Steve Parsons, CEO, Goldsource Mines Inc. (TSX-V: GXS) Discusses its Eagle Mountain Gold Project, Guyana, South America, Mineral Resource Estimate of 1.7 million oz, Shallow Gold Mineralization, and the Merits of Phased Development

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/22/2021

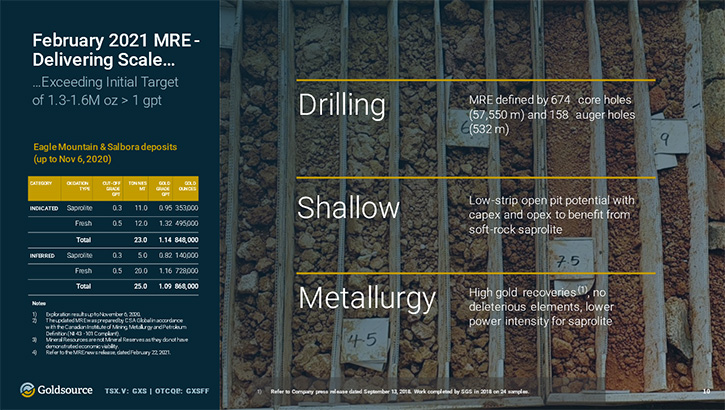

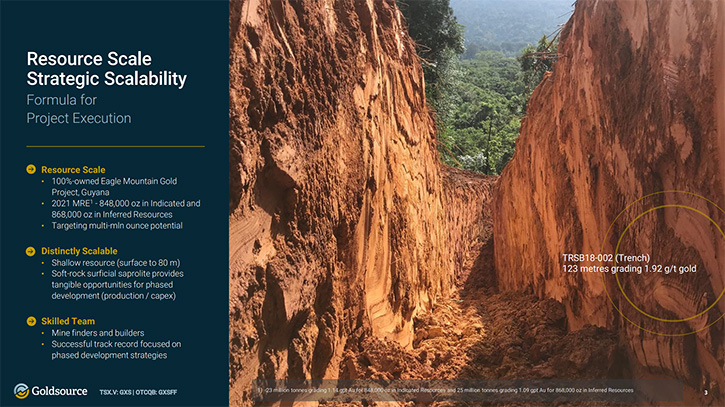

We spoke with Steve Parsons, CEO of Goldsource Mines Inc. (TSX-V: GXS), a Canadian exploration company, focused on the 100%-owned, Eagle Mountain Gold Project, in Guyana, South America. The Eagle Mountain Gold Project has a mineral resource estimate of 848,000 oz, in Indicated, and 868,000 oz, in Inferred categories, shallow mineralization (surface to 80 meters), allowing for low-strip, open-pit potential, with capex and opex to benefit from soft-rock saprolite. Next steps include another resource update later this year, further exploration of known high-priority targets, and a Prefeasibility study by mid-2022.

The Eagle Mountain Gold Project

Dr. Allen Alper: This is Dr Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Parsons, who is CEO of Goldsource Mines. Steve, could you give our readers/investors an overview of your Company, and what differentiates your Company from others?

Steve Parsons: Thank you for the opportunity to introduce Goldsource Mines to your readers/investors. We are a Canadian-listed exploration Company, focused on a phased development plan for our 100%-owned Eagle Mountain Gold Project, in Guyana.

We have a newly minted mineral resource of 1.7 million ounces of gold contained in the Indicated and Inferred resource categories. This is already of significant scale, yet we see scope for this to grow further, as the property hosts at least two structural trends that are auriferous.

In mining, resource scale matters, but is one of many factors that determines strategic significance or overall project quality. For a junior explorer looking to transition to producer status and do so with an asset that has significant resource scale, it is critical for that deposit to offer tangible opportunities to scale the development. In other words, offer low capex intensity baseline production that can be eminently funded by the junior. I would argue this is true for all producers, as investors shy away from large capex.

In the case of Eagle Mountain, approximately 30% of the mineral resource is hosted in soft-rock saprolite that starts at surface and is expected to be free-digging (no drilling, no blasting). Not only should this provide OPEX benefits for the baseline production, but we expect the development CAPEX to be relatively low and the construction cycle shorter. Furthermore, the Eagle Mountain resource is shallow and tabular, which provides the flexibility to systematically target higher grade areas early in the mine life – something that is harder, with deposits that are vertical in nature. Lastly, Guyana’s pro-mining framework is complementary to what we expect to be a relatively tight development timeline for the saprolite project. Thus, there is visibility for us to transition to development, at rates much faster than the industry average, based on the deposit style and jurisdictional support – two factors that need to be aligned. It’s a long answer, but together these factors support our view that Eagle Mountain is high quality.

Dr. Allen Alper: That sounds excellent. That's an excellent business plan! It is great to be able to take it in stages. And it's great that the OPEX, operating costs, and the CAPEX are expected to be very moderate.

Steve Parsons: That is the current opportunity and our outlook. We look forward to being able to provide more definition on the CAPEX, OPEX and phased development plans in 2022, with the release of a Pre-feasibility study. I think anybody, technical or not, can appreciate, from the images in our presentation and the configuration of the deposit that the project offers distinct advantages over many conventional hard rock projects.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors more about your plans for the remainder of 2021 and going into 2022?

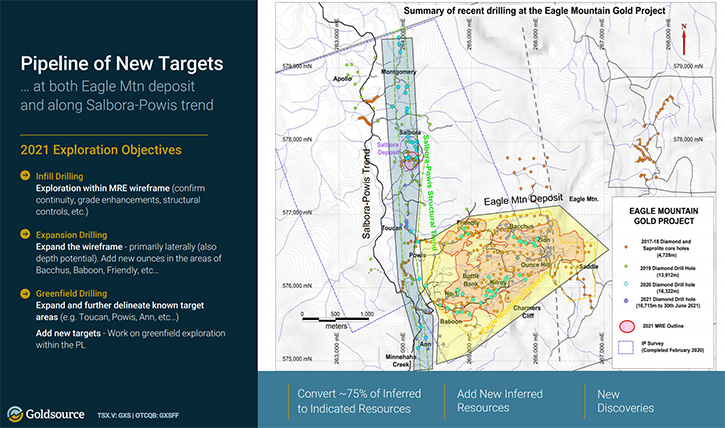

Steve Parsons: On our near-term plans for unlocking value, we are currently active on a 21,500-metre drill program. The plan is to deliver a follow-up resource update, in the fourth quarter of this year. This resource update will include all drilling completed from November 2020 to approximately October of this year. This next resource update will be used as a basis for the prefeasibility study, which is anticipated in mid-2022. In the meantime, we continue to explore for new targets and demonstrate the resource potential of the property. On this, we added 5,000 metres to this year’s drill program to test some of the known geophysical and historical artisanal mining targets that are outside the current resource outline. Moreover, next year, we plan to test the east side of our Prospecting License, for the first time. Some historical work was done there, but it was very preliminary and there are indications that it, too, could be prospective for gold.

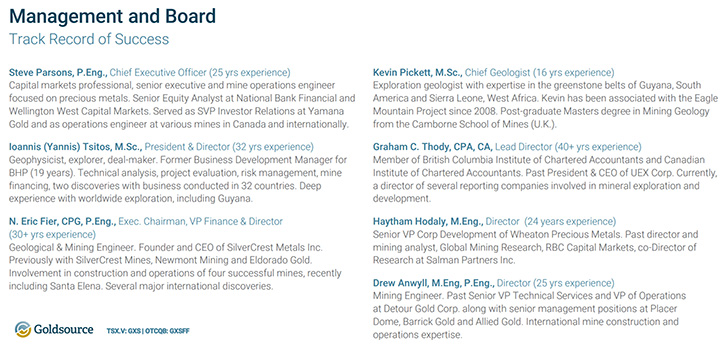

Dr. Allen Alper: It sounds excellent. Could you tell our readers/investors a little bit about your background and the Team?

Steve Parsons: The Management Team is comprised of a number of industry professionals, to cover all the key disciplines. As for myself, I started in mine operations and technical consulting, but relatively early in my career, after nearly 10 years on the technical side, I moved over to the Capital Market side of the business, where I’ve focused on mining for various investment dealers in Canada. I did that for approximately 15 years, travelling the globe and seeing some great examples of what to do, and certainly some challenges as well. Early in my career, it became apparent that it was the high-quality, bite-size projects that can better navigate the industry pressures and rise to the top. This bias attracted me to Goldsource.

Eric Fier is well known in the industry. He is the founder and CEO of Silvercrest Metals, which has a very high-quality project in Mexico. This is the latest project, where Eric is putting to use his proven expertise, with phased development strategies. Eric is the Executive Chairman of Goldsource Mines. He is also our Qualified Person (QP) for review of resources and technical information. Certainly, we benefit from his involvement. Yannis Tsitos, President and Director, rounds out the senior management. He was the architect of the deal that brought Eagle Mountain deposit into the Company. He has almost two decades, working in Guyana, initially with BHP. He also happens to be a geophysicist by training. Geophysics has been an exceptionally useful tool for us in terms of identifying new targets.

The Team on the ground in Guyana is impressive. Kevin Pickett is our Chief Geologist. Here’s been associated with the project since 2008 and has been instrumental in the growth of the mineral resource and discovery of new targets such as Salbora. We have a Team of approximately 45 people in the country. They have done a tremendous job delivering our recent exploration programs, particularly during the challenges brought on by COVID.

Dr. Allen Alper: All right! Sounds excellent! Could you tell our readers/investors about your share and capital structure?

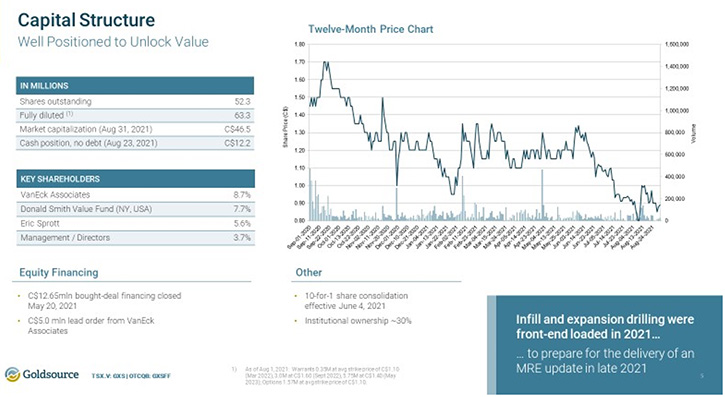

Steve Parsons: Certainly. Both the balance sheet and the capital structure have been transformed, in recent months. We just raised C$12.65 million, with a bought deal financing that brought in a number of high-quality institutions that are experienced mining investors. They like our phased development plan, the resource growth, the shallow resource, and our exploration results to date. We're happy to have a larger institutional presence in our stock. With the current cash balance, we are well funded through 2022, and also for the activities, which we expect to unlock value, in the asset and the stock, such as the PFS and exploration drilling.

Steve Parsons: Lastly in terms of the capital structure, this, too, has transformed. In early June, this year, we completed a 10-for-1 share consolidation. This is something that needed to be done to provide better alignment between the quality of the project and the quality of the capital structure. Now, both are of a high quality.

Dr. Allen Alper: That sounds excellent! Steve, could you tell our readers/investors, the primary reasons they should consider investing in Goldsource Mines?

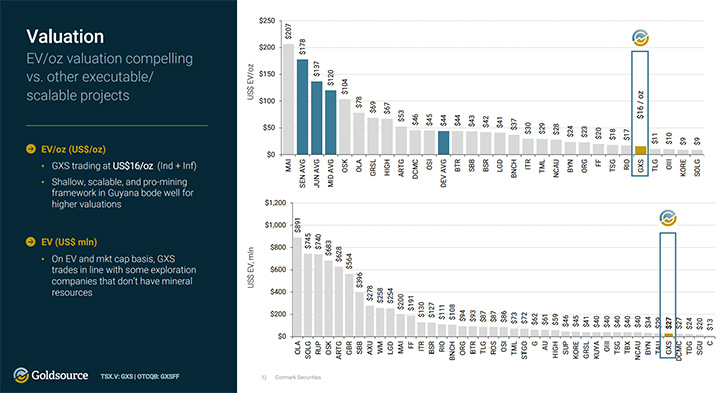

Steve Parsons: It is absolutely critical to identify a project that has high quality features, with development and mine plan flexibility, and the jurisdictional support. Eagle Mountain should benefit from this. At the moment, the Company is trading at an enterprise value per ounce of resource (all categories) of US$15/oz. This is very compelling compared to the peer group and in the context of the near and medium-term catalysts, as already discussed.

Dr. Allen Alper: Sounds excellent! These are very strong reasons for our readers/investors to consider investing in Goldsource Mines. Sounds like you and your Team have done a great job this year, getting the Company situated, in position for further exploration, and also for investors to invest in and support you.

Steve Parsons: Yeah. Thank you. I appreciate that! And there's lots more to come. The onus is on us to make sure that the industry and our investors understand what distinguishes Eagle Mountain, from the rest of the projects out there. It takes some work, and it takes some time, but when you have a project that's technically as high quality as ours, with the saprolite, with a very shallow resource, with a Team that's done it before, and in a jurisdiction where you can get it done. We think those elements do resonate, as we get the story out and as we continue to deliver results.

Dr. Allen Alper: That sounds excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.goldsourcemines.com/

Steve Parsons

CEO

Goldsource Mines Inc.

Telephone: +1 (604) 694-1760

Fax: +1 (604) 357-1313

Toll Free: 1-866-691-1760 (Canada & USA)

Email: info@goldsourcemines.com

|

|