Rob McEwen, Chief Owner and Chairman, McEwen Mining Inc Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/18/2022

We spoke with Rob McEwen, Chief Owner and Chairman of McEwen Mining Inc. (NYSE: MUX, TSX: MUX), a diversified gold and silver producer and explorer, focused on the Americas, with operating mines in Nevada, Canada and Argentina. In addition, they have a large exposure to copper, through their subsidiary, McEwen Copper, owner of the giant Los Azules copper deposit, in Argentina. Los Azules is one of the world's largest undeveloped, high-grade, open pit copper projects that contains significant further-growth potential. According to the project’s Preliminary Economic Assessment (PEA), completed in 2017, during the first 10 years of the 36 years of operations, the project is anticipated to be one of the world's larger copper producers, with costs in the lowest quartile. McEwen Mining reported that consolidated production, for the full year of 2021, was 34% higher than in 2020 and Q4, 2021 was 29% higher than in Q4 2020. Full year production was 154,410 gold equivalent ounces, consisting of 118,500 gold ounces and 2,572,000 silver ounces. In Q4, production was 40,150 GEOs, consisting of 31,300 gold ounces and 682,700 silver ounces.

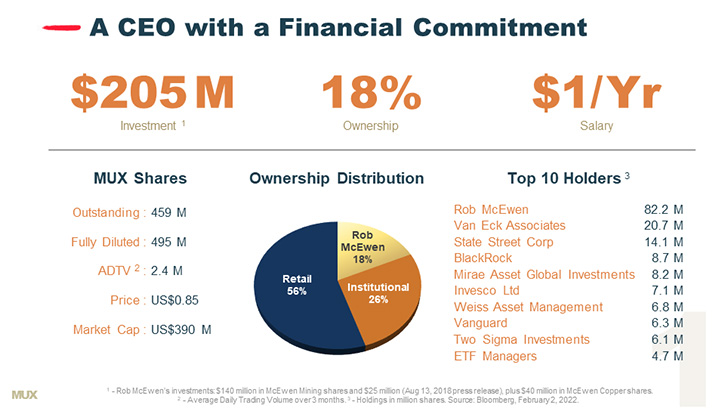

Rob is the founder of Goldcorp, where he took the Company from a market capitalization of $50 million to over $8 billion. At McEwen Mining (MUX), he owns 18% of the Company and takes a salary of $1/year. The cost of his investment in MUX and McEwen Copper exceeds US$200 million.”

Rob McEwen, Chief Owner and Chairman

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News. I’m talking with Rob McEwen, Chief Owner and Chairman of McEwen Mining (MUX: NYSE & TSX). Rob, I'm looking forward to interviewing you and updating our readers/investors on MUX and anything you would like to add on McEwen Copper, that would be great, too. I was thinking maybe we could start off broadly, with what's happening with gold and the gold market and inflation and what your views are on that.

Rob McEwen:

We're seeing big price increases across a wide spectrum of commodities. In the last two years, copper has gone from a low of $2 to over $4.00, oil has gone from $40 to over $86. Platinum and all food commodities are higher. But strangely, gold and silver haven't moved a lot. Precious metal prices and the associated stocks have been rather lackluster.

Up until very recently, the Federal Reserve felt that inflation was temporary, but not any longer! Investors are starting to focus on inflation, as they are beginning to see the product of the misallocation of capital, by governments around the world: massive monetary stimulation, the high levels of debt, government and personal, and rampant speculation, encouraged by the very low interest rates.

We appear to be in the late stage of a bull market, where historically prices of commodities and precious metals start moving higher.

Regarding an update on MUX, 2019 and 2020 were challenging years for us. We missed our production guidance, by a wide margin, due to human and natural causes, which produced a significantly shortfall in revenue and raised our costs/oz. As a result, we had to do several financings to maintain our activities and the impact on our share price was painful. I am pleased to say that we have been rebuilding our momentum, with a new Senior Management Team that has been able to deliver on guidance, in the last three quarters of 2021.

While we still have work to do, our gold and silver production in 2021 was 34% higher than in 2020. We have 3 sources of production, the Fox Complex in Timmins, Canada; Gold Bar in Nevada; San Jose in Argentina; and a former mine in Mexico.

So far this year, we released the highlights of our Fox Complex PEA (preliminary economic assessment) on January 26th, which provided a promising view of the future for Fox Complex: a much longer mine life, 9-12 years, an increased average annual production rate of 72,000 gold ounces coupled with lower production costs/oz of $800 cash and $1,225 all-in sustaining costs. Every aspect of PEA is good, except the payback period, of 6 years. It is longer than we will accept. We believe the exploration success that we are currently experiencing, at the Stock property, will result in a shortening of the payback period.

Our commitment to exploration provided the foundation for the PEA and provided the resource base for our successful startup of mining at our Froome deposit last year. (Stock and Froome deposits are part of the Fox Complex).

Dr. Allen Alper:

Well, that sounds great! I wonder if you could tell us a little bit about the highlights of 2021, some of the projects and then also talk about McEwen Copper.

Rob McEwen:

MUX owned a giant copper deposit (estimated resource of 32.9 billion pounds of copper equivalent) since 2012. I really liked it and thought it represented tremendous potential value for MUX, but the market wasn’t giving us value for it, despite the fact that the copper price had more than doubled in the past 2 years. I felt there were two key reasons why we weren’t seeing the value of Los Azules reflected in our share price: One, investors have a preference for pure plays, such as a copper company or a precious metal company, but not the combination: Two, MUX’s treasury isn’t strong enough to cover its development and exploration costs for its gold and silver mines and also fund the heavy costs of advancing its large Los Azules copper deposit; and Three, the MUX’s operating challenges, that I spoke of earlier, gave investors a reason to look elsewhere.

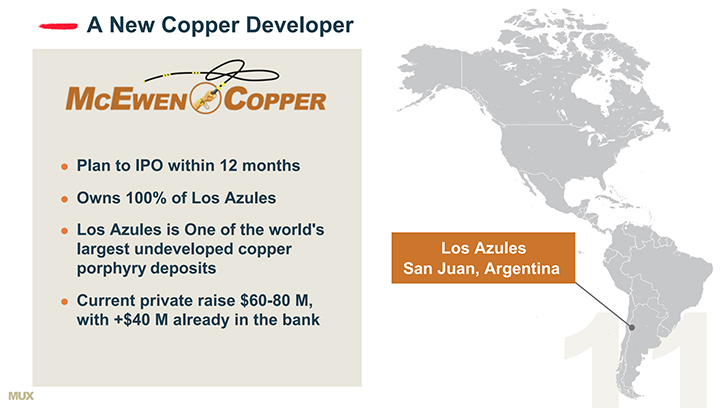

During 2021, we decided to create a new copper development Company, McEwen Copper, to hold our Los Azules copper deposit. We believe this arrangement would, allow us to fund the advancement of Los Azules, while retaining a controlling interest in this major copper, and sparing the MUX shareholders further dilution. And when we IPO McEwen, within the next 12 months, we are expecting a significant lift in value in McEwen Copper’s share value and the value of MUX’s holdings of McEwen Copper.

We are in the midst of a $80 million, Series B, private financing of McEwen Copper. I am so convinced of its potential, that I personally provided the lead order of $40 million. This investment brings my total investment in MUX and McEwen Copper to over $200 million. We are expecting to close the financing this quarter. The share price is $10, and the minimum investment is $250,000.

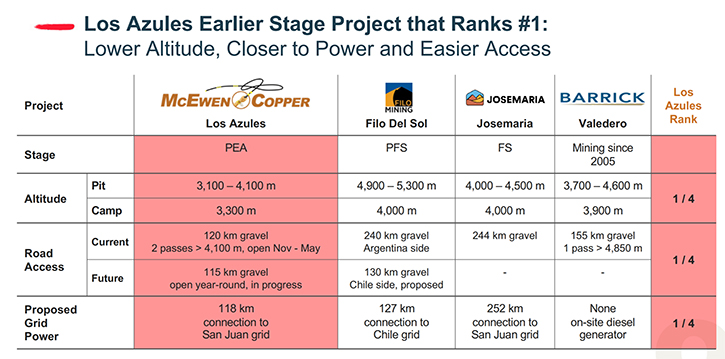

This is a potential copper bonansa. McEwen Copper’s Los Azules deposit is located in northern Argentina, in the pro-mining province of San Juan, on the border with Chile. Below is a chart that illustrates Los Azules’ more favorable location, being at a lower elevation and a shorter distance to the existing power gird and highways, relative to two other copper projects and the existing gold mine, in San Juan. It also shows that Los Azules is at an earlier stage of development, a PEA.

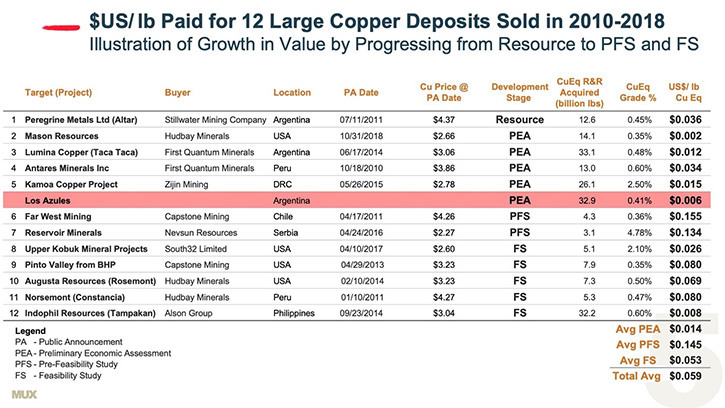

The purpose of the financing, is to fund the advancement of the property, from its current PEA (preliminary economic assessment) stage on to a PFS (prefeasibility study) stage of development. This step forward should take 18 months to complete. Based on past prices paid for large copper projects that have reached the PFS stage, we are expecting that Los Azules once it reaches the PFS stage it could command a minimum price of $0.03 to $0.05/ copper equivalent pound. In our current pre-IPO financing Los Azules is valued at $0.006/ copper equivalent pound equal to a property value of $175 million.

Should the value of Los Azules be valued at $0.03/pound, its value would increase from $175 million to just under $1billion dollars. If it were valued at five cents, its value would increase to $1.6 billion dollars. While these values represent large numbers, it is worth noting that these sale prices are at the low end of past sales, when looking at the sales of 12 sales of large copper projects, between 2010 and 2018.

See the Chart below.

These copper properties sold, range from the earliest stage of development, of a resource estimate, advancing through to PEA, the current stage of development of Los Azules, on to PFS and on finally to the FS stage of development.

Within this group of 12 transactions, only two were at the PFS stage of development and you can see in the right-hand column that these two PFS stage properties sold for over $0.13/copper equivalent per pound. This is the same stage to which we are advancing Los Azules.

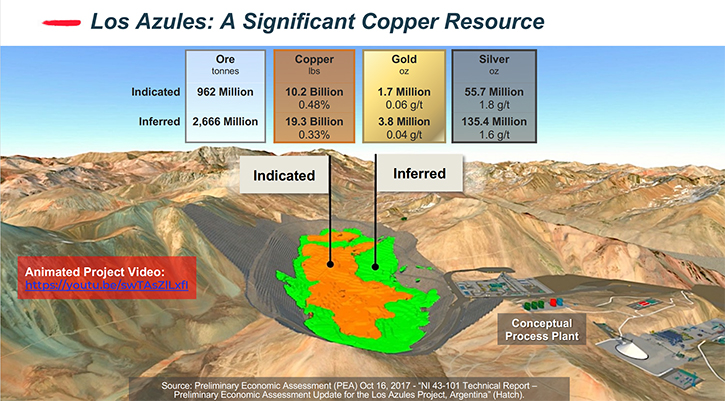

Los Azules is considered a giant copper deposit. Its mineral inventory is an estimated 32.9 billion copper equivalent pounds, composed of 29.5 billion pounds of copper, 5.5 million oz. gold. And 191 million oz. silver. These resources are classified as 1/3 indicated and 2/3. inferred. One of the activities that our financing will fund, is a 53,000-meter drill program that is designed to convert much of the Inferred resources into Indicated resources, thus enabling the completion to the PFS. Managing the advancement is a Team of senior staff and consultants, with long experience, designing, constructing and operating large copper projects in Latin America.

To give you another perspective, to appreciate the size of Los Azules, let’s play with some math. Assuming you take our estimated indicated and inferred resources of copper pounds and silver oz and convert them into the equivalent gold oz, using current metal prices. What you get is Los Azules being equivalent to an 80-million-ounce gold deposit.

Another thing to consider about McEwen Copper, is the change in political winds in South America. Argentina has long been viewed as a difficult place for a foreign investor to make money. However, investing in Argentina is looking much more attractive today, as a result of what is happening in Chile and Peru. These countries are two of the largest producers of copper production, in the world, and their newly elected governments have turned decidedly left, advocating higher taxes, taking larger interests in the mines and in some cases actually shutting down mines. With the growing demand for copper, Argentina is being viewed in a much more favorable light, by large mining companies. It is in the same prolific copper mineral belt and the government of Argentina has rolled out the welcome mat to foreign mining investment.

There have been large investments recently to develop Argentina’s lithium deposits and very recently, a large foreign investor has made a significant commitment to develop a green hydrogen energy industry there. Los Azules is located in San Juan province, a pro-mining district, with a long history of mining operations. Actively mining in the province, are companies, such as Barrick Gold and Shandong Gold, and Fortescue Mining is exploring, while Anglo American and Vale have been investigating opportunities there.

Dr. Allen Alper:

Well, that sounds excellent. It sounds like it's a fantastic property. And with Argentina getting better and further improving politically and so becoming more and more pro-mining, that sounds like an excellent situation. Rob, maybe you could say a few words about copper and why it's growing in importance and demand.

Rob McEwen:

A recent research report by Goldman Sachs, entitled Copper is the New Oil, highlights the major shift in energy and value. Numerous analysts are forecasting a copper production deficit, at a time when demand is expected to surge, due to the electrification of transportation.

What is likely news for many investors, is the fact that Copper is an essential component for the green economy, for decarbonizing the world. Many of the renewable energy sources are very reliant on technologies and equipment that utilize large amounts of copper. Adding to the demand picture, is the rapid urbanization of Southeast Asia.

One of the reasons we decided to create McEwen Copper was our belief that the value of Los Azules was not being reflected in the share price of MUX. But it could, if it were in a separate listed copper development company and MUX retained a large interest.

As I stated earlier, we plan to IPO McEwen Copper, once we have updated the PEA and have completed construction of a new road that will provide year-round access to the deposit. We expect the IPO will be launched, within 12 months.

Dr. Allen Alper:

That sounds excellent. What will be the relationship of the current owners of McEwen Mining investors to McEwen Copper?

Rob McEwen:

Since I'm the largest shareholder of MUX and have a large investment in McEwen Copper, I have a huge incentive to increase the value of both companies. Our current pre-IPO Series B financing is looking to raise up to $80 million. Assuming it's fully subscribed, the ownership in McEwen Copper would be 69% MUX and 31% the Series B shareholders. In addition, MUX retains one and a quarter percent NSR royalties, on Los Azules.

It's going to take a large capital expenditure to bring Los Azules into production. Over time, it's quite likely that MUX's interest will be reduced. The royalty will ensure that MUX shareholders have an additional source of value, once the mine goes into production. The current PEA has modelled a mine that has a long, 36-year mine life, large annual production, low cost and robust economics at a copper price of $3/pound. With the copper price today trading at a level almost 50% higher than the PEA, I feel the future of McEwen Copper and MUX looks very intriguing.

Dr. Allen Alper:

Oh, it sounds like that will be a great opportunity for McEwen shareholders and stakeholders.

Rob McEwen:

Yes. I couldn’t agree more! Investors have two ways to participate in this story. One, offers lower cost of entry and instant liquidity, buy shares of MUX, which will owns 69% of McEwen Copper; the other is to subscribe to the McEwen Copper Series B financing, but it is more expensive, $250,000 minimum, and it would be an illiquid investment until the IPO.

Dr. Allen Alper:

That sounds great! Rob, I wonder if you could tell us a little bit more about your share and capital structure?

Rob McEwen:

There are approximately 459 million common shares of MUX outstanding. I own 80 million common shares, representing some 18% of the Company. McEwen Copper, post the Series B financing, being fully subscribed, will have 25.5 million common shares outstanding. MUX will own 17.5 million shares, equal to 69% and the Series B shareholders will have 8 million shares equal to 31%. MUX has debt of $50 million and McEwen Copper has no debt.

Dr. Allen Alper:

Could you tell our readers/investors the primary reasons they should consider investing?

Rob McEwen:

Allen, there are three reasons.

- 1. MUX turn around is underway. Our share price was pushed down hard, a holdover from the operating challenges of 2019 & 2020. But it is rebounding. In the last 3 quarters of 2021, we met production guidance, and although we are not out of the woods completely, the trend is up.

- 2. McEwen Copper is a very large QA, with the potential for creating significant value for its shareholders, and MUX is its largest shareholder.

- 3. Historically, MUX has provided excellent leverage to gold, silver and now copper.

https://mcewenmining.com/

Investor Relations:

(866)-441-0690 Toll-Free

(647)-258-0395

Mihaela Iancu ext. 320

info@mcewenmining.com

|

|