John M. Darch, Chairman, and Ken MacLeod, President and CEO of Sonoro Gold Corp. Discuss Plans to Develop a 15,000 Ton Per Day, Heap Leach Mining Operation in Mining-Friendly Jurisdiction of Sonora, Mexico.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/23/2022

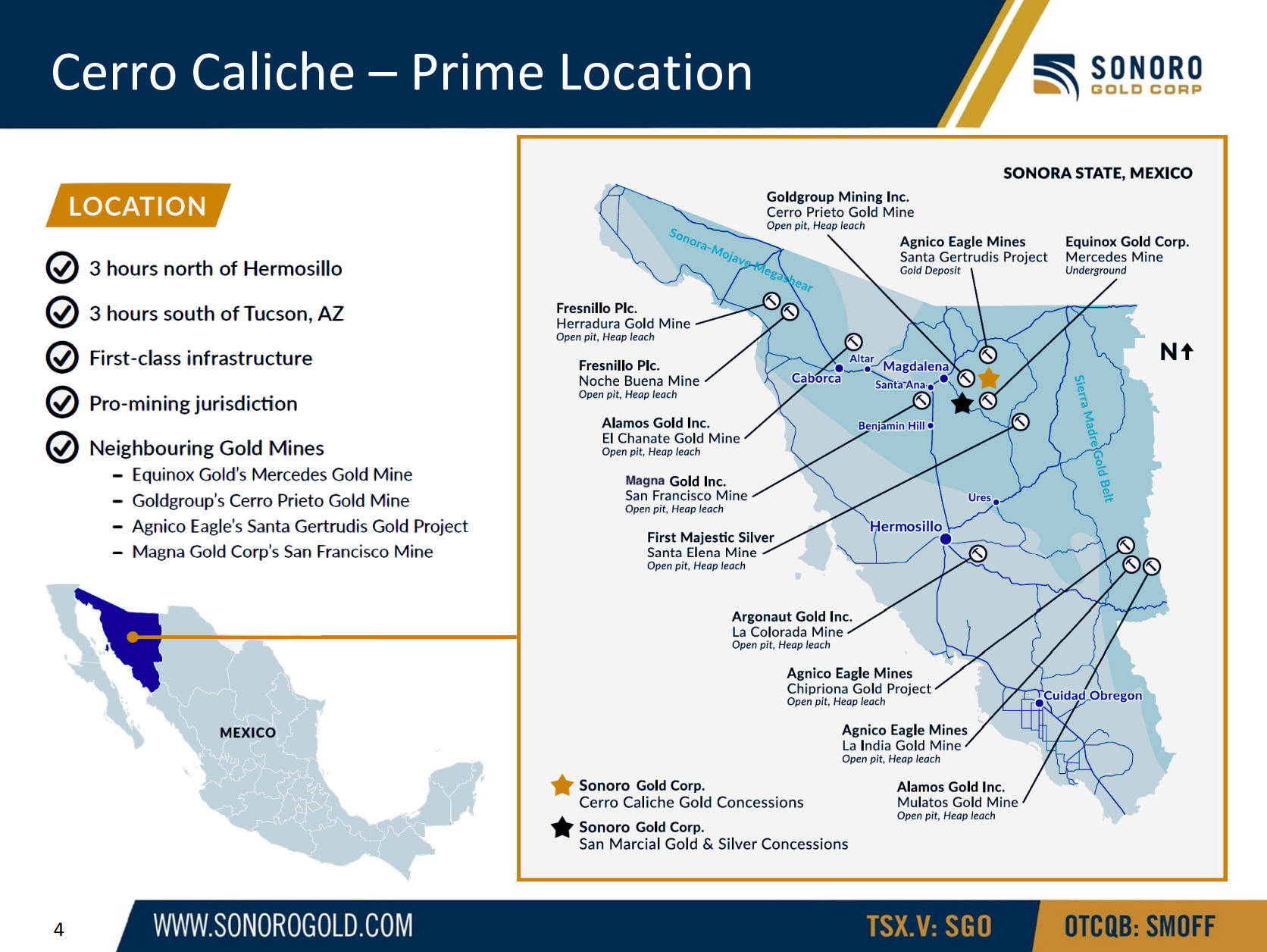

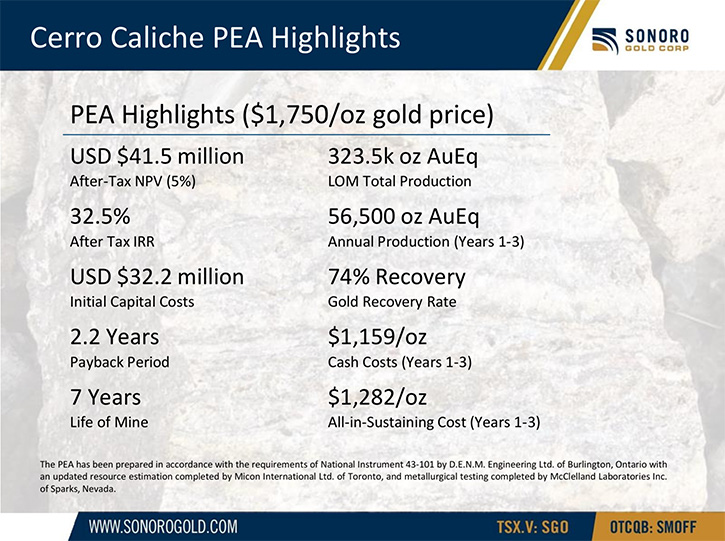

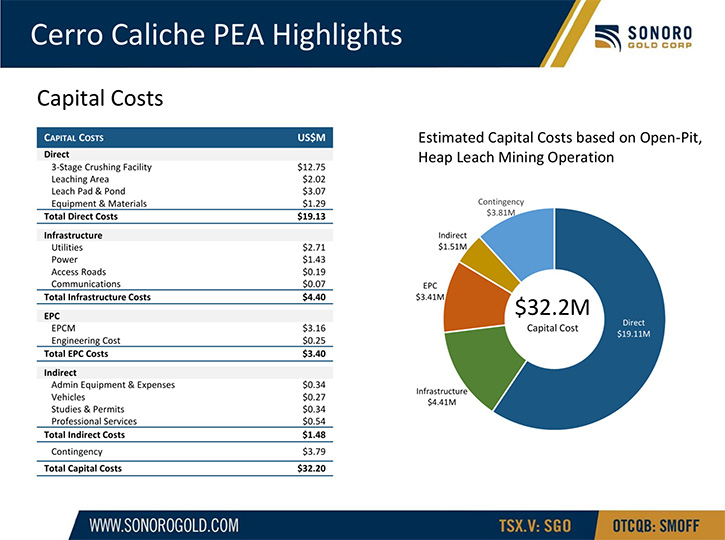

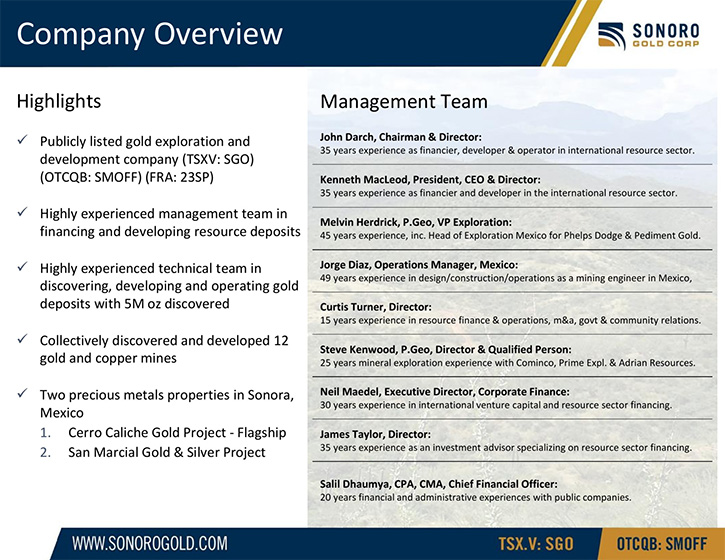

We spoke with John M. Darch, Chairman and Director, and Ken MacLeod, President & CEO and Director of Sonoro Gold Corp. (TSXV: SGO, OTCQB: SMOFF, FRA: 23SP), formerly Sonoro Metals Corp. (TSXV: SMO), a junior gold exploration, development and, soon to be, gold producer in the mining-friendly jurisdiction of Sonora, Mexico. Last October 29, 2021, the Company filed with the Canadian regulatory authorities (SEDAR) a preliminary economic assessment for their planned heap leach mining operation at its flagship property, the Cerro Caliche gold project. The study was completed by D.E.N.M. Engineering Ltd. of Burlington, Ontario and it indicated very robust economics for a 15,000 ton per day, heap leach mining operation (HLMO), further confirming the Company's plan to begin producing gold in the next year and subsequently utilize the generated cash flow to fund further exploration and development. Sonoro's Management collectively has a muti-decade track record of discovering, managing and financing the development of major gold or copper deposits. The Company has just completed a $3 million private placement, in which the insiders took down almost 20%, Mr. Darch and Mr. MacLeod each contributing $100,000 to the financing.

Sonoro Gold Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-chief of Metals News, talking with John M. Darch, Chairman and Director, and Ken MacLeod, President & CEO, and Director of Sonoro Gold Corp. Since we spoke last September, John, maybe you could highlight what has been taking place that's most interesting, and Ken could also discuss this.

John Darch: Certainly, Al. It is a pleasure for Ken and me to speak with you again. I think the most interesting corporate milestones were the filing of our PEA with the Authorities, our recent financing and the commencement of a 10,000-meter drilling program, which Ken will discuss. We completed our $3 million private placement on the 21st of December, which we were very pleased to achieve, considering the time of year.

Company insiders took down almost 20% of that financing, with Ken and me each investing an additional $100,000 in Sonoro. In addition, our senior geologist, Mel Herdrick, and our mining engineer, Jorge Diaz, each contributed almost $150,000 to the private placement. Obviously, the Company is very excited about completing the financing. Not only does it give us the ability to move forward, it also demonstrates a lot of confidence that the senior people and insiders have in the Company, that they were prepared to contribute to the financing to the extent that each did. It's worth mentioning that we've always contributed to each of the financings over the last three years.

Dr. Allen Alper: That sounds excellent. It's great to see that top Management has confidence in the Company and is willing to have skin in the game.

Kenneth MacLeod: Yes, and the PEA, as announced last September, is basically the foundation.

John Darch: We had really good participation from our shareholders, in Europe, Canada and the USA, especially the mining specialists, who came to the table very quickly. I think our path to becoming a gold producer is really becoming quite evident. Sonoro has made a complete transition from being an exploration opportunity two years ago, to having advanced to the engineering of our conceptual 15,000 ton per day heap leach operation. Our Team has really done a lot of excellent work and I was thrilled to see this confirmed, when the project's economics were independently assessed, by D.E.N.M. Engineering, i n the PEA we filed, with the regulators last October.

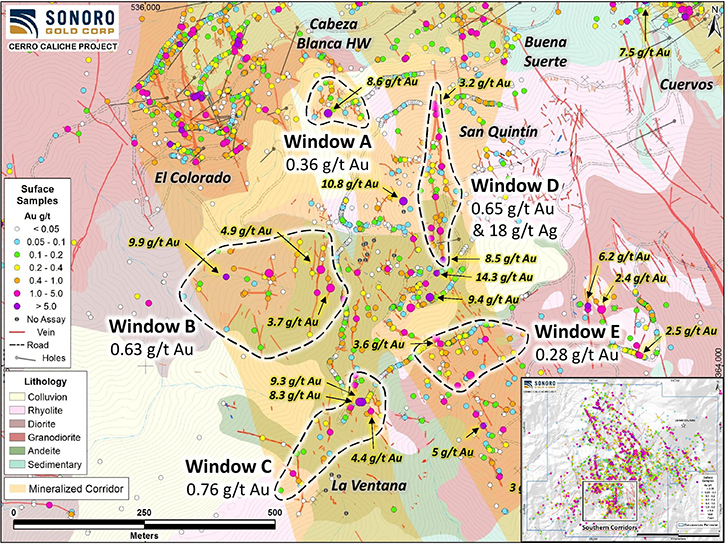

Yes, I think, as Management, we were very happy to increase our stake in the Company and really excited to see some new areas drilled, which were outlined in last summer's field campaign. The new areas or windows were extensions of the areas we plan to mine. They have multiple veins, with higher grade gold out-crops, so we are excited to start drilling. We have so much left to do, as we have only tested about a third of the known zones of near surface gold mineralization and our field work keeps extending them.

The objective of the drilling is to increase the size of the resource materially, within the expanded mineralized zones. If we can expand the size, even if the grade stays the same, not only would we lengthen the mine life and increase the value, but the capital costs would also be paid for over a longer period, so the economics would improve, in this way too. I think there is a good chance to increase the gold grade, based on these new areas. All combined, there are multiple ways we can see building shareholder value.

SCR-280 Rig

Dr. Allen Alper: That sounds excellent! Let's see now, insiders and management buying, new higher-grade gold zones outlined and a really positive independent review of the project's economics. Sonoro's stars seem to be aligning.

Dr. Allen Alper: Ken, could you talk about the PEA and give us some more details regarding the ..current drilling?

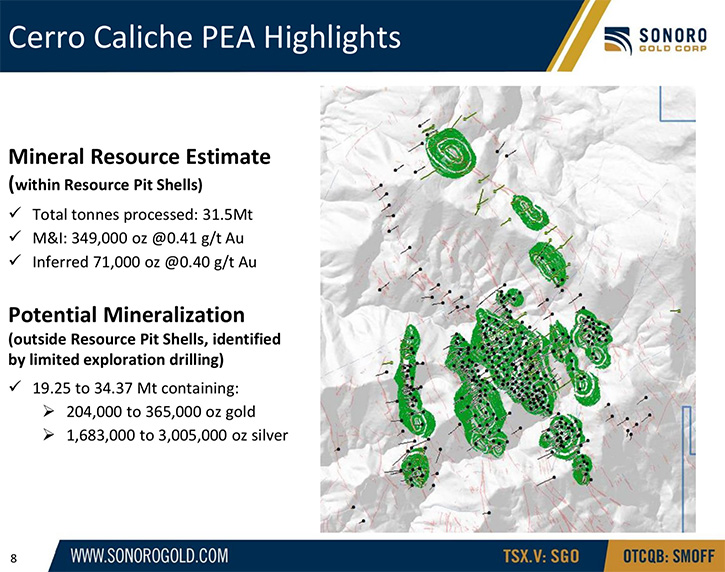

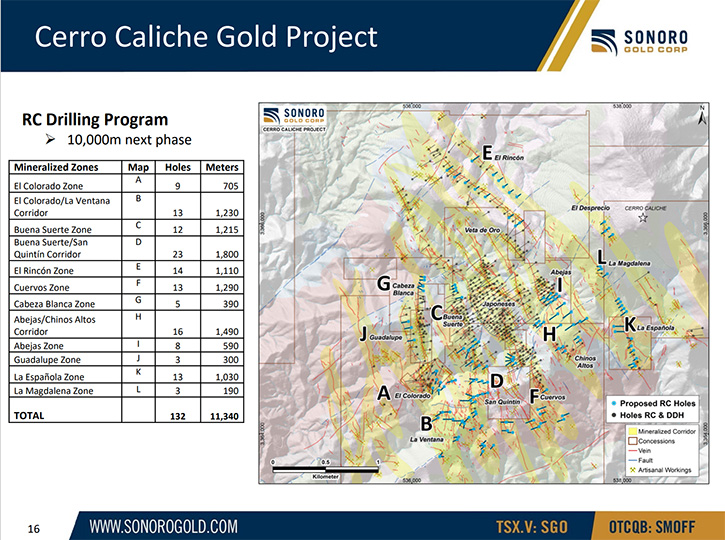

Kenneth MacLeod: Following our conversation, with you in September, Al, about the Preliminary Economic Assessment, which was a very, very successful episode, in the development of Sonoro. We have now been focusing more on building up the resource, even more than what was reflected in the PEA, plus working towards increasing the average grade. There were some very good holes that were not included in the resource, so we will drill around them to increase the drilling density, with the intention of expanding the resource. Then we have the new extensions to test. The 10,000-meter drilling program, we initiated in December, is focused on essentially giving us answers to these two major questions. How far can we go, with the expansion of the resource? Having only drilled 30% of the projected resource, identified to date at Cerro Caliche, we're still identifying new structures, as we drill, and samples, as we cut roads through overburden. It’s really an extensively mineralized area.

We believe, very strongly, that the potential increase in the size of the resource, over the next couple of years, will be very, very substantial.

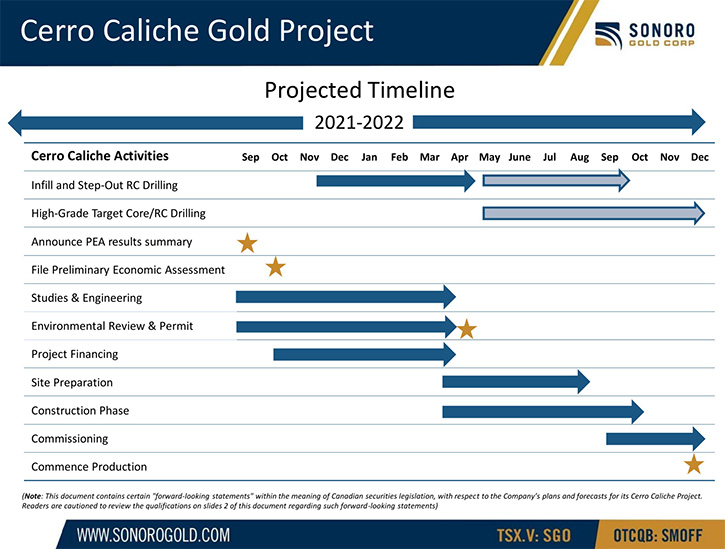

That's going to make the economics of the project even better than what we had shown in the PEA, which was quite substantial by itself, with a pre-tax, internal rate return up over 50%. Going forward, we also want to drill into areas, where we believe we will encounter higher grades. That will, of course, make the efficiency of the resource much, much greater as well; if we're developing higher grades, we should get a better return on the investment. Over the next four months or so, to the end of April, we will continue with the drilling program.

At the end of April, we will tally up what the new resource will be, at that time. We may commission another independent resource estimate. Based on the lower risk infill drilling we are doing and the new higher grade gold windows to be tested, we're very confident that it will be a meaningful increase in the size of the resource. Hopefully the average grade will increase as well, commensurate with the increase in the size of the resource. Therefore, those are the basics for our 10,000-meter drill program right now. I expect that between now and April, additional key steps will be completed, which will bring us closer to actual production. John can describe a little of that in greater detail.

Dr. Allen Alper: John, what is next? Can you give some guidance on how you are planning to finance the mine?

John Darch: Yes, Al. As we move forward, we are advancing discussions, with potential project financing groups, for project debt, as our principal objective is to advance to production as soon as possible. The more information that we're able to provide to the potential lenders, in terms of expanding the size of the resource and the grade which would extend the mine life beyond the seven years, as shown in the PEA, the more Sonoro becomes attractive to the lenders. Everything's moving ahead. We're very pleased, with what we have achieved and are very positive as we begin this new year.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit more about the timeline going into production? What are the big potential share price catalysts?

Kenneth MacLeod: Oh, absolutely! We have prepared all the documentation to secure the environmental permit, required for construction of the heap leach mining operation, and getting that permit could be a big catalyst. I know when Minera Alamos got the same permit in the summer of 2019, for its Santana project, its shares really came to life, so hopefully securing the permit will have the same effect for Sonoro Gold. We should be ready to file by the end of January. That will be the trigger point, at which time the clock starts to move forward towards building the mine, hopefully, by the middle of this year. Our goal is to start loading the leach pad towards the latter part of 2022. Thus, financing and then starting construction are two more big potential share price catalysts or additional milestones that we're all working towards right now. Revenues, or payable gold from the leach, will begin about three months following initial production, because it takes about 90 days from when the solution is dripped onto the leach pile for it to dissolve and recover the 74% of the gold contained in the mineralization. Therefore, I would say the first quarter of 2023 is when we expect to start generating revenues.

Sampling August 2021 Report

2021-2022 Program

Surface Sampling & Mapping

• Confirmed 750m zone extensions• Revealed mineralized “windows” along 2 structural corridors• Near surface, high-grade targets• 5 high-priority window targets- El Colorado - La Ventana

- 3 gold mineralized windows

- Buena Suerte - San Quintin

- 2 gold mineralized windows

Dr. Allen Alper: That sounds excellent. Could you update our readers/investors on your current capital structure?

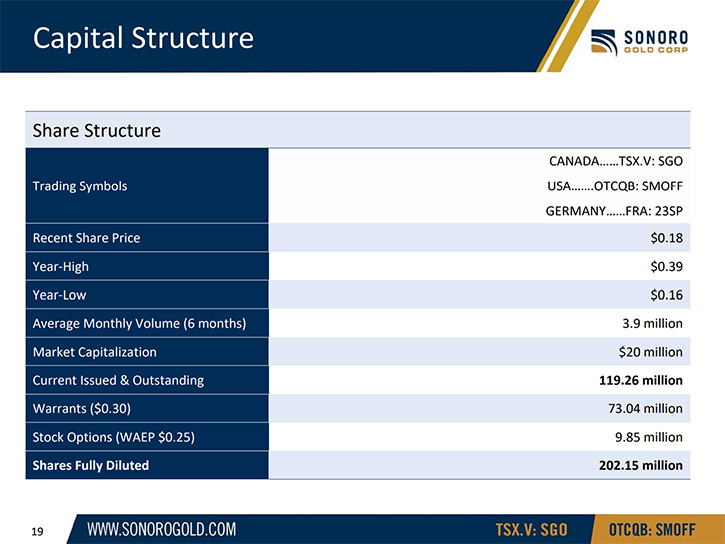

Kenneth MacLeod: By all means. There are approximately 120 million shares issued and outstanding, of which Management, as John mentioned, controls over 20%. Everybody involved at the managerial level of Sonoro has a vested interest in the Company, all the way from the senior management, through the middle management and through to the geologists in the field. Hence, we are all committed to making this project successful and all share the same vision. We have a unified voice when it comes to developing this project, where we're all very, very excited to be taking it through now to the next logical level, which is going towards production. Every effort is being made to ensure that we continue to advance the project according to our internal schedule and the key hurdles or catalysts, I mentioned, with a mine commissioning date targeted for the end of the year.

Dr. Allen Alper: That sounds great. I know you have a great Team, with a great background and a successful track record. I wonder if both of you could say a little bit about yourselves and your Team.

John Darch: Well, certainly Al. As you know, I'm the Chairman of Sonoro Gold and my background has always been in finance, in the banking world, in the UK and in Canada. I began in the public markets in the mid-80’s. During that time and through to 2006, I co-founded the Crew Group of Companies. Through Asia Pacific Resources, we made one of the world's richest potash discoveries in Thailand. Through Crew Development (later Crew Gold) we acquired control of South African’s Metorex, which had half a dozen mining operations. Through Crew we acquired and privatized Zambia’s Chibuluma copper mine and developed Greenland's first gold mine. Following a geothermal venture with Ken from 2002 to 2006 (Western GeoPower) in 2007 I took a break, a sabbatical, as you may say, to pursue a private non-mining interest. In late 2018 I returned to mining, teaming up with Ken again in Sonoro Gold. Fundamentally, my background is finance, corporate structure, strategy and importantly execution.

Kenneth MacLeod: My own background, Al, has been geared mainly towards the technical side.

I started off as a mechanical engineer, but then became involved in the corporate finance side of developing projects, whether it be in an oil and gas sector in the mining sector or renewable energy in the form of geothermal energy. Over the years, we've been involved in successful projects, where we're taking them through the feasibility study phase and then towards the production phase. Thus, this project is a culmination of about 35 to 40 years of experience, in the resource sector, and I believe that this is probably one of the finest projects that I've certainly been involved with and am looking forward to the next 12 months of milestones being achieved. I would suggest that we've done everything right over the past three years. Despite the pandemic, we've been very, very successful in raising capital for the drilling program and for the development of the project itself. It's a matter, right now, of going through another 12 months of development and we should start reaping the rewards.

Dr. Allen Alper: Sounds great! What are your plans to get more funding, to complete the development of the project, to go into production?

John Darch: The plans we have, Al, are to continue to reach out and develop the conversations we've had with potential lenders, who understand the nature of our business, understand the location, and have responded quite positively. In this way, as we move forward and put the project financing together, we'll be in a better position to define the structure. Currently it's a little premature to say more and therefore it's best to leave it that we are advancing discussions. The people, with whom we are speaking, are very experienced and have a great understanding of heap leach operations in Mexico.

Dr. Allen Alper: That sounds excellent! Both of you have great financial experience and a background and knowledge of the area. So, I'm sure you'll be able to do that very successfully.

John Darch: Well, thank you, Al. I think there's one thing more to say, which is very important. We, on Sonoro’s Management Team have a wealth of expertise. Each one of us has at least 30 to 35 years’ experience in our various disciplines, whether it's

geology, mining engineering, marketing, financing, and we've come together for just this one Company. For example, our Head of exploration, Mel Herdrick, is practically a legend in northern Mexico; he's made a half dozen copper and gold discoveries, over the past four decades and Jorge Diaz, our mining engineer, began his career during Glamis Gold's formational period, doing test leaches and operations for them. The last mine, of which he led the development, was Alamos Gold's Mulatos. Alamos was a 30-cent stock, when he first re-engineered the deposit's development. It’s a big success and look at Alamos now. Jorge is a believer in our project, as I mentioned earlier, he and Mel just took down another $150,000 each of the financing. Therefore, we are a Team of committed mine development experts and it is clearly a commercial operation. We work on a very professional level and are very delighted, with our shareholder base, which is now developing and obviously supporting us, as we move forward, with not just the additional drilling, but also with the goal to move to production. in the very near future.

Dr. Allen Alper: That sounds excellent! John and Ken, could you both highlight the primary reasons our readers/investors should consider investing in Sonoro Gold Corp.?

Sampling control, SCR-270

Kenneth MacLeod: I believe that the most compelling reason for your readers/investors to look at Sonoro and invest is that we are on the threshold of moving the Company, from an exploration phase, into the development phase. Traditionally, I would suggest that this is when an increase, in market capitalization, could be significant. So, I would say that over the next 12 months, the market should start to reflect the value of the underlying asset, which will be in production at that time. Then the market dynamics will determine the share price, obviously because instead of the higher risk exploration phase, where companies traditionally suffer a bit of a higher risk profile, in the marketplace, we will become a much more reliable source of revenue, which will then create a much more stable market for us. As traditionally mining companies traded multiples of their earnings, if Sonoro were able to generate a net 20 to 30 million of cash flow per annum, you would see the trading price of the shares reflecting an evaluation substantially above that cashflow value.

Dr. Allen Alper: That sounds like an excellent opportunity for your shareholders.

John Darch: I'd like to expand on what I mentioned earlier, which is that we truly do have the five essential components of being a success, as a mining company, and that's very important from an investor's point of view. It starts off with the people, their experience, their commitment to the Company, their ability. Then, of course, it's the property which we have spoken about. Next of course, is the share structure and the insider's ownership, i.e. the level of the insider's commitment. Further, very importantly, we have a defined business plan and strategy and that business plan, which was to move to production as soon as possible, was there from the very beginning. Over the last two years, we've seen that transition successfully completed.

The last of all the five central components, of course, is the ability to raise funding and I think that we've been able to demonstrate that despite COVID, we've been very successful. From August 2020, until now, despite COVID and all the sentiments, in the gold sector, we've been able to raise $14 million and I think that's just a reflection of what the investors see in our Company, that we have all that it takes to become successful.

Dr. Allen Alper: Well, that's excellent. It shows that the marketplace has confidence in your Company and they're willing to back you and that also, as you pointed out before, the Management, from the top through the Company, also is putting their own money into the project and they have great confidence in what you're doing. Is there anything else you'd like to add?

Kenneth MacLeod: From my perspective, I think we've said it all. John, do you have anything else to add?

John Darch: No, just thank you, Al, for giving us your time and the opportunity to present Sonoro. We're obviously delighted that we were able to complete this financing at the tail end of the year. We are pleased that the drilling program continues and, as always, it's been on time and within budget. Finally, we are looking forward to announcing the results, the initial results, of the drilling program towards the end of January.

Dr. Allen Alper: Well, that's excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

hdps://sonorogold.com/

Kenneth MacLeod President & CEO Tel: (604) 632-1764

info@sonorogold.com

|

|