Mark Brennan, CEO, Co-Chairman, and Founder of Cerrado Gold (TSX.V: CERT, OTCQX: CRDOF) Discusses Becoming the Next Mid-Tier Gold Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/8/2021

We spoke with Mark Brennan, CEO, Co-Chairman, and Founder of Cerrado Gold (TSX.V: CERT, OTCQX: CRDOF). Cerrado Gold is an emerging mid-tier gold producer that owns Minera Don Nicolas, located in Santa Cruz, Argentina, a newly producing, high-grade gold mine, with significant optimization, expansion, and exploration potential. Minera Don Nicolas has strong free cash flow, and is targeting annual Au production of ~45-55kozs, with AISC ~$900 to $1100/oz. In Brazil, the Cerrado is focused on expanding the resource base, at its prolific, high-grade Monte do Camo gold project, in Tocantins State. Monte do Camo has an indicated resource of 541kozs Au, at 1.85 g/t, and an inferred resource of 780koz Au at 1.85g/t. The August 2021 PEA showed an after-tax NPV 5%, of US$617M and an IRR of 94.8%, based on an LOM annual production of 104kozs, at an AISC of $612/oz.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News. I’m talking with Mark Brennan, CEO, Co-Chairman and Founder of Cerrado Gold. Mark, I wonder if you could tell our readers\investors about your exciting Company and your great projects in Brazil and in Argentina. Could you give us an overview and also tell us what differentiates Cerrado Gold from others?

Mark Brennan:

We started Cerrado Gold, with an asset in Brazil. Some geologist friends of ours, whom we've known for 30 to 35 years and who actually discovered and grew the largest known undeveloped gold deposit, in Brazil, right now. It's called the Volta Grande Project, owned by Belo Sun, with about 7.4 million ounces. They came to us and suggested that they had a project, Monte do Camo felt the district would have north of five million ounces and largely we could control the district.

We went and did our due diligence. We did it with the old Largo Team, we did it with some of the Team who actually sold Jacobina to Yamana from Desert Sun. Kurt Menchen, who is also the Country Manager for Largo, was also the Country Manager for Desert Sun, which we sold to Yamana for $700 million in 2006. All around, we did our due diligence. We concurred that the possibility for that size resource was there. We founded the Company in 2018, did some very successful drilling and culminated, with the second drilling program that concluded in April this year, with a PEA that has a $617 million US after tax NPV, with an IR of about 94.5%.

Dr. Allen Alper:

That’s fantastic!

Mark Brennan:

Yeah, it's really substantial. The really impressive thing is that the first five years our all-in costs are anticipated to be $431 per oz at 150,000 ounces a year, for the first five years. For the first five years, we will be the lowest cost producer of gold in the world, which is pretty impressive.

Dr. Allen Alper:

That is excellent. That's a great position to be in.

Mark Brennan:

That was a good way to start the Company. Then we acquired Minera Don Nicolas in Argentina. We did that on the basis that we saw an opportunity. Now we looked at this opportunity in 2019, when gold was around $1,200. We thought, okay, what we can do here is we can buy this asset and basically what would happen is we'd have eight or nine years, 50,000 ounces a year at an average all-in costs of about $1,000.

Obviously now gold's gone up to $1,800. The ability at 50,000 ounces per year at $1,000 all-in cost, which we expect to be at the end of this year means that we generate about 30 to 35 million of free cash. We also saw tremendous opportunity, much more, as we became involved in the story, than when we initially did our due diligence. The reality is that there's been no exploration on this property for many, many years. We own 330,000 hectares. It's a huge land mass. We think there's lots of opportunity to expand the resource, and expand that opportunity, that 50,000 ounces over eight to nine years.

Dr. Allen Alper:

Well, that's fantastic. Those are two outstanding projects that you have! That's great! You’re well on your way of becoming the next mid-tier gold producer. Could you tell us a little bit more about your plans to get there?

Mark Brennan:

We're completing the PEA! We've already embarked upon our environmental impact study that's expected to be concluded by the first or second quarter of 2023. Basically, we'll complete a feasibility study, which will start at the beginning of 2022 and end by the middle of the next year. And then our objective is to be in construction early in the second half of 2023 and in production by late 2024.

Dr. Allen Alper:

That’s excellent. I must say you and your Team could be extremely proud of what you've done, in a very short time, it's really outstanding.

Mark Brennan:

We got lucky on this one. It is always nice to get lucky!

Dr. Allen Alper:

Well, that's great. Mark, I know you and your Team have very excellent backgrounds, great experience, and a great record of success. Could you tell our readers/investors a little bit about yourself, your Team, and your Board?

Mark Brennan:

We have a group of guys who worked together for basically 20 years. We like working together. We're builders. We like to grow things. The reality is that Kurt and I started off with Desert Sun. Then we grew a couple of other members, with regard to Largo. From Desert Sun we went to Largo, and we took a hole in the ground, we raised $300 million. We took the resource up substantially, we brought it into production. Then some of the group moved on and restructured a Company called Sierra Metals, which when I joined, had a market cap of $200 million. When I left, two years later, it had about $600 million.

Then we all got together for Cerrado. Three or four years later, from the initial friends and family round, our investors have made about seven times their money. I think we're having fun. The important thing is, we have a really strong group of guys, who are very conscientious, and very engaged. We think alike, and we own 35% to 40% of Cerrado. We think our interests are very strongly aligned, with that of our shareholders. We're having fun because we were dealt a very lucky card.

Dr. Allen Alper:

Oh, that's excellent. It's great to see the Management and the Board have skin in the game and be aligned with investors. It’s great that you have confidence and you're willing to put your money in the Company and continue to do so. So that's excellent!

Mark Brennan:

Yeah, we're very pleased! We're very pleased with the whole situation.

Dr. Allen Alper:

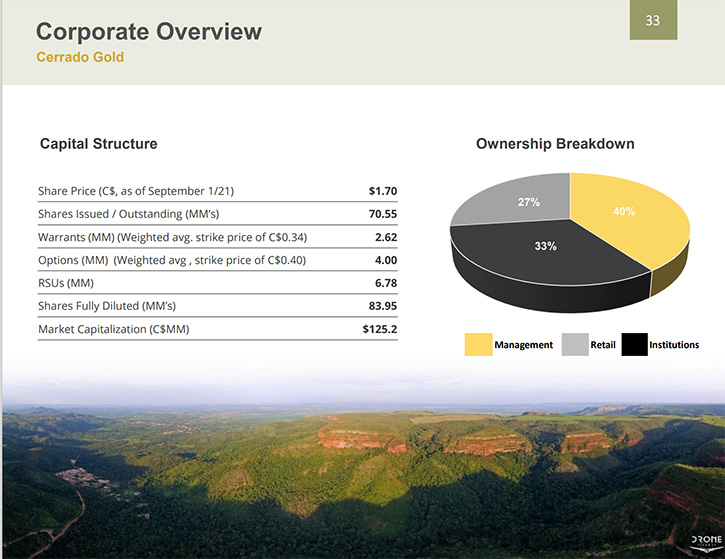

Could you tell our readers/investors about your share and capital structure?

Mark Brennan:

We have 70 million shares outstanding. We have 85 million shares, approximately, fully diluted. We are held by Management Directors, let's call it about40%, the balance being probably about 35% with institutions at about 25% with retail investors.

Dr. Allen Alper:

That sounds excellent! Mark, what are the primary reasons our readers/investors should consider investing in Cerrado Gold?

Mark Brennan:

First of all, it trades at a substantial discount to its peers. We’re a brand-new Company, we listed on February 25th. We've been listed as a public company now for six months, so we're largely under the radar. But the most significant element is that both our operations in Brazil and in Argentina are in their infancy. We're still in the discovery phase. These are growth stories! These are new assets with all the scope of lots of potential growth. They are unlike a lot of assets you see out there, which are old assets, where pricing has gone higher, and it's brought them on side.

I think at Cerrado, we have 1.3 million ounces now in Brazil. I think we can multiply that a few times. I think with Argentina, we have just under a million ounces, and I think we can grow that a few times as well, while generating very strong cash. The target for the Company next year, in Argentina, will be to generate $35 million of free cash. For a Company, with a market cap of $80 million US, it's pretty cheap.

Dr. Allen Alper:

Sounds like compelling reasons for our readers/investors to consider investing in Cerrado Gold! You have great properties, they're producing gold and you have the opportunity to greatly enhance the resources, reserves and your production. You're in a very rare position, compared to many other companies, and you have low costs. Mark, is there anything else you'd like to add?

Mark Brennan:

We're having fun, we're excited! We think we have a tremendous opportunity here and we love to have likeminded people join us on this journey.

Dr. Allen Alper:

Well, that sounds excellent! I think that's a great opportunity for investors!

https://www.cerradogold.com/

Mark Brennan

CEO and Co Chairman

Tel: +1-647-796-0023

mbrennan@cerradogold.com

|

|