Luke Gleeson, Head of Corp. Dev., Bellevue Gold Ltd (ASX: BGL) Discusses Bellevue Gold Project, One of the Highest-Grade and Fastest-Growing Gold Projects in Australia, Advancing to Gold Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/18/2021

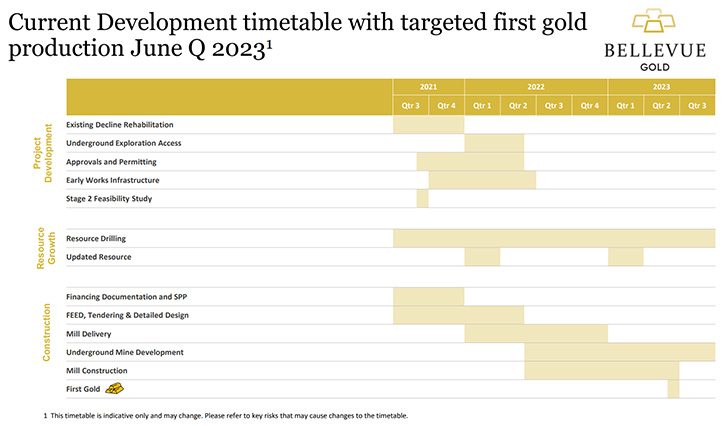

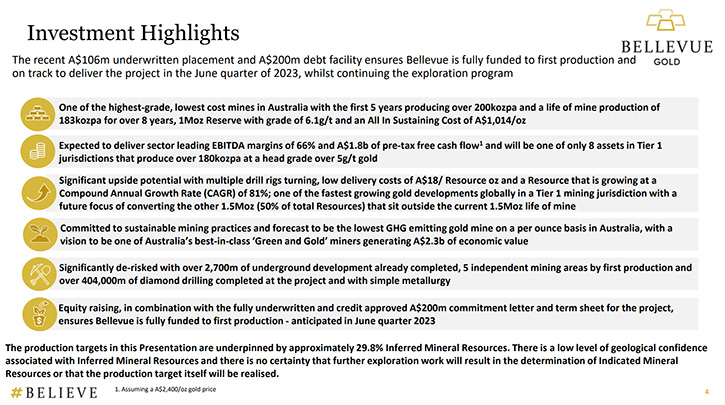

We spoke with Luke Gleeson, who is Head of Corporate Development of Bellevue Gold Ltd (ASX: BGL). Bellevue Gold Ltd. has discovered an exceptionally high-grade gold system, in the world-class Goldfields mining district, of Western Australia. The Bellevue Gold Project is one of the highest-grade and fastest-growing gold projects in Australia, and the Company is advancing to gold production. We learned from Mr. Gleeson that, over the last four years, Bellevue defined a three-million-ounce resource. The deposit is still open in every direction, providing for excellent upside potential. Last month, the Company announced an updated feasibility study, according to which, the project will generate free cash flows of around $1.78 billion, in the first 8.1 years of the mine life. Bellevue Gold is expecting first gold production in Q2 2023.

Bellevue Gold Ltd

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Luke Gleeson, Head of Corporate Development, Bellevue Gold. Luke, I wonder if you could give our readers/investors an overview of your Company, your great gold resources that you have in Australia, and also your plans to move into production. What differentiates your Company from others?

Luke Gleeson: The best way to describe the project and catch people up on the last three-and-a-half, close to four years now at Bellevue, is that what we've discovered is effectively one of the highest-grade gold discoveries in Australia, in recent years.

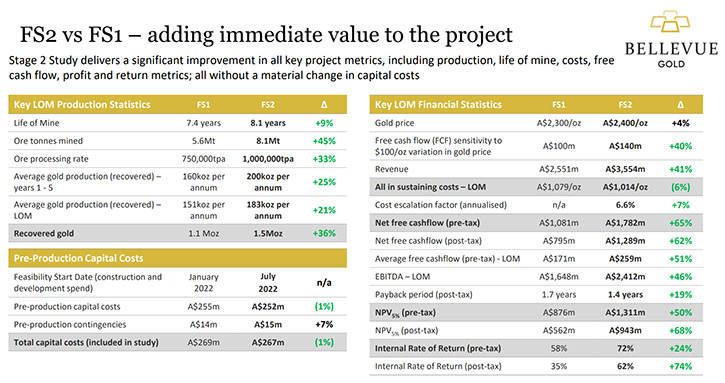

Over the last four years, we've been able to define a three-million-ounce resource. And last month, we announced an updated feasibility study that will see the project effectively generate undiscounted, free cash flows, of around $1.78 billion, in the first 8.1 years of the mine life.

The project itself will have an average production rate of over 200,000 ounces, for the first five years of the mine, sustaining costs of 922 Australian, and an average life of mine gold production rate of 183,000 ounces per annum, recovering 1.5 million ounces in the first 8.1 years.

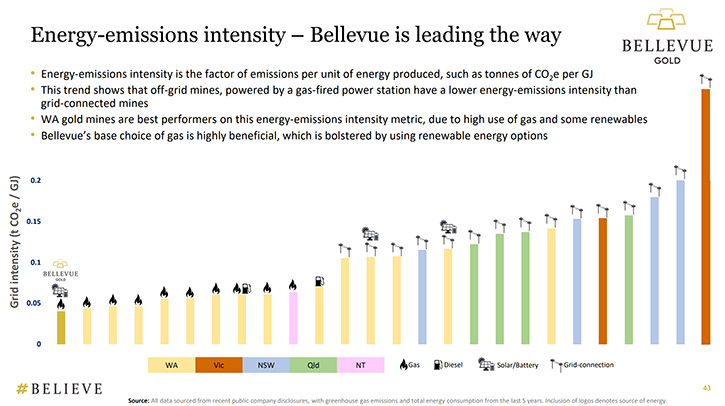

Of all the loads that we've defined at the project, they all remain open in every direction. And it's literally a function of us doing further drilling conversion work to convert the other 1.5 million ounces that currently are not in the mine plan. The internal rate of return, at the moment, is running at a very impressive, on a pre-tax basis, 72%, and then on a post-tax basis of 62%. The project's going to generate an EBITDA margin of over 66%. So, we'll be certainly one of the most profitable mines in Australia. And to look at the ESG credentials as well, we'll be positioned as the lowest emitter, on a per ounce basis, of any mine in Australia, when we go into production, with the view that we want to continue to cut those emissions on that pathway to production. So, a very exciting time for us, Allen.

Dr. Allen Alper: Well, that is exciting! It's great to have such an excellent project, an outstanding project that has such huge resources. And it's still a big opportunity to greatly increase the resources and also to have low costs and great infrastructure.

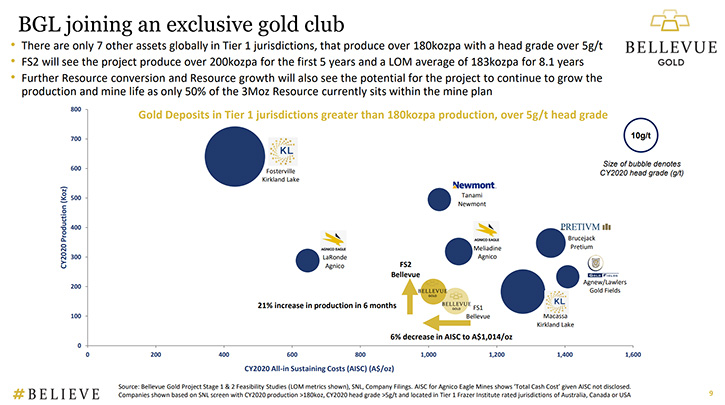

Luke Gleeson: Yes, it is! The capital intensity at the project, of all developing mines across the globe (when looking at the project itself) will have the lowest level of capital intensity, of any mine going into production. To give you an idea. We are looking at the Tier One jurisdictions, as rated by the Fraser Index, consisting of America, Canada, Australia, and Mali. There are only seven other mines, on the globe, that will be producing over 180,000 ounces at an overall head grade of five grams per tonne, and we'll be joining that exclusive club. So, it's pretty exciting here at Bellevue. There'll be further growth, on that pathway to production, as we go through the drilling. There are a lot of competitive advantages that we're continuing to exploit at the project.

Dr. Allen Alper: Oh, that's excellent! I know you're fully funded. Could you tell our readers/investors a little about that? And also, what are your goals to be into production?

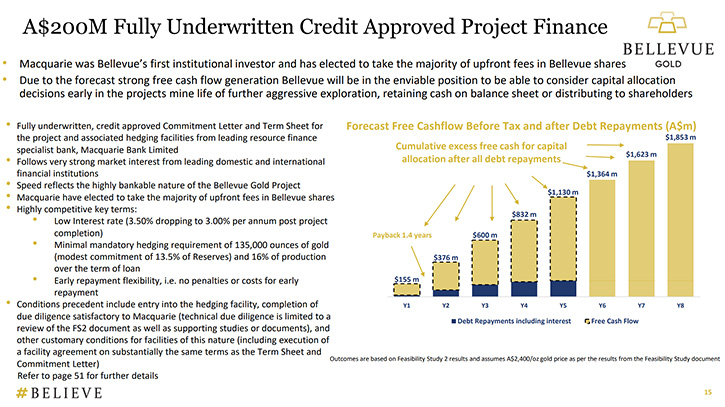

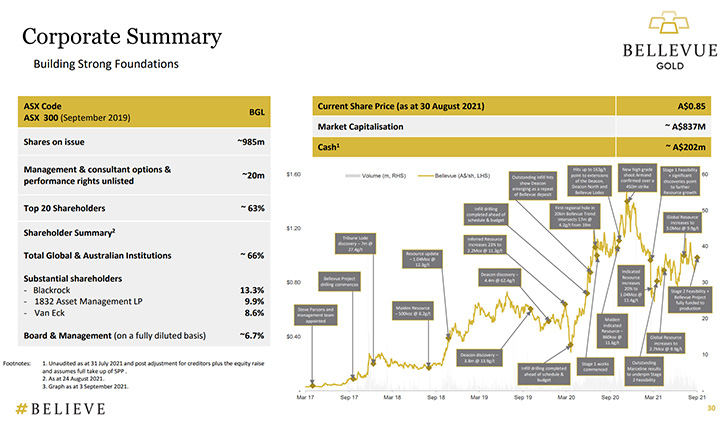

Luke Gleeson: From a funding point of view, we were able to secure a $200 million funding facility, from Macquarie Bank. From a debt perspective last month, Macquarie Bank is taking a large amount of their fees in equity, which is really positive for us and indicates their belief in the project. In terms of the funding, we had $106 million share placement last month. We're currently in the process of a $25 million share purchase plan that's still going through. But from a funding point of view, at the end of that process, we'll certainly say it's fully funded. So very exciting! A very exciting time for us!

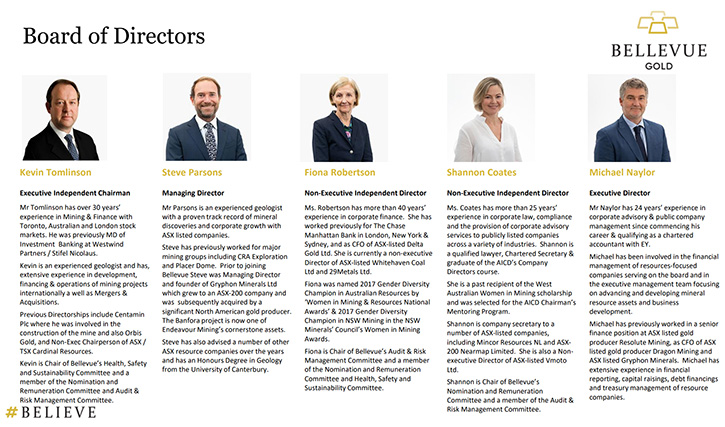

Dr. Allen Alper: Oh, that sounds fantastic. Could you tell our readers/investors a little bit about yourself, the Management Team, and the Board?

Luke Gleeson: The business' Managing Director is Stephen Parsons. Stephen had a lot of success with Gryphon Mining and the Banfora Discovery in West Africa, that's now one of Endeavour mining’s flagship assets, our Head of exploration, Mr Sam Brooks and Mike Naylor, our CFO all worked together at Gryphon. Craig Jones, our COO, and I previously worked at Northern Star Resources, another success story in Australian mining. In terms of the Board, we have Kevin Tomlinson, as Chairman of the Board. Kevin has had a lot of success in his career and has been very successful, as a geologist, who's now our non-executive Chairman. We have a very strong and capable Board, in Fiona Robertson and also Shannon Coates. From gender diversity, we're leading the Australian resources sector in diversity. We're trying to tick every box, here at Bellevue, on the Pathfinder production, which is really exciting.

Dr. Allen Alper: Well, that sounds excellent. And my understanding is your environmental impact is going to be minimal, compared to most mining companies.

Luke Gleeson: Yes. Being an underground gold mine, we are certainly blessed by a very low surface footprint. Also, from a perspective of power, and also greenhouse gas emissions, we are forecast to be the lowest emitting mine in Australia, which is really exciting. We have a goal to continue to push that even lower, from an emissions perspective, as well as in the business. We're certainly committed to it and we're very excited about the opportunities that presents.

Dr. Allen Alper: Well, that sounds excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Luke Gleeson: Yes. BlackRock is our largest shareholder. The main position there is run by Evy Hambro and as the world's largest resource investor, Blackrock owns 13.3% of the Company. That speaks volumes. 1832 asset management, out of North America, owns 10%run by Rob Cohen and Van Eck, another household name in resources. Joe Foster owns half of his 8.6% position, in their active fund and half in the ETF Fund. Board and Management owns 6.7%, so certainly aligned for success there. And I think currently there are 985 million shares on issue.

Dr. Allen Alper: It sounds excellent. That's nice to be well-financed.

Luke Gleeson: It is, yeah.

Dr. Allen Alper: And have such great backing.

Luke Gleeson: Yeah, thanks Allen.

Dr. Allen Alper: Could you tell us the primary reasons our readers/investors should consider investing in Bellevue Gold?

Luke Gleeson: Great question, Allen. I think that the main primary drivers there are competitive advantages that the project has on offer, and we will continue to exploit them. We will be Australia's next green and gold miner. One of the most profitable mines in Australia, and also one of the greenest. Further growth of the project, in terms of resource growth, as we move into production, with further drilling, you'll see more growth. A strong ESG focus, the forecast to be the lowest greenhouse gas emitter of any mine in Australia and a very healthy profile and cash position of around $168 million. So, it's really positive!

Dr. Allen Alper: All those are a very compelling reasons for our readers/investors to invest in the Bellevue Gold. Is there anything you'd like to add, Luke?

Luke Gleeson: I think that's a good summation Allen, and I do appreciate your time.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.bellevuegold.com.au/

Mr. Luke Gleeson

Head of Corporate Development

T: +61 8 6373 9000

E: lgleeson@bellevuegold.com.au

|

|