Mark Hepburn, Managing Director, Castile Resources Ltd. (ASX: CST) Discusses their Rover Mineral Field Property, in Northern Territory, Australia, Projected Annual Revenue about $150 to $160 Million

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/2/2021

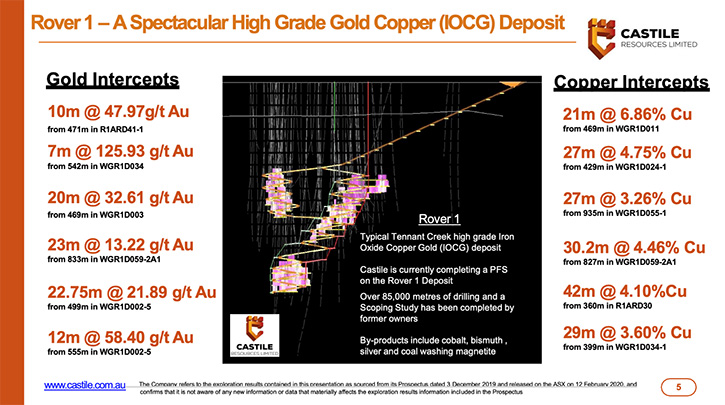

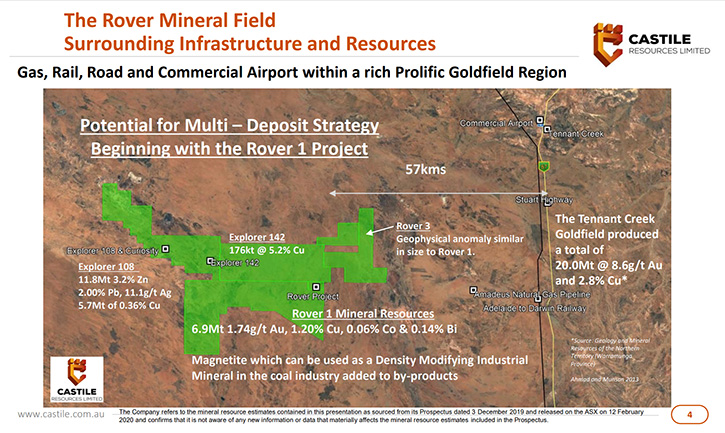

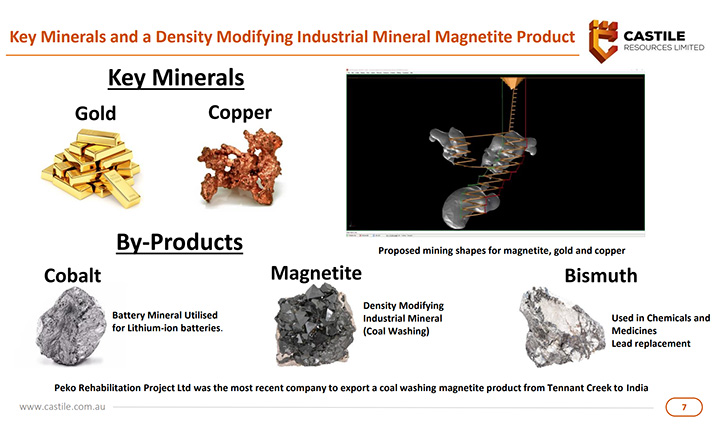

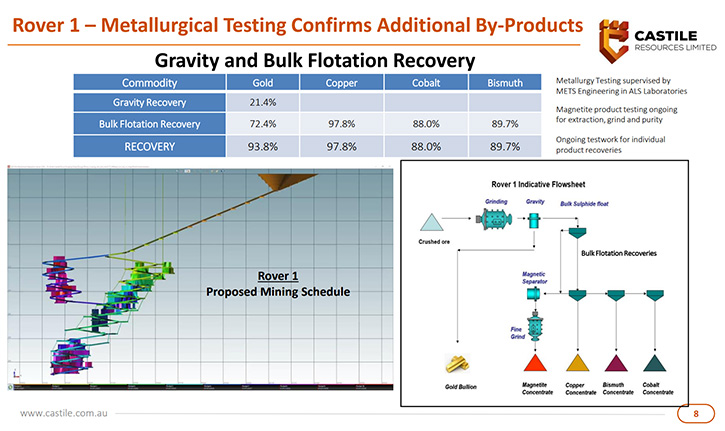

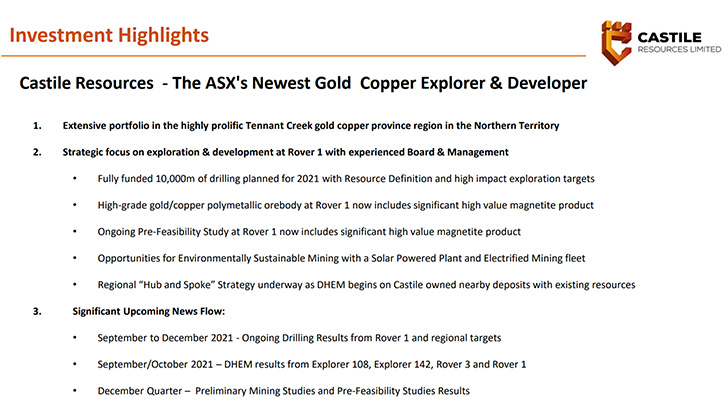

We spoke with Mark Hepburn, Managing Director of Castile Resources Limited (ASX: CST) - an Australian mineral exploration company that controls the Rover Mineral Field property, in the Northern Territory. Rover is a polymetallic deposit, with gold and copper, as the key minerals and the key drivers of projected revenue, with byproduct credits from a coal washing, industrial mineral, magnetite, as well as cobalt and bismuth. The current projected annual revenue is estimated at about $150 to $160 million, over the first eight years of the project, and in addition to that, the project is open at depth. The fully funded, 10,000m, high-grade, gold and copper drilling program started in April 2020. It focuses on the PFS at Rover 1 target, due at the end of the year. Castile received very positive results from some of their metallurgy work.

Castile Resources Limited

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metal's News, talking with Mark Hepburn, Managing Director of Castile Resources Ltd. Mark, I wonder if you could give us an overview of your Company and also what differentiates your Company from others?

Mark Hepburn:

From our point of view, we control the Rover assets, in the Northern Territory of Australia. It's a mineral field that has about 1,000 square kilometers. The flagship project, however, is a polymetallic deposit that has gold and copper as the key minerals and the key drivers of revenue, in our modeling. But also, has byproduct credits, one of them being magnetite that is used in the coal washing industry and also cobalt and bismuth, from which we will also draw revenues.

From that point of view, I think we’re covered, as far as a diversified revenue stream goes, on the one deposit. Recently, an independent research report, from Petra Capital, says that we should do revenue of about $150m to $160m Australian dollars, per annum, over the first eight years of the project, making $86m in EBITDA per annum. The research note assumed a 425,000 tpa per annum, mining, and processing. It's a boutique style deposit. From the research note, you can see it’s very profitable. The orebody remains open at depth, so we anticipate adding to that mine life.

Dr. Allen Alper:

Well, that's excellent! It's excellent to have such a great deposit. In my understanding, it's a very high-grade deposit.

Mark Hepburn:

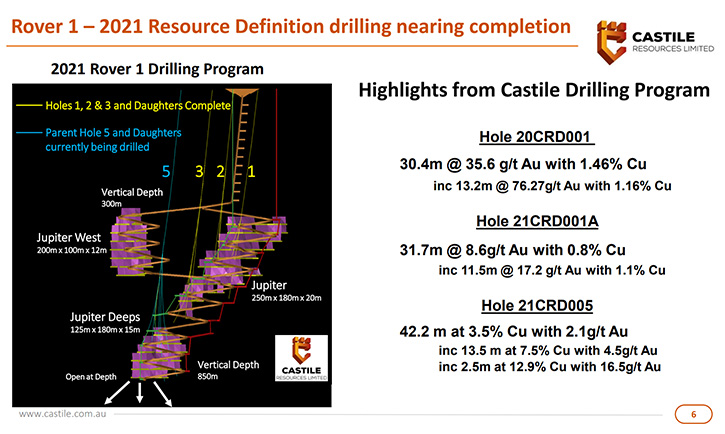

That's correct. Typically, being in the area around Tennant Creek, which is historically known for the highest grades, in the history, of Australian mining. We're in the right neighborhood, in that regard. We've had some unbelievable intercepts here, with both gold and copper. Just last year, we drilled a hole that had 30 meters at 36 grams per ton and 1.5% copper. So nice, broad mineralized thick, rich zones! That allows us, with our mining method and all the mining studies that we've done, to optimize, for profitability, the areas that we mined.

Dr. Allen Alper:

My understanding is that you have a very extensive exploration program in the works.

Mark Hepburn:

That's correct. We started that at the beginning of April this year, 2021. We've been drilling ever since. Initially, it was with two rigs, doing our resource definition program, and quite a comprehensive one. The last month or so, has only been one rig, as we finish off the deeper part of the program, with some more specialized drilling. We're getting great results from that. The last result we had was 42 meters of 3.5% copper, with two grams gold. That intercept included a zone that contained 2.5m at 12.9% copper and 16.5g/t gold, showing the very rich zones, within this deposit.

Dr. Allen Alper:

And you're working towards a Pre-Feasibility Study. How's that coming along?

Mark Hepburn:

There's been a scoping study done, on this deposit already. So, we're going in and getting all of our own data and making sure that we have confidence, in the data, for the Pre-Feasibility Study. We've done metallurgy and hydrology. We're doing some environmental studies, concurrently. But the most important thing is to complete this drilling and then upgrade the resource reserve that feeds into our Pre-Feasibility Study, which is due out towards the end of the year. We'll also have some results, regarding some of the interim preliminary mining studies. We've recently put out some very good results, from some of the metallurgy work that we've been doing. So, yeah, we are working towards that pre-feasibility. Obviously, that's our priority for the moment.

Dr. Allen Alper:

That sounds excellent. I noticed that you have a very balanced Management Team, of finance and technical. I wonder if you could tell us a little bit about that and also about your background, Mark, and some of the other key members of your Team.

Mark Hepburn:

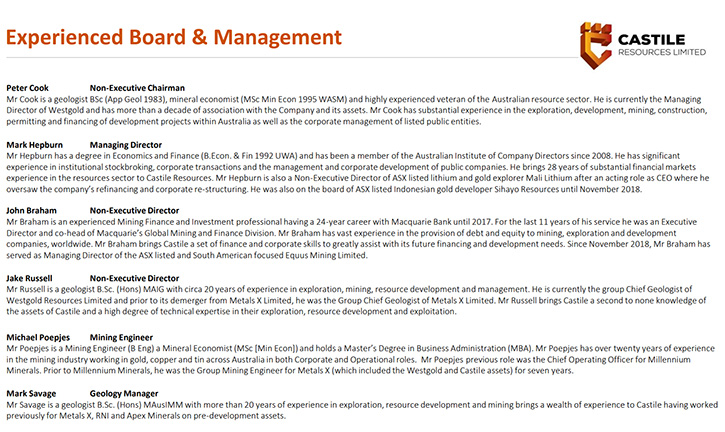

First and foremost, our Non-Executive Chairman is Peter Cook. He was, until recently, also the Executive Chairman of West Gold, which is the billion-dollar, 300,000 ounce per annum, gold producer, in the Murchison area of Western Australia. Peter is on Board, as our Non-Executive Chairman. These assets were actually demerged from West Gold, which is why the relationship with Peter is there. He's been working on these assets, for about the last five to six years, and has a 10-year background, with them, in total. From that point of view, it's great to have that prior knowledge of our assets.

Jake Russell is also a Non-Executive Director. He's also an employee up at West Gold. He is their Technical Services Director. John Braham is our other Non-Executive Director. People may know him from Macquarie Bank, where he was head of resource global financing for the best part of eight to ten years, within his 20-to-25-year career at Macquarie Bank.

My background is primarily in broking, until about the last seven or eight years, in which I've been working in corporates. I was an institutional broker and we raised money and did funding for projects exactly like the one we have here at Castile, the Rover Project. Also, on the corporate side, I've had experience at what has now become Firefinch and did the Board restructuring and refinancing of that Company, which is now a $700 million Company.

Dr. Allen Alper:

That sounds excellent. It sounds like an extremely strong background, and you have a great and diversified Board. Mark, could you tell us a little bit about your share and capital structure?

Mark Hepburn:

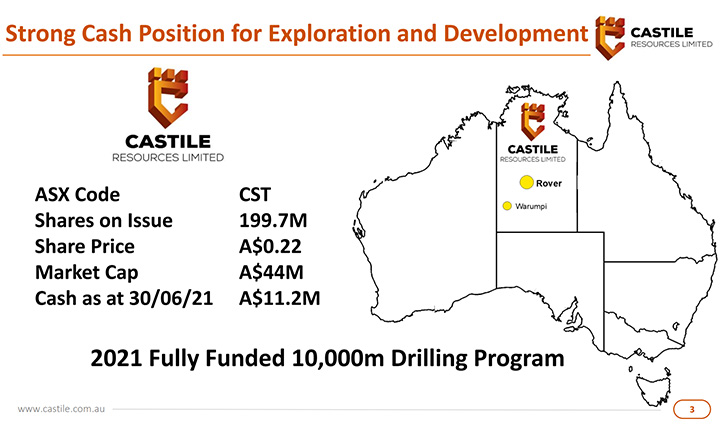

We have 200 million shares on issue, and we raised $20 million to start the Company, because it really is a pre-development Company, rather than just an exploration Company. We have that thousand square kilometers and we have targets that have lit up all over that 1,000 square kilometers. We've obviously had to prioritize our flagship asset, to get that into production and then we can use those funds for the wider regional strategy. With that in mind, as we still have the best part of that cash left, we're drilling continuously and with only 200 million shares on issue, it's a tight little capital structure, and that's been quite intentional by us.

Dr. Allen Alper:

Well, that's excellent, and that's rather unusual for Australia. So, commendable!

Mark Hepburn:

I think that's what we're trying to focus those funds on exactly, where we can add the most value for our shareholders.

Dr. Allen Alper:

That sounds excellent. Mark, I wonder if you could tell our readers/investors the primary reasons they should consider investing in Castile Resources?

Mark Hepburn:

I think it's because of the actual asset we have. In a recent Petra Capital note, they valued us at 51 cents. We're currently trading around that 20 percent level. But given the diversity of polymetallic products, which we have, in that we're gold and copper, but we're also this magnetite product that sells as a specialist product, it's a density modifying industrial mineral and cobalt bismuth. We have a wide range of revenues available to us. That adds up to about $150, $160 million in revenue a year, for what is a relatively small, boutique style operation.

It'll only be about 450,000 tons of mining and processing, per year, which is a very manageable operation. Those large revenues really do give it some value. We'll be using those revenues to go wider, in this highly prolific area that we're in. So, you don’t just have that revenue and development story, but you also have the wider exploration story.

Dr. Allen Alper:

That sounds excellent. Those sound like very compelling reasons for our readers/investors to consider investing in Castile Resources. Mark, is there anything else you'd like to add?

Mark Hepburn:

It'd be great if people kept an eye on us. It's an area that really is starting to open up. Majors have been stampeding into this area now. The Northern Territory government knows for a fact that the best way to rebound, from this pandemic, is to encourage both development and exploration. We're getting a lot of support from that Northern Territory government, as well, and also the Federal Government. We have a strong tailwind, as far as getting this development out.

Dr. Allen Alper:

Well, that sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.castile.com.au/

Mark Hepburn

Managing Director

Castile Resources Limited

For further information please contact:

info@castile.com.au

Phone: +61 89488 4480

|

|