Kevin MacNeill, CEO of EQ Resources Limited (ASX: EQR) Discusses their World-Class Tungsten Mine at Mt Carbine, in North Queensland, Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/23/2021

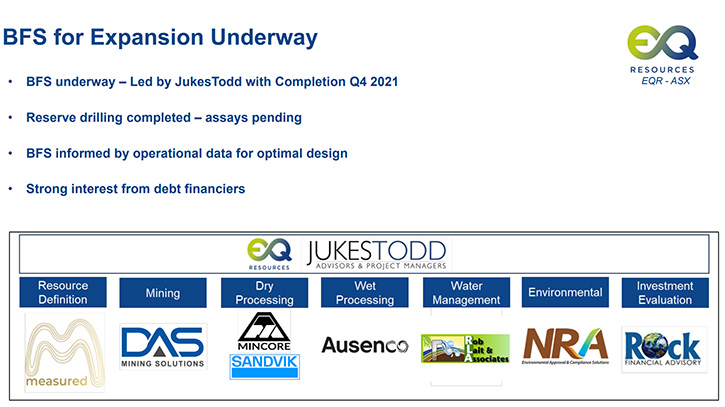

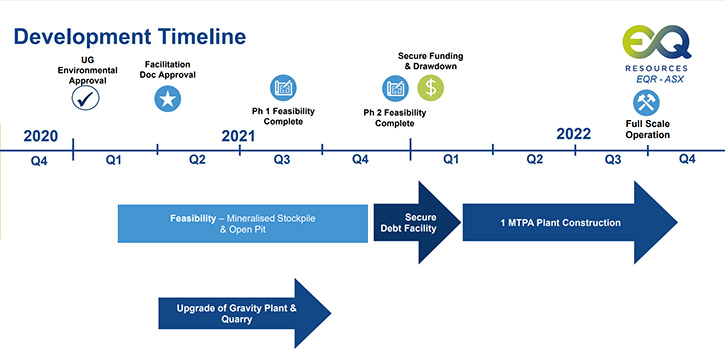

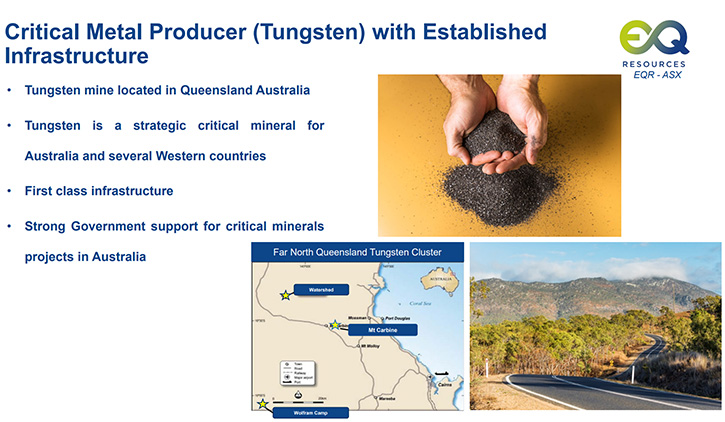

We learned from Kevin MacNeill, CEO of EQ Resources Limited (ASX: EQR) that they own a world-class tungsten mine at Mt Carbine, in North Queensland. It is the only primary tungsten producer in Australia, with by-product revenue, through a well-established quarry business. EQ Resources is currently in the process of expanding Mt Carbine, by way of a bankable feasibility study, leveraging advanced technology, historical stockpiles and unexploited resources, with the aim of becoming the pre-eminent tungsten producer, in Australia. The bankable feasibility study is led by Jukes Todd and is expected to be completed in Q4 2021. EQ Resources formed a 50/50 joint venture, with CRONIMET, on tailings and mineralized stockpiles.

EQ Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Kevin MacNeill, who is CEO of EQ Resources. Kevin, could you give our readers\investors an overview of your Company and what differentiates your Company from others?

Kevin MacNeill: Certainly, thanks, Al. We are a tungsten concentrate producer, with by-product revenues, from recycling our inert wastes for various quarry products. The quarry has been operating for 30-years. The fact that we are actually in production, differentiates us from most juniors. We have a fully functional operation, with all relevant infrastructure. We're now working towards expanding the operation, by way of a Bankable Feasibility Study (“BFS”) that is being conducted by a Company called Jukes Todd.

We recently completed a 4,500-meter drill program, to better define our mineral resource, under the historic open pit at the site. A positive for future development is that there is also a decline that's driven 480m underground that we're planning to reopen, in the coming years, to access more high-grade ore at depth.

Dr. Allen Alper: Oh, that sounds excellent. I noticed that you had a joint venture with Cronimet. Maybe you could tell our readers/investors about that.

Kevin MacNeill: Yeah, Cronimet is a large specialty metals trader, mostly in recycling of various metals, their largest being in stainless steel. They hold one of the largest market shares in the world for stainless recycling, but they are involved in tungsten and other various specialty metals. That's what attracted them to this particular project.

I came out of the CRONIMET Group originally. I was one of the Managing Director’s in South Africa for the Mineral Processing. As a result of my previous involvement with CRONIMET, they knew my skill set and asked if I would consider the CEO role for EQR. They're a very big proponent of the project and a very large Company, with a significant international presence, with 54 offices around the world, turning several billion Euro in revenue annually.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors, the primary uses of tungsten, why it's such a critical metal and Australia's position versus the rest of the world?

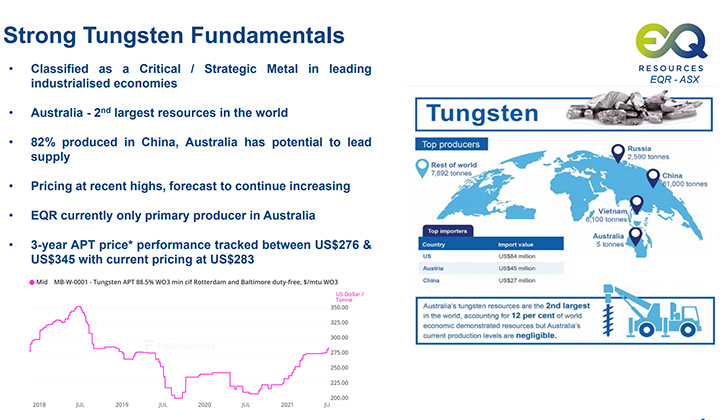

Kevin MacNeill: We're the only primary producer in Australia currently. There is another company who produces minor amounts of scheelite as a secondary product. But we're the only primary producer and are shipping concentrates on a monthly basis. Tungsten is mainly used for hardening metals. It is mainly used in the automotive manufacturing industry, mining, Oil & gas for drill bits, specialty steels, high wearing parts, and in the defense industry etc.

China currently produces 82% of the world's tungsten. They therefore have a stranglehold on the market, with Western countries relying heavily on China for supply of the metals for the above-mentioned critical industries, which puts Western countries in a precarious negotiating position, for critical supply chains. The Australian government has put tungsten on the strategic metals list to try to support companies that are producing or working toward a production positive position, to accelerate the mine development and increase supply to the Western world. Currently, our material has been shipped to producers in the United States, Europe and Asia.

Dr. Allen Alper: Well, that sounds great. Could you tell our readers/investors a little bit about the pricing of tungsten and APT?

Kevin MacNeill: In general, tungsten currently is trading about $29,000 per ton of tungsten, I think it's 80% ATP. The way you value tungsten is it is sold in MTUs. If we produce a 50% concentrate, a Metric ton unit “MTU” is 10 kgs, which is about $290 per MTU right now. Which is 10 kgs of pure tungsten.

We're currently producing roughly 25 tons of concentrate per month, and planning to ramp up in two stages. The first stage being 100 tons a month from our mineralized stockpile on surface, which is historic mine waste and the second stage being +300 tons a month, once the open pit operations come online.

Dr. Allen Alper: Could you tell us more about the timing of your projects?

Kevin MacNeill: We're finishing the bankable feasibility study in late October. We're looking at probably around a $20 million financing, at that stage, to expand our current activities, purchase a new crushing, screening and XRT Sorting plant, then restart the primary mining activities.

Our processing plant really doesn't need too much work. It's mostly around the crushing, screening, and mining side that needs the work. We're planning, in the new year, to put in all that new crushing equipment, at our 12 million ton mineralized stockpile. Then, we are starting to strip back and de-water the open pit and get it ready for mining the high-grade, currently at floor level of the open pit.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors about your background, your Team and Board?

Kevin MacNeill: Starting with the Board, we have one of the four global MDs of Cronimet, Oliver Kleinhempel, siting as the Non-Executive Chairman of our Board. We have two individuals, with significant experience in the equities space, Richard Morrow and Stephen Layton, then one of our significant investors, Zhui Pei Yeo who brings with Executive level experience across a range of industries. Tony Bainbridge and I are on the Technical Management side of things. I'm a metallurgist, Tony's a geologist.

Dr. Allen Alper: That sounds like you have a very experienced, talented, diverse Team. That's excellent!

Kevin MacNeill: Yeah, we do. It’s a really great mix of individuals and has created a strong leadership Team.

Dr. Allen Alper: That's excellent! Could you tell our readers/investors a little bit about your share and capital structure?

Kevin MacNeill: We have about 1.3 billion shares outstanding, and we're currently trading at around the 3 cents level (at the time of writing), with a market cap around 40 million Aussie or 30 million US dollars, in that range. The top 20 shareholders, as far as I know, have not sold a share in the last year. They hold over 50% of the currently issued share capital and are huge supporters of the project.

Dr. Allen Alper: That sounds excellent. It's nice to have support from shareholders that you could depend on and who are backing you strongly.

Kevin MacNeill: Yeah! They're very strong supporters. They see where the project is going. In the last six months we've taken 10 large bulk samples from our large 12-million-ton mineralized stockpile, trialing from all over to ensure consistent grade, which we have achieved. We have a gravity plant that has been upgraded, to increase throughput productivity.

The plant is able to process about 1,000 tons a day. Currently, we're running seven days on and seven days off, through the gravity plant, because we're constrained by the current crushing and screening capacity, as we are using the equipment inherited, with the project, which is more mobile machinery focused, rather than fixed plant.

We're also fulfilling quarry contracts, at the same time. So, we want to raise additional capital, to put in expanded crushing and screening capabilities.

Dr. Allen Alper: Kevin, Could you tell us the primary reasons our readers/investors should consider investing in EQ Resources?

Kevin MacNeill: For me, there are probably three main ones. The ramp up in production, in the next year, is going to be very significant. We have worked through all the problems, all the bugs, with the pilot set up that we've been operating, to test the mineralized stockpiles. I have been able to stabilize my plant at 1,000 tons a day continuously.

Now we're going to increase the capacity of the crushing and screening plant, so that we're able to supply more feed stock to the gravity plant. Currently, we're only able to supply about 12,000 to 15,000 tons of feed material a month. We want to focus on processing the mineralized stockpile material feed only. So that's the phase one ramp up.

Phase two ramp up is that we've drilled under the historic open pit. And we're currently re-defining the historic resource, with a new approach to the deposit. As you'll see from recent announcements, the grade is somewhere around five times higher than the waste dump that we're currently treating and is quick to access as the ore is immediately available in the floor of the historic open pit once water has been removed. The third reason is that we've identified, to the North of us, the extension of the Iron Duke deposit that is looking very high-grade and running to depth.

So, the geologists have been modelling the high-grade deposit to the North of us to see how that would impact the operation going forward. That would be accessible underground. It would be accessed from the existing ramp design that's already been excavated in 1985.

So, I think you have all the elements. You have a junior that's established a core operating Team, with all of its operational procedures and infrastructure in place. We currently have production cash flow. This allows us to design a plant that is 100% suited to the deposit and has not just been designed for a few trials in a lab. You have by-product production, from the quarry that's been here for 30 years. Then you have the open pit and underground operations, to come online, with the exploration upside of the deposit to the North.

Dr. Allen Alper: Those sound like very compelling reasons for our readers/investors to consider investing in EQ Resources. Kevin, is there anything else you'd like to add?

Kevin MacNeill: I think that's everything. I appreciate the interview.

Dr. Allen Alper: Thank you. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.eqresources.com.au/

Kevin MacNeill

Chief Executive Officer

Peter Taylor

Investor Relations

0412 036 231

peter@nwrcommunications.com.au

|

|