Keith Henderson, CEO, Latin Metals Inc. (TSXV: LMS, OTCQB: LMSQF), Discusses their Success as a Project Generator, with a Diversified Portfolio of Gold and Copper Projects, in South America

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/8/2021

We spoke with Keith Henderson, CEO of Latin Metals Inc. (TSXV: LMS, OTCQB: LMSQF), a state-of-the-art project generator, with a diversified portfolio of gold and copper projects, in South America. The investor-focused, project-generator model reduces share dilution. The exposure to multiple projects, reduces discovery risk, and the exposure to multiple commodities, reduces the impact of commodity price cycles. Some of Latin Metals' JVs’ former and current partners include; Newmont, Yamana Gold, Libero Copper and Gold, Patagonia Gold, and now - AngloGold Ashanti. Near-term plans include finding a JV partner for one of the Company's new exploration projects in Peru.

Latin Metals Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Keith Henderson, who is CEO of Latin Metals Inc. Keith, could you give our readers/investors an overview of your Company, and what differentiates your Company from others?

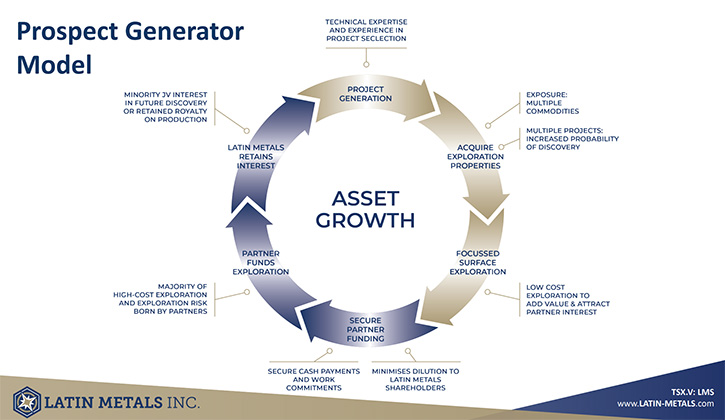

Keith Henderson: Yeah, absolutely, Allen. As the name Latin Metals suggests, we're operating in Latin America exclusively. And we're using a prospect generator-type model exclusively. That's not an uncommon model. It's something that I like, and I think it works well. Quite a few companies are trying to do it. I think we're doing it pretty well, though. I'll explain why.

As a prospect generator, our primary task is to locate and acquire high-quality projects as cheaply as possible. Base metals or precious metals are our two areas of focus, essentially gold, silver, and copper. We want to have those projects advanced and funded by major companies, or at least by partners.

They don't necessarily have to be major Companies, but they have to be Companies, with enough money to finance these things. We're aiming to take our projects to major discoveries. Our core strength is our technical expertise and our experience in South America. So, I think we have the ability to pick up the right kinds of projects, and the right kinds of projects will entice investment from major mining companies.

We are really focused on less costly surface exploration. That's what we do well, like project generation, acquiring projects, preferably by staking, getting the surface work done, and building up targets, and ultimately trying to move most of these projects to the point where they have a drill permit, because that entices a major company to come in.

Having done all of that, the majority of the really high-cost and high-risk exploration is always funded by the partners. So, we don't have to raise that kind of money. We always retain either a minority interest in the project or a royalty on production, one of those two things. So, if the exploration's successful, we ultimately benefit from that, and it significantly limits dilution. Project generators will tell you exactly what I've just told you. This is the business that they're in. But whether all project generators are actually capable of attracting major partners is one topic for conversation. A lot of these companies also tend to do quite a bit of financing. The idea of this model is that one shouldn't need to do that. We really want to take seriously the idea that we're going to limit dilution.

We do have to raise money from time to time, but we have a significant proportion of this Company owned by Management, and we really care about dilution, as I hope all of our shareholders do, as well. So that's the model in a nutshell.

Just one or two other little things that I think Latin Metals maybe does well. We're never focused on one commodity. We're always looking at a couple of commodities, and I think that limits exposure to maybe a downturn in gold or something. There are copper projects in the Company. So that reduces our risk. We're currently operating in two countries, which I think takes away some of the country's risk, as well. Because it means that if maybe Argentina goes through a year or two of difficult political situations, at least we hope that Peru is operating well, and we always have multiple projects being explored. So that fundamentally just increases your chance of success. Lots of projects, in lots of different places, all being actively explored.

Dr. Allen Alper: Oh, that sounds excellent. Looking over your website, I noticed you've had several successes and deals that you've made. Maybe you could highlight some of those.

Keith Henderson: Yeah. By all means. Historically, the Company has been successfully partnered with Newmont and with Yamana Gold. Both of those partnerships were in Argentina. In the last couple of years, we reframed the Company, into this prospect generator model. We set about moving projects forward and trying to get partners. This year we've signed three deals. All of those have been in Argentina. We signed deals with Libero Copper and Gold, also with Patagonia Gold, and I think most significantly, with AngloGold Ashanti. We all know AngloGold Ashanti. They're a leading gold producer, a $6 billion company. But what's most important for me is not just the money behind the Company and their ability to do this work. It's the accomplished exploration Team. I've been highly impressed with the guys that I've been dealing with in AngloGold.

And as we move forward, I'm really looking forward to working with them for the first time. I've never worked with the Company before. But the three deals that we've done this year basically add up to an investment of approximately 21 million dollars Canadian over the next five years. And that, of course, assumes that all of these deals continue through to the full term of the deals. That's a lot of non-diluted investment coming in. It comes in a couple of different forms. It comes as cash payments to Latin Metals, which helps cover our exploration costs, and it helps cover running the Company. But the money also comes in as, in some cases, payments to underlying vendors, where we are actually in an option agreement with a vendor. That helps to limit the cash outflows coming out of the Company. And then, most importantly by far, is the money going into the ground, because that's what gets you to the healthy new flow, and hopefully, it gets you to discovery, as well.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors some of your plans for the remainder of 2021, going into 2022?

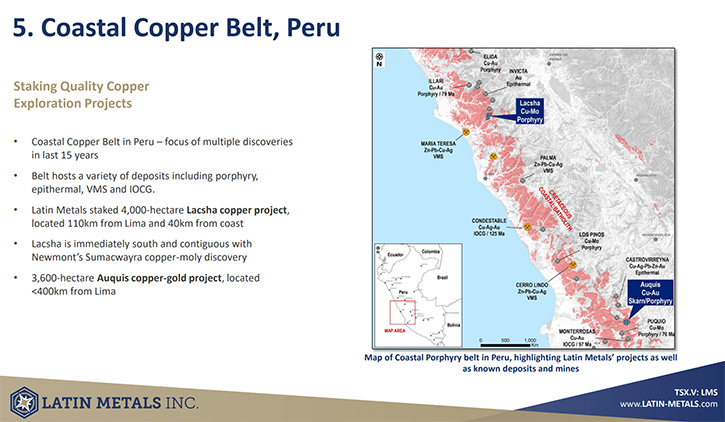

Keith Henderson: First thing is, I'd like to get another deal done this year. I'd like to be able to say that I've pulled off a successful deal once every quarter of the year. That would be a very good outcome for me. You'll notice that the three deals we've done are in Argentina. That's because the company historically had projects in Argentina that were reasonably well advanced. In Peru, we really only started in Peru about a year and a half ago. We are advancing those projects, and that's what people are going to see over the next few months. We're getting those projects to the point where I think they're ready for partners. This year, we acquired three pretty large-scale copper exploration projects in Peru, and we own all of those a hundred percent. We focused our project generative work on open ground so that we can acquire it by staking, not entering into expensive option agreements.

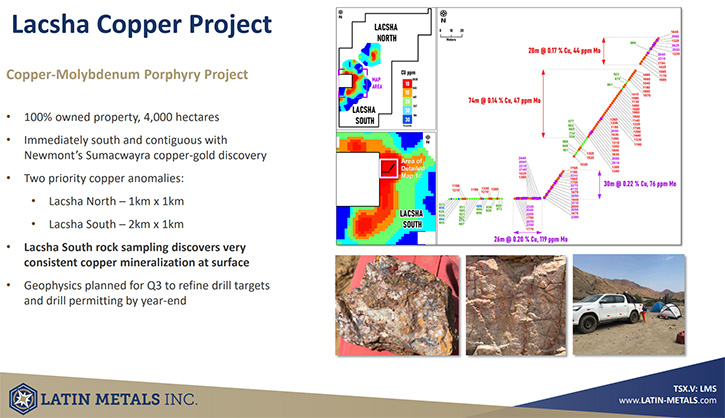

And that's worked very well for us. One example is our Lacsha Copper project. We've moved pretty quickly. We got a deal with the community to do surface exploration quite quickly, and deals with communities in Peru are very, very important. ESG is important. Working with communities is important because if you don't do that and you don't do it right, you'll never get a drill permit. And so, we did that. We got the permissions to work. We think we've made a significant discovery there. We have copper mineralization at the surface, and it's over tens of meters consistently. We're pretty excited about that.

We've done some geophysics, and we have a little bit more to do. I think by the end of the year, we'll be ready for a partner on that project. But you know that points to our technical expertise, and it points to what we value because we've been able to go into Lacsha, which is a brand-new property and where it was thought, there was nothing to find, and we've taken it from nothing, to drill targets, essentially in 12 months. People can expect to see more of that coming, both on the projects we've already acquired and with projects being acquired, as a result of the generative work that we do.

Dr. Allen Alper: Oh, that sounds excellent. It's great to have such a variety of projects and have a Team that can find them. It's excellent that you have a record of success, and you're opening up a whole new area, in Peru, for new successes. So that's excellent! Keith, could you tell our readers/investors a little bit about your background, your Team and your Board?

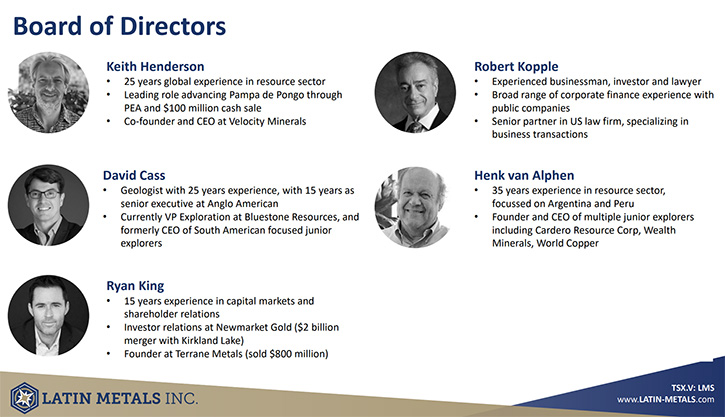

Keith Henderson: Yes, absolutely. I'm a geologist by training. I probably spent the first 15 years of my career pretty much working as a geologist, and I've spent the last 10 years being much more involved in funding companies, and financing and so forth. But I still think that geological background has value. I believe that the ability to look at projects submitted to the Company or that we are generating ourselves look at those with a very critical eye, and make sure that they really have the potential to become something. You can waste a lot of exploration dollars on projects that are completely rubbish. And I think the technical focus in the CEO role, while it's not my day-to-day concern, I think it's important in terms of what the Company acquires.

On the Board, we have many technical and non-technical people, many of whom have had pretty big successes. I'm not going to speak through all of those examples, but that's on the website, and you'll see some faces and names in there that I think would be recognized, within the industry.

What's important to me, from the Board's side, is that we have significant ownership on the Board. If you take Management and Board together, we have 49% of the Company. And even beyond that 49%, we have some pretty big shareholders who hold significant positions. So, we are very careful about diluting the Company. If you look at the trading float in the Company, that's only about 10 million shares. It's a really tight structure, and we do everything we can to keep it that way.

In terms of the day-to-day Team, we have two people in the Company, in Argentina and Peru, that are really driving things forward day to day. In Argentina, that's Mario Castelli, who's the President of our local subsidiary. And Mario has a great deal of experience in the mining industry, and he's been working in the mining industry in Argentina for probably 25, 30 years. And he's a very valuable addition to our Team.

On the technical side, our Exploration Manager, Eduardo Leon, is based in Lima but has overall responsibility, on the technical side, for Peru and Argentina, and other things that we're looking at in other countries. Eduardo has had tremendous experience over the last 15 to 18 years. He has some experience with major companies, lots of experience with mid-tier and very entrepreneurial companies, like Auryn, for example, and he's doing a fantastic job. His expertise in south America is just amazing. For a relatively young guy, he's worked in so many areas, and he makes very, very good exploration decisions, both in terms of generative work, in applications and in acquiring projects. And in terms of the exploration that we're doing. He was the one that identified Lacsha, and it's turned into something really, really interesting. I'm quite sure that we're going to be able to find a partner for that project by the end of the year.

Dr. Allen Alper: Oh, that sounds excellent. Keith, I wonder if you could summarize the primary reasons our readers/investors should consider investing in Latin Metal Inc?

Keith Henderson: I think the primary reason is lack of dilution. Unfortunately, many of the junior exploration companies that we see operating become known to investors, almost as serial financers. Like they're just raising money all the time. You make an investment in 2015, and by 2020, your investment is just such a small part of that organization because of all the dilution and financing that's been continually happening. I think our commitment to minimizing financing is important. It is exactly what we want to do, as significant shareholders of the Company. And I think investors can rely on that, to some extent. For example, we are just closing a financing right now. The previous financing had been a little over two years ago, and we went out to raise a million dollars.

We did have a lot of interest in the financing, and we sat down with the Board and decided to upsize that to $1.3 million. So, a small upsize, because there are some people interested that we wanted to get into the Company. We could have upsized that five times over, but we didn't want the dilution. We're not taking opportunities to grab money. We're protecting the structure of the Company, at all times. And I think that's fundamentally of great importance to investors. You add that to our technical expertise and our contacts, within the industry. We know people in the industry. We've worked in the industry for a very long time, and we have a network that includes senior executives and decision makers, importantly, in the major companies. That allows us to attract really, really high caliber, well-financed partners like AngloGold Ashanti.

Dr. Allen Alper: That sounds excellent. It's good to see Management is in with shareholders and stakeholders, by having such a large position in the Company.

Keith Henderson: Yeah. I think it's important.

Dr. Allen Alper: Keith, is there anything else you would like to add?

Keith Henderson: No, not really. I think that probably covers it. It's a good introduction to the Company. We're always here if investors have an interest in the Company. We're always available to speak to people, if they'd like to have a more detailed rundown of what we're doing, or have any additional questions. Thanks very much for the opportunity to have this discussion.

Dr. Allen Alper: Keith, you can be very proud of your Company! We'll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.latin-metals.com/

Keith Henderson

Phone: 604-638-3456

E-mail: info@latin-metals.com

|

|