David D’Onofrio, CEO, White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W) Discusses Its District Scale Property Portfolio Covering Over 420,000 Hectares, 40% of the Yukon’s Emerging White Gold District, Significant Defined Resources and Exciting New Discoveries

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 2/11/2022

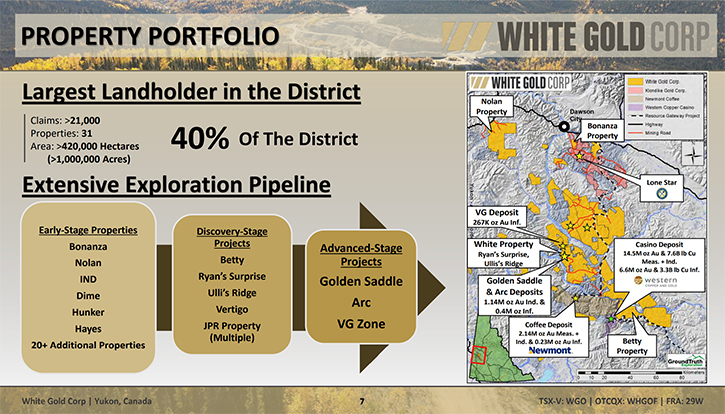

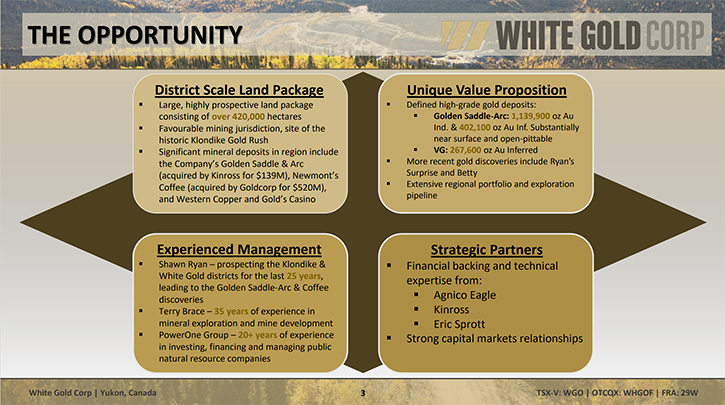

We spoke with David D’Onofrio, CEO of White Gold Corp. (TSX.V: WGO, OTCQX: WHGOF, FRA: 29W), a gold exploration Company, with a portfolio of properties, covering over 420,000 hectares, representing over 40% of the Yukon’s emerging White Gold District, with a unique mix of early and discovery-stage properties, along with advanced-stage exploration projects, with high-grade, open-pit gold resources. The Company’s flagship, White Gold property, hosts the Golden Saddle and Arc deposits, which have a combined mineral resource of 1,139,900 ounces indicated, at 2.28 g/t Au and 402,100 ounces inferred, at 1.39 g/t Au. The Company also owns the VG deposit, located 11km north of the Golden Saddle & Arc Deposits, which has 267,600 ounces inferred at 1.62 g/t Au. More recent gold discoveries include Betty Ford, Ryan’s Surprise and Ulli’s Ridge. White Gold Corp. enjoys financial backing and technical expertise, from Agnico Eagle, Kinross and Eric Sprott. Upcoming catalysts include, diamond drilling results and regional exploration work, from their extensive exploration program, to follow up on the Company’s high-grade gold discoveries and the commencement of 2022 exploration program.

White Gold Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with David D’Onofrio, who is CEO of White Gold Corp. David, could you give us an overview of your Company and what differentiates your Company from others?

David D’Onofrio: White Gold is actually a very different company from most other gold exploration companies. I've been in this business of financing exploration and development companies for quite a long time now, with Power One Capital. We've probably been one of Canada's leading mineral exploration financiers, for about 20 years now. Over that time, we have been involved with a lot of different companies; and we've been very fortunate to have been involved, with some very high-profile, international success stories, and we’ve see what it takes to go from exploration to major success. You need a lot of stars to line up, you need to have the right properties, you need to have the right Team, you need to have the right gold environment, you need to have the right access to capital, the right financial partners and most importantly, you need exploration success.

The odds of a company being successful, unfortunately, are very low. But the reality is, when they are successful, the rewards can be extremely large and that's what attracts people to this industry, myself included. What's been great is, over the years, being so involved, with so many different companies, you can get a better feel of how you optimize your probabilities for success. At the end of the day, you're investing your capital, and investors capital, and your job is to do as well as you can to help that capital appreciate in value.

White Gold really checks the boxes of all those different criteria that I've mentioned that are required for success. White Gold, even though it's a relatively new Company, really has the benefit of about 15 years of work by the notorious prospector Shawn Ryan and more than $100M invested in this district of the Yukon, Canada. Shawn Ryan went to this area, known as the Klondike District of the Yukon, almost 20 years ago. This is the area that was made famous 120 years ago, by the famous Klondike gold rush, where prospectors found millions of ounces of gold, sitting right on the surface, right in the creek beds. From that time, the area has continued to be mined for placer gold, right up to today, with the allure for riches continuing to draw interest as featured on TV shows like Gold Rush, highlighting this amazing part of the Earth where you’re finding millions and millions of ounces of gold right on surface.

Today, the records show that there's been about 20 million ounces of gold found on the surface. However, it wasn't until about 20 years ago that anyone really tried to figure out whether, if there's that much gold on the surface, would there be more in the bedrock below it. It wasn't until Shawn Ryan went there and started to test this idea. You’ll likely ask the obvious question, which is, why? Why are no people going there? 20M ounces of gold on surface is almost unheard of. And the answer to that is this area was not glaciated, so there are not a lot of outcrops, ie exposed bedrock. Outcrop is the typical tool that prospectors use to look for gold occurrences. But with no outcrops, your typical North American prospector didn't know how to work in that area, and they didn't bother doing much work. Shawn though, with his thesis that there should be a lot more gold in bedrock, has developed a different prospecting approach, which uses soil geochemistry as the primary indicator. Complimented through finding other trace finder elements, pathfinder elements, which could indicate gold existence, he started to identify the various mineralized systems beneath the surface.

When he identified a mineralized system, he would use more advanced exploration technologies, including a Geo Probe, trenching, drilling, etc. It's a very methodical, data driven approach. Once he nailed down that approach, he had a huge claim block that he had staked, and he started to offer these claims to the different junior exploration companies. What's remarkable is that almost immediately, once these companies started working and started diamond drilling these same blocks, they had incredible success.

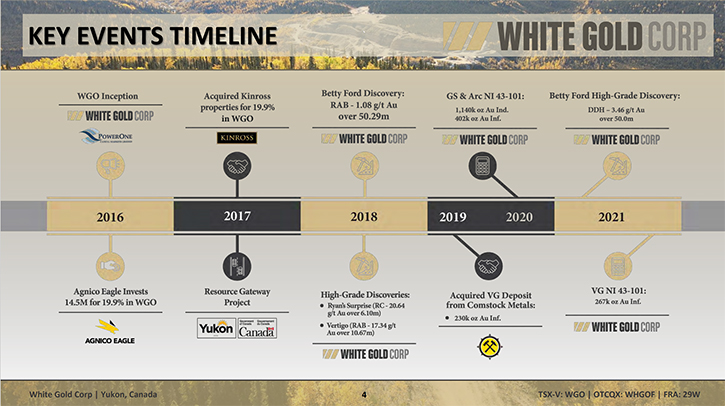

The first Company that he was a partner with, was called Underworld Resources. They made a discovery called the Golden Saddle Deposit. Within one year, Kinross bought them for $140 million. The next company he was working with, called Kaminak Resources, had another property in the district, two years later, they made a discovery called the Coffee Deposit, which was bought by Gold Corp. for $520 million just a few years ago in 2016. The speed of discovery, based on Shawn’s original thesis, is remarkable and almost unheard of in this industry. What happened afterwards was, the balance of the district didn’t really see much exploration because the junior mining market went soft, so there weren’t a lot of people working.

In the following years, Shawn recompiled all these claims, which had all this work done on them and put them into one company, because he really wanted to optimize his ability to benefit from the next round of gold discoveries when they were worked on again. That is when he created White Gold. He came to us, at the Power One Group, to show us what he had. We knew Shawn, we worked with him in the past, he’s a brilliant guy and what we saw was basically he had tied up an entire district, in a prolific region, which had seen very little modern exploration. But the exploration that had already happened has been tremendously successful. That recipe is almost unheard of currently, especially to be able to get that kind of opportunity in a Tier 1 mining jurisdiction.

We immediately partnered with Shawn, and we told him, this opportunity is so rare, so unique, that major mining companies will want to be a part of this from this very early stage. I think this is proof of how unique this opportunity was. When we partnered, we went to speak to a number of the majors, which all had close relationships with Power One through past transactions. They were all very interested. From that group, we chose Agnico to be our partner and they immediately invested, to buy 20% of the Company and become a partner with Shawn Ryan, PowerOne and White Gold, with the vision of exploring this exciting district.

The package that we put together, was effectively what is today about a million acres or 400,000 hectares. Imagine, being able to own that much of a Tier One mining camp, in North America, 100 years ago. We think this is like Timmins, 100 years ago, or the Abitibi, or the Nevada Gold Fields, and to own it all in one Company is almost unheard of. And we were able to accomplish this within White Gold. That was the first thing that really put this Company on the map.

The next thing we did, which I think makes White Gold such an attractive investment, for people interested in investing in the gold sector, is that we spoke to Kinross to acquire their Yukon assets through a very strategic proposal. Kinross owned the Golden Saddle & Arc deposit after acquiring Underworld Resources. The deposit they had bought, which was then a million-ounce deposit, around two and a half grams, was discovered by the White Gold team. We reassembled all the same technical guys who made the discovery, and they all really liked its potential. We proposed to Kinross, “We know this deposit better than anyone in the world. Why don't we merge your assets into our Company, you can get continued exposure to that asset, but now you can gain exposure to the rest of the district, and have it explored, by the guys who know it better than anyone else.” Kinross really liked that idea and rolled their Yukon assets into White Gold and became another of our major shareholders.

Now, fast forward to today. What has been accomplished, in the last five years, makes White Gold a remarkable opportunity. We’ve deployed Shawn’s systematic exploration approach, to not only expand our Golden Saddle & Arc deposit, but to also make additional new discoveries in the district. We now have over 1.8 million ounces of gold resources in Yukon, with tremendous blue-sky potential, on the balance of our portfolio. That’s quite a bit of value to have in a Junior Exploration Company and not something you see very often. The Company really offers the best of both worlds. Value and significant upside potential.

Even more exciting, is we have this incredibly large, underexplored land package that has so much prospectivity! And we're just starting to do some real diamond drilling on it. We've been incredibly successful, in making several new discoveries, in that period, which we think will allow us to define even more gold resources in the area. Our thesis that this is a significant gold camp, that's just starting to have the surface scratched, is being proven to be true.

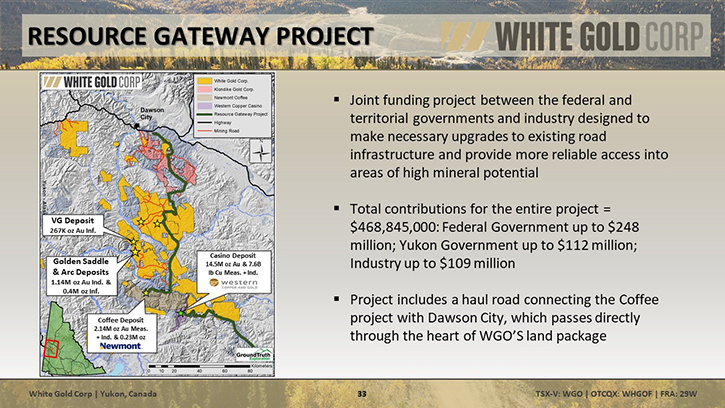

So, to summarize, what makes it so different? It is a huge land package, with two majors, Kinross and Agnico, that are backing us. These guys do their due diligence, they understand the vision here. We've been successful, in growing our deposits to 1.8 million ounces today. That's the real value! We have this incredible blue-sky opportunity, on which we've been successful in making a number of discoveries, about which I can get into more detail, and all the while more macro events have come, to support the development of this area. One is called the Resource Gateway project, which the federal and territorial governments have offered up and funded hundreds of millions of dollars to support mining exploration, in the district. This includes building roadways, which cut right through our portfolio, helping us tremendously.

Any sort of small pit you might find, a few hundred thousand ounces, you can truck to a mill, once the roads are built. You don't necessarily find two million ounces every time. That's huge. We're also continuing to see more major mining companies enter the district, with their investment. Newmont has bought Goldcorp, so they're now the operator of the Coffee Deposit, which is in our district. Rio Tinto, just this past year, has come in and made a significant investment in Western Copper, which is contiguous to our land package. Western Copper’s Casino deposit is a huge 20-million-ounce, copper-gold-porphyry project.

You're seeing the chips starting to come together. Some of the biggest, best mining companies in the world are investing in our district, and we're sitting there, with this incredibly large and prospective land package. I think that from a junior exploration company perspective, it is almost unheard of to have that much success and continued opportunity. For Junior Exploration Companies, the chances of getting to a resource like this one are one in a thousand, probably. We've done it, we've made the investment, it's there with real underlying value, it's growing and there's a tremendous amount of upside and blue sky opportunity. That's what makes this Company so different and makes us so excited about it.

Dr. Allen Alper:

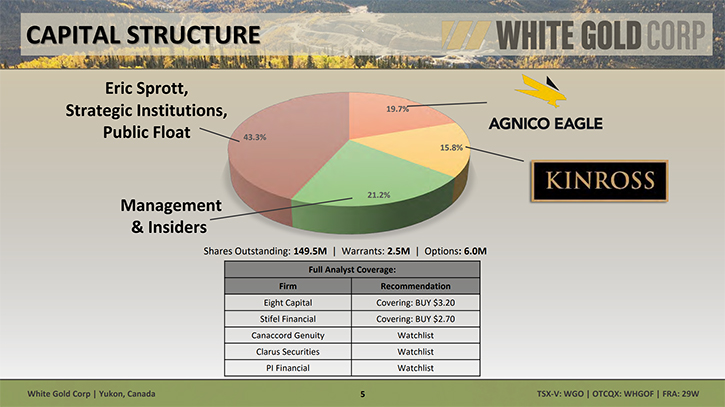

Sounds excellent! It sounds like you have a fantastic district-scale acquisition, and you have many projects going. You have great potential to increase what you've already found, which is significant. So that's excellent! David, could you tell us a little bit about your share and capital structure?

David D’Onofrio:

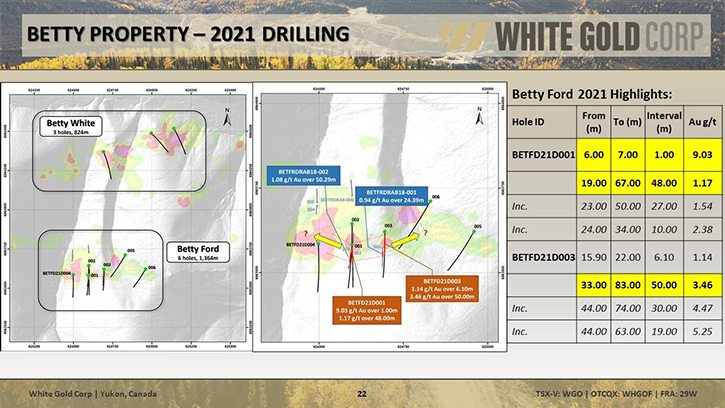

Yes, happy to do that. At some point, we should talk about some of the work we've just completed in 2021. We made a major new discovery drilling, with one of the best drill holes ever in Yukon. Our share structure right now, we have a little under 150 million shares outstanding, of that, Agnico owns 19.9% of the Company. I just mentioned, we made a major gold discovery this year, with our Betty Project, which is contiguous to the Coffee project, owned by Newmont. It's right along the same structural system called the Coffee Creek Fault. We have done a little bit of preparatory work, in the previous few years, and highlighted six targets there. This is contiguous to two major deposits in the district, one being Newmont’s Coffee, the other being this Casino Deposit, that's owned by Western Copper and Gold, where Rio Tinto is a partner. Of those six targets, we were able to diamond drill a couple in this year. This is the first time ever that a diamond drill has been put on the Betty. It's unbelievable that in 2021 no diamond holes had been put into this target yet, but we're fortunate to be that first person.

In our first campaign, we drilled 50 meters, of 3.46 g/t, from very near surface, with a high-grade upper zone as well. When Agnico saw that, they indicated that they wanted to increase their ownership up to 19.9%. This is the vision! This is our dream, why we all got in bed together at the beginning, and now it's coming to reality. They own 19.9%, Kinross is another significant shareholder, they own about 16%. The Power One Group, along with Shawn Ryan and other Management insiders, own about 21% percent and are strongly aligned with the shareholders’ ultimate goal of value appreciation. Some of the best and brightest people, you could ever want in the industry, are part of our share register, which I think should help give investors confidence in our vision here.

Dr. Allen Alper:

That's an impressive group of investors you have, and it's good to see that Management is in line with shareholders and is deeply invested.

David D’Onofrio:

We're real investors. The Power One Group’s background is investing in these things. I personally invested considerable sums of money in White Gold, and have participated in every round of financings done, including this last round that just closed in December of 2021.

Dr. Allen Alper:

Well, that's excellent. David, I wonder if you could highlight and summarize the primary reasons our readers/investors should consider investing in White Gold Corp.?

David D’Onofrio:

We have a very large prospective land package, in a district with prolific history that's seen very little exploration in modern times, The little exploration that has already occurred, has produced incredibly successful results. Many major mining companies are now moving to try and invest in this district. Our Company, itself, has already defined resources of approximately 1.8 million ounces, across all categories and open for further expansion. This is 2+ g/t of open-pitable material. I think assets of that size and tenure are few and far between these days, and the majors are looking to replenish their exploration pipelines as resource bases diminish. It's a very interesting asset for the development stage. This is based on over $100 million of work, done today, so we've already beaten the odds and now it's just a matter of building the value.

In risk reward perspective, there's very little downside. We have analysts that are covering us on their target list. Their average target price per share is over $2.70 Canadian and we only trade at 70 cents or so. But on top of that, and I think people should also really be excited by the several brand-new discoveries made in the last few years that are just open for expansion in all directions. One of them, I mentioned before, was on our Betty property. That's where we drilled the 50 meters of 3.46 g/t Au, from the very near surface. 100 meters away, we also drilled 48 meters, a little bit over 1 g/t Au. We see some continuity in a very robust shallow gold zone, which we'll be following up this year, with further drilling. Early days, but an extremely exciting new discovery!

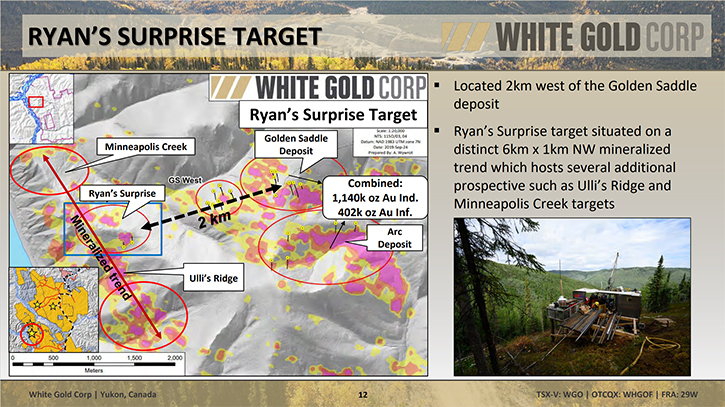

We also made two new discoveries in the last couple of years, within two kilometers of our flagship deposit. This is our Ryan’s Surprise Target and our Ulli’s Ridge target. The goal of that program was to demonstrate the ability to continue to grow our existing resources significantly, through the discovery of new zones of mineralization, in close proximity, as opposed to conducting costly delineation drilling. I think that's the best bang for your buck. We're tremendously successful there as well, having discovered significant mineralization 2km west of our Golden Saddle deposit, on a 6km+ long soil anomaly. Investors can look for more follow-on drilling in the current year. In addition, there are other very exciting, high-profile targets, which we'll be seeing, first ever diamond drill programs in the coming season. And we are fully financed, with Agnico popped up to 19.9%, we're ready to just continue to work in this great district of Canada, which is incredibly supportive of mining, which is very important. Jurisdictional risk is one of the most important factors in evaluating mining projects these days, and we’re fortunate to operate in the Yukon, with supportive government and a rich mining history. It's something that investors need to be mindful of. We really check all the boxes, I think, from what should make an investment opportunity attractive to investors.

Dr. Allen Alper:

Well, those are very compelling reasons for readers/investors to consider investing in White Gold Corp.

https://whitegoldcorp.ca/

David D’Onofrio

Chief Executive Officer

White Gold Corp.

(647) 930-1880

ir@whitegoldcorp.ca

|

|