George Bee, President, CEO and Chairman, U.S. Gold Corp. (NASDAQ: USAU) Discusses its Advanced-Stage CK Gold Project, in the Silver Crown Mining District, Wyoming

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/22/2021

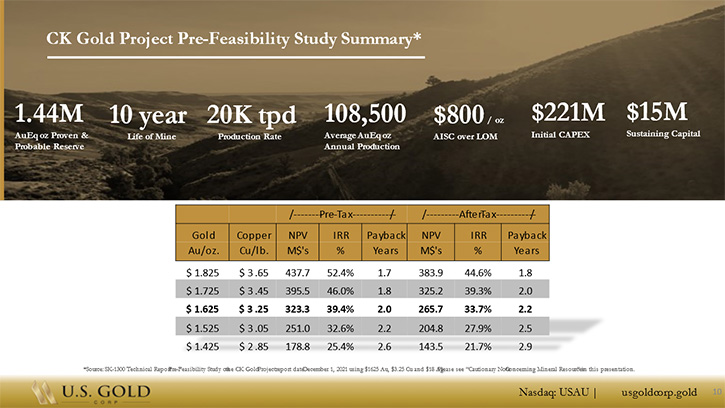

We spoke with George Bee, President, CEO and Chairman of U.S. Gold Corp. (NASDAQ: USAU), a U.S. focused, advanced-stage, gold exploration and development company, focused on their 100%-owned CK Gold Project property, located in the Silver Crown mining district, of southeast Wyoming, approximately 20 miles west of the city of Cheyenne. According to Mr. Bee, the project has 1.44 million gold equivalent ounces of proven and probable reserves. The project offers near-term, low CAPEX, open-pit production potential, as well as compelling value. The newly released December 2021 PFS shows a 10 year projected mine life of about 108,500 AuEq ounces/yr. The Company plans to file a permit application in 2022, Wyoming permitting process estimated at 12-18 months.

U.S. Gold Corp.

Dr. Allen Alper: I think you have a wonderful Company, with great projects in Wyoming, Nevada, and Idaho. Fill in our readers/investors on what's happening with U.S. Gold Corp.

George Bee: I joined U.S. Gold Corp. a little over a year ago. My background is as a mining engineer, amongst other things. I have been working 16 years with Barrick, operating, and developing mines. My involvement with U.S. Gold came about because we wanted to pivot the Company towards development and specifically the asset that we have in southeast Wyoming, the CK Gold Project. It used to be called Copper King. Because a lot of the value is in the gold, I have called it the CK Gold Project. While we still have a great exploration portfolio, our emphasis has been on taking the CK Gold Project, which had a preliminary economic assessment on the project, which was last updated in 2017, to a pre-feasibility level document. As of December 1st, we have published that document and it is now in the public domain on our website, and I’m happy to report on our findings.

Dr. Allen Alper: That’s great. That would be of great interest to our readers/investors, so please do.

George Bee: The pre-feasibility study really captures drilling that occurred in 2017, 2018 and 2020. What we now can reveal is that the mineral resource is 1.58 million equivalent gold ounces of measured and indicated resources. We have another approximately 0.36 million equivalent gold ounces of inferred material, but with M&I, that includes 1.11 million ounces of gold and 280 million pounds of copper. So those are the resources.

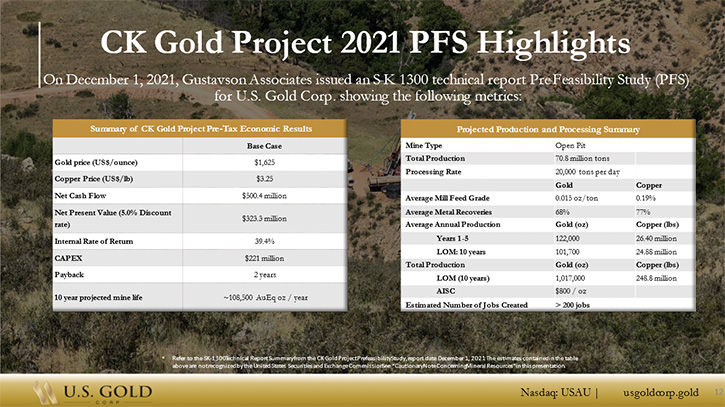

We have been busy doing the mine planning, the additional studies, and I am happy to report that the recently published PFS shows 1.44 million ounces - that is gold equivalent ounces, of proven and probable reserves. Those P1 and P2 reserves include 1.01 million ounces of gold and 248 million pounds of copper. The mine plan is now a 10-year mine plan, and we will be operating, with deliveries to the mill at 20,000 short tons per day, for a process rate, well up from the 9,800 rate in the PEA. That averages, over a 10-year period, 108,500 gold equivalent ounces per year. Importantly, the first three years comes in at 135,300 equivalent gold ounces per year. That really is an attractive production profile, front-end loaded, with some really good grades at the beginning of the project. The initial capital for this project is $221 million, but we see that we will pay that back in a two-year timeframe. The capital that we are looking at probably comes with some very interesting and suitable terms from equipment suppliers, because the bulk of the capital is for the process plant. We are also looking at potential for some development capital at competitive rates. The economics that we are looking at are all based on $1,625 per ounce gold and $3.25 per pound copper. It shows robust economics, with a 39.4% internal rate of return before tax and a 33.7% internal rate of return after tax. On a NPV basis, at a 5% discount rate, that is $323 million on a before-tax basis and $265 million on an after-tax basis net present value.

The exciting thing about this project is it is very robust, and we see an all-in sustaining cost (AISC) at $800 per equivalent gold ounce. With those metrics, at the $1,625 per ounce and $3.25 per pound of copper, we have high project sensitivity to the increasing metal prices. As you start looking at today's prices, even with a recent decline, it is a very attractive project.

Dr. Allen Alper: That's excellent!

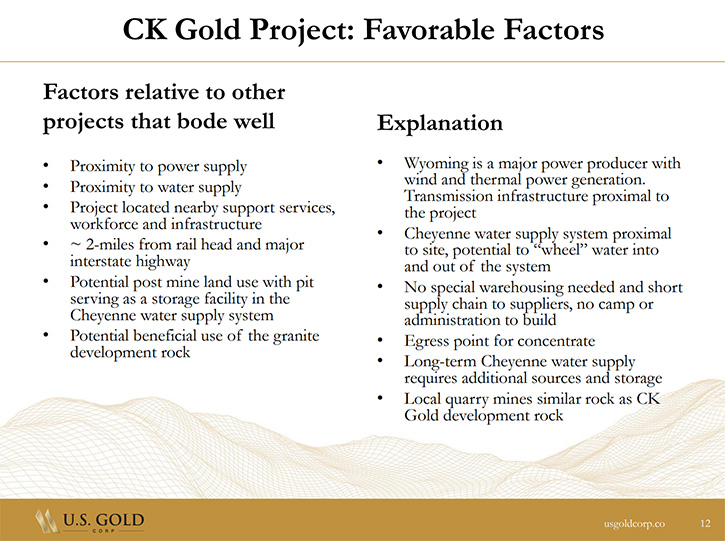

George Bee: Yes. I guess beyond that we have some potential upsides and one of the upsides relates to the fact that we are 20 miles to the west of Cheyenne, Wyoming and we are at the northern end of the Colorado front range, where there is a lot of growth happening and development. Also, looking to Biden's infrastructure package, we feel that we will be in a position to sell our waste rock, which we have tested, and it is a very marketable and attractive aggregate. We strongly believe we will be looking at the potential to add that to the economics of the project into our feasibility study.

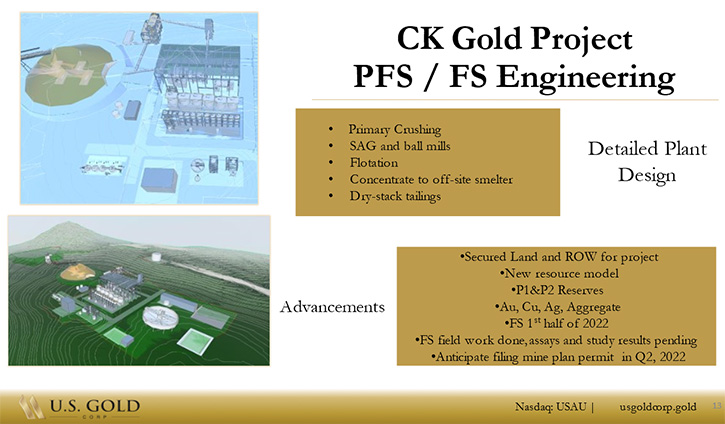

As we go into feasibility studies, we will be looking at value engineering around the plant to optimize and eliminate some of the conservatism that we have in the pre-feasibility study. The ongoing metallurgical test work should enhance recovery and we also have the potential to expand the deposit. Our focus, with the pre-feasibility study, was showing and revealing the value proposition that we have around the resource that we currently understand. But, we have upside potential at depth, and also to the southeast of the current resource.

The good thing about this project, and the thing that sets us apart, is that we are sitting on Wyoming state land and have a lease, and we will be paying a royalty to the State of Wyoming for K-12 education, but we are surrounded by private land, and we have no federal government involvement. We had the U.S. Army Corps of Engineers tell us in February, 2021 that we were non-jurisdictional, at least for the footprint of the project. We will be essentially permitting with Wyoming agencies and there is the potential to submit the permit application in 2022 and receive approval in 2023. Unlike many projects, which are trapped in a long-term permitting review, we feel that there is an opportunity to move this project along very quickly. That is really what we are highlighting in our pre-feasibility study, which is available on our website, and we have put a press release out as of December 1st, 2021 on that.

Dr. Allen Alper: Well, that sounds excellent. That's really great news for your stakeholders and shareholders. That's really great! It should attract many other investors. It's great to have a project moving so rapidly and having such great gold resources, and also copper credits. It is in a great location, great infrastructure, and access to production so rapidly. And I think they picked the right fellow to head up the project and get the mining moving.

George Bee: Well, thank you very much, Allen. We have not skipped a beat, while putting the finishing touches to our pre-feasibility study, we have just concluded our 2021 field season in Wyoming. What that does for us is it provides the detailed geotechnical and hydrological information that will be incorporated into the feasibility study. We continue to do site environmental monitoring and engagement with our local stakeholders. We anticipate announcing the results of the tender for our feasibility study and ongoing EPCM contracting.

It is all going well on the CK Gold Project. However, we have not lost sight of our additional exploration portfolio, with some really interesting intercepts this summer at our Maggie Creek property, in Nevada on the Carlin trend. Then also, we will certainly be looking to advance our 20 square mile Keystone project, of very perspective property on the Cortez trend, also in Nevada. Our Challis Gold Project, in Idaho, has a historical resource of over 300,000 ounces of gold and we hope to expand upon that. There is a lot going on Allen, and I really appreciate your interest.

Dr. Allen Alper: Sounds excellent. Could you just highlight and summarize the primary reasons our readers/investors should consider investing in U.S. Gold Corp.?

George Bee: Well, if you look at the other companies out there, since 2008, there has been a lull in overall exploration activity. I think with the recent increase in gold prices and copper prices, especially with the new infrastructure bill and electrification, the interest in both gold and copper is at a new high. Because of the prior lull in exploration and moving projects along the development path, U.S. Gold Corp. is well-situated now, with respect to being able to advance a project on a rapid basis to catch this cycle. Because of the opportunity of working in Wyoming, under the Wyoming authorities' jurisdiction, without federal government, we can bring this project to book quickly. I think the timing is auspicious. We are looking at inflation. The best hedge against inflation, in at least a portion of your portfolio, should always be in gold. And gold prices, despite a little hiccup, will be rising.

With all the work on electrification and the new infrastructure project, copper is going to be increasing. We are well-positioned to play into that market – producing American copper and gold with American jobs. Also, with our potential to produce some aggregate and value that into the equation, we believe we have additional upside economics into our Feasibility Study in 2022. We are a fast-moving Company. We have the right people. We can move this project forward quickly and catch the rising tide in gold, copper, and development at a time when particularly Wyoming needs additional diversification away from coal.

Dr. Allen Alper: Well, they sound like very compelling reasons, George, for our readers/investors to consider investing in U.S. Gold Corp. That's excellent! Is there anything else you'd like to add George?

George Bee: The only thing that I would like to add is that, as you look at the financing of the project, we have had some discussions, with the process equipment manufacturers. F.L. Smidth and Metso Outokumpu have some really compelling terms at low interest rates to promote the sale of their products. We are currently talking to them. We do hope to pursue some development capital from the State of Wyoming. There is precedent for that capital at very attractive interest rates. In terms of being able to finance the project, we do not see that there is necessarily going to be too much of a dilution to shareholders, from an equity raise, and we can rely on some very favorable terms on debt.

At the same time, we have lots of entities in and around the area in Wyoming that are very proficient at contract mining and we will be looking at that. Really, as you look at the fact that we are an hour and a half north of Denver, six hours away from Salt Lake City, four hours south of Gillette, Wyoming, we are in an ideal situation. Our major infrastructure, the I-80 and the I-25 interstate highways are near to the property, as is the Union Pacific rail line. All of those things bode well for us to control our costs and be competitive as we put this project forward.

Dr. Allen Alper: Well, that sounds excellent! Really outstanding! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.usgoldcorp.gold/

U.S. Gold Corp. Investor Relations:

+1 800 557 4550

ir@usgoldcorp.gold

|

|