Don Mosher, President and Director, Desert Mountain Energy (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01) Discusses Building their Holbrook Basin Helium Project, Arizona, into a Vertically Integrated Helium Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/12/2021

We spoke with Don Mosher, President and Director of Desert Mountain Energy (TSX.V: DME, U.S. OTC: DMEHF, Frankfurt: QM01). Desert Mountain Energy is building their Holbrook Basin Helium Project, in Arizona, into a vertically integrated Helium producer, with their own solar facility, to produce their own electricity, and with plans to sell directly to end users, primarily in Arizona. They have now successfully drilled four wells, and announced the discovery of McCauley Field, with commercial grade helium, in discovery well #4. The Company is looking to move forward, through the development stage and into production and positive cash flow, by second quarter of 2022.

Desert Mountain Energy

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Don Mosher, who is President and Director of Desert Mountain Energy. Don, could you give our readers/investors an overview of your Company, what differentiates your Company and discuss your helium projects and rare earth gas projects. Also tell us a little bit about the philosophy of your Company.

Don Mosher:

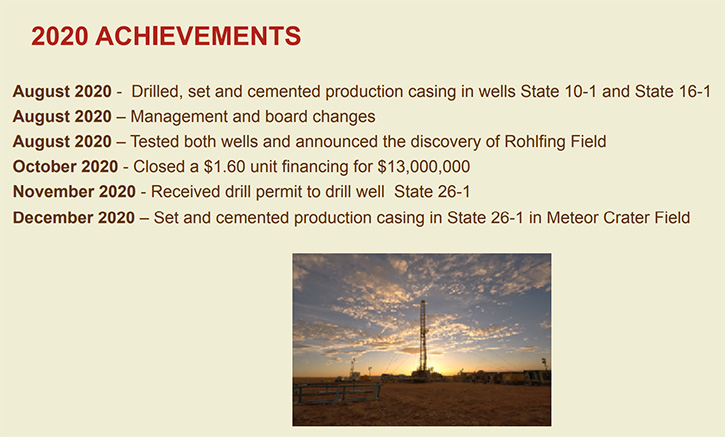

I would call us a fast-developing company. The last 14 months has gone from grassroots exploration, without having drilled a single well and simply having a geological concept, to now having successfully drilled four wells. We are looking to move forward, through the development stage and become a vertically integrated helium producer, by second quarter of 2022. Our philosophy is to be socially responsible, environmentally responsible and hopefully supply a much-needed commodity to the U.S. domestic market for high-tech purposes of using helium.

Dr. Allen Alper:

Could you elaborate on the uses of helium and also rare Earth gases?

Don Mosher:

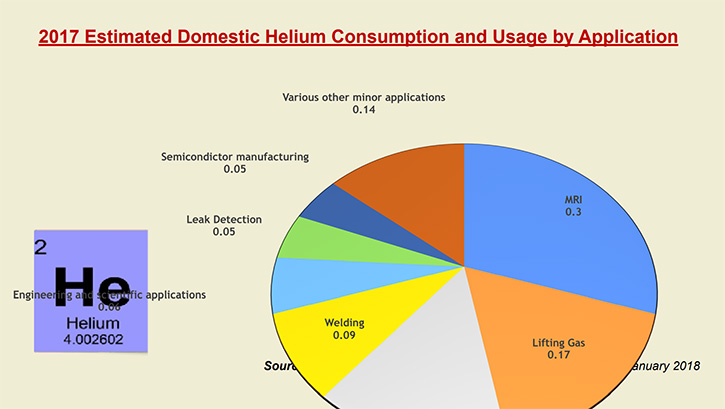

Traditional uses of helium, starting with lifting gas, leak detection, deep sea diving, welding and it has now morphed into a high-tech. It's used extensively now as a coolant for applications, such as cooling the magnets in MRIs. MRIs used about 20% to 30% of all production currently on a global basis. But with the development of cloud-based technologies and the supercomputer sites that are necessary to supply those services, it's used for coolant by Google, by Microsoft, by all those companies.

Even the bitcoin mining, those computers produce a lot of heat, so they're using it for bitcoin mining. In the revitalization of the space program, with SpaceX, Blue Horizon, it's used for purging the ballistic rockets, before a space launch. It's also used for creating an environment to manufacture a number of high-tech products, such as liquid hard drives and fiber optics. Uses of it are broadening out, and it's absolutely irreplaceable as far as the commodity needed to have those modern-day services that we're starting to rely on so heavily.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about the supply and demand of helium?

Don Mosher:

Well, what we've seen is a growing demand for helium and actually a bit of a drop in production. The deficit this year, in the global helium market, will be about two Bcf out of an industry that only demands about 12.5 Bcf. We are seeing a reversal in natural gas prices, which is going to help solve this problem. But helium comes out of natural gas and specifically in the U.S. the shales have come on stream and supplied so much gas that it's basically discouraged the development of traditional natural gas fields.

You've seen the production of traditional natural gas from 2015 to 2019 dropped from 9.3 Bcf down to about 7.7 Bcf, while the production out of the shales has gone from 15.7Bcf up to 27.7. Natural gas, until the last couple of months, couldn't catch a bid. I think today it's about $6. If natural gas can hold a $6 or $7 price, you will start to see some develop money go back into the traditional fields. But the helium production, coming out of those fields, is simply as a byproduct. They view commercial helium grades, in a natural gas field, 0.3 to 1% helium.

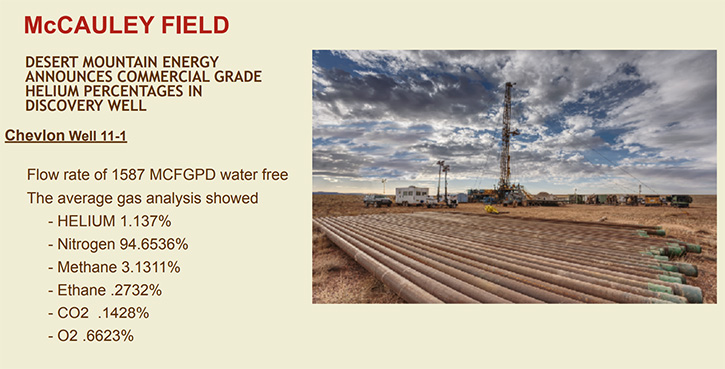

What differentiates us from that is we're finding helium, in a nitrogen environment, in Arizona. The nitrogen in our wells, which are dry gas wells, we're not looking to have anything in the wells in the way of water. What we hopefully find, is a majority of nitrogen, with a relatively high-grade of helium and a few background gases. Our wells have run anywhere from 77% to 94.6% nitrogen. Our helium grades have run 1.137% helium, up to better than 7% helium.

What can complicate that is what you're calling the rare Earth gases and the noble gases argon, krypton, neon, xenon in the background. They also need to be removed, and that can be an expensive process. Each one of those gases needs a separate step to isolate it. The well that we just announced, and the stock took quite a beating on that announcement, unknown to me, why. We have now identified the first field that we're going to put into commercial production, the McCawley field, 1.137% helium was in well number four that we drilled in that field.

The reason we're putting it into production first is because the composition of the gas is so simple. We don't need to deal, with those extra steps that you would get, with the noble gases. In this instance, the other grade was low at 1.137%, but that would be a bonanza grade, in a natural gas field, 94.66% nitrogen is something that will vent off at the wellhead. We will not have to deal with it because nitrogen is environmentally benign. Then we had 0.22 percent CO2, which is basically trace, .66% oxygen, which again can be vented off and 3.5% methane ethane, which we will collect and use for background generator purposes.

We've identified five potential plants that we can currently buy. We don't have to deal with long lead time components for them. It's a matter of identifying, which one will meet our needs, based on engineering specifications, dismantling and relocating the plant to Arizona, as well as having obviously negotiated a fair price, on them, that we're happy with.

Dr. Allen Alper:

That sounds excellent. It's amazing how rapidly you've been going from exploration, to development and then into production and becoming a vertically integrated Company. That's amazing progress!

Don Mosher:

Thank you. It’s much quicker than the mining business, let's put it that way.

Dr. Allen Alper:

That's terrific! I know you strengthened your Team this year. Could you tell our readers/investors a little bit about your Management Team and also your Board and yourself?

Don Mosher:

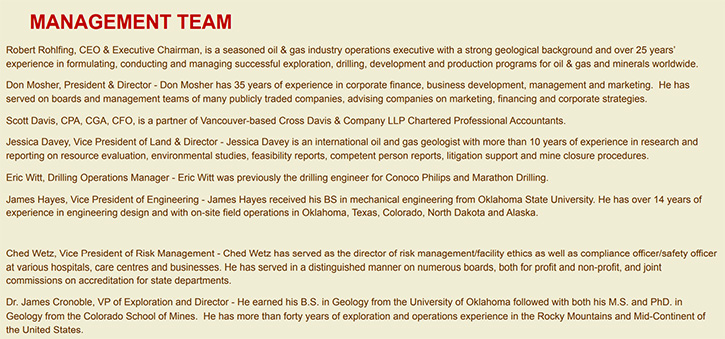

I came on board in mid-August of 2020, at the invitation of Rob Rohlfing, who at the same time went from being VP of Exploration to taking over the Chairman and CEO role. Rob comes out of private industry. This is his project, 100%. He developed the geological concepts, he targeted the leases that we own. He targeted the drill targets that we successfully completed on, and he actually ran the drilling programs himself. But he doesn't have any public market experience, so that's what he brought me on for.

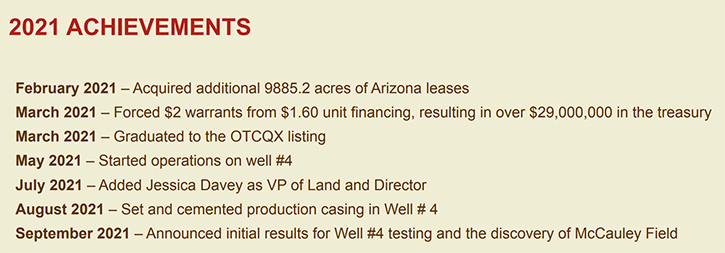

With the success we've had, we've started to build a Team, starting basically in May June of 2021. We brought on Ched Wetz, as VP of Risk. We brought on Eric Witt, as Drilling Operations Manager. He came from Marathon. We brought on Jessica Davey, she formerly worked for Sproule. She's our VP of Land, she deals with the Land Commission and the Oil and Gas Commission and deals with acquiring new leases and getting permits for drilling, etc. That has helped free Rob up to look for more business opportunities. Most recently, we brought on James Hayes as VP of Engineering. He came to us from ConocoPhillips.

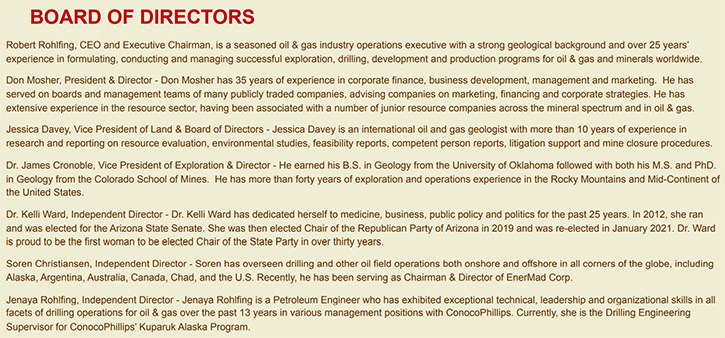

On our Board, we have Rob, Jessica Davey also joined the Board. Dr. Jim Cronoble came to us from the University of Oklahoma. He acts as our VP of Exploration. He came to us in August last year, when I joined. In addition to that, Jenaya Rohlfing came to our Board. She's Rob's daughter and she's a VP with ConocoPhillips.

Then finally, Dr. Kelli Ward joined us. She specializes in children's medicine, igniting her interest in the medical applications for helium. She brings her political connections as the Head of the Arizona Republican Party. We have a good rounded out Team here now, with everybody having extensive qualifications for their positions.

Dr. Allen Alper:

Well, it's great to see such a knowledgeable, well-balanced Board. That's excellent! Business, technical and financial, that sounds excellent!

Don Mosher:

Unlike most companies out there, we have a balanced Board, with three women and four men. I think you're going to see more companies moving in that direction, with different views from men and women. A more balanced opinion on how to move forward on different social environmental aspects, as well as just the business aspect of the business!

Dr. Allen Alper:

That sounds excellent. Don, could you tell our readers/investors a little bit about your share and capital structure?

Don Mosher:

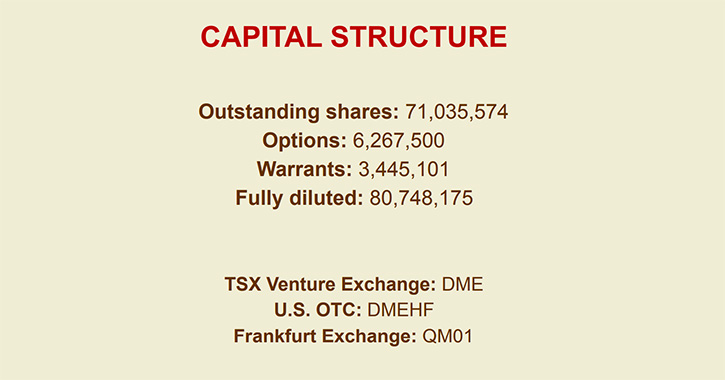

We have 81 million shares issued, fully diluted; we have about 71 million shares out. We have approximately $25.5 million Canadian in the Treasury, which we think is enough money to get us through to production. We don't have any plans of financing in the near future. If we do, it would be as a result of some new business opportunity, coming forward. But we're really focused on becoming a vertically integrated producer and the entire focus, of the Company and the Treasury, is aimed in that direction.

Dr. Allen Alper:

It sounds excellent. Don, could you tell our readers/investors the primary reasons they should consider investing in Desert Mountain Energy?

Don Mosher:

Our projects are unique in that they're going to allow us to be a primary helium producer, we're not looking at being held hostage by natural gas prices, for example. We think we'll get to production and positive cash flow, in six to eight months, looking forward, which is a very rapid transition from being an exploration development to a production company. When we announced the discovery and the McCauley field, we didn't do a very good job of communicating the value of that field to the market. The day the announcement was made, we saw about $140 million get carved off our market cap. I think, with the current price of $2.80 Canadian, as opposed to trading at $4.50 to $4.95, it offers a unique opportunity if you want to enter into a helium investment.

Dr. Allen Alper:

That sounds excellent. That sounds like very compelling reasons to be in a product that has unique uses that are growing and that there's a supply and demand gap and that you are so well positioned, to go from exploration to production in such a short time. You're in a very favorable location, in Arizona, with a great experienced Team. So that sounds excellent!

Don Mosher:

Yeah, we will continue to build our Team out, as we move forward. We'll continue to drill more of our prospects, and I think the investment community can now look forward to us announcing results from further work being done, both downhole, as well as the acquisition of the processing facility and starting to move into the construction phase shortly.

Dr. Allen Alper:

That sounds excellent. Don, is there anything else you'd like to add?

Don Mosher:

I think that pretty well covers it. We do have the ambition of uplifting these Company shares to a NASDAQ listing, from its current listing QX on the OTC and the TSX Venture Exchange listing that we have. We do have NASDAQ ambitions that would allow an easier way for U.S. investors to get into our shares.

Dr. Allen Alper:

That sounds excellent! I would guess that will make it easier for U.S. investors, give them a better opportunity and more liquidity. We’ll publish your press releases, as they come out, so our readers/investors can follow your progress.

https://desertmountainenergy.com/

Don Mosher, Vice President of Finance

(604) 617-5448

E-mail: Don@desertmountainenergy.com

|

|