Jeff Quartermaine, Managing Director and CEO, Perseus Mining Ltd. (ASX/TSX: PRU) Discusses the Rapidly Growing, Diversified, Multi-Jurisdictional, and Multi-Operational, West African Gold Producer, Developer, and Explorer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/21/2021

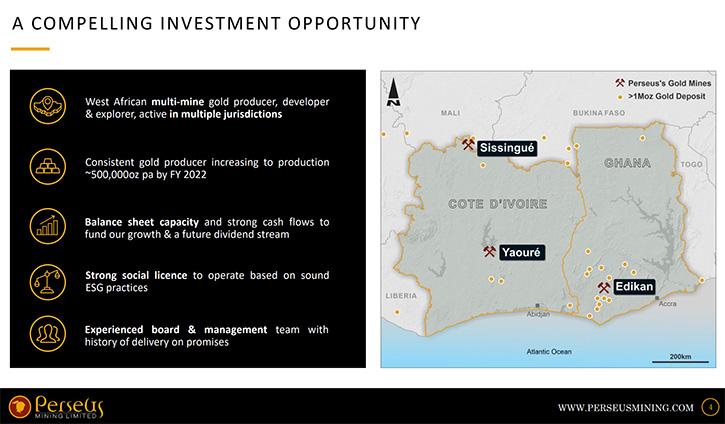

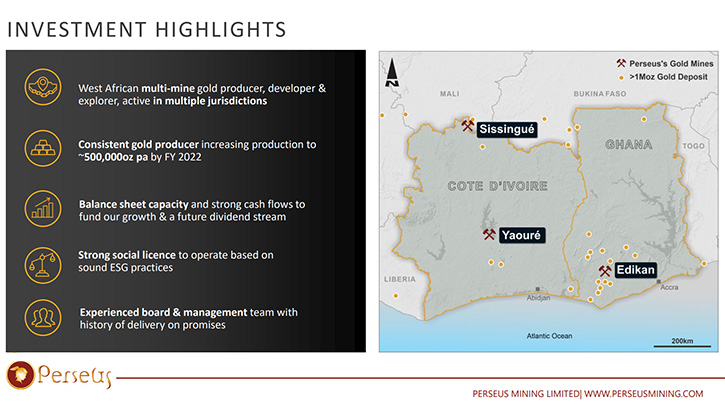

We spoke with Jeff Quartermaine, Managing Director and CEO of Perseus Mining Limited (ASX/TSX: PRU), a rapidly growing, diversified, multi-jurisdictional, and multi-operational, West African gold producer, developer, and explorer. Perseus operates three gold mines in West Africa: The Edikan Gold Mine in Ghana that commenced commercial production in 2012, the Sissingué Gold Mine in Côte d’Ivoire, that commenced commercial production in 2018, and the Yaouré Gold Mine in Côte d’Ivoire, that commenced commercial production in 2020. Perseus plans to increase annual gold production, to more than 500,000 ounces per year, by 2022. Perseus Mining has become a very reliable and consistent producer of shareholder value and was able to commence their first dividend payment this year.

Perseus Mining Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Jeff Quartermaine, Managing Director and CEO of Perseus Mining. Jeff, first I'd like to say, over the years we've been talking, and your Company has done an outstanding job, from becoming explorer, just a few years ago, to now on your way to becoming a 500,000-ounce annual producer. You've become a multi-national, multi-mine developer and producer. Outstanding performance! I'll start with this question, Jeff. Could you give us an overview of your Company? What differentiates your Company and tell us what's happening with your Company?

Jeff Quartermaine:

We're an Australian Company originally, although all of our activities are located in West Africa. We are listed on the Australian and the Toronto Stock Exchanges, so a public Company. We operate three gold mines in West Africa and as you quite rightly said, we're on track to be producing half a million ounces or 500,000 ounces of gold, a year, from this year onwards. In fact, at this moment, and for the last couple of months, we've been producing at that particular rate; 42,000 ounces plus per month, which takes us over the 500,000-ounce level.

What makes us a little different from some of our peers is the fact that we are a multi-jurisdictional, multi-operation company. In other words, we have spread the risk of investment across a couple of countries and across a series of operations. That means that if something goes wrong, as it does in the mining business from time to time, at one of our operations, the chances are that the other operations are going well and can cover for that short term issue.

This means that our Company has become a very reliable and consistent producer of not only gold, but because of that cash flow and earnings, we were able to commence our first dividend payment this year. We declared our maiden dividend, following the release of our full year financial results, and that first dividend will be paid to shareholders, later this week or early next week. We are, as I say, a multi-national, multi-jurisdictional, consistent, strong producer of gold, cash flow and earnings, run by a very experienced Board and Management Team and operating with a very, very strong social license to operate, which is extremely important in this part of the world. I think in a snapshot that's Perseus Mining.

Dr. Allen Alper:

Well, that's excellent. Could you tell our readers/investors a little bit more about your three projects? Not only are you a growing producer, but you're also an active explorer. Could you tell us about the main projects?

Jeff Quartermaine:

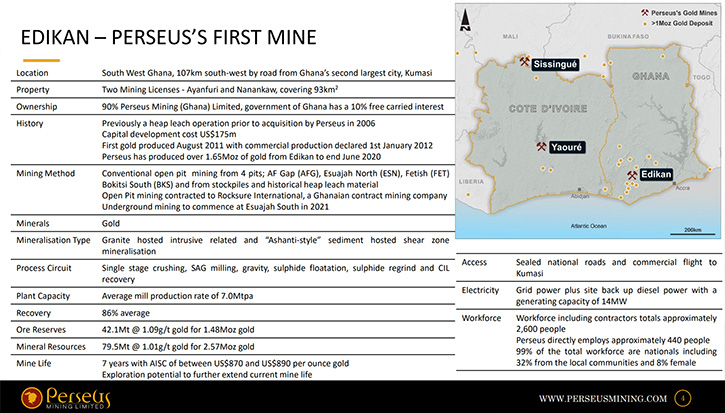

We have three operations, we have one in Ghana, which is the Edikan Mine that was started back in 2012 and since then has produced close to two million ounces of gold. Edikan is a series of low-grade ore bodies. It's reasonably challenging, but nevertheless we have made that into an extremely efficient operation and it's doing reasonably well. Recently we've made a discovery, within eight kilometers of the mill. We expect to be able to materially extend the mine life of that project, based on that discovery and others in close proximity, so Edikan is the first of our mines.

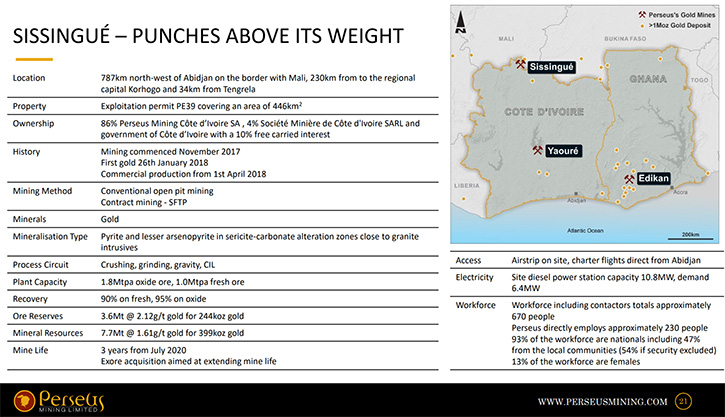

The second of our mines is called Sissingué. It's a small operation, located in the north of Côte d'Ivoire, reasonably close to the border with Mali. It is quite small relative to Edikan, but it is higher grade and very low cost. This was a project that was brought on stream in 2018. It repaid all of its capital, within two years. Since then, it's been generating a very healthy cash flow to our business. We are in the process of updating our life of mine plan, for this operation, and we will be publishing those results in the new year. But certainly, on the back of the work that I'm seeing to date, I have every confidence that the life of the Sissingué operation is going to be extended well beyond the current projected mine life and that, of course, means additional cash flow to the business.

The third of our mines is the most recent mine, the Yaouré Gold Mine and it’s also located in Côte d'Ivoire. We caught our first gold at Yaouré last year, the 17th of December and that was ahead of schedule five weeks ahead of schedule and under our construction budget of $265 million. Building and commissioning that mine, during the COVID pandemic, was something of an achievement, of which we're quite proud. Since pouring that first gold in December, things have ramped up very rapidly and the mine is operating exceptionally well.

I was in Africa myself, about two weeks ago. I visited all three of our properties, but particularly spent some time at Yaouré and I have to say that it is everything we hoped it would be, and then some. It's now generating approximately 60% of our overall production, monthly and is going to be a major piece of our business for many years to come. As it currently stands, the life of the projects around eight and a half years, however, we have made very significant discoveries up to the side of the pits and we have identified an underground mining opportunity, which we are currently drilling out as we speak. We expect to bring the first of that underground ore into the reserve inventory next year.

However, we've only stepped out a few hundred meters, on that particular structure. Having done a three-dimensional seismic survey of the area, we can see, from that seismic work that that structure extends for several kilometers down into the Earth. Whether it's mineralized all the way or not, is something that we will determine in the future. But for the short term, we know that it's mineralized down to at least 500 meters, and we expect we'll be on that site.

The Yaouré Mine is an outstanding mine and we're very proud of that achievement, having brought it on stream under fairly difficult circumstances. With the quality of the workforce and the Management Team that we had, it was something that occurred unexpectedly, I think by the market in general. In that regard, I think that it hasn't fully been appreciated. Although when we release our next quarter results, I think it'll be very plain, for all to see, that this is an outstanding operation and one that will underpin our business for many years to come.

Dr. Allen Alper:

Well, that’s outstanding work and you and your Team can be very proud of what was accomplished. Could you tell our readers/investors about your overall resources and reserves?

Jeff Quartermaine:

The overall situation is just that we have about 5.5 million ounces in resource, as it stands today and about a little over about 3.5 million ounces, in reserve now. When I say resources, I'm talking about measured and indicated mineral resources, not inferred or not imagined, which is a category of resource that a lot of juniors seem to use these days. We're talking measured and indicated, mineral resources and we're talking proven probable ore reserve.

We differentiate ourselves, from our peers, when we talk about these things, because our business is to monetize these resources. Unless they are economically, demonstrably economically exploitable, they really have not much value to us. I know that that isn't necessarily the approach that our peers take, but it is the approach that we take. I think your readers/investors should understand that when we quote these numbers, these are resources that can actually be converted into gold bars and into cash flow.

Dr. Allen Alper:

That sounds outstanding. Jeff, could you refresh the minds of our readers/investors on your background, your Team, and your Board?

Jeff Quartermaine:

Our Board comprises seven people, of whom two are relatively recently appointed women. We have a fair representation gender wise. We also have a fair representation in terms of nationality. Our Chairman, Sean Harvey, is based in Toronto. We have several Directors based in Australia, Perth and in Melbourne, and also a Director, based in London. We have a fair spread of experience across the Board and that, of course, is very helpful in terms of building the Company.

In terms of my Management Team, I have five direct reports to me. All of our executives are in fact very experienced people, who have worked in a multitude of countries and jurisdictions. That's extremely important, in terms of being able to operate in a country that is not your own country. We need to recognize that we are guests in a country of others and then conduct ourselves accordingly, to ensure that we achieve our fundamental mission, and that is to generate benefits for all of our stakeholders.

Dr. Allen Alper:

Oh great. I know you have a very strong Board and Management Team, very well balanced between technical and financial, so that’s great. Jeff, could you tell our readers/investors a little bit about your share and capital structure and your balance sheet?

Jeff Quartermaine:

We have about 1.2 billion shares on issue, at the present time, which is many shares relative to a lot of North American companies, which gives us, based on current price, a market capitalization, I think it must be a touch under $2 billion Australian, or about $1.4 billion US. It's not the biggest Company in the world, by any stretch of the imagination, but it is getting larger. It is truly an international company, in the sense that something like 41% of our shares are owned by investors from the United States, 25% by investors out of the UK and Europe and 25% from Australia. The other 10% or so is spread around the world. It's a widely owned Company from a geographic perspective. It is reasonably tightly held. I think 80% of our shares are owned by institutional investors, as opposed to retail. If you look at the quality of the investors, on our register, it actually speaks volumes.

In terms of investors, who would be familiar with your readership, VanEck, T Rowe Price, Franklin, for instance, are large North American investors. And then, of course, we have several large European investors, in the form of Ruffer, Ninety-One, and Konwave, a Swiss company. All these people are fundamental, specialist investors in resources stocks and seriously understand that Perseus is a very valuable stock and one that has enormous potential to grow in the future.

Dr. Allen Alper:

Well, that's excellent. Could you tell our readers/investors the primary reasons they should consider investing in Perseus Mining?

Jeff Quartermaine:

The most fundamental reason is that we believe, at the present time, based on the future ahead of us, our shares are fundamentally mispriced in the market. We believe that when the market fully understands and accepts the fact that we are now a very significant gold producer, there is opportunity for the stock price to re-rate. That's the most fundamental issue of the lot. But aside from that, I think it's clear looking at the numbers, we are a reliable, consistent producer of gold and earner of profits.

It's a very well-managed Company, very professionally managed, very transparent, what you see is what you get. We are all highly motivated to work towards achieving material benefits for all our stakeholders. I think those reasons; growth, consistency of earnings, ability to return capital to shareholders, diversity of risk, lower risk profile than somebody who is concentrated in one area and being underpriced. They're all things that recommend this stock to potential investors.

Dr. Allen Alper:

Well, I must say that those are all compelling reasons to consider buying Perseus Mining stock. You have demonstrated that you can do more than you have promised in the past, and your Team accomplishes what you say they will and gets outstanding performance.

Jeff Quartermaine:

Well, thank you for that. It is something that we do pride ourselves on. One of our core values is doing what we say we are going to do. That is something that all of our team lives by, on a day-to-day basis. We don't say we can do it unless we can, and then we must set about delivering on that. So, it is nice that one of our values is actually being lived and recognized by observers such as yourself.

Dr. Allen Alper:

Excellent! Jeff, is there anything else you'd like to add?

Jeff Quartermaine:

I think that's a pretty fair summary of where we sit at the moment. You asked me about our balance sheet, and I didn't answer that question specifically. But we are in in a net cash position at the present time. At the end of September, we had $200 million of cash on our balance sheet, $100 million in debt, so we were net cash positive about $100 million. The feature of that is in 2016 we spent $400 million US, building two mines. Yet here we are, in 2021, not burdening the company with debt, but in fact being cash positive. That is something to be proud of, having invested $400 million, but we're still a $100 million ahead of the game.

Dr. Allen Alper:

That's outstanding performance and highly unusual. I know, in the mining business, it takes a lot of money to build mines and your Team, and you have done an outstanding job creating cash, and being debt free and cash positive. So that's excellent!

https://perseusmining.com/

Jeff Quartermaine

Managing Director & CEO

jeff.quartermaine@perseusmining.com

|

|