Blake Morgan, CEO, Opawica Explorations Inc. Discusses Its Strong Portfolio of Precious and Base Metal Properties, in Rouyn-Noranda, Abitibi Gold Belt, Québec and in Central Newfoundland and Labrador

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/22/2021

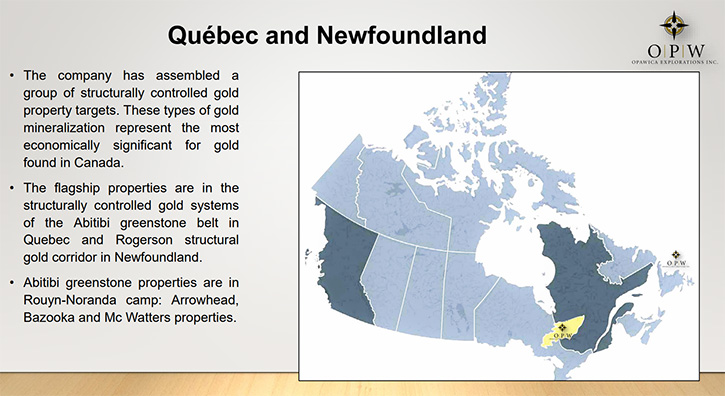

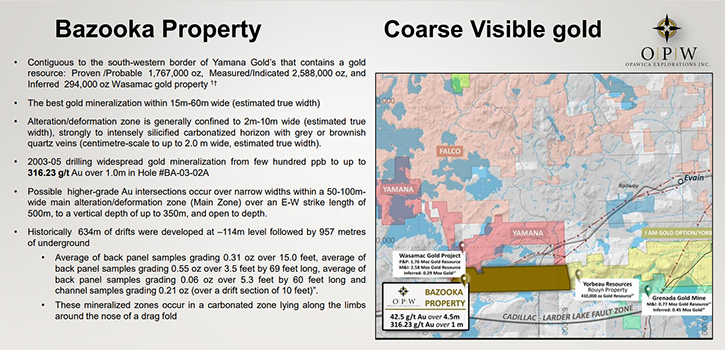

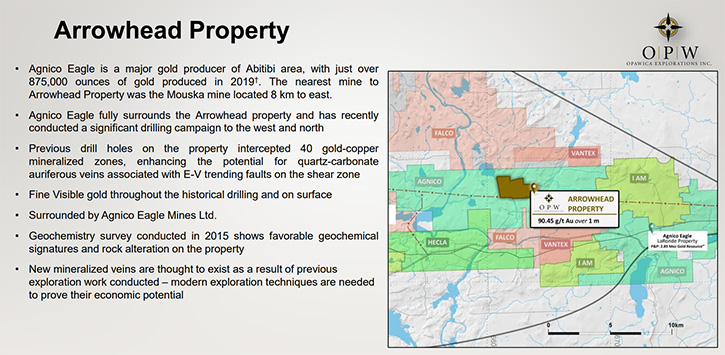

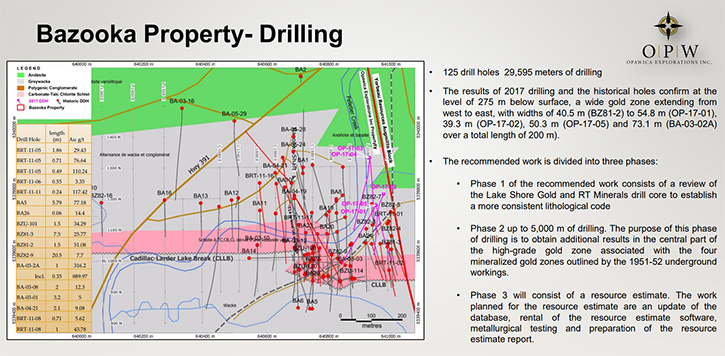

We spoke with Blake Morgan, CEO of Opawica Explorations Inc. (TSXV: OPW, FSE: A2PEAD, OTCQB: OPWEF), a junior Canadian Exploration Company, with a strong portfolio of precious and base metal properties, within the Rouyn-Noranda region, of the Abitibi Gold Belt, in Québec and in Central Newfoundland and Labrador. This summer, Opawica raised 5.3 million dollars, with a lead investment from Eric Sprott, and they are starting a very robust 10,000 meters drilling campaign, at their 100% owned Bazooka property that occupies seven kilometers of strike length, along the prolific Abitibi Greenstone Belt, on the Cadillac Larder Lake Break. The Company is working closely, with GoldSpot, on target generation. Opawica’s other significant property is the Arrowhead property, completely surrounded by Agnico Eagle, a major gold producer of the Abitibi area.

Opawica Explorations Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Blake Morgan, who is CEO of Opawica Exploration. Blake, I wonder if you could tell us a little bit about your Company, give us an overview, and also tell us what differentiates your Company from others and about your properties in Newfoundland and, and also Quebec.

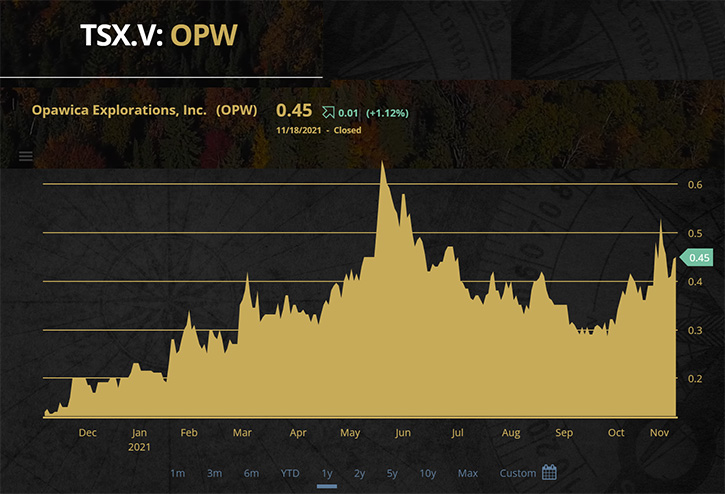

Blake Morgan: Certainly Al, thanks for having me on. Opawica is a junior Canadian exploration Company. We have a strong portfolio of assets in the Rouyn Noranda camp, on the Abitibi gold belt, in Quebec. We also have 40,000 hectares in the new gold rush zone of Newfoundland. In June, we recently raised 5.3 million dollars, with a lead investment from Eric Sprott, who put in about 1.6 million dollars and the raise was done at 40 cents, with a half warrant at 60 cents. Then we did some flow-through at 50 cents, with a half warrant at 60 cents. We only have 37 million shares out, so we're very tight. We put that capital together and we're well funded. Now we're moving towards a very robust drilling campaign, on Bazooka property, in the Abitibi. What we have there, is something quite substantial.

We have a high-grade zone that we're going to be attacking. We also have seven kilometers, of the Cadillac ladder fault zone, to explore. We're going to be drilling that high-grade zone. At the same time, we're going to be exploring the other seven kilometers and looking at how big we can expand. Our deposits are open in every direction, except the east. So, we have a fair bit of room to grow. On top of that, we have a beautiful asset, called the Arrowhead, completely surrounded by Agnico Eagle. We are looking to drill that asset also, later on in the year. That's what we have around the Abitibi.

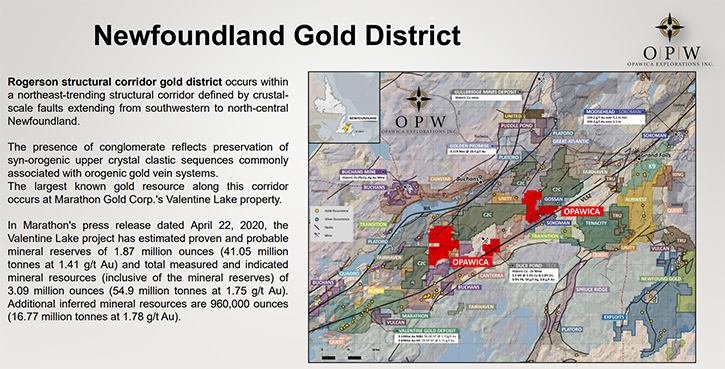

We also have our 40,000 hectares, in Newfoundland. There we're methodically taking our time. We've just recently done about a six-week program, and we did some till and sediment samples. We're going to move in and do some mag and some other geophysics, and we'll look to drill some of those properties next year. We're well-funded. We're looking to drill 10,000 meters on the Bazooka, starting in the next few weeks, and then we're going to move to drill around 5,000 meters on the Arrowhead project. That's about where we are at the moment.

Dr. Allen Alper: It sounds great! It sounds like it's an exciting time for your stakeholders and shareholders. Could you give us a little more detail on your exploration plans, going forward?

Blake Morgan: Certainly! We've recently started an airborne survey over our Bazooka property, Arrowhead property, and the McWatters property. We're doing a bit of geophysics there, to have a look at this structure and look through the ground. We're also doing a deep-seated, seismic survey on the Arrowhead property, just so we can get into the nuts and bolts of things and really look at what we're attacking. That's what we're doing in the Abitibi. In Newfoundland, we're doing something similar. We're waiting for assays to come back from our rock chip sampling and our soil, and then we'll also move to do some geophysics in there. The plan, with the Bazooka, is pretty straightforward. We originally were going to drill around 5,000 meters, but things are progressing much better than anticipated, and we're going to upgrade that to over 10,000 meters now.

We just recently put out news, with 14 high-priority drill targets. That's just the tip of the iceberg. So, we're first going to start attacking them and we're hoping to start drilling, around the start of December, maybe even close to the end of this month. We'll first attack those 14 high-priority, drill target types and then we expect more high-priority drill targets to come in as GoldSpot, use that other technology and do some data compilation. We also have an agreement with GoldSpot and they're working very closely, with our geological Team, to come up with these high priority drill targets. Because we are fully funded and we have over 5 million dollars we recently raised, we can do quite a large robust drill program and we plan on doing just that.

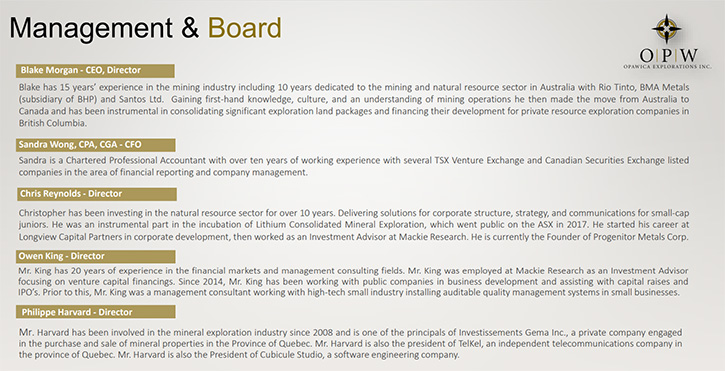

Dr. Allen Alper: Oh, that sounds excellent! It must be a great time for your Team, getting ready to drill, getting ready to do extensive exploration and being well-funded. My understanding is that you have a very successful and accomplished Team. I wonder if you could tell us a little bit about yourself, your Team and your Board?

Blake Morgan: Yes, certainly. I've been involved in the mining industry for some time now. My father worked for Rio Tinto for over 40 years and that's where I started. I spent my first six years in the mining industry, with Rio Tinto, working in Australia. There I learned my craft and I moved over and started working with BHP. I spent about three years, with BHP and then moved on to Santos oil and gas. I spent around two and a half, nearly three years with them. I have about 10 years with the majors under my belt. I've taken that experience, knowledge, and connections over with me, to Opawica. I took over the Company back in early 2020 and we've really started to develop something. We've put a bunch of new assets in, we've raised a bit of money and things are going quite well. We also have a couple of other Board Members. We have Owen, who used to be a broker at Mackey research. He was one of the head research analysts there. So, we have him working in the industry. He's been involved in mining for over 25 years, so he's really helping out. A lot of his groundwork is helping us get the knowledge we need to go a bit further. So, there's a bit of background on our Board.

Blake Morgan: Certainly, certainly. My father worked for Rio Tinto for about 40 years and that's where I got my start. I spent my first six years in the mining industry, working for Rio Tinto throughout Australia and building up my craft and knowledge. From there I stepped out of Rio Tinto, and I moved over and started working with BHP. I spent around three years with BHP, throughout Australia. From there I moved on to Santos oil and gas and spent around two and a half years with them. So, I have over 10 years with the majors, under my belt and, I've learned the craft and gotten the connections and I've moved that over to Opawica. Since taking over Opawica, we've gone from a small company, not doing too much, to raising 5 million dollars, acquiring some phenomenal assets in our portfolio and obviously we're going to be drilling them soon. We also have Owen. Owen is one of our Directors. He used to be a researcher for Mackey. He was a quality broker, so he has a lot of background knowledge. We're using Owen extensively to help us take those few extra steps that we need to, to get the results that we want. That's a bit of background on myself and one of our Board members.

Dr. Allen Alper: That sounds excellent. Great experience, great track record. That's excellent. You have fantastic properties. Could you tell our readers/investors a little bit more about your share and capital structure?

Blake Morgan: Certainly can. What's exciting about Opawica is that our share structure is phenomenal. We only have 37 million shares out, we're fully diluted. We're sitting around 46 million. We have 6 million warrants at 60 cents. We have a few options and we have 1 million warrants at 30 cents. There are no cheap shares with us. Our last financing was done at 40 and 50 cents, with a half warrant at 60 cents. So, the thing about us is we're very tight. We don't have any 5 or 10 cent papers coming back to us. We're a very well-structured Company, well-funded Company and we're sitting in a good predicament.

Dr. Allen Alper: Ah, that's excellent! You're in a great position! Enviable! Very few juniors are in your position. So that's really great! Blake, could you highlight the primary reasons our readers/investors should consider investing in Opawica Exploration?

Blake Morgan: Yes, certainly. Our share structure is definitely impressive, but what we have is unlike some other companies, we're not just a green field. The Bazooka property is a bit of a brownfield. We have over 30,000 hectares, drilled into this property, and we have some absolute monster grades. For example, we have 77 grams over nearly six meters, 25 grams over nearly eight meters, eight grams over 20 meters and seven grams over 17 meters. So, we already have a large established deposit there. We have capital to expand on that, and that's what we plan on doing. And that's just one of the properties. We also have the Arrowhead property, where we have 90 grams over a meter, surrounded by Agnico Eagle, who is drilling about 200 meters from our border. We have a fair bit of excitement there. Then if we step over into Newfoundland, there's a bit of a gold rush going on there.

We were lucky enough to move into that region before the gold rush happened. We picked up some phenomenal ground. Not only do we have our brownfield area, which we are going to be drilling, expanding, and trying to put out a resource. We also have the beautiful greenfield area of Newfoundland, which we are going to slowly work those properties up methodically, do the proper work, do the geophysics, and then we'll look to drill those properties next year. With a good cast position, a tight share structure, some phenomenal grades, I think Opawica is a fantastic choice for investors to look at.

Dr. Allen Alper: Well, those are very, very compelling reasons for readers/investors to consider investing in Opawica Exploration. You have a great Team! You are well funded. You have two areas of great properties, great potential and the money to explore it. That's excellent! You also have very strong backing. That sounds excellent, Blake. Is there anything else you'd like to add?

Blake Morgan: Well, I'd just like to say thank you for having me. It's been great chatting with you. I implore investors out there, just to go and have a look at Opawica. Look at the press releases, we've been putting out. Have a look at our structure. Have a look at our grades. I think it will be a very compelling story for people to really get involved. We look forward to bringing some more shareholders and investors into Opawica.

Dr. Allen Alper:

Oh, that sounds excellent! We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://opawica.com/

Blake Morgan

President and Chief Executive Officer

Opawica Explorations Inc.

Telephone: 604-681-3170

Fax: 604-681-3552

|

|