Brett Matich, CEO and President, Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2) Discusses Advancing the Newly Discovered District-Scale CESAR Copper-Silver Project, in Colombia and the Recently Acquired RT Gold Project in Peru

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/27/2021

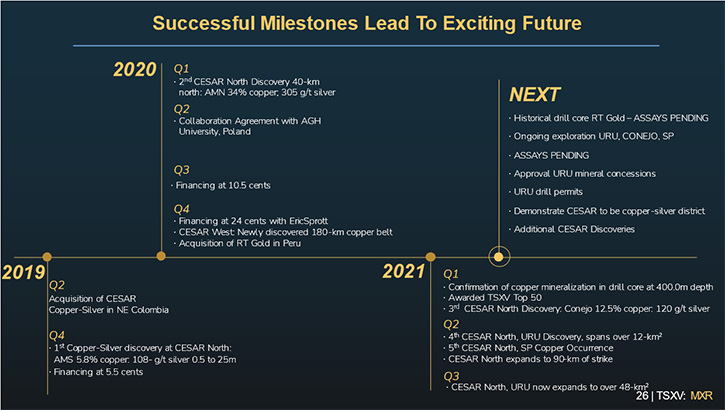

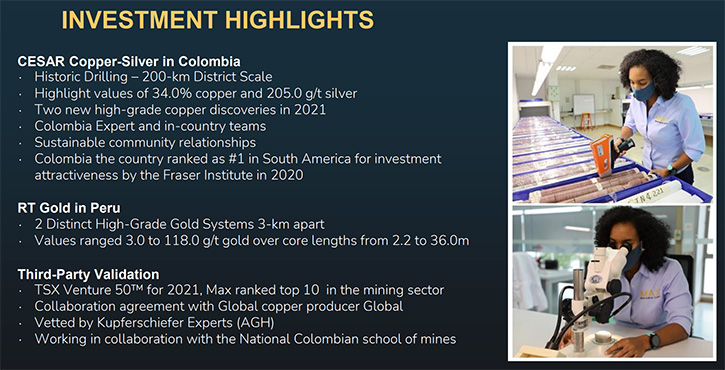

We spoke with Brett Matich, CEO and President of Max Resource Corp. (TSX.V: MXR; OTC: MXROF; Frankfurt: M1D2). Max Resource Corp. is a copper and precious metals exploration Company that was awarded a Top 10 Ranked Company, in the Mining Sector, on the TSX Venture 50™ for 2021, achieving a market cap increase of 1,992% and a share price increase of 282% in 2020. Max Resource is advancing both the newly discovered district-scale CESAR copper-silver project, in Colombia and the newly acquired RT Gold project in Peru. Both projects are 100%-owned and have potential for the discovery of large-scale mineral deposits. Near term plans include year-round exploration, to expand the resource at CESAR. In Peru, the Company plans to apply for drilling permits for this year.

Max Resource Corp.

Dr Allen Alper: This is Dr. Allen Alper, Editor and Chief of Metals News, talking with Brett Matich, who is CEO and President of Max Resources Corp. Brett, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

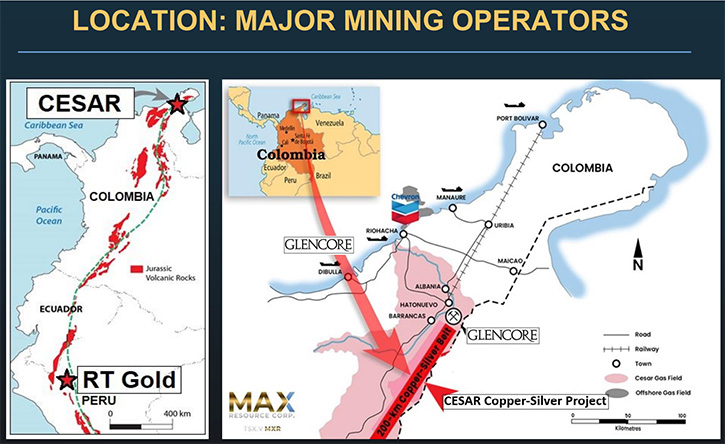

Brett Matich:Max Resource is listed on the Toronto Stock Exchange, our ticker is MXR. We're a Canadian junior exploration Company. We have two projects. One is a copper silver project called CESAR, in Columbia, and the second is a gold project in Peru. The difference in relation to our exploration model is in Colombia, we have arguably the largest copper silver exploration project that I know of in the world. It's a sedimentary system. The two comparisons are, a copper mine called Kupferschiefer in Poland, which is the largest silver producer in the world and number six copper producer, and the African belt where there was the last major copper discovery by Ivanhoe Mines.

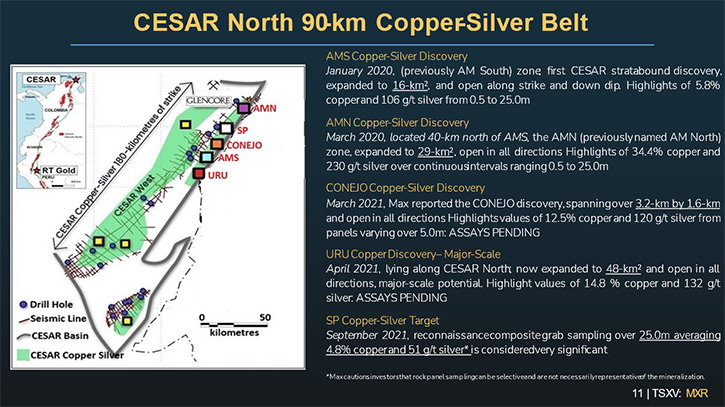

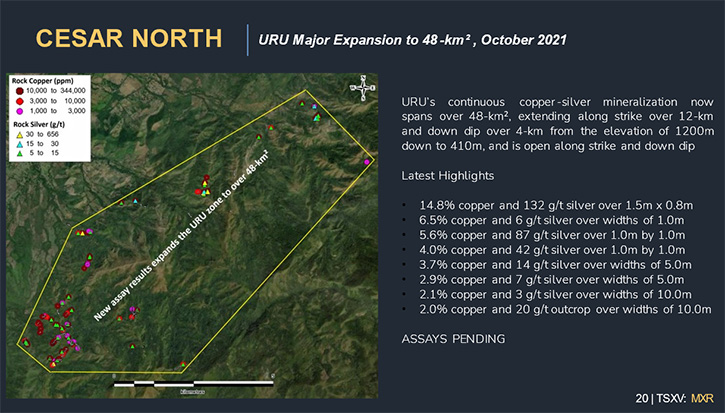

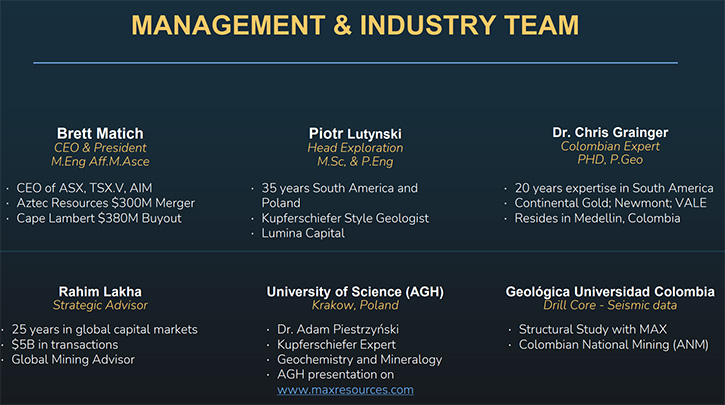

Brett Matich: We started exploration two years ago, in 2019. We have an in-country Team. Our Team is very successful in developing deposits. Our Team and I have been involved, in iron ore deposits, copper nickel deposits, through to production, in Australia. Our In-Country Manager was involved with a Company called Continental Gold in Colombia, which was taken over for $1.4 billion in 2019. The work we're doing is demonstrating the amount of copper and silver, over a huge land area. We just had a news release today, regarding one of our potential deposits, we've identified copper over an area of 48 square kilometers at the URU zone, which is massive. It's one of the biggest exploration copper targets that I know of.

Dr Allen Alper: That's excellent. Could you tell us a little bit about the grade, et cetera, and maybe how a deposit like that originates?

Brett Matich: Okay. So, this deposit is in a sedimentary system. It originates way back, with the ocean and a basin. The ingredients that you have are coal, this is a major, one of the largest coal mines, or the largest coal mine in South America. And we have oil and gas production.

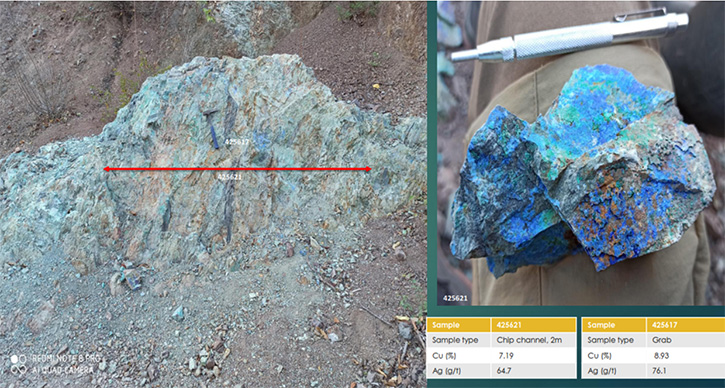

In Colombia, they are pushing for copper exploration. A lot of the companies’ policies now are to get out of thermal coal, thermal coal exploration. The grades are sensational. We get grades of up to 34% copper and up to four ounces per tonne silver. The reason we can get a lot of this exploration done is that the amount of copper and silver at surface is huge. In this particular area, it's called URU. The discovery was only six months ago and now we've identified copper over 48 square kilometers, which is huge.

It's over topography that is up to 600 meters. And the infrastructure is excellent because of the oil and gas operations. There are five ports, sophisticated grade systems, airports, railway, and so forth. So, we've had a lot of interest from majors. We've announced that we have a CA, with one of the largest copper producers in the world, and we have a CA with a global miner.

Dr Allen Alper: Well, that sounds excellent. That's great to have such a huge resource, with high grades and to have such great infrastructure and access to water shipping. What are your plans for the rest of 2021, going into 2022, for the CESAR deposit?

Brett Matich: With CESAR, copper/silver deposits, our plan, through 2021 and early 2022, is to focus on URU, to expand it. We are currently waiting for approval of the mineral claims, which we expect in the coming weeks. Followed by that, we would do IP Geophysics. And we'd look at filing a drilling permit, towards the end of this year, to look at the first drilling program early next year.

So that's simply what we are doing. Exploration is all year round. We have an in-country Team. We have 10 geologists. Because it's in-country, we don't have to fly geologists in and out of the Country. So that is our direction for 2021.

Dr Allen Alper: That sounds excellent. Could you tell our readers/investors about your gold property in Peru?

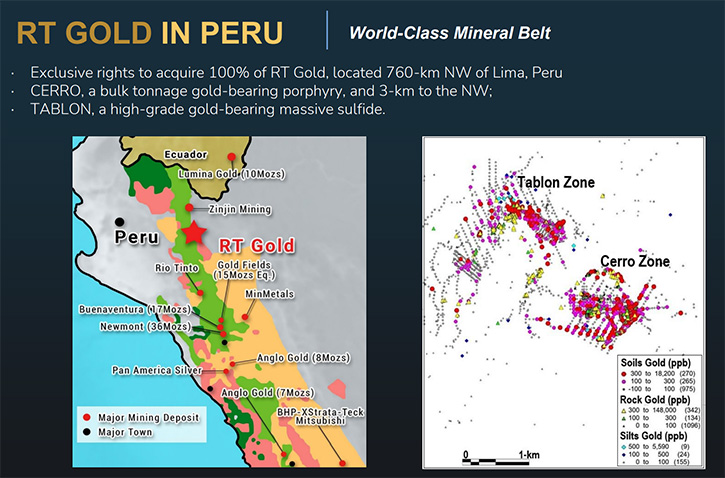

Brett Matich: The gold property in Peru has two types of deposits. One is a vein system. There was drilling in 2001, when the gold price was only $300 an ounce, it's now $1,800 an ounce. It's very high-grade. We have grades going as high as 119 grams per ton. We have wide intersections, for example, 25 meters at eight grams a ton. It's drilled over 700 meters.

With this particular one, we're assessing all the drill core to delineate a drill program. In the three kilometers to the southeast, we have a gold porphyry system. The porphyry remains in situ, so we have a system that is basically a hill, 300 meters high, and the area of mineralization is one and a half kilometers by two kilometers, which is huge.

We're looking to do a field visit this year. It'll be the first field visit in 10 years. We are making preparations for drilling permits this year, to then drill. Our largest shareholder, is a major investor, called Eric Sprott. He holds approximately 10% of Max. His attraction to Max was the gold project in Peru.

Dr Allen Alper: Oh, that sounds excellent. It's nice to have such an experienced and knowledgeable investor. That shows that an expert has faith in your projects. So that's excellent! It’s also strong backing. Could you tell our readers/investors a little bit more about your background, your Team, your Board?

Brett Matich: I'm Australian. I made it to Canada in 2010, so I have been here a decade. I've previously been involved in identifying projects, and I've been the CEO of a number of companies. One is a Company in Australia called Aztec Resources. It was an old iron ore mine. Between 2000 and 2007 the Company went from a $1 million market cap to a $300 million merger. At that point, it was starting production. So that shows my experience in dealing with institutions.

There was another Company in Australia called Fox Resources. We bought it. I put it together from a closed nickel copper mine to full operation, within two years. My first in Canada was a company called Cap-Ex Ventures, from 2011 to 2016. We were nominated as number three mining company, on the TSX Venture Exchange in 2012. It was an iron ore magnetite deposit that had never had a drill hole. We went from no drill hole back in 2011, to delineating a 43-101 resource, of eight billion tons, at 29% iron content. And we completed a PEA, which is a prefeasibility economic assessment study. So that's a little bit of my experience.

I've dealt with finances and institutions in Canada, Australia, and in Asia. The important thing is, when you have these projects, is to look at where you want to take the project. At CESAR copper and silver, the direction was to demonstrate the prolific amount of copper, copper grades and silver, in an entire belt, to then attract a major to come in and do sophisticated drilling, which is in the tens of millions. And we have achieved that. From the very start, you have to work on the direction in which you want to take the project.

Dr Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your share and capital structure?

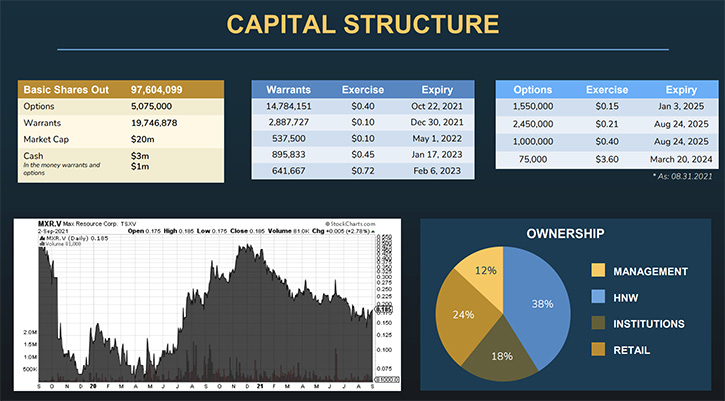

Brett Matich: Our share and capital structure, in relation to cash, we have $3 million cash in the bank, which is sustainable for the exploration that is required. We have 98 million shares on issue. Our trading price, at the moment, is 18 cents. We've been as high as 50 cents. We've come back, with what's happened with the market, so it's very strong. We have a market cap, at present, of 18 million. Our comparison would be a company that's very similar, with a code that is ARU, it's on the Toronto Stock Exchange. They have a market cap of 80 million. That provides a comparison to our peer. There's quite a gap there that we can catch up.

Dr Allen Alper: It sounds very good. Could you tell our readers/investors the primary reasons they should consider investing in Max Resource Corp?

Brett Matich: Considering investment, the first is looking at Management, then looking at the commodity and copper is the largest commodity in demand, in relation to clean new energy infrastructure. Without copper, you can't go forward with that. Electric vehicles need three times more copper than a standard vehicle. You look at the commodities. The other commodity we are in is silver. Silver is needed in all types of electronics, like solar heaters. It's needed in 5G networks. We leveraged on gold as well. So gold is your safe haven. And then you also should look at the country, Colombia. In a CEO survey, Colombia was voted number one mining jurisdiction in South America.

Dr Allen Alper: Oh, that sounds excellent! They sound like very compelling reasons to consider investing in Max Resources. Brett, is there anything else you'd like to add?

Brett Matich: Yes, we'll have a number of news releases coming out this year. We had one today. Please look at our website, which is www.maxresource.com. And our ticker on the Toronto stock exchange is MXR. It's been a pleasure talking with you.

Dr Allen Alper: Well, that sounds great! We’ll publish your press releases as they come out so our readers/investors can

follow your progress.

https://www.maxresource.com/

For additional information contact:

Max Resource Corp.

Tim McNulty

E: info@maxresource.com

T: (604) 290-8100

|

|