Stephen Wilkinson, President and CEO, Gold’n Futures Mineral Corp. (CSE: FUTR, FSE: G6M, OTC: GFTRF) Discusses Advancing its Flagship Hercules Gold Project, in the Heart of the Prolific Beardmore–Geraldton Gold Mining Camp

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/16/2021

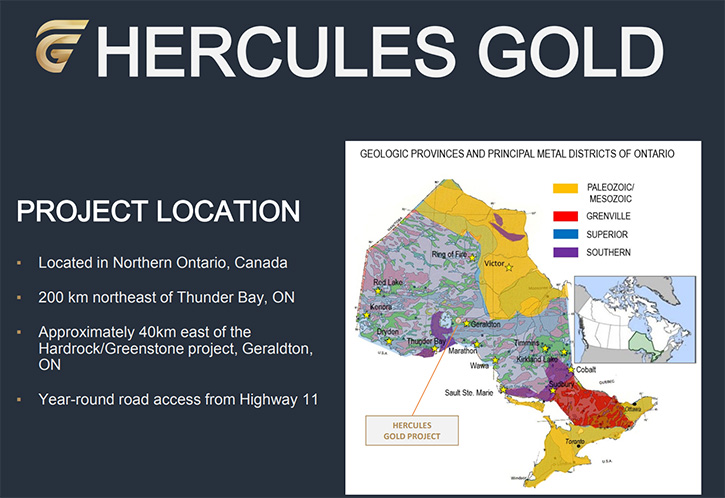

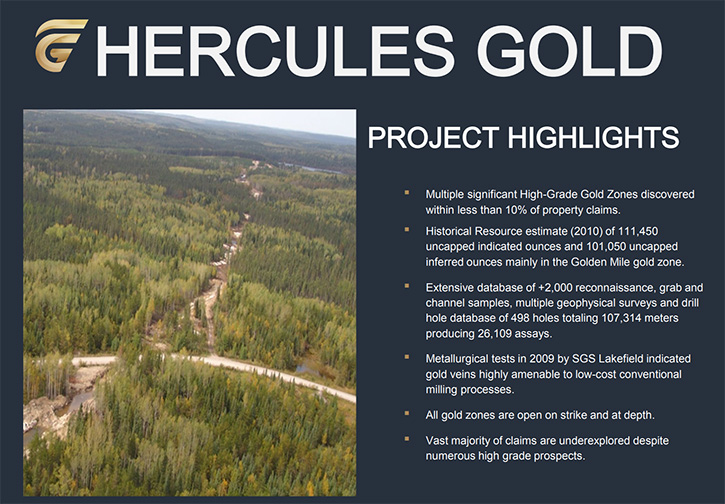

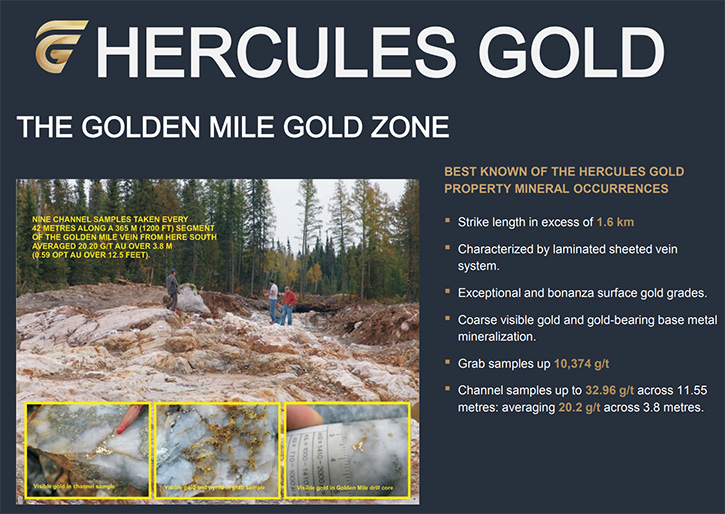

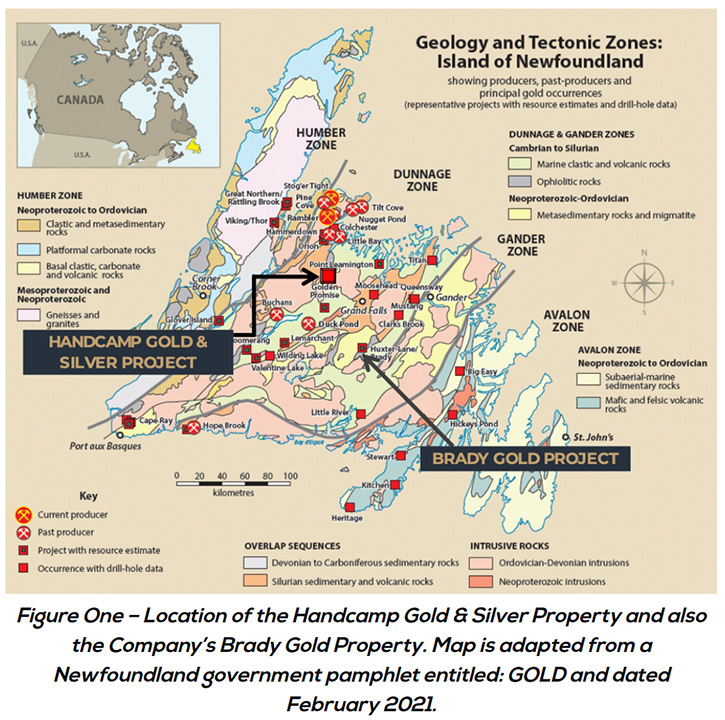

We spoke with Stephen Wilkinson, President and CEO of Gold’n Futures Mineral Corp. (CSE: FUTR, FSE: G6M, OTC: GFTRF). Gold’n Futures is a Canadian based exploration company, focused on advancing its flagship Hercules gold project, located 200 kilometres northeast of Thunder Bay, Ont., in the heart of the prolific Beardmore–Geraldton gold mining camp. Gold’n Futures has built an extensive historical database that includes surface grab samples, grading up to 10,374 g/t gold and channel samples, up to 32.96 g/t gold, across 11.6 metres at the Golden Mile Zone. We learned from Mr. Wilkinson that this summer the Company brokered financing with Canaccord Genuity Corp. and raised about $2.8 million. Gold'n Futures has recently engaged GoldSpot Discoveries consulting group, which uses their proprietary artificial intelligence to locate high-probability gold targets. The Company's other properties include the Brady Gold project in central Newfoundland, and the Handcamp Gold & Silver Property in the Buchans-Roberts Arm Volcanic Belt, Central Newfoundland.

Gold’n Futures Mineral Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Stephen Wilkinson, President and CEO of Gold’n Futures. Steve, could you give our readers/investors an overview of your Company and tell them all the different and interesting things that have been going on, since we spoke in April?

Stephen Wilkinson:Gold’n Futures is a relatively new company, so every day we see things happening and the Company moving ahead. Since we talked last, the most important item that we've completed was a brokered financing with Canaccord, here in Canada. They raised about $2.8 million for us during the summer. Of course, if anybody is familiar with the junior resource market, during the summer, normally it's a pretty quiet and difficult time. With COVID, it was just an unbelievably difficult time. But the folks at Canaccord came through like real pros and we are actually oversubscribed on that financing.

Dr. Allen Alper:

That’s great. People must have understood the potential of your great properties in Canada, Ontario.

Stephen Wilkinson:

Well, exactly. Our principal property is called Hercules, and Hercules is situated in the Beardmore - Geraldton gold camp, in north central Ontario, just east of Lake Nipigon and north of Lake Superior. The Trans-Canada Highway bisects the belt. At the east end of the belt is the town of Geraldton, a gold mining camp town, and the site of the Greenstone Hard Rock mine development, that is building on a multimillion-ounce reserve that has been discovered and developed around a series of old mining operations. We're in the middle of the Beardmore-Geraldton belt, in the Hercules, about 40 kilometers to the west of Geraldton.

Our property is a fairly large property, it's over 11,000 hectares and it encompasses a number of gold showings. But most spectacularly, there is what we call the Golden Mile Zone. The Golden Mile area is pretty much in the center of the Hercules property. It's an intrusive hosted gold mineralization, but it's incredibly high-grade in places. It was discovered in about 2006-2007 and explored in very great detail by a company called Kodiak. Kodiak merged with another company, Golden Goose to become Prodigy, which was bought by Argonaut. Argonaut is the company from which we've optioned the property and Argonaut is a good mid-tier, mid-sized gold producer, which is currently focused on the development of a new gold mine, called Magino.

For our purposes, this Golden Mile zone, within the Hercules, is very, very attractive. It's been traced for about 3,000 meters in strike length. It has a number of secondary veins around it, about a dozen. But within the Golden Mile, there's a very good zone, with a global resource of about 220,000 ounces, in about a million tonnes of vein. Within that 3,000-meter strike length is only about 400 meters of that strike length that contains that gold resource. Not only is there strike potential for the Golden Mile gold zone, but there is parallel vein potential, and all of that lies only in about 5% of the property.

Since you and I last talked, we've been doing a great deal of work around the property, looking at the historical geophysics, some of the old work that was done there and have started identifying other prospective areas, within the property. And there's probably what I feel is a likelihood of being four similar style zones to the Golden Mile. They're represented by good geophysical signatures, good alteration signatures and in a couple of instances, gold grains, actually, in the overlying glacial overburden. I see Gold’n Futures will be very, very busy, exploring the Hercules Property.

Dr. Allen Alper:

Oh, no, not at all.

Stephen Wilkinson:

I just have one thing to say about the exploration on the Hercules that I think is very important. We've recently engaged a company called GoldSpot Discoveries. GoldSpot is a very interesting consulting group, which has been developing its own artificial intelligence programs, to basically look at all the data available for mining properties and then vector in on the zones that they feel would be high priority drill targets for gold and other styles of mineralization.

If anybody's familiar with some of the exciting things that have been going on in Newfoundland, the Company, Newfound Gold has been very successfully applying the programs from GoldSpot. Newfound Gold has a number of very exciting discoveries, based on the recommendations of GoldSpot. So, we think that we have a similar type of situation here, where we have an interesting layering effect of geology, geophysics and geochemistry, which should fit right into the programs in GoldSpot. GoldSpot has starting work on our Hercules property. So we're looking forward to that, as getting away from just the traditional prospecting, and looking at some of the applied good science, to make more discoveries.

Dr. Allen Alper:

Well, that's excellent, I spoke to Denis Laviolette of GoldSpot several times. I'm very impressed with his Company and what he's been doing. So, you're in good hands.

Stephen Wilkinson:

Well, thank you, I like to hear that because it gives us encouragement that we're going down the right path. Denis is very wise and a very good scientist, there's no doubt about that. The crew, that he's assembled, are very bright, younger geoscientists and geophysical scientists that are coming to the table here to contribute.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about your Brady project?

Stephen Wilkinson:

The Brady Project is in central Newfoundland, and it's actually in the same belt as Newfound Gold. It is about 1,000 hectares in size. It hosts another intrusive-hosted, gold occurrence. It has about 175,000 ounces of gold, as an inferred resource, within the area that's been drilled. There have only been about 30 holes, compared with the Hercules, where about 500 drill holes have been put into the property. The Brady has a number of geophysical targets right now. We will probably have GoldSpot take a look at that property with us.

The Brady gold zone is a geophysical target, it's not well represented in surface occurrences. It's on a major structural break that tends to welcome gold mineralized solutions. We're going to be doing a program this year, assembling the historical data, building-out a layered model, between the geology, geophysics and the mineralization grades that we have there. We're building the database, to bring GoldSpot on, to take a look at that.

It’s also a very interesting gold target. It has a lot of attributes of the huge deposit in Alaska, Fort Knox. I don't know whether or not it would be that kind of size. But certainly, it has some very interesting potential. It could well, with where it sits, with excellent access, be another easy one to move into a more advanced stage, even a development stage, with a bit more work.

Dr. Allen Alper:

Well, it's great that you have two excellent projects and great locations, and you have the assistance of a great Company working with you. It sounds like you have everything going for you and you are now well-funded from Canaccord.

Stephen Wilkinson:

We do have a very large third property, of about 300 mineral claims. It's also in Newfoundland, but it's in the Buchans Volcanic Belt. If any of your readers/investors are familiar with the old Buchans Mine, that was probably one of the highest-grade base and precious metals mines, in North America, during its life. It was principally zinc-copper and silver-gold. We're in the same belt, with the 300 claims containing five or six very good, strong, gold-base metal showings.

We've just finished a geophysical assessment of the structural geology. We have follow-ups on approximately 14 targets that we have to look at. So, it's going to be an interesting blue-sky property for us, as we go forward here. In other words, I won't have any days, with nothing to do.

Dr. Allen Alper:

Well, that's excellent. It's great to be in that position. I recently did an article on Sokoman, and Newfoundland has become a really hot spot for gold discovery. That's great.

Stephen Wilkinson:

Exactly, and it's one of those things where history has now favored the junior explorers that have gotten into Newfoundland, which was historically tied up in land grants. It wasn't until about 50 years ago that most of that land was released for staking. There's still more land that's coming available and we're learning a huge amount about the mineral attributes of Newfoundland. It's a very well-endowed island. It's where I can see many, many mines being built, and the island could become one of the wealthier areas of North America because of that.

Dr. Allen Alper:

That sounds excellent. It's wonderful to have such great projects to go forward, in such excellent areas. Steve, you have a great background and great experience. I wonder if you could tell our readers/investors a little bit about that and some of your Team.

Stephen Wilkinson:

I've been involved in in mining, in one way or another, since I was 19 years old, before I went to university. My first job was Bethlehem Copper Corporation, which operated one of the mines in the Highland Valley in 1971. That now is one of the main assets of Teck Corporation, in the Highland Valley. Teck incorporated three previous producers into one giant pit.

Since then, I received my bachelor’s degree from the University of Western Ontario and master's degree in Geology. Then I attended Clarkson University, in New York State, to get my MBA in finance & marketing. I used that background to work within the finance industry for about a decade, as a mining analyst, both for small boutique firms, out of England, here in Vancouver, and then ultimately finishing that career, working for Royal Bank of Canada, at Dominion Securities.

Dr. Allen Alper:

That's an excellent background, that's really great!

Stephen Wilkinson:

Well, you can say one thing about me. I really liked going to university. I enjoy learning and I think everybody should always be enjoying what they can learn, every day they are alive.

Dr. Allen Alper:

I agree. Learning is a great experience! Broadening yourself in different fields is excellent. Geology is a wonderful field. I have always enjoyed it.

Stephen Wilkinson:

I always described geology as the artsy side of science and technology. Because you really have to use your imagination to think in three dimensions, in order to appreciate what the rocks are telling you, when you stand on an outcrop.

Dr. Allen Alper:

That's great. I went to Columbia University and one of the buildings there said, ‘Speak to the Earth and it will teach you.’

Stephen Wilkinson:

That is an excellent way of looking at it. I think I should mention Walter Hanych. Walter is our Lead Geologist. He's also a Director of the Company, with at least 40 years of applicable exploration, development, and mining background. He's overseeing the setting-up of our programs and masterminding how we go forward. He has been hiring some of the consulting groups that we have working, on the ground, right now at the Hercules.

We have three geologists at the Hercules right now. Two senior geologists and a junior prospector level geologist. We're going to be having a driller on site, probably within a week. We have just about all the core, from approximately 500 holes, in good condition and stored in a secure location on the property. We're going to be engaging the geophysics teams, both the ground geophysics such as IP and airborne geophysical surveys, which we hope to have done by the end of November.

Very soon, our diamond drilling permits should be in, and beginning in November, we should be commencing our first thousand meters of diamond drilling, as infill on the Hercules Golden Mile. We're going to have quite a crew of people up there. We're hoping that we can engage a lot of our local stakeholders. We have at least three First Nations Bands, from whom, we can source some of our people. With my history of working in the area around Beardmore, we had a very large contingent of men and women from all different backgrounds. I felt very, very pleased to have some of those people brought in from the local neighborhoods, because they have a vested interest in seeing the development of the countryside.

Dr. Allen Alper:

That sounds excellent!

Stephen Wilkinson:

In terms of what we're going to be doing, going forward, Gold’n Futures is going to expand its head office. We’ll be looking at adding a Communications Specialist to help us get the press releases and news communicated to the investment community and our shareholders. We'll probably expand our accounting group, as we get busier and busier. I'm anticipating where this company should be growing, with the data we generate at the Hercules and at the Brady. And ultimately, I'm hoping we can find some very progressive young people to take over the Senior Management of the Company, because this will be a very busy and growing group.

Dr. Allen Alper:

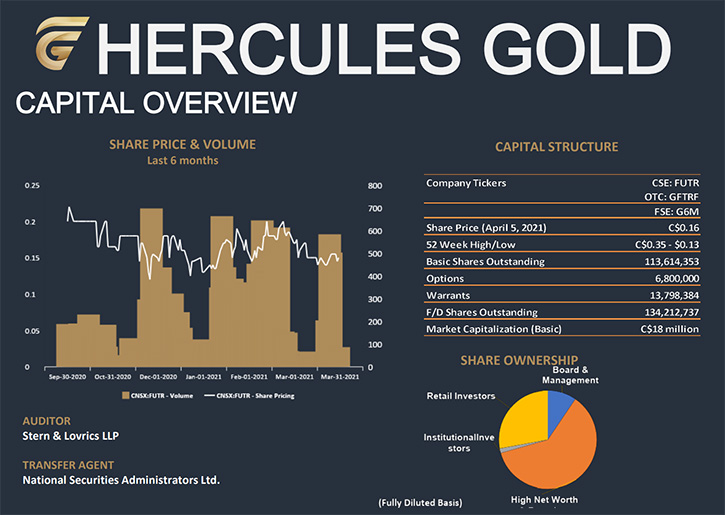

Oh, it sounds like you have great properties and great locations and are assembling a great Team. It sounds excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Stephen Wilkinson:

With the latest raise, where we started out with fully diluted shares, outstanding warrants, and options of about 134 million shares. If you consider the fully diluted cash in the Company, we would be also at $7 million or so on the same basis. So, we're starting to get a fair number of shares outstanding. But of those shares, myself and the Board and our Founders still control about 60% of the issued and outstanding of the Company. The institutional holding is about 5% and the remaining 35% would be in the hands of retail investors.

Dr. Allen Alper:

Well, it's good to see Management and the Board have skin in the game and believe in the project and be willing to invest, along with shareholders and stakeholders. That's excellent!

Stephen Wilkinson:

Well, that's the best way to have it, too. Any Company that has a high degree of interest, by a group, such as we have in Gold’n Futures, has a very high confidence level in the property. I think that the Hercules is one where we can look forward, and without too much extrapolation, we can see this as being a viable high-grade deposit. Because it's a high-grade, it won't necessarily be needing four or five million ounces at half a gram to be viable. This is something, with a current indicated grade, of about 15 grams per ton, the Hercules is in the top 10 percentile of all mines in the world. I believe it would only require an indicated resource in the order of a million ounces to define a viable potential. And we're 25% of the way there now.

Dr. Allen Alper:

It sounds fantastic. Steve, could you tell our readers/investors the primary reasons they should consider investing in Gold’n Futures?

Stephen Wilkinson:

Probably one of the best reasons for looking at us, is we’re not looking for a gold occurrence, we're developing advanced gold zones in our properties. Our blue-sky potential clearly is due to the fact that the known gold zones occupy only a small fraction of the total property. Yet throughout the remainder of the properties, there are indicators of repeats of that style of gold mineralization. So, the upside is huge!

Two, because we're dealing with gold resources now. If you were to compare us with other gold explorers, I believe, with our current cash position and capitalization, we should probably be trading at about twice our current market cap. But because we're a new Company and we've had very limited news flow; we're quite definitely trading at the low end of any valuation that might be otherwise appreciated by any other gold junior that has gold resources.

The last and final thing is where we're looking for gold. We're in a jurisdiction, where mining is well accepted, where the science of mining and exploration is probably the best throughout the world. And we're able to bring in experts that are renowned for their efficiency, in defining exactly what we're trying to do here, and that's gaining new targets to expand our existing resources. I think those are very compelling reasons to be looking at our Company.

Dr. Allen Alper:

Oh, those are very compelling and outstanding reasons for readers/investors to consider investing in Gold’n Futures. Is there anything else you'd like to add, Steve?

Stephen Wilkinson:

Well, I really appreciate it that you and I are together again, talking about gold occurrences. I think you should be recognized for the way that you're able to generate a lot of valuable information that I don't think a lot of investors would otherwise be able to have access to, or really be able to appreciate. So, you should pat yourself on the back for that.

The other thing is that we're in a new era for junior mining. Gold’n Futures right now is preparing its ESG policies to fit into the sort of new regime that's coming in here, with respect to mining. People in the mining industry used to be very unconcerned with how they went about doing their exploration work, and not necessarily concerned that maybe, it might be damaging hundreds of thousands of hectares of land in order to extract the metals.

Nowadays, we're starting to look at not only protecting the land, but we have to think of our atmosphere and the pollutants we're putting out. We have to look at all of our stakeholders and particularly where we are in northern Ontario, Canada, and northern countries in general. Our First Nations stakeholders have a huge interest in making sure that that the Earth is properly looked after.

There are some lands there, which we have to recognize have special importance to some of our First Nations Bands, and we're cognizant of that also. And that's being built into our ESG policy, that's going to be a mandate of the Company. It's a changing world, and I may be an old dog, but I think I can learn a few new tricks and we can be able to operate, with this new sort of consciousness of how we do things, not just to get to the bottom line.

Dr. Allen Alper:

Well, that's excellent. That's nice to see a Company with respect for the land and responsibility towards the environment and stewardship for the land and for the people living in the community. So that's excellent! And I personally have enjoyed our long-term relationship, we’ve now known each other almost 20 years and I enjoy talking with you. I have great respect for you and what you've accomplished and how you work in mining, respecting the environment.

Stephen Wilkinson:

Thank you very much, Allen. I'm looking forward to next March, when we can all hopefully get together again in Toronto and get back on track with the Prospects and Developers Association convention.

Dr. Allen Alper:

Great. I’m all signed up. I’m a media partner. We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://www.goldnfuturesmineralcorp.com/

Stephen Wilkinson,

President and CEO

789 West Pender St., Suite 810

Vancouver, BC V6C 1H2

604-687-2038

contact@goldnfutures.com

|

|