Filip Kozlowski, CEO, Leading-Edge Materials Corp. (TSXV: LEM, Nasdaq First North: LEMSE, OTCQB: LEMIF) Discusses Woxna Graphite Anode and Norra Karr HREE Projects

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 1/11/2022

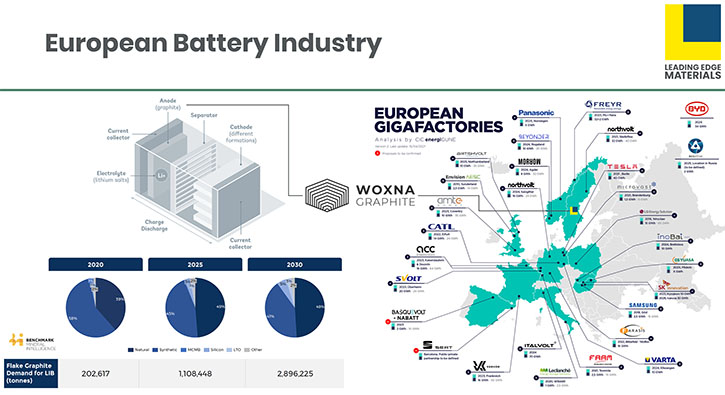

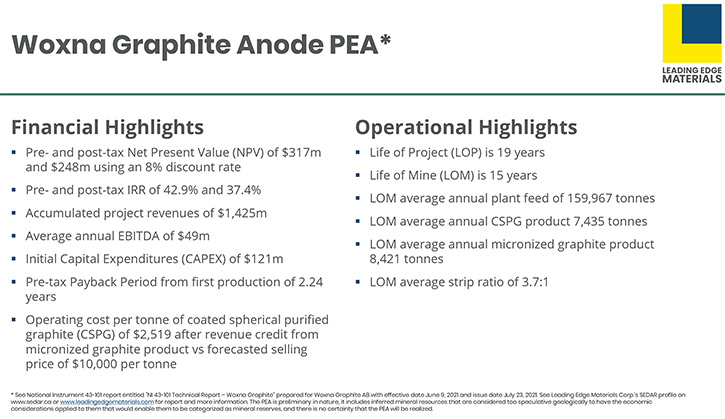

We spoke with Filip Kozlowski, who is CEO of Leading-Edge Materials Corp. (TSXV: LEM, Nasdaq First North: LEMSE, OTCQB: LEMIF, FRA: 7FL) - a Canadian public Company, focused on developing a portfolio of critical raw material projects, located in the European Union. The Company's two main projects are located in Sweden. The Woxna Graphite Mine, which is transitioning into a graphite anode project, and the Norra Karr REE Project, which is one of the world's most significant heavy rare earth deposits and the only one of its kind in Europe. Leading Edge Materials has recently announced the filing of Preliminary Economic Assessment Reports for both projects, showing very robust financial numbers. The proposed JV plan with Sicona, Australia, is targeting the production of advanced natural graphite and silicon-graphite-carbon composite active anode materials using natural graphite from the Woxna Graphite mine as feedstock to offer the European lithium-ion battery manufacturing industry a secure and sustainable supply of high-performance anode materials.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Filip Kozlowski, who is CEO of Leading Edge Materials. Filip, could you give our readers/ investors an overview of your Company? I know you’re positioned to supply critical elements to the European Union and the growing need for materials for EVs, energy storage and wind power, etc. I also know that recently you've had some very robust preliminary economic assessments, on your two key projects. Could you give us an overview of your Company and what differentiates it from others?

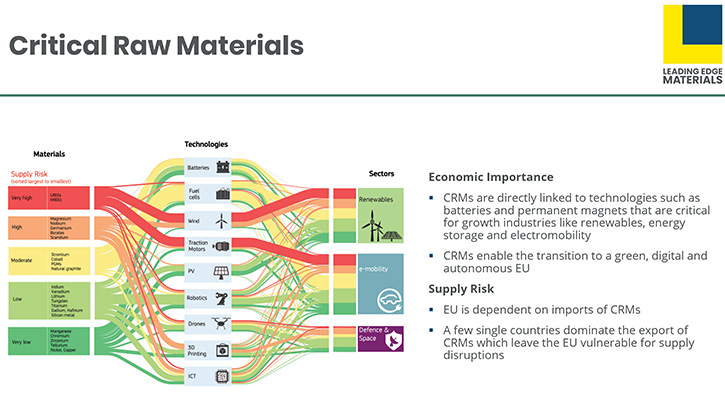

Filip Kozlowski:Leading Edge Materials is a Canadian public Company. We're focused on developing a portfolio of critical raw material projects, within the borders of the European Union. The European definition of what defines the critical raw material, is the economic importance and the potential suppliers of those materials. The economic importance mostly comes from expected high-demand growth, from technologies and industries that are directly linked to the energy transition. When you talk about renewable energy, we have the wind power generators, needing permanent magnets. We are talking about energy storage, lithium-ion batteries for electric vehicles and electric motors to close the circle.

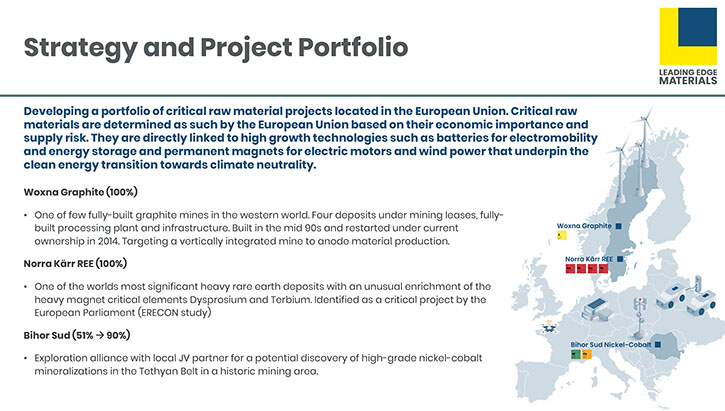

Although being a Canadian public Company, our two main projects are in Sweden, the Woxna Graphite Mine, which is transitioning into being a graphite anode project. And we also have the Norra Karr rare earth element project, which is one of the world's most significant heavy rare earth projects and the only one of its kind in Europe. Lastly, we have an early-stage exploration project, through a joint-venture in Romania.

On October 6, 2021 – Leading Edge Materials Corp. announced that its 100% owned Swedish subsidiary Woxna Graphite AB (“Woxna”) has signed a non-binding Heads of Agreement (the “MOU”) with Sydney, Australia, based Sicona Battery Technologies Pty Ltd (“Sicona”). The MOU lays out the path for the establishment of a Sweden based 50/50 Joint Venture (the “JV”) targeting the production of advanced natural graphite and silicon-graphite-carbon composite active anode materials using natural graphite from the Woxna Graphite mine as feedstock to offer the European lithium-ion battery manufacturing industry a secure and sustainable supply of high-performance anode materials.

The JV is a direct fit for the fully built and permitted Woxna Graphite mine in Sweden and plans for a vertically integrated production from mine to active anode materials utilizing a low carbon footprint thermal purification process, as recently reported in a Preliminary Economic Assessment study.(see press releases dated June 9, 2021 and July 26, 2021) The Company believes that the existing mine and developed downstream processes together with Sicona’s innovative technology offers the opportunity to deliver a secure and sustainable supply of high-performance battery materials for the European battery industry.

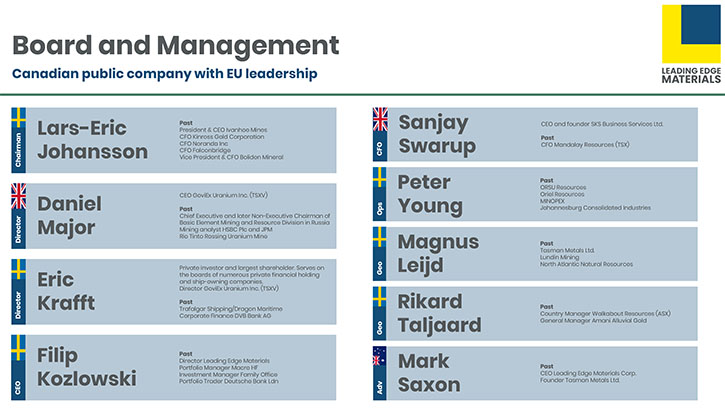

The Company's been around for slightly more than 10 years, when a group of founding Australian entrepreneurs founded Flinders Resources and Tasman Metals in 2009 and 2011 respectively, which merged in 2016 to become Leading Edge Materials. There was a change, in leadership of the Company last year, becoming more European/Swedish. We now have Lars-Eric Johansson, previously CEO and President of Ivanhoe Mines, who joined our Company as Chairman. We also have Daniel Major, who is a UK citizen and the CEO of Goviex Uranium. Lastly, Eric Krafft, who is the biggest shareholder and a very successful industrial entrepreneur, has taken a big interest in the energy transition and looking at any raw materials that could enable a low carbon footprint for society, joined the Board to become more involved in the success of the Company.

That was the new Board of Directors that was put in place. They're all based out of Europe. I was previously a non-executive Director, focusing on financial strategy, I was offered the opportunity to become the CEO of the Company, as we looked at the strategy to turnaround the Company and unlock value, across our various projects. My background is not in the industry. I come from a financial industry background, macro investing and hedge fund management. It's been an exciting time for me, over the last few years, getting involved with this Company and now running the Company, within this major fundamental sector trend, where we have political tailwinds pushing for policy change that supports demand growth for these critical raw materials. At the same time, we're seeing a huge pulling demand from consumers, looking to either shift their electricity supply to renewable sources or replace their internal combustion engine vehicle, with an electric vehicle. All of this is directly supporting the investment case for our project.

When I started as the CEO, I was given a mandate to unlock the value of our project portfolio, which we felt was very undervalued, compared with our peers in Canada and Australia. For the graphite project, the Company had never presented the investment case for the vertically integrated production of a natural graphite anode material, using our existing mine and processing plant, combined with the additional downstream upgrade processes that the Company had developed over the years. This has now been presented, in the recently released Preliminary Economic Assessment report, for that project. For the Norra Karr REE project, the most obvious way to increase the valuation of that asset is to demonstrate an increased probability of that project getting permitted. Towards that end, we decided to redesign the project, with the objective to maximize resource utilization and, by doing so, minimize the potential environmental footprint of the project at site. The outcome of that exercise has also now been presented, as part of the Preliminary Economic Assessment report, which was released recently. We also decided to sell our lithium exploration project, Bergby in Sweden, to have more internal resources for our main projects. Lastly, we are waiting for our exploration license in Romania, to progress exploration of that exciting project.

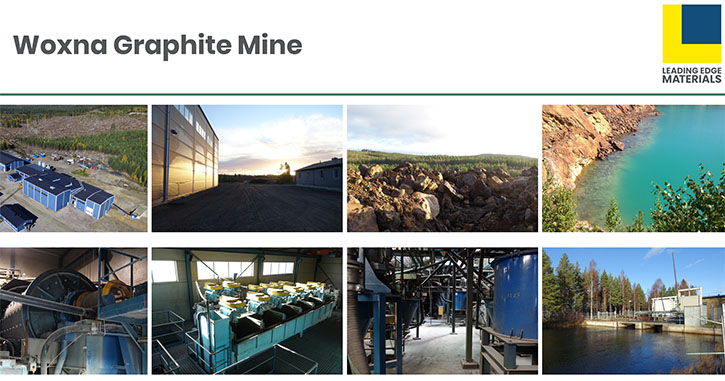

The Woxna Graphite mine was built in the mid-90s by a Swedish Company and purchased by our Canadian Company in 2011. It was refurbished and brought back into production in 2014. But production was quite quickly halted, due to only being able to produce a traditional, low value, graphite concentrate, where the pricing for that graphite product was too low for it to be attractive enough to continue operations. So, the Company, at that point, started to look at how we can value add our products to have higher margin and higher revenue for the project. It was really around that time, when Tesla started emerging, as the driving force behind the EV revolution.

It became obvious, quickly, that for the batteries, you're going to need a lot of material and the material choice is in graphite, whether it’s synthetic graphite or natural graphite. Over the years, we've been developing the downstream processes to take our low value graphite concentrate, into a very high purity specialty material, through sizing, shaping, purification and coating. There are a number of aspiring peers, doing the same around the world, since currently the market for these materials is completely dominated by China. So, everyone in the rest of the world is looking for more sustainable and secure supply alternatives, for each respective regions booming battery industry.

For the purification method, which is the most critical one, we are taking a different approach from most of our peers. You need to take a graphite concentrate that is around 95% TGC to above 99.95%. Being located where we are in Sweden, we have access to hydropower. We've chosen a thermal purification route, which gives us a number of advantages. We can achieve a higher purity level, we've demonstrated that not only can we achieve the 99.95%, which is a minimum, but we can also achieve 99.99%. Whether or not that is going to be in demand by the customers, we have to see, but we have that opportunity.

Normally, due to the energy intensity, thermal purification is not cost competitive. But in Sweden, hydropower electricity, in the north region, is very cost competitive. We've demonstrated, through the PEA that we could do it cost competitively. The other benefit is that using the electricity source that we have, hydropower, we have a very low associated carbon footprint, with the production. This was recently announced, through an ISO-compliant life cycle assessment report, showing a potential 90% reduction in the CO2 footprint of our production, compared with current Chinese supply.

Coming back to my mandate for this project, which was to demonstrate what the investment case is for a vertically integrated production, from mine to anode material and we have now released the results of that in the PEA.

It's clear the economics are very attractive and we're now looking to move to the next stage, which is to scale up our material production. We started on all of our test work, with external laboratories. We're now moving to an in-house production of larger volume samples, for potential customers here.

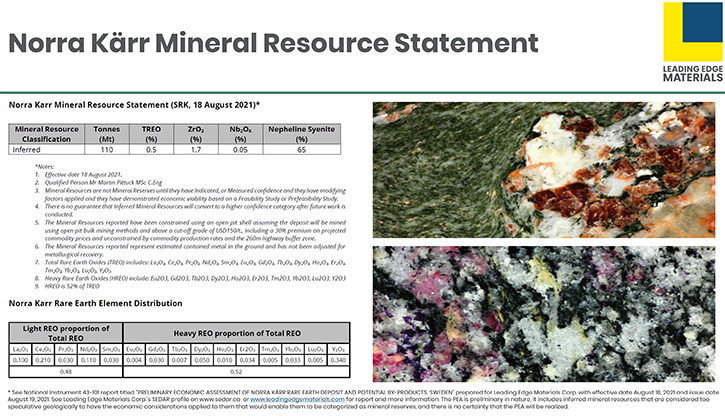

Moving over to the Norra Karr Project. The Norra Karr Project is a fantastic, rare earth deposit. It's recognized, around the world, as a significant heavy rare earth deposit. It was discovered in the early 1900s by the Swedish Geological Survey. Our Company staked it in 2009 and quickly identified it as a very attractive project for rare earths.

How much introduction to rare earth elements do you need for your readers?

Dr. Allen Alper:

Well, they know quite a bit about it. But I think it would be nice for you to talk a little bit about the applications of rare earths and why they're so important. Also mention the heavy ones that are the most critical in magnets.

Filip Kozlowski:

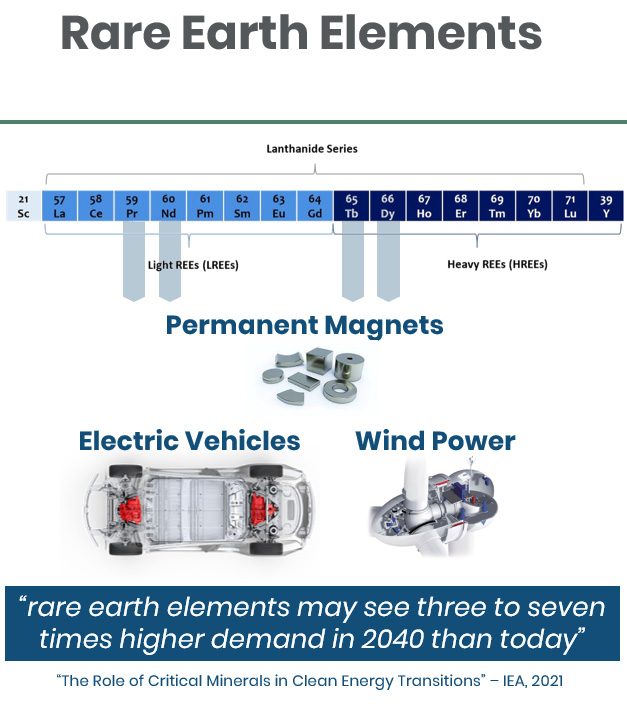

Rare earth elements were first discovered in Sweden in the 1700s, in a small village outside of Stockholm, called Ytterby. The 17 elements that are grouped into rare earth elements, are the 15 elements in the lanthanoid series, together with scandium and yttrium. These elements have very unique chemical properties and in addition, magnetic properties. The permanent magnets that are used in electric motors and in the wind power generators are the strongest type of magnets that you can find, Neodymium Iron Boron magnets (NdFeB).

Why is the strength of the magnet so important? It all comes back to the efficiency of magnets. The stronger the magnet that you have is, the more efficient that magnet is. The more efficient the magnet is, the more efficient the electric motor, you have, is. The more efficient electric motor you have, the longer you can drive and the faster you can drive electrically. Same thing, with wind power generators, the more efficient the magnets are, the more energy you can generate, from that wind power that's used to catch it. That's important, and that's really where this explosive demand growth is coming for permanent magnets and the REEs needed, like Neodymium, Presidium, Dysprosium and Terbium. Mainly Neodymium and Praseodymium are used for the NdFeB permanent magnets, however, in order for those magnets to perform, as efficiently, at high temperatures, you need an addition of dysprosium or terbium. Neodymium and Praseodymium are light rare earth elements, Dysprosium and Terbium are heavy rare earth elements. That distinction between light and heavy rare earth elements is very important. The lighter rare earth elements are much more abundant. Whereas the heavier elements are more difficult and much rarer to find.

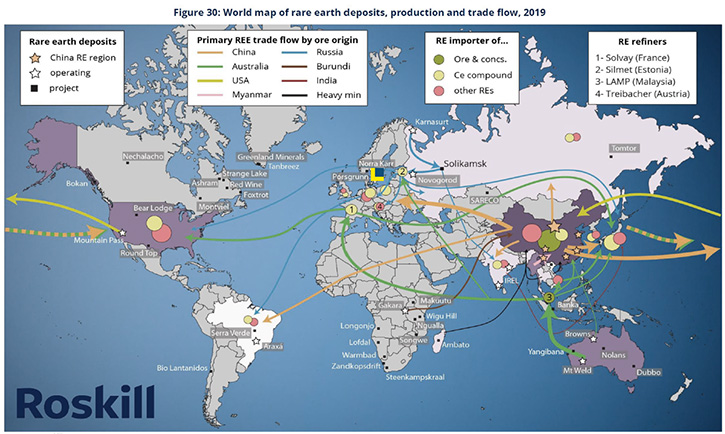

This is reflected in the pricing of the rare earth elements. So, when you look at the Neodymium and Praseodymium Oxides, at the moment, they price around $100 per kilo. Whereas Dysprosium is closer to $400, and Terbium $1,200 per kilo. Another key aspect of rare earth elements is that China completely dominates the value chain for these elements and the production of them. Europe is more or less 100% dependent on China for the permanent magnets. That's obviously not sustainable and resilient in any way.

We're looking to be an alternative to the Chinese supply and we're coming back to the distinction between the light and heavy rare earth elements. The heavy earth elements are so rare, even China relies on imports from, for example, Myanmar. When you listen to Lynas, the main producer for rare earths outside of China, they started talking about how they can extract more of the heavy earth elements and materials. They've also been funded by the U.S. government, to develop US based processes, to produce more of the heavy elements. JOGMEC Corporation is the Japanese Government arm, tasked with securing natural resource supplies. They've invested in a project in Namibia, which is quite enriched with heavy rare earth elements. And there was a recent investment by Korean investors in an Australian company, called Australian Strategic Materials, which also has a heavy rare earth project, very similar to Norra Karr. With this global scramble to secure supplies of heavy rare earth elements, Norra Karr is the most obvious alternative for Europe.

Dr. Allen Alper:

That's an excellent, excellent project. Could you say a few words on your preliminary economic assessment that was done on that project?

Filip Kozlowski:

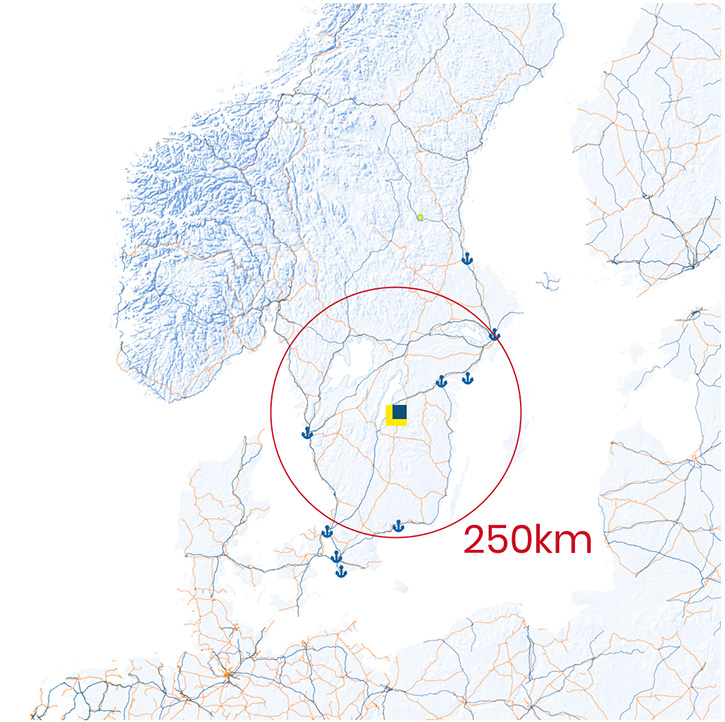

The objective was slightly different for the Norra Karr PEA, compared to the Woxna Graphite PEA. The Norra Karr Project is located, from a mining perspective, in both a fantastic and a challenging location. It's situated right next to the biggest highway in Sweden, so south-central Sweden, near major cities, very easy access to water, very easy access to power. However, on the other side of the highway from the deposit, you have the second biggest lake.

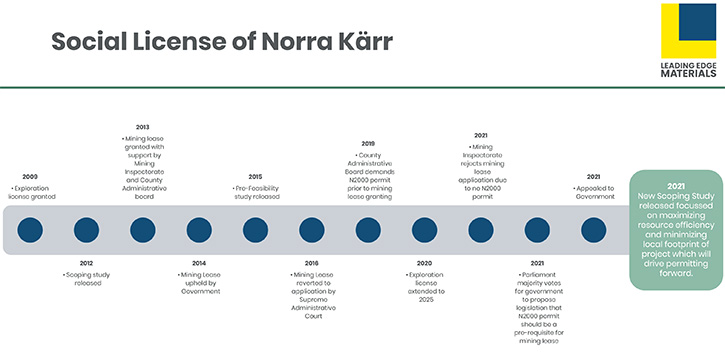

This has made the public acceptance of the project quite challenging in the past. The result of this is that there was a mining lease granted for the project in 2013. The granting of the mining lease was upheld by the Swedish Government. However, the Supreme Administrative Court reverted the mining lease to an application status, so the valuation of the project has been held back, by the uncertainty around the permit.

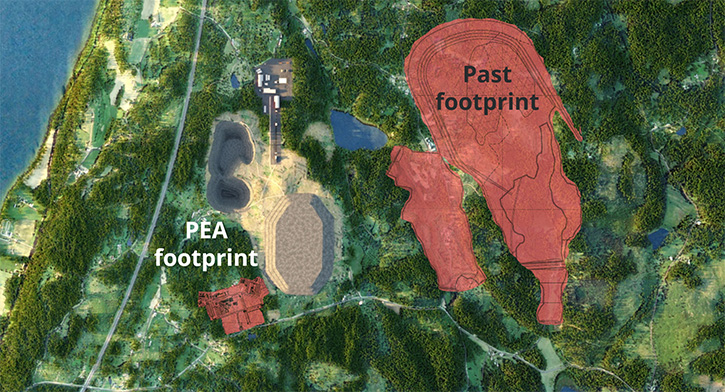

The objective of the recently released PEA was to demonstrate a new design of the project, where we minimize the footprint of the project site and maximize the resource efficiency. We're looking to have mining and beneficiation only on site and moving the chemical leaching stages, off site, to a location that is more suitable for that type of chemical process. The result of that is, a close to 80% reduction in land use at site, and the removal of any wet tailings and the need for a tailings dam.

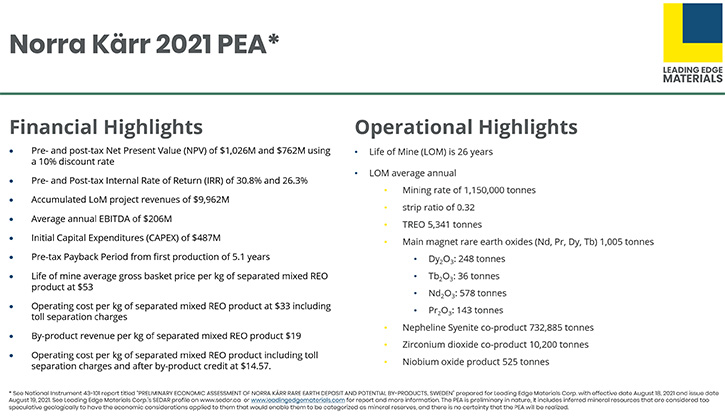

We're also looking to valorize more of the material that we have in the deposit. 65% of the mineralized material that is mined, is a nepheline feldspar, nepheline syenite, industrial minerals product. We're looking to sell that, which will immediately reduce the amount of waste by a significant amount. Through the chemical leaching stages, we're also looking to recover some of the zirconium oxide and the niobium oxide, which are also elements that enrich the deposit. All of it has now been presented, together with the PEA. The economics is a side benefit that we got through the redesign of the project.

I think it's worth noting that the size of the deposit is significant. The economic analysis for the PEA is based on a 26-year life of mine, whereas we've also published a mineral resource, which is much bigger than that production rate. Summarizing all of that, it's a really unique project. It's the best opportunity for Europe to become more self-reliant on the rare earth elements and the value chains, and it's a fantastic investment case for our investors.

Dr. Allen Alper:

That's excellent. Could you tell our readers/ investors a little bit about your 50% owned Cobalt Nickel Project in Romania?

Filip Kozlowski:

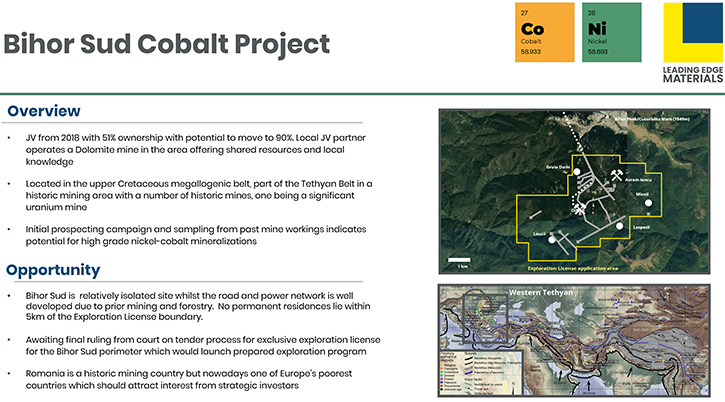

We've covered our two main projects. We do have exploration upside potential, through our joint venture in Romania. Currently we have 51% ownership in that joint venture. We can move up to 90% on various terms. It’s in the northern part of the Tethyan Belt, up in the Apuseni Mountains. It’s a historic mining area, where this is a historic uranium mine. We've identified this area as a potential target for high-grade nickel cobalt mineralizations.

We've gone through the process with a nonexclusive prospecting license, which has given us the opportunity to sample material on the ground. And the findings that we saw made us optimistic enough to apply for an exclusive exploration license. Unfortunately, the granting of the exploration license has been held back by a legal case, to which we are not a party. We've been waiting for that for a couple of years now, and it's been prolonged by COVID. But we're hopeful that when the day comes for the granting of the exploration license, should that happen, we have a clearly defined exploration program and we're very excited to put our feet back on the ground there.

Dr. Allen Alper:

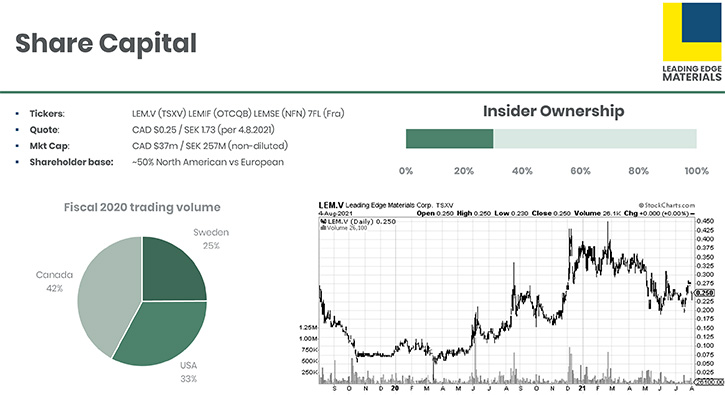

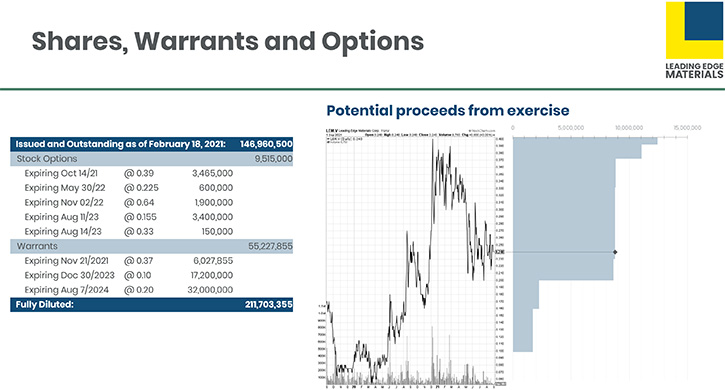

That sounds very good. Could you tell our readers/ investors a whole bit more about your share and capital structure?

Filip Kozlowski:

We're currently sitting at a market cap of around $35 million Canadian. We have around 147 million shares on issue, fully diluted around 210 million shares. More than a third of the shares are owned by insiders. Our shares traded on the Toronto Venture Exchange, on the OTCQB. And we also have to do a listing on the NASDAQ Stockholm exchange. Our trading volume is roughly a third between Canada, US and Sweden. Our Swedish listing was started, beginning in 2018, to attract a Swedish investor base, due to having two major Swedish projects. That has been very successful, in attracting a Swedish shareholder base to the Company. We also have a number of warrants and options that are in the money, that offer us the opportunity internally, to fund working capital, going forward.

Dr. Allen Alper:

That’s very good. Could you tell our readers/investors the primary reasons they should consider investing in Leading Edge Materials?

Filip Kozlowski:

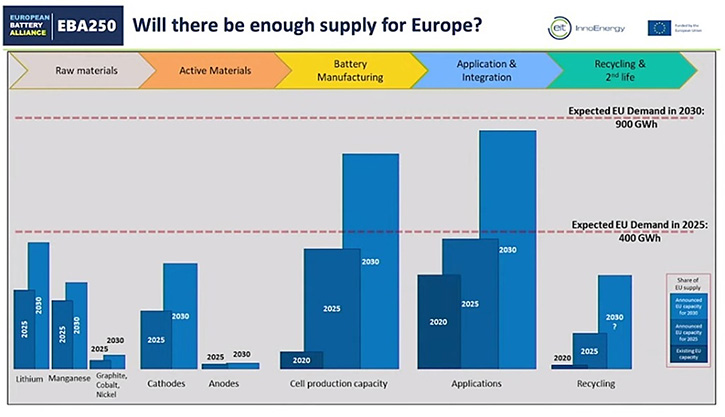

Our two main projects give direct exposure to the most critical raw materials in Europe. Europe is really leading the development of the energy transition. China is the dominant factor now, but Europe is catching up fast. If you look at maps and announced plans for battery factories to be built, it's all happening in Europe. The US, under the new Biden Administration, is slowly catching up. However, Europe is at the center stage of the Western world emergence of a battery industry and with the electric vehicle revolution, driven by the German auto manufacturers, targeting to move towards full electric product offering.

Our projects are unique opportunities for Europe to become more self-reliant. We can do that, with a significant improvement in the environmental footprint, of the production of those materials. The materials that we're looking to produce are graphite anode materials, through a mine to anode, fully integrated production, rare earth oxides that are critical for electric motors and wind turbines and the potential of finding nickel and cobalt in Romania.

The two Swedish projects are not early-stage projects. The Woxna Graphite Mine is a built and permitted mine. Same thing with the rare earth project, Norra Karr, where the geology of the deposit is well understood. The PEA, now released, is actually subsequent to a PFS that was released in 2015. The reason for going back to the PEA level is that we're including some of the additional byproducts, like the nepheline syenite, the zirconium oxide and the niobium oxide, which makes it a lower level of confidence scoping study and mineral resource statement. We've been on this project for more than 10 years now, and we're at the inflection point, where the explosive demand growth, for these materials, is really starting to show. You've seen rare earth element prices going up significantly, over the last 12 months. We don't expect that to change and that's just improving the potential of our project. It's the same for graphite, where everyone expects significant supply, especially in Europe.

But I think it's worth mentioning that now, with the Board of Directors, we have as local as possible leadership, operating the Company, running the Company out of Stockholm. We have Lars-Eric Johansson, a very experienced mining executive, as the Chairman. Daniel Major, a mining engineer and CEO of another successful TSXV listed issuer. We also have the biggest shareholder of the Company on the Board of Directors, actively involved in the development of the Company and looking after shareholders interest. I think our projects, together with the leadership of the Company and our location, put us in a very unique proposition for investors that are looking at this space.

Dr. Allen Alper:

Well, that sounds excellent. You have a great Team, very accomplished, very knowledgeable and great projects. You're in a great location to support Europe, with rare earth elements, graphite and potentially, at some point, cobalt and nickel. It sounds like you're right, you have the critical materials to support a growing need for electrification, particularly in Europe. We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://leadingedgematerials.com/

Filip Kozlowski, CEO

info@leadingedgematerials.com

|

|