeline to potential production.

The discovery represents enormous opportunity for the Company, with mineralisation already encountered along 7km of a 30km gold bearing shear zone. We are focused on ‘Unlocking the Entire Gold Corridor’ at Alice River and aim to deliver continued strong shareholder returns, via further exploration discovery growth in what shapes as an exciting 2022.

With experienced management, strong cash position and multiple rigs on site, ‘How big could this be?’ is the question we plan to answer.

Dr. Allen Alper:

Sounds excellent! Sounds like very compelling reasons for our readers/investors to consider investing in Pacgold. Tony, is there anything else you'd like to add?

Tony Schreck:

We've had amazing success using geophysics on the project, and that's the first time it has been applied on this project. The geophysics is what's led us, immediately, into our new high-grade zone underneath the pit. We've now completed IP geophysics surveys over several kilometers of strike to define a continuous target over the entire length of the survey. That's what gets us excited moving forward. We have high grades that we can follow to depth, and we have some substantial, compelling targets, along strike, in the IP geophysics.

Dr. Allen Alper:

It really sounds great! It sounds like you've just touched the surface, in exploring your properties.

Tony Schreck:

Yes, it's been an amazing journey since the IPO. With a market cap of only A$40 million, there’s a lot of upside to grow the Company and particularly as we start to develop and put together resources on the project. We're at the bottom of that exploration discovery curve and the potential upside is the most compelling part for the investors!

Dr. Allen Alper:

That sounds great. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://pacgold.com.au/

Tony Schreck

Managing Director

tschreck@pacgold.com.au

+61 (0) 419 683 196

|

|