John Darch, Chairman and Ken Macleod, President and CEO, Sonoro Gold Corp. (TSXV: SGO, OTCQB: SMOFF, FRA: 23SP) Discuss Becoming a Gold Producer in the Mining-Friendly Sonora, Mexico

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/12/2021

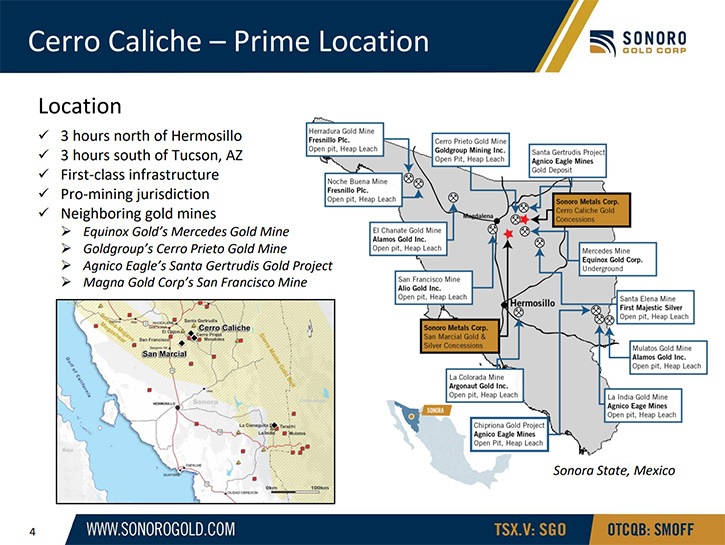

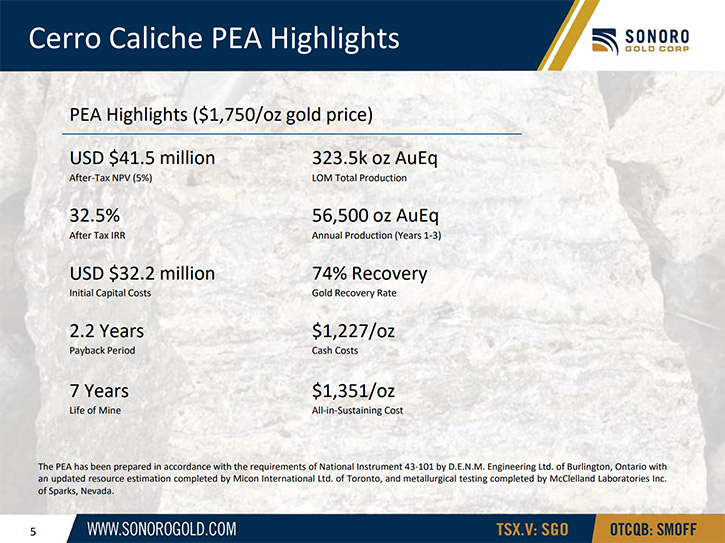

We spoke with John Darch, who is Chairman and Director, and Ken MacLeod, who is President and CEO, of Sonoro Gold Corp. (TSXV: SGO, OTCQB: SMOFF, FRA: 23SP). Sonoro Gold is a junior gold explorer, making the transition to gold producer, with properties in the mining-friendly jurisdiction of Sonora, Mexico. On September 15, 2021, Sonoro Gold announced positive PEA results and a new mineral resource estimate for the Cerro Caliche gold project, which demonstrates a pre-tax NPV of US$68.7 million and an IRR of 52.7%. The Company will work towards going into production, as soon as possible, expecting strong cash flow. Over the next two years, Sonoro Gold will work on doubling the life of the mine with additional drilling.

Sonoro Gold Corp.

Dr. Allen Alper:

Dr. Allen Alper, Editor-in-Chief of Metals News, talking with John Darch, who is Chairman and Director, and Ken MacLeod, who's President and CEO, and Director of Sonoro Gold Corp. Since there are two of you, it would be good to identify yourselves before you start talking. Maybe I'll start with you, John. Since we last spoke, there was a PEA study that was done and published. Maybe you could bring our readers/investors up to date. Could you give an overview of the company and what differentiates your company and then go into the PEA?

John Darch:Sonoro has gone through a complete transition from being an exploration company into an advanced development stage and near-term producer. Over the last while we've been able to complete our initial PEA.

Ken MacLeod:

The PEA highlights show an after-tax net present value of U.S. $41.5 million with an after-tax IRR of 32.5% and a payback period of 2.2 years on capital costs of $32 million. The life of mine is currently at seven years. That's based upon a gold recovery of 74%, and the cash costs are $1,227 per ounce produced with all-in sustaining costs of $1,351. As it stands right now, that is simply based upon the drilling to date, which amounts to approximately 47,000 meters of drilling, over 433 drill holes.

The goal now is to work towards going into production as soon as possible because of the strong IRR and the strong cash flow that is expected from this size of plant and then continue with the drilling program in order to extend the life of mine from the currently proposed seven years to hopefully doubling that with additional drilling over the next 18 months to two years.

Dr. Allen Alper:

Yeah, I think excellent, that's very robust economics, that sounds excellent. John, from what I understand also that even since the PEA was published you've had more information, more input from potential mine builders that might even indicate that your costs might even be less than in your PEA. Is that correct?

John Darch:

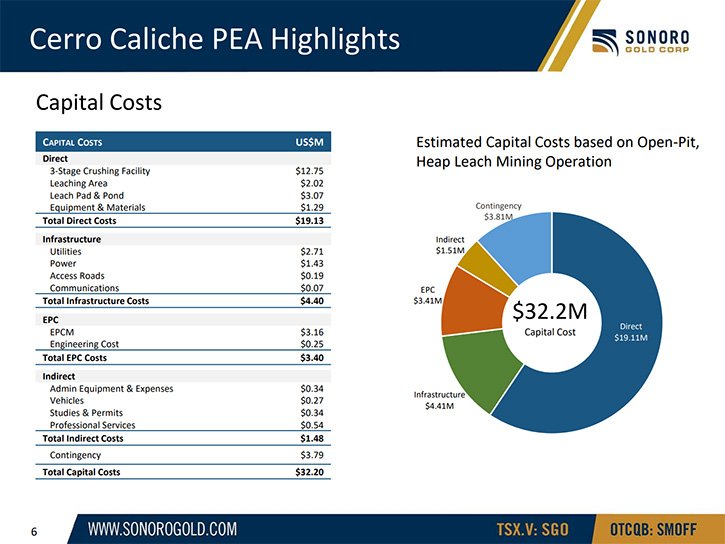

The capital cost came out higher than anticipated, simply because when we were planning to move forward, it was always on the proviso of outsourcing the mining, which would include the contracting or leasing of the crusher. We've gone ahead with the outsourcing of the mining and that's included in the budget. But as we were unable to show to the authors of the PEA that we had the leasing tied up for a crusher, we had to include the cost of a new crusher. That is what added to the capital cost.

Since that time, we continue to have discussions with entities and suppliers of crushers to look at a leasing opportunity or a contract crushing arrangement. Delaying or postponing the cash required to purchase the three-stage crusher would have the impact of reducing the capital cost by $12 or $13 million upfront. So that would have a positive impact on the IRR in the NPV. So those are the areas that we're working on at the moment.

Dr. Allen Alper:

Well, that sounds excellent. To me, it sounds like the current PEA is very robust and now with the new data and information you have, it will even be significantly better.

John Darch:

Yes, I think that's correct, and we must also remember that when we were beginning this project, it was always with the proviso that we would establish sufficient resource to support a six or seven year mine life, with the intention of covering future exploration from the cash flow. We've not really changed at all from that model. The PEA does reflect quite accurately our business plan. We've achieved what we said we were going to achieve. If we can enter into a leasing arrangement for the crusher, that will reduce the capital cost and improve the IRR and the NPV.

We hope to recommence a drilling program in November to identify additional ounces. In doing so, that will enable us then to expand the life of the mine. If we look at this in terms of what the potential may be, that is if we're able to demonstrate a minimum of a million ounces by ongoing drilling, then that of course will add considerable value to the project. We are planning an expansion drilling program, in known mineralized areas, where we have identified higher grades, through surface sampling, and we are comfortable that we'll progressively be able to show to the market that the ounces can increase, thus extending the life of the mine.

Within the seven-year mine life we have identified, all the capital costs must be amortized. But if we're able to demonstrate that there are a million ounces, that would extend the mine life to 14 or 15 years, meaning that all the capital costs would be amortized over that longer period. I must state that while we do have areas where we anticipate we may be able to find the additional ounces, until they are drilled, we can't give a definitive number.

Dr. Allen Alper:

That sounds excellent. Ken, could you tell our readers/investors a little bit more about some of your exploration plans.

Ken MacLeod:

Within the PEA, the independent geological consulting company, Micon, has identified not just the resource that has been estimated at 440,000 ounces of minable resource, but they have also identified additional potential for increasing the resource. To summarize the mineral resource estimate, as it stands today, Micon is postulating the total resource to be processed amounts to 31.5 million tonnes, containing 349,000 ounces of measured and indicated resources at a grade of 0.41 grams per tonne of gold and gold equivalent of 0.43 grams per tonne.

Micon has also estimated an inferred resource of 71,000 ounces, at a similar 0.40 grams per tonne for gold. That resource estimation has been calculated entirely within the pit shell outlines of the various zones in the property. Outside of the pit shell is a very substantial amount of potential resource that has been partially drilled, but not yet drilled with close enough spacing to enable Micon to be able to calculate an inferred resource at this time. It is up to us now to convert that into an actual resource. They're suggesting that the potential is between 19 and 34 million tonnes, containing between 204,000 and 365,000 ounces of gold at the same cutoff grade as we have in the original estimate and also a similar average grade for production purposes.

I think that is low hanging fruit for us, right now, because we know that we should be able to increase the resource, because of the fact that we have very good intercepts in these particular zones. But now it's up to us to make the drilling closely spaced in order to start quantifying the actual resource. If that were the case, the potential then increases from the current estimate of a total of 440,000 minable allowances. And if Micon is correct at the upper end of that scale for additional potential, that could conceivably be increased by up to 365,000 ounces.

I think that would be a prime target for us to continue exploring, because we have done the preliminary work to know that the gold is in the ground there and now let's quantify it properly. We also identified additional zones within the property, such as an area to the south of the existing central zone, where we have been conducting road building in a deep canyon with steeply sloping sides. These road cuts that we're sampling are yielding some very good grades from the channel sampling that's taken place. We're getting multiple target areas, within these road cuts, with multiple instances of over 1.2 meters of channel sampling, where we're getting grades of five, seven, 10 grams and over per tonne.

These surface results are very indicative of the potential for us to be able to go in there with the drill and hopefully expand the resource into these southern zones. We know that the continuation of these two zones, called Buena Suerte and El Colorado, are extending from zones which have higher than average grades. If that is indicative of higher than average grades, in this new zone we're going to be drilling, we're quite excited to anticipate that, over the next six months or so, we could be extending these particular higher-grade zones by at least 650, or even over 750 meters in length.

Beyond that, there are other multiple target zones, where we've been conducting rock chip and channel sampling along with the occasional drill hole, to identify the potential at depth. I would say, right now, we have only scratched the surface, as far as known structures are concerned. Our best estimate, right now, is that we've only drilled less than 30% of the known mapped structures on the property. We have a lot of work still to do and the potential is great to increase the size of the resource accordingly.

Dr. Allen Alper:

Well, that sounds excellent. Sounds like you have a great resource right now and a great PEA and you have the opportunity to greatly increase the life and the size of your resource. I wonder, John and Ken if both of you could summarize the primary reasons our readers/investors should consider investing in Sonoro Gold Corp.?

John Darch:

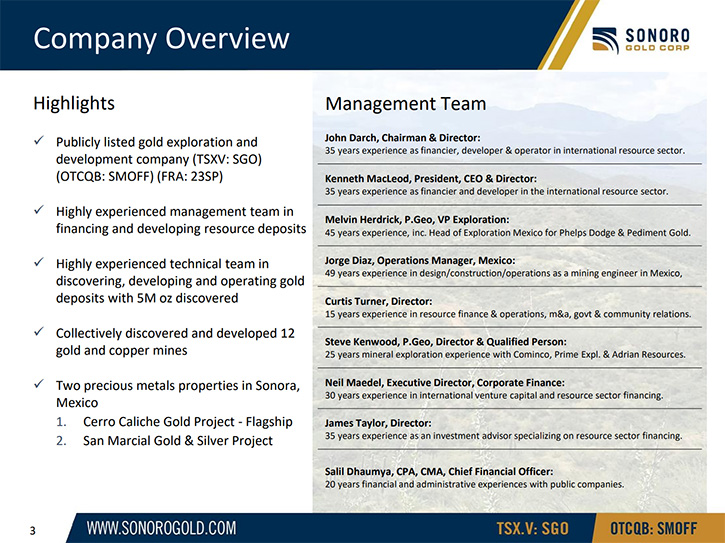

What we would like to present is that Sonoro has the five essential components for a successful company. It has a diversified, complementary Management Team, with decades of experience, in all areas of geology, finance, mining, and marketing. That's number one. Number two, an outstanding property which, over the last three years, we've transformed totally, from exploration through to development, to near production. We have a capital structure, in which the Management and all the staff own, collectively, about 20% of the issued shares of the Company. Our shares’ average purchase price runs about 19 cents. We're all very, very committed here.

There are two other important factors or components. One, we have a very clear business plan, from which we've never wavered, to move to production as soon as possible to generate cash flow, from which we can continue to expand the resource. Finally, a demonstrated ability to raise funding for projects. Collectively, we have completed probably $400 million or more in fundraising over the last 20 or 30 years.

As a junior company, that puts us in a very distinctive position. It's worth saying that all our targets have been met on time and within budget. In that regard, while we are a small unit, we're dedicated, commercially minded, and determined to move forward, in a very professional way, for the benefit of our shareholders.

Dr. Allen Alper:

Well, that sounds excellent. Ken, is there anything else you'd like to add?

Ken MacLeod:

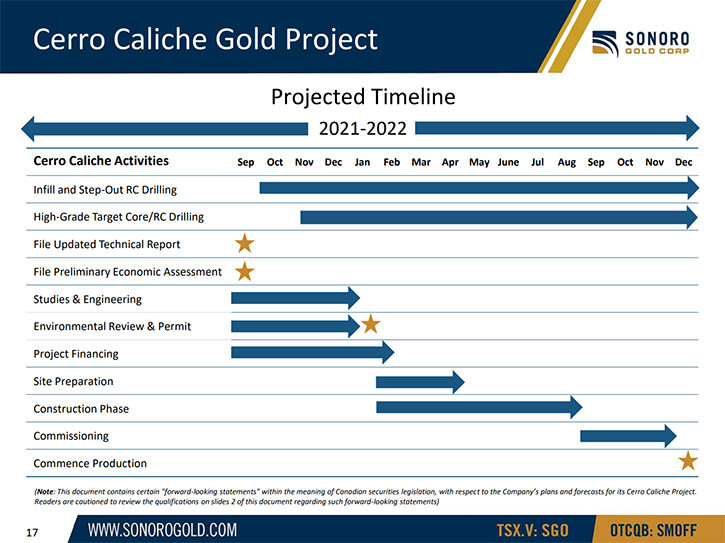

No, I think John summarized it very succinctly. I believe that as far as a short-term, medium-term, and long-term investment, Sonoro Gold is very attractive for your readers/investors. Because first, we have now identified a resource that has economic viability, according to the PEA. Our intention is to go into production at the earliest opportunity, by which we hope to be able to start construction in the first half of 2022 and be in production by the end of 2022. And finally, we intend to keep on increasing the size of the resource, so that we can realize the full potential of the project. So, there will be a constant stream of news coming with regards to the Cerro Caliche project, for years to come.

Dr. Allen Alper:

Oh, that sounds excellent. It sounds like it's an exciting time for your shareholders and stakeholders and it’s a great opportunity for discovery. I will be very interesting to learn how you proceed, with your production and development.

John Darch:

I would like to add one thing. In addition to the transformation of the project, we've seen a transformation in our shareholder base, from the original 2019 and early 2020 investments by friends and family here in Canada to a more international shareholder base, with strong shareholders in the USA, Europe, the UK and over in Asia, so we're getting greater and greater international recognition. The investors who are coming into the company now fully understand that we do intend to go into production. That's why I think we will find that we will continue to gain strong recognition in the market, with good liquidity and stability, as we move forward with our goal of going into production.

Dr. Allen Alper:

Well, that sounds excellent. Those are very compelling reasons, John and Ken for our readers/investors to consider investing in Sonoro Gold Corp. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://sonorogold.com/

Kenneth MacLeod

President & CEO

Sonoro Gold Corp.

Tel: (604) 632-1764

Email: ken@sonorogold.com

General Email: info@sonorogold.com

Twitter: https://twitter.com/SonoroGold

LinkedIn: https://ca.linkedin.com/company/sonoro-gold-corp

Facebook: https://www.facebook.com/sonorogold/

YouTube: https://www.youtube.com/channel/UC_yosp0_k2pG0MxpK7JgNTQ/

|

|