Kevin MacLean, CIO, Star Royalties Ltd. (TSXV: STRR, OTCQX: STRFF) Discusses the World’s First Carbon Negative Gold Royalty Platform, with an Increasingly Negative Carbon Footprint

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/23/2022

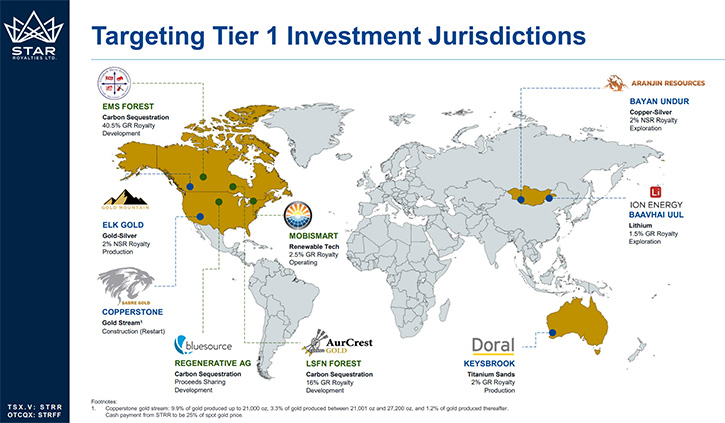

We spoke with Kevin MacLean, Chief Investment Officer of Star Royalties Ltd. (TSXV: STRR, OTCQX: STRFF). Star Royalties Ltd. is a precious metals and green royalty and streaming investment company. Star Royalties created the world’s first carbon negative, gold royalty platform and offers investors gold exposure, with an increasingly negative carbon footprint. We learned from Mr. MacLean that the interest on the carbon credit royalties was so big that the Company has created a subsidiary, called Green Star Royalties, and have already innovated a $5 M regenerative agriculture carbon credit project in the United States. The Company's portfolio of carbon royalties includes; EMS Forest Royalty (Canada), LSFN Forest Royalty (Canada), and Regen Ag Royalty (USA). On the metals side, Star Royalties' key assets include Elk Gold (cash-flowing gold royalty in British Columbia), Copperstone (near-term gold stream, Arizona) and Keysbrook (cash-flowing mineral sands royalty in Australia).

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metal's News, interviewing Kevin MacLean, Chief Investment Officer of Star Royalties, Ltd. Kevin, could you give our readers/investors an overview of your Company and update them on what's been happening since my last interview and article in March?

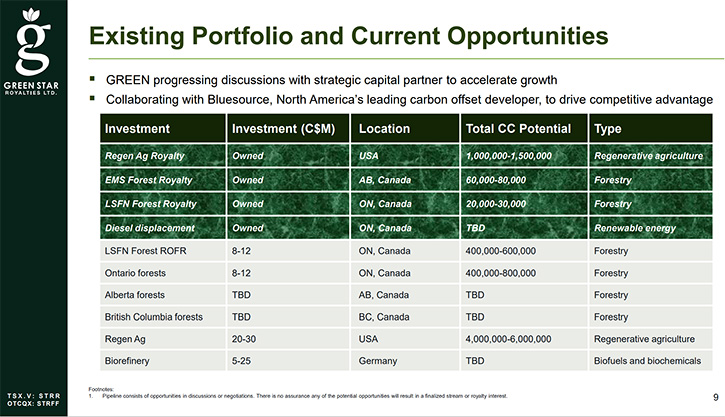

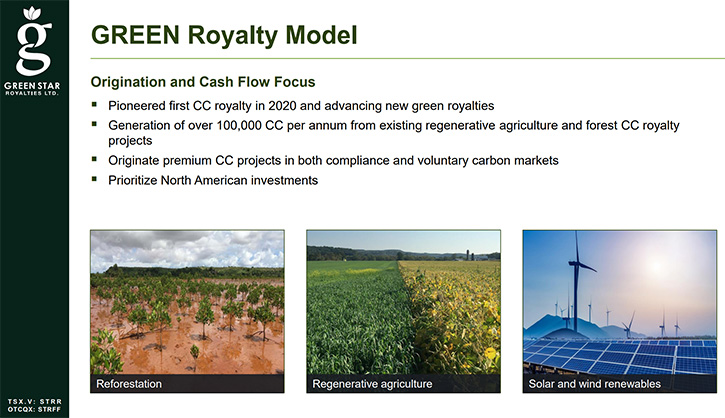

Kevin MacLean: Star Royalties is a precious-metals-focused royalty and streaming Company, with a significant green component. We have created a subsidiary, called Green Star Royalties, which is incubating a growing portfolio of carbon credit royalties attached to forestry and agricultural, carbon-sequestration projects.

We have made a pivot from our initial intention, when we got going, two years ago, as a private Company. We were originally planning to cap the portfolio, at about 20% green and 80% precious metals. But we've been literally swamped, with interest, on the carbon credit royalties that we initiated in forestry projects, in Canada. So we've recognized quickly that there is tremendous demand for that sort of investment. Particularly, with many professional investment managers being mandated to greenify their portfolios by holding a significant component of measurable green equity content.

We're responding to that demand and have created a subsidiary Company, which can be capitalized, independently of the parent company, so we can grow our green business, without limit. We are in negotiations with a deep-pocketed, well known capital partner that wants to participate in that initiative. They are of a sufficient size that they can work with us, as both an equity partner and co-investor in carbon credit projects that we might originate. We think the change of strategy is quite exciting and we're spending a lot of our time now, on the green front, as well as maintaining our due diligence on opportunities in the precious metals space. We're growing in a slightly different way from what we envisioned, a couple of years ago, but our shareholders are telling us that they are equally excited about this accelerated green initiative.

Dr. Allen Alper:

Well, that sounds excellent. Could you give us more details on what has been happening? I know you've made investments and secured royalties in several companies, since we last talked.

Kevin MacLean:

Last summer, we announced our second carbon credit, a forest carbon credit royalty, with the Elizabeth Metis Settlement, an Indigenous Community in Alberta, Canada. We invested CAD$300,000 to obtain a percentage of the carbon credits, to be generated from their forestry lands. A portion of their forested land is being repurposed from a logging operation into long-term carbon sequestration, essentially conserving the forest to grow naturally by capturing carbon. We recently were offered an opportunity to increase our investment in the EMS royalty, on the same investment terms. We accepted the offer and have increased our investment to CAD$900,000.

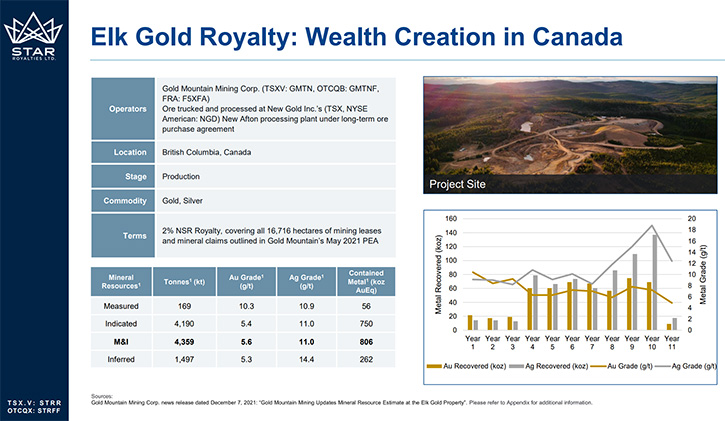

On the precious metals side, in October, we announced a $10.6 million investment for a 2% royalty on the Elk Gold Mine Project, in south-central British Columbia here in Canada. That's a project being run by Gold Mountain Mining Corp. It's a restart of a past high-grade, open pit, mining operation. It has been fast-tracked back into production, by a mill processing agreement with New Gold Inc., which has a mill called the New Afton Mill, about 130 kilometers away, with lots of excess capacity. They've arranged for their ore to be trucked and processed in exchange for 11% of the payable metal value, which will go to New Gold as the mill operator.

That's saved them a few years in the timeline of getting the mine back into production. As you know, it takes a considerable number of years to permit, raise the capital, and construct a milling operation. Not to mention the associated environmental considerations, with tailings ponds and all sorts of things. All of that has been done away with by having this offtake agreement with New Gold.

The Company not only did that, but they put some money in the ground to expand the resource in a very successful manner. By successful, I mean that a year ago they did a program of 41 drill holes, to try to expand the known resource and they had a 100% hit rate on their drill program. They added 260,000 high-grade ounces to their resource inventory, at a finding cost of just below $8 Canadian per ounce. That is an exceptional start to expanding the resource and making sure they have enough ore in front of them, to have an 11-year mine life and what we suspect will be a higher production and longer term mine life scenario, as they continue to explore and add additional gold resources.

To give you some numbers on the mine plan, they are currently ramping up to about 65,000 ounces per year, average production level, from primarily open pit mining. Over the next 11 years, 82% of the gold will come from open pit, 18% from underground. The open pit ore is at 5.4 grams per ton, which is about 10 times the global average grade for open pit mining, so it is a very low-cost operation. It's contemplated to be a $554 U.S. per ounce, all in sustaining cost mine. The underground component, when it comes on stream in year four, will be mined at about 12 grams per ton, which is also high-grade for underground mining.

Just two months after we purchased the royalty, the resource was updated to include the results of the Phase 2 drill program. We are pleased to say that the 100% hit rate continued and another 258,000 ounces of similar grade gold was discovered.

The Phase 3 drill program, now underway, is also drilling six targets outside of the current mine lease area, which they think have the potential to introduce new mining zones to the property. The one that they're most excited about is called the Elusive Zone, which is about 5 kilometers southwest of the current mining pit. This target has the second highest gold in soil anomaly on the property. The first hole into the Elusive Zone hit 2 m of 51 g/t gold so they are off to an excellent start!

The significance of that to Star Royalties, as an owner of a 2% royalty on the entire 16,000-hectare land package, is simply that whatever they find, we get 2% of the net payable gold at no additional cost. If they happen to have similar results on their Phase 3 program, as to what they discovered in Phases 1 and 2, that would imply another quarter million ounces or so added to their resource inventory.

If you allow for the 92% recovery rate, in the mill, and the 96% payable amount that comes back from the smelter and then the 11% that's paid to New Gold to do all of this for them, that would work out to approximately 4,000 ounces of payable gold to Star. To put that in perspective, the $10.6 million that we paid for this asset, if you want to put that in gold ounce terms, would equate to about 6,000 ounces of gold, paid to receive about 9,000 ounces of gold over 11 years. The Phase 2 drill program already added about 4,000 ounces of payable gold inventory to our credit. If Phase 3 results are similar then our gold receivable will have almost doubled, in the first year of our investment.

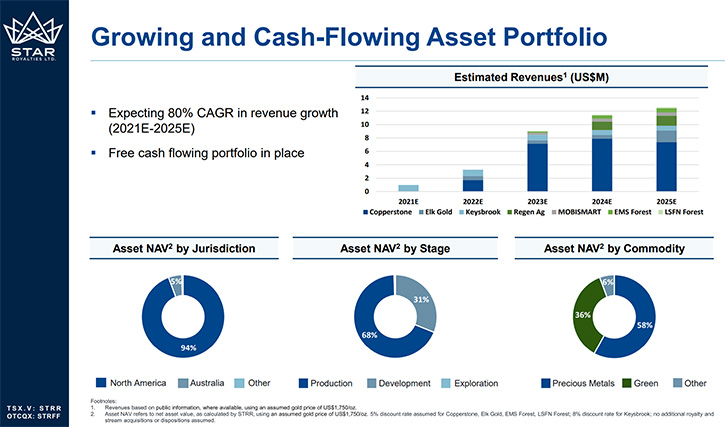

When you discover more ounces, you typically want to bring them to account faster. So, the Elk Project has been touted by management as one that could be expanded to 100,000 ounces per year, in year 4 production, as opposed to 65,000 ounces. To put some perspective on that, our peak royalty payment to Star, at the 65,000-ounce level, would be about $2.2 million a year. If they go to 100,000 ounces, it's about $3.3 million a year. So that would be an exceptional annual return from a $10.6 million investment.

We're quite pleased that first of all, it is a cash flowing royalty, because they started mining in November and shipping ore in February. So, it's an investment that, unlike many royalties, you don't have to wait for development activity to take place and permitting activity to take place, we're getting paid almost immediately. We've been a public company now for about one year, one of our objectives was to establish free cash flow quickly, so we're not dependent on the market to keep the lights on. We've achieved that now, between our existing portfolio and the addition of Elk Gold, we look at about $1.7 million U.S. of revenues, coming into the Company per annum, starting now. We are running at G&A costs of about $1.5 million U.S. So, we have free cash flow there. Not a lot, but it's better to have a positive free cash flow than a negative one. So, we've ticked that box and we're looking forward to some success at the Elk Mine, to kick that cash flow up a bit.

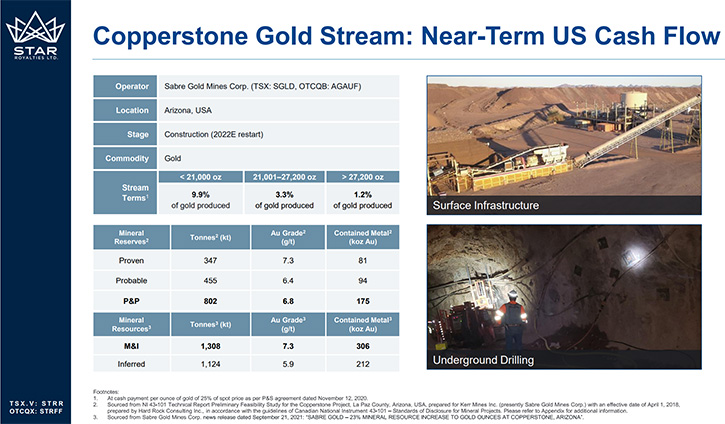

From our previous portfolio, we expect the Copperstone Stream that we acquired in Arizona, to be coming on stream late this year. That's behind schedule because we were expecting to have production coming in Q1 of 2022. The Company had a drilling contractor get themselves into some difficulty and take the drill rig off the property, which delayed them several months.

When the Copperstone asset gets up and running, we do expect to have another $5 million per annum or so of free cash flow from that investment as well. Achieving that milestone, would comfortably get us out of the gate, as a Company, with meaningful free cash flow that could be used to support a credit facility, so we're not tapping the market for equity, every time we want to do a transaction, and of course, give us free cash flow to reinvest or, at the right time, to pay a dividend.

Dr. Allen Alper:

Well, that sounds excellent. It sounds like you are in a great position, Star Royalties, and you'll have great potential as your invested resources grow.

Kevin MacLean:

Yes. We've all been in this business for a long time, and we have a very defined checklist, of what we want to see, when we invest money on behalf of shareholders. We're quite happy so far that we're managing to check those boxes.

Dr. Allen Alper:

That’s excellent. Kevin, could you tell our readers/investors a little bit about your background and the Team?

Kevin MacLean:

The Team has two engineers and two geologists and we've added our CFO, Ken Ngo, who's joined us from Franco Nevada. He brings superb expertise to our decision-making process. The Team has over 100 years of experience encompassing mining and geology as well as the flip side of that, the investment world related to mining, which would be mining research, portfolio management and investment banking. We've covered all the bases on both sides.

I'm the oldest member of the Team, I've been doing this since 1988, so I have a few decades of primarily portfolio Management, specializing in precious metals, mining and resource investing. I headed up the resource team, at a Company called Sentry Investments, for thirteen years. They were bought out, in 2017, by another group, called CI Financial, which is why I became free to do this with Star Royalties.

Along the way, I managed to rack up a number of awards, for risk adjusted returns, called Lipper awards and I received several Brendan Woods Top Gun awards. I think there's been some recognition that my approach to investing in the space has merit. The Lipper awards are something I'm quite pleased about, because the mining sector is full of risks. There's a long list of things that can go wrong, and I think I've managed to have a disciplined approach to investing that mitigates those risks to a large degree, where you can't avoid them.

Our CEO, Alex Pernin, comes out of Barrick Gold, where he managed capital allocation. He was involved in acquiring Randgold, the largest gold acquisition in a decade, at that time, and negotiating the deal with Newmont, for their Nevada Gold Mines operations merger. He's a young guy, but he's old beyond his years, in terms of a professional approach to doing business, and we're all delighted to work with him.

Our Chairman, Tony Lesiak, used to be head of global mining research, for Canaccord Genuity. A geologist himself, he literally knows everybody in the mining world. Peter Bures, our CBDO, is a mining engineer, who has been in the trenches in the investment world for a couple of decades. He used to work, with me, back in 2007-2011 on the portfolio management side.

Tony, Alex and Peter also worked together at Canaccord Genuity, in mining research, for a period of time. We all know each other, and we all knew what we were getting into, when we set up shop. A very nice Team to work with!

Dr. Allen Alper:

It’s excellent to have a Team that's so knowledgeable, so successful, so diverse, and to have a long-term relationship of working together. That really is great!

Kevin MacLean:

It makes it easy to have those daily conversations. It's interesting because of the COVID situation, we are running a virtual office, so we're keeping our overheads low. We all work out of our homes, and we do everything by Teams and Zoom and the various ways of communicating online. So, it is a new world, but it works out quite well for us.

Dr. Allen Alper:

It sounds like even in this new world, Star Royalties is accomplishing great things.

Kevin MacLean:

We're trying. We think we have about a two-year, head-start on the field, in terms of originating and structuring carbon credit royalties. We were quite comfortable, with our precious metals expertise, but it's been quite a rewarding experience to really dive into the green world of carbon credits and get the experience of originating new, nature-based, carbon capture projects and to deploy capital to help the battle against climate change. These things are not done at the drop of a hat, it takes a lot of effort to structure them properly, establish relationships, and I'm going to say, go where no man has gone before. Again, we have pioneered the regenerative agriculture carbon credit royalty structure. The carbon credit royalties, on forestry, also had not been done before. We have the skill set on royalties, but we also have the skill sets, in terms of just innovation of capital structure. I think we all have something to contribute there.

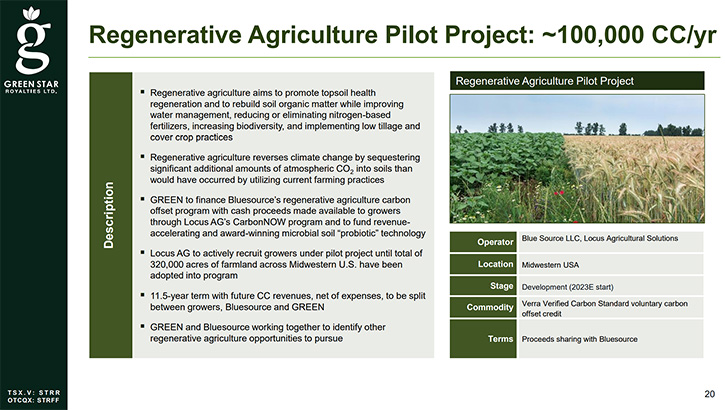

We worked on the Regen Ag royalty, for about eight months and there're a lot of moving parts that have to be considered. You're now inviting in American farmers, as your partners, and you want to make sure they're happy with the soft benefits of being a green farmer, but also the economic benefits of increased crop yields and participation in carbon credits, being generated by their state-of-the-art green farming practices.

The other interesting angle, in the precious metals or the mining world in general, we can go out and find a gold royalty that we think is quite attractive and we can buy it. But then we must go out and beat the bushes for another attractive opportunity. Whereas in the carbon credit world, let's take U.S. farmland, for example, we've started a pilot project royalty structure, on a few hundred thousand acres of American farmland. There's a billion acres out there, so once you get the first one done we can quickly scale the business and we can say that farmers are knocking on the door to get involved.

There's lots of demand, so once we do one and we advertise that we've done it, we think our ability to do a second one is immediately in front of us. We just tap into a different group of farmers, who are lined up to do this. It's quite different, in a nice way, from the precious metals world in that people are lined up to do these deals as opposed to having to go out and use your expertise to identify, structure and negotiate a precious metals mining royalty. That's why we took the lid off the green side, because we can go much faster on green than we can on precious metals.

Dr. Allen Alper:

Well, that sounds excellent. It sounds like that's a great opportunity for Star Royalties. You’re moving rapidly and you have a unique position.

Kevin MacLean:

We really do think it's unique, we've had a couple of competitors call us up and ask if we want to collaborate on something and we've just politely declined, because we don't need the help and we don't need to share the first mover advantage that we have.

Dr. Allen Alper:

That’s excellent. Kevin, could you update our readers/investors on your capital and share structure?

Kevin MacLean:

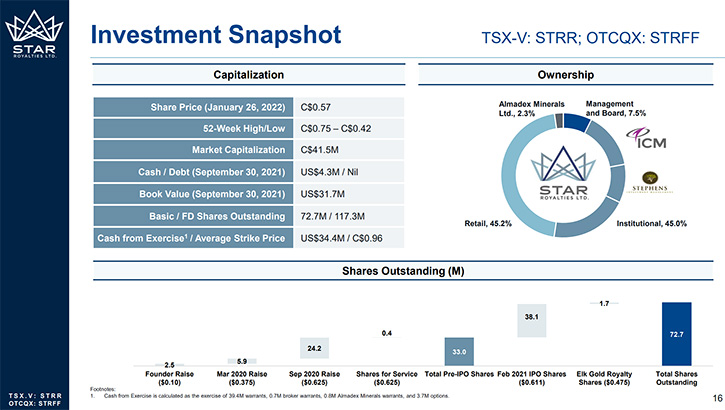

We have 72.7 million shares outstanding. We have approximately 40 million warrants outstanding. The weighted average price, on those warrants, is about CAD$1 and those are primarily warrants that were issued, during our initial public offering, in February of last year. They have two years remaining on them, and the strike price is well above market and so they'd be very anti-dilutive if they were exercised anytime soon. The cash on the balance sheet is just a little under $5 million U.S. We're hoping to spend that in the next couple of months and replenish it by financing directly at the Green Star subsidiary level. As we grow Green Star, we belief the value creation will be reflected in the share price of the parent company, Star Royalties.

Dr. Allen Alper:

That sounds excellent. Great opportunity for your shareholders and stakeholders!

Kevin MacLean:

We're all professional critics of the mining industry and we're very cognizant of what investors want to see, in terms of minimizing dilution and maximizing growth. We're super sensitive to it and we're thinking long and hard about how to grow this Company, to optimize the share price. I have insisted on not taking a salary. I want to make sure that I'm fully aligned with the shareholders so that the only way that I win here is if all the shareholders win.

To that note, I would just add that even with our existing 72.7 million shares, we were very careful how we issued them by not issuing a lot of cheap stock to the founders, and my average cost is 47 cents per share. The stock's trading at about 60 cents a share right now. So yes, I managed to invest below market, by buying all the financings along the way, but I'm pretty much as close to market as you're ever going to see, I think, with a startup company issuing new capital.

Dr. Allen Alper:

Well, that's excellent to see that Management is aligned with investors and has skin in the game.

Kevin MacLean:

Yeah, that's the idea. We're trying to do everything best-in-class, as much as possible.

Dr. Allen Alper:

That sounds excellent. Kevin, could you highlight the primary reasons our readers/investors should consider investing in Star Royalties?

Kevin MacLean:

I've gone over the unique green opportunity. We're really the first people to be doing it and we're doing it well. Getting back to the precious metal side, I have a soft spot in my heart for precious metals, I've done that most of my career. The trick to investing successfully, in the precious metals world, is to get yourself exposure to exploration potential, in the least risky way possible. And the riskiest way is simply buying exploration. The next best way is just to buy an operating mine that's profitably generating cash flow that they can reinvest in exploring for gold. But sometimes mines have operating difficulties and their share price suffers, despite exploration success.

But it's been demonstrated, quite clearly, that the royalty company structure seems to be the least risky way of capturing exploration upside. So you look at royalty companies, and over the years they've done extremely well. They've outperformed gold and outperformed the mining sector. And why is that? It's because they don't have that capital risk, they just have free cash flows that they reinvest. When they buy a royalty or a stream, they generally get participation in the exploration, some percentage of it for the rest of the mine life, whatever that might be.

And that, in my view, is the best way to go about capitalizing on discovery. And just to remind your readers/investors Franco Nevada, which is the all-time success story in royalties, got started with a $2 million check to acquire a royalty interest on the Goldstrike property in Nevada. That $2 million check has turned into several billion. The gold royalty investments that we have are already adding ounces to our account. So, there's a lot of rationale to have exposure to exploration success through a royalty vehicle.

Dr. Allen Alper:

Well, that sounds excellent, it sounds like a very wise investment technique.

Kevin MacLean:

Well, it's the best I can do. I've been investing in gold mining for 30 years and it’s the best I can do.

Dr. Allen Alper:

Is there anything else you'd like to add, Kevin?

Kevin MacLean:

I would add that one of our near-term objectives, as we grow the Company, is to get a primary listing in the U.S. markets on the Amex or New York Exchange. There are some size requirements to get that done, but we are very much interested in it. We're now spending a lot more time marketing to US investors. We have an over-the-counter listing currently, but we hope, as we grow the Company, to upgrade to one of the bigger Boards in the U.S. so investors can comfortably trade our shares.

Dr. Allen Alper:

Well, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://starroyalties.com/

For more information, please contact:

Alex Pernin, P.Geo.

Chief Executive Officer and Director

apernin@starroyalties.com

+1 647 801 3549

Dmitry Kushnir

Head of Investor Relations

dkushnir@starroyalties.com

+1 647- 287 3846

|

|