Andre Liebenberg, Executive Director and CEO, Yellow Cake Uranium PLC (AIM: YCA, OTC: YLLXF) Discusses how it Offers Exposure to the Uranium Spot Price, by Buying and Holding physical U3O8 and Acquisition of Uranium Royalties and Streams

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/9/2021

We spoke with Andre Liebenberg, Executive Director and CEO of Yellow Cake Uranium PLC (AIM: YCA, OTC: YLLXF): a Company that offers exposure to the uranium spot price, through its strategy of buying and holding physical triuranium octoxide - U3O8, as well as through the acquisition of uranium royalties and streams or other uranium related activities. We learned from Mr. Liebenberg that the uranium equities took off this summer, due to the increased demand, thanks to the climate change and carbon commitments by governments around the world, combined with impacted global supply. In July, the Sprott and UPC transaction was a big catalyst for the uranium market. Presently, Yellow Cake's balance sheet has almost 16 million pounds of uranium and around $20 million in cash.

Yellow Cake Uranium PLC

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Andre Liebenberg, Executive Director and CEO of Yellow Cake Uranium PLC. Things have really greatly improved as far as pricing and market appreciation for uranium, since we last talked in May. I wonder if you could give our readers/investors an update on what's happening in the market, what the outlook looks like, and why. I know when we talked back in May, you thought this was imminent at any moment.

Andre Liebenberg:

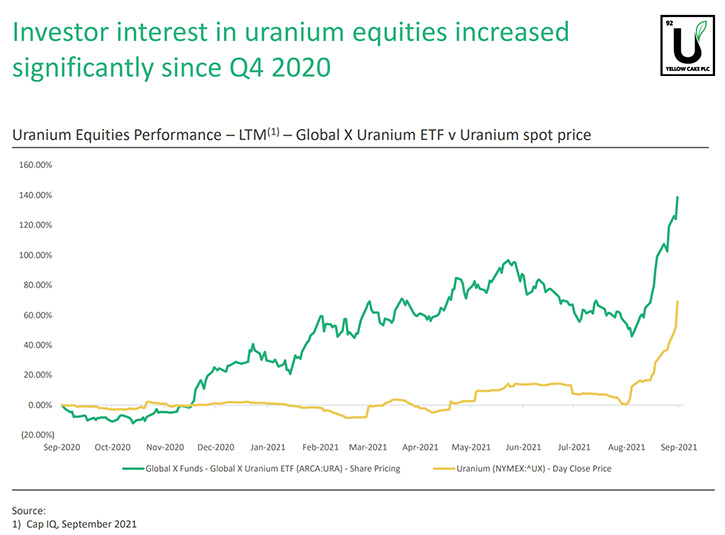

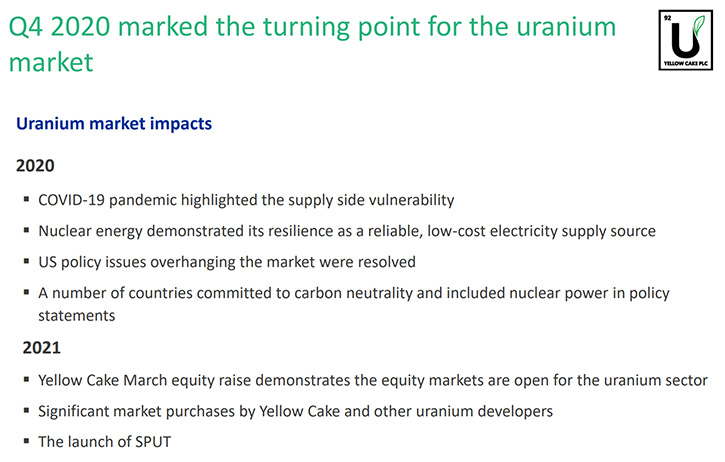

I think one has to go back a little bit before May. Last year, a number of factors came together that ignited the interest in the uranium sector. If you look back almost a year ago, that is when the uranium equities took off. Taking the Global X ETF, as a proxy, and some of the underlying equities, were up 200%, 300%. While COVID impacted the supply side, the demand side stayed very strong, for nuclear, and a number of the US policy issues were resolved.

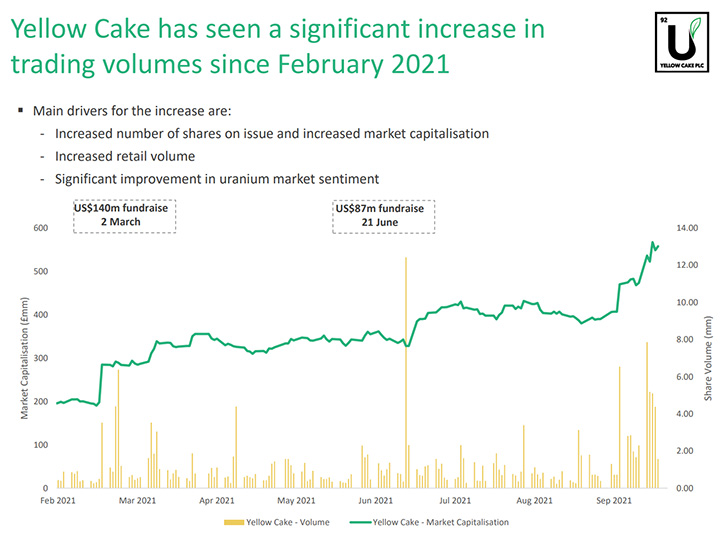

Then increasingly, governments made climate change and carbon neutrality commitments, and many of these commitments included a role for nuclear technology. We saw the equities take off around October, last year, but the underlying uranium price didn't really move. When we came into February of this year, when we did our first equity raise, we were a little cautious as to how successful it would be. We hadn't seen any equity raises for uranium stocks for quite some time.

But our equity raise was very successful. It was heavily oversubscribed, and we upsized the offering. At the same time, a number of other companies came to market in the uranium space, which demonstrated that the uranium equity market was open for capital raisings. I think something like a billion dollars was raised in about two months after our March raise.

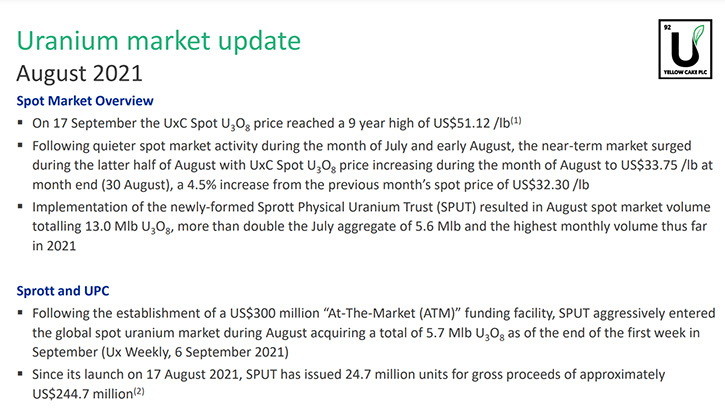

Then the uranium price sort of ticked up modestly, got up to about $34 and then drifted back again. The Sprott UPC transaction was announced, with a view that that would be approved in July. So, in June, we went to market again to raise equity, purchase some more uranium. We thought there'd be an opportunity to get some uranium, ahead of the Sprott transaction closing.

In June, when we raised the equity, we were looking to raise $90 million. That book was two and a half times covered, so the demand was once again phenomenal. In July, the Sprott transaction was consummated, and then in August, they put in place their first, at the market facility, and started purchasing uranium quite aggressively in the spot market.

I think if you'd gone back a few years and the Sprott vehicle had come to market, they could have bought uranium all day and not really moved the price. But I think we have moved from an oversupplied spot market into an undersupplied market and having a purchaser like that in an undersupplied market had a big impact. We saw the uranium price run up from $33/lb. odd up to $50 quite quickly.

I would like to say that we and others, earlier in the year, did some of the heavy lifting, in terms of raising equity and purchasing uranium, and the Sprott vehicle has really done that lately. So, I think that's really what has happened in the market. If you'd asked me two months ago where I thought the uranium price would end this year, I would have said somewhere between $35 and $40 a pound. If you asked me that same question today, I think it could be anywhere between $40 and $60.

Certainly, the volatility has gone up quite dramatically. We saw the price go from $50 back down to $37. And then yesterday it went up from $40 to $47. So, there's a lot of volatility and I think the market is quite thin. So, not a lot of volume will have quite a big impact on the price.

There are other factors at play. If you look here in the UK, the wind didn't really blow in August, so the electricity generation, from wind farms, was down significantly and energy prices went up dramatically. I think the wholesale electricity price went up 10 or 11 times. Gas prices have gone up significantly. In Europe, gas prices have gone up and energy prices have gone up. We will have COP26 in a few weeks’ time. What's happened with the wind and the energy markets really demonstrates that nuclear is a necessary technology if you want to pursue a low carbon future.

It's going to be interesting to see what happens at COP26. But I think what's happened in energy markets has highlighted the fact that nuclear is going to be needed. In China, they have energy shortages and are pushing coal mines quite hard. Here in the UK, a couple of coal fired power stations have had to restart to ensure their sufficient electricity.

We're in a very interesting environment. I think nuclear is getting a lot more acceptance, as part of the mix. The energy markets are demonstrating that it's a necessary component. Alongside the COP26 Conference, which I'm sure will be long on policy and probably short on action. There's also an NEI Fuels Conference, which I think is one of the first times that the industry is going to get together physically, and that's in Georgia at around the same time as COP. So, I think it's going to be interesting again to see what utilities are saying about the market.

The long-term price, last week, kicked up from $37 to $45. We have a situation where the spot price is trading at $50 and the term price was at $37. So, the fact that the long-term price has kicked up means that there's some activity in that part of the market. I think the anecdotal evidence is that there's growing interest from utilities, in entering the contract market.

All in all, the set up for uranium is positive. For me, long-term pricing will be driven by incentive pricing. We need new supply. Mines are shutting down, exhausting their resources. Demand is growing, new supply will be needed. Unless prices are at a level to induce that new supply, you know that supply won't come on stream. But in the short term, I think we're going to see some heightened volatility, we could see the price overshoot or undershoot. I think that previously we were trading at the $30 to $33 range. I think now we have a new floor, probably at around the $40 range. I don't see the price drifting back to $30 a pound, but I see certainly that it could run quite hard from here.

Dr. Allen Alper:

Well, that sounds excellent. Could you talk a little bit about your strategy and a little bit about what's happening with the use of uranium short-term and long-term?

Andre Liebenberg:

Our strategy is buy and hold physical uranium and give investors exposure to the underlying uranium price, through our share price. What we plan to do, if we trade at a premium to net asset value, we will issue shares and buy uranium. And if we are at a modest discount, we won't do anything. With a big discount, as we did last year, we'll sell a little bit of uranium and buy back our shares because that's the cheapest way of buying the exposure to the uranium price.

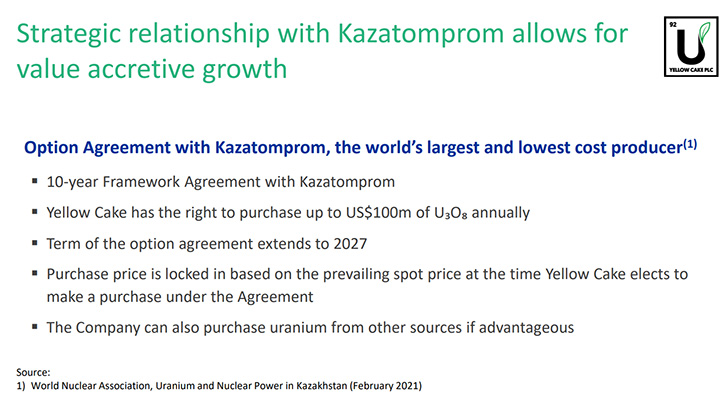

We have this agreement with Kazatomprom where we can buy up to $100 million a year of uranium at the spot price. We've fully exercised the 2021 option in February-March of this year. So that option renews for us again first of January next and runs through to 31 December next year. So, I think for us, the next interesting time will be early next year. If we are trading at a premium to net asset value, we would certainly like to be able to exercise the full option, as soon as possible, in the new year.

But given the volatility in the spot price at the moment, I wouldn't like to just raise equity and sit on a big cash position. Because, as we saw earlier this week, if I had raised equity on Tuesday, expecting to buy uranium at $40, I woke up on Wednesday and found that the price has gone to $47.

What we've tended to do is set our sights on a block of uranium, at a price and then build our equity raise around that, as we did in June, we raised just under $90 million. We'd secured two million pounds from Kazatomprom and then raised a bit more and made some additional purchases in the spot market. But it was important that we had an anchor purchase, at a price that was held. It allowed us to raise the equity and add additional pounds.

Dr. Allen Alper:

Well, that sounds like an excellent strategy. Could you tell our readers/investors what's happening with the use of uranium long-term and how uranium fits with climate change, et cetera, and decreasing the carbon emission?

Andre Liebenberg:

Nuclear power is essentially a zero-carbon power source. It is one of the lowest operating cost sources of low carbon electricity and it provides baseload power 24-7. Last year, when we had COVID, the nuclear plants were able to run 24-7. So, they are good baseload suppliers of carbon free electricity. Renewables like wind and solar are important. But they're very variable, as we discovered here in August, in relation to the wind. I think nuclear has a strong part to play. But nuclear also, above just being able to generate electricity, can generate heat, district heating. It can also be used to generate green hydrogen for a hydrogen economy.

In the Middle East, it's a good source of heat for desalination, for drinking water. So, it has multiple uses in terms of demand growth. Clearly, the biggest driver is going to be China. Now, China currently has around 48 reactors, producing 50 gigawatts of electricity. Their 14th Five-Year Plan, which was published earlier in the year, talks about taking the 50 gigawatts of electricity to 70 gigawatts by 2025. And you know, some of their nuclear companies are talking about that going to 100 or 110 gigawatts by the end of this decade.

In nine years, we could see a doubling of China's nuclear power. Now they've built a lot of reactors, they had 13 reactors at the time of Fukushima, they now have 48. So, they've learned how to build these reactors on an industrial scale. I think they can build them within five years. So, if anyone can build reactors on a consistent scale and time frame, I think the Chinese will be able to do it. And the more they do it, the better they will get at it. So, I think that's going to be a big growth area.

India, likewise, has quite an aggressive growth program. Certainly, under the Biden Administration, we see a strong sense of wanting to keep the existing nuclear fleet alive. In the US the nuclear fleet provides over 50% of carbon free electricity and 20% of overall electricity supply. So, it's an important part in the US. The US has the biggest nuclear fleet. The existing nuclear fleet is the cheapest form of capacity because it's already built. So, I think there's going to be support for keeping those alive.

We saw in Illinois, very recently, the two plants there were given a new lease on life, as they had been due to shut down. I think that that's going to be a feature. I don't think the US will build big new plants, but I think they will keep the existing plants alive as far as possible. Then small modular reactors, I think are going to be an important part of the future, towards the end of this decade. And I think you will find that those will be built in the US. There's talk of putting them where we have existing coal fired power stations because there's grid connectivity and infrastructure, so I think that's going to be an interesting phase.

Here in the UK, there is some talk about new nuclear again and certainly talk about small modular reactors. France, in the last day or two, came out saying they wanted to put more emphasis on their nuclear program, given that nuclear provides 75% of France's electricity. I think they're sitting pretty at the moment, with high gas prices all around them and high energy prices, they have a secure form of carbon free electricity.

Dr. Allen Alper:

It sounds like a very positive forecast for nuclear energy and also how it fits in trying to deal with climate change. Andre, could you tell our readers/investors a little bit about your share and capital structure?

Andre Liebenberg:

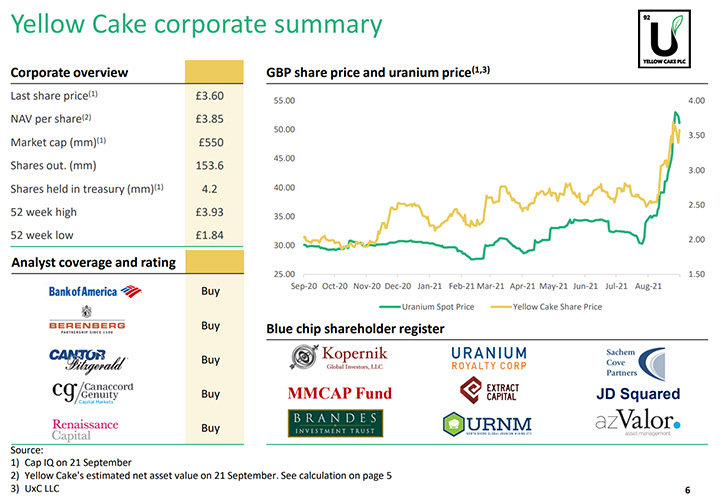

We are a London listed company. Our shares are listed on the AIM section of the London Stock Exchange. When we IPO’d in 2018, we were trading around 200,000 shares a day. Our liquidity has gone up significantly, to the point where we trade 1.2 million shares a day. here are days where we've traded 7 million shares. In terms of the register, about half our register is North American and about a third from the UK and we have quite a big retail component, probably around 20 to 22%.

Dr. Allen Alper:

That sounds excellent. Andre, could you tell our readers/investors the primary reasons they should consider investing in Yellow Cake Uranium?

Andre Liebenberg:

We're a very simple Company. We have two employees. We don't have a London office. Both of us work from home. We outsource our IT and accounting. So, it's all about keeping the costs as low as possible and allowing investors to invest in the shares that track the underlying uranium price. Our shares are in very close correlation, with the underlying uranium price. So, it allows investors to take a view of the uranium price through our share price.

We don't do any hedging, we don't do any trading, we don't have any debt. So, it's an all equity financed structure. If we trade a premium to net asset value, we'd look to issue equity and acquire uranium. If we traded at a big discount, for a persistent period, we would look to buy back our shares. It's a very simple and clean structure. The only things we have in our balance sheet, on a pro forma basis, are almost 16 million pounds of uranium and around $20 million of cash. That's it.

Dr. Allen Alper:

Well, those sound like very compelling reasons for our readers/investors to consider investing in Yellow Cake Uranium. Andre, is there anything else you'd like to add?

Andre Liebenberg:

No, I think nuclear has a much higher profile today than it had three years or five years ago. I think more and more people accept that it has to be part of a low carbon future and with the US going back into the Paris Agreement and the COP26 Conference coming up, I think it's a bright time for the nuclear industry and for uranium.

Dr. Allen Alper:

Oh, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.yellowcakeplc.com/

Yellow Cake plc

Andre Liebenberg, CEO

Tel: +44 (0) 153 488 5200

|

|