Rob Smakman, Managing Director, Alvo Minerals Ltd. (ASX: ALV) Discusses their Flagship Palma Project, a High-Grade Copper/Zinc/Lead/Silver/Gold District-Scale VMS Deposit in Central Brazil

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/21/2021

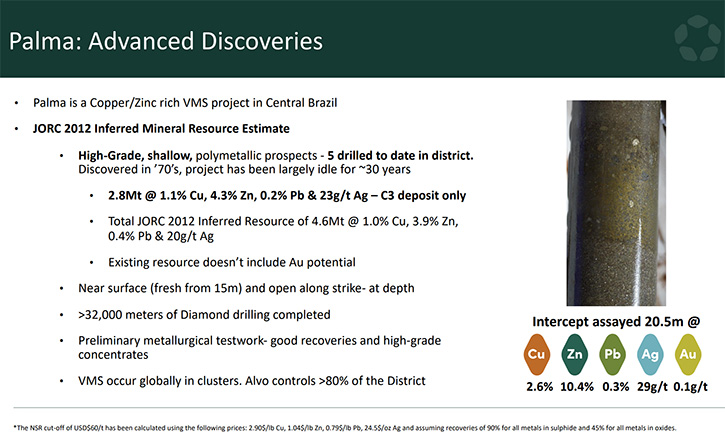

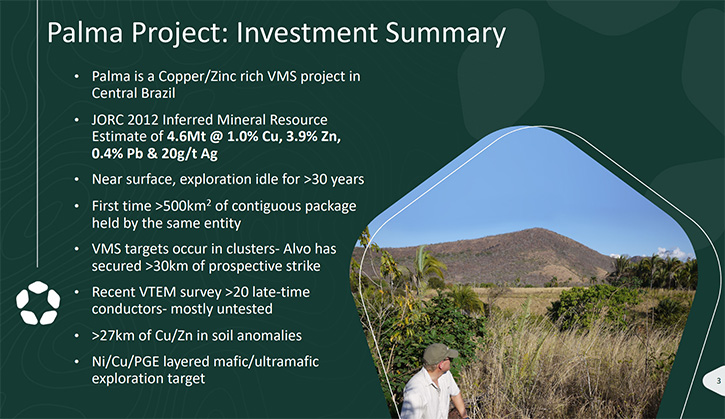

We spoke with Rob Smakman, who is Managing Director of Alvo Minerals, a Brazil-focused mineral exploration company that has just listed on ASX, with their flagship Palma Project, a high-grade copper/zinc/lead/silver/gold, district-scale VMS camp, located near the town of Palmeiropolis, in Central Brazil. The Palmeiro polis area has excellent infrastructure. The Palma Project was discovered and drilled by the Brazilian Geological Survey and recently acquired by Alvo who have estimated a JORC inferred resource on two of the five prospects, previously drilled in the 1980’s. The Company's ultimate goal is to define a large resource and to become a base metal producer in Brazil.

Alvo Minerals

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in- Chief of Metals News, talking with Rob Smakman, who is Managing Director of Alvo Minerals LTD. Rob, could you give our readers/investors an overview of your Company? What differentiates your Company from others and your vision for the Company and your experience with Brazil and how you're looking forward to moving Alvo Minerals forward?

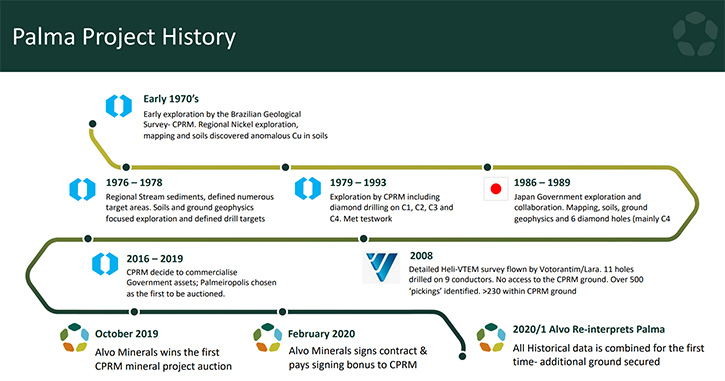

Rob Smakman: Well, thanks Allen. I'll start with the elevator pitch for Alvo. It's a company that's just listed on the ASX. We raised 10 million dollars at 25 cents Australian, but we've been around for a few years now. Alvo was formed when I was working in Brazil and just always cognizant of other opportunities that were available in the market. I lived and worked in Brazil for over 10 years, and during that period, I was at a conference and saw a presentation by the Geological Survey of Brazil. I'm a geologist by background and was attracted to the scope, high-grade nature and the fact they hadn’t worked on the project for a long time. They were talking about potentially selling some of their projects, accumulated over the years. As is often common with a government institution, it took a few years for that to eventuate.

But in 2019, some private investors and I participated in the very first auction that they put together on the Palma project. That's how it came about. We were at the first auction of the projects in Brazil, and we are the lucky winners. So, we've believed in this project for a long time. In February 2020, when we signed the deal, our thoughts changed as it was straight before the COVID crisis hit worldwide. Fast forward a few months and the copper and the zinc price have gone up significantly. So, it kind of worked in our favor in some ways. We've managed to list, raise the money and now we're actively exploring and excited by what we’ve seen to date.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a little bit about your properties and what your thoughts are in moving forward with exploration?

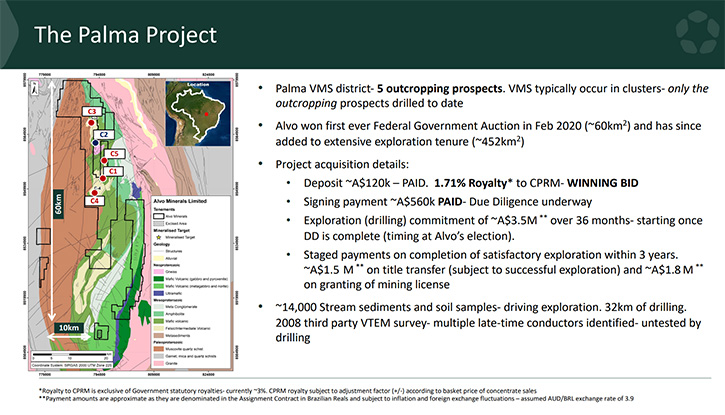

Rob Smakman: Yeah, for sure. The Palma project is over 500 square kilometers of a district that prospective for VMS style mineralisation. The key part of the project was won by Alvo, from the government, which was only 60 square kilometers and the rest of it, are areas that we've acquired for ourselves. the reason that we're so confident that we're going to make a discovery there, is because we know from our analysis of historical data that the Brazilian Geological Survey only found the resources that are actually outcropping on surface. So, where they've had successful geochemistry and geological mapping, they've managed to drill and make some discoveries, all of VMS mineralization. That all happened in the 1970s and 1980s.

The project has largely been idle since then. But one of the real key things that happened in 2008, was that an independent Company flew an EM survey across the district. And that highlighted dozens and dozens of conductors for late time conductors, which could be prospective for all new bodies. Of course, these don't outcrop. So, they were never discovered by the Brazilian government survey at the time, they didn't have access to that data. And so, we think that there's a huge opportunity to marry the signatures of these conductors in the known deposits to exploring for new prospects and new discoveries utilizing that technology. That's why we're really excited about the potential for a new district of VMS in central Brazil.

Dr. Allen Alper: That sounds excellent. Rob, could you tell us a little bit more about your background?

Rob Smakman: I'm a geologist. I studied and graduated here in Melbourne, Victoria, Australia. I've been working in Australia and around the world for over 25 years now, based all over the place. I’ve worked in Australia, but also lived and worked in Africa, Eastern Europe and worked a significant period of time in Brazil where I lived for over 10 years with my family. When I got there, I didn't speak Portuguese. I started up a new Company. I bought some projects and developed them. I put a small iron ore operation into production in Brazil and found over two and a half million ounces of gold. I had a very interesting, successful journey in Brazil, managing teams and building inventories of different resources. My background in geology is technical, but I've also had experience on the corporate side, running companies, raising money, building teams to explore and develop projects into production.

Dr. Allen Alper: That sounds very good. Could you give us more information about other members of your Team or Board?

Rob Smakman: We have a very tight Board; Graeme Slattery is the Chairman. Graeme is a partner in a major law firm, out of Perth in Australia. He's had a lot of experience dealing with mining companies internationally, to the point where he's managed and overseen various privately owned companies around the world. Beau Nicholls is another geologist on the Board. He's non-exec but hands-on and he has lived in Brazil for nine years running Coffey international- a large consultancies for mining and exploration. Beau has managed a lot of projects in not only in Brazil, but South America/Africa/Australia as well. So, we come at it from different perspectives. He's worked on lots of different projects, and I've really focused in on several larger ones. And that combination is extremely beneficial to us.

Then of course, very importantly, we have the team on the ground in Brazil. We have two real key guys, Julio Liz who's my exploration manager, has over 30 years of experience in Brazil and South America. He's a geologist, who has worked for a lot of the major companies, like Anglo American, Xstrata, Codelco, Barrick, but also worked for some junior companies, over the years. So, a great blend of experience. He's worked on VMS style mineralisation, he's worked on gold, and other commodities as well. And then Luiz Noronha a lawyer, who is my Administration Manager over there. I've had a very long relationship with Noronha- you could say he’s been my right-hand man for a long time, and a key in navigating the Brazilian bureaucracy and that's enough of a job as it is.

Dr. Allen Alper: Well, it sounds like an excellent Team, very well balanced and very well experienced and very knowledgeable about working in Brazil. So that's excellent! Rob, could you tell me a little bit about your key plans for exploration 2022?

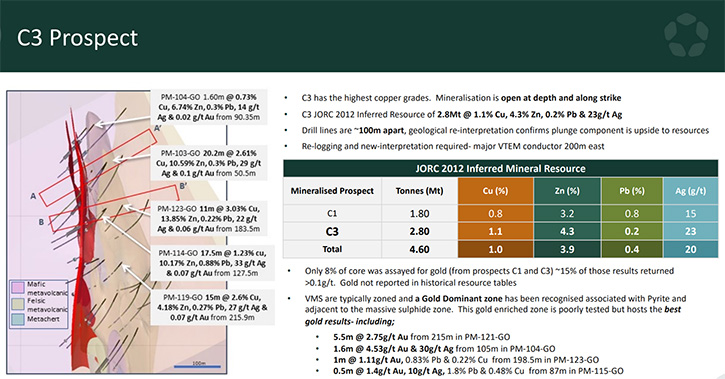

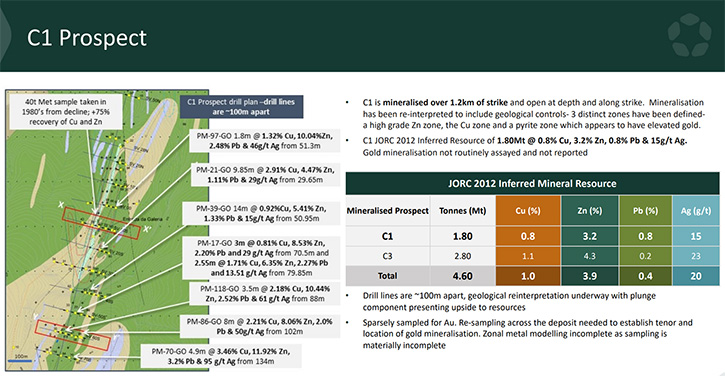

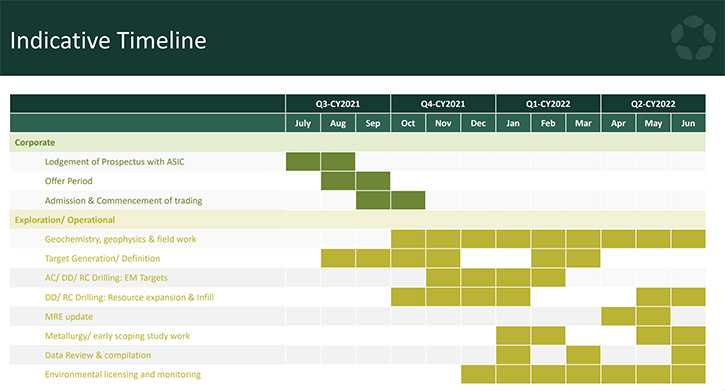

Rob Smakman: I'll start with this year, because we've already kicked off our maiden drilling program. I'm really proud that we listed on the 20th of October 2021, and within a week, we had a first drill rig on site and commenced drilling. Within two weeks, we had our first hit into the C3 target, which was over 20 meters of massive sulfide mineralization - quite a spectacular hit. I managed to be in Brazil for that particular intercept. We're actively drilling and our first drill program is an aggressive 10,000 meters of diamond drilling, mainly on the C3 and C1 targets. We intend to upgrade and expand those resources.

We are also initiating a Fixed Loop Electromagnetic survey across the C1 prospect- this has the potential to allow us to direct target drilling into highly mineralized parts of the orebody.

We currently have an inferred mineral resource on C1 and C3. Combined, they are about 4.6 million tons at 1% copper, 3.9% zinc, with a little bit of lead and silver thrown in. Historically, the CPRM not systematically test for gold. But typically, these systems have gold in their polymetallic makeup. So, we expect to have some gold, and we have some samples in the lab, trying to ascertain what the gold content could be.

We've already initiated our exploration. We've starting drilling at C3. We have started FLEM survey at C1. We are planning on upgrading and expanding those resources at C3 and C1. In fact, we plan on accelerating that drilling, early in the next year, with a couple more diamond rigs on board, to get through the program at a faster pace.

From a standing start, we got up and going very quickly and we intend to accelerate as we go into 2022. In conjunction with the drilling, we plan on doing quite extensive ground electromagnetic exploration - starting at C1. We think that's the correct tool for assisting us with our drilling program, where we think that the new technology that EM has, both fixed loop and down hall surveys, can be quite good for targeting drilling. We are confident the amount of chalcopyrite in the ore bodies is sufficient for us to utilize EM for targeting.

We are quite excited by the combination of ground EM, with diamond drilling, to not only upgrade and expand our drilling, but to make new discoveries as well. So, our first drill program is 10,000 meters. We refer to it as, ‘Upgrade, Expand and Discover’. The "Discover" portion comes once we have the EM on the ground. We have a bunch of targets that we want to drill, but until we build up the geological knowledge, around them, we won't be going there until we're pretty certain that we're going to be drilling new discoveries.

Dr. Allen Alper: Well, that sounds excellent! Sounds like there's great potential! You have a great Team and you are planning on a very extensive drilling program exploration.

Rob Smakman: That's the plan. The 10,000 meters is the beginning. I'm really hoping that we can even expand that as we continue - based on success. But clearly, we'll start with 10,000 and we'll move on from there.

Dr. Allen Alper: Oh, it's great! Sounds like, as you mentioned, the timing is great with prices for copper and zinc strong and the need for those materials and electrification of the world.

Rob Smakman: We have a really strong focus on ESG. When you're operating in an emerging economy like Brazil, it can be easy to make that a secondary part of your strategy. But in our project, we are driving this as a priority. People look at copper and zinc as two of the key metals, moving forward. I know that the US has recently put zinc onto the strategic minerals list. It is a strategic mineral for many companies and countries around the world. ESG (environmental, social and governance) is of more immediate importance to Alvo than electrification- which is a possible result of better ESG management.

In Brazil, we have a really important advantage on our project. That is being the first partnership with the government, where we bought it from the government. They are helping us and holding our hands in terms of our social and government relations, to ensure that we have a really smooth licensing and social licensing part of the equation. It's an important part that's really difficult to quantify, but the local community is really receptive and extremely supportive for our access and for our exploration and potential development route, for the project. Just to give you an example, when we arrived on the ground, only weeks before we started drilling, we needed agreements with the local farmers to enter their areas and to get access to start drilling and exploring. The locals have been really receptive, and we have had no issues to date, they are all hopeful the projects become mines.

It is very easy to talk to people and they've been very receptive. They've actually been waiting for someone like us to come into the town and hopefully turn this from an exploration dream, into a reality. I think that's been an important part. On the environmental side, Brazil has a high percentage of hydroelectric power and in fact, our project is quite blessed in the sense as we're surrounded by hydroelectric schemes. So, I can understand that we'll have renewable and sustainable energy, really close by the project. We're choosing and using lots of recycled plastic and products where we can, on site. So, there’s a real focus already from the exploration team on the ESG side and I know that's really imperative part for us, as well.

Dr. Allen Alper: That sounds excellent. It's great to have the support of the community where you're working. That's excellent! Rob, could you summarize the primary reasons our readers/ investors should consider investing in Alvo Minerals?

Rob Smakman: I think the real reason Alvo should be considered by your investors, is it's an advanced project with a district scale. If you compare us to our peers, we're extremely cheap, we're well funded, we're drilling, we're going to be exploring aggressively, over the next six to 12 months. And I hope that we'll be able to expand, upgrade and make new discoveries on our Palma project.

Dr. Allen Alper: Oh, that sounds excellent! Is there anything else you'd like to add?

Rob Smakman: I think that's the basic summary of Alvo - a funded, aggressive Brazilian base metals explorer with a district scale opportunity. We do have another project to the Southeast, prospective for nickel-copper-cobalt, PGEs. It's a layered intrusion, with some interesting stream sediment sampling across it. It's a very early-stage project and it hasn't been granted by the government yet. Once it has been granted, which we expect in Q1 next year, we'll initiate some exploration there, and we'll be looking for massive sulfide nickel, copper, cobalt and PGE’s. Yes, it's early stage, but it's the extension to an area called Niquelandia, which is further to the south. Niquelandia literally translates to "Nickel land" and it's been the source of mining for tens of years. It produced the majority of Brazil's nickel, through nickel laterites. We won't be exploring for laterites in our area, but we think the rocks are prospective for the sulfides. It's an early-stage project, but hopefully one to which shareholders will gain exposure, in the new year.

Dr. Allen Alper: Well, that all sounds like very strong reasons to consider investing in Alvo Minerals. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://alvo.com.au/

Rob Smakman

Managing Director

Alvo Mineral Limited

rob@alvo.com.au

+61 491 260 374

|

|