Kerem Usenmez, President and CEO, Metallum Resources Inc. (TSXV: MZN), Discusses Developing Its World-Class Superior Zinc and Copper Project, Ontario, Canada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/31/2022

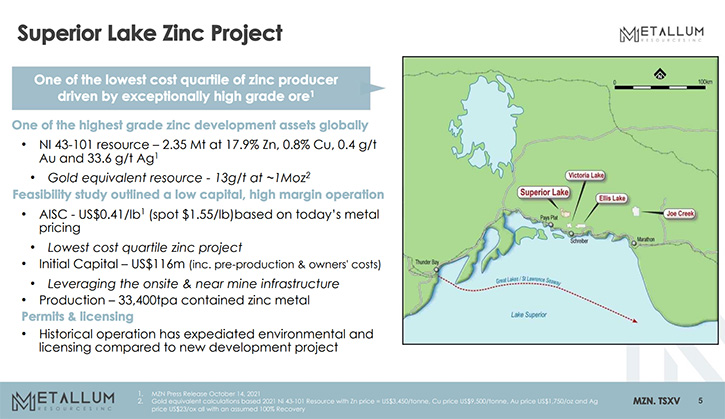

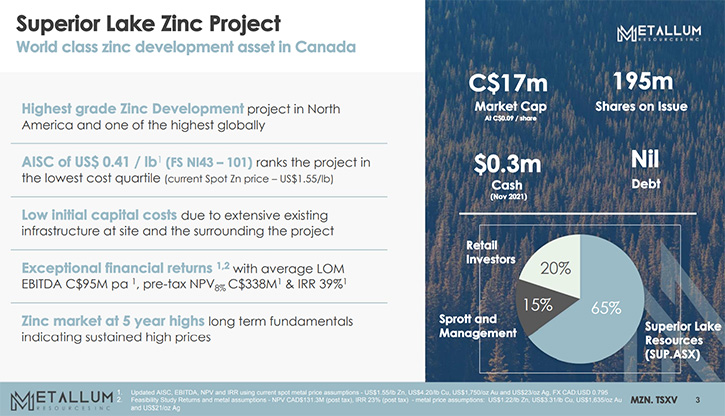

We spoke with Kerem Usenmez, President and CEO of Metallum Resources Inc. (TSXV: MZN), a zinc and copper focused resource company, developing its flagship world-class Superior Zinc and Copper Project, located in Ontario, Canada. Superior is the highest-grade, zinc development project in North America and one of the highest globally, as well as one of the lowest cost quartiles, of zinc producers. The project has a NI 43-101 resource of 2.35 Mt at 17.9% Zn, 0.8% Cu, 0.4 g/t Au and 33.6 g/t Ag. The feasibility study outlined a low capital, high margin operation, producing 33,400 tpa of highly desirable, clean concentrate, with global export potential.

Metallum Resources Inc.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Kerem Usenmez, who is the President and CEO of Metallum Resources, Inc. Kerem, could you tell us about your projects, your Company and what differentiates your Company from others? I know that it's a very great zinc prospector and you have great resources.

Kerem Usenmez:

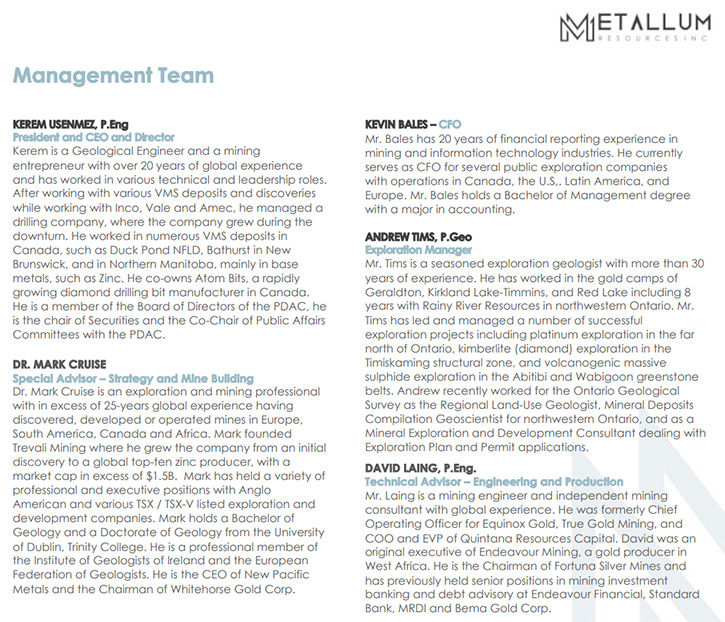

Let me give you a background on myself. My name is Kerem Usenmez. I'm the current President and CEO of Metallum. I'm a Geological Engineer, with more than 20 years of experience in the sector, in all stages of exploration and mine development, as well as production. We have a highly experienced Board and a Team that can build the mine, grow it and bring tangible shareholder value. We've done it before, we know how to do it, and we are working hard to get that done again.

Our flagship project is Superior Lake zinc and copper project. It has one of the highest-grade zinc developments in Canada. It has a lot of infrastructure being close to high grade, and a fantastic location in Ontario. That gives us a lot of advantage of not having huge capital costs and having a short timeline to production. It is a past producing mine, which was closed at the end of the 90's after 10 years of production, due to very low zinc prices at the time. Now that the zinc prices are high, we are looking at reopening the mine.

We acquired this asset earlier this year, when we started trading, from Superior Lake Resources, which is an Australian company. They wanted a Canadian Team to build this mine, and with COVID it was getting even more difficult for them to run from Australia. We made the deal in 2020, and we closed the deal in April 2021 and started trading, then they became our biggest shareholders. Our shares are tightly held about 80% percent is institutional and insiders, retail represents about 20%.

They have published a feasibility study, on their Australian standards, which we weren't able to refer to until recently. We just started marketing, since we published our 43-101 feasibility study in October. The feasibility study outlines and confirms the robust economics, with how attractive this project is. In fact, it is one of the lowest cost quartile zinc producers, driven by basically exceptionally high-grade ore. It is the highest-grade zinc development project out there right now. The remaining ore is at 2.35 million tons at 18% Zinc, 1% copper, some precious metals like 34 grams per ton Silver and .4 to .5 grams per ton gold. When you convert that into gold equivalent resource, it correlates to 13 grams per ton at one million ounces, so it's super high-grade any way you look at it.

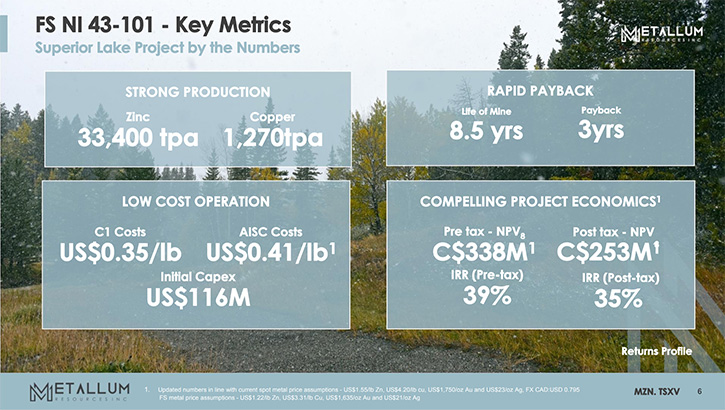

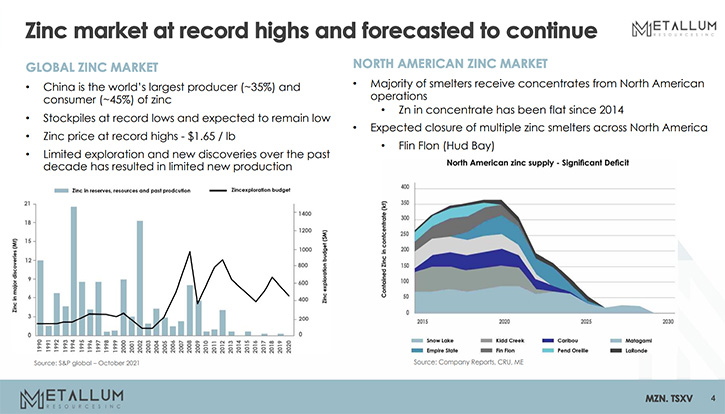

The cost to run the mine after tax, all sustaining costs is at 41 cents per pound. With today's zinc prices at 1.6, that's like four times. It will generate $95 million EBITDA per year, over the course of the mine life. So pre-tax NPV is $340 million with IRR at 39%. With today's numbers after taxes, $250 million Canadian and 35% IRR. The global zinc inventories are at critical lows and expected to remain low for another 3-5 years. The power shortage in Europe in the fall this year forced three European smelters to close in October. Demand is growing, especially with $1.3 trillion infrastructure bill signed in the US last week.

That is going to be the main driver, U.S. as well as in Canada, zinc is one of the critical minerals, as well as copper, and we have both in high-grade in our project. On the other hand, when you look at our Company's market cap, we have the lowest market cap to NPV, roughly around 5% of the project NPV, the global standard is around 20 to 50. We are undervalued by about minimal four times up to 10 times, based on the industry standard.

The reason for that is partly we are new, we just acquired this asset and just started doing the marketing, we weren't able to do so before. We are very well positioned to provide high-quality zinc concentrate, for the years to come. It's really great timing for us. We evaluated all of the zinc projects that have more than 5% zinc in the world. Out of 117, most of them are in high-risk jurisdictions, so we eliminated those. You get 31 assets globally, that have zinc equivalent grade over 10% in good jurisdictions and then you look at zinc grade alone, 7%, you get 19 and then you look at the zinc resource over 400,000 you only get five assets in the world that fit the criteria.

But out of five, four of them are multibillion dollar companies. Metallum is the only one with a $12 million U.S. of market cap. It's by far the lowest market cap compared to the asset we have, so it should only go up from here, really. That's the opportunity, I think, for investors, but it has the highest grade. What was CapEx, possibly the highest return on investment given the market cap.

Dr. Allen Alper:

That sounds excellent!

Kerem Usenmez:

Do you want me to give you a little bit of history and what was produced and what we are looking at producing?

Dr. Allen Alper:

Yes, that would be great.

Kerem Usenmez:

When they mined in the 90s, the grade was actually so high that they had to dilute the ore in order to process it. I learned that from a local person that worked in the processing plant at the time. In the 90s, over nine, ten years mine life, they basically mined over 900 million pounds of zinc, 54 million pounds of copper, one million ounces of silver and 51,000 ounces of gold. All of this means they've mined $1.8 billion US worth of metals and most of it coming from zinc, about $1.4 billion.

Let's talk about the definitive feasibility numbers a little bit. With the current resource over two million tons, we're planning for a 1,000 tons per day production, which will provide us with 33,400 tons per year of zinc, roughly 75 million pounds of zinc every year. What's interesting is that the cost to produce is one of the lowest in North America. We're looking at cash costs of 35 cents per pound U.S., so that basically makes the return on the project so highly attractive. With zinc being at around, let's say, 1.55 today per pound after tax NPV at 8% discount will be at $253 million Canadian and IRR is at 35% post-tax. The initial CapEx is very low, it's $115 U.S. despite the fact that this assumes all the equipment bought brand new.

43-101 dictates that you assume to buy everything brand new. Even though the Capex outlined in the Feasibility Study is quite low, we aim to spend even lower than what is projected, because we plan on leasing and buying used equipment wherever possible. However, when you compare it to the asset, it's very low because of the infrastructure being in place. There's a tailings dam, polishing pond, active water treatment plant, there's a 25-kilometer access road well-maintained year-round from the main TransCanada Highway to the mine gate. There's power, also the project is on grid, with the transmission lines and the transformer on site. There are shafts, various ventilation shafts, as well as the main shaft, 16-kilometer underground workings, right to the ore and so forth. Very compelling project metrics.

It's near Schreiber, Ontario, where there's a railway station where they used to ship the ore to Thunder Bay. Thunder Bay has a port 150 kilometers away, and Schreiber's 25 kilometers from the Mine Gate. We can also truck it, because the highway goes to Thunder Bay. That will give us access from Thunder Bay port to the European smelters, the railway station and the highway will give us access to smelters across Canada as well as in Tennessee. So there's one in Valley Field in Montreal as well as in. B.C., but also from Vancouver, we can ship it to China. So, we are not limited to one or two customers, but we will have a variety to choose from. Easy access, the concentrate is clean, free from deleterious materials, has very high recoveries. In fact, metal traders, mine developers and financiers are currently interested in helping us out and develop it. So, we leverage these advantages, which will provide us small capital investment and really short timeframe to production.

Dr. Allen Alper:

Well, that sounds excellent, that's a great position to be in. Could you tell our readers/investors a little bit about uses of zinc?

Kerem Usenmez:

Traditionally, zinc has been mainly used for galvanizing and strengthening the metal. The main use of that is the iron and steel that predominantly goes into bridges, all kinds of dams, all kinds of infrastructure, buildings. Automotive and infrastructure almost go hand in hand on that. Traditionally, 50% to 60% was going there. On the other hand, energy storage. Energy storage, nutrition, zinc is the main ingredient for sunscreens. The health stuff is about 10% and various other things. For example, I take zinc tablets when I'm traveling to boost my immune system.

So to stimulate the economy, countries globally are introducing stimulus packages that involve infrastructure and support automotive, which means Zinc. But what's interesting is what's happening currently with the energy green economy. Zinc air batteries are getting more traction. Not only that, but zinc ion batteries. In fact, Edison used that one first to develop the batteries. But zinc air batteries are getting more and more common in the United States alone, in Buffalo, Colorado, California. They're doing pilots right now because it is superior to store energy in a cheap matter. They're working on zinc air batteries and they are mostly being used for hearing aids because they're light, they're super safe, they don't combust. You can transport them without any licenses because they're safe to transport, nontoxic, they don't explode like others. It's becoming more popular and it's very cheap compared to others. That is getting traction, I think that's the future. But with all the stimulus packages that the governments are doing or introducing the infrastructure, that means zinc as well as copper. We have it in very safe jurisdiction, close to production, clean and one of the highest grades, so the return is amazing.

Dr. Allen Alper:

Yeah, that's excellent. I know you have a very impressive Board. Could you say a few words about that?

Kerem Usenmez:

We assembled a really good Team and Board. Our Chairman, Simon Ridgway, has discovered a lot of deposits around the world and built mines. He was the founder of Fortuna Silver Mines. He's brought in billions of dollars from nothing, he's been very successful. He's also the founder of our Company. He did this deal and he's been super supportive. We have some VMS geologists, on our Board, that know the quality, know how to guide me and our Team to find more. There's a lot of upside potential on this.

On the other side, we have a very good geologist in-house that's local from the community. He knows this area very well and VMS deposits. But also, I have Mark Cruise as our Strategic Advisor, who built Trevali Mining, a zinc company from nothing to a market cap of $1.5 billion and one of the top 10 zinc producers in the world with four mines. So he found, he developed discoveries and mine development.

We also have David Laing, who built mining companies and built mines in Canada, as well as around the world. We have a very good VMS Advisor as well, Jim Pickell. We know the quality, we know what to do and next will be building the mine, with a good Team.

Dr. Allen Alper:

Oh, that sounds great! Could you summarize and highlight the primary reasons our readers/investors should consider investing in Metallum Resources, Inc.?

Kerem Usenmez:

This deposit is in a very good, low risk location, with easy access to ports, railways and highways, located in Ontario, 20 kilometers well maintained year around. The infrastructure is there, the location is amazing. The concentrate is very clean, free from deleterious materials, high recoveries. Just to recap, it's one of the highest-grade zinc projects, in the world and most advanced in North America. It is highly desirable from traders and smelters’ point of view and with exploration off site, to increase the mine life, with two to three years, is very, very high. Most importantly, the valuation discount is one of the best currently. Given that zinc prices are going up, the demand is increasing. It is the time to invest in zinc companies like ours.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors to consider investing in Metallum Resources, Inc. Kerem, is there anything else you’d like to add?

Kerem Usenmez:

The one other thing I want to add is the social and ESG side of things, our social impact. The local communities and the First Nations are very supportive and we have a fantastic relationship with them. Not only will we benefit from the highly skilled workforce, with a history of mining, we will have the support of First Nations and local communities because we are doing, and we will be doing everything environmentally friendly. We benefit from Ontario's electricity coming 96% to 97% from non-carbon emitting resources. But we'll also be looking at other ways, like solar and electric fleet. I wanted to point out that our relationship is very good with the local communities, including First Nations, and they're very supportive.

Dr. Allen Alper:

Well, that's excellent, that's a great position to be in. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.metallumzinc.com/

Kerem Usenmez, President & CEO

Tel: 604-688-5288; Fax: 604-682-1514

Email: info@metallumzinc.com

|

|