Perpetua Resources Corp. (Nasdaq: PPTA, TSX: PPTA): Exploring, Restoring and Redeveloping Gold-Antimony-Silver Deposits, in Stibnite-Yellow Pine district, Idaho; Mckinsey Lyon, VP of external affairs Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/2/2021

We learned from Mckinsey Lyon, VP of external affairs for Perpetua Resources Corp. (Nasdaq: PPTA, TSX: PPTA), that they are focused on the exploration, site restoration and redevelopment of gold-antimony-silver deposits, in the Stibnite-Yellow Pine district, of central Idaho, encompassed by the Stibnite Gold Project. The Project is one of the highest-grade, open pit gold deposits in the United States and is designed to apply a modern, responsible mining approach to restore an abandoned mine site and produce both gold and the only mined source of antimony in the United States. Antimony is a federally designated critical mineral for its use in the national defense, aerospace and technology sectors. Currently, Perpetua is working through the permitting process. A supplemental Draft Environmental Impact Statement is now anticipated in Q1 2022, with a Final Record of Decision in the first half of 2023.

Perpetua Resources Corp.

Dr. Allen Alper: This is Dr Allen Alper, Editor-in-Chief of Metals News, talking with, Mckinsey Lyon, who is a VP of external affairs for Perpetua Resources. Mckinsey, could you give our readers/investors an overview of your Company and also what differentiates your Company from others?

Mckinsey Lyon: Thank you, Dr. Alper.

Perpetua Resources’ proposed Stibnite Gold Project is a unique opportunity to responsibly develop one of the largest gold resources in the country, restore an abandoned mine site and provide the nation’s only mined source of the critical mineral antimony – a key component to the battery storage technology necessary for a reduced carbon future.

It is very rare to find a project of this caliber. What makes Perpetua unique is that we get to solve environmental problems and restore an abandoned brownfields site through the development of our project.

The project is located in the Historical Stibnite Mining District, where mining first began in 1899 and most of the mining activity occurred during the WWII era for tungsten and antimony. This was long before the environmental regulations and ethos of today and as a result, many environmental legacies were left behind.

Our proposal is to use modern mining and the resources from gold and antimony production to provide the environmental cleanup and repair this area has needed for decades.

For example, today, the East Fork of the South Fork of the Salmon River flows into an abandoned mining pit, blocking fish migration to critical habitat for over 80 years. Our plan reconnects fish migration immediately and restores the natural flow of the river and establishes permanent migration access.

Today, water quality is degraded by historical tailings and waste. Through modern operations, we can pick up, reprocess, and safely store legacy tailings and improve water quality at the site.

This project has so many examples of where modern responsible mining can bring environmental benefits.

Dr. Allen Alper: That sounds excellent. Two goals can be accomplished at one time. Could you tell our readers/investors the different applications for antimony?

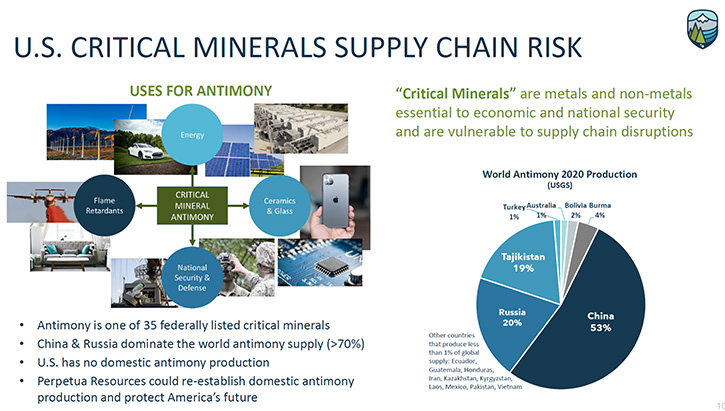

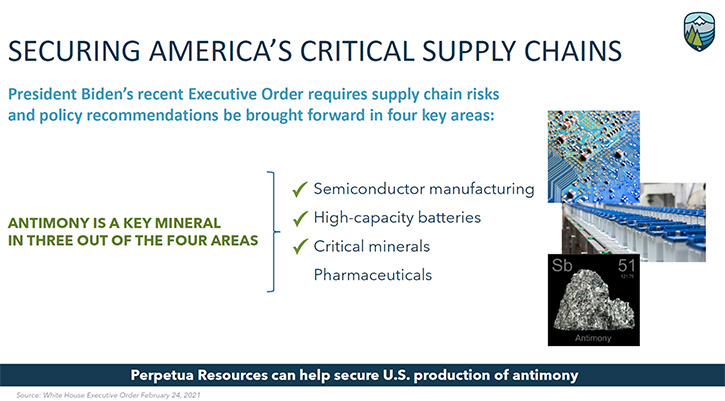

Mckinsey Lyon: Antimony is one of the 35 critical minerals here in the United States and it is necessary for many essential technology, energy, and defense applications. For example, antimony is in semiconductors, babbitt bearings of wind turbines, solar panels, munitions, fire retardants and in the protective coating around wiring.

Significantly, antimony plays a crucial role in the stationary battery technology necessary to reach net-zero carbon energy grids. The “liquid metal battery” technology requires a combination of antimony and calcium to produce a grid-scale, long-life, lower-cost, battery to store wind and solar power.

Yet, there are no mined sources of antimony in the United States today. Instead, over 90% of the global supply of antimony is controlled by China, Russia, and Tajikistan.

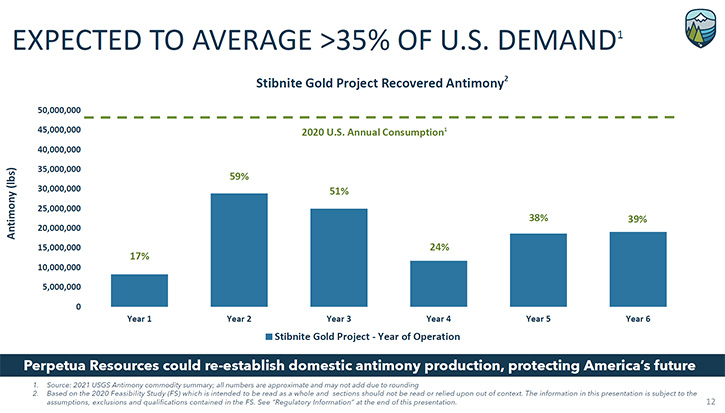

Antimony is a product that we absolutely need to meet our energy and infrastructure goals, and yet we have lost control over it. However, our project is one of the largest economic resources not controlled by our adversaries and could supply 35% of the U.S. demand in the first 6 years of the project.

Dr. Allen Alper: That sounds excellent. You can help fill a need for antimony and help the United States become less dependent on other countries.

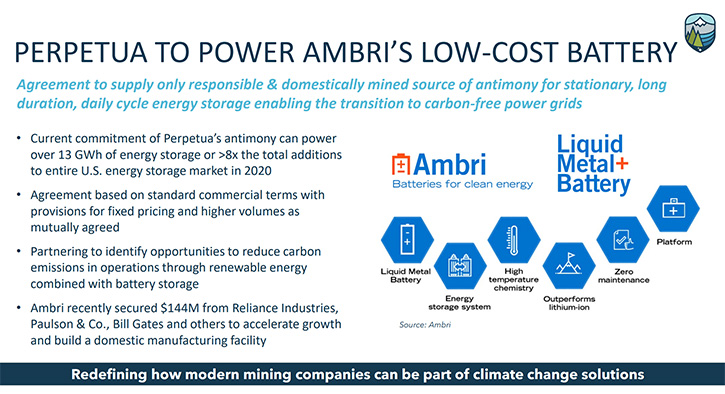

Mckinsey Lyon: Recently, we signed an agreement to provide a portion of our antimony to Ambri, an American company getting ready to commercialize their liquid metal battery technology.

Ambri’s Liquid Metal Battery technology relies on a combination of calcium and antimony to produce daily cycling, grid-scale batteries with a projected 20-year life cycle, at costs that are 30-50% below similar lithium-ion systems in 2022-2023.

Antimony committed from Perpetua’s proposed Stibnite Gold Project would power over 13 gigawatt hours of clean energy storage, that is the equivalent of over eight times the total additions to the entire U.S. energy storage market in 2020 and enough storage capacity to power ~1 million homes with solar power over the 20-year lifespan of the batteries.

This partnership sets the path for responsible US sourcing for our nation’s clean energy future and continues our pursuit of providing environmental solutions through mining.

Not only is domestic mining required to provide secure and responsible sources of the minerals needed for the clean energy transition, but by mining here, we can better control the ethical, economic, and environmental conditions under which mining is conducted.

Dr. Allen Alper: That sounds exciting, your antimony Stibnite mine is noted for its gold reserves. Can you tell us a little bit about that?

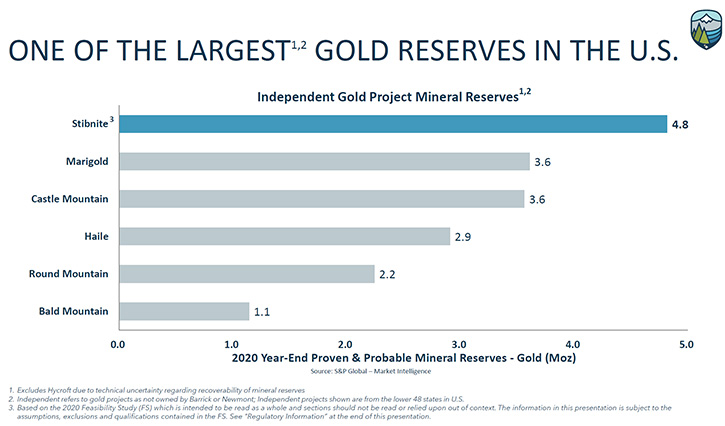

Mckinsey Lyon: The Stibnite Gold Project is both an antimony project and gold project. The Stibnite Gold Project will redevelop one of the largest, lowest cost, long life gold projects in the United States, with great economics, a 15-year reserve life and less than a three-year payback period. The overall economics of the project are driven by gold and gold supports the environmental restoration and antimony production.

Dr. Allen Alper: Could you tell our readers/investors your plans, going forward and your schedule?

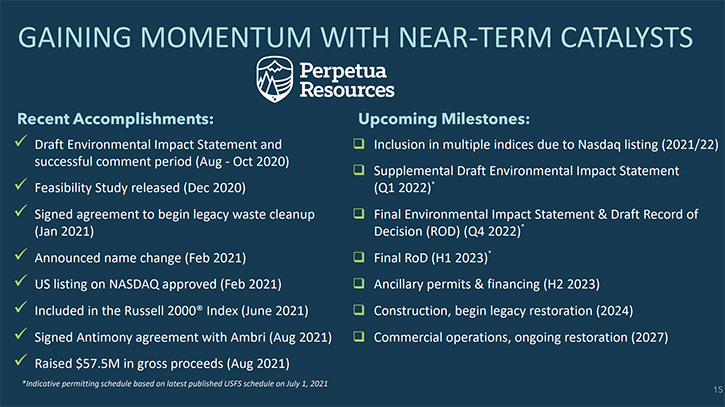

Mckinsey Lyon: Absolutely. The project is currently being reviewed under the National Environmental Policy Act. Our Plan of Restoration and Operations for the Stibnite Gold Project was submitted to the lead permitting agency, the U.S. Forest Service, in 2016. Since then, the US Forest Service released our Draft Environmental Impact Statement (DEIS) for public review and a 75-day public comment period in August of 2020. The comment period ended in October 2020, with about 10,000 individual comments received by the Forest Service, the majority of which were in support of the project.

After reviewing the document and subsequent public comments, Perpetua identified a series of refinements to our project that improve the project’s environmental outcomes by reducing the project footprint, improving water quality and lowering water temperature.

In early 2022, the U.S. Forest Service is expected to release, for public review, an updated analysis, focused on the improved project design. We anticipate the final Record of Decision, completion of ancillary permits, and financing in 2023.

It is important to note that we've achieved some pretty major milestones as a Company in the last year, including the partnership with Ambri to support commercialization of their grid-scale battery, inclusion in the Russell 2000 index, joining the NASDAQ in February 2021 and of course changing our name from Midas Gold to Perpetua Resources. Tt's been a busy year with a lot of momentum and an exciting future ahead.

Dr. Allen Alper: That sounds excellent, can you tell our readers/investors a little bit about the Team and the Board and their backgrounds?

Mckinsey Lyon:Perpetua Resources is led by CEO, Laurel Sayer. Laurel is a remarkable choice to lead a mining company as it advances through the permitting process. She is a conservationist by background and has spent her career in natural resource policy and bringing people together around conservation issues. For her to take the helm of a mining company speaks to the values of who we are as a Company and what we're trying to accomplish.

Our Management and Executive Team is the best of the best. We recently brought on Jessica Largent, as our Vice President of Investor Relations and Finance. She comes to us, with over 15 years of experience in the industry, most recently for Newmont and previously for Rio Tinto.

John Meyer is our Vice President of Development; he brings a robust set of experiences specific to project development within the mining industry. His role has been to help design the project to mine and restore legacy features on site at the same time, and John lead the 2014 Pre-Feasibility Study and 2020 Feasibility Study.

Alan Haslam is our Vice President of permitting. He comes to us from Agrium. His background is in Permitting and Mine Operations in Idaho. Alan has worked all levels of the mining industry, and having successfully permitted mines here in Idaho, he uniquely understands the complexity of the permitting process and how to get to approval.

Our Board recently saw some changes that brought with them a renewed set of expertise and experience to help the project at this phase of development.

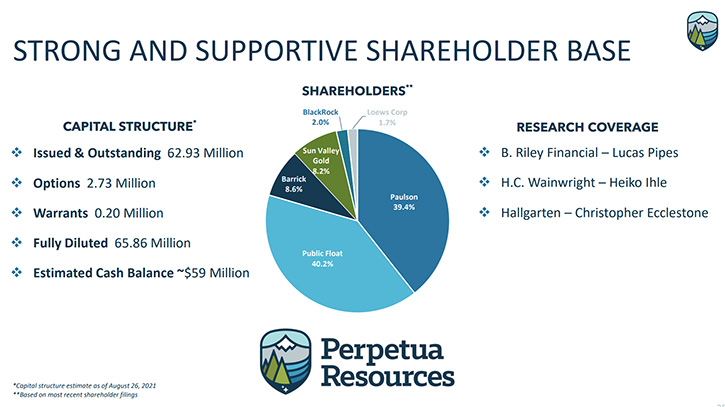

Dr. Allen Alper: Great, could you tell our readers/investors a little bit about your share and capital structure?

Dr. Allen Alper: Could you tell our readers/investors the primary reasons they should consider investing in Perpetua Resources?

Mckinsey Lyon: Our investment thesis is centered on redeveloping one of the largest, lowest cost, long-life gold projects in the United States, with a 15-year reserve and a three-year payback coupled with the right approach and strong ESG principles

When we think about mining in the United States and what it takes to make it possible, it's not just a strong reserve. It's not just a strong payback. Instead, we have to show value to all of our stakeholders including our shareholders and our communities along with showing value to environmental interests and needs.

Which is why anyone would be hard pressed to find another project in the U.S. with a better profile – we have a strong gold reserve and an economic project, we have a much-needed critical mineral, we have a direct supply relationship with storage batteries, we are a partner with our communities, and we have this unique upside of repairing the environment at an abandoned mine site. It really can’t get better than that.

Dr. Allen Alper: Oh, that's nice to see a Company that's so socially responsible.

Mckinsey Lyon: I find it very encouraging and exactly what is needed. I believe many mining Companies are headed in this direction and it is an exciting time to be a part of the industry. It is not just us, but I'm very happy to say that we're trying to lead, wherever we can, in that regard.

Dr. Allen Alper: Oh, that sounds excellent, Mckinsey, is there anything else you'd like to add?

Mckinsey Lyon: Successful mining requires a modern approach. As a Company, that that means building transparency and accountability between us and communities and our investors, investing in environmentally sustainable and community-focused practices, and doing the business the right way, will lead to a project that benefits all stakeholders and shareholders. And it is why so many people, including myself are excited about this project.

Dr. Allen Alper: Well, that sounds excellent. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://perpetuaresources.com/

Mckinsey Lyon

Vice President External Affairs

media@perpetua.us

|

|