David Garofalo, Chairman & CEO, Gold Royalty, Ian Ball, President & CEO, Abitibi Royalties, Discuss the Combination of Assets, Resulting in Nearly 200 royalties, Primarily Quebec and Nevada

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/30/2021

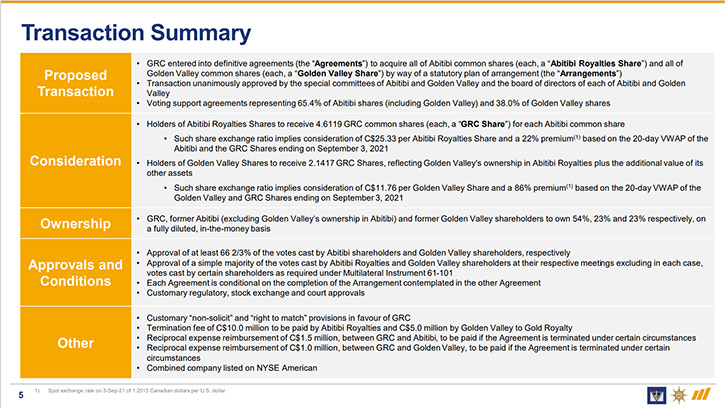

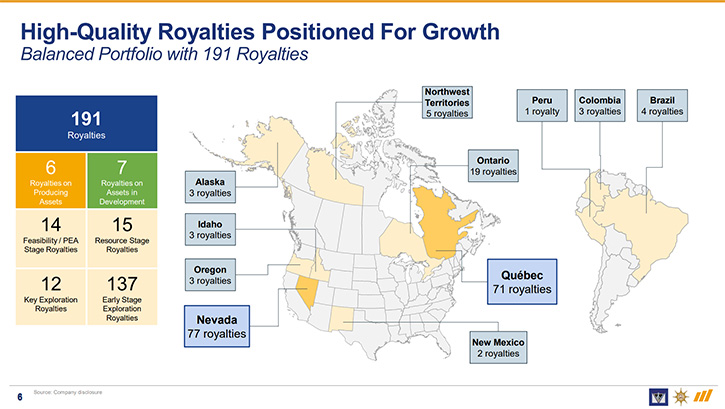

In early September of 2021, Gold Royalty Corp. (NYSE American: GROY), Abitibi Royalties Inc. (TSX-V: RZZ, OTC-Nasdaq Intl: ATBYF), and Golden Valley Mines and Royalties Ltd. (TSX-V: GZZ, OTC QX: GLVMF) announced their decision to combine, to create a leading growth and Americas-focused precious metals royalty Company. We spoke with David Garofalo, who is Chairman and CEO of Gold Royalty, and with Ian Ball, who is President and CEO of Abitibi Royalties. The combination of assets will result in nearly 200 royalties, exclusively focused on the Americas, with 90% of the exposure on the royalty side, coming from gold. Nearly three quarters of the value of the assets is focused on Quebec and Nevada, the top two mining jurisdictions in the world, according to the Fraser Institute. The Canadian Malartic Mine will become the cornerstone asset, providing value for the Company's shareholders for decades to come. According to Mr. Ball, so far, the combination of assets has resulted in a rise in the share price of each of the three Companies.

The Canadian Malartic Mine

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with David Garofalo, who is Chairman and CEO of Gold Royalty and also with Ian Ball, who is President and CEO of Abitibi Royalties. David, I thought I would start with you. Could you give our readers\investors an overview of what the combination, the importance and the vision of the combination of Gold Royalty, Abitibi Royalties and Golden Valley, as one very strong royalty Company?

David Garofalo:

Collectively, putting these three Companies together gives us nearly 200 royalties, exclusively focused on the Americas, with 90% of our exposure, on the royalty side, coming from gold: some silver and copper as well, but predominantly gold. Nearly three quarters of the value of our business is focused on Quebec and Nevada, which are the top two rated jurisdictions, by the Fraser Institute, in the world to do mining from the standpoint of mineral potential, low regulatory risk and low political risk.

We're in the right metal and the right places of the world, with significant growth ahead of us. In Canadian Malartic, a cornerstone asset that, as I've said time and again, is our Goldstrike as Goldstrike is to Franco-Nevada and the royalty they have on that asset. Canadian Malartic represents that kind of quality of asset for us and will be an annuity for our shareholders for decades to come. Given where it's located, the operators involved, the geological prospectivity, it's all very, very exciting.

Dr. Allen Alper:

That sounds excellent, Ian, could you tell us a little bit about Abitibi Royalties and why you are so in favor of this combination.

Ian Ball:

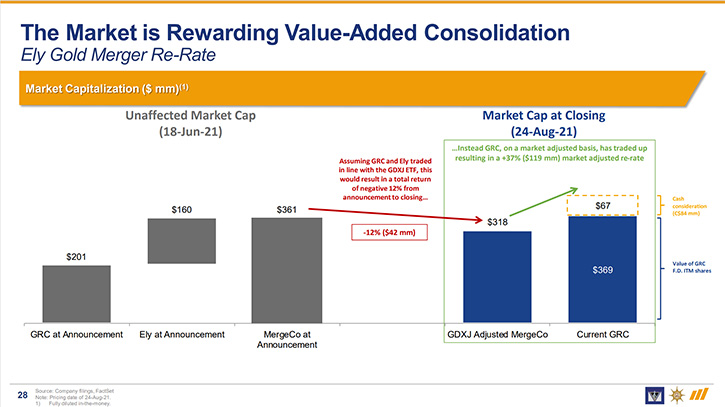

Well, we looked at it and there were a couple of items, influencing our decision. One was, we thought the three companies were stronger together than they were individually. That was first off. Second, we were bringing the cornerstone royalty to the equation and Gold Royalty was providing a very well-balanced portfolio. So, when you combine a cornerstone royalty, with the Gold Royalty portfolio that they already had, it was our belief that the market would reward the combined company, higher than what they would have done separately.

So far, we've seen exactly that, as this has been one of the rare occasions, where both the acquirer and the acquired have seen their share price rise post announcement. The thesis that was driving that has so far proven to be correct. From our perspective, all that we were really looking at was the share price and saying is this going to be good for our shareholders.

Dr. Allen Alper:

That sounds excellent. David, could you say why this combination is good also for Golden Valley investors?

David Garofalo:

What I could say is that I spoke to Golden Valley's largest shareholder, Jimmy Lee, and that's really what initiated the discussions, early on, about putting this combination of the three together. What I tried to sell Jimmy on, and Ian has already alluded to this and quite eloquently, is the potential for a double bump. I was offering him a premium up front or a share that was actually quite severely discounted, because of its holding company nature. Then I also sold him on the prospect of achieving a second bump as that asset gets rerated, within the bigger portfolio. As Ian pointed out, that's already come to pass, to a degree.

They've gone to upfront premiums, and as Ian correctly pointed out, the shares of Gold Royalty have appreciated, quite significantly, since the announcement. Because the exchange ratio is fixed, Golden Valley and Abitibi shareholders have benefited immensely from the re-rate that we've already started to achieve, as a result of the announcement. I would say that's the benefit for Golden Valley, and I think it's the same for Abitibi. They've enjoyed the re-rate in the Gold Royalty Corp. shares as a result of this announcement.

Dr. Allen Alper:

Well, that sounds great David, could you also give us more details on the type of royalties the combination will have? What will be the advantage, to investors, of this combination?

David Garofalo:

We're singularly focused on precious metals. I think that's an advantage, relative to many of the similar sized peers in the space, who have much more diversified portfolios. It's been empirically demonstrated that companies that are singularly focused on precious metals, in the royalty space, get better multiples. We see a potential dramatic growth rate in our portfolio, as a result of the scale that we're achieving, by putting these companies together.

We have six royalties that are currently producing, another seven in construction and many earlier stage, from early-stage exploration right through the feasibility. So, we have tremendous organic growth, for the foreseeable future, maybe for decades to come, as a result of the significant optionality in our portfolio. Even in the short term, in the next three to five years, we expect our cash flow to increase fivefold.

And really beyond that five-year horizon, as the Odyssey underground mine is brought into production by Agnico and Yamana at Canadian Malartic, we see the prospect for even further cash flow growth, from things that are already in construction in development. It's exciting! All key metrics, both in terms of the mineral endowment that we have underlying our assets, but also the cash flow growth for many of the near-term royalty opportunities we own in the portfolio.

Dr. Allen Alper:

Well, that's excellent. David, I know you have an outstanding successful background. I wonder if you could tell our readers/investors about your background and your Team.

David Garofalo:

I come from an operating and development background. I've spent over 30 years, with a number of large cap companies. Most recently, I was the CEO of Goldcorp Inc. and I helped to engineer the merger to create the world's biggest gold company, by market cap and production, when we merged with Newmont in 2019. Before that, I was the CEO of Hudbay and we built three mines there, including the large scale Constancia Mine in Peru.

Then in Agnico Eagle, during its formative years, I was the CFO from '98 to 2010. We built a succession of mines there, about six mines, three in Canada, in the same Abitibi Greenstone belt where Malartic is situated, but also in Finland, in Mexico and northern Canada as well. All told, for over 30 years, I've been involved in the construction of 15 separate mines and helped operate countless more.

Then if you look at my Board and Management, there's a similar technical skew to it. Alan Hair is on our Board. Alan was my successor at Hudbay. He was my COO there and a prolific mine builder, in his own right, with 35 years as a metallurgical engineer. Alastair Still is our Director of Technical Services, and he's the CEO of our former parent company, Gold Mining Inc. Alastair, himself, as a geologist and mine operator and mine builder, brings quite an impressive technical resume as well.

We have quite a few people on the Board that have built mines and operated mines, which gives us a clear-eyed view of the underlying risk of any royalty opportunity we're taking on. Beyond that, I have Ian Telfer as a cornerstone investor. Ian was my Chairman at Goldcorp, but also was a very successful company builder, having helped found the modern Gold Corp. and founded Wheaton River. He also created Wheaton Precious Metals 15 years ago.

Dr. Allen Alper:

Well, those are certainly outstanding successes.

David Garofalo:

We spun out Gold Royalty, from Gold Mining, Inc. Like Ian did back 15 years ago, with Wheaton Precious Metals, he spun it out of Goldcorp, with initially a royalty portfolio on Goldcorp's assets. Then rapidly went about diversifying that asset base and growing that royalty portfolio, to the point where Wheaton is the second biggest royalty and streaming company, by market cap, in the world right after Franco-Nevada.

I'm certainly leaning on that experience with Ian. He's been a trusted advisor of mine now, for years, in creating this Company, initially with the spin out from Gold Mining, back in March, when we raised $90 million US and an IPO on the New York Stock Exchange. Then rapidly used our new currency to buy Ely Gold, to double our size from a $200 to a $400 million market cap. And we're looking to effectively double our size again, with this three-way merger, from a $400 to almost an $800 million market cap.

That scale is extremely important to be competitive, both in terms of our ability to access capital cost effectively, but also to be able to bid on royalty opportunities of scale. And so, scale does matter, given that royalty companies essentially act as a financing conduit to the explorers and developers. We're at a point, in the cycle now, where it's forcing developers, out of existential necessity, to have to start investing back into exploration development meaningfully, given the fact that reserves are down dramatically, from where they were seven years ago, 40%, in the gold business.

Dr. Allen Alper:

Wow! You have assembled an excellent Team and excellent properties and royalties. And the combination looks like a fantastic opportunity for investors. Ian, would you like to say anything more about Abitibi and why it’s playing such a key role in this combination?

Ian Ball:

I would finish by saying a few things. One, I have no doubt in my mind that as a Company, Abitibi is stronger, with Gold Royalty and Golden Valley, than it was two weeks prior before the deal. The second is that, when we started Abitibi, and how we've run it over the years, our sole focus has always been about respecting the shareholders and trying to create capital gains for the owner, because that's what we're here for, at the end the day. Gold mining is about wealth creation for the owners of the Company.

When I looked at the transaction, it was very easy to see the merits of it. A lot of transactions, in the mining industry make sense, but they don't actually proceed because of the social issues involved. But when I looked at it, when your investment is 20 times your annual salary, the social issues disappear pretty quickly and you focus on what's right for the shareholders, which was this transaction.

Dr. Allen Alper:

Well, that sounds excellent. David, could you tell us a little bit about the timing?

David Garofalo:

There will be a circular mailed, in the coming couple of weeks, to the shareholders of Golden Valley and Abitibi. There will be a shareholder vote, called by both companies, and that's expected to happen in either late October or very early November. This is a plan of arrangement, so we expect it to close, within a couple of days of the shareholders meeting. I should add that we have tremendous support from the shareholders of both companies, 65% of Abitibi shareholders have signed support agreements and 38% of Golden Valley’s key shareholders signed support agreements as well. We feel like we're going to have tremendous support at the meetings when they do take place.

Dr. Allen Alper:

Sounds excellent, David! Could you summarize the primary reasons Abitibi and Gold Valley royalty investors should support this combination? And also, why our readers/investors should consider investing in Gold Royalty.

David Garofalo:

Well, I really do believe we're going to be entering a point in the cycle, where there's going to be massive amounts of investment, in new mine capacity, in the gold business and for that matter, the base metal business. Base metals companies quite often deal with the precious metal streamers, because they have byproduct precious metals, they're looking to sell, to help finance the construction of new mines. We are entering, what I think is going to be a tremendous cycle, for mine development out of need, both from the demand side, but also because of declining supply.

Royalty companies play an important part in the ecosystem, in helping to finance new mine development. They provide that conduit to capital, that quite often isn't available to the developers and explorers. But in order to be successful to do that, you have to have scale, you have to have liquidity, you have to have a low cost to capital and we're adding strength to strength here. We're adding Abitibi and Golden Valley's tremendous asset base, with their cornerstone Canadian Malartic asset, to a very well diversified portfolio of assets in Quebec and Nevada and other parts of the Americas already.

That strength and scale will make us competitive as we look to add further to our portfolio, continue to grow the business and do so in a very creative basis. We allocate capital, expecting to get double digit rates of return for our shareholders. We take the entrusting of our shareholders capital and savings very, very seriously. We allocate the capital, with a clear-eyed view of the underlying risk. We do a lot of technical due diligence, on everything we look at, given the strength of our Board in that regard. We do that expecting to get strong rates of return, to ensure that we perpetuate the savings of our shareholders.

Dr. Allen Alper:

That sounds excellent. Those are very compelling reasons for people to support investors, to support the combination and for new investors to invest in the new Gold Royalty company. David and Ian, is there anything else you'd like to add?

Ian Ball:

Nothing on my end. Kudos to David and his Team! If you look at the quality of the Team that David has been able to assemble at Gold Royalty, it's quite remarkable. You combine that with the shareholder list of Eric Sprott, Rob McEwen being the second and third largest shareholders after Gold Mining. It's a pretty unique combination of the Management and Shareholder Registry that not too many companies of our size possess. I think the assets are unique, but so are the people. And ultimately, that's what's going to make the Company much more successful, going forward.

Dr. Allen Alper:

That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goldroyalty.com/

Abitibi Royalties Inc.

Ian Ball, President & CEO

Tel.: 1-888-392-3857

Email: info@abitibiroyalties.com

Gold Royalty Corp.

David Garofalo, CEO, President and Chairman

Tel.: 1-833-396-3066

Email: info@goldroyalty.com

|

|