Mike Davies, CFO, Discusses Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF), the Largest Underground Gold and Silver Producer in Colombia, Its Core investments, Diversification and Excellent Financial Results

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/10/2021

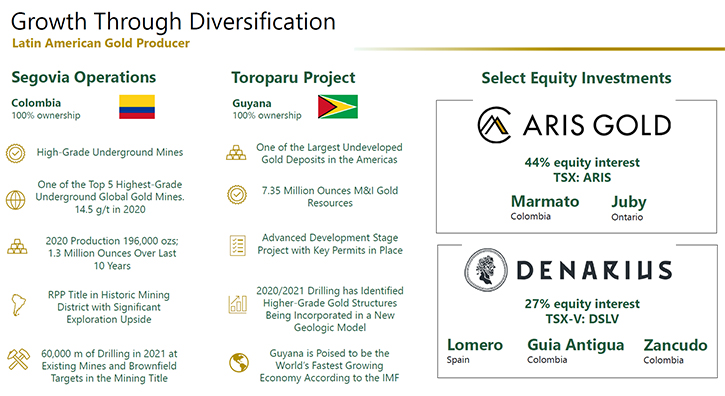

We spoke with Mike Davies, who is CFO of Gran Colombia Gold Corp. (TSX: GCM; OTCQX: TPRFF), the largest underground gold and silver producer in Colombia, with several mines in operation at its high-grade Segovia Operations, which are expected to produce between 200,000 and 220,000 ounces of gold this year. In Guyana, the Company is advancing the Toroparu Project, one of the largest undeveloped gold projects in the Americas. Early in 2021, Gran Colombia Gold completed the spin out of the Marmato Project, to Aris Gold, in which the Company now has a 44% interest. In addition, Gran Colombia Gold owns approximately 27% equity interest in Denarius Silver Corp. (TSX-V: DSLV) that is exploring the Lomero-Poyatos project in Spain, and an approximately 26% equity interest in Western Atlas Resources Inc. (TSX-V: WA)

Dr. Allen Alper:

This is Dr. Allen Alper, Editor-in-Chief of Metals News, talking with Mike Davies, who is CFO of Gran Colombia Gold. Mike, could you start by giving us an overview of your Company, what differentiates it from others, and then tell us about the exciting things that have happened since we talked last March. Also update our readers/investors on the great first half you've had.

Mike Davies:Gran Colombia Gold has had another busy year in 2021. We have focused on making progress on our strategy to create value for our shareholders. This year we have focused on continuing our strategy of growth through diversification. We can start at the beginning of the year, completing the spin out of the Marmato Project to Aris Gold, in which the Company now has a 44% interest. There’s a new dedicated Management Team in Aris, looking after the development of the Marmato Project.

In March, Gran Colombia turned its attention to the Toroparu Project, which was owned by GoldX Mining. Gran Colombia had about an 18% interest in GoldX, at the time. We acquired the other 82% of GoldX, in a transaction that closed on June 4th. On August 9th, we closed a US$300 million senior unsecured notes financing. So, we now, along with the stream from Wheaton Precious Metals that was in place in GoldX, we have all the funds we need to develop the Toroparu Project.

We also inaugurated Denarius Silver earlier this year. It's a junior company listed on the venture exchange, of which we own 27%. And we're very excited about the exploration projects in Denarius, which include the Lomero Project in Spain, as well as the Guia Antigua and Zancudo Projects in Colombia. So, a very important year for us to push forward in our strategy of growth through diversification. Not just geographic, but also bringing some other metals into our future revenue mix, beyond just exposure to gold.

Dr. Allen Alper:

That sounds excellent. Sounds like a very strategic year, a very excellent year, expanding your resources on diversifying. Could you tell us a little more about some of those key projects that you've acquired and advanced?

Mike Davies:

From a Gran Colombia standpoint, we now have two cornerstone assets. We have the high-grade Segovia Operations. They've been the backbone of our free cash flow generation over the last 10 years and certainly continue to be forefront in our plans as we move forward. This year is characterized by another year of strong production and an increased focus on exploring the brownfield areas of the title in addition to continuing to have a solid exploration program around the existing mining operations.

To that we added the Toroparu Project in Guyana, one of the largest undeveloped gold operations in the Americas. We see that as an opportunity to take our production from 200,000 ounces a year to 400,000 ounces a year once the construction of Toroparu is complete, which we expect will be in early 2024. Then with Aris and Denarius, we have a portfolio of other assets that we believe, in time, will come to fruition to bring additional shareholder value creation for our shareholders.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors about your results for the first half and the second quarter?

Mike Davies:

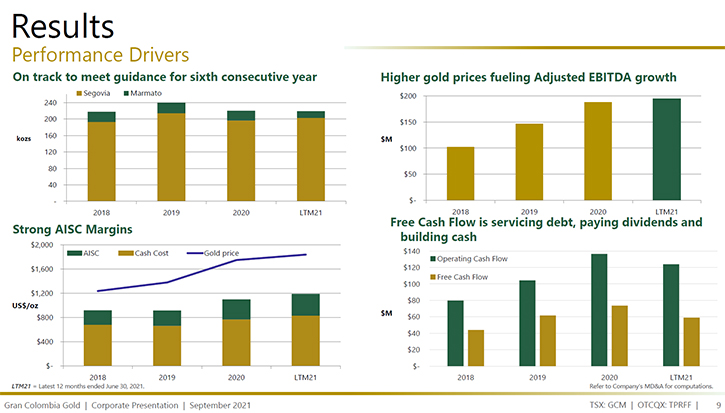

2021 is going along as we expected this year. We’re on track with our production guidance from Segovia. We had guided the market, earlier this year, that Segovia would be expected to produce between 200,000 and 220,000 ounces of gold this year. In the first half, we reported production from Segovia of about 101,000 ounces, so we're well on our way to our annual goal. We're picking up a bit of momentum the last few months.

The second quarter was 52,000 ounces of production from Segovia. Our trailing 12 months total at the end of June was 203,000 ounces. So, we're very confident in our performance at Segovia. Cash cost through the first half of the year has averaged about $816 an ounce. That's in line with our expectations. We have an all-in sustaining cost through the first half of the year of $1,100 an ounce, also within expectations. With gold prices continuing to average around $1,800 an ounce through the first half of 2021, we generated $200 million of revenue and adjusted EBITDA of $94 million.

That puts us on track, again this year, to be over $180 million of EBITDA, which is what we did in 2020. Fairly strong adjusted net income performance, once you take out all the non-cash fair value measurements. We had $45 million of adjusted net income, which represented about 69 cents US per share through the first half of 2021 and net cash flow from operating activities was about $26 million.

We were break even on free cash flow in the first half of 2021 largely because of two things. One is that we've done, as usual, a heavy payment of income taxes in Colombia in the second quarter of 2021. Our free cash flow will again begin to increase in the second half of the year now that those obligations are out of the way. We've also seen our spending on our sustaining capital programs seasonally return a bit more normal this year. Last year, we saw a delay in capex spending til the latter part of the year in response to things that were going on during the national quarantine in Colombia related to the pandemic. With no quarantine this year, we've seen our capital programs now taking place more evenly across the year. As such, we saw a bit more CapEx in the front half of this year than we did a year ago.

But all in all, our business is running well. We had US$58 million of cash at the end of June on the balance sheet. Our gold notes obligation was down to about US$20 million. With the recent notes financing we did, we will fully retire the remaining gold notes on September 9th when we complete our final redemption. So it's a really good first half and we're really excited about how they're setting us up for the second half of the year.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little bit more about how it is to operate in Colombia and also Guyana?

Mike Davies:

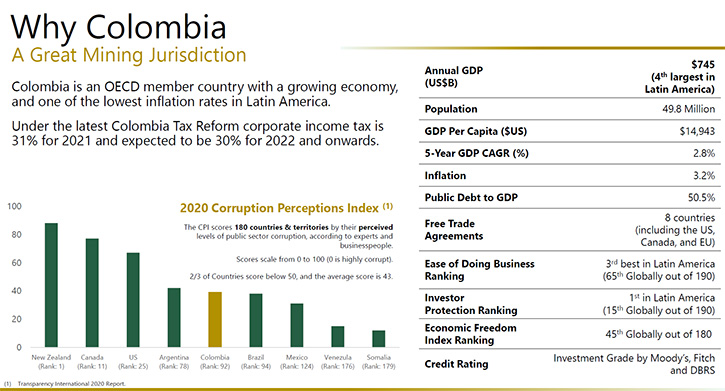

In Colombia things have been operating well for us. We have been operating normally. Our major operations are in the Antioquia District of Colombia. We've had a key focus through the 10 years we've operated the assets on ESG, long before it became more in vogue to talk about ESG as it is of late. We did file our first ESG sustainability report on our website in the middle of June this year. We're very proud of our accomplishments that we've been able to document for our investors to see. We’re really focused on the community, the environment, as well as governance and that has continued to strengthen our relationship with the community. So, while there were reported disturbances and unrest in Colombia earlier this year, all of which seems to have come back to normal of late, we didn't suffer any disruption in our mining operations as a result of that. We do believe it's a result of the positive relationship we have with the community in Colombia. We are one of the top 50 employers in Colombia and one of the top 10 companies in the Antioquia Region, certainly the top employer in Segovia.

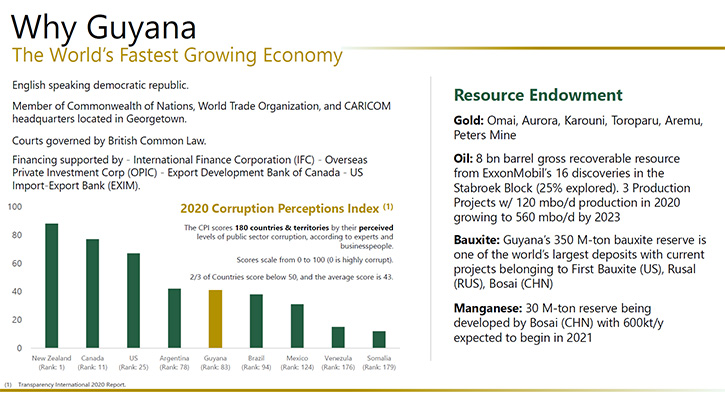

In Guyana, it's a new area for us to move into as part of our diversification strategy. And what our Chairman, Serafino Iacono, always points out, is that one of our strategic advantages in the way we operate is we have the know-how and the know-who in the regions in which we operate. Certainly, it has been a key attribute of our operating style in Colombia, and we're following the same road map in Guyana.

Our Senior Management Team has made a couple of trips over the last two months to Guyana to meet with the President of Guyana and other senior members of the government as well as local businesspeople to start to talk about what we're going to do, hear their thoughts and establish a good relationship within the country. We're starting to get going on the total project and we're excited about implementing an ESG program there as part of our construction project that will start off on the right foot.

We see Guyana as a country that's very motivated. A project like Toroparu, to come into operation, gives the country the continued development of another industry. They're becoming very well-developed on the oil side of things, but they would like to have some other industries also broaden. The mining industry is one of the key industries that they're focused on. They see this US$300 plus million project in Toroparu as a key project for them.

Dr. Allen Alper:

That sounds excellent. Could you tell our readers/investors a little about yourself, the Team and the Board?

Mike Davies:

We have a very seasoned team. I think our team’s strength is our experience in building and operating mines in Latin America. Our Chairman, Serafino Iacono, has had extensive experience in Latin America. Earlier in his career, Serafino built several mines in Venezuela, which certainly has proven to be beneficial now because he and our team, including our VP of Exploration, Alessandro Cecchi, have significant experience in the Guiana Shield on the Venezuelan side of the border. The geology and structures carry over to the Guiana Shield on the Guyana side where the Toroparu Project is. So our team has very solid, firsthand experience in that kind of geology and mineral structures, which will bode well for us as we move forward with the Toroparu Project.

Lombardo Paredes, our CEO, has extensive experience in building projects. He has done a terrific job spearheading the turnaround of Segovia since he joined in 2014 and architecting the growth and profitability enhancements that have gone in place in Segovia. He is the key behind the architecture of what's going to transpire with Toroparu as well. So solid team, good capabilities and the belief that having an on-the-ground presence in those countries in which we operate is fundamental to our success.

Dr. Allen Alper:

That sounds excellent. Mike, could you tell our readers/investors about your shared capital structure?

Mike Davies:

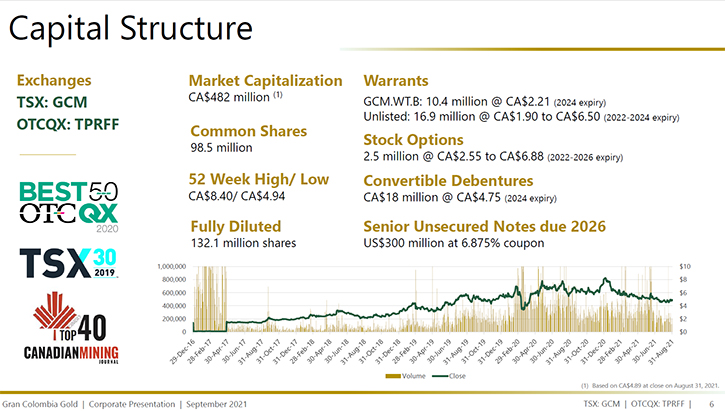

With the acquisition of GoldX, which was an all-share deal, we now have about 98.5 million shares issued and outstanding trading on the TSX:GCM and OTCQX:TPRFF. With options and warrants, as well as convertible debentures that brings us up to about 132 million shares on a fully diluted basis. I'd mentioned earlier that we have about US$20 million principal gold notes outstanding, which are listed. We will be moving to redeem those on September 9th as we've announced.

Our principal outstanding debt item will be the new US$300 million senior unsecured notes due in 2026. We issued those on August 9th. They have a 6.875% percent coupon and will be paid out twice a year. We're currently working to have those listed on the Singapore Stock Exchange. This gives us a step up in our capital structure now where we have a piece of long-term debt that will allow us to build the Toroparu Project and brings in some fixed income investors into the Company in addition to the equity investors that we have.

Dr. Allen Alper:

That sounds excellent. I am very impressed with the business operation, the strategic operation of your Company, as well as the great resources you have and your fantastic Team. Mike, could you tell our readers/investors the primary reasons they should consider investing in Gran Colombia Gold?

Mike Davies:

First and foremost, we have a strategy of growth through diversification, with two really strong core assets. Our current share valuation is about $500 million Canadian market cap at the moment. Relative to peers, based on our adjusted EBITDA generation, we're trading at less than two times adjusted EBITDA. We are paying a dividend of 1.5 cents Canadian per share per month. At current share prices, that works out to close to a 4% dividend yield.

We're one of the only mining companies that's paying our dividend to shareholders on a monthly basis. So strong assets, strong balance sheet, management with proven capabilities, value re-rating potential as we develop the build-out of our assets. We still think the gold environment is a good environment to be invested in with some upside opportunity that we expect will come in the future.

Dr. Allen Alper:

Well, those sound like very compelling reasons for our readers/investors to consider investing in Gran Colombia Gold. Mike, is there anything else you'd like to add?

Mike Davies:

I think we've covered all the main points today. We stick to the things we can control, focus on the execution and our costs and use of cash and are really excited about what lies ahead now with Toroparu. We’re well capitalized to build the project. And we have an updated resource estimate and an updated mine plan for the Toroparu Project expected to be announced around the end of September to give investors a clearer picture of the path forward for the construction and eventual operation of Toroparu, as well as ongoing news on the Segovia exploration programs. We've come a long way through the first 10 years of Gran Colombia and we're really excited about how we're starting out year 11, to set the Company up for its next 10 years.

Dr. Allen Alper:

Well, that sounds exciting! I'm very impressed with how well run your Company is and how well Managed. It is a truly great Company.

Mike Davies:

We focus on what we can control. Between Serafino, Lombardo and myself, we’ve been able to set our direction, stick to the program, focus on the execution of the operations, focus on improving the strength of the balance sheet. I think we were rewarded for the work we've done, with this US$300 million note financing, which really is a next level company type of financing. We receive B+ ratings from both Fitch as well as S&P on the credit for that facility, which for us was very positive. This puts our Company on a really good footing for moving ahead and being successful.

Dr. Allen Alper:

That’s excellent! We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|