Dr. Michael Anderson, Managing Director, Firefinch Ltd (ASX: FFX) -Discusses its Two Outstanding Assets in Mali – the Morila Gold Mine (80% Interest) and Goulamina Lithium Project (JV with Ganfeng Lithium)

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/15/2021

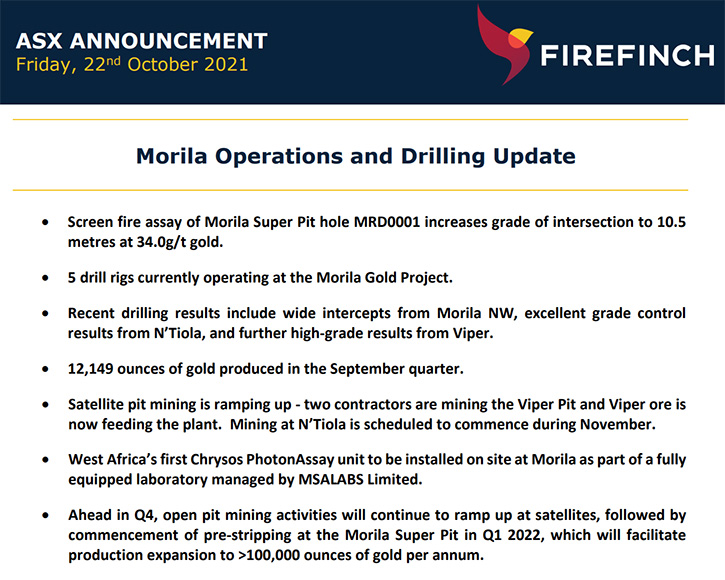

We spoke with Dr. Michael Anderson, Managing Director of Firefinch Limited (ASX: FFX) - a gold miner and lithium developer, with two outstanding assets in Mali – the Morila Gold Mine (80% interest) and Goulamina Lithium Project (JV with Ganfeng Lithium). At Goulamina, Firefinch has been busy, with a definitive feasibility study update, paving the way to demerge the Company's share of the Goulamina Joint Venture, into a new Company that will be called Leo Lithium Ltd. At Morila, 12,149 ounces of gold was produced, in the September quarter. Ahead in Q4, open pit mining activities will continue to ramp up at satellites, followed by commencement of pre-stripping, at the Morila Super Pit, in Q1 2022, which will facilitate production expansion to >100,000 ounces of gold per annum.

Firefinch Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Dr Mike Anderson, Managing Director of Firefinch. Mike, could you give us an overview of your Company and let our readers/investors know what you've accomplished, since we interviewed in August.

Dr. Michael Anderson:

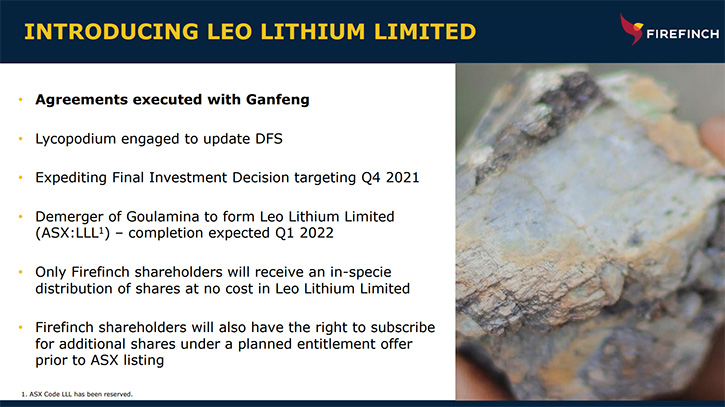

I think we’ve made a lot of progress on both projects; Goulamina on the lithium side and Morila on the gold. Pretty exciting developments at Goulamina, with the joint venture between ourselves and Ganfeng, having satisfied a number of the conditions precedent, including the receipt of support from the Mali government. Last week, we announced that we'd received all the Chinese regulatory approvals, which are the catalyst for the initial transfer of the first tranche of equity, which we're expecting soon from Ganfeng.

Behind the scenes, we've been busy, with a definitive feasibility study update, just refreshing that from the study that we did about a year ago. That will hopefully lead to a final investment decision, before the end of 2021. All with the backdrop, of course, of some very, very positive lithium price developments and spodumene concentrate prices are significantly higher than what we modeled out in our study, which was around $660 a ton.

Contract prices are probably nudging $1,000 a ton, and some of the spot auctions that Pilbara has been conducting, have achieved over $2,000 a ton. So, a very healthy pricing environment! And all of this work, of course, is paving the way for us to demerge our share of the Goulamina Joint Venture, into a new Company that will be called Leo Lithium Ltd. We were very excited to have appointed Simon Hay, the former CEO of Galaxy Resources, as the new Managing Director of Leo, and he will join us early in the new year to lead that business.

I'll be staying on the gold side, with a lot of progress underway and ongoing at Morila, where the drilling continues. We had some very exciting first holes we drilled into the deeper high-grade zones, where we intersected 10.5 meters at 34 grams per ton, and we're following up on that. Our current mining activities are underway, at the satellite projects, Viper and N’Tiola, and they're already feeding over into the mill.

We had a quarterly production of around 12,000 ounces, which is still modest. But we're doing a lot of preparatory work ahead of pre stripping the main Morila ore body, and getting back to mining there, early in 2022. And that's the real prize! I'll be heading back over to Mali myself in a couple of days and I’m very excited to see the progress that we've been making firsthand.

Dr. Allen Alper:

Oh, that sounds excellent! Could you tell our readers/investors a little bit about yourself and your Team?

Dr. Michael Anderson:

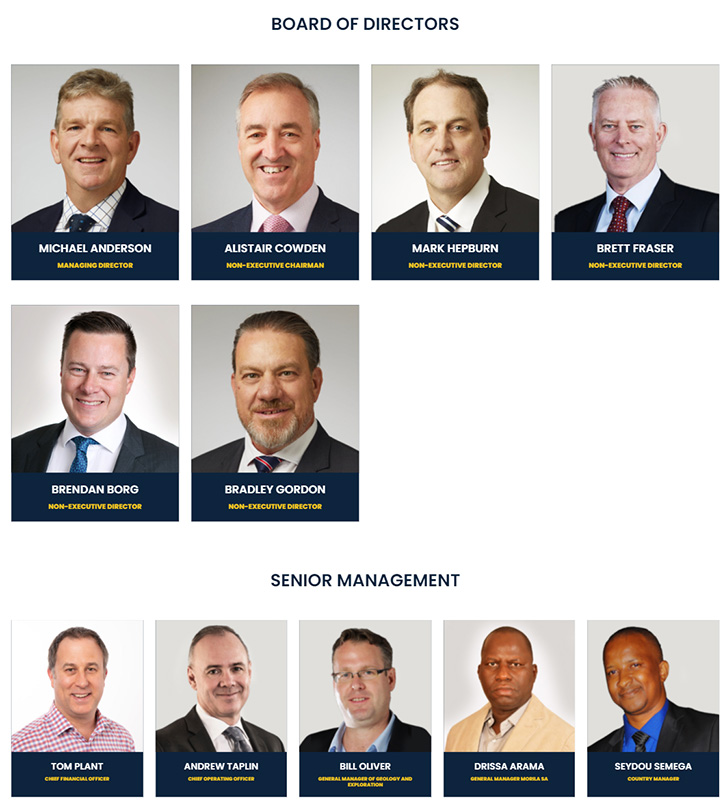

I took on this role six months ago. I spent the previous 10 years in the funds management business; equity and debt, with Taurus Management Fund. Prior to that, I've been Managing Director of a Company, called Exco Resources, here in Australia. We believe we have two fantastic projects here in Mali. We have had a substantial reevaluation, in recent weeks and months, and we still believe there's plenty of upside left. The Board, in particular, has a lot of experience taking companies forward and maximizing valuation.

Alistair Cowden has a long track record of success and has Brad Gordon, I mentioned Simon on the lithium side. Simon was CEO of ASX-Listed Lithium company Galaxy resources,andt prior to that he was Head of Business Development at Iluka. We've also been successful in attracting a new CFO, a gentleman by the name of Tom Plant, also from Iluka. Tom’s been with us for a couple of months, a very steady, solid pair of hands.

Our COO, Andrew Taplin, just arrived back on site in Mali. Under his watch, a lot of things are happening at Morila. The last six months have seen us starting to dewater the pit, and recommissioning the crushing and grinding circuit. We've commenced mining, drilling, blasting and mining at the satellites, paving the way for mining atMorila Super Pit. Lots of good people are doing lots of good things, and we continue to build the Team, both here and in Australia, and also on-site.

Mali is under the managership of General Manager, Drissa Arama, with the Team we inherited from Barrick. Drissa was a key leader and he's still showing a tremendous amount of strength and leadership, as we look to restore Morila to its former glory.

Dr. Allen Alper:

Well, that's a great Team. You have a fantastic background and you've put together a great Team, so that's excellent. Could you tell our readers/investors a bit about your share and capital structure?

Dr. Michael Anderson:

We have over 900 million shares. This Company's been around about 10 years, one of the legacies of that is raising the money that we've needed to not only acquire Morila, but now to go on and get ourselves on the brink of remining that main ore body. We've had share price appreciation, over the last 12 months. The money we raised to acquire Morila, we raised at 16 cents, per share. We've been trading in and around 60 cents, per share, the last short while.

We're actually launching a share purchase plan today, to reward our long-standing supportive shareholders. That's being run at 58 cents, per share, a 10% discount to our last closing price. So that sees us capped today at about 550 million Australian dollars, which is a healthy rerate from where we started 12 months ago. But we believe we've got two billion dollar projects here. Morila, when it gets back to producing 150,00-200,000 ounces per annum. Our peers who are doing that already, are billion-dollar companies and we will get to that level very soon.

On the lithium side, Goulamina, with a 50-million-ton reserve at 1.5% lithium oxide, is a world class ore body. Our current production plans will see us producing over 400,000 tons of spodumene concentrate. The companies that are doing that, in the marketplace, at the minute, are capped at multiples of billions of dollars. Not only do we aspire to that level, but we are already looking at expanding our resources and reserves at Goulamina. There's no shortage of upside, in the resource, and looking at a stage two potential expansion, once we've established stage one, at that 400,000 ton per annum level.

Dr. Allen Alper:

That sounds excellent. Mike, could you tell our readers/investors the primary reasons they should consider investing in Firefinch?

Dr. Michael Anderson:

Since we're sitting today at a market capitalization of 550 million Australian dollars, and we believe each project, in its own right, could support billion-dollar valuations, we have a job to do, to deliver on that potential. It'll come, as we continue to de-risk the projects and ramp them both up to those steady state production levels that I spoke about. As we do, the market will, hopefully, take notice and take cognizance of the value.

We believe the demerger strategy that we're on, with the lithium, will assist in that and we'll end up with two clean businesses, one on the gold side, one on the lithium side. I think the analyst community will be able to assess that and value that more straightforwardly. I think in the future, in the next 6 to 12 months here, unlocking that value looks very promising, from our perspective. So, I’m confident recommending Firefinch, as an investment proposition, not only to current shareholders, who have been supportive, but anyone, who hasn't come on board yet. There's still plenty of upside remaining!

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Firefinch. You have a fantastic gold project and a fantastic lithium project, and you're well-funded and well supported and have a great Team. Those are excellent reasons for readers/investors to consider investing. Mike, is there anything else you'd like to add?

Dr. Michael Anderson:

No, I think we've hit the highlights. There is obviously plenty of news flow with Firefinch. You can look out for the DFS update and further confirmation of the conditions, ahead of demerging, Leo Lithium. On the Morila side, plenty of drilling is happening. There are lots of milestones ahead, as we get back into the heart of the ore body.

https://firefinchltd.com/

Dr. Michael Anderson

Managing Director

Firefinch Limited

info@firefinchlimited.com

+61 8 6149 6100

|

|