Nicole Galloway Warland, Managing Director, Thor Mining Plc (AIM, ASX: THR, OTCQB: THORF) Discusses Advancing its Diversified Portfolio of Precious, Base, Energy and Strategic Metal Projects in USA and Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/6/2021

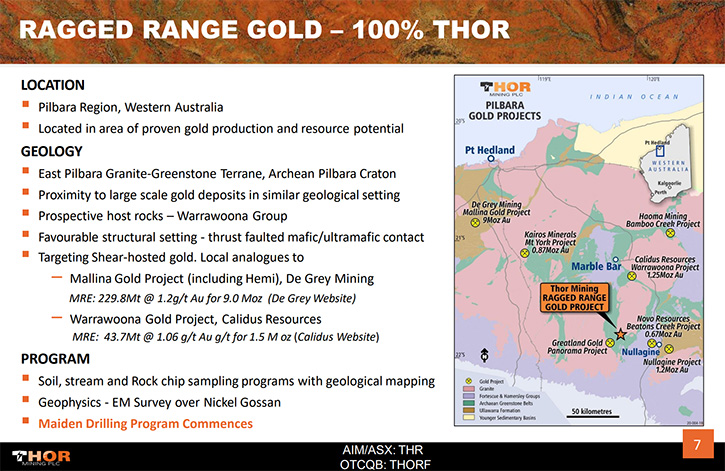

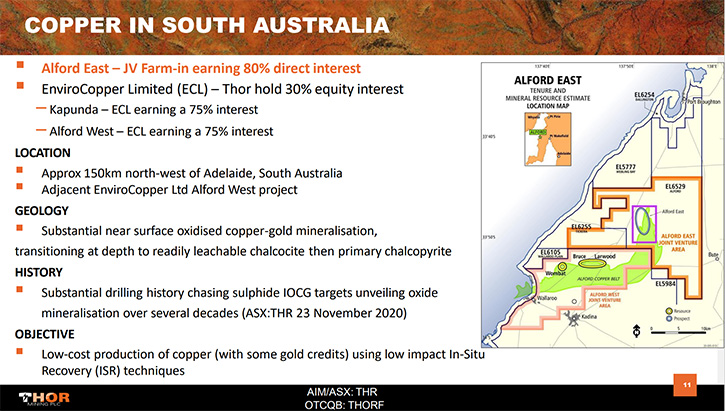

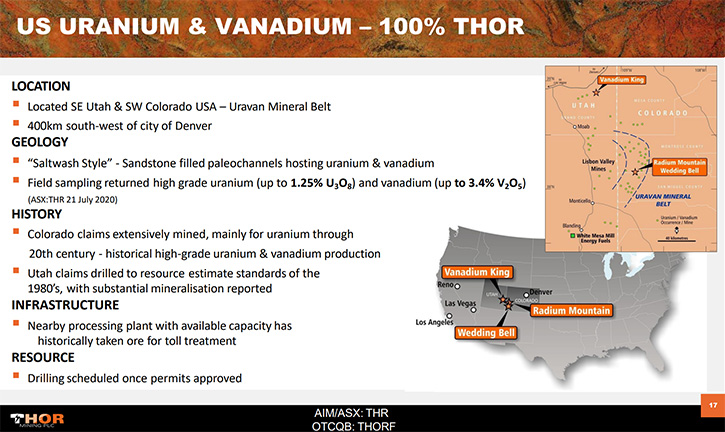

We spoke with Nicole Galloway Warland, Managing Director of Thor Mining Plc (AIM, ASX: THR, OTCQB: THORF). Thor Mining is advancing its diversified portfolio of precious, base, energy and strategic metal projects across USA and Australia. Thor owns 100% of the Ragged Range Project, comprising 92 km2 of exploration licenses, with highly encouraging early-stage gold and nickel results, in the Pilbara region, of Western Australia, for which a 3000m RC drilling program has commenced targeting large scale shear hosted gold mineralization associated with regional structures within greenstone belt. At Alford East, in South Australia, Thor is earning an 80% interest in copper deposits, considered amenable to extraction, via In Situ Recovery techniques (ISR). In January 2021, Thor announced an Inferred Mineral Resource Estimate of 177,000 tonnes contained copper & 71,000 oz gold. They recently completed diamond drilling highlighted broad high-grade zones of Copper and gold mineralization significantly above mineral resource grades. Thor holds 100% interest, in two private companies, with mineral claims in the US’ states of Colorado and Utah, with historical high-grade uranium and vanadium drilling and production results. Thor also holds a 30% interest in an Australian copper development company, EnviroCopper Limited, which in turn holds rights to earn up to a 75% interest, in the mineral rights and claims, over the resource, on the portion of the historic Kapunda copper mine and the Alford West copper project, both situated in South Australia, and both considered amenable to recovery by way of ISR. In addition, Thor holds interests in three major tungsten projects, in Australia and in the USA.

Thor Mining Plc

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Nicole Galloway Warland, who is Managing Director of Thor Mining PLC. Nicole, could you give her readers and investors an overview of your Company and what differentiates Thor Mining from others?

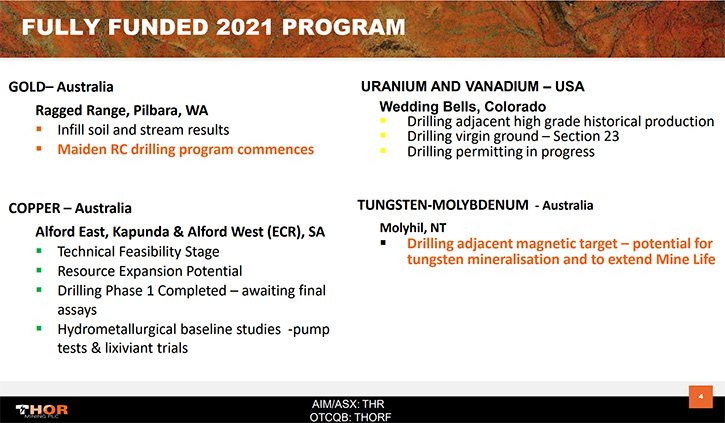

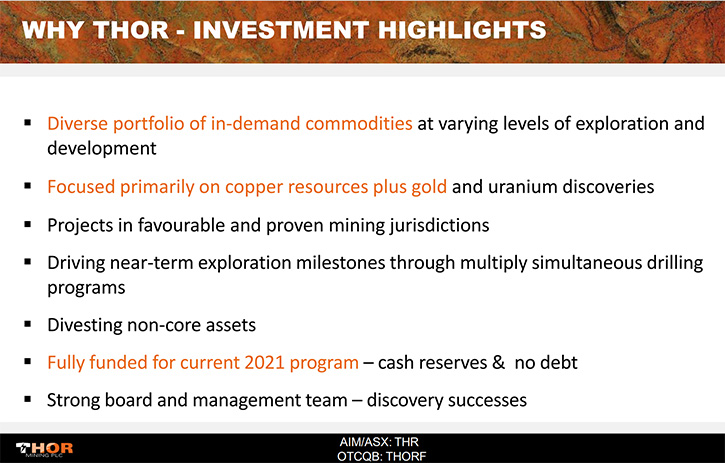

Nicole Galloway Warland:Thor Mining is an exploration and development company, with a strategic portfolio of projects. We have gold, copper, uranium and tungsten molybdenum projects. Each are in different stages, which means that we can continue to build our exploration momentum. So while we're in the field with one project, we can be waiting on assays at another project and waiting for approvals on another. We can have continuous news flow and continuous exploration momentum. All our projects are in favorable mining jurisdictions.

We're fully funded for our upcoming program and have a strong Board and Management Team to really drive our upcoming exploration programs.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about the various projects you're working on and what differentiates them?

Nicole Galloway Warland:

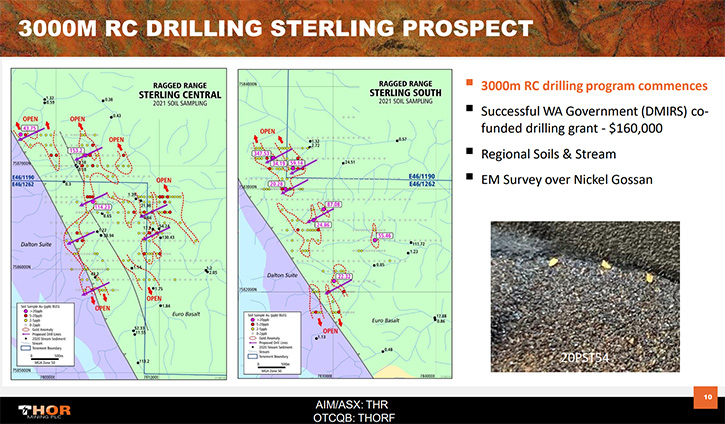

Over in Pilbara, WA, we have our Ragged Range Gold Project. This is highly prospective for large ounce gold mineralization. We're targeting share-hosted gold, associated with large regional shares. We've identified a 13-kilometer gold corridor, which we've called the Sterling Prospect. This is a long thrust of altered contacts between the Mafic and Ultramafic. Our surface cam has identified about eight anomalous gold mineralized zones. We have just commenced a 3000-meter RC drilling program to test this surface Geochem anomaly.

In addition, there are other prospects in the area, looking at copper, gold, nickel, as well as lithium. But our focus, at the moment, is on that gold mineralization. In South Australia, we have Alford East project, but also indirect interests in two other projects: Kapunda and Alford West, through a 30% equity in EnviroCopper. In these projects, we're looking at large copper oxide mineralization and looking at developing them, using the environmentally alternative traditional mining. So looking at using this technique to recover gold and copper mineralization, in these weathered oxide zones.

In the U.S., we have our Wedding Bell, Colorado project. This is located in the Uravan Mineral Belt, which is a historic high-grade uranium and vanadium mineral province. We're just about to commence drilling three prospects and we're just working through the county permits, at the moment, and targeting sandstone hosted, high-grade, uranium/vanadium mineralization.

Last but not least, we have our Molyhil Project, which is a tungsten/molybdenum project. This is essentially at a shovel ready stage. We did a detailed feasibility study in 2018, which shows that project was profitable, with low operating costs and about a 12-month development phase. We've just been working on some optimization studies for that project. In that process, we've identified new magnetic targets, which we will be diamond drilling, in the next few weeks. We're optimistic that this is a continuation of the magnetite skarn, which hosts the tungsten molybdenum mineralization. So quite a busy few months ahead of us, with two, if not three drilling programs being carried out.

Dr. Allen Alper:

Oh, that sounds excellent! You have a great portfolio of projects, very diversified gold, copper, uranium, tungsten, molybdenum and vanadium. That sounds excellent!

Nicole Galloway Warland:

I see that as very much a positive. It means we are leveraged, when one commodity is very active, such as copper at the moment. We have that project and tungsten molybdenum prices are now back up to a two year high, so we can re-ramp up on Molyhil. It does give us that level of flexibility, with this diverse portfolio, of in-demand commodities.

Dr. Allen Alper:

That's excellent! And you are located in all excellent areas, like Australia and the United States, which are safe, mine-friendly jurisdictions.

Nicole Galloway Warland:

That's right! That's correct! That's one of our strategies, making sure we are in proven mining jurisdictions. It de-risks the projects from that perspective.

Dr. Allen Alper:

That's excellent. Nicole, could you tell our readers/investors a little bit about your background, your Team and your Board?

Nicole Galloway Warland:

I joined Thor Mining, approximately 12 months ago, as the Exploration Manager, transitioning into Managing Director, in April this year. I'm a Geologist with 30 years in the industry, working in exploration, project evaluation, development through both open cut and underground mining, commodity focus on gold, copper, gold, base metals, uranium and lithium. I've worked with a few larger companies and in more recent times, in with junior explorers, working in Australia, Eastern Europe, South America and the US. I'm also a Director of the Australian Institute of Geoscientists, so geological education, compliance and transparency is pertinent to me.

Dr. Allen Alper:

That’s an excellent background.

Nicole Galloway Warland:

Thank you. We have a strong technical and financial Board. We have Mark Potter, as our Non-Executive Chair, and we have Mark McGeough and Alastair Clayton, who have come on as Non-Executive Directors, both with strong technical backgrounds. So, we have a really good mix of both technical and financial management. So, a good, strong Board.

Our Exploration Manager is Mark Wittwer, who has also a strong technical background, particularly working in Australia and taking projects from exploration into development. So quite a good Board and a fun Board to work with.

Dr. Allen Alper:

It sounds excellent. It's great to have such a successful and diversified Team to work with. Nicole, could you tell us a little bit about your share and capital structure?

Nicole Galloway Warland:

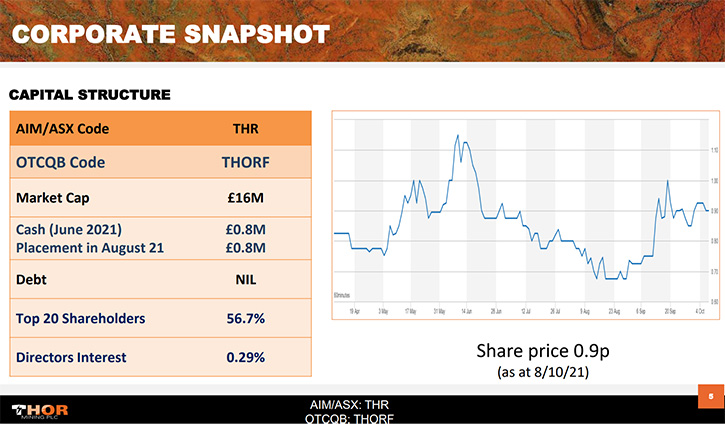

We are triple listed, so we're a UK Company, based and listed on the AIM (AIM:THX), but we're also listed on the ASX (ASX:THR) as well as the OTC (THORF) markets. Market cap sitting around, depending on which currency you look at, sitting on around $32 million AU, or that's about $16 million pounds, just under the $3 million in the bank, that's Australian. Our top 20 shareholders hold about 56% and the Directors about 0.3%. Our share price, at the moment, is sitting at about 0.9 p or 1.8 cents in Australia.

Dr. Allen Alper:

Well, that sounds excellent. Nicole, could you tell us the primary reasons our readers/investors should consider investing in Thor Mining?

Nicole Galloway Warland:

I think that the biggest thing that separates us from a lot of other junior explorers is the diversity of our excellent suite of projects. Ragged Range, we're currently drilling there now. This project, as I've mentioned, has huge potential for large ounce gold mineralization. We're the first company to drill in this area, so it really has the opportunity to be a company maker, with a discovery. So really excited about that project!

From an ASG perspective, our copper projects looking at those with a different perspective. So, coming in with a more environmentally friendly, low carbon emission strategy, to develop these copper oxide materials, is certainly something I think we need to be looking at, as we move forward. Copper is very much in demand with renewables, with sustainability and electric vehicles, etc. So, we need copper, but we need to mine it in a sustainable way. And that's where I think this in-situ recovery, for copper and gold technique, is perfect to take the industry forward.

https://www.thormining.com/

Nicole Galloway Warland, Managing Director

+61 8 7324 1935

nicole@thormining.com

|

|