Ingrid Hibbard, President and CEO, Pelangio Exploration Inc. (TSXV: PX; OTC PINK: PGXPF) Discusses Discovering Gold in Ghana, West Africa, and Canada and an Agreement, with First Mining Gold Corp.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/2/2021

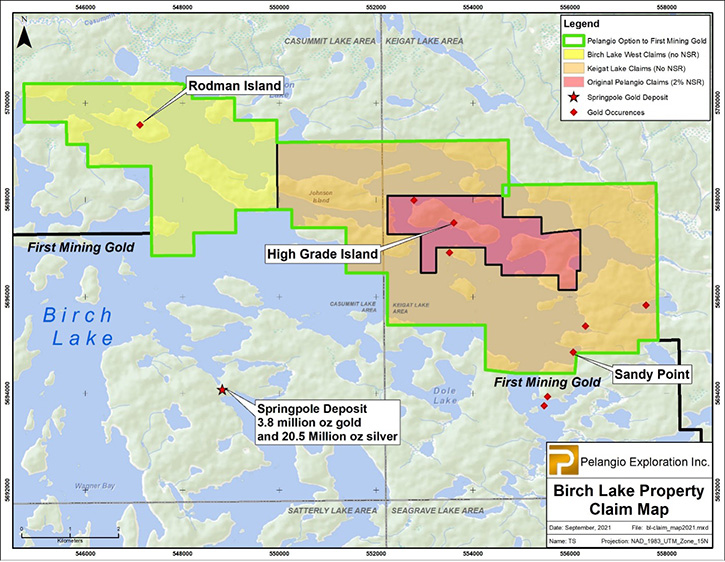

We spoke with Ingrid Hibbard, President and CEO of Pelangio Exploration Inc. (TSXV: PX; OTC PINK: PGXPF), a gold exploration company, focused on Ghana, West Africa, and Canada. Pelangio announced recently that it has entered into an earn-in agreement, with First Mining Gold Corp. and Gold Canyon Resources Inc., a wholly owned subsidiary of First Mining, on Pelangio’s Birch Lake Project, which is adjacent to First Mining’s Springpole Gold Project, located approximately 120 km northeast of Red Lake, Ontario. The next few months will see a lot of exploration drilling, to expand resources, both in Canada and in West Africa.

Birch Lake - Diamond drilling, Ontario

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Ingrid Hibbard, who is President and CEO of Pelangio Exploration. Ingrid, you've had a very exciting year and you have great exploration going on in Canada and also in Ghana. Recently you had a very exciting option of your Birch Lake property to First Mining. I was wondering if you could update our readers/investors on what's happening and tell them the great news.

Ingrid Hibbard:

For Pelangio, it's been a good year in terms of drill results and ongoing drilling and what we're looking at going forward. Well, let's start first with First Mining because we're quite excited about that. This is a project that Pelangio has owned for quite a while, and the deal represents the importance of project generation to resource exploration. It's a project that we always thought had a lot of value, but it took time for that value to be recognized by the market.

Birch Lake was optioned out a couple of times previously and Pelangio did quite well in those previous deals. But this time, we think we’ve placed the project in an ideal position, to receive the exploration work it deserves, at an opportune time. First Mining owns the Springpole deposit, a four-million-ounce deposit to the south of us. We think they're an excellent partner for us. The Birch Lake project has previous high-grade drill results, and we think a little bit of high-grade could have a big impact on their Springpole deposit. So, it is an excellent match, and they are really focused, in that area and are experts in the region.

The deal we struck is that they can acquire up to an 80% interest by spending $3.5 million in the ground and paying us cash option payments of $750,000, $400,000 of which they can choose to pay in stock if they wish. In addition, First Mining will issue us 1.3 million shares.

This is a deal that really shows how we like to operate. Developing truly significant exploration projects is about collaboration. First Mining has the drive and expertise to develop their Springpole deposit and the deal allows our shareholders to maintain the upside through a 20% interest, plus the shares that we're going to have. The deal means we're really working together, but really leveraging off their success at Springpole and their experience in the Red Lake neighborhood.

Dr. Allen Alper:

Well, that's excellent. You're working with a partner that has about four million ounces of gold and is well financed. So, it's a great partner and great synergy. I'm always very impressed, Ingrid, with not only the exploration activities that you and your Team do, but also your business understanding and arrangements that you can work out with partners. I think that shows an amazing ability.

Ingrid Hibbard:

Well, thank you. Our Team has had a lot of experience, together a lot of years in the mining industry. Which means a lot of contacts. Also, a lot of experience in doing the deals and finding ways that they can be successful for both parties.

Dr. Allen Alper:

Well, that's excellent, that's great. It's always a win-win for both parties. It's fair to both parties and it's great for your shareholders and stakeholders. Could you tell us more about your projects, like the Dome West Project and your Ghana projects?

Ingrid Hibbard:

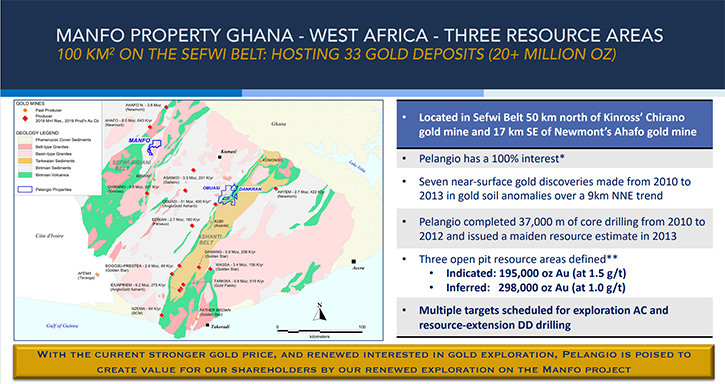

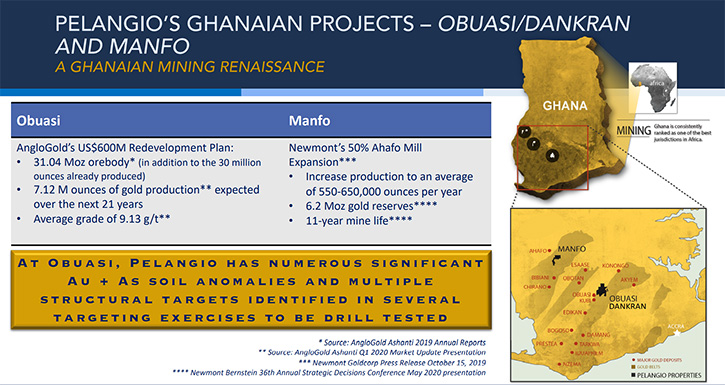

Let's go through them, in the order in which we expect things to happen. We'll focus on the one, where there is, or will be activity, in the next few months. Right now, we are drilling in Ghana, West Africa. That is the Manfo Project, which has a resource of almost half a million ounces. Our goal is to grow the resource and we're looking for new opportunities, which will help us on this mission.

The Manfo Project is a 100 square kilometer land package. It's about 17 kilometers from Newmont's Ahafo Mill, and it's on strike, with the Bibiani Mine to the south of us, which is just being reinvigorated. There was about $73 million raised recently, so that Asante could acquire that mine and get it going again. We are seeing a bit of a renaissance in exploration in Ghana.

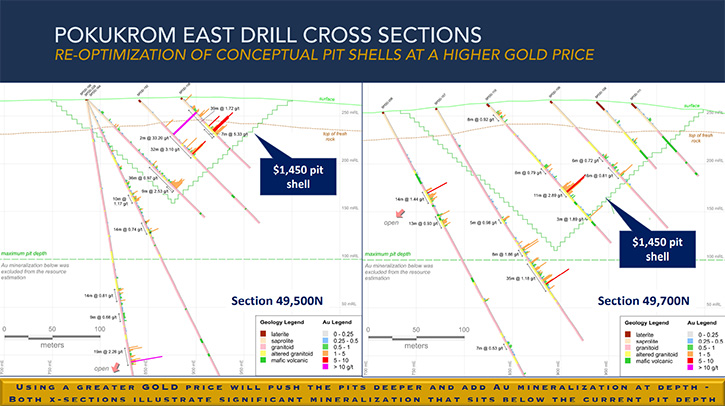

The Ahafo Mill was a major investment, made by Newmont and they've expanded the mill at Ahafo and they have also made the decision to proceed with the Ahafo North development. We are seeing a lot more mine development activity in Ghana. We think this is good news for our Manfo Project. Our resource is defined by several mineralized zones. The largest one is Pokukrom East and the smaller one is Pokukrom West. They're very close to each other. These two zones are separated by only 200 or 300 meters. What excites us about Pokukrom West is that is a high-grade target.

By now, people will have forgotten the excellent grades we’ve found at Pokukrom West. I just want to remind people because that's where we're going to be doing the next two holes, looking for some extension of that mineralized zone. Previous results are numbers like 10 meters of almost 33 grams, 12 meters of 6.86 grams, 12 meters of 8.6 and 8 meters of 5.81. That's where we're going to be drilling a couple of holes and that drilling is currently underway.

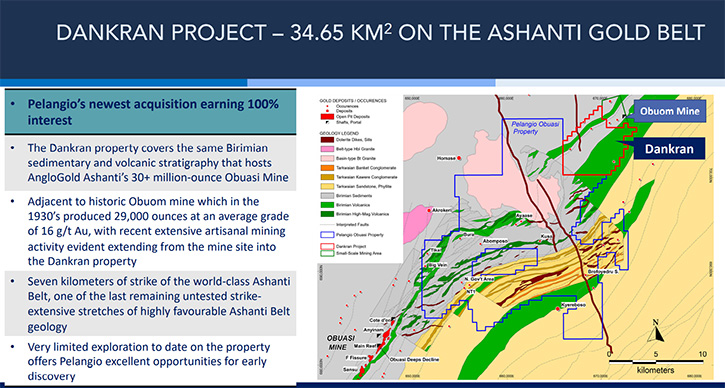

We have also expanded our land package on the prolific Ashanti Belt through our acquisition of Dankran, which is beside our Obuasi property. Our Obuasi property is adjacent to and on strike, with AngloGold’s Ashanti Obuasi mine, which has over 30-million-ounces in resources and 30 million ounces already produced. It's been reinvigorated as well. AngloGold Ashanti made a huge investment in order to reopen the mine. And we are quite excited to be their neighbour. Upon acquiring the Dankran Project, we went in and did 2,500 meters of RC drilling, along two and a half kilometers.

With the results of that maiden drilling at Dankran, we demonstrated the potential for discovery along that whole two-and-a-half-kilometer long structure, with assays like 6 grams over 2 meters and 14 grams over 3 meters, including almost 40 grams over one meter, then a broader interval of 10 meters of half a gram. So, with these numbers from our initial first pass program, this is a pretty exciting target, and we know we are in the right location as there is an old mine, along strike, just north of our property boundary. We look forward to following up at Dankran, after our planned work at Manfo and our programs in Canada.

Dr. Allen Alper:

Well, before you go on to Canada, could you just say a few words on how rich and important Ghana is for mining and exploring for gold?

Ingrid Hibbard:

Ghana used to be called the Gold Coast, so it has been a source of gold for the world for centuries. In recent times it has now surpassed South Africa as the largest gold producer in Africa. The Ashanti Belt is one of the world’s greatest gold belts, hosting AngloGold Ashanti’s Obuasi mine and several other mines and deposits. It is really the most prolific belt in all of West Africa. We've talked often about our strategy of always attempting to be located in really prolific belts and areas where there's been production, areas with significant potential.

One of the interesting things about the recently acquired Dankran project that we have now, is that by combining the Obuasi and Dankran land packages together, we have well over 300 square kilometers of highly prospective geology. And you know, this land package is relatively underexplored, certainly compared to the Timmins Porcupine Camp. Obuasi and Dankran are really tremendous opportunities. To see two and a half kilometers, that's been underexplored, it really hadn't had any work in the last 25 to 30 years; these are amazing opportunities and Ghana is a very stable democracy and excellent jurisdiction for mining and business. It is the most stable country in West Africa. In our opinion, it is one of the most favorable mining jurisdictions, in the world, because of its stability, its mining history and its gold endowment and because of its comparatively short timeline from resource discovery to mine development.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your Dome West Project?

Ingrid Hibbard:

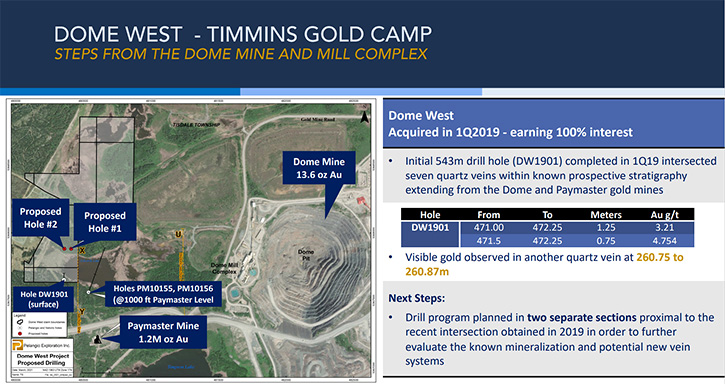

We have two projects we're going to be focusing on very shortly, both in the Timmins area. Dome West is a project located 800 meters from the current Dome pit. The Dome Mine has been in production for 70 years, and our ground is merely 800 meters from the Dome Mine’s open pit. You can sit on our property and see the pit or the shaft from the old mine.

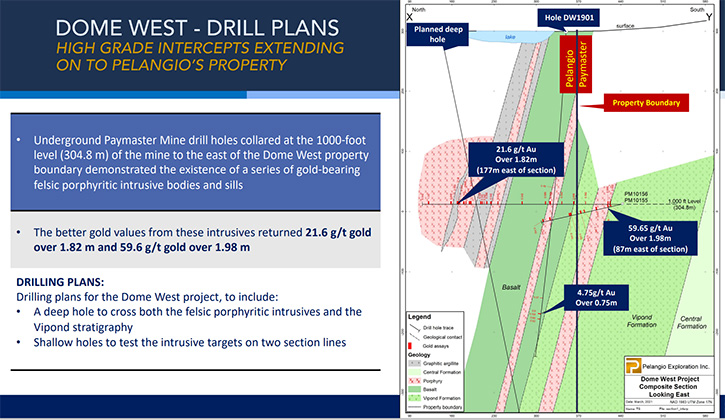

We did do some drilling back in 2019, and we got some sniffs of gold. We did get one and a half meters of three grams and there was some visible gold, so we definitely knew we were in the right environment. What's really interesting about this project is the fact that not only do we tie on to the Dome Mine, but we also tie on to the Paymaster Mine. So, there are two mines that have workings, which come to about 120 meters from our property boundary.

Using historical information from the mine workings and holes at the 1,000-foot level at the Paymaster Mine, we've been able to do a good job of pinpointing what our targets are going to be for this year. We think we’re going to be drilling Dome West in the October to November time frame. It's been a little bit challenging, getting drill rigs and drillers this year, between lots of exploration going on and COVID, as well as helicopters which have been redirected, to abate forest fires, in other areas of northern Ontario.

One of the holes is designed to target the porphyry system, which hosts a significant amount of gold in the camp, which is nearer to surface. As well, the program will examine the deeper Vipond Group Sediments, which hosts a significant amount of high-grade gold, from veins at the Dome Mine. One of the holes will target both the porphyry and the Vipond Group, depending upon how things change when you start to see the core and refine your understanding of the project’s geology. But, the other hole, currently proposed, is really just to target the porphyry this time. We're pretty excited about having mine workings that close to us. We think we have a pretty good handle on targeting these holes.

Dr. Allen Alper:

That sounds very exciting. It sounds like this October-November will be a very exciting time for your shareholders and stakeholders, as you get more and more drill results.

Ingrid Hibbard:

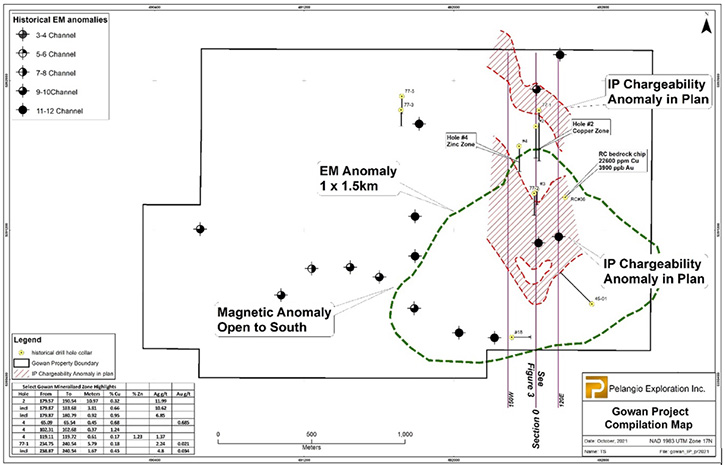

One hundred percent. Another exciting project, Pelangio is exploring, is our polymetallic Gowan Project, located 16 km from the Kidd Mine. At first Gowan was a lower priority target, but is currently giving us a number of reasons to be excited This is why we love exploration! There had been a couple of previous gold numbers on it. It hadn't received much work since the 70s and we had limited data to justify a big expenditure on the project, at the time. However, we knew there was exploration potential, if we could budget appropriately. We wanted to fly one of those, recently advanced technology, deep penetrating airborne surveys. They're generally quite expensive, particularly because you have to pay for the equipment, to come up from elsewhere.

Kevin Filo, our Canadian geologist, talked to the suppliers and said, “Listen, we really don't want to pay the costs for mobilization because it's not a high priority for us. But if you're ever in the neighborhood, why don't you just tack it on and fly our property too. It'll be good for you. It'll add a little extra and it'll be good for us because we'll get it done cost-effectively.” So, we negotiated the airborne VTEM survey, at a price we could justify, but we didn't really have any say on when it would happen. But lo and behold, it did happen several months ago, and this project is 16 kilometers, from the famous zinc copper Kidd Creek mine.

In the 1970s, people were exploring like mad around Timmins, for another Kidd Creek. There were a few holes put in this property, back in the day. We did know that it had had some copper, zinc, silver and gold numbers, but not economic at that time. They were relatively shallow holes. When the airborne survey came back and then the anomaly was outlined, it was really big. It's a kilometer by a kilometer and a half long anomaly.

We are pretty excited. This copper zinc silver gold project would be something quite different for Pelangio, which has historically been a gold exploration company. Right now, we have completed ground geophysics to help us refine the drill targets. The initial drill program is funded, and we hope to be drilling that after we finish the drilling at our Dome West property. Drilling is expected to start in early 2022. Given its proximity to Kidd Creek, Timmins is a little unusual in that there's been some big nickel plays in the area too, so there's more than just gold, in the Timmins camp.

Gowan is your classic exploration surprise. We have just received the results of the follow up ground IP survey, which has actually defined two high-priority base metals targets – a copper-zinc VMS target and a nickel-copper target.

Dr. Allen Alper:

That sounds excellent. Those metals are very important in the electrification of the world.

Ingrid Hibbard:

Exactly.

Dr. Allen Alper:

Ingrid, you have a very excellent and outstanding background and a record of success. Could you say a few words about that?

Ingrid Hibbard:

The Detour Project was an incredible journey for Pelangio and me. When Placer had it up for sale, back at the bottom of the market in 1998, we identified it as an unbelievable opportunity that seemed to be completely unrecognized at the time. We saw an opportunity to buy the Detour Mine, which was closing at the time, 52 square miles around it, all on underexplored portions of the Abitibi Greenstone Belt. In 1998 Pelangio was a very tiny junior, we couldn't possibly see how we could come up with the money to acquire it.

We went to Franco-Nevada for assistance, with the acquisition, and I will send you a little video clip, because David Harquail and I recently sat down and had a stroll down memory lane and did a little video about our “handshake deal”. In addition, Paul Brink and David Harquail, very nicely, invited me to go up to the Detour Mine site, with their Board, to see what it's become all these years later. Pelangio was able to acquire the Detour Mine property, through collaboration with Franco-Nevada, who put up the money to allow us to finance the purchase, when most everyone else in the industry did not see the potential.

It's amazing to see how Detour’s grown, as it went from the 1.2 million ounces, we thought we were buying from Placer Dome, to what it is now. Kirkland Lake Gold just recently added 10 million ounces to their resource at Detour. Furthermore, I think that camp is going to be finding more ounces and will be mined for a long time to come. Kirkland Lake is just doing a great job, honing the production, getting costs down, producing efficiencies. The Kirkland Lake Team and the Detour Team, before that, have been doing a great job of optimizing it.

Dr. Allen Alper:

That sounds excellent, something you and your Team could be very proud of.

Ingrid Hibbard:

I'm actually sitting, as we speak, up at our place, located just outside of Timmins, my family home, where I grew up looking at the autumn leaves. One of the drivers, for our Detour acquisition, was job creation for the North. When you grow up in the north, you realize how important it is to support the local economy. One of the things, Kevin Filo and I thought at the time, “Wouldn't it be cool if we could save this mine, that's closing? Wouldn't it be wonderful to be able to create new jobs?”

And that's what it's done. It's created a thousand new jobs and 20% of those jobs are indigenous workers. It is wonderful for our shareholders, wonderful for the local communities of Timmins and Cochrane and wonderful for the indigenous community. So, another one of those win-win-wins.

Dr. Allen Alper:

Well, that's excellent. That's really fantastic. Could you tell our readers/investors a little bit more about some of the members of your Team and Board?

Ingrid Hibbard:

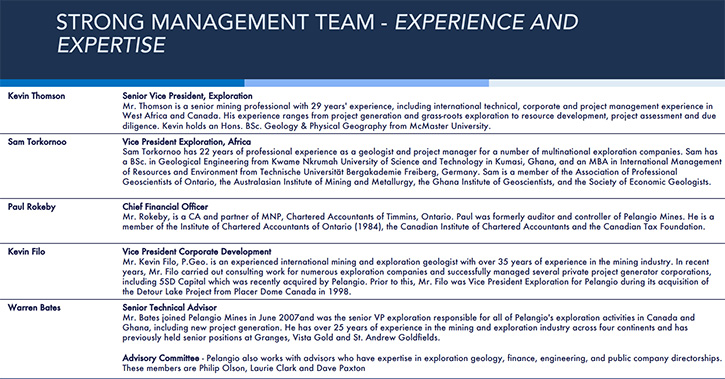

Kevin Thompson is our Senior VP, and he looks after Africa. Kevin brings years of experience in Canada first, but he then went over to Ghana and focused on Ghana for 20 years, lived there for 12. He went there originally with Hemlo, which became Battle Mountain, which became Newmont. He was looking after regional exploration for them. Then he was working with Perseus and drilled off a number of deposits. He has years of experience in West Africa.

Sam Torkornoo, is our VP Africa, based out of Ghana itself. He has a geological engineering degree from Kumasi in Ghana, as well as an MBA from Freiburg, Germany. He runs his own consulting company, so he's a huge asset for us.

Kevin Filo is our VP Corporate Development. He's really the fellow who worked hardest to get the Birch Lake deal done. He and I have worked together, since we were sitting down one day, back in 1998, saying wouldn’t it be awesome if we could figure out how to buy the Detour mine? That's really our key to success: stellar people.

On the Board, we have JC St-Amour, who has corporate finance experience and is also CEO of a couple of companies. He is our Chairman.

Al Gourley, a very well-known Canadian lawyer, who has been based out of London for years, with tons of mining experience. He and I worked together back at Noranda many, many years ago.

Kevin Thompson is also on the Board.

David Mosher has been working with Pelangio for years. He was formerly the President of High River that had projects in Burkina Faso. When we first were making the move to Ghana, he was hugely supportive and a great source of advice for us, about operating in Africa and what a great jurisdiction Ghana was and is.

Dr. Allen Alper:

Well, you have a great Team and Board, well experienced. That's excellent, Ingrid. Could you tell us a little bit about your share capital structure?

Ingrid Hibbard:

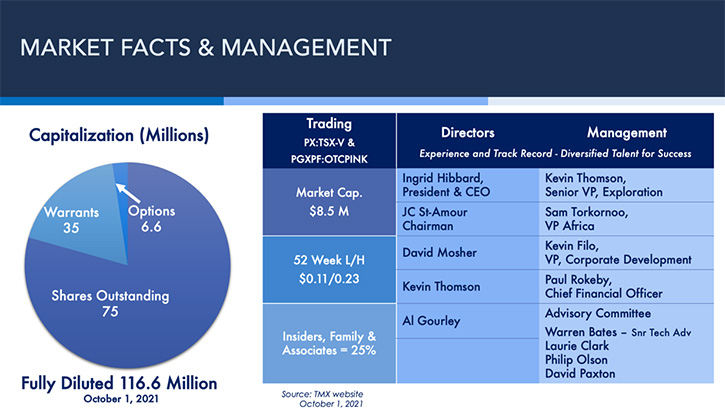

We have 75 million shares outstanding, and fully diluted 116 million. There are a fair number of warrants issued, at higher prices than our current share price, given where the current state of the market is. Considering the asset base, with Obuasi, Dankran, Manfo, Dome West, Gowan and Birch Lake. When you look at the value attributed to Birch Lake, as a result of this recent deal, with First Mining and you compare it to our entire market cap, it shows you that the current market conditions, if you're a buyer, are an excellent opportunity for an entry space into gold, because the gold space is tremendously undervalued right now.

Dr. Allen Alper:

True, that's absolutely true! To summarize, what are the primary reasons our readers/investors should consider investing in Pelangio Exploration?

Ingrid Hibbard:

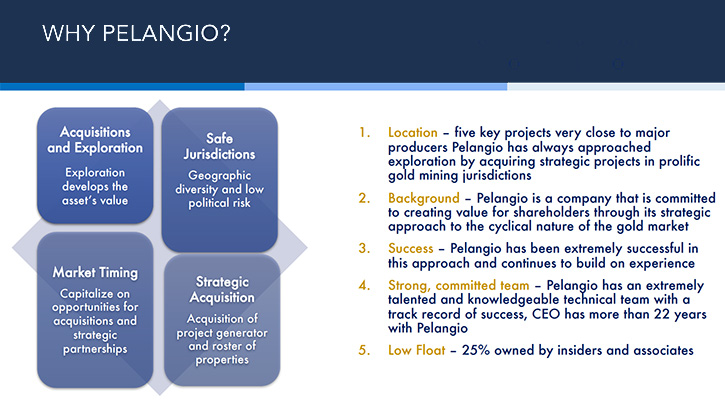

With Pelangio, what you have is geographic diversity, in two world class mining jurisdictions, with wonderful gold endowment. Both Countries boast more than a century of mining production, in both the Abitibi and Ghana. Pelangio has an experienced Mining Team that has had success in the past. All of us are experienced and successful in resource discovery and at drilling off some deposits.

We recognize that collaboration is necessary and not one company or one group can have the entire skill set. We have excellent upside potential, if you look at where we're drilling, even in the next three months, what we're doing at Manfo, in the area of the existing resource. You already have a half a million-ounce resource and drilling in the Pokukrom West high-grade area of the pit shell.

So Pelangio has a lot of activity in the coming months. Resource drilling at Manfo, upside potential of Dome West, which is right beside the Dome and the Paymaster. Then the tremendous blue sky of what Gowan might be. This is why we love what we do, in the early stage of exploration, when you are working on a new prospect. Gowan could be a Company maker, all on its own! Then the ability to do the kind of deals that we did with First Mining.

Dr. Allen Alper:

Those are very compelling reasons for our readers/investors to consider investing in Pelangio Exploration. You have a great successful Team, with a great track record, and you have great projects and outstanding areas, and now exploration that will give results and interest to the marketplace. Your Company is way undervalued, so that's an opportunity for investors.

Ingrid Hibbard:

Yes, 100% right. We're undervalued, as is the whole sector, although of course, we think we're more undervalued than most and we have drilling about to be happening in three separate projects and in two geographic areas, one in Ghana and two in Canada. One of which is drilling on an already existing resource. So, you know, the risk reward, I think, is very much why people play exploration and here you have one where there are three projects going to be drilled, showing their potential in the next three months.

Dr. Allen Alper:

That sounds excellent. It'll be an exciting time for Pelangio’s shareholders and stakeholders.

Ingrid Hibbard:

And we’d love to be welcoming some new shareholders, so if anybody has any questions, they should give us a call.

https://pelangio.com/

Ingrid Hibbard, President and CEO

Tel: 905-336-3828

Toll-free: 1-877-746-1632

Email: info@pelangio.com

|

|