Nic Earner, Managing Director of Alkane Resources Limited (ASX: ALK) Poised to Become Australia’s Next Multi-Mine Gold Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/8/2021

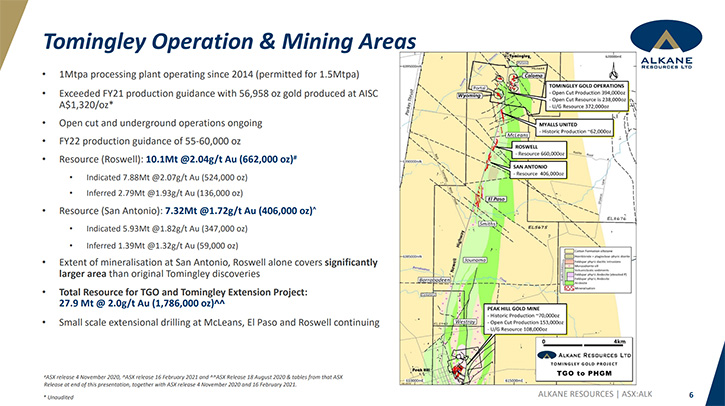

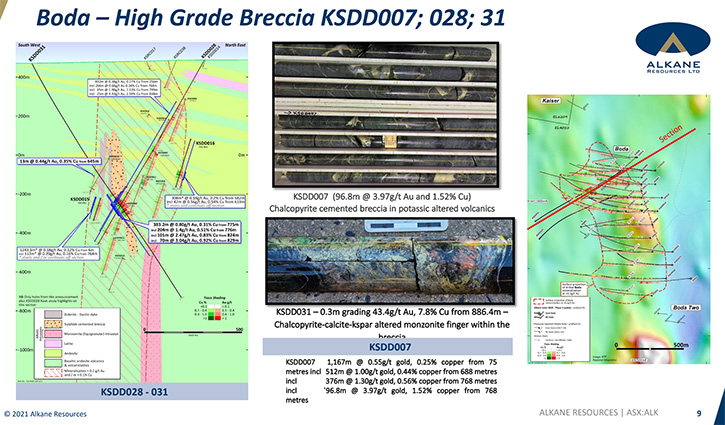

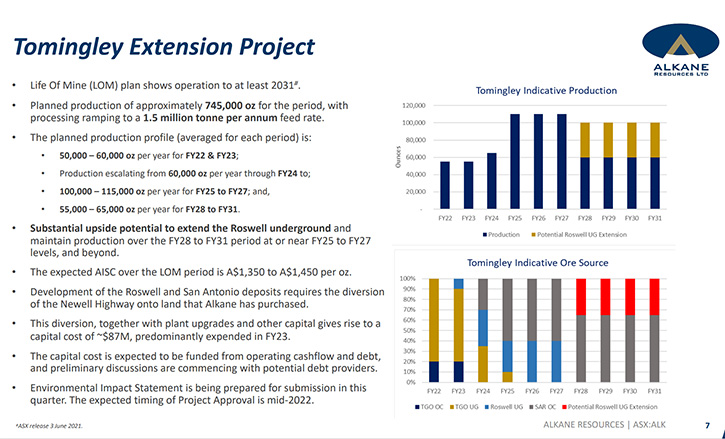

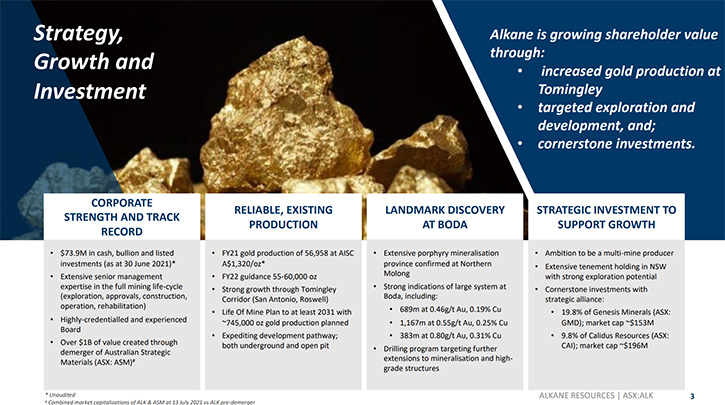

We spoke with Nic Earner, Managing Director of Alkane Resources Limited (ASX: ALK). Alkane has been listed on the ASX, since the early '80s. It's market capitalization is around US$600 million. Alkane Resources is poised to become Australia’s next multi-mine gold producer. The Company’s current gold production is from the Tomingley Gold Operations, in Central West New South Wales, where it has been operating since 2014 and is currently expediting a development pathway, to extend the mine’s life beyond 2030. In 2019 Alkane made a very large porphyry gold-copper mineralization discovery, at Boda, where the Company is spending close to AUS$15 million on doing RC and diamond drilling this year. This, as well the Tomingley mine life extension, will provide a steady news flow, potentially including an initial inferred resource, within the 12-month period.

Alkane Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Nic Earner, Managing Director of Alkane Resources, Ltd. Nic, could you give our readers/investors an overview of your Company and what differentiates your Company from others?

Nic Earner: Sure. Thanks Allen. We're a gold producer and explorer. The Company was incorporated in the late '60s and we've been listed on the ASX since the early '80s. Our market capitalization is around US$600 million, and we’re in the ASX 300. We have an active gold mine that was open-cut and is now also underground in New South Wales, at Tomingley, near the large town of Dubbo, about four hours’ drive to the west-northwest of Sydney. We also have a very large gold-copper porphyry discovery and tenement area, which people know as Boda.

Some of your audience may know that Alkane has been associated, for a very long time, with rare earths and rare metals, through its Dubbo Project. However, we underwent a full demerger in the middle of 2020, and created the ASX-listed Company, Australian Strategic Materials or ASM, to develop the Dubbo project. ASM has a market capitalization over one and a half billion dollars today. Some people may associate the name Alkane with the rare metals sector, but that's no longer what we do.

What differentiates us? As a small Australian gold producer, we have development underway to lift Tomingley – our gold mine near Dubbo – to 100,000 ounces production rate, for the next decade or more. That's underway, with new discoveries, development and approvals. But what differentiates us, from other companies that have that sort of asset, is our very large porphyry discovery at Boda. So rather than presenting – as many of our peers do – a gold production asset that may be extended or expanded, which may or may not produce a small dividend, we have a potential tier-one discovery that could create significant value for shareholders.

Dr. Allen Alper: That sounds great. It's excellent to have a landmark discovery at Boda. So that's great! Could you tell our readers/investors a little bit more about your plans for 2021 going into 2022?

Nic Earner: Certainly. Our plans, around the extension of the mine life at Tomingley, are underpinned by some near-mine discoveries. In the coming 12 months, we’ll focus on government approvals and early-stage development of those resources, both underground and open cut, as well as continuing to operate the mine.

At Boda, we're spending close to AUS$15 million on another 60- thousand-plus meters of RC and diamond drilling there. We will steadily release those results, potentially including an initial inferred resource. Those are the two core activities in our plan for the next 12 months.

Dr. Allen Alper: Oh, that sounds great. Sounds like these next few quarters are going to be an exciting time for your shareholders and stakeholders.

Nic Earner: Yes. Recent quarters have been exciting and value-adding for shareholders, with the discovery of Boda, the definition of all the resources near an existing mine and the splitting of the Company in two. And we hope to continue that experience.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your strategic investment to support growth?

Nic Earner: Some time ago, before the discovery of Boda, we invested in two companies, both listed on the ASX: Calidus ASX CAI, and Genesis ASX GMD. We took a cornerstone stake in each, when they both needed capital to continue their exploration and development plans. Calidus now has its processing plant, under construction in the Pilbara, in the Northwest of Western Australia. We own just under 10% of that.

We own just under 20% of Genesis, with a Board seat, and they are continuing to get some exciting exploration results and are finalizing their feasibility study for an independent mill. They're situated near Leonora, just north of Kalgoorlie, which is a much more interesting space, in terms of consolidation and tracking opportunities and things like that.

We intend to continue as a supportive shareholder, both financially and technically, in both of those projects. We understand that our primary purpose there is to create value for our shareholders and potentially drive merger and acquisition discussions with them. That conversation is one of many value opportunities for those companies. They're under a continued watching brief, because we could liquidate those investments and move the money into Boda exploration, which we also find very exciting. So, we have a choice of excellent investment opportunities, for the Company's profits out of Tomingley.

Dr. Allen Alper: It sounds like those are excellent strategic investments, so that's great! Could you tell our readers/investors a little bit about the Team, Management, Board and yourself?

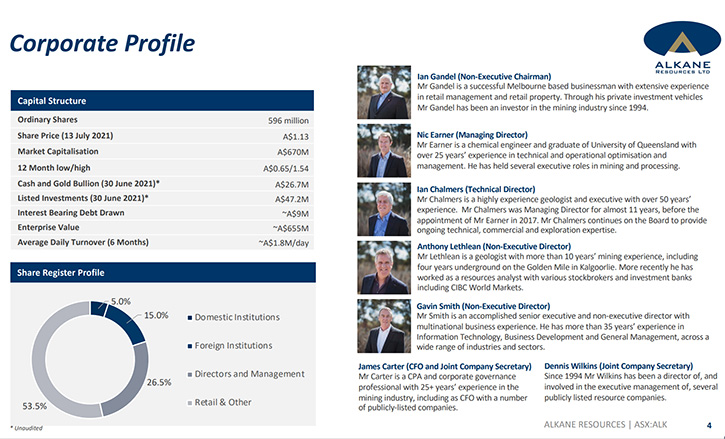

Nic Earner:Alkane has a five-person Board. The Chair is Ian Gandel. Ian comes from a successful retail and real estate family, in Melbourne. Ian himself has run a mining investment portfolio for over 20 years. He owns about 25% of Alkane Resources and also of Australian Strategic Materials that was split from Alkane. He has a long-term strategic view.

Also on the Board is Ian Chalmers, a geologist with over 40 years’ experience, who was my predecessor as Managing Director. I was Ian's Chief Operations Officer and took over as Managing Director in 2017, when Ian became the Technical Director on the Board. I would call it semi-retirement, but he's incredibly active. He's the brain trust of our exploration effort. Ian and I have a fantastic relationship and it's a privilege to have him still on the Board – that’s one of our foundational strengths.

We have Tony Lethlean on our Board too. Tony started as a mine geologist and has a long background in finance. He has been a key partner in several advisory firms. Then we have Gavin Smith, CEO of Bosch Oceania, the electronics and automotive company that many readers/investors will know. He brings a wealth of international business experience to the Board.

Myself, I'm a chemical engineer. I’ve been in the mining industry for over 25 years, in a wide range of development and operational roles. I started with Alkane, about eight years ago, and was promoted from COO. So that's the Board.

Then we have an excellent Operations Team. A lot of Australia is fly-in-fly-out, but almost all our people are residential, either around the mine or our exploration projects. We have our corporate office in Perth, in Western Australia, where a lot of smaller cap mining companies are.

Dr. Allen Alper: Well, you have a very strong Board and a very balanced Board. It looks excellent, and you have great experience.

Nic Earner: Thank you.

Dr. Allen Alper: Could you tell our readers/investors a little bit about your capital structure and your share structure?

Nic Earner: We have just under 600 million shares on issue. Our share price is just under AUS$1.00. We have two debts. Firstly, financing for our underground equipment, which is secured by only that equipment, for around $15 million. Every dollar I mention is Australian, by the way. Secondly, we have an undrawn $20 million working capital facility. At the end of last quarter, we had $20 to $25 million in the bank. Our market investment, in those two companies I spoke of earlier, is worth $50 million. So, we're very well capitalized. Although we do have development outflows ahead of us, for the Tomingley expansion, and of course, we're spending money on exploration.

Ian Gandel, our Chair, is the major shareholder at 25% holding. Domestic institutions comprise around another 12%. International funds are about 10% and the majority are indexed funds, because we're in the ASX 300. Ian Chalmers and I hold 1.5-2% of the Company, after years of investing part of our salary package. After that, it's primarily retail holders or very small fund holdings, almost all within Australia, with probably 5% to 10% overseas ownership only. We're actively traded on the ASX, with quite a high-volume turnover, but we have some shareholders, who have been with us for a long time.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors the primary reasons they should consider investing in Alkane Resources?

Nic Earner: Consider investing in us if you are interested in value creation through exploration, because that is one of the main drivers of our historical and current value. Expect to see the Company's profits put into that. That's number one.

Two, if they look at the Company, they will see fair value representation of a single mine asset and all the multiples that come and go with that. But then consider our potential porphyry deposit, in a tier-one jurisdiction, unlike many other locations, that's wide open for value creation. They should read the reports that we put out around that deposit, as well as look at our long history of successful operation, and draw their conclusions from that.

We're going to continue to unlock value through delivering production, but particularly through our exploration drill bit. We've done that historically and I believe we'll continue to do that, but they would need to come to that conclusion themselves.

Dr. Allen Alper: Well, those sound like very compelling reasons. It's rare to find a Company that is producing and is growing the production of the deposit and the resource they have and the mine they have, and now have the opportunity of exploring and developing another, and becoming a multi-mine producer. Is there anything else you'd like to add, Nic?

Nic Earner: No, I don't think so. I think your questions have been excellent and captured the nub of it. It depends on each investor's risk appetite, but I think, if they watch Alkane, and they want to see the expansion plans for the existing asset underway, there's a constant, steady news flow about that progress. If they want to see repeat structures of high-grade, within the porphyry appear, then there's continued news flow about that progress.

Of course, one would expect the value to rise, during that period. But I think there's enough liquidity and events occurring, within Alkane that people can form a view of price versus risk and enter Alkane at various points along the journey. I don't think this is a now-or-never situation. So, it's well worth investors adding it to their watch list, until it meets their criteria for investment.

Dr. Allen Alper: That sounds like a very reasonable approach. It sounds like those who read it and study your Company, may be ready to jump in now. And the advice for others to keep it on their watch list and watch your news flow, in the next six or so months, and decide then. That sounds like a very reasonable approach for our readers/investors.

https://www.alkane.com.au/

Tel: 61 8 9227 5677

Fax: 61 8 9227 8178

Email: info@alkane.com.au

|

|