Denis Laviolette, Executive Chairman and President, GoldSpot Discoveries Corp. (TSXV: SPOT, OTCQX: SPOFF) Discusses their Artificial-Intelligence-Driven-Solutions Mineral Exploration Company

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/5/2021

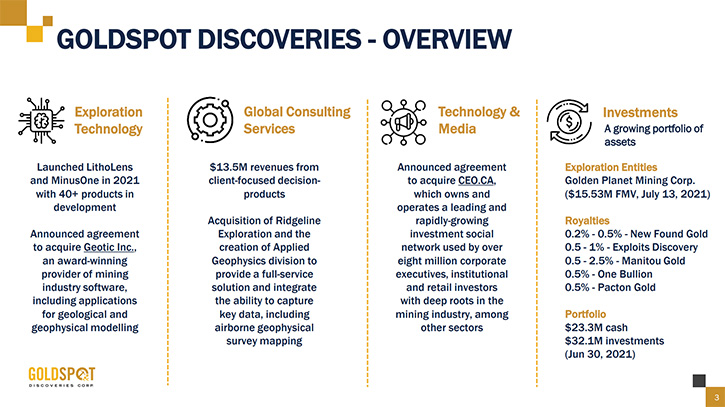

We spoke with Denis Laviolette, who is Executive Chairman and President of GoldSpot Discoveries Corp. (TSXV: SPOT, OTCQX: SPOFF). GoldSpot Discoveries is an artificial-intelligence-driven-solutions Company, in mineral exploration, that has developed an impressive equity and royalty portfolio, through their growing software service offering, with over 40 mining software products in development. We learned from Mr. Laviolette that in 2021, GoldSpot made several strategic acquisitions of technologies that show tremendous amount of potential, including Geotic Inc, CEO.CA and Ridgeline Exploration Services. GoldSpot reported record earnings for the second quarter of 2021.

GoldSpot Discoveries Corp.

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Denis Laviolette, Executive Chairman and President of GoldSpot Discoveries. Denis, I wonder if you could give our readers/investors an overview of your Company and also update them on some of the excellent projects that you have been working on since we talked in May.

Denis Laviolette:GoldSpot Discoveries is an artificial intelligence driven, solutions company, we are a technology company servicing a combination of both mid-tier major companies and grassroots junior explorers. We like to bring modern tools and technology into the fold and leverage those technologies to improve the expiration hit rates and improve the odds of success for discovery. We've been focused on building our brand, our balance sheet, our revenue, and our client pipeline.

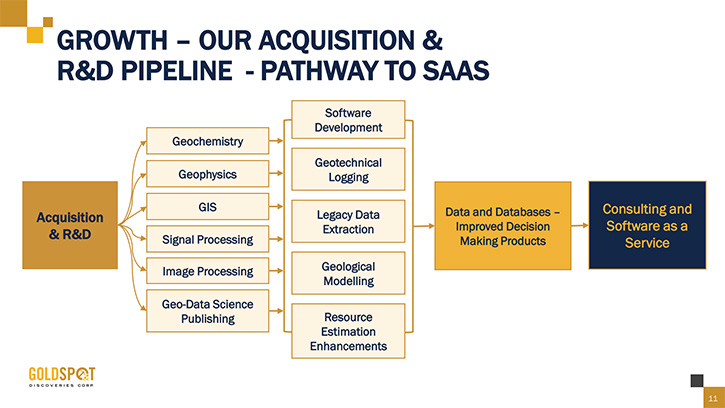

GoldSpot has completed approx. $20M of financing this year and our share price has appreciated, quite measurably since inception. We've moved into an acquisition mode, or model, to start to look at technologies that we see in the space that have a tremendous amount of potential, but for whatever reason, remain untapped. A lot of these technologies are synergistic, with innovation projects that we had been cultivating internally and looking to monetize further.

We are looking for nice receptacles to plug our products into, to help monetize and deploy them into the market. Our focus has historically been on investing and revenue generation, through consulting work. We're looking to supplement that revenue strategy, with recurring licensing revenue from software as a solution (SaaS). That's been the mandate. You may have seen some of the acquisitions.

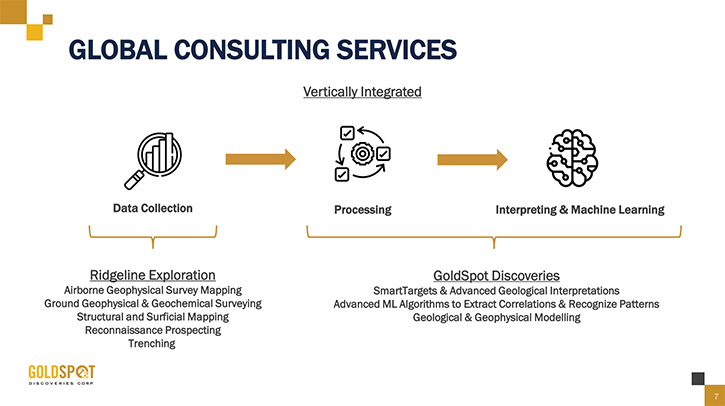

One of them was Ridgeline Exploration. Ridgeline is a geological services company with a promising geophysics division. They've been flying geological surveys and preparing for issue reports and scoping studies, as well as conducting geochemistry, field programs, mapping, sampling, and project management. We felt that that team had a great group of people working there and had experience in running a geophysics business and we wanted to build out a data collection department.

By bringing on a gentleman by the name of Peter Dueck, who has built and sold a couple of geophysics companies, to help guide our growth strategy, and then accelerate that by bringing in Ridgeline, we were able to shape together our Data Collection Division. GoldSpot traditionally has always been a data interpreter, we've been working with data that companies have provided us with and that we've sourced from public sources. Now we've brought that data together, in a unique way, to gain deeper insights. With the addition of the Data Services Division, now we can collect new data for our clients for our partners and for the broader industry for us to leverage our team and tools, to improve the products that those data sources would generate. Building out an in-house geophysics division was the key to that acquisition.

Dr. Allen Alper:

That sounds excellent. Could you give us more examples of how your services work and what companies you've worked with? How have you solved problems and put together geological, geophysical and geochemical information?

Denis Laviolette:

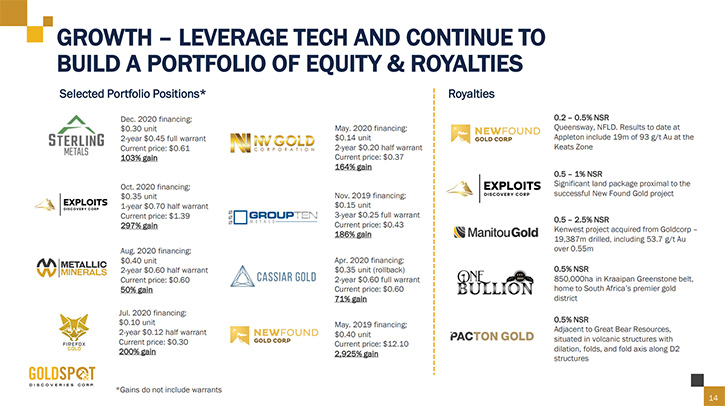

We work with companies. I'll name a few; Vale on the large side, Majestic, Fortuna Silver and Gran Colombia. On the junior side, companies like Sterling Metals, Critical Elements Lithium, Exploits, Opawica Exploration in that group. Some of the success cases, one of the most obvious ones is New Found Gold. Part of our strategy there was to invest money in the company and develop an exploration strategy that's data driven. Looking at all the geophysics data, geochemistry data, everything else to come up with an exploration plan and a target model. We had tremendous success building those targets and then we've all seen how that played out in the market.

GoldSpot also has a royalty on those assets, which is obviously a tremendous benefit to our shareholders and our Company, in addition to a robust equity stake in the Company. That seems to be the model for us. We like to get positions. Sometimes when it comes to major companies, we work strictly for cash. They pay us a service fee and we perform that service. When we get into the world of junior companies, oftentimes they don't have the capital to pay us that fee. So, we make a strategic investment in that company. We roll up our sleeves to get involved in that story.

They ultimately engage us for a service contract as well. So, we get a portion of our funds back, via service contract, and we end up with a large equity stake in that name, in addition to a service contract. Then we roll up our sleeves to get involved. Typically, we will structure a royalty as part of the deal and warrants alongside our equity exposure. If our technology team is successful in unlocking value for the Company, our shareholders are rewarded, and our Company is rewarded by means of appreciation of the shares or that royalty or whatever may trickle back into our balance sheet. That's how the model works. We've managed to turn $7.5 million dollars in the spring of 2019 into $65 million of assets under management today. The model works well, and we've been involved with some tremendous discoveries.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about yourself, your Management and your Board?

Denis Laviolette:

I'm a geologist by background. I was an investment analyst on the buy side of Pinetree Capital. I then went on to be VP of Investments for a company called ThreeD Capital. Then I decided to venture off and create my own companies. Before that, I was in Ghana with Xtra-Gold, of which I still sit on the Board. I had quite a bit of experience in the field. I cut my teeth, in the capital markets world, with Pinetree Capital and the experience thereafter.

I became very familiar with a variety of different commodity types, with a lot of the CEOs and a lot of the Management teams, with how the money flows in the banks and investment banks and all that kind of stuff. Bringing all those worlds together, that's what really helped lead to this.

We have a tremendous team. Cejay Kim is a co-founder, with me. He has a CFA and MBA, really strong finance background, with Marin Katusa on the KCR Fund. He was a good analyst; he knows all the moving parts and the mining side of the business quite well.

Vincent Dubé-Bourgeois was also a co-founder with us. Vincent comes from the Institute of National Research in Quebec City, where his team was working on artificial intelligence and its application in exploration. It's really around Vincent's team that we formed GoldSpot. I think it was about building on that original founding team of members and growing it from sourcing-out like-minded individuals that were working on a similar problem, all around the world and bringing those people into GoldSpot as well.

Our Chief Technical Officer is Shawn Hood has a Master's and Ph.D. in Economic Geology, with a focus on machine learning application to that space. We picked Shawn up, he joined us out of CODES, which is an academic institution in Australia.

Another gentleman who joined the ranks recently, is Josh Duggan and Josh is just a tremendous talent. He ran the special situations team at one of Canada’s leading consulting firms and co-founded technology startups through Y Combinator in San Francisco. He understands the technology space, the legal framework, and he's quite cunning in the world of M&A. Josh has been a tremendous help, as we look to grow and acquire other companies along our path.

Dr. Allen Alper:

That sounds excellent. It sounds like you have a great experienced team. You and your team have a great background and expertise. Denis, could you tell us a little bit about your share and capital structure?

Denis Laviolette:

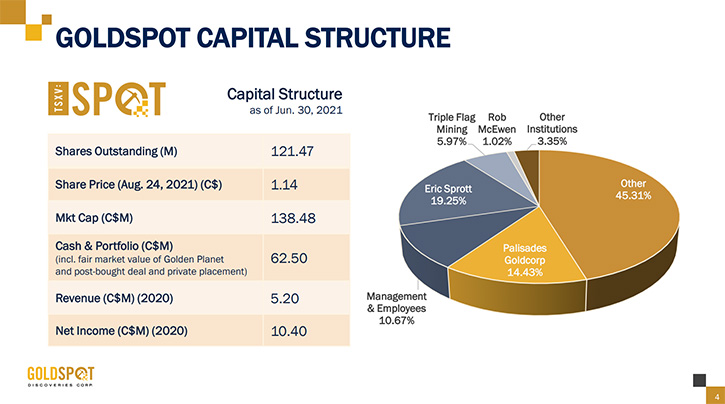

We have 121.5 million shares with no warrants outstand. Our largest shareholders would be Eric Sprott among institutions like Triple Flag Mining, a portfolio company of Elliott Management, as well as thousands of global retail investors.

Dr. Allen Alper:

That's great. It sounds like you have very strong backing. What are the primary reasons mining companies should use your services?

Denis Laviolette:

Miners and explorers are really good data collectors. That's something that the industry has been very, very good at for a long time. They are good at collecting data and recording it however they are particularly poor at interpreting it. So, traditionally in this space, a lot of mining companies and explorers like to silo data types and categories into various subdisciplines. Take geophysics, for example, or geochemistry or structural geology, the industry is comfortable getting expertise in structural geology, but they do it all in silo and don't really bring it together very well.

What that means is, if we take structural geology and geophysics, for example, they may have two experts weighing in, and interpreting those two products, giving deep insight into what they see in the patterns that they recognize, etc. Now, let's say a geophysicist exploring geophysics data, comes up with a structural framework to tease out various faults and fractures out of the geophysical data. But the structural geologist has been using different data types, observations in the field mapping and they come up with a particular interpretation. Oftentimes, in the industry, those two interpretations don't jive. The company ends up receiving both products and doesn't really know which one to believe in because they conflict. There are conflicts in their interpretation, there are conflicts in the results.

What GoldSpot’s does is we've taken those various subdisciplines and we've included it into one Company. Our geophysicists debate their findings with our structural experts, and they find common ground, they can agree on certain things, they can disagree on certain things, and they can work all of that out with each other and have a cohesive, final product, which may be different from what either of them would have generated on their own. This is a very rudimentary but accurate way of explaining the benefits of GoldSpot.

It means that it doesn't matter how big or small a company you are. Most companies in this space are doing this, and the business is about risk and reward. It's about taking that data, finding patterns in that data, finding breadcrumb trails, and chasing them to discovery and that costs money. The more homework you can do to unravel that ball of yarn, to sort out some of those discontinuities, to sort out some of those quirks, the more refined you can be, with your exploration strategy. Ultimately what that translates into is you can find more for less money. If a company is interested in making more use of their data and hopefully finding something that their internal experts haven't found or pieced together, then they should be interested in bringing GoldSpot in to see what they can do.

Dr. Allen Alper:

Sounds like excellent reasons our mining executives should consider using your services! Denis, could you tell our readers/investors the primary reasons they should consider investing in your Company?

Denis Laviolette:GoldSpot is for the astute investor, who knows how to read a press release, that understands the geological jargon that's embedded in paragraphs of technical releases and interpreting the various tables, maps and having a deeper understanding of relative values in the space. They could certainly continue investing in the deal that speaks loudest to them. But for most people in the space, they don't have that skill set. They don't have that tacit knowledge for that encyclopedia of what they're reading.

At GoldSpot, we're picking the best deals and we're exposed to the asymmetrical upside that discovery could present. We're all investors in this space because we want to turn a small investment into a very large reward and hopefully picking the right ponies in the mixture. What I can offer investors is a diversity of exposure into discovery plays that are using the very best and brightest and cutting-edge technologies to improve their odds.

But moreover, what I can offer prospective resource and technology investors is a new way to play this space. It's a bit of a hybrid of Frankenstein, of a royalty’s company, an investment company that served as company and a technology company, all folded into this one beautiful package that, for instance, grows its assets under management from 7 to 65 million in two years. We are outperforming the benchmarks that are available to your average investor. It's a great place to gain equity exposure to the very awesome upside potential that mining discovery can offer. With a team that really understands how it's placing its bets and it's doing the very best it can do to ensure that those various bets work out well.

Dr. Allen Alper:

Those sound like excellent and compelling reasons for our readers/investors to consider investing in GoldSpot Discoveries. Denis, is there anything else you’d like to add?

Denis Laviolette:

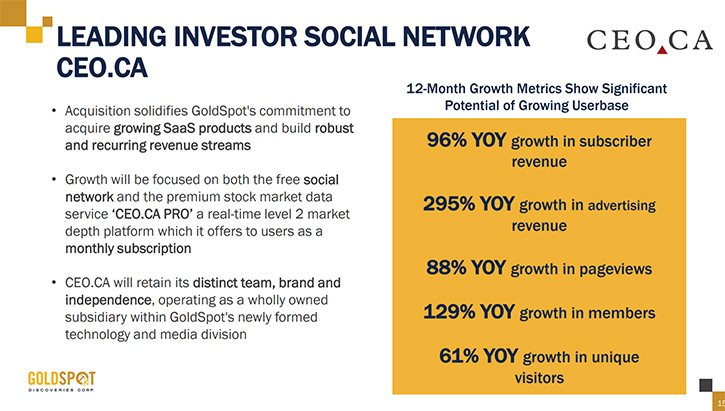

Well, I'd like to add a recent acquisition of CEO.CA.

Dr. Allen Alper:

Excellent! Please continue.

Denis Laviolette:

I'll just give you a few topical points. CEO.CA is really the town square for mining, and it's a giant megaphone for small cap sector stocks. This is where people chatter about mining stocks and it’s really the number one place that chatter happens. It's a free website and people can go on there and they can look up various stocks and see what others are saying about them. It's also a business that generates recurring revenue and that has substantial upside potential. It's an exceptional branding opportunity for gold, spotless clients, and investors. It has an immediate and substantial upside, serving GoldSpot clients, as a marketing channel, who are deeply undervalued financial technology platforms with industry leading engagement.

One of the interesting things that we mentioned with CEO.CA is that it has eight million users. And so not only is this a beautiful technology company that generates revenue that we can have a very clear plan in how we're going to improve that experience and build on that. It's also the largest audience that one could reach in the space. We've acquired CEO.CA recently, and we believe it's going to be transformational acquisition for us.”

Dr. Allen Alper:

That sounds excellent. That's great. I like that information.

Denis Laviolette:

Oh, well, thanks. And there's also a Level Two service there as well. If you like Level Twos and seeing the market depth of various trades, you can subscribe to that. That's the paid component. But it's a great service and it's comparable to what you would see on Stockwatch or StockHouse at a competitive price.

Dr. Allen Alper:

Oh, that sounds very good. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://goldspot.ca/

Denis Laviolette

Executive Chairman and President

GoldSpot Discoveries Corp.

Tel: 647-992-9837

Email: investors@goldspot.ca

|

|