Interview with George H. Gregor, Executive President of Libcoin: The New Green Token

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 3/7/2022

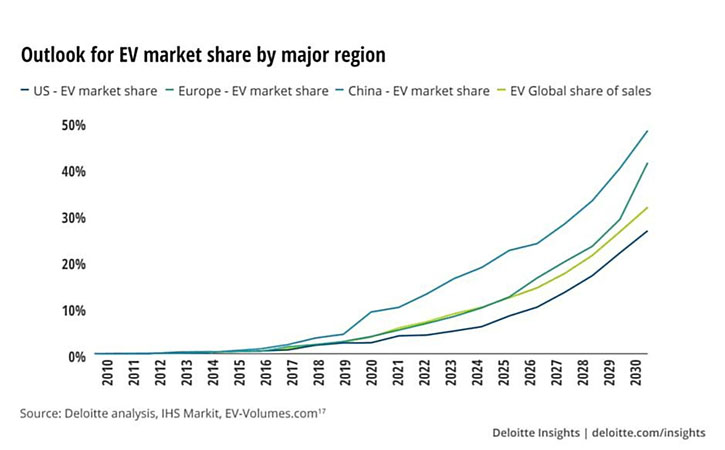

We talked with George H. Gregor, Executive President of Libcoin, soon-to-be-listed “utility” token that will provide holders a unique exposure to investments and rewards in the booming green battery technology industry. Libcoin, with its innovative one-of-a-kind digital asset, has serious potential for growth by bringing in a coin that democratizes access to a new class of investors, essentially allowing them to participate in green energy investments. With the world pledging to achieve net-zero emissions by 2050, Libcoin combines the best of both worlds: financing and the “green” ecosystem. Libcoin brings a sustainable crypto asset that not only accelerates the transition into clean energy, but also fills a huge market gap: it addresses the growing demand for green energy investment opportunities. Libcoin’s backers are planning India’s first Gigafactory and have committed 25% of net profits to annual token “burn.” With a projected annual revenue of $5B at maturity, Libcoin’s early backers should benefit from the renewable energy transition.

Dr. Allen Alper:

This is Dr. Allen Alper, interviewing George H. Gregor, Executive President of Libcoin Pte. Ltd. (Singapore) and Victor Webb, President of Marston Webb International.

Dr. Allen Alper:

George, could you tell our readers/investors about your background, and how you became associated with Libcoin, and an overview of Libcoin. Also, in what way does the coin become associated, with the lithium battery, the electrical battery bus company and so forth going forward?

Mr. George H. Gregor: In brief, my background is thirty-three years of international banking, gained through time spent with Citibank, Bank of America, Nomura and Deutsche Bank. If I have a professional skill, I call it international capital markets. I ran the corporate trust division at Citibank and again at Deutsche Bank. I had more than my share of financial engineering opportunity and this is where you not only deal with securities, but you create new securities for the first time. Of course, no one acts alone, and I had some good teams behind me.

Dr. Allen Alper: Examples?

Mr. George H. Gregor: An example was the merger of DaimlerChrysler, back around 1999, when a new security had to be created, and we did that from Deutsche Bank for Daimler in the form of global registered shares. Before that, there was a string of securities innovations, especially at Citibank. Citibank, under Walter Wriston, was a great place to work, because Citibank pioneered medium-term notes, certificates of deposit and a lot of international structures, and I was in the middle of many of those. I handled the $29B Brady Plan at Citibank for Mexico; six years later, at Deutsche Bank, I helped the United Mexican States issue $6Bn in eurobonds to begin to repay the U.S. Treasury following the Tequila Crisis of 1994. I actually walked in on a Salomon Brothers planning session in Beverly Hills, from which Citibank garnered $6Bn in eurobond issues for American savings and loans, through some creative structuring, at a time when U.S. thrifts had no access to conventional capital markets. Invited to dinner in New York by the treasurer of Union Pacific and a couple of company lawyers – all to discuss UP’s first entry into eurobonds – maybe it took three bottles of wine, but that first eurobond issue was denominated in Kuwaiti Dinars. And then we brought the first Polish and Turkish issuers to the S.E.C. with a different kind of derivative instrument. There were other examples, but that’s history. Although I must say we are all products of our cumulative experiences, and today that brings me to Libcoin, that promises to be another “first.”

I was introduced, about a year ago, to the Duggal Family Trust, whose Chairman, Ricky Duggal, asked me if I'd be interested in a new enterprise, which became Libcoin. The Trust is very active across Asia and other parts of the world – and getting into a cryptocurrency activity did not seem to me at the time to be the most exciting thing of dozens of initiatives Ricky was doing. But he asked me to be the “face” of Libcoin – and a week later, said the Board would like me to be the Executive President. And that happened in early December. The Libcoin project management Team, the Amsterdam firm of AW3L – expert in the field of tokenization and in the forefront of “Web 3.0” – also “drafted” several of my business associates, from my consulting firm, who have been close to me for years. They are now Libcoin advisors.

Now, some “background music” on Libcoin and the “greenery” and the EV business. There was a Company in Australia, named Avass, associated closely with a Chinese Company, named Brighsun. For a period of time, the Australians contributed the intellectual property or the technical skills, which were chemical skills, because they were pioneering battery power. They worked together and manufactured in China, winning a Guinness Book of Records distinction, of the farthest distance traveled by a motor coach, over a thousand kilometers, on a single charge.

Dr. Allen Alper: Guinness Book of Records. Quite an achievement!

Mr. George H. Gregor: That was in 2015. By 2017 things happened. There were geopolitical disturbances, there were Chinese disputes on trade issues. And so, a disconnect between the Chinese and the Australians. Avass Group, the Australian part of it, went on their own and around 2017, they had a capital squeeze. When 2019 rolled around, they were acquired by a private firm called DFT. The Duggal Family Trust. Ricky Duggal, CEO. The pandemic slowed things down. Ground to a halt! Some prototyping continued, but research and development on what was then Lithium-ion battery power never slowed. Strategic changes included resuming EV production – and what will be the first Gigafactory to produce batteries in India – and some other places, in the revived plan. As reported about the time of this interview, Ricky Duggal, together with the Avass CEO, Dr. Allen Saylav, were in Riyadh signing letters of agreement, with members of the Royal Family. And, as reported in December press releases, Indonesia ranks high on our Avass and Libcoin battery agenda.

Today we can brag about having this Guinness distinction because the scientists, under Dr. Saylav, moved to DFT and Libcoin, and the Avass Group is now owned by DFT. Then sometime in November, they had the vision of taking the step towards cryptocurrency, as a vehicle for raising funds, and in a manner all of us believe to be unique. To answer Victor's question, we believe that there is no notable project in crypto that supports sustainability, through technological innovation and in fact doing it in the “green” world. Because of the electric vehicle nature of the busses and other vehicles, and because the Lithium-ion batteries that Avass, under DFT, continues to develop, that's the green place.

Dr. Allen Alper: Please explain the connection between the token investment and real “green” assets.

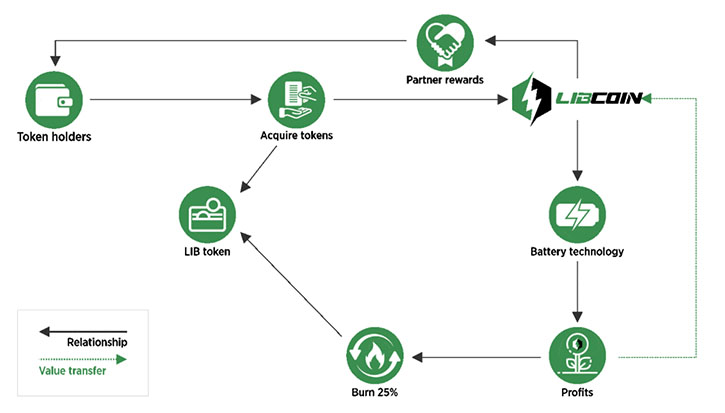

Green: When the Libcoin coins, known as tokens, emerge, after we get them all listed, on various crypto exchanges, there would be, what is known as a “governance and reward” token, backed by battery technology. So, if you're looking at what makes it different, and how do you call yourself green? Well, that's the tagline that I would go with. It's a governance and reward token, backed by battery technology.

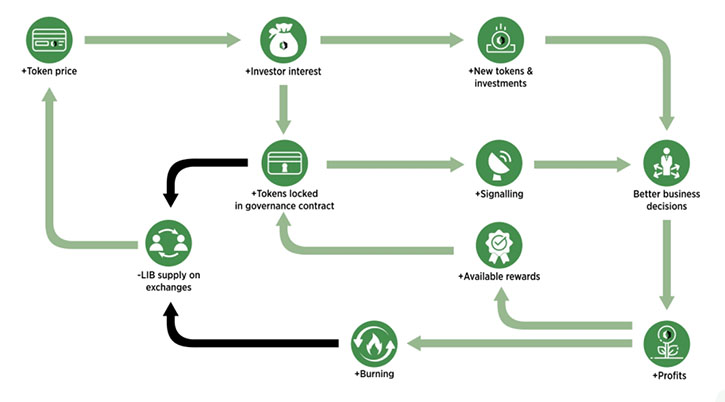

Now, among the features known to cryptologists and token-ologists, I guess you might say, well, there are features like the token “burn.” The burning of tokens is one way of retaining the loyalty of investors – in the digital economy, such investors are sometimes known as the “community.”And there is an objective here to build an ecosystem of investors in the coin now, and that will be the “community” in which the governance and rewards comes in when token holders get to vote on future projects. At Libcoin, we pledge that all such projects would be supportive of sustainable and renewable energy. And token holders, who continue to hold – and be part of the Libcoin “community – will be rewarded through opportunities tied to the products of our commercial partners.

Webb: This notion of an investment “community” is significant. As we have said, the Marston Webb promotion idea is to be interactive. Nothing more interactive than permitting investors – here loyal token holders – to participate in Company direction as to future projects.

Mr. George H. Gregor: If you're looking for a link between the investors in Libcoin, that is to say, the coin that becomes a token and the underlying projects like battery factories, a Gigafactory, for example, and there's going to be at least one and likely more than one EV or Avass bus Company factory, initially the proceeds of the sale of the tokens or the Libcoins will be diverted to launch the production of the early days of these factories. Not completely, but this activity will support some conventional funding, some of which is already at hand. Such as construction lending as well as incentives from our host Countries.

However, if everything goes well, the value of the coins is going to increase. And with that in mind, only about 15% of the authorized tokens are going to be admitted into the market as soon as we launch. We're going to be registering or listing what is known as IEOs and IDOs. The world seems to have passed International Coin Offerings, into International Exchange Offerings, thinking that there's greater safety, more KYC and AML scrutiny exerted by exchanges, than was found when the digital world was into ICOs, only three years ago.

Right now, we're focused on Tier 1 and Tier 2 and even Tier 3 crypto exchanges. Our first listing – of many – is expected to be a top-20 crypto exchange. Almost 200 “soft” launch press releases were issued in December and January, mostly across South and Southeast Asia. And the idea there is that the word is going to get out, and with the help of folks like Victor and his Marston Webb International agency, I think we have a winning game now.

You may ask, well, who else is helping you; Duggal Family Trust is a family. You might say the founding party. They made the investment when they acquired the Avass Group, with its Management and scientists. Avass, if I were going to give you a list of participants, partners, we have Avass, which is actually owned by DFT and they are the bus manufacturer. They also have the technology for the battery. There is Maz Technosoft, a web development Company, based in India. They have over 500 projects, with 88 clients, so we need folks to do that.

Cerdik, is a specialist in blockchain security; they are in AI and smart contract security technology. They're almost like an auditor agent. Edge & Pace is a solid, reputable blockchain and crypto consultancy; they have some interesting people. AW3L has provided the Project Manager in Amsterdam. We have KPMG, which is the third largest auditor and accounting firm. Dentons Rodyk & Davidson is the largest law firm in the world.

We have the Farringdon Asset Management Company, which we need, because we're going to be dealing with wealth management. There was a pre-IEO fundraiser that didn't take too much time and didn't raise too much money. It got us going with the initial expenses of listing on crypto exchanges.

There were some marketing companies. Momentum 6 is one. Carmine Communications in India. And then Marston Webb was added because of Victor’s long experience in every part of the world. Marston Webb is more than a PR and Media Relations specialist: Victor’s Agency represents countries and corporations and is also experienced in arranging funding projects.

That's one reason we're talking now, we are ready to expand a hard launch, soft launch, somewhere in between. What we're doing here is more interactive than the kinds of press releases that first issued in December. This is the way Victor and Marston Webb are accustomed to doing it, which is, I think, a lot more interesting, deeper, rewarding and professional. And I’m delighted with the opportunity to speak with you today, and certainly thank you for indulging me and Libcoin.

The near-term future, beyond the initial listings and attracting token investors? Is there another Guinness Record to surpass? I don't know. I'm not an expert in the field. It may take a deviation or a diversion or complete departure from the Lithium-ion technology, into something else, to be able to announce a claim in the next technological leap.

Dr. Allen Alper: Why India, as a beginning?

We begin in India, as it is the fifth largest vehicle market, the government is committed to a transition to renewable energy, and, even in the world of crypto we understand there is a current assessment on how to regulate this emerging financial phenomenon. Just as the U.S. is doing.

Dr. Allen Alper: Well, it sounds great. Could you tell our readers/investors the primary reasons they should consider investing in Libcoin?

Mr. George H. Gregor: Well, the number one reason anyone does, is hoping that when they buy it at 10 or 20 cents, it's going to go up. And the second thing they want to know is, what makes it different? What enhances the prospects of increased market value? Now we shy away from promoting investment that way or making promises or making representations that we can't back up. What I'm saying is it's common to all investments, whether it's stocks, bonds or crypto.

But what we can say is that there is this direct link to sustainable, ecological “greenery,” so to speak, and it's very closely tied to battery technology that already has proven some technical supremacy, by the same team that moved over when this Company stopped being a Chinese company, five years ago, into something different. So, someone looking at it that way would say, well, okay, I know that there are investors in this particular field, which is new, who go for the latest shiny thing.

Webb: If I may . . . we can tell that by the Twitter universe. We have about 1,500 followers, and when you look at the comments that you read there, you wonder, are these people interested in electric vehicles? Are they interested in battery advances, or do they just want the latest “shiny thing” and Libcoin sounds like it's the first of its kind? It's very difficult to assess the emotion of investor behavior.

Mr. George H. Gregor: I've been in the securities business for about 40 years now. So, there's always the buyer beware syndrome and people have to make their own investigation assessment and consult advisers. The other interesting thing is that when you look at something like the Libcoin, people will measure you against other crypto currency tokens that are not backed by anything. They're not stable coins and they're not utility tokens. We got a legal opinion that, initially for Singapore, our organizational home, this is not a security. That's an important distinction, I would expect the question from you, for example, is it a security? Because that makes a difference? If I didn't mention it, the format of Libcoin might be regarded as an SAFT, Simple Agreement for Future Tokens, that's really at the heart of the opportunity to the investor.

Future tokens is what they would get. Now the question is, will they then be getting a security? The SAFT was devised for issuers to stay out of trouble, with respect to violation of securities regulations. So, you have this thing called SAFT, but you also have SAFE, with the conversion being into a future equity. I don't think that Libcoin Management is thinking of that kind of conversion. I think we're going to stick with SAFT as opposed to SAFE. It's not a simple agreement for future equity, I'm not saying that it can't evolve into that, I'm just giving you a sense of where I see this at the moment.

Dr. Allen Alper: It sounds very good. Victor, is there anything else you'd like to add or ask?

Webb: No, I think that George has given us a very good overview of what the Company has been doing. We intend to, apart from listing, look into the possibility of having our own exchanges in the future. It's in the planning stage now. But Ricky is a kind of visionary guy, who has several plans that he would like to bring forth. So, I think that you're going to hear a lot more about the coin and its potential. Overall, the cryptocurrency scene has gone through a lot of ups and downs, but the concept of this becoming a more universal currency. Crypto coin seems to be in the offing. A lot more governments, around the world, have been forced almost to take this thing very seriously, the coins themselves.

Mr. George H. Gregor: If I went over it too fast, there is a principle that should be emphasized. When we speak of connecting the coin to the underlying “greenery” or the factories or other future projects, this “governance and rewards” system rests on the premise that token holders, who keep their tokens, can vote in the future. There's a Company that manages this kind of activity, of voting on future products projects. They're all going to be categorically in the world of greenery, so to speak. That's a commitment now.

Just to read a phrase from a roadmap document, that is private now, as part of the planning. But there's a statement made by us that, “This creates a unique token burn approach that innovates on how crypto can be connected to real world use cases while remaining a utility token.” This idea of a burn 25% of the net profits of the underlying real businesses, the Gigafactories, the bus factories and anything else that comes along later on.

We may get involved in the solar business in Africa two years from now, we don't know. But this burning of tokens, takes tokens out of circulation. That's what burning means. When that happens, it means that the supply and the available tokens, which you might call the float, will decrease. Now, when you decrease the supply, you think that you would increase the value, the price. So it's not clear whether this is going to come out at 15 cents or 20 cents, something like that. But you know, it could be $2 or it could be $20. We don't know, no one can predict it. But the “burn” would have the effect of putting upward pressure at the same time, funding future expansion of the real green businesses that underlie this and rendering it a utility token, as opposed to something vacant, like a bitcoin or some of these other currencies that really are not in the same discussion, because they’re not stable coins, utility coins, and they're not security coins.

So, I don't know that we want to be a security coin in every country. One reason for staying out of the United States is because it's still up in the air, just like India, this week announced a new budget, I spent some time reading it the other night. They're establishing crypto regulation, which from Ricky's point of view, he seems to be happy with, we're reading in the new Indian approach. Especially since we chose India as the first factory and the first Gigafactory. The first bus factory and the first Gigafactory will be somewhere in India. India was chosen because it's the fifth largest country in the world, when it comes to electric vehicles, so it's a huge opportunity.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

Contact Information:

Web Site: https://www.libcoin.net/

Twitter: https://twitter.com/libcoin_token

Email: info@libcoin.net

Telegram: https://t.me/libcoin_official

Victor Webb

Marston Webb International

marwebint@cs.com

|

|