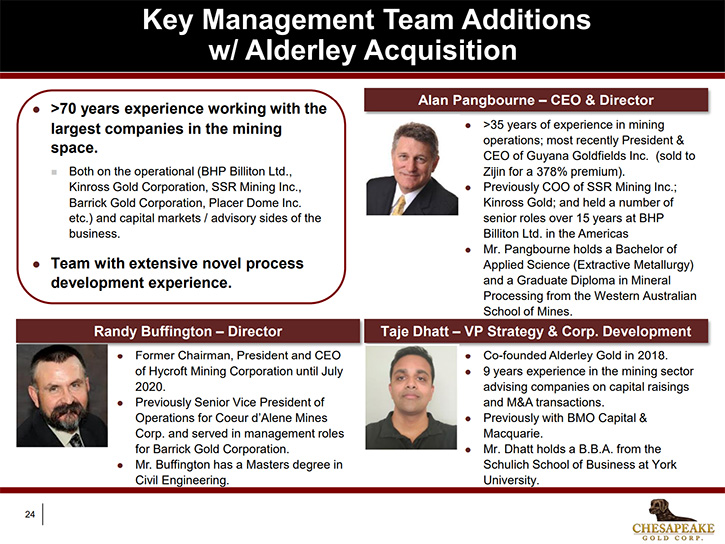

Alan Pangbourne, CEO, Chesapeake Gold Corp. (TSXV: CKG, OTCQX: CHPGF) Discusses the Development of its Flagship Metates 18 M Oz Gold and 500 M Oz Silver Project, Durango State, Mexico

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/10/2021

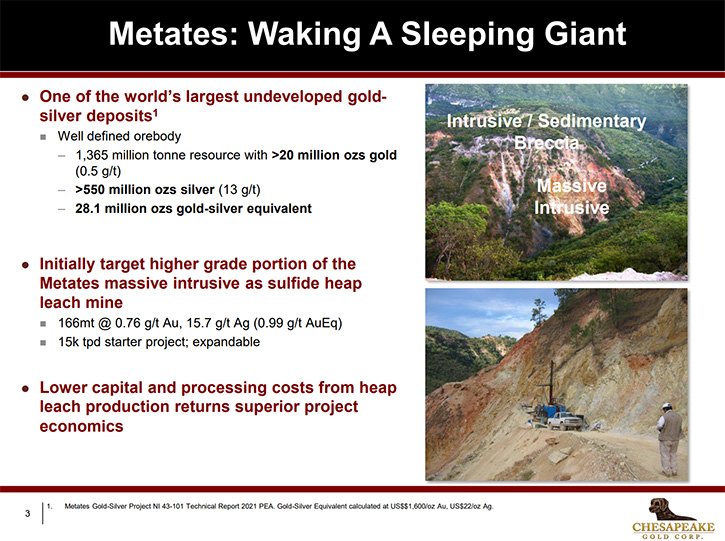

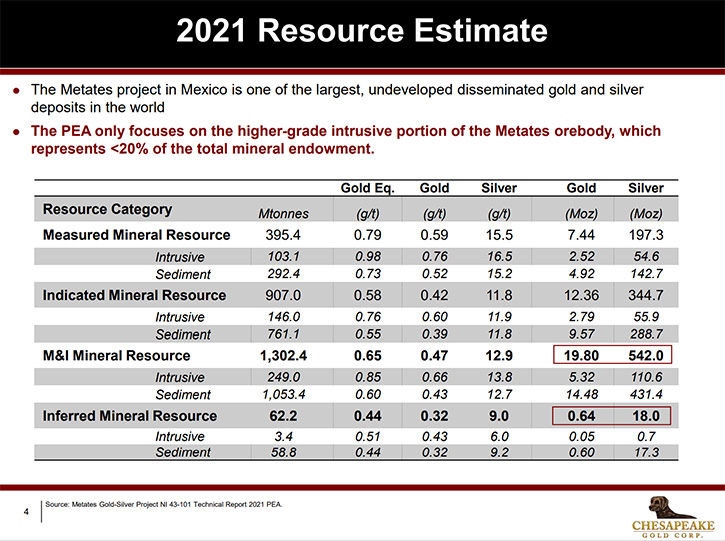

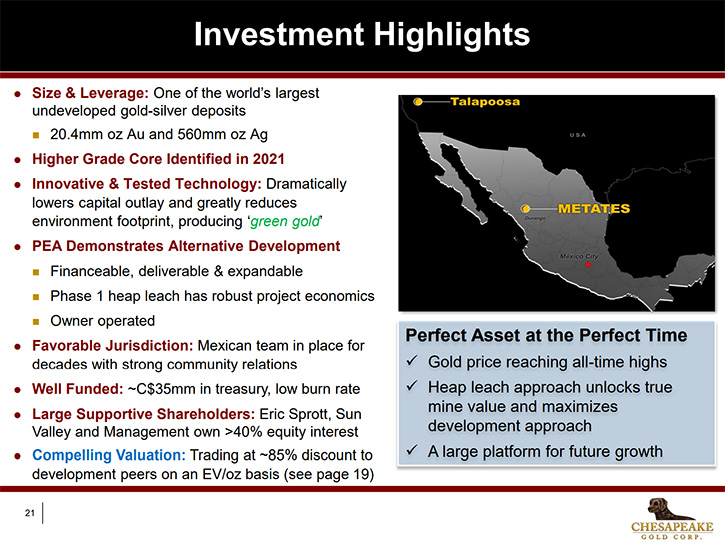

We spoke with Alan Pangbourne, who is CEO and Director of Chesapeake Gold Corp. (TSXV: CKG, OTCQX: CHPGF), the mineral exploration company, focused on the development of its flagship Metates gold-silver-zinc project, located in Durango State, Mexico. Metates hosts over 18 million ounces of gold and 500 million ounces of silver and is in the top five undeveloped deposits in the world. We learned from Mr. Pangbourne that the recent drilling showed 19% higher grades than they expected. The PEA, on the new heap leach process, shows a credible path to production, using significantly less capital, significantly less water, significantly less power and removes a lot of infrastructure need, focusing all of the operations on one site at the mine. So, there are no remote operating issues. The PFS is expected in the latter half of 2022.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking to Alan Pangbourne, who is CEO of Chesapeake Gold Corp. Alan, could you give our readers/investors an overview of your Company? What differentiates your Company from others and what are the most exciting things that have occurred since our last interview in May?

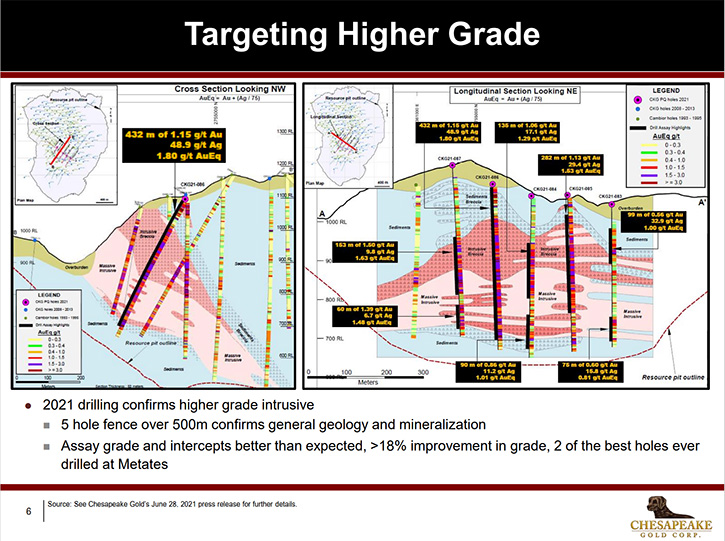

Alan Pangbourne:Chesapeake had a management change in January. When we spoke in May, I talked a little bit about that. I guess what's changed over the last six months are a couple of important things. Firstly, we did some drilling to get metallurgical samples and they showed about a 19% higher grade than we expected when we compared that back to the block model. So that's really important because obviously those samples were aimed at where the first materials will come out for the process. If it's a 19% higher grade, that has a significant impact on the economics.

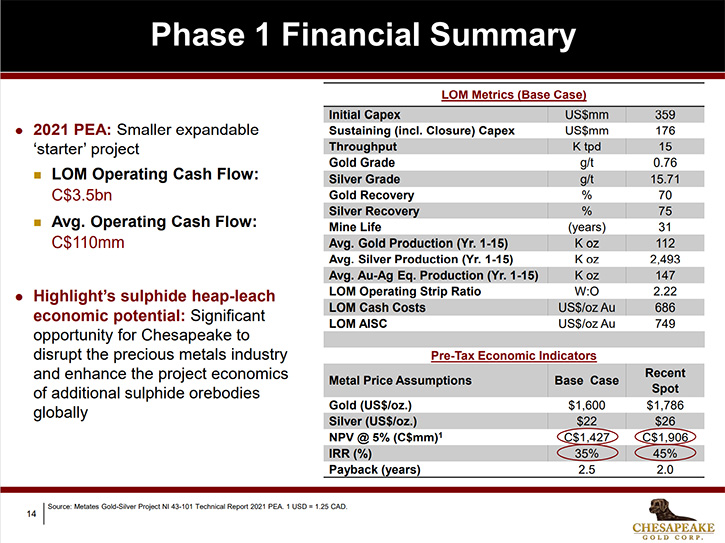

The second thing that we've done over the last six months is in August we put out our inaugural PEA on the new heap leach process, which is what we're focusing on for a credible, financeable and deliverable development of the Metates Project in Mexico, compared to some of the previous studies that were done by previous Management. That was a very exciting study and shows that we have a credible path to production, using a heap leach, sulfide leach process that needs significantly less capital at only $360 million instead of billions of dollars for the autoclaves project, which was the previous option.

It uses significantly less water and significantly less power, to the point that we can actually connect to a line that is nearby. So, it removes a lot of infrastructure and focuses all of the operations on one site at the mine, so there's no remote operating issues. And it shows that we should continue with what we're doing and look at improving the quality of the study and the accuracy of the study, which is what we're doing.

Then the last thing that's happened is we put out an announcement on Tuesday this week, where we said we're going to go back and drill another 16 holes. We're doing that for multiple reasons. But firstly, because when we found that 19% higher grade, we thought we should follow up on that and understand how pervasive that is across the rest of the ore body.

The first thing those sixteen additional holes will do is step up and down from the previous holes and understand this higher-grade core that we're focused on and how pervasive that is in the deposit and how much bigger it is than those initial five holes. The second thing it will do is we will do them in the same orientation and using the same diameter core so that there are no issues with that. It will give me a lot more sample to be able to do significantly more metallurgical test work, focused on variability test work in the future, as we move forward with the metallurgical test work program.

Then all of that data, the infill drilling, the test work, that's ongoing at the moment, will all feed into a pre-feasibility study, which we hope to produce in the latter half of 2022. So, that gives me a clear work plan for next year. The results for the first drilling should be available in late Q1, early Q2. The results for the ongoing metallurgical test work will be available in Q2 heading into Q3. That will all inform and lead to an updated model and pre-feasibility study, for the latter half of the year.

That gives us our ongoing work program. Obviously, we hope that that pre-feasibility study will continue to confirm what we believe from the PEA, as we move this project forward to become a reasonably large sulfide heap leach process, to recover the massive, massive resource that is in Mexico. So that's where we're all going and what we've done.

Dr. Allen Alper:

Well, that sounds excellent. You've made great progress since we last talked. You also have made it easier for US investors to invest in your project. Also, your plans, for a preliminary feasibility study, are excellent. Could you tell our readers/investors a little bit more about your robust PEA, some of the numbers, like the net present value, it's a very robust study.

Alan Pangbourne:

There's a full presentation on our website, so people can go through that and see all the numbers for the resource and the economics, capital costs and the breakdown of that. But overall, the summary around the PEA, the capital is about 360 Million, which is significantly less than the previous capital cost estimates. It's about a 15,000 ton a day operation, producing about 112,000 ounces a year of gold and an additional two and a half million ounces a year of silver for the first 15 years of a 31 year mine life.

So, a very long mine life. Multiple people have asked why such a long line life? That's really the first phase, focused on the high grade intrusive. It's a 31 year mine life, but obviously that's excessive. Once we're up and running and show that everything's working, we'll be looking at a Phase Two. The obvious Phase Two is to expand the process rate and reduce that mine life somewhat and increase the production potentially.

Dr. Allen Alper:

Well that sounds excellent, it's an outstanding project. Could you tell our readers/investors a little bit about the area your project is located and working in Mexico?

Alan Pangbourne:

If you take the silver as a byproduct credit, that actually gives us cash costs of $686 an ounce and all in sustaining costs of $750 an ounce, that's based on a $1,600 gold price and $22 silver, so quite a bit lower than current spot and gives us an NPV of $1.4 billion Canadian, with an IRR of 35%. If you use something that approximates spot, that NPV moves up to just shy of $2 billion Canadian and an IRR of 45%. As you suggested, when you started the question, that is a very, very robust project and I think your readers will agree it's a financeable, deliverable sized project and paves the way for multiple expansions, to take advantage of the massive reserve and resource that are Metates.

You asked about Mexico. We're located in Durango. Durango is one of the more mining friendly states in Mexico. I previously worked in Durango, when I was with SSR Mining. As the COO, we had a large silver project in that province. I still have a lot of contacts, know the local authorities, and we'll be traveling down to Mexico shortly, to renew all those contacts.

What else can I tell you about Mexico? It's still quite an attractive Country. You're seeing a lot of capital inflows, particularly in exploration and development projects. A couple of projects recently have been able to get their permits and been built. Orla is an obvious one. They're just starting up at the moment and others have been doing expansions. So, it's still a great place to go, great place to invest and a great mining jurisdiction, from my point of view.

Dr. Allen Alper:

Oh, that sounds excellent. Could you tell our readers/investors a little bit about yourself, your Team and your Board?

Alan Pangbourne:

I'm a Metallurgist by profession. I've worked in the mining industry my entire career. I have over 35 years of experience. I worked for BHP, built some of the largest copper projects in the world. I built the Spence Project in 2004. That was a 250,000 ton-a-day mine, producing 220,000- 230,000 tons a year of copper. It was actually the largest sulfide, heap leach project in the world at the time, which is important because that ties into the technology we're using, in the gold space, with Chesapeake. Which hasn't been done in the gold space before. But it has been done in the copper space, for well over 30 years. So it's not new from that point of view.

I’ve lived in seven different countries. I’m fully bilingual in English and Spanish. I've actually worked in probably three times that many countries, predominantly in South America. I spent 22 years in South America. Most recently, I was the CEO of Guyana, when we sold it to the Chinese for about 400% premium over where we were trading at the start.

Prior to that, I was the COO of SSR Mining, from when we were a single struggling asset in Argentina to after we bought Seabee and Chinchillas and had taken the Company from being a 100,000 ounce a year equivalent producer and struggling, to a multi asset. We had three mines, producing over 400,000 to 450,000 ounces a year equivalent and took the market cap from 500 million or so up to over 2.5 billion, over about a five-to-seven-year period.

That was a great journey and a great job. In some ways, we're slowly bringing some of the Team back together, to try and do it again, with Chesapeake. Our Board has several people that are quite experienced. Randy Buffington recently took the role of CEO of Nevada Copper. Previously, he was at Hycroft Mining. Before that he was with Barrick Gold, also as an operator. Amazing library of information on gold assets around the world!

Randy Reifel was successfully at Francisco Gold and developed it, and eventually it was sold into Glamis that became Goldcorp. and he was on the Board of Goldcorp. for many years, up to the Newmont acquisition. So, there are some really solid people on the Board.

In Management, my CFO and I used to work together years ago, in BHP, he was the CFO for Apoquindo Minerals. They had a copper project in Peru. He's also bilingual, worked in multiple Latin American countries. That's a bit about the Team. We have a strong Team, a strong Board and look to be moving this project forward into production, over the next three years or so.

Dr. Allen Alper:

Well, you and your Board have outstanding backgrounds and records of success. As you've mentioned, your background ties in very well with your goals of developing your Chesapeake property in Mexico. So that's excellent. Alan, could you tell our readers/investors little bit about your share and capital structure?

Alan Pangbourne:

We have 67 million shares outstanding. We have a couple of significant shareholders in Eric Sprott and Peter Palmetto, from Sun Valley. Eric and Peter and the Alderley Group that was purchased, we own over 40% of the equity in that Company, so that gives us very strong alignment, with all the other shareholders. I personally have 7.4 million shares, so about 11% of the Company.

We currently have over $30 million in cash, in the bank, which means we're well funded. We have a low burn rate, at the moment during development, principally because the bulk of the infill drilling and the resource definition drilling has all been done. One of the biggest expenses, as you move a project through, is usually drilling and that has all been done. There is a solid resource behind this that is 43-101 compliant and has been reviewed multiple times by multiple parties.

So no debt, 24 million ounces of gold, 560 million ounces of silver, $35 million in the bank at the end of Q2. Strong, supportive shareholder base, with significant Management ownership, which aligns us with shareholders. And we're in Durango, which is a great place to operate.

Dr. Allen Alper:

That sounds excellent. It's great to see Management have skin in the game and benefit like the shareholders and stakeholders! That's really excellent! Alan, could you summarize and highlight the primary reasons our readers/investors should invest in Chesapeake Gold Corp.?

Alan Pangbourne:

I think three or four things. Firstly, we are one of the largest undeveloped gold and silver deposits, in the world, at 20 million ounces of gold and 560 million ounces of silver. There are very, very few competitors in that space. A massive, massive resource! It's in a decent jurisdiction. We've just produced a PEA that demonstrates that there is a credible development path to production, at a reasonable size, at 100,000 ounces of gold a year, for over 31 years, 2.5 million ounces of silver. That is a significant mine in anybody's book, and it's expandable.

The study shows that it's financeable, deliverable and then expandable. Very robust economics, $750 an ounce, all in sustaining capital is a really good place to be on the cost curve. Given the current metal prices, gives us really good margins. So, I think when you put all of that together, no debt and Management has skin in the game, we're very undervalued at the moment. You can see a path to deliver that project and have an economic operation in Durango, in the near future.

Dr. Allen Alper:

Those are very compelling reasons for readers/investors to consider investing in Chesapeake Gold. Alan is there anything else you'd like to add?

Alan Pangbourne:

If anybody's looking for more information, go to our website, there's the current presentation, and there are all sorts of other things. Look us up on YouTube, Twitter, Facebook. There are multiple interviews that I've done previously, talking about the project. Please have a listen. Reach out if you want to understand more about the Company. I’m more than happy to discuss it with you.

Dr. Allen Alper:

Excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.chesapeakegold.com/

Alan Pangbourne

invest@chesapeakegold.com

|

|