Interview with Dale Verran, CEO of Fortune Bay Corp. (TSXV: FOR, FWB:5QN): Gold & Uranium Exploration in Canada’s Top-Ranked Jurisdiction

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/11/2022

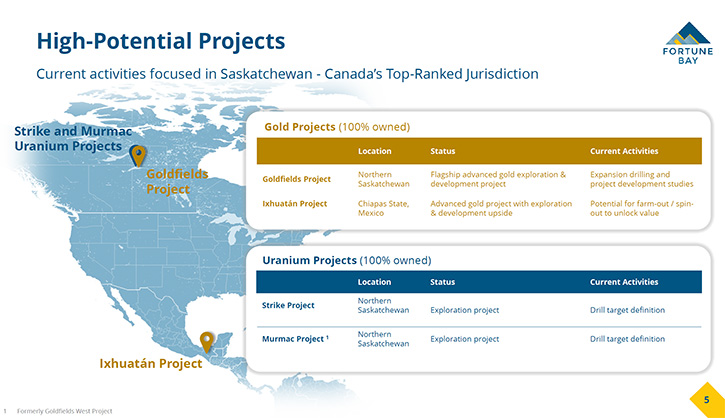

We spoke with Dale Verran, CEO of Fortune Bay Corp. (TSXV: FOR, FWB:5QN), an exploration and development company, with 100% ownership, in two advanced gold exploration projects, in Canada, Saskatchewan (Goldfields Project) and Mexico, Chiapas (Ixhuatán Project), both with exploration and development potential. The Company is also advancing the 100% owned Strike and Murmac uranium exploration projects, located near the Goldfields Project, which have high-grade potential typical of the Athabasca Basin. The Company has a goal of building a mid-tier exploration and development Company, through the advancement of its existing projects and the strategic acquisition of new projects to create a pipeline of growth opportunities. Plans for 2022 include lots of exploration drilling at Fortune Bay's gold and uranium properties.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dale Verran, who is CEO of Fortune Bay Corp. Dale, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Dale Verran: We are an exploration and development Company, listed on the TSXV, under the symbol FOR and in Frankfurt, under the symbol 5QN. Our activities are focused on Northern Saskatchewan, which is Canada's top-ranked mining jurisdiction. In that area, we have our flagship gold asset, called the Goldfields Project. It has around a million ounces of indicated gold resources, and it's an open-pit constrained resource.

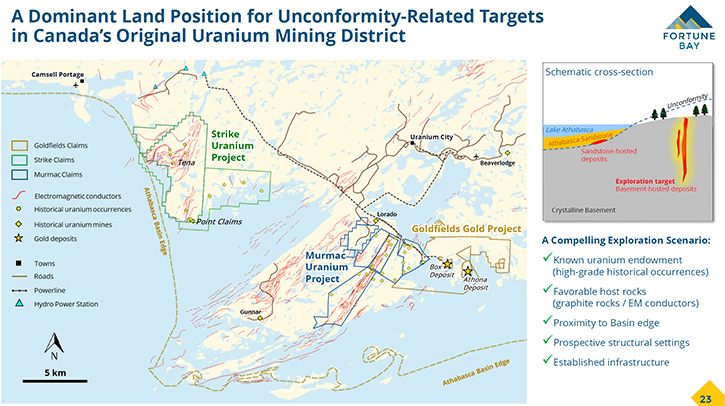

The gold project also has excellent exploration potential, which is the focus for drilling, both last year and, again, this year. Being in Uranium City, because of our Team and our background in Athabasca Basin uranium exploration, we couldn't help noticing some excellent uranium exploration opportunities, right on our doorstep, in Uranium City. We've announced two uranium projects, and both of them have the potential for high-grade uranium deposits, typical of the Athabasca Basin.

Historically, numerous high-grade uranium occurrences have been identified on these projects and they have all the right geological ingredients to host a high-grade basement-hosted deposit, so we've announced plans recently to advance these projects. This year we will be doing some geophysics, on both projects, through the winter months, and then following that up, with some planned drilling, through the summer on both projects. We already have exploration targets on the uranium projects, but the winter geophysics is planned to refine those targets, before drill testing in the summer. So, with the financing that was competed in December, we raised $6.9 million, we have an expansive set of exploration plans, which is weighted this year toward our uranium projects, but also continuing to advance our core gold project.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a little bit, in more detail, about the specific projects?

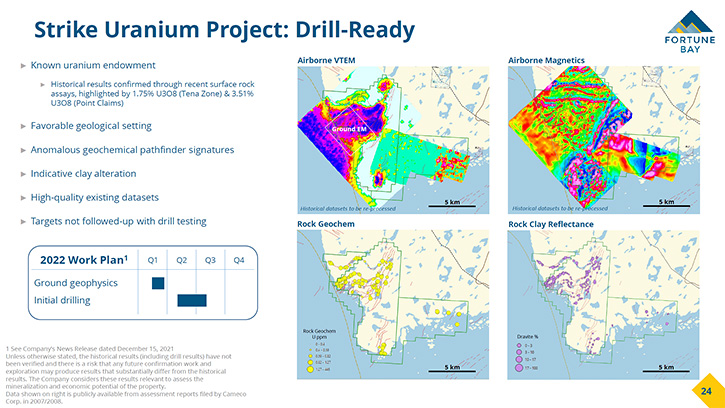

Dale Verran: Yeah. Talking about the two uranium projects, the first project I'll talk about is called the Strike Uranium Project. That covers an area of around 10,000 hectares. Cameco held the ground from 2004 to 2008, and collected some excellent data sets, including both airborne and ground geophysics. They also did prospecting and sampling on the ground, but they never got to drill that project. It lapsed in 2012, just after Fukushima, when uranium exploration activity had quietened down. And we were fortunate to stake that project and inherit these public data sets that make the project drill-ready. So, the next step for us there, is a gravity survey, to refine some of those targets, before we embark on an initial drilling campaign, for the Strike Uranium Project.

What's really exciting about Strike, is that there was actually some historical mining, back in the 1950s, at the Tena occurrence. There was about a thousand tons mined, at grades of 0.6% to 3.5% U3O8, and those are the typical grades of Athabasca Basin basement-hosted deposits.

If one goes to look at that occurrence, which we have, the style of mineralization indicates an unconformity-related system, which suggests potential on the whole project for these types of deposits. The Tena occurrence represents an initial exploration target, but outside of that, there are numerous other targets along the electromagnetic conductors on the property.

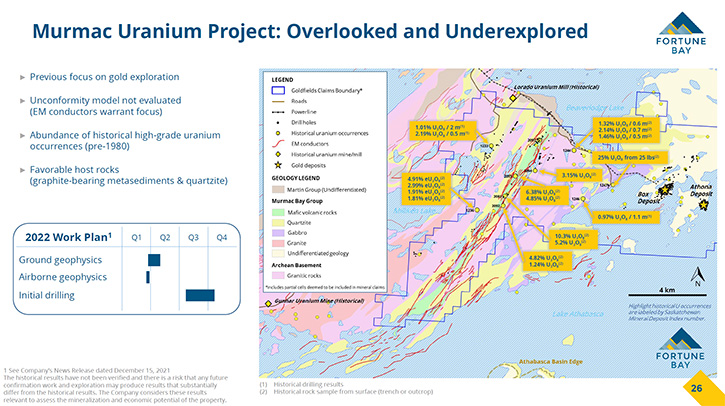

The Murmac project is our other uranium project. Now, that is really on the western side of the original Goldfields Project.

And there, we have a 12-kilometer package, of these electromagnetic conductors, which represent the favorable graphitic host rocks, for these Athabasca high-grade deposits. What's interesting about that project, is that historically, there was prospecting work done and numerous high-grade occurrences were found. It's common to see grades of over a percent on surface.

However, all that work was done up to the 1980s, and there was never focus on exploring the electromagnetic conductors. Since the 1980s, it’s been a gold project, so the uranium's really been overlooked since then. Our focus is to come back in and look at these electromagnetic conductors and target them directly for these high-grade deposits. And that really sums up the two uranium projects.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a little bit more about your gold projects?

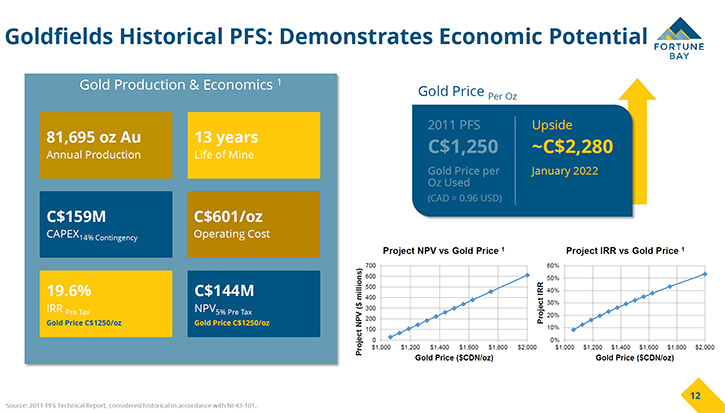

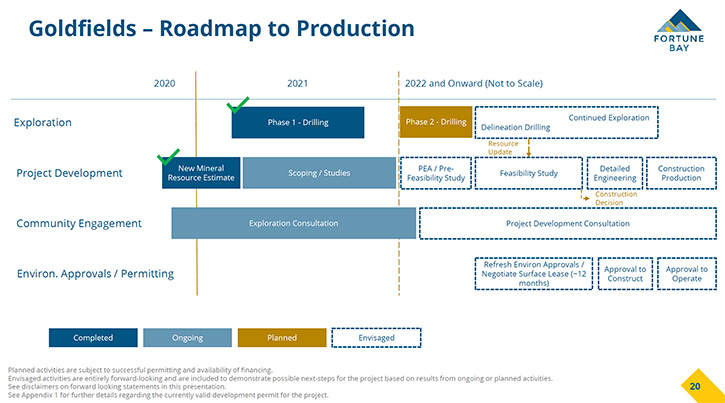

Dale Verran: At our gold project in Saskatchewan, we have around a million ounces indicated, that's an open-pit constrained resource. That project's been the subject of previous mining studies. The most recent study was in 2011, which showed an NPV of $144 million and an IRR of 19.6%. That study was done at a Canadian gold price of $1,250 ounce. Today, that Canadian gold price is almost doubled, so we are in a much better gold price environment for this project to advance.

We completed a new mineral resource estimate, in March last year, and using that new resource estimate, we've been working on a number of scoping studies, to evaluate what's going to be the best development path for this project, going forward.

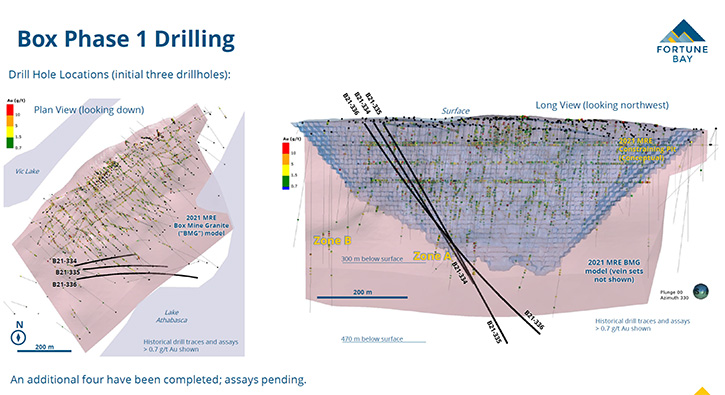

Results from the scoping studies are currently being reviewed, before we decide whether to advance to a PEA or PFS. In tandem with that, looking at the potential of the project around the existing resource, we've also been doing some exploration. So, last year we completed a Phase 1 drilling program, and got some good results. At Athona, we showed the deposit is open to the south, and we expanded the mineralized footprint at that deposit. At the main deposit, called the Box deposit, we also drilled seven holes last year. We've only had assay results for the first three holes, but all of those show a significant expansion of the mineralization, up to 220 meters, outside the current mineral resource estimate. And we've also seen some really good grades, from the drilling we've done, down dip of the deposit. So, it's an exciting area for potential resource expansion, on the project, too.

Going into this year, we see the potential particularly at Box, and that could be the subject of some follow-up drilling while we wait for the final assay results.

In the interim, we have started a drilling program between the two deposits, where we've identified a number of exploration targets, within what they call the Goldfield Syncline, where we see geological potential to discover a new deposit on the property.

Dr. Allen Alper: Well, it looks like 2022 is going to be a very exciting time for your shareholders and stakeholders, as your drilling results are obtained in both uranium and your gold projects.

Dale Verran: Yeah. I think, in the coming year, we are looking at a number of potential catalysts for the Company. I mentioned, we raised that $6.9 million. We're going to be starting drilling on the gold project first, in January, because the drill rig is already there, and we have targets. While we are drilling on the gold, we'll be doing some geophysics on both uranium projects, refining those targets, and then, come spring, in May, we plan to kick off the uranium drilling and we'll see that drilling go three to four months through the summer months. So, we're looking at potential steady news flow, including drilling and results to come from that.

Dr. Allen Alper: That sounds excellent. Dale, could you tell our readers/investors a little bit about yourself, your background, your Team, your Board?

Dale Verran: Well, sure. I'm a geologist by training, over 20 years in the mineral exploration industry. I studied in South Africa, worked all over Africa for many years, starting with Gold Fields, but also with other Companies, moved to Canada seven years ago and joined Denison Mines Corp in Northern Saskatchewan. That gave me tremendous exposure to uranium exploration and project development in Northern Saskatchewan.

With Denison, we had a really exciting, successful time. At Denison, I was involved in the discovery of two deposits, the Gryphon deposit, and the Huskie deposit. Now, both of those deposits are exactly the type of deposits we are looking for, with Fortune Bay, so I've had experience discovering and delineating those sorts of deposits. And my time with Denison, advancing their main assets, through PEA and PFS stages, I learned a lot about project development, in Northern Saskatchewan, which is playing well into what we are doing on the Goldfields project.

And outside of that, in our Exploration Team, our guys have gold experience, and a number of them, lots of uranium experience as well, with the Companies like Cameco, NexGen, and Fission. So, we are well positioned to tackle these uranium projects, in addition to our experience in gold. And then, on our Board, we have a really well-balanced Board, from geologists to financiers, entrepreneurs, experience in the capital markets, very strong on the governance and also legal side. The details are available on our website.

Dr. Allen Alper: Oh, that sounds excellent. Very strong Board, great experience, so that's terrific. Could you tell our readers/investors a little bit more about your capital and share structure?

Dale Verran: Yes, for sure. We have about 43 million shares outstanding, and 15% of the Company is owned by Management and Board, so there's a strong alignment with shareholders. Recent market cap is around $30 million.

Dr. Allen Alper: It's good to see Management having skin in the game. That's great. Dale, could you tell our readers/investors, the primary reasons they should consider investing in Fortune Bay Group?

Dale Verran: Well, firstly, the value of our Company is underpinned by gold ounces in the ground. We have drill-defined resources at Goldfields. And what I haven't even mentioned is we have another project in Mexico, where we also have, across the categories, about 1.7 million ounces of gold. So, across the categories and both projects in Saskatchewan and Mexico, we have almost 3 million ounces of gold in drill-defined resources. Those resources underpin the Company, and we are attractively valued considering that amount of gold in the ground.

Then, we have these uranium assets, which offer tremendous upside for shareholders. I don't need to explain what an exciting time it is in the uranium market. And we've identified two projects that are easy for us to operate, being near our gold project, that have the potential for these high-grade uranium deposits, very similar setting to what we see on the southwestern part of the Athabasca Basin in the recent discoveries at Arrow by NexGen and Triple R by Fission.

Having both gold and uranium gives us both diversification and optionality. Additional reason to invest, is the experience of our Technical Team and our Board that has a proven track record. We are poised for growth, having raised $6.9 million and an expansive set of exploration plans. We have potential catalysts expected this year, from our planned exploration drilling, as well as project development work on our gold project.

Dr. Allen Alper: Oh, that sounds excellent. Those are very compelling reasons for readers/investors to consider investing in Fortune Bay Corp. Is there anything else, Dale, that you'd like to add?

Dale Verran: No, I think that sums it all up, Al.

Dr. Allen Alper: Okay. Great! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://fortunebaycorp.com/

Dale Verran

Chief Executive Officer

902-334-1919

|

|