Leigh Curyer, CEO & President, NexGen Energy Ltd. (TSX: NXE, NYSE: NXE, ASX: NXG) Discusses Developing the World's Largest, Highest Grade, Arrow Uranium Deposit, Clean Air Energy Fuel

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/20/2021

We spoke with Leigh Curyer, who is CEO, President and Director of NexGen Energy Ltd. (TSX: NXE, NYSE: NXE, ASX: NXG). NexGen is a Canadian company with a focus on the acquisition, exploration, and development of Canadian uranium projects. NexGen holds a portfolio of prospective uranium exploration projects, in the southwest Athabasca Basin, Saskatchewan, Canada, and is advancing the Rook I Project – host of the 100% owned Arrow deposit and the world’s largest, highest-grade uranium project, under development. NexGen’s flagship asset (the Rook I Project) will be the source of clean air energy fuel, for future generations in Saskatchewan. The Arrow Deposit hosts a NI 43-101 compliant, U3O8 resource, of 209.6 M lbs. in Measured category, 47.1 M lbs. in Indicated category, and 80.7 M lbs. in Inferred category. The Rook I Project is supported by a NI 43-101 compliant Feasibility Study, which outlines elite environmental performance as well as industry leading economics.

The Rook I Uranium Project

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Leigh Curyer, who is the CEO, President and Director of NexGen Energy. Leigh, I wonder if you could give our readers/investors an overview of your outstanding uranium projects. And also, what differentiates your Company from others and what role your Company will play in the global electrification of the world.

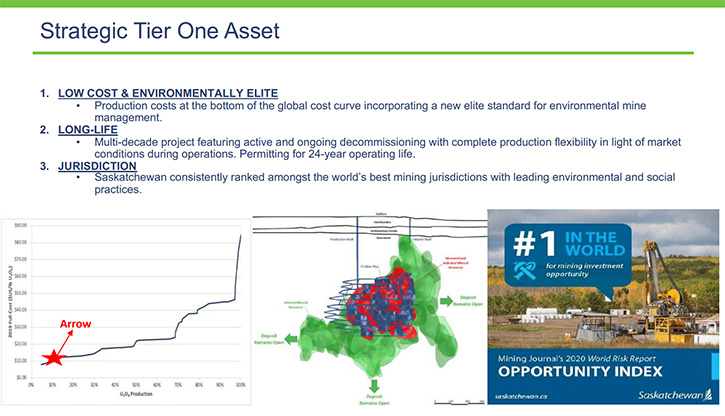

Leigh Curyer:NexGen Energy is developing what is the largest, highest-grade uranium deposit, which will be a significant supplier of uranium to help meet growing global demand for electricity from clean, low-carbon sources such as nuclear power, all the while delivering sustainable economic, social and environmental benefits to the province of Saskatchewan.

The project is very large scale, yet it has a very small environmental footprint. It's actually one of the tiniest underground mines on the globe. When you consider it's moving only 1,300 tons of rock per day, yet it will contribute approximately 25% of world mine production, based on 2019 production figures.

Dr. Allen Alper:

That's excellent, could you tell us a little bit more about the project? Also, at some point, you have an outstanding feasibility study, could you tell us about that too?

Leigh Curyer:

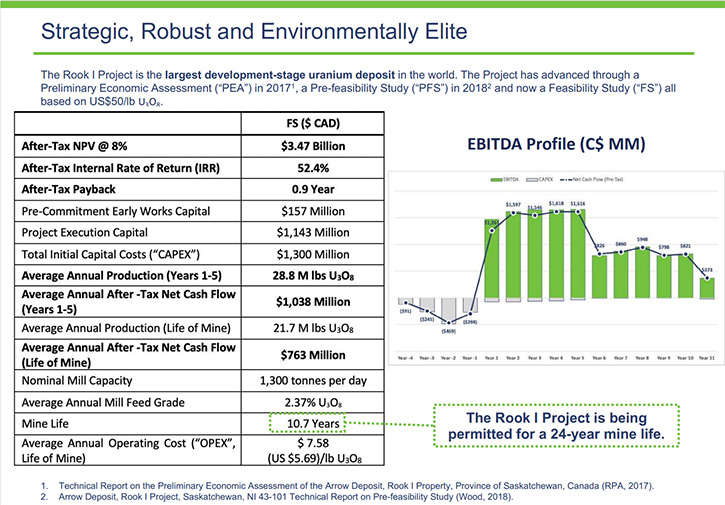

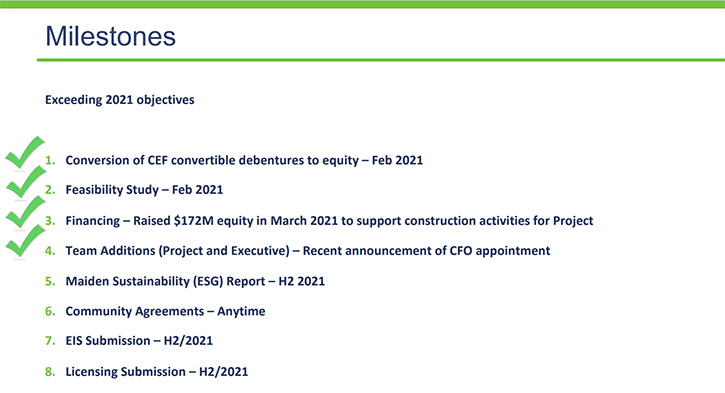

The feasibility study, which we released in February of 2021, demonstrated that it's one of the most economically powerful mineral resource bodies, anywhere in the world and across any other mineral resource. It has an extremely fast payback period, of a little under one year. It was currently designed for a 10.7-year mine life, and we have material mineralization in the third category that, with future drilling, will be brought over into the measured and indicated. We also have additional zones of mineralization, which aren't currently on the resource statement.

Whilst the feasibility study is for an initial 10.7-year period, we are permitting for a 24-year mine life. This speaks to the confidence of our geological Team, our consultants, and our entire Team around the resource growth that we have in front of us. Given that it is a very large, high-grade resource, we have an enormous amount of drilling to do to fully understand the true extent of mineralization, both in and around the project. To be clear - we have, by no means, fully understood the level of mineralization that is on the Rook 1 Property, which is widely regarded as the most prospective uranium property on the planet.

Dr. Allen Alper:

Outstanding. I know you have a fantastic Team, could you tell our readers/investors a little bit about your background, the Team, the Board?

Leigh Curyer:

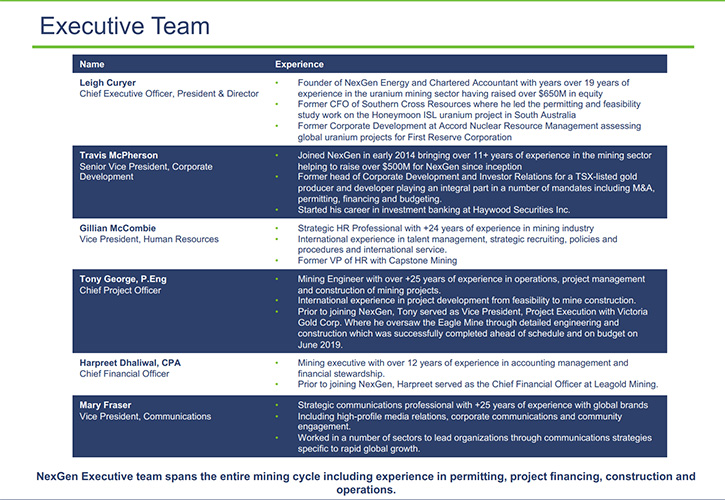

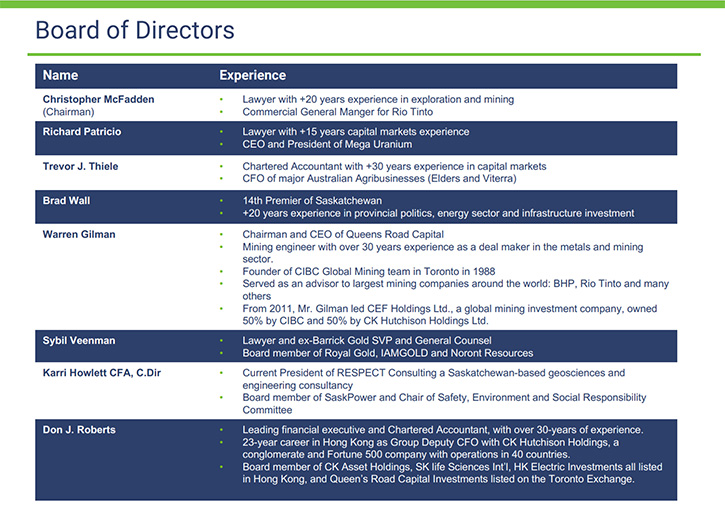

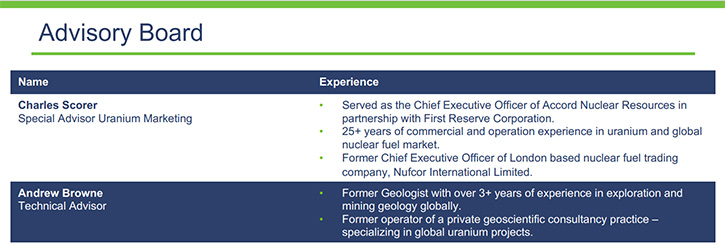

The Board, the Executive Team and I are a group of professionals, who all came together across all disciplines of mining, from exploration right through to production and closure. A very good mix or diversification of large company, medium development company and startup company experience, across all the disciplines you'd like to see for creating what will be a top 15, world mining company, in the future, when we go into production.

We came together in 2011, and everyone had a very solid track record in their previous roles. We have continually attracted the best of the best of the sector. Most recently, we attracted Harpreet Dhaliwal, our CFO, and Tony George, who has built a number of mines, around the world, on time and on budget. There's a Technical Team, reporting up to Tony, covering all facets. It really is a privilege to be stewarding such a fantastic group of professionals, who are highly committed and dedicated to delivering this project. In addition to delivering a clean energy fuel that is going to materially address carbon emissions on a global scale, the Rook I Project is going to create enormous amount of positivity for all stakeholders, local communities, the people of Saskatchewan and Canada, the government, and shareholders.

Dr. Allen Alper:

Could you give our readers/investors some numbers on how this project will decrease carbon emissions?

Leigh Curyer:

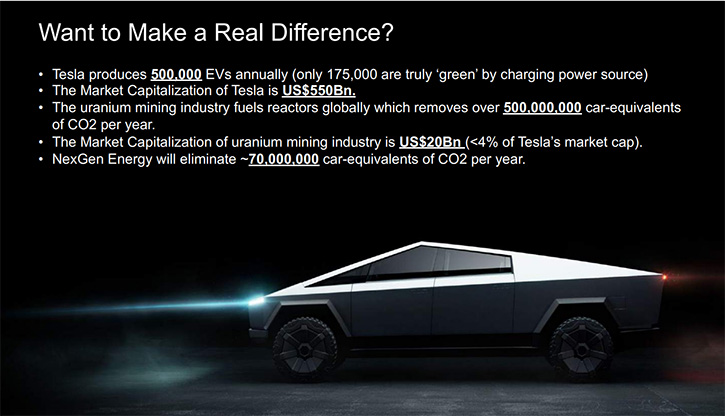

I can give you one analogy for your readers/investors. Tesla produces 500,000 vehicles a year. NexGen will produce the equivalent of removing 70 million vehicles worth of CO2 emissions annually, when in production. It's quite remarkable, what we're talking about here. It's going to have the impact of removing 70 million vehicles off the road annually, in terms of its clean energy output.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit about the uranium market and its outlook?

Leigh Curyer:

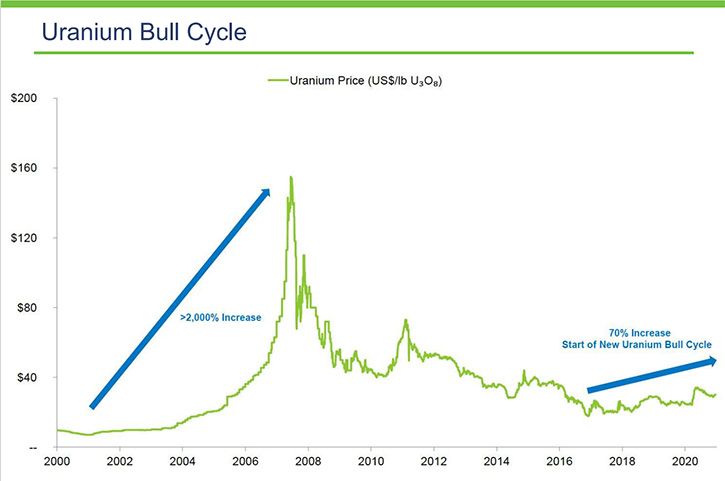

Yes, is a very interesting time for all your readers/investors. Uranium is a cyclical industry. We've seen, in the past, quite prolonged periods of suppressed prices. The industry living off historically high contracts from up to 10 years prior. And we're coming into that zone, at the moment, where after a long period of suppressed prices, the price is about to react very, very strongly to the rising cost of production, across all the major producers.

The current price of uranium is about $30 a pound. It's estimated that approximately maybe 20% of the current mines, in production in the world, are making money or barely breaking even at $30 a pound. Readers should have a lot of confidence that the price of uranium is about to rise. We've seen it before, back in 2004, where the price was $10 a pound after a 10-year period. It went to $140 a pound within a four-year period between 2004 and 2008.

We're on the cusp of one of those situations as we speak. When you consider that the rising cost of production is, on average, north of $50 a pound, the current price at $30 a pound was just natural economics. For those mines to stay in production, the price of uranium has to rise. We've seen it before. Anyone looking at the charts will see the cyclical nature. We're at the beginning of a real upward trend in the uranium cycle, based on everything that we have reviewed and the major market observers in the uranium industry.

Dr. Allen Alper:

That sounds excellent! A great opportunity for stakeholders and shareholders! Could you tell our readers/investors your schedule and steps going into production?

Leigh Curyer:

We're about to conclude and complete our environmental impact study, which is the culmination of more than 8 years of engagement and detailed data collection and analysis, incorporating all technical, environmental and community aspects. It is scheduled to be completed in December of this year, and we’ll be filing it very shortly thereafter, where it will undergo review by the regulatory bodies, both federally and provincially in Saskatchewan.

We are undertaking early site preparation work; surface clearing, geotechnical drilling for the foundations, airstrips, et cetera. The permitting process will run parallel to that, all going according to schedule. We expect to see the Rook 1 Project head into production somewhere in the middle part of this decade.

Dr. Allen Alper:

That sounds very good. It sounds like the timing will meet the expansion of electric vehicles.

Leigh Curyer:

Yes, exactly, and we have that overlay at the top of all of this. The expansion of electric vehicles is going to put enormous pressure on the electrical grid. We have small modular reactors being developed as well, which are a magnificent initiative by the Canadian government, as well as Bill Gates in the US. These small mod reactors are the single most important factor that can help raise the average standard of living for the world's population.

Imagine putting a small module reactor into parts of Africa and the Asian continent, where still less than 3% of the population, in some areas, have power at night. It's an incredible initiative that could really improve the average standard of living for the world's population, at a time that overall population growth, et cetera, is seeing continued demand and consumption of power. On top of that, the requirement for it to be clean. So, it is a very exciting initiative that we are working on, in developing the Rook 1 Project. Very rarely do you get the ability to have such a material impact on such a global initiative.

Dr. Allen Alper:

That sounds outstanding. It's great to be part of a project that will provide electricity throughout the world. That's excellent! Leigh, could you tell our readers/investors a little bit about your share and capital structure.

Leigh Curyer:

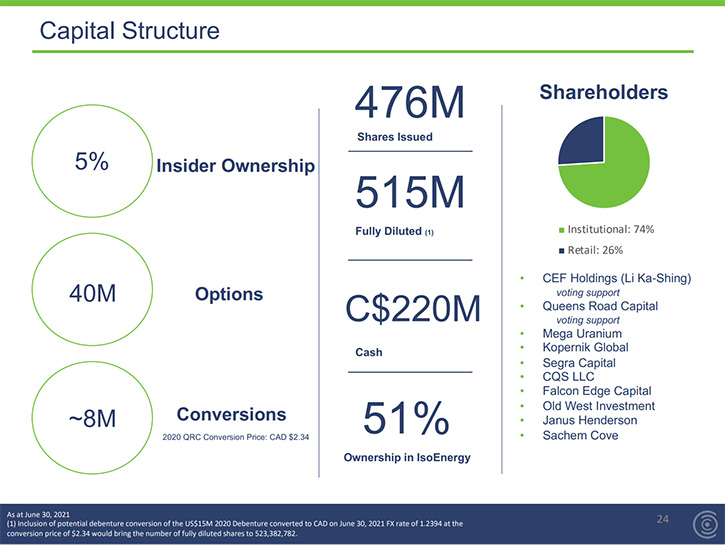

We have approximately 475 million shares issued. Currently, CK Holdings, headed by Li Ka-shing, one of Asia's richest and the world's richest men, currently holds about 19% of the stock. Importantly, we have to see voting rights around that 19%, so he votes in favor of Board and Management resolutions. Followed by Queen’s Road Capital, which is headed by Warren Gilman, a well-known resource industry executive. Incredible experience over a 30-year period.

Then, the who's who of investment funds that specialize in the resources sector, in the uranium sector. We are listed on the Toronto Stock Exchange, the New York Stock Exchange and recently, as of the second of July, we listed on the Australian Stock Exchange, who are very familiar with, and interested in uranium. We've had a lot of demand, down on the ASX, for those ASX only funds to give them exposure to NexGen. We're listed on the three main Boards, for resource companies at our stage of development.

Trading liquidity is approximately about $30 million a day. A highly liquid Company, with a very strong shareholder base, which can give shareholders, or potentially new interested shareholders, a lot of confidence that we are well supported and well structured. We also have $200 million currently in that Treasury, which funds us very, very strongly for all of our planned activities over the next three years.

Dr. Allen Alper:

It sounds like the Company is in an excellent position, very enviable, to almost all mining companies. That sounds excellent. Leigh, could you tell our readers/investors the primary reasons they should consider investing in the uranium industry?

Leigh Curyer:

First of all, it revolves around the price forecast for uranium. I think if you ask anyone familiar with the sector, the uranium price is under enormous pressure to rise in the very near term. So, we're in the right sector. Further, we are actually materially going to address decarbonization, by providing clean energy fuel for the many reactors around the world. The US recently spoke about the need for nuclear energy now. And so, what you're seeing there are reactor life extensions and subsidies coming into place to promote a nuclear power generation.

We're seeing the same in Europe as well. There's a lot of momentum and the challenge for clean air energy fuel to exist forever. This is not cyclical in nature. It's here, it's present and it's the number one task that all countries need to address, after getting on top of the COVID-19 pandemic.

With respect to the fundamentals, which are clearly very strong, NexGen is very well positioned given its stage of development, which hasn't been overnight. We've been working very diligently, for over 10 years, to get the asset into the stage that it's in. We’ve derisked it, which was incredible. A lot of hard work has already been done. We've built an extraordinary Team, who is well prepared to execute this next stage of this exciting Company.

Dr. Allen Alper:

Those sound like very compelling reasons for our readers/investors to consider investing in NexGen. Leigh, is there anything else you'd like to add?

Leigh Curyer:

Just that I really appreciate the opportunity to speak with you today and I appreciate your interest in NexGen very much.

Dr. Allen Alper:

Well, that sounds great! I enjoyed talking with you. I really think you have a fantastic, outstanding project, both financially and for humanity.

Leigh Curyer:

Thank you very much! That's very important to me, the Board, and the entire Team. We understand the responsibility we have. We have a really dedicated, committed Team, who takes that responsibility very seriously and it is a pleasure for me to be the steward of it. I really thank you for your interest in our story and look forward to talking with you again.

https://www.nexgenenergy.ca/

Leigh Curyer

Chief Executive Officer

NexGen Energy Ltd.

+1 604 428 4112

lcuryer@nexgenenergy.ca

Travis McPherson

Senior Vice President, Corporate Development

NexGen Energy Ltd.

+1 604 428 4112

tmcpherson@nexgenenergy.ca

|

|