Glenn Mullan, Chairman and CEO, Golden Valley Mines and Royalties Ltd. Discusses the Combination, with Gold Royalty Corp and Abitibi Royalties Inc., Forming Nearly 200 Royalties in the Americas.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/30/2021

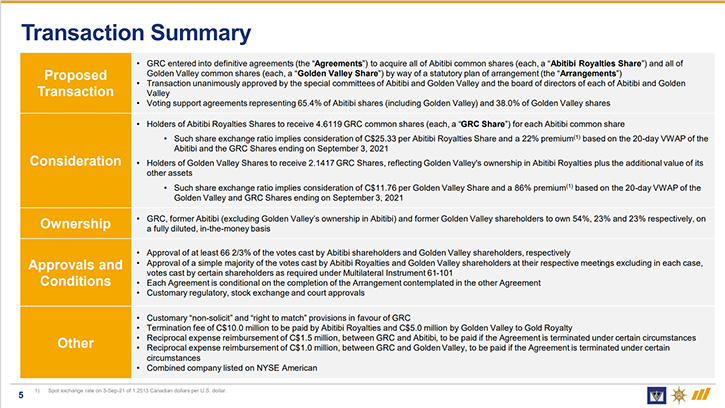

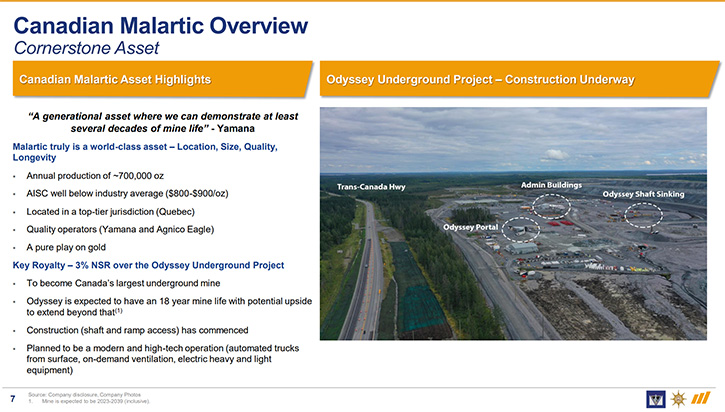

We spoke with Glenn Mullan, Chairman and CEO of Golden Valley Mines and Royalties Ltd. (TSXV: GZZ, OTC QX: GLVMF), a Canadian project and royalty generator that is set to combine, with Gold Royalty Corp. (NYSE American: GROY) and Abitibi Royalties Inc. (TSXV: RZZ, OTC QX: ATBYF) to create a leading growth and Americas-focused precious metals royalty company. The combination of assets will result in nearly 200 royalties, exclusively focused on the Americas, with 90% of the exposure, on the royalty side, coming from gold. Nearly three quarters of the value of the assets is focused on Quebec and Nevada, the top two mining jurisdictions in the world, according to the Fraser Institute. The Canadian Malartic mine will become the cornerstone asset, providing value for the Company's shareholders for decades to come. Mr. Mullan will be joining Gold Royalty’s Board of Directors on completion of the transaction.

Matachewan, Ontario

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Glenn Mullan, President, CEO and Chairman of Golden Valley Mines and Royalties. Glenn, I thought I'd like you to tell our readers/investors your thoughts on the combination of Gold Royalty, Abitibi Royalties and Golden Valley Mines and Royalties.

Glenn Mullan:

I'm very enthusiastic. I think the very first phone call, with the principals of Gold Royalty, namely John Griffith and David Garofalo, was quite inspiring. It really didn't take very long for us to construct the architecture for this combination. The right transaction, with the right parties, at the right time. Ian Ball from Abitibi Royalties and myself from Golden Valley Mines and Royalties, I think we felt that we had taken the Companies as far as we could legitimately expect, from pure exploration public vehicles, effectively right through to present day.

Looking forward, over the next few years, there seem to be some obvious synergies and benefits from this proposed combination. Certainly, the principals track record on the other side, the Gold Royalty principals was one of the main attributes. It didn't escape our attention that despite the positive exploration results from Canadian Malartic, and notwithstanding some of the other attributes and sources of cash flow we've developed and other assets, that one of the main attributes was the NYSE American listing that Gold Royalty has.

Small companies have small liquidity and Golden Valley, before this transaction, probably had an average daily volume in the range of 3,000 shares a day. And that's based on its 20-Year trading history. Abitibi Royalties traded about 2,000 shares a day over its 10-year existence. Compare that to the impressive volume that we now witness daily on GROY, not just since the transaction was announced, but prior to the transaction, and their IPO was only in March. They're averaging over 1.5M shares a day on the NYSE American.

All of those attributes together, encouraged Ian and me to keep an open mind. Look at the other assets, look at what kind of synergies might be developed, if we were to put our cards together with theirs. In terms of jurisdictions, Nevada, Quebec, Ontario, I think we're really very well situated for not just the cornerstone assets, but the pipeline of development projects that will follow.

Dr. Allen Alper:

That sounds excellent. Is there anything else you'd like to add, Glenn?

Glenn Mullan:

Well, I'll be sorry to see our baby go, but with Golden Valley and Abitibi, we incorporated and listed them both, took them forward, acquired the original assets, have developed them to present day. I suppose a certain part of it is feeling a bit nostalgic, looking at them move through the development pipeline into another larger entity.

But I can also see all of the benefits of the transaction far outweigh any of the memories. I'm very much looking forward to seeing what we can achieve collectively, with Gold Royalty. It's no secret that both Golden Valley and Abitibi were run by very small management teams. It'll be quite exciting for us to actually look at what can be done with the real bench depth that Gold Royalty brings to the table in terms of business development, marketing, exploration, and general business development strategy. We're looking forward to further growth and participating in that with them, through our cornerstone asset at Canadian Malartic.

Drilling at Malartic

Dr. Allen Alper:

It sounds like the combination will be fantastic, and form a great, strong gold and precious metals royalty Company, which is located in North America,

Glenn Mullan:

Yes, I'm really looking forward to seeing what this hybrid will look like; between Quebec, Ontario and Nevada and of course, the other assets. I think there are over 191 royalties in the combined or pro forma entity, and certainly the development pipeline is also one of the main characteristics of the combination. Not just the royalties that are cash flowing today, but those that are already in the development stage, those that have completed PEAs, those that are pure exploration and still being aggressively explored. We certainly have an interesting and very well diversified portfolio, through North and South America.

Dr. Allen Alper:

That sounds excellent. I'll be very interested to follow the new combination and report to and updating our readers/investors, as it moves forward and develops.

Glenn Mullan:

Thank you, Dr. Alper. I'm thinking about some of the other features that the combined entity will hold. Of course, the flagship asset and the reason for the transaction are the royalties that we hold at Canadian Malartic Gold Mine, the largest gold mine in North America. But some of the other free carried interests and NSR’s (net smelter returns or net smelter royalties), are also quite interesting, such as some of the royalties that we hold in the mid-north (James Bay) of Quebec, around the Newmont Eleonore Deposit, some of the other royalties that we hold throughout Quebec and Ontario. And, of course, the recent Ely Gold transaction that preceded this announcement that was mostly assets in the state of Nevada. I don't think it's escaped anyone's attention that both the Province of Quebec and the State of Nevada consistently rank as two of the top jurisdictions in the world for mining, exploration, and support for the industry. Putting them together just made good sense, if our strategy was based on forward looking development and trying to develop these assets into something more meaningful.

Dr. Allen Alper:

Sounds excellent! Sounds like a fantastic combination, very, very synergistic. Is there anything else you'd like to say?

Glenn Mullan:

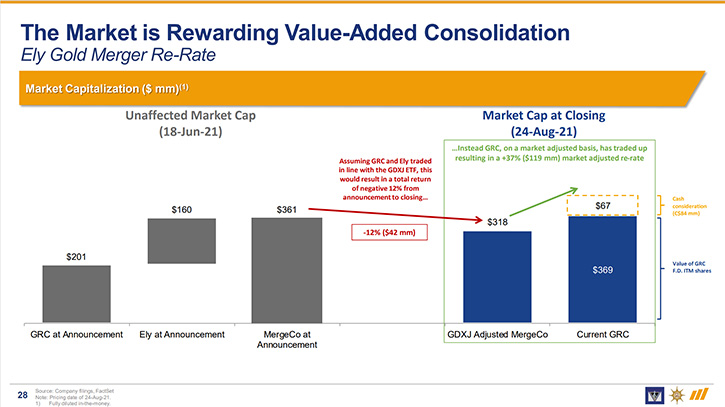

So many mining transactions result in, I suppose, what many call settling of share prices. There's a little bit of an upward spike on the announcement and then the prices retract or pull back. Often the aftermath is not at all what shareholders anticipated or understood. I think this is one of the very few transactions where all three parties immediately spiked upwards and have maintained that trajectory.

Over the past few weeks, the price of gold hasn't exactly cooperated, it has pulled back as a commodity. The general economy is still fraught with challenges, and yet Golden Valley Mines and Royalties, Abitibi Royalties and Gold Royalty have all done very well, on not just an upward trajectory on the announcement, but more importantly, since the announcement and continuing to move in that direction. I think that attests to the general enthusiasm by most of our shareholders.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out, so our readers/investors can follow your progress.

https://gvmroyalties.com/

Glenn J. Mullan

Chairman, President, and CEO

Golden Valley Mines Ltd.

2864, chemin Sullivan

Val-d’Or, Québec J9P 0B9

Telephone: 819.824.2808 ext. 204

Email: glenn.mullan@goldenvalleymines.com

|

|